Bitcoin Price Prediction 2025

Bitcoin, the world’s first and most well-known cryptocurrency, is notorious for its price volatility. One day it can soar to record highs, the next it can plummet, leaving investors both exhilarated and anxious. This inherent unpredictability, however, fuels a constant fascination with long-term price predictions, with many speculating on where Bitcoin’s value might be in the years to come. Understanding the potential trajectory of Bitcoin’s price is crucial for both investors and those simply curious about the future of this digital asset.

Several factors contribute to Bitcoin’s price fluctuations. These include macroeconomic conditions (like inflation and interest rates), regulatory changes in various jurisdictions, technological advancements within the Bitcoin network itself, the overall sentiment and adoption rate within the cryptocurrency market, and the activities of large institutional investors. Predicting future price movements requires careful consideration of all these intertwined elements, and even then, accuracy remains elusive.

Factors Influencing Bitcoin’s Price in 2025

The price of Bitcoin in 2025 will likely be shaped by a complex interplay of factors. While predicting the future with certainty is impossible, analyzing current trends and potential developments can provide a framework for understanding possible scenarios. For example, widespread adoption by institutional investors could drive significant price increases, mirroring the impact of large-scale investments seen in previous years. Conversely, negative regulatory actions or a major security breach could lead to substantial price drops. Technological advancements, such as the implementation of the Lightning Network for faster and cheaper transactions, could also influence price appreciation by enhancing Bitcoin’s usability. The overall economic climate and investor sentiment will undoubtedly play a pivotal role, as seen with Bitcoin’s correlation with traditional market movements during periods of economic uncertainty.

Potential Price Scenarios for Bitcoin in 2025

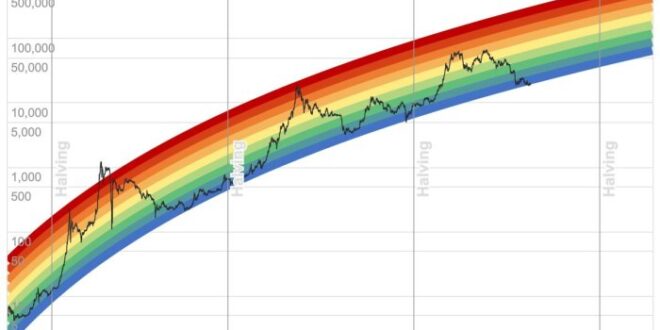

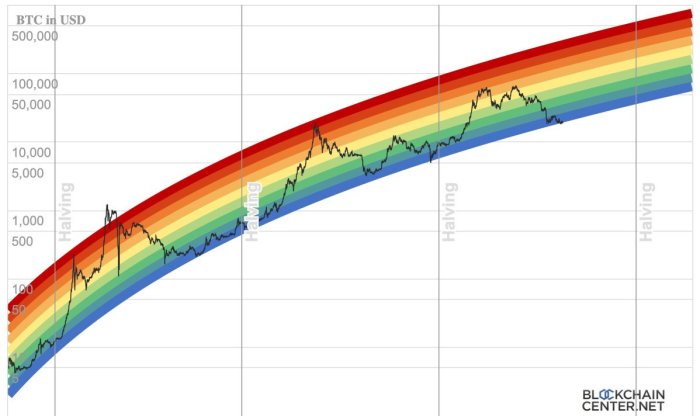

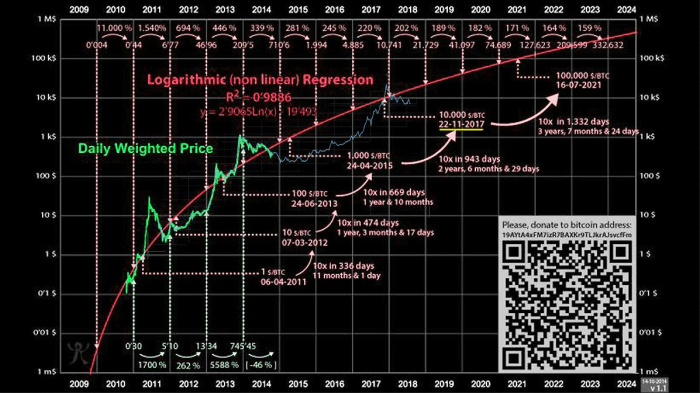

Considering the multifaceted factors at play, several price scenarios for Bitcoin in 2025 are plausible. A bullish scenario, predicated on widespread adoption, positive regulatory developments, and continued institutional investment, could see Bitcoin’s price exceeding $100,000 USD. This would require a continuation of the positive trends observed in previous bull markets, coupled with a significant increase in the overall market capitalization of cryptocurrencies. Conversely, a more bearish scenario, characterized by negative regulatory intervention, a major security flaw, or a prolonged period of economic downturn, could see the price remain below its current levels, perhaps even falling to significantly lower values. A more moderate scenario, assuming a continuation of current trends with some degree of volatility, might place Bitcoin’s price somewhere in the $50,000 – $75,000 USD range. It’s crucial to remember that these are just potential scenarios, and the actual price could fall outside these ranges. Past performance is not indicative of future results. For instance, the price surge to approximately $69,000 in late 2021 followed by a significant correction illustrates the unpredictable nature of Bitcoin’s market.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently complex, relying on a confluence of interconnected factors. While no single element dictates its value, understanding these influences provides a clearer picture of potential price movements. These factors encompass macroeconomic conditions, regulatory landscapes, technological advancements, market sentiment, and the competitive cryptocurrency ecosystem.

Macroeconomic Conditions and Bitcoin’s Value

Global macroeconomic conditions significantly impact Bitcoin’s price. High inflation, for example, can drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, a recessionary environment might lead to risk aversion, causing investors to sell assets like Bitcoin to cover losses in other investments, thereby depressing its price. The strength of the US dollar, a dominant global currency, also plays a role; a stronger dollar generally correlates with a weaker Bitcoin price, as investors may shift towards more stable assets. For instance, the 2022 bear market coincided with rising inflation and interest rates globally, leading to a significant drop in Bitcoin’s value.

Regulatory Changes and Government Policies

Government regulations and policies surrounding cryptocurrencies profoundly influence Bitcoin adoption and, consequently, its price. Favorable regulations, such as clear legal frameworks for cryptocurrency trading and taxation, can boost investor confidence and increase market liquidity, potentially driving up the price. Conversely, restrictive regulations or outright bans can stifle adoption and reduce price. The differing regulatory approaches across various jurisdictions – some embracing Bitcoin, others remaining cautious or hostile – create a complex and dynamic environment. For example, El Salvador’s adoption of Bitcoin as legal tender initially saw a surge in interest, although its long-term impact remains a subject of debate. Conversely, China’s crackdown on cryptocurrency mining led to a significant price drop.

Technological Advancements and Bitcoin’s Usability

Technological advancements within the Bitcoin ecosystem influence its usability and, by extension, its price. Layer-2 scaling solutions, such as the Lightning Network, aim to improve transaction speed and reduce fees, making Bitcoin more practical for everyday use. Successful implementation and widespread adoption of these technologies could lead to increased demand and potentially higher prices. Similarly, advancements in security and privacy enhance Bitcoin’s appeal to a broader range of users. However, the success of these technological improvements depends on their widespread adoption and integration into existing infrastructure.

Market Sentiment and Investor Behavior

Market sentiment and investor behavior are powerful drivers of Bitcoin’s price. Increased institutional adoption, such as large investment firms adding Bitcoin to their portfolios, signals growing confidence and can drive prices upward. Conversely, negative news or a loss of confidence among retail investors can trigger sell-offs and price declines. FOMO (Fear Of Missing Out) and FUD (Fear, Uncertainty, and Doubt) play significant roles in shaping market sentiment and driving price volatility. The 2017 Bitcoin bull run, fueled by significant retail investor interest, serves as a prime example of market sentiment impacting price.

Competing Cryptocurrencies and Bitcoin’s Dominance

The emergence and growth of competing cryptocurrencies influence Bitcoin’s dominance and price. The rise of altcoins, offering alternative functionalities or technologies, can divert investment away from Bitcoin, potentially reducing its market share and price. However, Bitcoin’s first-mover advantage, established brand recognition, and robust security continue to provide a strong foundation. The competitive landscape is dynamic, with the success of altcoins potentially impacting Bitcoin’s dominance but not necessarily eliminating its value. For instance, the rise of Ethereum and its smart contract capabilities attracted significant investment, but Bitcoin has maintained its position as the leading cryptocurrency by market capitalization.

Potential Bitcoin Price Scenarios in 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, relying on numerous interconnected factors. However, by considering various economic and technological trends, we can Artikel three plausible scenarios: bullish, neutral, and bearish. These scenarios are not mutually exclusive and the actual price may fall somewhere between them, or even outside entirely.

Bullish Bitcoin Price Scenario in 2025

This scenario assumes widespread adoption of Bitcoin as a store of value and a medium of exchange, coupled with positive regulatory developments and continued technological advancements. Increased institutional investment, coupled with growing retail interest, fuels significant price appreciation.

| Scenario | Price Range (USD) | Key Factors |

|---|---|---|

| Bullish | $150,000 – $250,000 | Widespread institutional adoption; significant regulatory clarity; increasing global macroeconomic uncertainty driving safe-haven demand; successful layer-2 scaling solutions; positive media coverage and increased public awareness. |

A bullish market would likely be characterized by sustained positive media coverage, increasing institutional investment (think large corporations and financial institutions allocating significant portions of their portfolios to Bitcoin), and a general sentiment of confidence in the cryptocurrency market. This could be fueled by a global economic downturn, driving investors towards Bitcoin as a hedge against inflation and economic instability, similar to the 2020-2021 bull run. Furthermore, advancements in Bitcoin’s scalability and usability, such as the widespread adoption of the Lightning Network, would significantly enhance its functionality and appeal to a broader user base.

Neutral Bitcoin Price Scenario in 2025

This scenario assumes a period of consolidation and sideways trading, with neither significant gains nor substantial losses. This could be due to a balance between positive and negative factors influencing Bitcoin’s price.

| Scenario | Price Range (USD) | Key Factors |

|---|---|---|

| Neutral | $50,000 – $75,000 | Slow and steady institutional adoption; mixed regulatory signals; moderate macroeconomic stability; limited technological breakthroughs; fluctuating media sentiment and public interest. |

A neutral market would be characterized by a lack of major catalysts for significant price movements, either up or down. Regulatory uncertainty could persist, preventing large-scale institutional investments. Technological advancements may be incremental rather than revolutionary, and media coverage could be mixed, neither overwhelmingly positive nor negative. This scenario would likely resemble the periods of sideways trading observed in Bitcoin’s history, following significant price increases or decreases.

Bearish Bitcoin Price Scenario in 2025

This scenario assumes a downturn in the cryptocurrency market due to negative regulatory actions, a major security breach, or a significant loss of investor confidence.

| Scenario | Price Range (USD) | Key Factors |

|---|---|---|

| Bearish | $20,000 – $35,000 | Stringent regulatory crackdowns; major security incidents; significant macroeconomic downturn; lack of technological advancements; negative media coverage and decreased public trust. |

A bearish market could be triggered by several factors. Stringent regulatory actions, such as a complete ban on Bitcoin trading in major economies, could significantly depress its price. A large-scale security breach affecting Bitcoin’s network could also erode investor confidence. Furthermore, a global economic recession could lead investors to liquidate their Bitcoin holdings to cover losses in other assets. Negative media coverage and a general loss of public interest could further exacerbate the decline. This scenario would represent a significant correction from current prices, similar to the 2018 bear market.

Risks and Uncertainties

Predicting Bitcoin’s price in 2025, or any future date, is inherently fraught with risk and uncertainty. Numerous factors, both internal to the cryptocurrency market and external to it, could significantly alter the trajectory of its price. Understanding these risks is crucial for anyone attempting to assess potential future values.

While bullish predictions abound, it’s vital to acknowledge the potential for substantial price drops or even a complete market collapse. The volatility of Bitcoin, a characteristic that has both attracted and repelled investors, remains a significant risk factor. This volatility stems from a combination of technical, regulatory, and market-driven forces.

Security Breaches

The security of cryptocurrency exchanges and individual wallets remains a persistent concern. High-profile hacks and thefts in the past have led to significant losses for investors, and the potential for future breaches could trigger substantial price drops. A large-scale security breach impacting a major exchange, for example, could erode investor confidence and lead to a sell-off, pushing the price down considerably. The Mt. Gox hack in 2014, which resulted in the loss of hundreds of thousands of Bitcoins, serves as a stark reminder of this risk. The impact of such an event on market sentiment could be devastating, potentially triggering a prolonged bear market.

Regulatory Crackdowns

Governments worldwide are still grappling with how to regulate cryptocurrencies. Increased regulatory scrutiny, or even outright bans, in major markets could significantly impact Bitcoin’s price. A sudden change in regulatory landscape, such as the imposition of strict trading restrictions or heavy taxation, could lead to a sharp decline in demand and consequently, price. China’s crackdown on cryptocurrency mining and trading in 2021 provides a clear example of how government action can dramatically affect Bitcoin’s price. The uncertainty surrounding future regulations creates a significant risk for investors.

Market Manipulation

The relatively decentralized nature of the cryptocurrency market makes it susceptible to manipulation. Large holders, or “whales,” can potentially influence the price through coordinated buying or selling activities. This manipulation can create artificial price bubbles or crashes, leading to significant losses for smaller investors. While difficult to definitively prove, instances of suspected market manipulation have occurred in the past, highlighting the vulnerability of the Bitcoin market to such tactics. The lack of stringent oversight and the difficulty in tracing the origins of large transactions contribute to this risk.

Inherent Uncertainties in Long-Term Forecasting

Predicting the price of any asset years into the future is inherently challenging. The cryptocurrency market, in particular, is characterized by its rapid evolution and susceptibility to unforeseen events. Technological advancements, changes in investor sentiment, and macroeconomic factors can all impact Bitcoin’s price in unpredictable ways. Attempts to predict Bitcoin’s price five years out often rely on extrapolating past trends, which may not accurately reflect future developments. The complexity of the factors influencing Bitcoin’s price makes accurate long-term forecasting extremely difficult. For example, the widespread adoption of Bitcoin as a mainstream payment method, while a potential bullish factor, is still far from guaranteed and its timeline is highly uncertain.

Examples of Bitcoin’s Price Volatility

Bitcoin’s history is punctuated by periods of extreme price volatility. The rapid price increases in 2017, followed by a significant correction in 2018, illustrate the unpredictable nature of its price movements. Similarly, the sharp price drop in March 2020, coinciding with the onset of the COVID-19 pandemic, demonstrates the impact of global macroeconomic events. These examples highlight the inherent risk associated with investing in Bitcoin, underscoring the limitations of long-term price predictions. The unpredictable nature of these fluctuations underscores the need for caution and a thorough understanding of the risks involved before investing.

Investment Strategies and Considerations

Investing in Bitcoin, like any other asset class, presents both significant opportunities for profit and substantial risks of loss. The highly volatile nature of Bitcoin necessitates a careful consideration of one’s risk tolerance and financial goals before committing any capital. Understanding various investment strategies and seeking professional advice are crucial steps in navigating this dynamic market.

Bitcoin’s price is notoriously unpredictable, influenced by a multitude of factors including regulatory changes, technological advancements, and market sentiment. Therefore, a well-defined investment strategy is paramount to mitigating potential losses and maximizing potential gains. This involves a thorough understanding of your own financial situation, investment timeline, and risk appetite. It’s essential to remember that past performance is not indicative of future results.

Risk and Reward Assessment in Bitcoin Investment

Bitcoin’s potential for high returns is undeniable, with instances of significant price appreciation over its history. However, this potential is accompanied by equally significant risks. The cryptocurrency market is known for its volatility, experiencing sharp price swings in relatively short periods. This volatility can lead to substantial losses for investors who are not prepared for such fluctuations. Furthermore, the regulatory landscape surrounding cryptocurrencies is still evolving, and changes in regulations could negatively impact Bitcoin’s price. Security risks, such as exchange hacks or wallet compromises, also pose a threat to investors’ funds. A comprehensive understanding of these risks is crucial before making any investment decisions. For example, the Bitcoin price crash of 2022, where the price dropped significantly from its all-time high, serves as a stark reminder of the inherent volatility in the market. Investors need to weigh the potential rewards against these considerable risks.

Long-Term Holding Strategy

This strategy, also known as “hodling,” involves buying Bitcoin and holding it for an extended period, typically several years or even longer. It is best suited for investors with a high risk tolerance and a long-term investment horizon. The underlying assumption is that Bitcoin’s price will appreciate significantly over time, outweighing any short-term fluctuations. This strategy minimizes the impact of short-term volatility and allows investors to potentially benefit from long-term price growth. A real-life example would be an investor who purchased Bitcoin in 2011 and held onto it until 2021, experiencing substantial gains despite periods of significant price drops.

Dollar-Cost Averaging Strategy

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the price. This strategy reduces the risk of investing a large sum of money at a market peak. By consistently investing, investors mitigate the impact of price volatility and average out their purchase price over time. This approach is suitable for investors with a moderate risk tolerance and a medium-to-long-term investment horizon. For example, an investor might choose to invest $100 in Bitcoin every week, regardless of whether the price is rising or falling. This helps to smooth out the impact of price fluctuations.

Importance of Research and Professional Advice

Before investing in Bitcoin or any other cryptocurrency, thorough research is essential. This includes understanding the underlying technology, market dynamics, and potential risks involved. It is highly recommended to seek professional financial advice from a qualified advisor who can assess your individual financial situation, risk tolerance, and investment goals. A financial advisor can help you create a diversified investment portfolio that aligns with your risk profile and overall financial plan, ensuring Bitcoin investments are a suitable component within your broader financial strategy, not the entirety of it. Ignoring this advice can lead to significant financial losses.

Frequently Asked Questions (FAQ): Bitcoin Expected Price 2025 Usd

This section addresses common questions regarding Bitcoin’s price prediction for 2025, acknowledging the inherent uncertainties involved in any such forecast. Remember that cryptocurrency markets are highly volatile, and past performance is not indicative of future results.

Bitcoin’s Most Likely Price in 2025

Predicting Bitcoin’s price in 2025 with certainty is impossible. Various scenarios, ranging from significantly higher to considerably lower prices than the current value, are plausible depending on a multitude of interacting factors. The potential price range discussed earlier highlights this considerable uncertainty. Any specific number would be purely speculative.

Bitcoin as an Investment for 2025

Investing in Bitcoin presents both significant potential rewards and substantial risks. The potential for substantial gains exists, as demonstrated by Bitcoin’s past performance. However, the market is known for its extreme volatility, and significant losses are equally possible. Before investing, thorough due diligence, including understanding your own risk tolerance and seeking professional financial advice, is crucial. Investing only what you can afford to lose is paramount.

Factors Influencing Bitcoin’s Price Increase or Decrease, Bitcoin Expected Price 2025 Usd

Several key factors can significantly impact Bitcoin’s price. Regulatory changes, technological advancements (or setbacks), macroeconomic conditions (like inflation and interest rates), adoption rates by businesses and individuals, and market sentiment all play crucial roles. For example, positive regulatory developments could boost investor confidence and drive prices up, while a major security breach could trigger a sharp decline. The interplay of these factors makes accurate prediction extremely challenging.

Reliable Sources for Bitcoin Price Information

Several reputable sources provide reliable Bitcoin price tracking and market analysis. Major cryptocurrency exchanges (such as Coinbase, Binance, Kraken) display real-time prices. Financial news outlets (like Bloomberg, Reuters, and the Wall Street Journal) offer market analysis and commentary. Specialized cryptocurrency news websites and analytical platforms also provide valuable data and insights. However, it’s crucial to critically evaluate information from any source and compare it across multiple sources to form a balanced perspective.

Bitcoin Expected Price 2025 Usd – Predicting the Bitcoin expected price in 2025 USD is challenging, with various factors influencing its trajectory. To gain further insight into potential price movements, exploring resources like this article on What Will Bitcoin Price Be In 2025 can be beneficial. Ultimately, the Bitcoin expected price in 2025 USD remains speculative, depending on market adoption and technological advancements.

Predicting the Bitcoin expected price in USD for 2025 is challenging, relying heavily on various market factors and technological advancements. To gain further insight into potential price trajectories, exploring resources focused on Bitcoin’s future value is helpful, such as this comprehensive analysis of Bitcoin Coin Price 2025. Ultimately, understanding these projections helps form a more informed perspective on the Bitcoin expected price in 2025 USD.

Predicting the Bitcoin Expected Price 2025 USD is challenging, with various analysts offering widely differing forecasts. A key factor influencing these predictions is the Bitcoin price in December 2025, which will significantly impact the overall yearly average. To gain insight into this crucial month, you might find this resource helpful: Bitcoin Price Dec 2025. Ultimately, the Bitcoin Expected Price 2025 USD will depend on a confluence of market forces and technological advancements.

Predicting the Bitcoin expected price in 2025 USD is challenging, with various analysts offering widely differing forecasts. A key factor influencing these predictions is the potential for a significant bull run, as discussed in this insightful article on the Bitcoin Price 2025 Bull Run. The intensity and duration of such a bull run would directly impact the final Bitcoin price in 2025 USD, making accurate prediction difficult but a fascinating area of speculation.

Predicting the Bitcoin expected price in 2025 USD is challenging, with various factors influencing its trajectory. To gain a broader perspective on long-term Bitcoin value, it’s helpful to consider projections further out, such as those found in analyses of the Bitcoin Price In 2030, for example, Bitcoin Price In 2030. Understanding these longer-term forecasts can provide context for more near-term price estimations, helping to refine expectations for the Bitcoin expected price in 2025 USD.