Bitcoin Halving 2025

The Bitcoin halving, a pre-programmed event reducing the rate of new Bitcoin creation by half, is set to occur in 2025. This event has historically generated significant market volatility and altered the dynamics of Bitcoin mining. Understanding its potential impact requires examining past trends and considering current economic conditions.

Historical Impact of Bitcoin Halvings, Bitcoin Halving 2025 Day

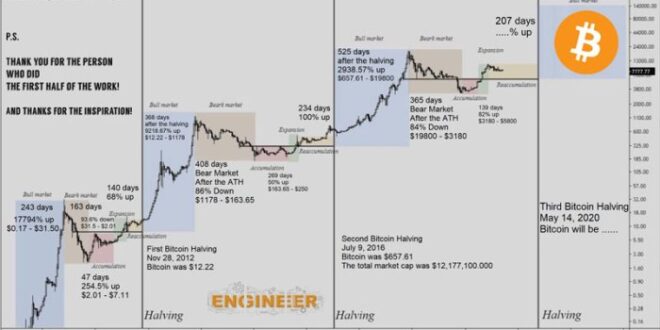

Previous Bitcoin halvings have demonstrably influenced both price and market sentiment. The first halving in 2012 saw a relatively modest price increase in the following months. The second halving in 2016 preceded a substantial bull market, leading to a significant price surge. The third halving in 2020 was followed by another period of considerable price appreciation, though the market experienced subsequent corrections. While a direct causal link isn’t definitively proven, the halvings have consistently coincided with periods of increased market interest and price volatility. The reduced supply of newly mined Bitcoin, coupled with increasing demand, has been posited as a key driver of these price movements.

Economic Factors Influencing the 2025 Halving

Several economic factors will likely influence the 2025 halving’s impact. Global macroeconomic conditions, including inflation rates and interest rate policies by central banks, will play a crucial role. The overall regulatory landscape for cryptocurrencies, particularly in major markets like the US and EU, will also significantly impact investor sentiment and market behavior. Furthermore, the adoption rate of Bitcoin as a payment method and store of value will contribute to its overall demand, influencing its price trajectory post-halving. For instance, increased institutional adoption, similar to what was observed in the lead-up to the 2020 halving, could amplify the price effects.

Comparison of Anticipated Market Reactions

While past halvings offer valuable insights, predicting the exact market reaction to the 2025 halving remains challenging. The increased awareness and institutional participation in the Bitcoin market since the 2020 halving suggest a potentially different dynamic this time. The market may react more swiftly and intensely due to heightened anticipation and a larger pool of informed investors. However, the presence of considerable macroeconomic uncertainty could also dampen the bullish effect typically associated with halvings. Unlike previous cycles where the halving was a relatively unexpected event for many, the 2025 halving is widely anticipated, which could lead to a different market response than in previous cycles. The price action may be less dramatic due to already-priced-in expectations.

Technical Aspects and Impact on Mining

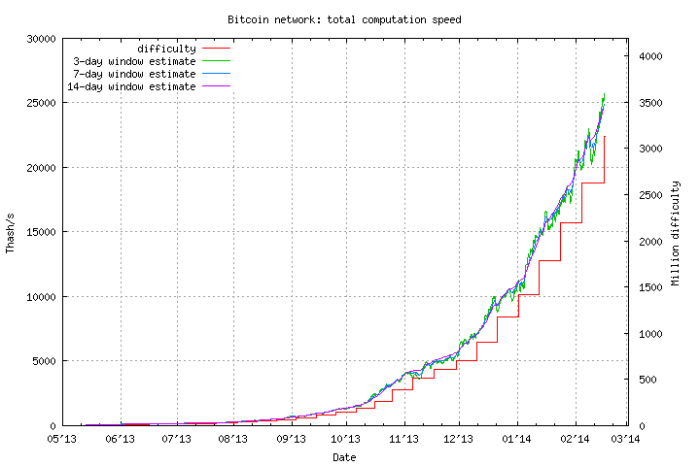

The 2025 halving will reduce the block reward for Bitcoin miners from 6.25 BTC to 3.125 BTC per block. This directly impacts miners’ profitability and could lead to increased competition and consolidation within the mining industry. Less profitable miners may be forced to shut down operations, leading to a decrease in the overall hash rate (the computational power securing the network). However, technological advancements in mining hardware and potentially lower energy costs could offset some of these negative impacts. The long-term effect on network security will depend on the interplay of these factors. The halving also affects the rate of Bitcoin inflation, further reducing the supply entering the market.

The Impact on Bitcoin’s Price

The Bitcoin halving, a programmed event that reduces the rate of new Bitcoin creation, is widely anticipated to influence the cryptocurrency’s price. While not a guaranteed price mover, historical data suggests a correlation between halvings and subsequent price increases, albeit with varying timelines and magnitudes. Understanding the interplay of various factors is crucial to projecting potential price scenarios.

Potential Price Scenarios

Predicting Bitcoin’s price is inherently speculative, but analyzing past halvings offers insights. The 2012 halving was followed by a gradual price increase over a period of roughly 18 months. The 2016 halving saw a more dramatic rise, reaching a peak within approximately two years. The 2020 halving showed a similar pattern, though with a longer lead time to peak price. Based on these precedents, several scenarios are plausible for the 2025 halving. A conservative scenario might see a modest price increase over 12-18 months post-halving. A more bullish scenario could envision a significantly higher price, potentially within two years. However, a bearish scenario, influenced by negative macroeconomic factors or regulatory crackdowns, could see a less dramatic, or even no significant, price response. These scenarios are purely speculative and dependent on numerous market forces. It’s important to remember that past performance is not indicative of future results.

Regulatory Changes and Macroeconomic Trends

Regulatory landscapes and global macroeconomic conditions exert considerable influence on Bitcoin’s volatility. Stringent regulations, such as outright bans or excessive taxation, could suppress price growth. Conversely, favorable regulatory frameworks, including clear guidelines for cryptocurrency trading and taxation, could boost investor confidence and drive price appreciation. Macroeconomic factors like inflation, interest rates, and overall economic growth significantly impact investor risk appetite. Periods of high inflation or economic uncertainty might push investors towards Bitcoin as a hedge against inflation, driving demand and price. Conversely, a strong economy with low inflation might divert investment away from riskier assets like Bitcoin. The interaction of these factors around the 2025 halving will be crucial in determining the price trajectory. For instance, the 2020 halving occurred amidst a global pandemic, which influenced investor behavior and created volatility.

Investor Sentiment and Market Speculation

Investor sentiment and market speculation play a powerful role in shaping Bitcoin’s price. Positive news, technological advancements, and institutional adoption fuel bullish sentiment, pushing prices upward. Conversely, negative news, regulatory uncertainty, or security breaches can trigger sell-offs and price declines. Market speculation, driven by hype and fear of missing out (FOMO), can amplify price movements, leading to rapid price increases or crashes. The period leading up to and following the 2025 halving will likely see increased speculation, with analysts and investors offering varying price predictions. The collective sentiment of these market participants will significantly influence Bitcoin’s price action. The 2017 Bitcoin bubble serves as a stark example of how market speculation can lead to extreme price volatility.

Comparison with Previous Halvings

Comparing the price performance following previous halvings reveals both similarities and differences. All three previous halvings (2012, 2016, and 2020) were followed by periods of price appreciation, although the timing and magnitude varied. The time lag between the halving and peak price appreciation differed across these events. Moreover, the overall market conditions and the level of Bitcoin adoption were significantly different during each halving cycle. While the halving itself creates a predictable reduction in supply, the resulting price action is influenced by the dynamic interplay of external factors, making direct comparisons challenging. It is crucial to consider the evolving regulatory landscape, the increasing maturity of the cryptocurrency market, and the growing institutional involvement when analyzing the potential impact of the 2025 halving.

Mining and the Halving Event

The Bitcoin halving, a pre-programmed event reducing the block reward paid to miners by half, significantly impacts the profitability of Bitcoin mining operations and, consequently, the network’s security and decentralization. Understanding these effects is crucial for predicting the future trajectory of Bitcoin’s ecosystem.

The halving directly affects miners’ revenue. With fewer newly minted Bitcoins awarded per block, miners’ income stream is reduced. This decrease in profitability forces miners to reassess their operational costs and adapt to maintain viability. The magnitude of this impact depends on several factors, including the prevailing Bitcoin price, electricity costs, and the efficiency of their mining hardware.

Miner Profitability and Responses

The halving creates a challenging environment for Bitcoin miners. Lower profitability can lead to several responses. Some miners may choose to shut down less efficient operations, leading to a consolidation of the mining industry. Others might seek to reduce operational costs, such as negotiating lower electricity prices or relocating to regions with more favorable energy policies. Finally, miners may increase their hashrate (computing power) through upgrading their hardware or expanding their mining farms, to compensate for the reduced block reward. This dynamic depends heavily on the price of Bitcoin; if the price rises significantly following the halving, the reduced reward may be offset by higher revenue per Bitcoin. For example, the 2020 halving saw a subsequent price increase, mitigating the immediate impact on miner profitability.

Impact on Network Security and Decentralization

The halving’s effect on network security is complex. While a reduction in miner profitability might lead to some miners exiting the network, the resulting decrease in hashrate could potentially compromise the network’s security against 51% attacks. However, this risk is often mitigated by the increased efficiency of newer mining hardware and the potential for a price increase post-halving, attracting new miners to the network. Furthermore, the increased profitability of more efficient miners might lead to a consolidation of the mining industry, potentially centralizing the network’s hashrate, a concern for decentralization advocates. A hypothetical scenario illustrating this risk would be a situation where a few large mining pools control a significant portion of the hashrate post-halving. Conversely, a price surge post-halving could encourage smaller miners to join the network, bolstering decentralization.

Technological Adaptations for Maintaining Profitability

Miners will likely adopt several technological strategies to adapt to the reduced block rewards. This includes upgrading to more energy-efficient ASICs (Application-Specific Integrated Circuits), optimizing mining farm infrastructure for better cooling and power management, and exploring alternative energy sources, such as renewable energy, to reduce electricity costs. The adoption of these technologies is not just about profitability; it also contributes to a more sustainable and environmentally friendly Bitcoin mining industry. For instance, companies are already investing in hydropower and solar power to reduce their carbon footprint and operating expenses.

Consolidation within the Bitcoin Mining Industry

The halving often acts as a catalyst for consolidation within the Bitcoin mining industry. Less efficient and less capitalized mining operations are more vulnerable to reduced profitability and are likely to be forced to shut down or merge with larger entities. This leads to a more concentrated mining landscape, with fewer, larger players controlling a larger share of the network’s hashrate. This consolidation, while potentially increasing efficiency, also raises concerns about network centralization and the potential for increased influence by a smaller number of powerful entities. The 2012 and 2016 halvings saw similar trends, with smaller miners struggling to compete and larger operations expanding their market share.

Bitcoin Halving 2025

The Bitcoin halving event, scheduled for 2025, is a significant occurrence in the cryptocurrency’s lifecycle, impacting its price, mining dynamics, and overall market sentiment. Understanding the potential ramifications and formulating appropriate investment strategies is crucial for investors seeking to navigate this period effectively. This section explores various investor strategies, associated risks and rewards, and provides a guide for informed decision-making.

Investor Strategies for the 2025 Bitcoin Halving

Investors can employ a variety of strategies in anticipation of the 2025 Bitcoin halving. These strategies range from conservative approaches suitable for risk-averse investors to more aggressive strategies for those with a higher risk tolerance. The choice depends heavily on individual investment goals, risk profile, and time horizon.

Risk and Reward Assessment of Different Investment Approaches

Each investment strategy carries inherent risks and potential rewards. For example, dollar-cost averaging (DCA), a strategy of regularly investing a fixed amount of money regardless of price fluctuations, mitigates risk by reducing the impact of volatility. However, it might also result in lower potential returns compared to lump-sum investments made at market lows. Conversely, attempting to time the market by buying before the halving and selling after a price surge carries higher risk but potentially greater reward if the prediction is accurate. However, inaccurate timing can lead to significant losses. Holding Bitcoin long-term (HODLing) is another strategy that reduces the impact of short-term price fluctuations, relying on the long-term growth potential of the asset. This strategy, while minimizing risk, requires patience and a belief in Bitcoin’s future.

Long-Term versus Short-Term Investment Strategies

Long-term strategies, such as HODLing, often involve buying and holding Bitcoin for an extended period, typically years, to benefit from its potential long-term growth. This approach minimizes the impact of short-term price volatility. Short-term strategies, such as day trading or swing trading, focus on exploiting short-term price movements to generate quick profits. These strategies are significantly riskier due to their reliance on accurate market timing and prediction, which is notoriously difficult. The 2012 and 2016 halvings offer real-world examples. Following the 2012 halving, Bitcoin’s price experienced a significant increase over the subsequent year. Similarly, the 2016 halving was followed by a period of price appreciation, although the timing and magnitude of the price increases varied significantly. However, these past events don’t guarantee similar outcomes in 2025.

A Guide for Investors: Key Considerations Before Investing

Before making any investment decisions, investors should carefully consider several key factors. These include:

- Risk Tolerance: Understand your comfort level with potential losses. Higher-risk strategies offer higher potential returns but also carry a greater chance of losing money.

- Investment Goals: Define your objectives. Are you aiming for short-term gains or long-term growth?

- Time Horizon: How long are you willing to hold your investment? Short-term strategies require frequent monitoring and trading, while long-term strategies necessitate patience.

- Market Research: Thoroughly research Bitcoin and the cryptocurrency market before investing. Understand the underlying technology, its potential, and its inherent risks.

- Diversification: Don’t put all your eggs in one basket. Diversify your portfolio to mitigate risk. Investing only in Bitcoin is inherently risky.

- Regulatory Landscape: Stay informed about the evolving regulatory landscape for cryptocurrencies in your jurisdiction.

Remember: Investing in cryptocurrencies, including Bitcoin, involves significant risk. Past performance is not indicative of future results. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

The Broader Cryptocurrency Market

The Bitcoin halving, a significant event in the Bitcoin ecosystem, doesn’t exist in a vacuum. Its effects ripple outwards, impacting the broader cryptocurrency market in complex and often unpredictable ways. The correlation between Bitcoin’s price and the overall crypto market health is strong, making understanding the potential consequences of the 2025 halving crucial for investors and market analysts alike.

The inherent interconnectedness of the crypto market means that Bitcoin’s price movements significantly influence the performance of other cryptocurrencies. This is particularly true for altcoins, which often see their values rise and fall in tandem with Bitcoin’s dominance. The halving’s potential impact on Bitcoin’s price, therefore, directly affects the entire landscape.

Bitcoin’s Price and the Broader Crypto Market Correlation

Historically, a strong positive correlation exists between Bitcoin’s price and the performance of the broader cryptocurrency market. When Bitcoin’s price rises, altcoins often follow suit, and vice-versa. This correlation, however, isn’t always perfect, and deviations can occur depending on individual project fundamentals, market sentiment, and regulatory changes. For instance, during periods of high Bitcoin volatility, some altcoins may exhibit less pronounced price swings, demonstrating a degree of decoupling. Conversely, during bull markets, the correlation tends to strengthen, with altcoins mirroring Bitcoin’s upward trajectory. Analyzing historical data surrounding previous halvings reveals a similar pattern, albeit with varying degrees of intensity. The 2012 and 2016 halvings, for example, were followed by periods of significant price appreciation for both Bitcoin and many altcoins, although the timing and magnitude of these price increases varied considerably.

Altcoin Reactions to Changes in Bitcoin Dominance

Bitcoin’s dominance, often expressed as its market capitalization percentage relative to the total cryptocurrency market cap, is a key indicator of its influence. Following a halving, if Bitcoin’s price appreciates significantly, its dominance may increase. This could lead to a “flight to safety” phenomenon, where investors move funds from altcoins into Bitcoin, perceiving it as a less risky investment. Conversely, if Bitcoin’s price increase is muted or if altcoins showcase stronger fundamental growth, Bitcoin’s dominance could decrease, potentially leading to a more diversified market with increased interest and investment in altcoins. The extent of this shift depends on various factors, including the overall market sentiment, the development of promising altcoin projects, and the regulatory environment.

A Potential Market Shift Scenario Post-Halving

One possible scenario following the 2025 Bitcoin halving involves a period of initial price consolidation for Bitcoin, followed by a gradual increase driven by reduced supply. This could lead to increased investor confidence, attracting new capital into the crypto market. However, the initial price increase might not be immediate or uniform across all cryptocurrencies. Altcoins with strong fundamentals and real-world utility could experience growth, potentially decoupling from Bitcoin’s price action to some degree. Conversely, altcoins lacking clear use cases or facing regulatory challenges might experience a period of stagnation or even decline, as investors prioritize established and perceived safer assets like Bitcoin. This scenario could lead to a reshuffling of the cryptocurrency market landscape, with some altcoins gaining prominence while others lose ground. The eventual outcome, however, remains contingent upon various unpredictable factors, including macroeconomic conditions, technological advancements, and regulatory developments.

Frequently Asked Questions (FAQ): Bitcoin Halving 2025 Day

This section addresses common questions surrounding the Bitcoin halving event of 2025, providing clarity on its mechanics, potential impacts, and associated risks. Understanding these aspects is crucial for anyone interested in navigating the cryptocurrency market around this significant event.

The Bitcoin Halving Mechanism

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. Approximately every four years, the reward given to Bitcoin miners for verifying transactions and adding new blocks to the blockchain is cut in half. This mechanism is designed to control inflation and maintain the scarcity of Bitcoin over time. The initial reward was 50 BTC per block; after several halvings, it’s currently 6.25 BTC. The 2025 halving will reduce this reward further.

The Precise Date and Time of the Bitcoin Halving in 2025

Pinpointing the exact date and time of the 2025 Bitcoin halving requires monitoring the blockchain’s block generation time, which can fluctuate slightly. While a precise moment cannot be given months in advance, it is expected to occur sometime in the Spring of 2025. The halving will take effect upon the mining of a specific block, triggering the reward reduction. Dedicated Bitcoin block explorers provide real-time data and will offer the precise timestamp once the event happens.

The Halving’s Impact on Bitcoin’s Price

Historically, Bitcoin’s price has shown a tendency to increase following previous halving events. This is largely attributed to the reduced supply of newly mined Bitcoin, potentially increasing demand. The 2012 and 2016 halvings were followed by significant price rallies, although the timing and magnitude of these rallies varied. However, it’s crucial to remember that numerous other factors influence Bitcoin’s price, including regulatory changes, market sentiment, and macroeconomic conditions. Therefore, predicting the price impact of the 2025 halving with certainty is impossible. The price movements following past halvings serve as data points for analysis but do not guarantee future performance.

Investing in Bitcoin Before the Halving: Pros and Cons

Investing in Bitcoin before a halving presents both opportunities and risks. A potential pro is the anticipation of a price increase following the halving, potentially leading to significant returns. However, a significant con is the inherent volatility of the cryptocurrency market. The price could decline before the halving, leading to losses. Furthermore, the price increase may not materialize as expected, or the timing could be unpredictable. Therefore, investors should carefully assess their risk tolerance and only invest what they can afford to lose.

Risks Associated with Bitcoin Investment

Investing in Bitcoin carries several risks. Market volatility is a primary concern, with Bitcoin’s price subject to significant fluctuations. Regulatory uncertainty, particularly varying governmental regulations across different jurisdictions, adds another layer of risk. Security risks, such as hacking and theft from exchanges or personal wallets, are also prevalent. Finally, the relatively nascent nature of the cryptocurrency market introduces unforeseen risks and challenges. Mitigation strategies include diversifying investments, using secure storage methods for Bitcoin, and staying informed about regulatory developments and market trends.

Illustrative Data Representation

Understanding the impact of Bitcoin halvings requires analyzing historical data and projecting potential future scenarios. This section provides visual representations to aid in this understanding, focusing on price movements, mining profitability, and projected price trajectories. While precise prediction is impossible, analyzing past trends and current market conditions offers valuable insights.

Historical Bitcoin Halvings and Subsequent Price Movements

The table below summarizes the dates of past Bitcoin halvings and the subsequent price movements. It’s important to note that correlation doesn’t equal causation; many other factors influence Bitcoin’s price. This data serves as a historical reference point, not a predictive tool.

| Halving Date | Approximate Price Before Halving (USD) | Approximate Price 1 Year After Halving (USD) | Approximate Price Change (%) |

|---|---|---|---|

| November 28, 2012 | $13 | ~$100 | ~669% |

| July 9, 2016 | ~$650 | ~$2,000 | ~208% |

| May 11, 2020 | ~$8,700 | ~$29,000 | ~234% |

Projected Bitcoin Price Scenarios

This chart depicts three potential price scenarios leading up to and following the 2025 halving. These are illustrative projections based on historical data and current market sentiment, and should not be interpreted as financial advice.

[Description of a hypothetical chart: The chart would show three lines representing different price scenarios: a bullish scenario (significant price increase after the halving), a neutral scenario (moderate price increase), and a bearish scenario (minimal or no price increase, possibly a decrease). The X-axis would represent time (leading up to and after the 2025 halving), and the Y-axis would represent the Bitcoin price in USD. Each line would be clearly labeled, and key data points (e.g., the halving date, projected price points at various times) would be indicated with labels and possibly annotations explaining the reasoning behind the projection for that specific scenario. For example, the bullish scenario might reflect increased adoption and institutional investment, while the bearish scenario might incorporate factors such as regulatory uncertainty or macroeconomic headwinds.]Impact of Halving on Bitcoin Mining Profitability

The halving reduces the block reward miners receive for validating transactions, directly impacting their profitability. This chart illustrates how mining profitability (measured, for example, as revenue minus operating costs) might change following the halving.

[Description of a hypothetical chart: The chart would show a line graph representing mining profitability over time. The X-axis would represent time (leading up to and after the 2025 halving), and the Y-axis would represent mining profitability (e.g., in USD per day per terahash). The line would show a sharp drop in profitability immediately after the halving, reflecting the reduced block reward. However, the line might gradually recover over time due to factors like increased Bitcoin price and potential improvements in mining efficiency. Key data points, such as the halving date and the projected minimum profitability threshold for miners to remain operational, would be clearly indicated. The chart could also include annotations explaining the impact of factors such as electricity prices and mining difficulty on profitability.]