The Role of Bitcoin’s Underlying Technology in Price Predictions

Bitcoin’s price isn’t solely determined by speculation; its underlying technology, the blockchain, plays a crucial role in shaping investor sentiment and, consequently, its value. Improvements and advancements in this technology directly influence Bitcoin’s scalability, security, and transaction speed, all of which are vital factors impacting its long-term viability and attractiveness to investors. Therefore, analyzing the technological trajectory of Bitcoin is essential for formulating accurate price predictions.

Bitcoin’s blockchain technology is a decentralized, distributed ledger that records all transactions transparently and immutably. This inherent security feature, combined with its cryptographic design, is a major draw for investors seeking a hedge against inflation or traditional financial instability. However, limitations in scalability and transaction speed have historically hampered its wider adoption as a daily payment system. Addressing these limitations through technological advancements is key to unlocking Bitcoin’s full potential and driving future price appreciation.

Bitcoin Scalability Improvements and Their Price Impact

Ongoing development focuses on enhancing Bitcoin’s capacity to handle a larger volume of transactions without compromising speed or security. Solutions like the Lightning Network, a layer-2 scaling solution, allow for faster and cheaper off-chain transactions, significantly reducing congestion on the main blockchain. Successful implementation and widespread adoption of such solutions would alleviate a major current bottleneck, potentially leading to increased usage and, subsequently, a rise in demand and price. For example, if the Lightning Network achieves widespread adoption by 2025, we might see a significant reduction in transaction fees and faster confirmation times, potentially attracting a new wave of users and driving up the price.

Security Enhancements and Investor Confidence

The security of the Bitcoin network is paramount to its long-term success. Continuous research and development are focused on enhancing its resistance to attacks, such as 51% attacks or sophisticated hacking attempts. Increased security translates directly into increased investor confidence. A more secure network is less vulnerable to manipulation or theft, thereby reducing risk and making Bitcoin a more attractive investment. Consider the impact of a major security breach – a significant drop in price would likely follow. Conversely, demonstrably improved security measures would bolster investor confidence and likely lead to price stability or even growth.

Transaction Speed Improvements and Usability, Bitcoin February 2025 Prediction

Faster transaction speeds are crucial for Bitcoin’s wider adoption as a medium of exchange. Current transaction times, while improving, are still relatively slow compared to traditional payment systems. Technological advancements aimed at reducing confirmation times are therefore vital. For example, improvements in block propagation and mining efficiency could significantly decrease transaction finality times, enhancing the user experience and making Bitcoin more practical for everyday use. This increased usability could translate to higher demand and, consequently, a higher price. If transaction times consistently average under 10 seconds by 2025, we might see a substantial increase in its use for micro-transactions and everyday purchases, fueling price growth.

Risk Assessment and Investment Strategies

Investing in Bitcoin, while potentially lucrative, carries significant risks. A thorough understanding of these risks and the implementation of appropriate investment strategies are crucial for navigating the volatile cryptocurrency market and protecting your capital. This section Artikels key risks and offers strategies for mitigating them, catering to different investor profiles.

Key Risks Associated with Bitcoin Investment

Bitcoin’s price is notoriously volatile, experiencing dramatic swings in short periods. This volatility stems from factors such as market sentiment, regulatory changes, and technological developments. Regulatory uncertainty poses another substantial risk, as governments worldwide grapple with how to regulate cryptocurrencies. Different jurisdictions may adopt contrasting approaches, creating legal ambiguity and potentially impacting Bitcoin’s accessibility and value. Security risks are also prevalent; exchange hacks, private key loss, and sophisticated scams can lead to significant financial losses for investors.

Investment Strategies for Bitcoin

The optimal investment strategy depends heavily on an individual’s risk tolerance and financial goals. Conservative investors might opt for a dollar-cost averaging (DCA) approach, investing a fixed amount of money at regular intervals, regardless of price fluctuations. This strategy mitigates the risk of investing a lump sum at a market peak. More aggressive investors might consider leveraging, borrowing funds to amplify potential returns, though this significantly increases risk. A balanced approach could involve a combination of DCA and strategic purchases during market dips, aiming to capitalize on price volatility while managing risk. For example, an investor might allocate a portion of their portfolio to Bitcoin, while maintaining a significant investment in more stable assets like bonds or index funds.

Diversification to Mitigate Risk

Diversification is a cornerstone of risk management in any investment portfolio, and Bitcoin is no exception. Including Bitcoin alongside other asset classes – such as stocks, bonds, real estate, or other cryptocurrencies – can help reduce overall portfolio volatility. For instance, a portfolio heavily weighted in traditional equities might benefit from the inclusion of a small allocation to Bitcoin to potentially enhance returns while diversifying away from correlated risks. This allocation should reflect the investor’s risk tolerance and understanding of Bitcoin’s volatility. A hypothetical example could be an investor allocating 5% of their portfolio to Bitcoin, 60% to stocks, and 35% to bonds, creating a balanced portfolio that minimizes exposure to any single asset’s risk. This diversification helps buffer the impact of potential Bitcoin price drops on the overall portfolio performance.

Risk Mitigation Strategies

- Price Volatility: Employ dollar-cost averaging (DCA) to reduce the impact of price fluctuations.

- Regulatory Uncertainty: Stay informed about regulatory developments and consider diversifying geographically (e.g., using exchanges in different jurisdictions).

- Security Risks: Use secure wallets, enable two-factor authentication, and avoid suspicious websites or offers.

- Exchange Risk: Diversify across multiple reputable exchanges to reduce the impact of a single exchange failure.

Frequently Asked Questions (FAQ): Bitcoin February 2025 Prediction

Predicting the future price of Bitcoin, or any asset for that matter, is inherently speculative. Numerous factors influence its value, making precise predictions impossible. This section addresses common questions surrounding Bitcoin’s price, risks, and investment strategies, providing informed perspectives rather than definitive answers.

Bitcoin’s Price in February 2025

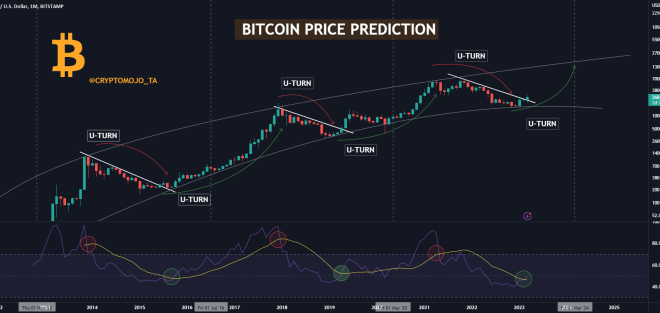

Predicting Bitcoin’s price in February 2025 is challenging due to its volatile nature and the influence of various macroeconomic and technological factors. While some analysts might offer price targets based on technical analysis or market sentiment, these are ultimately educated guesses, not guarantees. For example, a bullish prediction might point to widespread adoption driving prices upwards, potentially exceeding previous all-time highs. Conversely, a bearish scenario could involve regulatory crackdowns or a broader cryptocurrency market downturn, leading to significantly lower prices. Ultimately, the actual price will depend on a complex interplay of factors that are difficult to predict with certainty. Past performance is not indicative of future results.

Risks Involved in Investing in Bitcoin

Investing in Bitcoin carries substantial risks. High volatility is a primary concern; Bitcoin’s price can fluctuate dramatically in short periods, leading to significant gains or losses. Regulatory uncertainty is another major risk, as governments worldwide are still developing frameworks for cryptocurrencies. Changes in regulations could impact Bitcoin’s price and accessibility. Furthermore, the decentralized nature of Bitcoin, while a strength, also means that there is no central authority to protect investors from fraud or loss. Security breaches, hacking incidents, and the loss of private keys can result in the permanent loss of funds. Finally, the overall cryptocurrency market is still relatively young and unproven, making it susceptible to speculative bubbles and sudden crashes.

Alternative Cryptocurrencies with Lower Volatility

While Bitcoin is the most established cryptocurrency, many alternative cryptocurrencies (altcoins) exist, each with varying levels of volatility. Some altcoins aim for stability through mechanisms like algorithmic price stabilization or backing by fiat currencies. However, even these “stablecoins” have experienced periods of significant price fluctuations. Generally, altcoins tend to be more volatile than Bitcoin due to their smaller market capitalization and often less established ecosystems. It’s crucial to conduct thorough research before investing in any altcoin, as the risk of loss can be even higher than with Bitcoin. For instance, while some altcoins might exhibit less volatility than Bitcoin at certain times, their overall price history often demonstrates higher risk and reward characteristics.

Safe Storage of Bitcoin

Safeguarding your Bitcoin requires prioritizing security. Hardware wallets are generally considered the most secure option, as they store your private keys offline, protecting them from online attacks. Reputable cryptocurrency exchanges also offer storage solutions, but these carry inherent risks associated with online security vulnerabilities and the potential for exchange failures. Regardless of the chosen storage method, it’s crucial to practice strong security habits, such as using strong, unique passwords, enabling two-factor authentication, and regularly updating software. The responsibility for securing your Bitcoin ultimately lies with you, and negligence can lead to irreversible loss of funds.

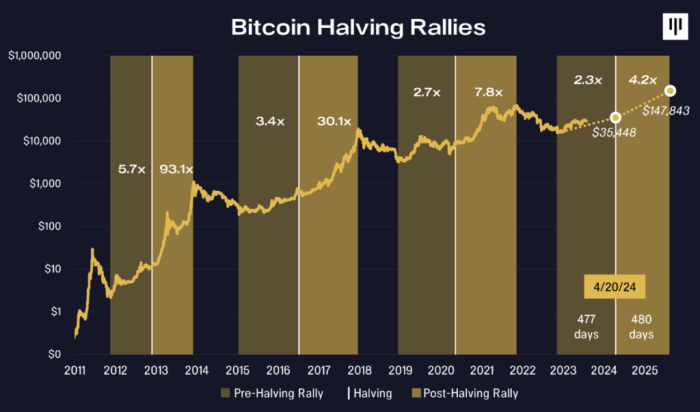

Bitcoin February 2025 Prediction – Predicting Bitcoin’s price in February 2025 is challenging, with various factors influencing its trajectory. A key event to consider when forming such a prediction is the Bitcoin halving, which significantly impacts the rate of new Bitcoin entering circulation. To understand the timing of this crucial event, check out this resource on When Is The Halving Of Bitcoin 2025.

Knowing the halving date allows for a more informed assessment of potential price movements leading up to and following February 2025.

Predicting Bitcoin’s price in February 2025 is challenging, with various factors influencing its trajectory. A key event to consider when forming such a prediction is the Bitcoin halving, which significantly impacts the rate of new Bitcoin entering circulation. To understand the timing of this crucial event, check out this resource on When Is The Halving Of Bitcoin 2025.

Knowing the halving date allows for a more informed assessment of potential price movements leading up to and following February 2025.

Predicting Bitcoin’s price in February 2025 is challenging, with various factors influencing its trajectory. A key event to consider when forming such a prediction is the Bitcoin halving, which significantly impacts the rate of new Bitcoin entering circulation. To understand the timing of this crucial event, check out this resource on When Is The Halving Of Bitcoin 2025.

Knowing the halving date allows for a more informed assessment of potential price movements leading up to and following February 2025.

Predicting Bitcoin’s price in February 2025 is challenging, with various factors influencing its trajectory. A key event to consider when forming such a prediction is the Bitcoin halving, which significantly impacts the rate of new Bitcoin entering circulation. To understand the timing of this crucial event, check out this resource on When Is The Halving Of Bitcoin 2025.

Knowing the halving date allows for a more informed assessment of potential price movements leading up to and following February 2025.

Predicting Bitcoin’s price in February 2025 is challenging, with various factors influencing its trajectory. A key event to consider when forming such a prediction is the Bitcoin halving, which significantly impacts the rate of new Bitcoin entering circulation. To understand the timing of this crucial event, check out this resource on When Is The Halving Of Bitcoin 2025.

Knowing the halving date allows for a more informed assessment of potential price movements leading up to and following February 2025.

Predicting Bitcoin’s price in February 2025 is challenging, with various factors influencing its trajectory. A key event to consider when forming such a prediction is the Bitcoin halving, which significantly impacts the rate of new Bitcoin entering circulation. To understand the timing of this crucial event, check out this resource on When Is The Halving Of Bitcoin 2025.

Knowing the halving date allows for a more informed assessment of potential price movements leading up to and following February 2025.