Bitcoin and Ethereum Price History and Trends (2010-2024)

Bitcoin and Ethereum, the two leading cryptocurrencies, have experienced dramatic price swings since their inception, shaped by technological advancements, regulatory changes, market sentiment, and adoption rates. Analyzing their historical price movements offers valuable insights into their potential future trajectory, though predicting the future of volatile assets remains inherently challenging.

Bitcoin Price History (2010-2024)

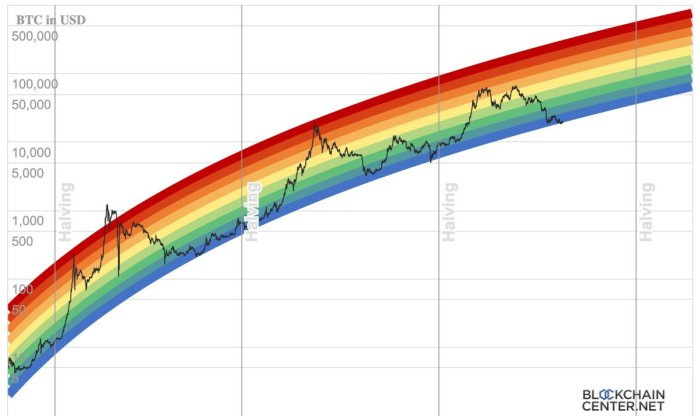

Bitcoin, launched in 2009, initially traded at negligible prices. Its early years saw slow, gradual growth, punctuated by periods of relative inactivity. However, significant price increases began around 2013, driven by increased media attention and growing adoption. The price reached its first major peak in late 2017, exceeding $19,000, before experiencing a sharp correction. Subsequent years witnessed further volatility, with periods of substantial growth followed by market downturns. Factors such as the 2020 halving event (reducing the rate of new Bitcoin creation), institutional investment, and macroeconomic conditions significantly influenced Bitcoin’s price during this period. The price fluctuated considerably throughout 2021 and 2022, reaching new highs and lows before settling into a more consolidated range in 2023 and early 2024. Throughout this time, the narrative around Bitcoin’s role as a store of value, a hedge against inflation, and a decentralized digital asset continuously shaped its market performance.

Ethereum Price History (2010-2024)

Ethereum, launched in 2015, followed a different trajectory compared to Bitcoin. Its initial price was also low, but it experienced more rapid growth in its early years, partly due to its innovative smart contract functionality and the burgeoning decentralized finance (DeFi) ecosystem. Ethereum’s price movements have been significantly influenced by developments within its ecosystem, including upgrades to its blockchain, the emergence of DeFi applications, and the rise of non-fungible tokens (NFTs). Like Bitcoin, Ethereum’s price has shown considerable volatility, mirroring the overall cryptocurrency market trends. Major price increases were observed in 2017 and 2021, followed by subsequent corrections. The transition from proof-of-work to proof-of-stake consensus mechanism (the “Merge”), a significant technological upgrade, also had a notable impact on its price, although its long-term effects are still unfolding.

Comparison of Bitcoin and Ethereum Price Performance

While both Bitcoin and Ethereum share the characteristic of high volatility, their price movements have exhibited some key differences. Bitcoin, as the first and most established cryptocurrency, has generally shown a more pronounced trend of long-term growth, acting as a benchmark for the entire market. Ethereum, while also demonstrating significant growth, has experienced periods of more rapid price appreciation and sharper corrections, often linked to specific events within its ecosystem. Both cryptocurrencies have been susceptible to broader macroeconomic factors and investor sentiment, with overall market trends significantly impacting their prices. However, their distinct underlying technologies and use cases have led to diverging price patterns over time.

Factors Influencing Bitcoin and Ethereum Prices

Several interconnected factors have historically influenced the prices of both Bitcoin and Ethereum. These include:

* Regulatory developments: Government regulations and policies concerning cryptocurrencies have had a significant impact, influencing investor confidence and market liquidity.

* Technological advancements: Upgrades and innovations within the Bitcoin and Ethereum ecosystems, such as the aforementioned Ethereum Merge, have often resulted in price fluctuations, reflecting the market’s assessment of these changes.

* Market sentiment and media coverage: Positive or negative news coverage and overall market sentiment can create significant price swings, driven by investor psychology and speculation.

* Adoption rates: Increased adoption by individuals, businesses, and institutions has generally been associated with higher prices, reflecting growing demand.

* Macroeconomic factors: Global economic conditions, such as inflation, interest rates, and geopolitical events, can indirectly affect cryptocurrency prices, as investors may shift their allocations based on broader market trends.

* Competition: The emergence of alternative cryptocurrencies and blockchain technologies introduces competitive pressures that can influence the relative prices of Bitcoin and Ethereum.

Technical Analysis of Bitcoin and Ethereum

Technical analysis offers a valuable framework for understanding potential price movements in Bitcoin and Ethereum. By examining historical price data, traders can identify patterns, trends, and key support and resistance levels, informing their trading strategies. It’s important to remember that technical analysis is not a foolproof predictor of future price action, but rather a tool to enhance decision-making.

Bitcoin Support and Resistance Levels

Identifying key support and resistance levels is crucial for Bitcoin price prediction. Support levels represent price points where buying pressure is expected to outweigh selling pressure, preventing further price declines. Conversely, resistance levels mark price points where selling pressure is anticipated to dominate, hindering upward momentum. Historically, Bitcoin has shown significant support around the $20,000 and $30,000 levels, while resistance has frequently appeared near $40,000 and $60,000. These levels, however, are dynamic and can shift based on market sentiment and overall economic conditions. For example, during periods of heightened market uncertainty, the $20,000 support level may prove more resilient, while during bull markets, the resistance levels could be breached more easily.

Ethereum Support and Resistance Levels

Similar to Bitcoin, identifying key support and resistance levels for Ethereum is critical. Past performance indicates significant support around the $1,000 and $1,500 levels, with resistance often encountered at $2,000 and $3,000. However, these levels are subject to change depending on factors like technological advancements within the Ethereum ecosystem, regulatory developments, and broader market trends. A major upgrade to the Ethereum network, for instance, could shift these levels considerably, potentially creating new support and resistance areas.

Technical Indicators: Moving Averages

Moving averages, such as the 50-day and 200-day simple moving averages (SMA), are commonly used to identify trends. A bullish crossover occurs when the shorter-term moving average (50-day SMA) crosses above the longer-term moving average (200-day SMA), often signaling a potential uptrend. Conversely, a bearish crossover, where the 50-day SMA falls below the 200-day SMA, can suggest a potential downtrend. For both Bitcoin and Ethereum, observing these crossovers in conjunction with other indicators provides a more comprehensive picture of market sentiment. For example, a bullish crossover confirmed by rising trading volume could indicate a stronger uptrend.

Technical Indicators: Relative Strength Index (RSI)

The RSI is a momentum indicator ranging from 0 to 100. Readings above 70 generally suggest an overbought condition, indicating potential price corrections. Readings below 30 typically signal an oversold condition, potentially foreshadowing a price rebound. Applying the RSI to Bitcoin and Ethereum can help identify potential buying or selling opportunities. For instance, if the RSI for Bitcoin reaches 80, it might suggest a short-term selling opportunity, while an RSI of 20 might suggest a buying opportunity. However, it’s important to note that RSI divergences, where price action contradicts the RSI trend, can also be valuable signals.

Technical Indicators: Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator that compares two moving averages. A bullish signal is generated when the MACD line crosses above the signal line, potentially indicating an upward trend. A bearish signal occurs when the MACD line crosses below the signal line, suggesting a potential downward trend. Analyzing the MACD for Bitcoin and Ethereum in conjunction with other indicators provides a more holistic view of the market. For example, a bullish MACD crossover confirmed by a bullish crossover of moving averages and rising trading volume can provide a strong buy signal.

Hypothetical Trading Strategy for Bitcoin

A hypothetical trading strategy for Bitcoin could involve combining moving averages, RSI, and MACD. A buy signal could be generated when the 50-day SMA crosses above the 200-day SMA, the RSI is below 30, and the MACD shows a bullish crossover. Conversely, a sell signal could be triggered when the 50-day SMA crosses below the 200-day SMA, the RSI is above 70, and the MACD shows a bearish crossover. This strategy would aim to capitalize on both trend changes and momentum shifts. Risk management, including stop-loss orders, is crucial for mitigating potential losses.

Hypothetical Trading Strategy for Ethereum

A similar strategy could be applied to Ethereum. A buy signal could be generated when the 50-day SMA crosses above the 200-day SMA, the RSI is below 30, and the MACD shows a bullish crossover. A sell signal could be generated when the 50-day SMA crosses below the 200-day SMA, the RSI is above 70, and the MACD shows a bearish crossover. Again, risk management is paramount. This strategy would be adjusted based on the specific risk tolerance and investment goals of the trader.

Potential Scenarios Based on Technical Indicators

Various scenarios are possible depending on the interplay of these technical indicators. For example, if all three indicators (moving averages, RSI, MACD) point towards a bullish trend for Bitcoin, a significant price increase could be anticipated. Conversely, if all indicators suggest a bearish trend, a substantial price drop might occur. However, it’s essential to remember that these are just potential scenarios, and actual price movements can be influenced by numerous other factors, including macroeconomic conditions and regulatory changes. A scenario where the price of Bitcoin consolidates sideways for an extended period is also entirely possible, particularly if the indicators provide mixed signals.

Fundamental Analysis of Bitcoin and Ethereum

Bitcoin and Ethereum, while both cryptocurrencies, possess distinct fundamental strengths and weaknesses that influence their long-term potential and adoption rates. Understanding these differences is crucial for assessing their future price trajectories. This analysis will examine their utility across various sectors and delve into the factors driving their scarcity and value propositions.

Bitcoin’s Fundamental Strengths and Weaknesses

Bitcoin’s primary strength lies in its established position as the original cryptocurrency and its robust, decentralized network. Its limited supply of 21 million coins ensures inherent scarcity, making it a potential store of value similar to gold. However, Bitcoin’s weaknesses include its limited smart contract functionality, resulting in a comparatively less versatile ecosystem compared to Ethereum. Its relatively slow transaction speeds and high fees during periods of network congestion also pose challenges to its widespread adoption for everyday transactions. The energy consumption associated with Bitcoin mining is another frequently debated weakness.

Ethereum’s Fundamental Strengths and Weaknesses

Ethereum’s strength stems from its smart contract functionality, enabling the creation of decentralized applications (dApps) and decentralized finance (DeFi) protocols. This versatility has driven significant innovation and adoption within the DeFi space, NFTs, and other emerging sectors. However, Ethereum’s scalability remains a challenge, leading to high transaction fees and network congestion during periods of high activity. Furthermore, the complexity of its smart contract system introduces risks related to security vulnerabilities and potential exploits. While Ethereum aims to improve scalability with upgrades like Ethereum 2.0, the transition and its ultimate success remain uncertain factors.

Bitcoin and Ethereum Utility and Adoption Across Sectors

Bitcoin’s primary adoption is within the finance sector, primarily as a store of value and an alternative investment asset. Its adoption in other sectors remains relatively limited due to its aforementioned limitations. Ethereum, on the other hand, has seen significant adoption in the DeFi sector, powering numerous lending, borrowing, and trading platforms. Its use in the NFT market has also been substantial, facilitating the creation and trading of digital collectibles. While both cryptocurrencies see some adoption in the finance sector, Ethereum’s smart contract capabilities extend its utility significantly beyond Bitcoin’s reach. For example, the MakerDAO platform (a DeFi application on Ethereum) allows users to collateralize crypto assets to generate stablecoins, a functionality not directly possible with Bitcoin.

Long-Term Potential Based on Technology and Network Effects

Bitcoin’s long-term potential rests on its established network effect, its scarcity, and its role as a digital gold. As more individuals and institutions adopt Bitcoin as a store of value, its network effect strengthens, increasing its value and resilience. Ethereum’s long-term potential is linked to the continued growth and development of its ecosystem. The success of Ethereum 2.0 and other scalability solutions will be crucial in determining its ability to handle increasing transaction volume and maintain its position as a leading platform for dApps and DeFi. The evolution of the broader Web3 ecosystem is also inextricably linked to Ethereum’s success.

Factors Contributing to Scarcity and Value Proposition

Bitcoin’s scarcity is primarily driven by its fixed supply of 21 million coins. This inherent limitation, combined with increasing demand, contributes to its value proposition as a deflationary asset. Ethereum’s value proposition is more nuanced. While its supply is not fixed, its utility as a platform for decentralized applications and its role in the broader Web3 ecosystem contribute to its value. The network effect – the increasing value of the network as more users and developers join – plays a significant role in both Bitcoin and Ethereum’s value proposition. The security and decentralization of both networks also contribute to their perceived value and trust amongst users. For instance, the difficulty in altering the Bitcoin blockchain, due to its cryptographic security, contributes to its perceived scarcity and reliability.

Expert Opinions and Predictions for 2025

Predicting the future price of cryptocurrencies like Bitcoin and Ethereum is inherently speculative. However, analyzing predictions from reputable sources offers valuable insights into potential market movements. These predictions often employ diverse methodologies, reflecting the complexities of the crypto market and the varying perspectives of analysts. Understanding the rationale behind these predictions is crucial for a comprehensive assessment.

Summary of Price Predictions from Reputable Analysts

Several prominent analysts and firms have offered price predictions for Bitcoin and Ethereum in 2025. These predictions vary significantly, reflecting different underlying assumptions about technological adoption, regulatory landscapes, and macroeconomic factors. It’s crucial to note that these are merely predictions, and actual prices may differ substantially.

Bitcoin Ethereum Price Prediction 2025 – For instance, some analysts, basing their projections on continued technological advancements and increasing institutional adoption, predict Bitcoin could reach prices exceeding $100,000 by 2025. Others, taking a more conservative stance and considering potential regulatory hurdles or market corrections, predict a more modest price range, potentially between $50,000 and $80,000. Similarly, Ethereum price predictions range widely, with some analysts forecasting prices above $10,000 based on the anticipated growth of the Ethereum ecosystem and DeFi applications, while others offer more conservative estimates in the $5,000 to $7,000 range.

Predicting the Bitcoin and Ethereum prices for 2025 involves complex market analysis. Understanding the broader cryptocurrency landscape is crucial, and a related factor to consider is the potential performance of altcoins. For instance, you might find insights into smaller-cap cryptocurrencies by checking out this resource on Baby Bitcoin Price Prediction 2025. Ultimately, however, the trajectory of Bitcoin and Ethereum will likely be the dominant influence on the overall crypto market in 2025.

Comparison of Prediction Models and Methodologies

The methodologies employed in generating these price predictions vary considerably. Some analysts utilize technical analysis, focusing on chart patterns, indicators, and historical price movements to identify potential future price trends. Others rely on fundamental analysis, evaluating factors such as network adoption, technological developments, and macroeconomic conditions. A hybrid approach, combining both technical and fundamental analysis, is also frequently used.

Technical analysis, for example, might identify support and resistance levels based on past price action, suggesting potential price targets. Fundamental analysis, on the other hand, might focus on factors such as the increasing number of Bitcoin transactions or the growth of decentralized applications on the Ethereum network to project future value. The differences in these approaches lead to a divergence in predicted price ranges.

Predicting the Bitcoin and Ethereum prices for 2025 is a complex undertaking, involving numerous factors and varying expert opinions. A significant portion of the online discussion focuses specifically on Bitcoin’s trajectory, and you can find a wealth of community-driven speculation on this topic by checking out the lively conversations on Bitcoin Price 2025 Reddit. Understanding these discussions provides valuable context when considering broader cryptocurrency market predictions, including the future price of Ethereum alongside Bitcoin in 2025.

Potential Outliers and Reasoning for Differing Predictions

The wide range of price predictions highlights the inherent uncertainty in forecasting cryptocurrency prices. Outliers, or predictions that significantly deviate from the consensus, often stem from differing assumptions about key market drivers. For example, predictions significantly higher than the average might reflect an optimistic outlook on the widespread adoption of cryptocurrencies as a mainstream form of payment or a belief in the transformative potential of specific technological advancements.

Conversely, more conservative predictions often account for potential risks such as increased regulatory scrutiny, security breaches, or the emergence of competing technologies. These factors can significantly impact market sentiment and price fluctuations, leading to considerable divergence in the predictions made by different analysts.

Predicting Bitcoin and Ethereum prices for 2025 involves considering various factors, including technological advancements and regulatory changes. To gain a broader perspective on long-term cryptocurrency trends, it’s helpful to examine projections further into the future; for instance, understanding potential scenarios outlined in this article about the Bitcoin Price In 2030 can provide valuable context. Ultimately, these longer-term forecasts help inform more nuanced predictions for the Bitcoin and Ethereum market in 2025.

Risks and Uncertainties in Cryptocurrency Price Prediction

Predicting the price of cryptocurrencies like Bitcoin and Ethereum is inherently fraught with risk and uncertainty. The volatile nature of these markets, coupled with the influence of numerous unpredictable factors, makes accurate long-term forecasting exceptionally challenging. Even sophisticated models often fall short, highlighting the limitations of current predictive methodologies.

The inherent volatility of the cryptocurrency market is a primary source of uncertainty. Unlike traditional asset classes, cryptocurrency prices can experience dramatic swings in short periods, driven by factors ranging from market sentiment and regulatory changes to technological advancements and major events. These rapid fluctuations make it difficult to establish reliable trends and extrapolate them into future price predictions.

Limitations of Prediction Models

Current prediction models, whether they rely on technical analysis (chart patterns, indicators), fundamental analysis (market capitalization, adoption rates), or machine learning algorithms, suffer from significant limitations. Technical analysis, for example, is often subjective and prone to interpretation bias. Fundamental analysis struggles to accurately quantify intangible factors like public perception and regulatory risk. Machine learning models, while potentially powerful, are only as good as the data they are trained on and can be easily misled by unforeseen events or shifts in market dynamics. For instance, a model trained on data from a bull market may perform poorly during a bear market. The complexity of the cryptocurrency ecosystem and the interplay of various economic, technological, and geopolitical factors make it difficult for any model to capture the full picture.

Impact of Unforeseen Events

Unforeseen events can significantly impact cryptocurrency prices, rendering even the most sophisticated predictions inaccurate. A major security breach on a leading exchange, for example, could trigger a sharp decline in prices due to a loss of investor confidence. Similarly, stringent regulatory crackdowns in major markets could drastically alter the market landscape and significantly impact the price trajectory of Bitcoin and Ethereum. The 2021 China cryptocurrency ban serves as a stark reminder of the potential impact of regulatory actions. The ban led to a significant sell-off and a period of market uncertainty.

Potential Black Swan Events

Black swan events – highly improbable but potentially impactful events – pose an additional layer of uncertainty. These could include unforeseen technological breakthroughs (e.g., the emergence of a superior blockchain technology), a major geopolitical crisis significantly impacting global markets, or the widespread adoption of a competing cryptocurrency with superior features. The sudden collapse of the TerraUSD stablecoin in 2022 serves as a real-world example of a black swan event that had cascading effects across the cryptocurrency market. While impossible to predict with certainty, considering the possibility of such events is crucial when evaluating the reliability of any cryptocurrency price prediction. The impact of such an event could be dramatic and unpredictable, potentially causing significant price volatility and rendering existing forecasts obsolete.

Alternative Cryptocurrencies and Their Impact

The rise of Bitcoin and Ethereum has spurred the creation of a vast ecosystem of alternative cryptocurrencies, often referred to as “altcoins.” These altcoins, with their diverse functionalities and technological approaches, present both opportunities and challenges to the dominance of Bitcoin and Ethereum. Understanding their potential impact is crucial for accurately predicting the future price movements of the leading cryptocurrencies.

The emergence of altcoins with unique features and functionalities can significantly influence the market capitalization and price of Bitcoin and Ethereum. Some altcoins offer faster transaction speeds, lower fees, or specialized functionalities not found in Bitcoin or Ethereum, potentially attracting investors and developers away from the established players. This shift in attention and resources can, in turn, affect the price dynamics of Bitcoin and Ethereum.

Altcoins with Significant Market Capitalization and Potential Impact

Several altcoins have established significant market capitalization and possess characteristics that could potentially challenge the dominance of Bitcoin and Ethereum. These include projects focusing on scalability solutions, decentralized finance (DeFi), and non-fungible tokens (NFTs). Their growth and adoption could directly impact the price trajectory of Bitcoin and Ethereum.

Scalability Solutions: A Challenge to Transaction Speed and Fees

Bitcoin and Ethereum have faced criticism for their relatively slow transaction speeds and high fees during periods of high network congestion. Altcoins like Solana and Cardano have emerged as potential alternatives, offering faster transaction processing and lower fees. Solana, for instance, boasts significantly higher transaction throughput than Ethereum, while Cardano emphasizes a robust, peer-reviewed development process. The success of these projects in addressing the scalability limitations of Bitcoin and Ethereum could lead to a shift in market share and, consequently, influence their respective prices. If a significant portion of users migrates to these faster, cheaper alternatives, the demand for Bitcoin and Ethereum might decrease, potentially leading to lower prices. For example, if a major decentralized application (dApp) were to migrate from Ethereum to Solana due to lower transaction costs, it could negatively impact Ethereum’s price.

Decentralized Finance (DeFi) and its Influence, Bitcoin Ethereum Price Prediction 2025

The DeFi sector has witnessed explosive growth, with many altcoins playing a crucial role in offering innovative financial services on blockchain technology. Projects like Uniswap (Ethereum-based) and Aave (also Ethereum-based) have revolutionized lending, borrowing, and trading, attracting substantial user bases. However, other altcoins are developing competing DeFi ecosystems, aiming to offer better functionality, security, or scalability. The success of these competing DeFi platforms could lead to a redistribution of market share within the DeFi space, potentially impacting the demand for Ethereum, which currently dominates the DeFi landscape. If a new DeFi platform built on a different blockchain attracts significant market share from Ethereum-based platforms, the demand for Ethereum could decrease, resulting in a price correction.

Non-Fungible Tokens (NFTs) and their Impact

NFTs, while often associated with Ethereum, have seen the rise of altcoins specifically designed to support NFT creation and trading. Some platforms offer lower gas fees or improved functionality for NFT creators and collectors. The growth of these alternative NFT platforms could lead to a decrease in Ethereum’s dominance in the NFT market, potentially affecting its price. For example, a surge in popularity of a new NFT marketplace built on a different blockchain could draw users away from Ethereum-based marketplaces, thereby influencing Ethereum’s price.

Illustrative Examples of Price Prediction Scenarios (Table): Bitcoin Ethereum Price Prediction 2025

Predicting cryptocurrency prices is inherently speculative, influenced by a complex interplay of technical, fundamental, and external factors. The following table presents four potential price scenarios for Bitcoin (BTC) and Ethereum (ETH) in 2025, illustrating the wide range of possibilities. It’s crucial to remember that these are illustrative examples and not financial advice.

Each scenario considers a combination of factors such as regulatory changes, technological advancements, macroeconomic conditions, and market sentiment. The values presented are estimations based on various analyses and expert opinions, and significant deviations are entirely possible.

Bitcoin and Ethereum Price Scenarios in 2025

| Scenario | Bitcoin (BTC) Price | Ethereum (ETH) Price | Description |

|---|---|---|---|

| Bullish | $150,000 | $15,000 | This scenario assumes widespread adoption, positive regulatory developments, and continued technological innovation leading to significant price appreciation. It mirrors the market enthusiasm seen during previous bull runs, albeit potentially on a larger scale. This would require sustained high demand and a lack of major negative events. For example, a successful implementation of layer-2 scaling solutions on Ethereum could drive substantial growth. |

| Bearish | $20,000 | $1,000 | This scenario anticipates a significant market downturn driven by factors such as increased regulatory scrutiny, a global economic recession, or a major security breach impacting investor confidence. It reflects a pessimistic outlook, potentially triggered by factors like a prolonged crypto winter or a loss of investor faith in the underlying technology. This could be similar to the 2018 bear market, but potentially more severe. |

| Neutral | $50,000 | $5,000 | This scenario represents a relatively stable market with moderate growth. It assumes a balance between positive and negative factors, with neither significant bull nor bear market conditions. This could involve a period of consolidation after a previous bull run, characterized by sideways trading and gradual price increases. This scenario reflects a more conservative prediction, anticipating less volatility. |

| Unexpected | $250,000 | $20,000 | This scenario accounts for unforeseen events that could drastically impact the market, such as a breakthrough technological advancement or a major geopolitical event. This scenario could involve a sudden surge in demand, perhaps due to a previously unknown use case for cryptocurrencies gaining traction. This high degree of volatility makes prediction extremely difficult. |

Predicting the Bitcoin and Ethereum prices for 2025 is a complex task, involving numerous market factors. A key element to consider is Bitcoin’s trajectory, and for insights into that, you might find the analysis from Forbes helpful; check out their predictions at Bitcoin Price Prediction 2025 Forbes. Understanding Bitcoin’s projected value significantly impacts the overall cryptocurrency market forecast, influencing the potential price of Ethereum and other altcoins in 2025.

Predicting the Bitcoin and Ethereum prices for 2025 is a complex task, involving numerous factors influencing their respective trajectories. A key element in this prediction is understanding Bitcoin’s potential, which is directly relevant; to explore this, consider the insightful analysis found at What Price Will Bitcoin Reach In 2025. This understanding then informs a broader prediction for both Bitcoin and Ethereum’s value in 2025, considering their interconnectedness within the crypto market.