Bitcoin Halving 2025

The Bitcoin halving, a pre-programmed event in the Bitcoin protocol, is anticipated to occur in early 2025. This event significantly impacts Bitcoin’s monetary policy by reducing the rate at which new Bitcoins are created. Understanding its mechanics and historical precedents is crucial for navigating the potential market volatility surrounding this event.

Bitcoin Halving Mechanics and Historical Impact

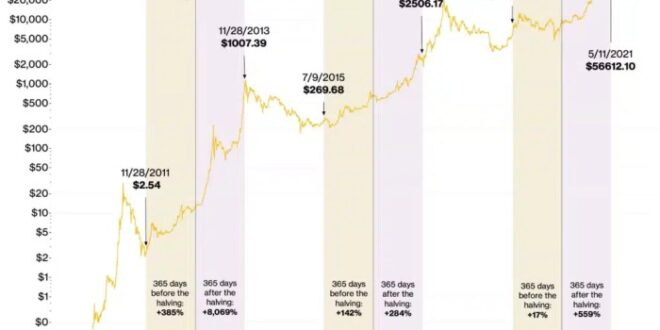

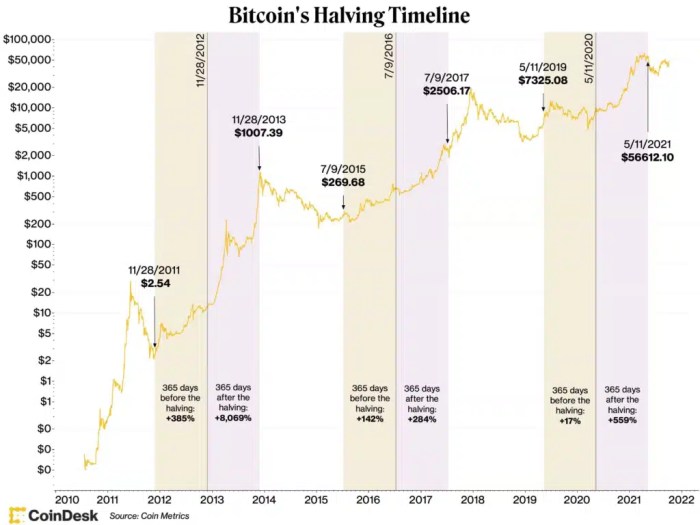

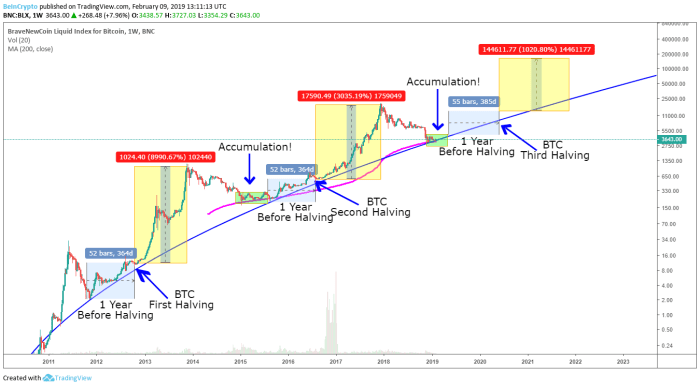

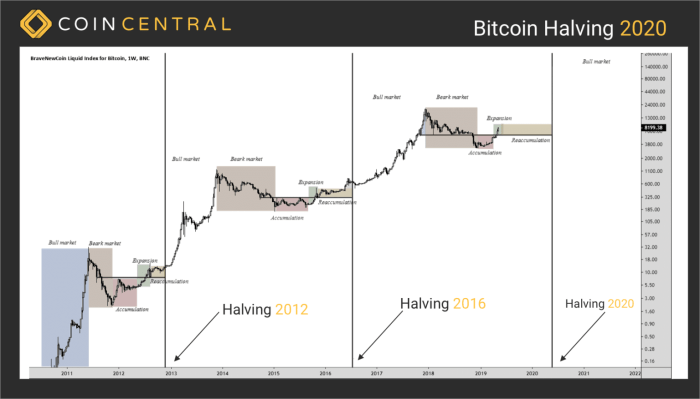

The Bitcoin halving mechanism reduces the reward miners receive for validating transactions and adding new blocks to the blockchain by half. This occurs approximately every four years, or every 210,000 blocks mined. Historically, halvings have been followed by periods of increased Bitcoin price, although the timing and magnitude of these price increases have varied. The first halving in 2012 saw a relatively gradual price increase. The second halving in 2016 preceded a significant bull market. The third halving in 2020 was followed by a substantial price surge, though this was also influenced by other macroeconomic factors. These past events demonstrate a correlation, not a guaranteed causation, between halvings and price appreciation. The underlying mechanism is the reduction in Bitcoin supply, which, in a context of increasing demand, can lead to price increases due to basic economic principles of supply and demand.

Anticipated Effects on Supply and Demand in 2025

The 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC. This reduction in the rate of new Bitcoin creation will inherently decrease the inflation rate of the Bitcoin network. Assuming demand remains consistent or increases, this reduced supply coupled with potentially increased demand could drive the price upward. However, it’s crucial to remember that market dynamics are complex and influenced by numerous factors beyond just the halving itself. For example, increased adoption, regulatory changes, and macroeconomic conditions can significantly impact the price regardless of the halving.

Factors Influencing Bitcoin Price Before, During, and After the 2025 Halving

Several factors will play a role in shaping Bitcoin’s price trajectory surrounding the 2025 halving. Before the halving, anticipation and speculation could lead to price increases. During the halving, the actual event itself might cause temporary volatility. After the halving, the reduced supply could contribute to price appreciation, but this effect could be dampened or amplified by other market forces. These factors include macroeconomic conditions (like inflation and recessionary fears), regulatory developments, technological advancements in the Bitcoin ecosystem, and overall investor sentiment and market psychology. The interplay of these factors makes precise prediction extremely challenging. The 2020 halving, for instance, saw a price surge, but this was intertwined with broader trends in the cryptocurrency market and global financial landscape.

Comparison of Past Halvings and Projected Impact of the 2025 Halving

While past halvings offer valuable insights, it’s crucial to avoid direct comparisons. The cryptocurrency market in 2025 will likely differ significantly from previous halving cycles. The market’s maturity, regulatory landscape, and overall adoption rate have evolved considerably. Therefore, while a price increase after the 2025 halving is a plausible scenario, its magnitude and timing remain uncertain. The 2012 halving saw a more gradual price increase compared to the sharper rises following the 2016 and 2020 halvings. This highlights the unpredictable nature of the market’s response.

Timeline of Key Events Leading Up To and Following the 2025 Halving

The following timeline illustrates key events anticipated surrounding the 2025 halving, though it is inherently speculative:

Bitcoin Halving 2025 Dates – Pre-Halving (2023-Early 2025): Increasing anticipation and speculation, potential price increases driven by market sentiment.

Predicting Bitcoin Halving 2025 dates requires careful analysis of block generation times. To gain further insight into the precise timing, a useful resource is the Spanish-language site detailing the Fecha Halving Bitcoin 2025 , which provides valuable data. Understanding these dates is crucial for anticipating potential market shifts associated with the Bitcoin Halving 2025 event.

Halving Event (Early 2025): The actual block reward reduction occurs. Potential short-term volatility.

Speculation surrounds the precise Bitcoin Halving 2025 dates, with various predictions circulating. Pinpointing the exact moment requires careful consideration of block times and mining difficulty adjustments. To clarify any confusion about past halvings, you might find this resource helpful: When Was The Bitcoin Halving In 2025. Understanding past events provides valuable context for anticipating future Bitcoin Halving 2025 dates and their potential market impact.

Post-Halving (Mid-2025 Onwards): Reduced supply potentially leads to price appreciation, but this effect is intertwined with other market factors. The long-term price trajectory depends on multiple variables.

Predicting the precise Bitcoin Halving 2025 Dates requires careful consideration of block times. To find out more about the specific date, you can check a reliable resource like this one: What Date Is The Bitcoin Halving 2025. Ultimately, the Bitcoin Halving 2025 Dates will significantly impact the cryptocurrency market, influencing miner profitability and potentially the price of Bitcoin itself.

Predicting Bitcoin’s Price After the 2025 Halving: Bitcoin Halving 2025 Dates

Predicting the price of Bitcoin after any halving event is inherently challenging, given the volatile nature of the cryptocurrency market and the influence of numerous unpredictable factors. While historical patterns offer some insights, they are not definitive predictors of future performance. This analysis will explore various methods used to forecast Bitcoin’s price following the 2025 halving, highlighting their limitations and considering the impact of external forces.

Historical Price Movements Following Previous Halvings

Analyzing the price movements of Bitcoin following the 2012 and 2016 halvings reveals a general trend of price increases in the periods following these events. However, the timing and magnitude of these increases varied significantly. The 2012 halving was followed by a gradual price increase over several years, while the 2016 halving resulted in a more rapid and substantial price surge, peaking in late 2017. It’s crucial to remember that other factors, such as increased adoption, regulatory changes, and market sentiment, also played a role in these price movements, making it difficult to isolate the halving’s sole impact.

Price Prediction Models and Their Limitations

Several models attempt to predict Bitcoin’s price, including stock-to-flow models, on-chain analysis, and technical analysis. Stock-to-flow models, for example, focus on the relationship between Bitcoin’s supply and demand, suggesting a price increase based on scarcity. However, these models often fail to account for unforeseen market events or shifts in investor sentiment. On-chain analysis examines data from the Bitcoin blockchain to identify trends and patterns, but interpreting this data requires significant expertise and doesn’t guarantee accurate predictions. Technical analysis relies on chart patterns and indicators, but its effectiveness is debated, and past performance doesn’t predict future results. All these models have limitations and should be viewed with caution.

Impact of Macroeconomic Factors

Macroeconomic factors, such as inflation, interest rates, and global economic growth, significantly influence Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against inflation, increasing its demand and price. Conversely, rising interest rates can make holding Bitcoin less attractive compared to traditional investments, potentially leading to price declines. Geopolitical events and regulatory changes also play a crucial role, impacting investor confidence and market liquidity. The 2025 halving’s impact will be intertwined with the prevailing macroeconomic environment.

Expert Opinions and Predictions

Various experts offer diverse predictions for Bitcoin’s price after the 2025 halving, ranging from conservative estimates to extremely bullish forecasts. Some analysts predict a modest price increase, while others anticipate a much more significant surge, potentially reaching six-figure prices. These differing opinions reflect the inherent uncertainty surrounding Bitcoin’s future and the diverse methodologies used for forecasting. It’s important to consider the underlying assumptions and biases of each prediction.

Summary of Price Predictions

| Analyst/Model | Price Prediction (USD) | Timeframe | Underlying Assumptions |

|---|---|---|---|

| Analyst A (Stock-to-Flow) | $150,000 | 2025-2026 | Continued institutional adoption, limited supply |

| Analyst B (On-Chain Analysis) | $100,000 – $120,000 | 2026 | Strong network growth, increasing transaction volume |

| Analyst C (Technical Analysis) | $75,000 | 2025 | Based on historical price patterns and chart indicators |

| Conservative Estimate | $50,000 – $70,000 | 2026 | Considering potential market corrections and macroeconomic uncertainty |

The Impact of the 2025 Halving on Bitcoin Mining

The Bitcoin halving event of 2025, scheduled for approximately April 2025, will significantly impact the Bitcoin mining industry. This reduction in block rewards, from 6.25 BTC to 3.125 BTC, will directly affect miners’ profitability and necessitate strategic adaptations to maintain operational viability. The consequences will ripple through the network, potentially influencing its energy consumption and degree of centralization.

The halving’s primary effect is a reduction in the revenue generated per block mined. This immediately lowers the profitability of mining operations, particularly for those operating with less efficient hardware or higher energy costs. Miners will need to adjust their strategies to compensate for this decreased income stream. The magnitude of this impact will depend on several factors including the price of Bitcoin, the cost of electricity, and the efficiency of mining hardware. For example, a miner operating with older ASICs (Application-Specific Integrated Circuits) and paying high electricity prices might find their operations unsustainable after the halving, while those using newer, more energy-efficient hardware and benefiting from lower electricity costs might remain profitable.

Bitcoin Mining Profitability and Miners’ Operations

The decrease in block rewards necessitates miners to carefully evaluate their operational costs. Profitability will be directly tied to the Bitcoin price. A higher Bitcoin price can offset the reduced block reward, maintaining or even increasing profitability for many miners. Conversely, a lower Bitcoin price could force many less efficient miners to shut down operations, leading to a consolidation within the mining landscape. This could involve miners upgrading their equipment, seeking out cheaper electricity sources, or consolidating operations to achieve economies of scale. We can look at previous halvings as examples. Following the 2016 and 2020 halvings, we saw periods of consolidation where less efficient miners exited the market, and the remaining miners benefited from reduced competition.

Energy Consumption of the Bitcoin Network

The halving’s effect on energy consumption is complex. While the reduced block reward might initially incentivize some miners to exit the network, leading to a decrease in overall hash rate and energy consumption, this effect might be counteracted by miners upgrading to more efficient hardware. The adoption of more energy-efficient ASICs and improved mining techniques could lead to a decrease in energy consumed per Bitcoin mined, even with a potentially smaller reduction in overall network hash rate. This is a critical aspect to monitor as environmental concerns surrounding Bitcoin mining remain a significant area of discussion.

Centralization or Decentralization of Bitcoin Mining

The 2025 halving could potentially lead to either increased centralization or decentralization of Bitcoin mining, depending on how miners adapt. If only large, well-funded mining operations with access to cheap energy and advanced hardware can remain profitable, this would lead to increased centralization. However, if technological advancements make mining more accessible to smaller operations, or if the price of Bitcoin rises significantly, it could lead to increased decentralization. The outcome will likely depend on the interplay between Bitcoin’s price, the cost of electricity, and technological advancements in mining hardware.

Miner Adaptation Strategies

Miners will employ various strategies to adapt to the reduced block rewards. These strategies may include upgrading to more energy-efficient hardware, optimizing their mining operations to reduce costs, diversifying revenue streams (e.g., offering mining-as-a-service), or seeking out regions with lower electricity costs. Some miners might explore alternative consensus mechanisms or layer-2 scaling solutions to improve their profitability. The success of these strategies will depend on the market conditions and the individual miner’s capabilities and resources.

Challenges and Opportunities for Bitcoin Miners

The 2025 halving presents both significant challenges and opportunities for Bitcoin miners.

- Challenges: Reduced profitability, increased competition, higher capital expenditures for hardware upgrades, regulatory uncertainty, and potential for increased centralization.

- Opportunities: Increased market share for efficient miners, potential for higher Bitcoin prices leading to increased profitability, technological advancements leading to improved efficiency, and the development of new revenue streams.

The 2025 Halving and Bitcoin’s Long-Term Outlook

The 2025 Bitcoin halving, reducing the rate of new Bitcoin creation by half, is a significant event with far-reaching implications for the cryptocurrency’s long-term trajectory. While past halvings have historically been followed by price increases, predicting the future with certainty is impossible. However, analyzing historical trends, considering Bitcoin’s evolving role in the global financial landscape, and acknowledging potential risks allows for a more informed assessment of its future prospects.

Bitcoin’s long-term value proposition rests on several key pillars. Its scarcity, capped at 21 million coins, makes it a potentially attractive store of value, similar to gold, albeit with a digital, borderless nature. Its decentralized and transparent nature offers a potential hedge against inflation and government control, particularly appealing in times of economic uncertainty. Furthermore, growing adoption as a medium of exchange, albeit still limited compared to fiat currencies, signifies a gradual shift in its utility.

Bitcoin as a Store of Value

Bitcoin’s deflationary nature, driven by the halving mechanism, is a central argument for its potential as a store of value. Unlike fiat currencies prone to inflation, the limited supply of Bitcoin makes it inherently scarce. This scarcity, coupled with increasing demand, could drive its price upward over the long term. The historical performance of Bitcoin following previous halvings lends some credence to this theory, although past performance is not indicative of future results. This potential is further bolstered by its growing acceptance among institutional investors, who are increasingly viewing Bitcoin as a diversifying asset in their portfolios. The argument rests on the fundamental economic principle of supply and demand: limited supply coupled with increasing demand should lead to price appreciation.

Bitcoin as a Medium of Exchange

While Bitcoin’s adoption as a medium of exchange is still nascent, its potential in this area is considerable. The increasing number of merchants accepting Bitcoin, the development of lightning networks for faster and cheaper transactions, and the emergence of Bitcoin-based financial services are all contributing factors. However, widespread adoption faces significant hurdles, including volatility, scalability issues, and regulatory uncertainty. For example, the success of El Salvador’s adoption of Bitcoin as legal tender remains a subject of debate, highlighting the challenges involved in integrating Bitcoin into existing financial systems.

Bitcoin as a Hedge Against Inflation

The potential of Bitcoin to act as a hedge against inflation is attracting significant attention. Its fixed supply contrasts sharply with fiat currencies that are susceptible to inflationary pressures due to government policies. During periods of economic uncertainty or high inflation, investors might seek refuge in Bitcoin, driving up demand and price. For instance, the surge in Bitcoin’s price during periods of heightened inflation in various countries globally demonstrates this potential. However, the correlation between Bitcoin’s price and inflation isn’t always consistent, and its volatility can negate its effectiveness as a pure hedge.

Risks and Challenges to Bitcoin’s Growth

Several factors could hinder Bitcoin’s growth after the 2025 halving. Regulatory uncertainty remains a significant challenge, with governments worldwide grappling with how to regulate cryptocurrencies. Increased regulatory scrutiny or outright bans could dampen adoption. Furthermore, technological advancements could lead to the emergence of competing cryptocurrencies with superior features, potentially eroding Bitcoin’s dominance. Security concerns, including the risk of hacks and theft, also pose a significant challenge to Bitcoin’s widespread adoption. Finally, the environmental impact of Bitcoin mining continues to be a point of contention, potentially affecting its long-term sustainability.

Factors Contributing to Bitcoin’s Adoption

Increased institutional investment, improved infrastructure (like Lightning Network), and growing public awareness are key drivers of Bitcoin’s adoption. The development of user-friendly wallets and exchanges is also crucial for making Bitcoin accessible to a wider audience. Furthermore, the integration of Bitcoin into existing financial systems, including its use in payment processing and decentralized finance (DeFi) applications, will play a significant role. Positive regulatory developments in key markets could also boost confidence and encourage broader adoption. Ultimately, successful integration into mainstream finance will be a pivotal factor in Bitcoin’s future success.

Bitcoin’s Potential Trajectory Post-2025 Halving (Illustrative Representation)

Imagine a graph charting Bitcoin’s price over time. The x-axis represents time, starting from the 2025 halving. The y-axis represents Bitcoin’s price in USD. The line initially shows a period of consolidation or even a slight dip immediately following the halving, reflecting the usual market volatility. Then, a gradual upward trend emerges, punctuated by periods of correction. Key milestones along this upward trajectory could include increased institutional adoption, significant regulatory clarity in major markets, and the widespread adoption of Bitcoin-based payment solutions. Potential price points are difficult to predict precisely but could see Bitcoin reaching progressively higher price levels, perhaps surpassing previous all-time highs, over a period of several years, though significant price corrections should be anticipated along the way. The overall trend, however, would be one of steady growth reflecting the underlying scarcity and increasing demand for Bitcoin.

Frequently Asked Questions about the Bitcoin Halving 2025

The Bitcoin halving, a significant event in the cryptocurrency’s lifecycle, occurs approximately every four years. This process reduces the rate at which new Bitcoins are created, impacting supply and potentially influencing price. Understanding the mechanics and potential consequences of the 2025 halving is crucial for anyone involved in the Bitcoin ecosystem.

The Bitcoin Halving Date in 2025

The precise date of the 2025 Bitcoin halving is dependent on the block generation time, which is approximately 10 minutes. While predicting the exact date months in advance is difficult due to minor fluctuations in block times, the halving is expected to occur around April 2025. This date is determined by counting the blocks since the previous halving and extrapolating based on the average block time. The Bitcoin network itself automatically adjusts the block reward after a specific number of blocks have been mined.

The Halving’s Effect on Bitcoin Supply

The halving mechanism directly impacts Bitcoin’s supply. Before each halving, miners receive a certain number of newly minted Bitcoins as a reward for validating transactions and adding blocks to the blockchain. The halving cuts this reward in half. For example, if the reward is 6.25 BTC per block before the halving, it will decrease to 3.125 BTC afterward. This controlled reduction in new Bitcoin creation is a fundamental part of Bitcoin’s deflationary design, limiting the total number of Bitcoins that will ever exist to 21 million.

The Halving’s Impact on Bitcoin Price, Bitcoin Halving 2025 Dates

Historically, Bitcoin’s price has often seen an increase following a halving event. The 2012 and 2016 halvings were followed by significant price rallies, although the timing and magnitude of these price increases varied. However, it’s crucial to understand that correlation doesn’t equal causation. While reduced supply can theoretically increase demand and price, other market factors, such as overall economic conditions, regulatory changes, and technological advancements, also significantly influence Bitcoin’s price. The 2020 halving, for instance, did not immediately lead to a substantial price surge, highlighting the complexity of price prediction.

Potential Risks Associated with the Halving

While often viewed positively, the halving also presents potential risks. The anticipation leading up to the event can create market bubbles, leading to price volatility and potential crashes if expectations are not met. Moreover, the reduced miner rewards might force less efficient miners out of the network, potentially impacting the security and decentralization of the Bitcoin blockchain. Furthermore, unforeseen external factors, like a global economic downturn, could overshadow the halving’s impact on price.

Preparing for the 2025 Bitcoin Halving

Preparing for the 2025 halving requires a balanced approach. For investors, thorough research and risk assessment are paramount. Diversification of investment portfolios is recommended, and only investing what one can afford to lose is crucial. For Bitcoin holders, securing their private keys and using reputable wallets and exchanges are vital. Staying informed about market trends and technological developments within the Bitcoin ecosystem will also aid in navigating the potential volatility surrounding the halving. Remember that past performance is not indicative of future results.

Predicting precise Bitcoin Halving 2025 dates requires careful analysis of block times. Understanding the mechanics behind this event is crucial, and a comprehensive resource for this is available at Bitcoin 2025 Halving , which delves into the intricacies of the halving process. Therefore, further research into the Bitcoin 2025 Halving helps to refine estimates for Bitcoin Halving 2025 dates.

Pinpointing the exact Bitcoin Halving 2025 dates requires careful observation of the blockchain, but speculation is rife. A key consideration for investors is understanding the potential impact on price, which is why researching predictions about the Bitcoin Price After 2025 Halving is crucial. Ultimately, the Bitcoin Halving 2025 dates themselves will influence the market’s reaction and subsequent price movements.

Precise Bitcoin Halving 2025 dates are anticipated based on block generation times, but minor variations are possible. To understand the historical context and confirm the projected timing, it’s helpful to review previous halvings. For a clear explanation of when the next halving is expected to occur, refer to this resource: When Was The Bitcoin Halving 2025.

This information helps clarify the Bitcoin Halving 2025 Dates and their significance for the cryptocurrency’s future.