Bitcoin Halving 2025

The Bitcoin halving, a pre-programmed event occurring approximately every four years, is a significant moment in the cryptocurrency’s lifecycle. It reduces the rate at which new Bitcoins are created, impacting supply and potentially influencing market price. Understanding the mechanics and historical context of these halvings is crucial for navigating the anticipated effects of the 2025 event.

Bitcoin Halving Mechanics and Historical Price Impact

The Bitcoin halving mechanism is embedded within the Bitcoin protocol. Every 210,000 blocks mined, the reward given to miners for verifying transactions is cut in half. This halving reduces the rate of Bitcoin inflation. Historically, halvings have been followed by periods of increased Bitcoin price, although this correlation isn’t guaranteed. The scarcity created by reduced supply is often cited as a primary driver of this price appreciation. However, other market factors, including regulatory changes, technological advancements, and overall economic conditions, also play a significant role.

Anticipated Effects of the 2025 Halving on Supply and Demand

The 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC. This reduction in newly minted Bitcoin will further decrease the inflation rate, potentially increasing the scarcity of Bitcoin and influencing its price. The anticipated effect on demand is complex; while some investors may anticipate price increases and increase their buying, others might adopt a wait-and-see approach. The overall impact will depend on a confluence of factors, including macroeconomic conditions and investor sentiment. The previous halvings demonstrate a tendency towards price appreciation following the event, but this is not a guaranteed outcome.

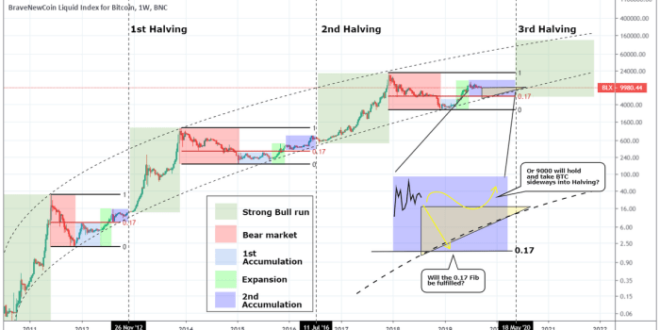

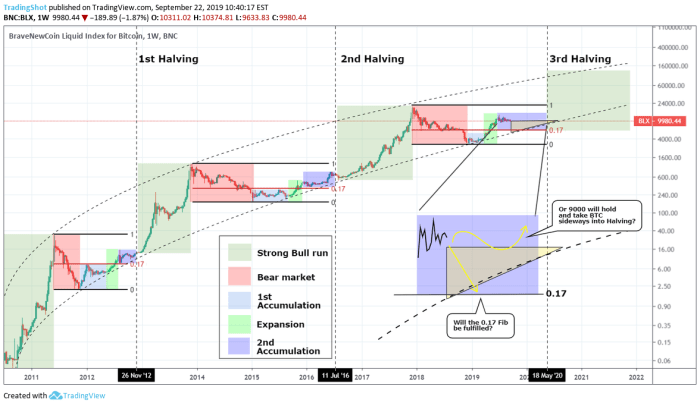

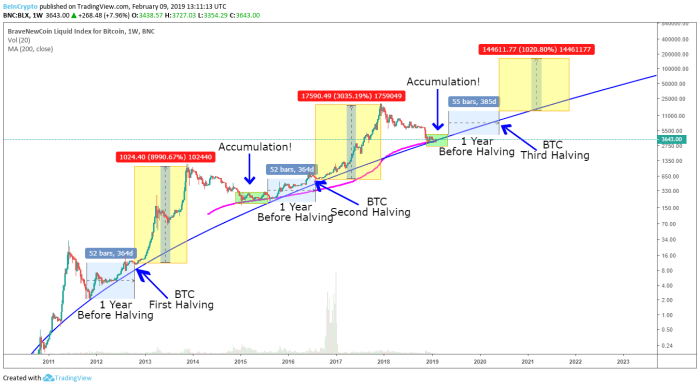

Comparison of the 2025 Halving to Previous Halving Events

The 2025 halving shares similarities with previous halvings in its core mechanism: a reduction in the block reward. However, significant differences exist in the broader macroeconomic and market conditions surrounding each event. The first halving in 2012 occurred during Bitcoin’s early days, with a relatively small market capitalization and limited regulatory scrutiny. The subsequent halvings in 2016 and 2020 occurred in vastly different market environments, with increased institutional involvement and heightened regulatory attention. The 2025 halving will likely take place within a mature market with established institutional participation and increased global awareness, leading to potentially different price reactions compared to previous cycles.

Timeline of Key Events Surrounding the 2025 Halving

The following timeline illustrates key events leading up to and following the anticipated 2025 Bitcoin halving. Note that these are estimations and actual dates may vary.

- 2023-2024: Increased speculation and market volatility in anticipation of the halving.

- Mid-2024: The exact block height for the halving is determined.

- March/April 2025 (Estimated): The Bitcoin halving occurs.

- 2025-2026: Potential price increase following the halving, but the extent and duration are uncertain.

- Beyond 2026: The long-term impact on price and market dynamics unfolds.

Comparison of Bitcoin Halving Events

| Halving Date | Block Reward (BTC) | Circulating Supply (Approximate) | Price Action (General Trend Post-Halving) |

|---|---|---|---|

| November 2012 | 25 BTC -> 12.5 BTC | 10.5 Million BTC | Significant price increase over the following year |

| July 2016 | 12.5 BTC -> 6.25 BTC | 16.0 Million BTC | Gradual price increase leading up to the next bull market |

| May 2020 | 6.25 BTC -> 3.125 BTC | 18.5 Million BTC | Significant price increase followed by a correction |

Fecha (Date) of the 2025 Bitcoin Halving

The precise date of the 2025 Bitcoin halving remains uncertain, despite its significance for the cryptocurrency’s future price and mining dynamics. Several factors contribute to this imprecision, making accurate prediction challenging, yet numerous models and analyses attempt to estimate the event’s timing.

Factors Influencing the Halving Date

The Bitcoin halving occurs approximately every four years, reducing the block reward miners receive by half. However, the exact date isn’t predetermined but depends on the time it takes for miners to solve complex cryptographic puzzles and add new blocks to the blockchain. This time fluctuates due to variations in network hash rate (the collective computing power of all miners), which is influenced by factors such as the price of Bitcoin, the cost of electricity, and the adoption of more efficient mining hardware. A higher hash rate leads to faster block creation, potentially slightly shifting the halving date earlier. Conversely, a lower hash rate would delay it.

Possible Date Ranges for the Halving

Given the inherent variability in block generation times, pinning down a single date for the 2025 halving is impossible. However, based on historical data and current network conditions, a reasonable range could be placed between late March and early June 2025. This broad window reflects the uncertainty inherent in the process. A scenario of significantly increased hash rate could shift the date closer to March, while a decrease in hash rate could push it towards June. More precise predictions require continuous monitoring of the network’s hash rate and block generation times.

Prediction Models for Halving Date Estimation

Several models are employed to estimate the halving date. The most straightforward method involves extrapolating from the average block time (approximately 10 minutes). This involves calculating the number of blocks until the next halving (which is a fixed number, approximately 210,000 blocks after the previous halving) and multiplying by the average block time. However, this simple approach ignores the inherent variability in block times. More sophisticated models incorporate statistical analysis of historical block times and network hash rate data to provide more refined predictions, often using time series analysis or other forecasting techniques. Some models even incorporate factors like Bitcoin’s price and miner profitability to refine their estimates.

Uncertainty and its Implications for Investors

The uncertainty surrounding the precise halving date carries significant implications for investors. While the halving is widely anticipated to be bullish for Bitcoin’s price in the long term (due to the reduced supply), the exact timing of this price increase remains unpredictable. Investors may engage in speculative trading based on their own predictions, potentially leading to market volatility in the period leading up to the event. The lack of certainty emphasizes the importance of a long-term investment strategy rather than relying on short-term gains based on precise halving date predictions.

Reputable Sources for Halving Date Predictions

Several reputable sources provide predictions and analysis related to the Bitcoin halving date. These often include blockchain explorers (such as Blockchain.com or Blockstream), cryptocurrency news outlets (like CoinDesk or Cointelegraph), and analytical firms specializing in cryptocurrency market data. However, it’s crucial to remember that these are predictions, not guarantees, and should be interpreted with caution. The methodologies employed vary, and the accuracy of any prediction depends on the accuracy of the underlying data and the model’s ability to account for unforeseen changes in network conditions. Comparing predictions from multiple reputable sources can offer a more balanced perspective on the likely timing of the 2025 Bitcoin halving.

Market Impact and Price Predictions

The 2025 Bitcoin halving, reducing the block reward for miners by half, is a significant event anticipated to impact Bitcoin’s price. While past halvings have generally been followed by periods of price appreciation, predicting the exact outcome for 2025 requires careful consideration of various factors. This analysis explores potential price scenarios, influencing factors, and comparisons to previous halvings.

Potential Price Scenarios Following the 2025 Halving, Bitcoin Halving 2025 Fecha

Several scenarios are possible following the 2025 halving. A bullish scenario might see a substantial price increase driven by reduced supply and increased demand. This could mirror the price surges observed after the 2012 and 2016 halvings, although the magnitude is uncertain. A more moderate scenario might involve a gradual price increase, possibly tempered by broader macroeconomic conditions or regulatory uncertainty. A bearish scenario, though less likely given historical trends, could see the price remain relatively stagnant or even decline due to factors such as increased selling pressure or a general downturn in the cryptocurrency market. These scenarios highlight the inherent uncertainty in price prediction.

Factors Beyond the Halving Influencing Bitcoin’s Price in 2025

The halving’s impact is not isolated. Several external factors could significantly influence Bitcoin’s price in 2025. These include the overall state of the global economy, regulatory developments in major jurisdictions, technological advancements in the Bitcoin ecosystem, and the adoption rate of Bitcoin by institutional and retail investors. For example, a global recession could negatively impact Bitcoin’s price, irrespective of the halving. Conversely, increased institutional adoption could bolster its price despite potential macroeconomic headwinds.

Comparison with Previous Halvings

The 2012 halving was followed by a period of relative price stability before a significant surge in 2013. The 2016 halving preceded a substantial price increase that culminated in the 2017 bull market. While these events suggest a positive correlation between halvings and price increases, it’s crucial to remember that other factors contributed to these price movements. Directly comparing past performance to predict future outcomes is inherently flawed due to the evolving market dynamics and the increased maturity of the Bitcoin market since 2012.

Impact on Bitcoin’s Market Capitalization and Dominance

The halving’s impact on Bitcoin’s market capitalization will depend on its price movement. A significant price increase could lead to a substantial increase in market capitalization, potentially solidifying Bitcoin’s position as the dominant cryptocurrency. Conversely, a stagnant or declining price could reduce its market cap and potentially lead to a decline in its market dominance relative to other cryptocurrencies. The interplay between price, market cap, and dominance underscores the complexity of predicting the halving’s full impact.

Visual Representation of Price Prediction Models

A line graph depicting various price prediction models would be useful. The x-axis would represent time (e.g., months following the halving), and the y-axis would represent Bitcoin’s price in USD. Several lines would represent different models: a bullish model showing a steep upward trajectory, a moderate model showing a more gradual incline, and a bearish model showing a flat or slightly downward trend. Each line would be clearly labeled, and a shaded area could represent the range of uncertainty surrounding each prediction. The graph would visually communicate the range of possible outcomes and the inherent uncertainty involved in price forecasting. For example, the bullish model might project a price of $100,000 within a year of the halving, while the moderate model might project $50,000, and the bearish model might project a price around $25,000. This visualization would effectively convey the diverse possibilities.

Bitcoin Halving 2025 and the Wider Cryptocurrency Market

The Bitcoin halving, a significant event in the cryptocurrency world, doesn’t exist in a vacuum. Its impact extends far beyond Bitcoin itself, rippling through the broader cryptocurrency market and influencing the performance of numerous altcoins. Understanding these potential ripple effects is crucial for navigating the evolving landscape of digital assets. The reduced supply of newly mined Bitcoin, a direct consequence of the halving, can create a complex interplay of market forces affecting other cryptocurrencies.

The 2025 halving’s impact on the wider cryptocurrency market is expected to be multifaceted and complex, depending on various factors such as the overall market sentiment, regulatory developments, and the adoption rate of cryptocurrencies. Previous halvings have shown varying degrees of influence on altcoins, sometimes resulting in correlated price movements and at other times showing a degree of decoupling. Analyzing these past trends and understanding the underlying market dynamics is key to predicting the potential outcomes of the 2025 event.

Impact on Other Cryptocurrencies

The reduced supply of Bitcoin post-halving often leads to increased demand and potentially higher prices. This can trigger a “flight to safety” effect, where investors shift funds from riskier altcoins into Bitcoin, leading to a temporary downturn in the altcoin market. However, this isn’t always the case. Some altcoins might experience increased interest if they offer unique features or functionalities not found in Bitcoin, potentially attracting investors looking for alternative investment opportunities. The 2012 and 2016 halvings saw different reactions; some altcoins followed Bitcoin’s price trajectory closely, while others exhibited independent price movements.

Cryptocurrencies Most Affected

Altcoins with high correlation to Bitcoin’s price are likely to be the most significantly impacted. These are typically cryptocurrencies that are considered to be more speculative or lack a strong, independent use case. Conversely, altcoins with strong fundamentals, distinct utility, and a dedicated community might experience less pronounced price fluctuations. For instance, altcoins with robust ecosystems and active development may prove more resilient to the market shifts associated with the Bitcoin halving.

Comparison of Market Reactions to Previous Halvings

Analyzing the market reactions to the 2012 and 2016 halvings provides valuable insights. While both events saw an increase in Bitcoin’s price eventually, the impact on altcoins varied considerably. In some cases, altcoins mirrored Bitcoin’s price movements, exhibiting a positive correlation. In other instances, altcoins showed a negative correlation, experiencing price drops despite Bitcoin’s price increase. These differing reactions highlight the complex interplay of market forces at play and underscore the difficulty in predicting precise outcomes for the 2025 halving.

Increased Volatility in the Cryptocurrency Market

The period surrounding a Bitcoin halving is often characterized by increased market volatility. The uncertainty surrounding the halving’s impact, combined with speculative trading activity, can lead to significant price swings in both Bitcoin and altcoins. Investors should be prepared for heightened market fluctuations and manage their risk accordingly. This increased volatility presents both opportunities and challenges, requiring careful consideration of investment strategies and risk tolerance.

Potential Impacts on Various Cryptocurrency Sectors

| Sector | Potential Positive Impact | Potential Negative Impact | Example Altcoins |

|---|---|---|---|

| Decentralized Finance (DeFi) | Increased demand for DeFi tokens due to Bitcoin price appreciation | Reduced liquidity in the DeFi market due to capital flowing into Bitcoin | AAVE, UNI, COMP |

| Non-Fungible Tokens (NFTs) | Potential increase in NFT trading volume if the overall market sentiment is positive | Reduced trading volume if investors shift focus towards Bitcoin | Various NFT projects on Ethereum and other blockchains |

| Layer-1 Blockchains | Increased transaction fees and network activity if Bitcoin’s popularity leads to increased usage of alternative networks | Reduced investment in Layer-1 projects if capital is concentrated in Bitcoin | Ethereum, Solana, Cardano |

| Meme Coins | Increased speculative trading volume based on market sentiment | Significant price drops if the overall market turns bearish | Dogecoin, Shiba Inu |

Long-Term Implications of the 2025 Bitcoin Halving

The 2025 Bitcoin halving, reducing the block reward for miners by half, will have profound and lasting consequences for the cryptocurrency’s trajectory. While short-term price volatility is anticipated, the long-term implications are far more complex and potentially transformative, impacting adoption, value proposition, and the broader cryptocurrency landscape. Understanding these long-term effects is crucial for investors, developers, and anyone interested in Bitcoin’s future.

The halving’s impact on Bitcoin’s value proposition as both a store of value and a medium of exchange is multifaceted. Its scarcity, a key feature amplified by the halving, is expected to bolster its appeal as a hedge against inflation and a safe haven asset. However, transaction fees will likely need to increase to incentivize miners, potentially impacting its usability as a daily transaction medium, especially if transaction volumes remain high. The balance between these two aspects will be crucial in determining Bitcoin’s long-term success.

Bitcoin’s Adoption and Value

The 2025 halving could accelerate Bitcoin’s adoption by increasing its scarcity and potentially driving up its price. Historically, previous halvings have been followed by periods of significant price appreciation, although this is not guaranteed. Increased price could lead to greater institutional and individual investment, boosting adoption among a wider range of users. Conversely, a lack of significant price increase post-halving might hinder adoption, potentially impacting its mainstream appeal. The overall effect will depend on several factors, including macroeconomic conditions and regulatory developments.

Bitcoin as a Store of Value and Medium of Exchange

The halving’s influence on Bitcoin’s role as a store of value is expected to be positive. Reduced supply, coupled with increased demand, should drive up its price, making it more attractive to investors seeking long-term value preservation. However, its role as a medium of exchange might face challenges. Higher transaction fees, resulting from reduced miner rewards, could make Bitcoin less competitive with faster and cheaper alternatives for everyday transactions. This necessitates further development of the Lightning Network and other second-layer solutions to improve scalability and reduce transaction costs.

Challenges and Opportunities in the Post-Halving Landscape

The post-halving landscape presents both challenges and opportunities. Increased competition from other cryptocurrencies, regulatory uncertainty, and potential macroeconomic downturns are significant challenges. Opportunities include advancements in layer-2 scaling solutions, the growth of decentralized finance (DeFi) built on Bitcoin, and increasing institutional adoption. Successfully navigating these challenges and capitalizing on opportunities will be critical for Bitcoin’s long-term success.

Bitcoin Mining and Energy Consumption

The halving will inevitably impact Bitcoin mining. Reduced block rewards necessitate miners to increase their efficiency to maintain profitability. This could drive innovation in mining hardware and renewable energy adoption, potentially leading to a more sustainable mining ecosystem. However, the energy consumption associated with Bitcoin mining remains a significant concern. Increased efficiency might mitigate this, but it’s unlikely to eliminate the issue entirely. The industry’s efforts to transition to more sustainable energy sources will be crucial for long-term viability and acceptance.

Potential Long-Term Scenarios for Bitcoin

The long-term future of Bitcoin after the 2025 halving is uncertain, but several potential scenarios can be envisioned:

Bitcoin Halving 2025 Fecha – The following scenarios illustrate the range of possible outcomes, influenced by technological advancements, regulatory developments, and macroeconomic factors.

- Scenario 1: Continued Growth and Mainstream Adoption: Bitcoin successfully addresses scalability challenges, achieves wider regulatory acceptance, and becomes a dominant store of value, leading to significant price appreciation and widespread adoption.

- Scenario 2: Stagnation and Niche Adoption: Bitcoin struggles with scalability and regulatory hurdles, resulting in limited price growth and adoption confined to a niche community of enthusiasts and investors.

- Scenario 3: Disruptive Technological Advancements: Significant technological breakthroughs, such as advancements in layer-2 scaling or the development of a superior consensus mechanism, lead to a paradigm shift within the cryptocurrency landscape, potentially impacting Bitcoin’s dominance.

- Scenario 4: Regulatory Crackdown: Stringent government regulations severely restrict Bitcoin’s use and trading, leading to a significant decline in its value and adoption.

Frequently Asked Questions (FAQ) about Bitcoin Halving 2025 Fecha

This section addresses common queries regarding the upcoming Bitcoin halving in 2025, focusing on its mechanics, market impact, and associated risks. Understanding these aspects is crucial for anyone interested in navigating the cryptocurrency market during this significant event.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, and it cuts the block reward – the amount of Bitcoin miners receive for verifying transactions – in half. This reduction in supply is a core element of Bitcoin’s deflationary monetary policy, designed to control inflation and scarcity.

Bitcoin Halving 2025 Timing

Pinpointing the exact date of the 2025 halving is challenging due to the unpredictable nature of Bitcoin’s block time. While the halving is expected to occur around the first half of 2025, a precise date can only be determined closer to the event as block times fluctuate. Historical data shows that halvings have generally been within a few weeks of the predicted date, based on a consistent block generation time of roughly 10 minutes.

Halving’s Effect on Bitcoin Price

Historically, Bitcoin’s price has shown a tendency to increase in the periods following halvings. This is often attributed to the reduced supply of newly minted Bitcoins, potentially leading to increased demand and price appreciation. However, it’s crucial to remember that price is influenced by numerous factors beyond the halving, including market sentiment, regulatory changes, and macroeconomic conditions. The 2012 and 2016 halvings saw significant price increases in the following months and years, though the timing and magnitude varied. These price increases were not solely due to the halving, but it certainly played a role in the bullish sentiment.

Risks of Investing Around the Halving

Investing in Bitcoin, especially around a halving, carries inherent risks. Price volatility is a significant concern; while historical trends suggest potential upward movement, substantial price drops are also possible. Market manipulation, regulatory uncertainty, and unforeseen technological disruptions can all impact Bitcoin’s price. Furthermore, the “buy the dip” mentality surrounding halvings can lead to overvalued assets if the anticipated price increase fails to materialize. Diversification of investment portfolios and careful risk management are paramount.

Alternative Cryptocurrencies and Halving Impact

The Bitcoin halving’s impact on alternative cryptocurrencies (altcoins) is complex and not directly proportional. Some altcoins might experience increased trading volume and price appreciation as investors seek alternative investments or speculate on potential cross-market effects. Others might remain largely unaffected. The correlation between Bitcoin’s price and altcoin prices varies significantly depending on individual projects, market conditions, and investor sentiment. For instance, altcoins with strong fundamentals and independent value propositions might decouple from Bitcoin’s price movements to a greater extent.

Determining the precise Bitcoin Halving 2025 Fecha requires careful consideration of the block reward halving mechanism. Understanding the exact date, however, hinges on knowing the precise day the halving occurs; for a detailed breakdown of this, you can consult Bitcoin Halving 2025 Day. Therefore, pinpointing the Bitcoin Halving 2025 Fecha depends on this crucial daily calculation.

The Bitcoin Halving 2025 Fecha is a significant event for the cryptocurrency market, impacting the rate of new Bitcoin creation. It’s interesting to compare this to the upcoming halving of another cryptocurrency; for instance, you can find details on the Bitcoin Cash Halving 2025 which will also have its own market effects. Ultimately, understanding both events is key to forecasting the overall cryptocurrency market trends around the Bitcoin Halving 2025 Fecha.

Determining the precise Bitcoin Halving 2025 Fecha requires careful consideration of block times. This event, where the Bitcoin reward for miners is halved, significantly impacts the cryptocurrency’s inflation rate. For a comprehensive understanding of this pivotal moment, consult this insightful resource on the 2025 Bitcoin Halving. Understanding this event is key to predicting the future trajectory of Bitcoin Halving 2025 Fecha and its broader market implications.

Determining the precise Bitcoin Halving 2025 Fecha requires careful consideration of block generation times. To find a reliable prediction for this significant event, you can consult resources dedicated to tracking this information, such as the comprehensive analysis provided on this website: Date For Bitcoin Halving 2025. Understanding the date is crucial for anticipating potential market shifts surrounding the Bitcoin Halving 2025 Fecha.

Pinpointing the exact Bitcoin Halving 2025 Fecha requires careful consideration of block times. However, the anticipated reduction in Bitcoin supply significantly impacts price predictions. To explore potential price movements following the halving, you might find this resource helpful: Bitcoin Halving 2025 Price. Understanding these price projections is crucial when considering the implications of the Bitcoin Halving 2025 Fecha on long-term investment strategies.

Determining the precise Bitcoin Halving 2025 Fecha requires careful consideration of the Bitcoin network’s block generation times. To understand the projected date, a helpful resource is available to clarify this: When Is 2025 Bitcoin Halving. This website provides insights into the expected timing, which is crucial for predicting the impact of the Bitcoin Halving 2025 Fecha on the cryptocurrency market.