Price Predictions and Market Analysis for 2025

The Bitcoin halving in 2025 is a significant event expected to impact its price. Predicting the exact price, however, is inherently challenging due to the volatile nature of the cryptocurrency market and the multitude of interacting factors. Various models and expert opinions exist, each offering a different perspective on Bitcoin’s potential trajectory.

Predicting Bitcoin’s price after the 2025 halving involves analyzing historical data, applying various forecasting models, and considering macroeconomic influences. These predictions are not guarantees but rather informed estimations based on current trends and assumptions. It is crucial to remember that unforeseen events can significantly alter the predicted outcome.

Price Prediction Models

Several models attempt to forecast Bitcoin’s price. Stock-to-flow (S2F) model, for instance, correlates Bitcoin’s price with its scarcity, suggesting a strong positive correlation. However, this model’s accuracy has been debated, particularly in light of recent price fluctuations. Other models incorporate on-chain metrics like transaction volume, mining difficulty, and network hash rate, aiming to provide a more holistic view. These models often utilize complex algorithms and statistical analyses to generate price projections, each with its own set of limitations and assumptions. For example, a simple linear regression model, based solely on historical halving events, might oversimplify the complex interplay of market forces.

Macroeconomic Factors and Their Influence

Global macroeconomic conditions significantly impact Bitcoin’s price. High inflation, for example, can drive investors towards Bitcoin as a hedge against inflation, potentially increasing its demand and price. Conversely, periods of economic stability or rising interest rates might lead investors to move away from riskier assets like Bitcoin, potentially causing a price decline. Geopolitical events, regulatory changes, and global economic growth rates also play a considerable role in shaping market sentiment and subsequently influencing Bitcoin’s value. The 2022 bear market, for instance, was partly attributed to rising interest rates and concerns about global economic slowdown.

Expert Opinions and Predictions

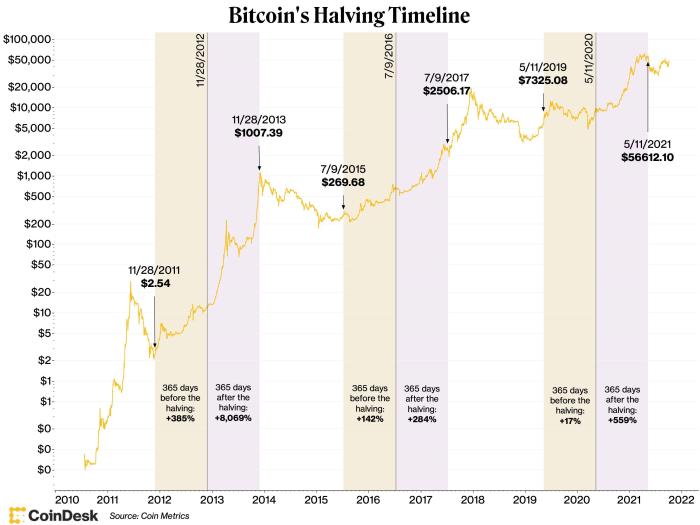

Expert opinions on Bitcoin’s post-halving price vary widely. Some analysts, basing their predictions on historical trends and the S2F model, anticipate a significant price surge following the 2025 halving. They might cite previous halving events as evidence of a consistent price increase in the period following the reduction in Bitcoin’s supply. Other analysts, however, express more cautious optimism, highlighting the unpredictable nature of the market and the potential for macroeconomic headwinds to negatively affect Bitcoin’s price. They might point to the influence of regulatory uncertainty or the emergence of competing cryptocurrencies as factors that could dampen price growth. The diversity of opinions underscores the uncertainty inherent in making long-term price predictions. For example, some experts might predict a price of $100,000 or more, while others might suggest a much more conservative estimate, highlighting the range of possible outcomes.

Mining Dynamics and Hash Rate Impact: Bitcoin Halving 2025 Expectations

The Bitcoin halving in 2025 will significantly alter the dynamics of Bitcoin mining, impacting profitability, the network’s hash rate, and ultimately, the security and decentralization of the Bitcoin network. The reduction in block rewards will necessitate adjustments from miners to maintain operational viability.

The halving event directly reduces the Bitcoin block reward received by miners for successfully validating transactions and adding new blocks to the blockchain. This immediate decrease in revenue will impact mining profitability. Many miners operate on tight margins, and the reduced reward could force less efficient or less capitalized miners to cease operations. This potential exodus could lead to a temporary decline in the network’s hash rate. However, more efficient miners with lower operating costs and access to cheaper energy sources are likely to remain operational, potentially consolidating the mining landscape. This adaptation may involve upgrading equipment, seeking out more cost-effective energy solutions, or consolidating mining operations.

Miner Adaptation Strategies, Bitcoin Halving 2025 Expectations

Miners will employ several strategies to counter the reduced profitability. These strategies include transitioning to more energy-efficient mining hardware (e.g., ASICs with improved hash rate per watt), negotiating lower electricity costs through contracts or relocating to regions with cheaper power, and potentially forming larger mining pools to benefit from economies of scale and reduce individual risk. The successful adaptation of miners will depend heavily on factors such as the price of Bitcoin, the cost of electricity, and the availability of advanced mining hardware. For example, a hypothetical scenario might involve a large mining operation in Kazakhstan, currently struggling with high energy costs, switching to a more energy-efficient ASIC and relocating to a region with hydro-electric power.

Hash Rate Adjustments Following Halving

The Bitcoin network’s hash rate, a measure of the total computational power dedicated to securing the network, is expected to experience fluctuations following the halving. An immediate drop is possible due to less profitable mining operations shutting down. However, the long-term impact is less certain. Historically, hash rate has generally recovered and even increased after previous halvings, driven by factors such as the anticipation of future price increases and the entry of new, more efficient miners. The recovery time will vary depending on market conditions and technological advancements in mining hardware. For instance, the introduction of a significantly more efficient ASIC chip could quickly offset the reduction in block reward and even lead to a hash rate increase.

Consequences for Bitcoin’s Security and Decentralization

Changes in mining dynamics directly affect Bitcoin’s security and decentralization. A significant drop in the hash rate could temporarily increase the network’s vulnerability to attacks, such as 51% attacks, where a single entity controls more than half of the network’s hashing power. However, the long-term consequences depend on the speed and extent of miner adaptation and the overall health of the Bitcoin market. If the hash rate recovers, or if the mining landscape becomes more decentralized through the participation of smaller, more geographically distributed miners, the network’s security could remain robust. Conversely, if the halving leads to significant centralization of mining power in the hands of a few large entities, this could potentially compromise the network’s decentralization and resilience. This potential scenario mirrors the concentration of mining power seen in certain regions historically, highlighting the ongoing tension between profitability and decentralization in the Bitcoin ecosystem.

Investor Sentiment and Market Behavior

Bitcoin halving events are significant catalysts for shifts in investor sentiment and subsequent market behavior. The predictable reduction in Bitcoin’s inflation rate often sparks anticipation and speculation, leading to periods of both heightened optimism and increased volatility. Understanding these dynamics is crucial for navigating the market around a halving.

Investor sentiment typically follows a cyclical pattern leading up to and following a halving. In the period before the event, a cautious optimism often prevails. As the halving date approaches, anticipation builds, potentially driving price increases due to increased buying pressure. However, this is not always the case, and periods of uncertainty and price corrections can also occur. Post-halving, the market reaction is diverse, depending on a range of macroeconomic and market-specific factors. While some expect a sustained price increase due to the reduced supply, others might anticipate a period of consolidation or even a price decline before the effects of the halving fully manifest.

Investor Strategies Around Bitcoin Halvings

The reduced supply of newly mined Bitcoin following a halving is a key driver influencing investor strategies. Many investors adopt a long-term holding strategy (“HODLing”), believing the reduced supply will eventually lead to price appreciation. Others employ more active strategies, such as short-term trading based on anticipated price volatility around the halving date, attempting to profit from price swings. Some sophisticated investors might utilize derivatives, like futures contracts, to hedge against potential price drops or to speculate on future price movements. For example, an investor might buy Bitcoin futures contracts before the halving, anticipating a price increase post-halving, and then sell the contracts at a profit if their prediction is correct. Conversely, an investor could use put options to protect against potential losses if the price drops unexpectedly.

Risks and Opportunities for Investors in the 2025 Halving

The 2025 Bitcoin halving presents both significant opportunities and considerable risks. One significant opportunity lies in the potential for long-term price appreciation driven by the decreased supply of new Bitcoin. However, the cryptocurrency market is inherently volatile, and external factors like macroeconomic conditions, regulatory changes, and competing cryptocurrencies could significantly impact Bitcoin’s price, irrespective of the halving. The risk of a market correction or prolonged bear market after the initial price surge is a significant consideration. Furthermore, the increasing institutional adoption of Bitcoin could influence market dynamics, creating both opportunities and risks depending on the direction of institutional investment. The historical performance of Bitcoin following previous halvings provides some indication, but it’s crucial to remember that past performance is not indicative of future results and that each halving occurs within a unique macroeconomic and market context. For instance, comparing the 2012 halving to the 2025 halving requires considering the differences in market maturity, regulatory landscapes, and overall economic conditions.

Anticipation is high regarding Bitcoin Halving 2025 Expectations, with many speculating on its impact on price volatility. Understanding the mechanics of this event is crucial, and a great resource for that is the comprehensive guide on Bitcoin Halving 2025. Ultimately, these expectations hinge on a variety of factors, making accurate prediction challenging but the event itself undeniably significant for the future of Bitcoin.

Anticipation is high regarding Bitcoin Halving 2025 Expectations, with many speculating on its impact on price volatility. Understanding the mechanics of this event is crucial, and a great resource for that is the comprehensive guide on Bitcoin Halving 2025. Ultimately, these expectations hinge on a variety of factors, making accurate prediction challenging but the event itself undeniably significant for the future of Bitcoin.

Anticipation is high regarding Bitcoin Halving 2025 Expectations, with many speculating on its impact on price volatility. Understanding the mechanics of this event is crucial, and a great resource for that is the comprehensive guide on Bitcoin Halving 2025. Ultimately, these expectations hinge on a variety of factors, making accurate prediction challenging but the event itself undeniably significant for the future of Bitcoin.

Anticipation is high regarding Bitcoin Halving 2025 Expectations, with many speculating on its impact on price volatility. Understanding the mechanics of this event is crucial, and a great resource for that is the comprehensive guide on Bitcoin Halving 2025. Ultimately, these expectations hinge on a variety of factors, making accurate prediction challenging but the event itself undeniably significant for the future of Bitcoin.

Anticipation is high regarding Bitcoin Halving 2025 Expectations, with many speculating on its impact on price volatility. Understanding the mechanics of this event is crucial, and a great resource for that is the comprehensive guide on Bitcoin Halving 2025. Ultimately, these expectations hinge on a variety of factors, making accurate prediction challenging but the event itself undeniably significant for the future of Bitcoin.

Anticipation is high regarding Bitcoin Halving 2025 Expectations, with many speculating on its impact on price volatility. Understanding the mechanics of this event is crucial, and a great resource for that is the comprehensive guide on Bitcoin Halving 2025. Ultimately, these expectations hinge on a variety of factors, making accurate prediction challenging but the event itself undeniably significant for the future of Bitcoin.