Bitcoin Halving 2025

The Bitcoin halving, a pre-programmed event occurring approximately every four years, reduces the rate at which new Bitcoins are created. This event has historically had a significant impact on Bitcoin’s price and market sentiment, making the 2025 halving a highly anticipated event within the cryptocurrency community. Understanding the historical trends and potential economic factors at play is crucial for navigating this period.

Historical Impact of Previous Halvings

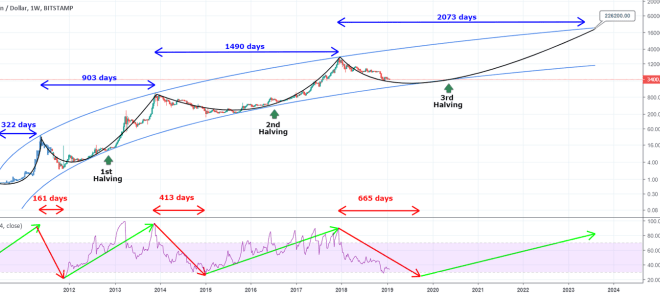

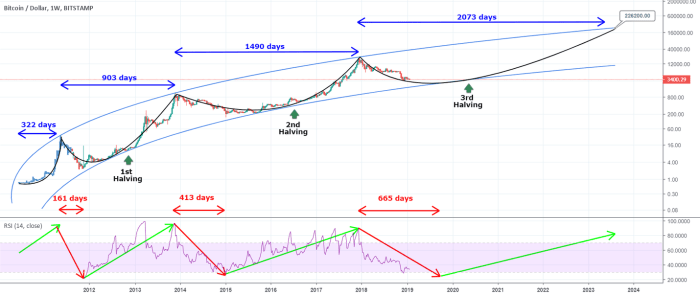

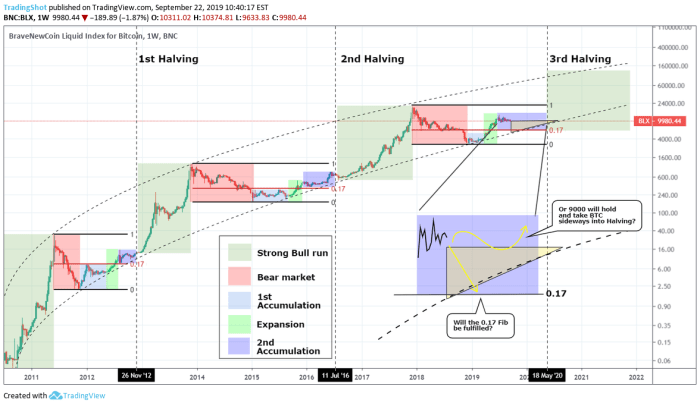

Previous Bitcoin halvings have generally been followed by periods of increased price appreciation. The first halving in 2012 saw Bitcoin’s price rise from approximately $12 to over $1,000 within the following year. Similarly, the 2016 halving preceded a substantial price surge, culminating in a peak of nearly $20,000 in late 2017. The 2020 halving, while not immediately followed by a dramatic price increase, did contribute to a later bull run in 2021, reaching an all-time high above $60,000. However, it’s important to note that other market factors, such as regulatory changes, technological advancements, and macroeconomic conditions, also play a significant role in Bitcoin’s price volatility. The correlation between halvings and price increases is not absolute, but historical data suggests a strong influence.

Economic Factors Influencing the 2025 Halving

Several economic factors could influence the 2025 halving’s effect. Global macroeconomic conditions, including inflation rates and interest rate policies set by central banks, will play a crucial role. The overall state of the global economy, particularly any recessionary pressures, could impact investor appetite for riskier assets like Bitcoin. Furthermore, regulatory developments in major jurisdictions will significantly influence institutional investment and adoption. The increasing adoption of Bitcoin by institutional investors and corporations will likely influence the market’s response to the halving. Finally, the development and adoption of competing cryptocurrencies and blockchain technologies could also impact Bitcoin’s price trajectory.

Potential Price Scenarios Following the 2025 Halving

Predicting the precise price movement of Bitcoin following the 2025 halving is impossible. However, considering historical trends and potential economic factors, several scenarios are plausible. A bullish scenario anticipates a significant price increase following the halving, driven by reduced supply and increased demand. This could be fueled by a combination of factors, including institutional adoption, macroeconomic stability, and positive regulatory developments. Conversely, a bearish scenario might involve a relatively muted price response or even a temporary price decline. This could result from negative macroeconomic conditions, regulatory uncertainty, or a lack of sustained investor interest. A more moderate scenario suggests a gradual price increase over an extended period, reflecting a balance between supply reduction and market sentiment.

Timeline of Key Events Surrounding the 2025 Halving

The period leading up to and following the 2025 halving will be marked by several key events. The months prior to the halving are likely to see increased speculation and volatility as the market anticipates the event. The halving itself will be a significant moment, potentially triggering immediate price fluctuations. The months and years following the halving will likely see a gradual adjustment in the market, influenced by the economic factors mentioned previously. Specific dates for these events are uncertain, but the anticipation and subsequent market reactions will shape the overall narrative.

Comparison of Previous Halvings and Projected Outcomes for 2025

| Year | Price Before Halving (USD) | Price After Halving (USD) (Peak within 1-2 years) | Market Sentiment |

|---|---|---|---|

| 2012 | ~12 | ~1147 | Bullish (Long-term) |

| 2016 | ~650 | ~19783 | Bullish (Short-term intense, followed by correction) |

| 2020 | ~9000 | ~68789 | Bullish (Delayed, but significant long-term impact) |

| 2025 (Projected) | (Variable, depending on market conditions prior to halving) | (Highly variable, dependent on numerous factors, potential range from modest increase to significant bull run) | (Uncertain, influenced by global economic conditions and regulatory landscape) |

Mining and the 2025 Halving

The Bitcoin halving, occurring approximately every four years, is a significant event that dramatically alters the economics of Bitcoin mining. The 2025 halving will reduce the block reward miners receive for validating transactions and adding new blocks to the blockchain, impacting profitability and potentially reshaping the mining landscape. This section explores the multifaceted implications of this event on Bitcoin mining.

Bitcoin Mining Profitability and Hash Rate

The halving directly reduces the Bitcoin reward miners receive per block. This immediately impacts profitability, as miners’ revenue is halved. To maintain profitability, miners must either reduce their operating costs or see the price of Bitcoin increase. If the price of Bitcoin doesn’t rise sufficiently, some miners may become unprofitable and be forced to shut down their operations. This can lead to a decrease in the network’s hash rate – the total computational power dedicated to securing the Bitcoin network. A lower hash rate increases the vulnerability of the network to 51% attacks, although the likelihood of this occurring is still extremely low given the current size of the network. The historical impact of previous halvings has shown a mixed bag: while some halvings have been followed by a price increase that offset reduced rewards, others have led to temporary dips in hash rate before recovering.

Energy Consumption of Bitcoin Mining

The halving’s effect on energy consumption is complex. A decrease in the hash rate, potentially caused by less profitable mining operations, could lead to a reduction in overall energy consumption. However, the long-term impact depends heavily on the price of Bitcoin and the technological advancements adopted by miners. If the price of Bitcoin rises significantly after the halving, the increased profitability might incentivize new miners to enter the market, potentially offsetting any initial reduction in energy use. Furthermore, miners constantly seek more energy-efficient hardware and mining techniques, which could independently reduce energy consumption regardless of the halving. This makes it difficult to predict a precise outcome.

Miner Responses to Reduced Block Rewards

Miners will likely adopt a range of strategies to adapt to the reduced block rewards. These responses might include:

- Cost Optimization: Miners will strive to reduce operational expenses, such as electricity costs, through negotiating better rates with energy providers, exploring renewable energy sources, and improving the efficiency of their mining hardware and cooling systems.

- Hardware Upgrades: Investing in more energy-efficient ASICs (Application-Specific Integrated Circuits) is crucial. The development and adoption of newer, more powerful ASICs can offset the reduced rewards by increasing the efficiency of mining operations.

- Mining Pool Consolidation: Smaller mining pools might merge with larger ones to achieve economies of scale and improve profitability. This reduces operational overhead and increases the collective mining power, potentially leading to a more centralized mining landscape.

- Geographic Relocation: Miners might relocate their operations to regions with lower electricity costs, such as those with abundant hydroelectric or geothermal energy. This requires significant investment but can significantly improve profitability.

Consolidation or Exit of Miners

The halving could trigger a wave of consolidation within the mining industry. Less profitable operations might be forced to shut down, leading to a smaller number of larger, more efficient mining entities. This consolidation might increase the network’s centralization to a certain degree, although this is a continuous process and not necessarily directly tied to the halving itself. The exit of miners will depend on factors like the price of Bitcoin, the cost of electricity, and the efficiency of their mining operations. Historical data from previous halvings can offer some guidance, but the precise extent of miner exits remains uncertain.

Technological Advancements Mitigating Reduced Rewards

Technological innovation plays a crucial role in mitigating the impact of reduced block rewards. Several advancements are likely to influence the mining landscape:

- Improved ASICs: The continuous development of more efficient ASICs will be essential for maintaining profitability. This involves increasing hash rate per unit of energy consumed.

- Renewable Energy Sources: A shift towards renewable energy sources like solar and wind power can reduce electricity costs and enhance the environmental sustainability of Bitcoin mining.

- Immersive Cooling: Techniques like immersion cooling can significantly improve the efficiency of mining hardware by reducing heat dissipation and enabling higher hash rates.

- Advanced Mining Software and Algorithms: Optimizations in mining software and algorithms can improve efficiency and reduce energy consumption.

Investor Sentiment and Market Predictions: Bitcoin Halving 2025

The Bitcoin halving, a predictable event reducing the rate of new Bitcoin creation, historically precedes periods of significant price volatility. Understanding investor behavior and market predictions surrounding the 2025 halving is crucial for navigating the potential opportunities and risks. This analysis will examine investor sentiment, compare it to past halvings, and explore various market prediction models.

Expected Investor Behavior Leading Up To and After the Halving

Leading up to the 2025 halving, we can anticipate increased speculation and price fluctuations. Investors, both retail and institutional, may engage in a period of accumulation, anticipating a price increase post-halving due to the reduced supply of newly mined Bitcoin. This could lead to a gradual price increase in the months preceding the event. Following the halving, the market reaction will be heavily influenced by several factors, including the overall macroeconomic climate, regulatory developments, and the adoption rate of Bitcoin. A positive market response could see a significant price surge, while negative factors could dampen the impact of the halving, leading to a more muted response or even a price decline. The historical precedent suggests a period of volatility, both upward and downward, immediately following the halving event.

Comparison of Current Market Sentiment to Previous Halvings

The current market sentiment surrounding the 2025 halving is complex and differs from previous cycles. While the anticipation of scarcity due to reduced supply remains a bullish factor, the overall crypto market is currently facing regulatory uncertainty and macroeconomic headwinds. Unlike previous halvings, which occurred during periods of relative market stability, the 2025 halving is approaching amidst a more challenging environment. The 2012 and 2016 halvings were followed by significant price increases, though the timing and magnitude varied. The 2020 halving, however, saw a more gradual price increase, influenced by factors such as the COVID-19 pandemic and increased institutional adoption. This illustrates that while the halving is a significant event, other factors play a crucial role in shaping the market’s response.

Potential Risks and Opportunities for Investors

The lead-up to the 2025 halving presents both significant opportunities and risks. Opportunities include the potential for substantial price appreciation if the halving triggers a bull market. However, the market’s reaction is never guaranteed, and risks include a delayed price increase, a prolonged bear market, or significant price volatility leading to losses. Investors should carefully consider their risk tolerance and diversify their portfolios to mitigate potential downsides. The timing of investment is also crucial; entering too early could lead to prolonged periods of low returns, while entering too late could mean missing out on significant gains. A thorough understanding of the market dynamics and a well-defined investment strategy are essential for navigating these potential risks and opportunities.

Role of Institutional Investors in Shaping Market Response, Bitcoin Halving 2025

Institutional investors, such as large corporations and hedge funds, play an increasingly significant role in shaping the Bitcoin market. Their participation can amplify both bullish and bearish trends. In the lead-up to the 2025 halving, their investment strategies will significantly influence price movements. If large institutional players accumulate Bitcoin, it could fuel a price increase. Conversely, a significant sell-off by institutional investors could trigger a price decline. Their actions are often driven by sophisticated market analysis, macroeconomic forecasts, and risk management strategies, which can influence the overall market sentiment and investor behavior. The degree of institutional involvement in Bitcoin will likely play a critical role in determining the magnitude of the price response to the 2025 halving.

Comparative Analysis of Different Market Prediction Models

Various market prediction models exist, each with its own methodology and assumptions. Some models focus on on-chain metrics, such as the supply-demand dynamics, while others incorporate macroeconomic factors, such as inflation rates and interest rates. These models often produce differing predictions, highlighting the inherent uncertainty in forecasting the cryptocurrency market. For example, some models might predict a price surge to $100,000 or more after the halving, while others might suggest a more moderate increase or even a price decline. The accuracy of these models depends on the validity of their underlying assumptions and the accuracy of the data used. It’s crucial to remember that no model can perfectly predict future price movements, and investors should use these predictions as a guide, not as definitive forecasts.

Bitcoin’s Long-Term Implications

The 2025 Bitcoin halving, reducing the rate of new Bitcoin creation by half, presents a pivotal moment with far-reaching consequences for the cryptocurrency’s future. Understanding these long-term implications requires analyzing its impact on scarcity, adoption, and its role within the broader financial landscape.

The halving’s primary impact is on Bitcoin’s scarcity. By reducing the supply inflation, each Bitcoin becomes inherently more valuable due to its limited total supply of 21 million coins. This increased scarcity is expected to exert upward pressure on its price, particularly if demand remains strong or increases. This mechanism is fundamental to Bitcoin’s design as a deflationary asset, intended to act as a hedge against inflation in traditional fiat currencies.

Scarcity and Value

The reduced supply, coupled with anticipated increased demand, could lead to significant price appreciation. Historical data shows a positive correlation between halving events and subsequent price increases, although the magnitude and duration vary. For example, the price surge following the 2016 halving was substantial, but the market dynamics are complex and influenced by many factors beyond the halving itself, including regulatory changes, technological advancements, and macroeconomic conditions. It is crucial to remember that past performance is not indicative of future results. Predicting the exact price movement is impossible, but the halving significantly contributes to the narrative of increasing scarcity and potential value appreciation.

Adoption Rate and Store of Value

The 2025 halving’s impact on Bitcoin adoption is multifaceted. Increased price appreciation could attract new investors seeking high returns, potentially boosting adoption. Conversely, a price correction or prolonged period of sideways movement might dampen enthusiasm. However, the halving itself doesn’t directly drive adoption; it is one factor among many influencing the narrative. Other factors such as regulatory clarity, institutional investment, and ease of use will continue to play a crucial role. The halving’s effect on Bitcoin’s status as a store of value is also linked to price stability. If Bitcoin demonstrates resilience during market downturns, its position as a store of value is strengthened.

Bitcoin’s Role in the Global Financial System

Following the 2025 halving, several scenarios are possible for Bitcoin’s role in the global financial system. One scenario involves increased integration into traditional finance, with more institutional investors and financial institutions adopting Bitcoin as an asset class. Another scenario sees Bitcoin operating as a parallel financial system, facilitating cross-border payments and providing an alternative to traditional banking. A third, less likely scenario might involve Bitcoin’s role diminishing due to competition from newer cryptocurrencies or regulatory crackdowns. The actual outcome will depend on a confluence of factors including technological advancements, regulatory developments, and macroeconomic trends. The 2025 halving is just one piece of the complex puzzle.

Comparison with Previous Events

Comparing the 2025 halving with previous events requires acknowledging the unique context of each halving. The first halving in 2012 occurred during Bitcoin’s early stages, with limited adoption and price volatility. The 2016 halving happened during a period of increasing mainstream awareness and institutional interest. The 2020 halving coincided with a global pandemic and significant economic uncertainty. Each halving presented different market conditions, making direct comparisons challenging. However, the consistent pattern of price increases following each halving suggests a strong correlation, although not necessarily causation.

Visual Representation of Adoption Rates

Imagine a graph showing Bitcoin’s adoption rate over time. The x-axis represents time, and the y-axis represents the number of Bitcoin users or transactions. Three distinct periods are visible: before the first halving, between the first and second halvings, and between the second and third halvings. Each period shows an upward trend in adoption, with a noticeable acceleration after each halving. However, the slope of the curve increases more significantly after the second and third halvings, suggesting that the impact of halvings on adoption might amplify over time. The graph illustrates a clear positive correlation, although other factors also influence the rate of adoption. The graph would also demonstrate periods of volatility in adoption rates, reflecting the influence of market cycles and external factors.

Frequently Asked Questions (FAQ)

This section addresses common queries surrounding Bitcoin halving events, offering clarity on their mechanics, impact, and implications for investors and miners. Understanding these aspects is crucial for navigating the cryptocurrency market effectively.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created and added to the circulating supply. This occurs approximately every four years, halving the block reward paid to miners for verifying transactions and adding new blocks to the blockchain. The initial block reward was 50 BTC, and it has been halved three times already.

Timing of the Next Bitcoin Halving

The next Bitcoin halving is expected to occur in the spring of 2025, around April or May. The precise date depends on the time it takes to mine the blocks, but it will be close to the four-year mark since the previous halving in May 2020.

Bitcoin Halving’s Effect on Price

Historically, Bitcoin’s price has tended to increase in the period leading up to and following a halving. This is largely attributed to the reduced supply of newly mined Bitcoin, potentially increasing scarcity and demand. The 2012 and 2016 halvings were followed by significant price rallies, although the market conditions and other factors always play a role. Predicting the precise impact of the 2025 halving is challenging, as it depends on various market dynamics including regulatory changes, overall economic climate, and adoption rates. It’s important to remember that past performance is not indicative of future results.

Risks and Rewards of Investing Before and After a Halving

Investing in Bitcoin carries inherent risks. Price volatility is a significant factor, and the market can experience substantial price swings regardless of halving events. Investing before a halving involves the risk of a potential price correction even if a long-term price increase is expected. After a halving, there’s the risk that the anticipated price increase may not materialize immediately or to the extent anticipated. However, the potential rewards include significant returns if the price appreciates as it has historically done after previous halvings. Diversification and careful risk management are crucial. One should only invest what they can afford to lose.

Impact of Halving on Bitcoin Miners

The halving significantly impacts Bitcoin miners’ profitability. The reduced block reward means they earn less Bitcoin for each block they successfully mine. This can lead to increased operational costs and reduced profit margins. Some less efficient miners might be forced to shut down their operations, leading to a consolidation of the mining industry. This can potentially lead to a more centralized mining landscape, although technological advancements and improvements in efficiency can offset this impact to some degree. Miners may need to adjust their strategies, potentially focusing on more energy-efficient mining operations or exploring alternative revenue streams.

The Bitcoin Halving in 2025 is anticipated to significantly impact the cryptocurrency market. For those looking to capitalize on the increased interest and volatility surrounding this event, effective advertising is crucial. Consider setting up a robust Google Ads Account to reach potential investors and traders during this period. Properly managing your Google Ads campaign can help you maximize your reach and engagement in the lead-up to and aftermath of the Bitcoin Halving 2025.