Bitcoin Halving 2025

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the reward given to Bitcoin miners for successfully adding new blocks to the blockchain by half. This event, occurring approximately every four years, is a significant factor influencing the supply and demand dynamics of Bitcoin, and consequently, its price. Understanding its mechanics and historical impact is crucial for navigating the cryptocurrency market.

Bitcoin Halving Mechanics and Historical Price Impact

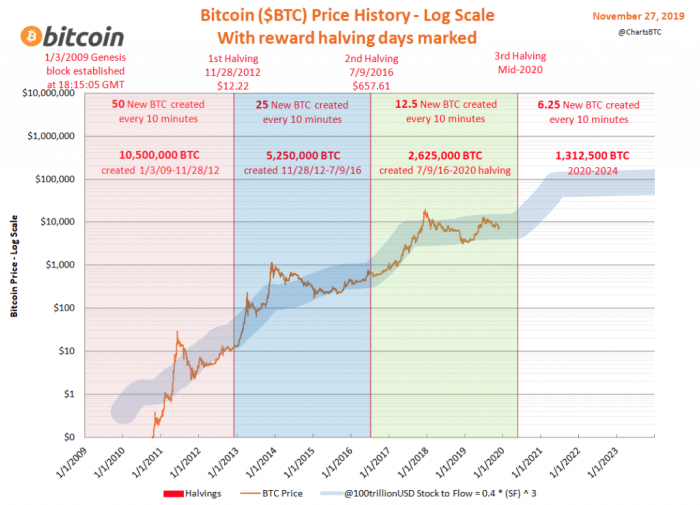

The Bitcoin halving is hardcoded into the Bitcoin protocol. Every 210,000 blocks mined, the reward for miners is halved. This directly impacts the rate at which new Bitcoins enter circulation. Historically, halving events have been followed by periods of increased Bitcoin price, although the timing and magnitude of these price increases vary. This is often attributed to the decreased supply of new Bitcoins coupled with sustained or increased demand. However, it’s important to note that other market factors also play a significant role in Bitcoin’s price movements. The halving itself doesn’t guarantee a price surge; it merely alters a fundamental aspect of the Bitcoin economy.

Expected Reward Reduction in 2025

The 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC per block. This represents a 50% decrease in the rate at which new Bitcoins are added to the circulating supply. This reduction in the rate of inflation is a key feature of Bitcoin’s deflationary monetary policy, designed to mimic the scarcity of precious metals like gold.

Comparison of Previous Halving Events with the Anticipated 2025 Event

While past halvings have shown a general upward trend in Bitcoin’s price following the event, it’s crucial to avoid assuming a direct correlation. The market conditions surrounding each halving are unique. The 2012 halving occurred during Bitcoin’s early stages, with a much smaller market capitalization and less mainstream awareness. The 2016 and 2020 halvings took place in more mature markets with increased regulatory scrutiny and institutional involvement. The 2025 halving will likely occur within a market shaped by evolving regulatory landscapes, macroeconomic conditions, and ongoing technological developments within the cryptocurrency space. Therefore, predicting the exact impact of the 2025 halving requires careful consideration of these diverse factors.

Timeline of Significant Events Leading Up to the 2025 Halving

Predicting precise dates for future events is inherently uncertain, but we can Artikel a likely sequence:

- Increased Mining Difficulty: As the block reward decreases, miners will need to increase their computational power to maintain profitability, leading to a rise in mining difficulty.

- Market Speculation: Anticipation of the halving will likely fuel market speculation, potentially impacting Bitcoin’s price in the months leading up to the event.

- Halving Event: The halving itself will occur at a specific block height, reducing the miner reward.

- Post-Halving Market Dynamics: The period following the halving will be crucial in observing the impact on Bitcoin’s price and overall market sentiment.

Comparison of Key Metrics Across Previous Halvings

| Halving Date | Block Reward Before | Block Reward After | Approximate Bitcoin Price Before (USD) | Approximate Bitcoin Price After (USD) (1 year post-halving) |

|---|---|---|---|---|

| November 2012 | 50 BTC | 25 BTC | $13 | ~$100 |

| July 2016 | 25 BTC | 12.5 BTC | ~$650 | ~$2000 |

| May 2020 | 12.5 BTC | 6.25 BTC | ~$8700 | ~$58000 |

Bitcoin Halving 2025 Calculator

A Bitcoin halving calculator is a valuable tool for anyone interested in understanding the potential impact of Bitcoin’s halving events on its price and the broader cryptocurrency market. These events, which occur approximately every four years, reduce the rate at which new Bitcoins are created, potentially impacting supply and demand dynamics. This calculator allows users to explore various scenarios and make informed predictions, though it’s crucial to remember that these are just projections and not guarantees.

Bitcoin Halving Calculator Functionality

The primary function of a Bitcoin halving calculator is to project the potential price of Bitcoin after a halving event, based on user-specified input parameters. It does this by modeling the interplay between the reduced block reward, changes in mining difficulty, and the anticipated impact on transaction fees. The calculator utilizes established economic principles and historical data to generate these projections. While it cannot predict the future with certainty, it provides a valuable framework for considering various possibilities.

Input Parameters and Their Influence

A typical Bitcoin halving calculator requires several input parameters to generate its projections. These parameters significantly influence the projected Bitcoin price. Let’s examine some key ones:

- Block Reward: This represents the number of Bitcoins awarded to miners for successfully adding a block to the blockchain. The halving event directly impacts this, cutting it in half. For example, if the current block reward is 6.25 BTC, after the halving it becomes 3.125 BTC. This reduction in newly minted coins is a core element influencing scarcity.

- Mining Difficulty: This measures the computational effort required to mine a block. It adjusts automatically to maintain a consistent block generation time (approximately 10 minutes). An increase in mining difficulty implies higher energy costs for miners, which can impact the overall cost of Bitcoin production and potentially influence price.

- Transaction Fees: These are the fees paid by users to include their transactions in a block. While generally a smaller component compared to the block reward, transaction fees can become more significant as network activity increases. Higher transaction fees can contribute to miner profitability, potentially offsetting the reduced block reward.

- Hash Rate: The total computational power dedicated to Bitcoin mining significantly impacts the mining difficulty and the overall security of the network. A higher hash rate generally translates to a more secure network and potentially higher mining difficulty.

The interplay of these parameters is complex. For instance, a higher hash rate might lead to increased mining difficulty, necessitating higher transaction fees or a higher Bitcoin price to maintain miner profitability after the halving. Conversely, a decrease in hash rate could lead to a lower mining difficulty, potentially impacting the price differently.

Using a Bitcoin Halving Calculator: A Step-by-Step Guide

Using a Bitcoin halving calculator is generally straightforward. Most calculators will have fields for inputting the aforementioned parameters.

- Identify a reputable calculator: Search online for a Bitcoin halving calculator from a trusted source. Consider the calculator’s reputation and the transparency of its methodology.

- Input current parameters: Enter the current values for the block reward, mining difficulty, and estimated transaction fees. These values can be found on various blockchain explorers.

- Adjust parameters (optional): Explore different scenarios by modifying the input parameters. For example, you might explore the impact of a significant increase or decrease in the hash rate on the projected price.

- Review the projections: The calculator will generate projections for the Bitcoin price after the halving, potentially showing various price scenarios based on your inputs.

Interpreting the Output and Limitations

The output of a Bitcoin halving calculator provides potential price projections, but it’s crucial to understand its limitations. These projections are based on models and assumptions, and the actual price may differ significantly. Factors not included in the model, such as unforeseen regulatory changes, major technological advancements, or significant shifts in market sentiment, could drastically alter the outcome. Therefore, it’s vital to treat these projections as potential scenarios, not definitive predictions. For example, a calculator might project a price of $100,000 based on certain assumptions, but the actual price could be significantly higher or lower due to unpredictable market forces. The calculator provides a framework for analysis, not a crystal ball.

Factors Influencing Bitcoin Price Post-Halving

Predicting Bitcoin’s price after the 2025 halving is inherently complex, involving a confluence of macroeconomic conditions, regulatory landscapes, and market dynamics. While the halving itself reduces the rate of new Bitcoin entering circulation, its impact on price is mediated by a range of other significant factors.

Macroeconomic Factors

Macroeconomic conditions significantly influence Bitcoin’s price. Global inflation rates, interest rate adjustments by central banks, and overall economic growth or recession all play a role. For example, during periods of high inflation, investors may seek alternative stores of value, potentially driving demand for Bitcoin. Conversely, rising interest rates can make holding non-yielding assets like Bitcoin less attractive, potentially leading to price declines. The strength of the US dollar, a global reserve currency, also impacts Bitcoin’s price, often inversely. A strengthening dollar tends to negatively correlate with Bitcoin’s value, while a weakening dollar may have the opposite effect.

Regulatory Changes

Regulatory clarity and changes in governmental policies concerning cryptocurrencies profoundly affect Bitcoin’s price. Increased regulatory scrutiny, such as stricter KYC/AML requirements or outright bans, can negatively impact investor confidence and liquidity, potentially depressing prices. Conversely, clear and supportive regulations can foster institutional investment and broader adoption, potentially driving price increases. The example of El Salvador’s adoption of Bitcoin as legal tender, despite initial volatility, demonstrates the potential impact of government policies, though this is a singular and potentially not broadly representative case.

Supply and Demand Dynamics

The halving directly impacts Bitcoin’s supply, reducing the rate of new coin issuance. This decreased supply, in theory, should exert upward pressure on the price, provided demand remains relatively constant or increases. However, demand is equally, if not more, crucial. Increased adoption by institutional investors, retail investors, and businesses, coupled with a reduction in selling pressure, is necessary for the halving to translate into significant price appreciation. Conversely, a decrease in demand, or a surge in selling, could negate the impact of the reduced supply.

Investor Sentiment and Market Speculation

Investor sentiment and market speculation are powerful drivers of short-term price volatility. News events, social media trends, and pronouncements by influential figures can trigger significant price swings, irrespective of underlying fundamentals. For example, positive news regarding Bitcoin adoption or technological advancements can generate excitement and buying pressure, pushing prices higher. Conversely, negative news, such as a major exchange hack or regulatory crackdown, can trigger fear and selling, leading to price declines. This demonstrates the significant influence of narratives and expectations on Bitcoin’s price.

Hierarchical Structure of Influencing Factors

- Macroeconomic Conditions: These factors represent the broadest context and exert a fundamental influence on Bitcoin’s price, affecting investor risk appetite and capital flows.

- Regulatory Changes: Government policies and regulations significantly impact investor confidence and market participation, creating both opportunities and risks.

- Supply and Demand Dynamics: The halving directly affects supply, but demand is the crucial factor determining the ultimate price impact. This factor directly interacts with the others.

- Investor Sentiment and Market Speculation: These factors create short-term volatility and amplify or dampen the effects of the other factors.

Predicting Bitcoin’s Price After the 2025 Halving

Predicting the price of Bitcoin after a halving event is notoriously difficult, yet many attempt it. Various methods are employed, each with its own strengths and weaknesses, and the inherent volatility of the cryptocurrency market makes accurate prediction extremely challenging. Understanding these methods and their limitations is crucial for interpreting any price forecast.

Forecasting Models Used to Predict Bitcoin’s Price

Several models attempt to predict Bitcoin’s price following a halving. These range from simple extrapolations of historical price movements to more complex econometric models incorporating factors like supply and demand, network growth, and macroeconomic conditions. Stock-to-flow models, for example, are popular but often criticized for their simplicity and lack of consideration for external factors. Other models incorporate machine learning algorithms, attempting to identify patterns in historical data to predict future price movements. However, even the most sophisticated models struggle to account for the unpredictable nature of the cryptocurrency market.

Examples of Past Price Predictions and Their Accuracy

Numerous predictions were made before previous Bitcoin halvings. For example, some analysts predicted significant price increases after the 2016 and 2020 halvings, based on the stock-to-flow model and historical trends. While these halvings were followed by periods of price appreciation, the magnitude and timing of these increases varied significantly from the predictions. The accuracy of these predictions was therefore mixed, with some predictions being wildly off the mark in terms of timing and price. The unpredictable nature of regulatory changes, market sentiment, and technological advancements all contributed to the inaccuracies.

Strengths and Weaknesses of Forecasting Methods

Stock-to-flow models, while simple and intuitive, often fail to account for unforeseen market events or changes in investor sentiment. Their strength lies in their simplicity and the apparent correlation between Bitcoin’s supply and its price historically. However, their weakness lies in their inflexibility and inability to incorporate external variables. Econometric models, on the other hand, can incorporate more factors but are often complex and require extensive data, making them prone to errors in data interpretation and model specification. Machine learning models can identify complex patterns but require large datasets and are susceptible to overfitting and may not generalize well to future, unseen data.

Challenges and Uncertainties in Predicting Bitcoin’s Price

Predicting Bitcoin’s price is inherently uncertain. The market is influenced by numerous factors, including regulatory changes, technological developments, macroeconomic conditions, investor sentiment, and unforeseen events (like the FTX collapse). These factors are often interconnected and difficult to quantify, making accurate prediction extremely challenging. Furthermore, the relatively short history of Bitcoin makes it difficult to establish reliable long-term trends. The lack of historical data and the high volatility inherent in the cryptocurrency market further amplify the challenges of accurate price prediction.

Summary of Bitcoin Price Predictions

| Source | Prediction (USD) | Date of Prediction | Accuracy (as of October 26, 2023) |

|---|---|---|---|

| Source A (Example) | $100,000 | October 2023 | To be determined |

| Source B (Example) | $50,000 | September 2023 | To be determined |

| Source C (Example) | $150,000 | August 2023 | To be determined |

| Source D (Example) | $75,000 | July 2023 | To be determined |

Risks and Opportunities Associated with Bitcoin Halving: Bitcoin Halving 2025 Calculator

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, presents both significant risks and compelling opportunities for investors. Understanding these aspects is crucial for making informed decisions, particularly given the inherent volatility of the cryptocurrency market. The impact of a halving isn’t guaranteed to be positive, and various factors influence the resulting price movements.

Potential Risks Associated with Bitcoin Halving

Investing in Bitcoin, regardless of the halving cycle, carries inherent risks. The price volatility is a primary concern, and this volatility can be amplified before and after a halving event due to heightened market speculation. A significant risk is the possibility of a price correction following the initial price surge often seen after a halving. This correction can be sharp and substantial, leading to significant losses for investors who entered the market at peak prices. Another key risk is the potential for regulatory changes or unforeseen technological developments to negatively impact Bitcoin’s price, regardless of the halving. Finally, the macroeconomic environment plays a crucial role; global economic downturns can negatively affect the entire cryptocurrency market, including Bitcoin.

Opportunities Presented by Bitcoin Halving for Long-Term Investors

Historically, Bitcoin’s price has tended to increase in the period following a halving. This is largely attributed to the reduced supply of new Bitcoins entering the market, creating a potential scenario of increased scarcity and potentially higher demand. For long-term investors with a high risk tolerance and a long time horizon, this presents a compelling opportunity to accumulate Bitcoin at potentially lower prices before the anticipated price increase. The halving acts as a predictable, albeit not guaranteed, catalyst for price appreciation over the longer term. Successful long-term investors often focus on riding out short-term volatility to benefit from the potential long-term growth.

Risk Profiles of Different Investment Strategies

Different investment strategies carry varying levels of risk. For example, a strategy of buying Bitcoin before the halving and holding it for an extended period (e.g., several years) involves higher risk during the initial period but potentially higher reward in the long run. Conversely, a strategy of buying after the halving and holding for a shorter period is likely to involve less initial risk but potentially lower overall returns. Dollar-cost averaging (DCA), a strategy involving regular purchases regardless of price fluctuations, mitigates some risk but may result in lower potential returns compared to buying at a lower price point. Finally, highly leveraged trading strategies amplify both risk and potential reward, making them unsuitable for risk-averse investors.

Importance of Diversification in a Bitcoin Investment Portfolio

Diversification is paramount in any investment portfolio, and Bitcoin is no exception. Allocating a portion of your investment portfolio to Bitcoin should be considered within the context of a broader strategy. Diversification can include investments in other cryptocurrencies, traditional assets like stocks and bonds, and even real estate. This reduces the overall risk of significant losses should the Bitcoin market underperform. The optimal level of diversification depends on individual risk tolerance and financial goals. For example, a younger investor with a longer time horizon might tolerate a higher allocation to Bitcoin than an older investor closer to retirement.

Risks and Opportunities Summary

| Aspect | Risk | Opportunity | Mitigation Strategy |

|---|---|---|---|

| Price Volatility | Sharp price corrections before and after halving. | Potential for significant price appreciation post-halving. | Dollar-cost averaging, long-term holding, diversification. |

| Regulatory Uncertainty | Changes in regulations could negatively impact Bitcoin’s price. | Positive regulatory developments could boost Bitcoin’s adoption and price. | Stay informed about regulatory developments, diversify investments. |

| Market Sentiment | Negative market sentiment could lead to price drops. | Positive market sentiment can amplify price increases post-halving. | Avoid emotional decision-making, focus on long-term prospects. |

| Technological Risks | Unforeseen technological issues could affect Bitcoin’s functionality. | Technological advancements could improve Bitcoin’s scalability and efficiency. | Research and understand the technology, diversify investments. |

Bitcoin Halving 2025 Calculator FAQs

This section addresses frequently asked questions regarding the Bitcoin halving event of 2025 and its potential impact on Bitcoin’s price. Understanding these aspects is crucial for anyone considering investment strategies related to this significant event in the cryptocurrency market.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by 50%. This occurs approximately every four years, or every 210,000 blocks mined. The halving mechanism is designed to control inflation and maintain the scarcity of Bitcoin over time. The first halving occurred in 2012, the second in 2016, and the third in 2020. The next is anticipated in 2025.

Impact of a Bitcoin Halving on Price, Bitcoin Halving 2025 Calculator

Historically, Bitcoin halvings have been followed by periods of significant price appreciation. This is primarily attributed to the reduced supply of newly mined Bitcoin, potentially increasing demand and driving up the price. However, it’s crucial to remember that other factors significantly influence Bitcoin’s price, such as market sentiment, regulatory changes, and overall macroeconomic conditions. The price increase after a halving is not guaranteed and is not always immediate. For example, the 2020 halving was followed by a period of price consolidation before a significant bull run in 2021.

Accuracy of Bitcoin Halving Price Predictions

Predicting Bitcoin’s price after a halving is inherently speculative. While historical data suggests a correlation between halvings and subsequent price increases, numerous other variables impact the market. No model can accurately predict future price movements with certainty. Many analysts use on-chain metrics, such as the miner’s revenue, the difficulty adjustment, and the circulating supply, to inform their predictions. However, these are just indicators and not definitive predictors of future price action. It is important to approach all predictions with a healthy dose of skepticism.

Risks of Investing in Bitcoin Before a Halving

Investing in Bitcoin before a halving carries inherent risks. While historical data suggests potential for future price appreciation, there is no guarantee. The price could decline before, during, or after the halving event due to various market factors. Furthermore, the cryptocurrency market is highly volatile, and significant price swings are common. Investors should be prepared for potential losses and only invest what they can afford to lose. Diversification across different asset classes is also a prudent risk management strategy.

Locating a Reliable Bitcoin Halving Calculator

Several online resources provide Bitcoin halving calculators. However, it’s important to choose reputable sources that use transparent and verifiable methodologies. These calculators typically estimate the future block reward and the overall supply of Bitcoin based on the halving schedule. While these calculators can provide helpful insights, remember they are based on assumptions and may not accurately reflect real-world market dynamics. Always critically evaluate the source and methodology of any calculator before relying on its predictions.

Illustrative Examples of Halving Impact

The Bitcoin halving, a programmed reduction in the rate of new Bitcoin creation, has historically been followed by periods of price volatility. However, the extent of this impact varies significantly depending on a confluence of macroeconomic factors, market sentiment, and technological developments. The following examples illustrate scenarios where the halving’s effect ranges from dramatically bullish to relatively muted.

Scenario: Significant Price Increase Post-Halving

In this scenario, the 2025 halving triggers a substantial price surge. Several factors contribute to this outcome. Firstly, a robust macroeconomic environment, characterized by low inflation and stable global markets, provides a favorable backdrop for risk-on investment strategies. Secondly, widespread institutional adoption continues, with major financial institutions increasing their Bitcoin holdings and integrating it into their investment portfolios. This increased demand significantly outpaces the reduced supply created by the halving. Thirdly, positive regulatory developments globally increase investor confidence and attract new capital into the cryptocurrency market. Finally, a narrative of scarcity, fueled by the halving and growing awareness of Bitcoin’s limited supply of 21 million coins, further boosts demand and price. This combination of factors leads to a significant price appreciation, potentially exceeding previous post-halving price increases. The resulting price trajectory could resemble the sharp uptrend observed after the 2016 and 2020 halvings, though the magnitude is inherently unpredictable.

Scenario: Less Pronounced Price Impact Post-Halving

Conversely, the 2025 halving could have a less pronounced impact on Bitcoin’s price. This scenario unfolds under different circumstances. A global recession or significant geopolitical instability could dampen investor appetite for risk assets, including Bitcoin. Regulatory uncertainty or negative regulatory actions in major markets could also suppress price appreciation. Furthermore, the emergence of competing cryptocurrencies or innovative blockchain technologies might divert investment away from Bitcoin. Finally, a lack of significant institutional adoption or a continued bearish market sentiment could prevent the halving’s supply-side effect from significantly influencing price. In this case, the price might experience a temporary surge immediately following the halving but subsequently consolidate or even decline, mirroring a less dramatic post-halving period.

Hypothetical Investor Portfolio Strategy

Consider a hypothetical investor, Alice, with a diversified portfolio including Bitcoin, traditional stocks, and bonds. Before the 2025 halving, Alice holds 20% of her portfolio in Bitcoin, reflecting a moderate risk tolerance. Based on her assessment of the macroeconomic environment and market sentiment, she decides to increase her Bitcoin allocation to 30% in anticipation of a potential price increase post-halving. This decision involves a calculated risk, acknowledging the possibility of price declines. If the halving leads to a significant price surge as described in the first scenario, Alice would experience substantial gains on her Bitcoin holdings. Conversely, if the halving has a less pronounced impact as in the second scenario, her gains might be modest or she might even incur a loss, but her overall portfolio diversification would limit the impact. Her strategy highlights the importance of careful risk management and portfolio diversification in navigating the volatility associated with Bitcoin and the halving event.

Projected Bitcoin Price Trajectory

The following table illustrates projected Bitcoin price trajectories under three scenarios: a bullish scenario (significant price increase), a neutral scenario (moderate price increase), and a bearish scenario (limited price increase or price decline). These are hypothetical examples and do not constitute financial advice.

Scenario 6 Months Pre-Halving Immediately Post-Halving 12 Months Post-Halving 24 Months Post-Halving Bullish $30,000 $40,000 $60,000 $100,000 Neutral $30,000 $35,000 $40,000 $50,000 Bearish $30,000 $32,000 $28,000 $25,000