Bitcoin February 2025 Price Prediction

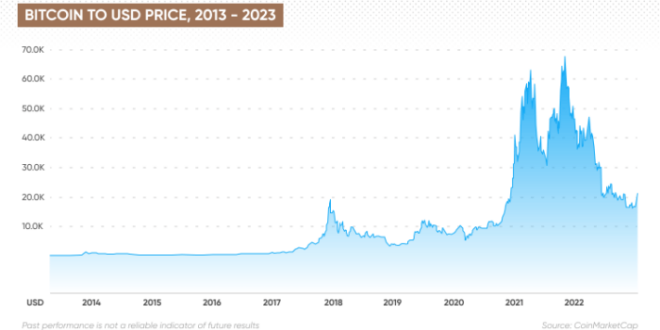

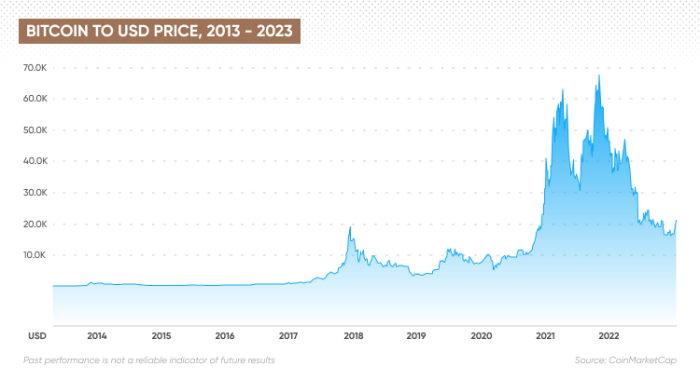

Bitcoin’s price history is a rollercoaster ride of dramatic highs and lows. Since its inception, the cryptocurrency has experienced periods of explosive growth, followed by significant corrections. This volatility is inherent to its nature as a relatively new asset class with a limited track record and high sensitivity to market sentiment. Understanding this volatility is crucial for any attempt at price prediction.

Factors Influencing Bitcoin’s Price are complex and interconnected. Technological advancements, such as the implementation of the Lightning Network for faster and cheaper transactions, can positively influence price by increasing usability and adoption. Conversely, regulatory changes, such as stricter government oversight or outright bans, can negatively impact price. Market sentiment, driven by news events, social media trends, and general economic conditions, plays a dominant role, often causing dramatic short-term price fluctuations. For example, Elon Musk’s tweets have historically shown a significant impact on Bitcoin’s price.

Understanding Price Predictions and Their Limitations

Predicting Bitcoin’s price with certainty is impossible. Numerous factors, many of which are unpredictable, influence its value. While analysts use various models and indicators, including technical analysis based on historical price charts and fundamental analysis based on adoption rates and technological developments, these are merely tools for informed speculation, not guarantees. Past performance is not indicative of future results, and any prediction should be viewed with a healthy dose of skepticism. Consider, for instance, the numerous failed predictions of Bitcoin reaching a specific price point by a particular date. These failures highlight the inherent uncertainty associated with predicting the price of a highly volatile asset. It’s crucial to remember that these predictions are not financial advice and should not be used as the sole basis for investment decisions.

Factors Influencing Bitcoin’s Price in 2025: Bitcoin February 2025 Price Prediction

Predicting Bitcoin’s price in 2025 is inherently complex, involving a confluence of factors that interact in unpredictable ways. While no one can definitively state the price, understanding these key influences offers a clearer perspective on potential price movements. This analysis explores several major factors likely to shape Bitcoin’s value by February 2025.

Bitcoin Halving Events and Price Impact, Bitcoin February 2025 Price Prediction

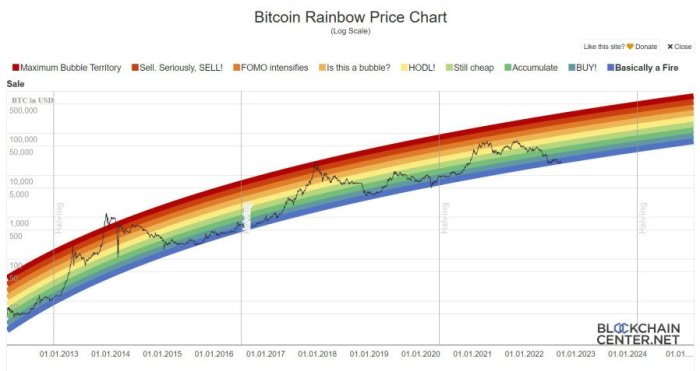

The Bitcoin halving, a programmed reduction in the rate of new Bitcoin creation, is a significant event anticipated to impact price. Historically, halving events have preceded periods of price appreciation. This is attributed to the reduced supply of new Bitcoins entering the market, potentially increasing scarcity and driving up demand. The next halving is expected in 2024, and its impact will likely be felt throughout 2025. While past performance is not indicative of future results, the market often anticipates and reacts to these events well in advance, leading to price speculation and volatility. For example, the halving in 2020 was followed by a significant bull run in 2021. However, macroeconomic conditions and other market forces will significantly influence the actual price movement.

Institutional Adoption and Investment

Increasing institutional adoption of Bitcoin as a store of value and an investment asset plays a crucial role in its price. Major corporations and financial institutions are gradually adding Bitcoin to their balance sheets, indicating a growing level of confidence and acceptance. This institutional investment injects significant capital into the market, influencing price stability and potentially driving further growth. The entry of large players like MicroStrategy and Tesla has already demonstrated the potential impact of institutional adoption on Bitcoin’s price. Continued institutional interest is likely to exert upward pressure on the price.

Macroeconomic Factors and Bitcoin Price Correlation

Macroeconomic factors such as inflation, interest rates, and global economic growth significantly influence Bitcoin’s price. During periods of high inflation, Bitcoin is often viewed as a hedge against inflation, leading to increased demand. Conversely, rising interest rates can reduce the attractiveness of Bitcoin as an investment, potentially leading to price corrections. Global economic uncertainty or recessionary fears may also cause investors to seek safe haven assets, potentially impacting Bitcoin’s price. For example, during periods of high inflation, as seen in 2021-2022, Bitcoin’s price increased, reflecting its role as a potential inflation hedge. However, the correlation is not always straightforward, and other factors often play a more significant role.

Disruptive Technologies and Events

Technological advancements and unforeseen events can significantly disrupt the cryptocurrency landscape and impact Bitcoin’s price. The emergence of competing cryptocurrencies, regulatory changes, or major security breaches could all influence investor sentiment and price volatility. For instance, the development of more energy-efficient consensus mechanisms or breakthroughs in quantum computing could impact Bitcoin’s dominance and its long-term value. Unforeseen geopolitical events, such as significant international conflicts or regulatory crackdowns, can also trigger substantial price fluctuations.

Social Media and Public Perception

Social media plays a significant role in shaping public perception and influencing Bitcoin’s price. Positive or negative sentiment expressed on platforms like Twitter and Reddit can trigger price swings, particularly in the short term. Influencer opinions and news coverage can also significantly impact investor confidence and trading activity. The impact of social media is amplified by the inherent volatility of the cryptocurrency market, making it susceptible to speculative bubbles and rapid price corrections. The influence of Elon Musk’s tweets on Bitcoin’s price serves as a clear example of this effect.

Bitcoin February 2025 Price Prediction – Predicting the Bitcoin price in February 2025 is challenging, heavily influenced by various market factors. A key event impacting this prediction is the date of the next Bitcoin halving, which significantly alters the rate of new Bitcoin entering circulation. To understand this crucial element affecting the February 2025 price, you should check the projected date: Date Of Bitcoin Halving In 2025.

Therefore, considering the halving’s impact is essential for any reasonable Bitcoin February 2025 price prediction.

Predicting Bitcoin’s price in February 2025 requires considering various factors, including market sentiment and technological advancements. To get a broader perspective, it’s helpful to examine longer-term forecasts, such as those found in this comprehensive analysis of the Bitcoin End Of 2025 Price Prediction. Understanding the projected year-end value can provide valuable context for refining our February 2025 prediction, allowing for a more nuanced assessment of potential price fluctuations.

Ultimately, both short-term and long-term predictions are crucial for navigating the volatile Bitcoin market.

Predicting the Bitcoin price in February 2025 is challenging, influenced by various factors including market sentiment and technological advancements. A key event impacting this prediction is the next Bitcoin halving, expected to significantly alter the supply dynamics. For more details on this pivotal event, you can check out this informative resource on the Next Bitcoin Halving 2025.

Understanding the halving’s impact is crucial for any accurate February 2025 Bitcoin price forecast.

Predicting the Bitcoin price in February 2025 is a complex task, influenced by numerous factors. A key element to consider is the upcoming halving event, and a useful resource for tracking this is the Contador Halving Bitcoin 2025 counter. Understanding the halving’s impact on Bitcoin’s supply and potential effect on its value is crucial for any accurate February 2025 price prediction.

Therefore, keeping an eye on the halving countdown is essential for informed speculation.

Predicting the Bitcoin February 2025 price is challenging, given the inherent volatility of the cryptocurrency market. However, understanding the impact of the Bitcoin halving is crucial; this event significantly influences the cryptocurrency ecosystem. To gain further insight into potential market shifts, exploring the relationship between Bitcoin’s halving and altcoin performance is beneficial, such as by reviewing analyses like this one on Solana Price After Bitcoin Halving 2025.

Ultimately, this broader perspective can help refine Bitcoin February 2025 price predictions.

Predicting the Bitcoin price in February 2025 is challenging, but a key factor influencing this is the upcoming Bitcoin halving. To understand the potential impact, it’s crucial to consider the analysis provided by resources like Bitcoin Halving 2025 Prognose , which offers insights into the halving’s effect on scarcity and, consequently, potential price fluctuations. Ultimately, the February 2025 price will depend on various market dynamics in addition to the halving’s influence.