Frequently Asked Questions about the Bitcoin Halving 2025

The Bitcoin halving is a significant event in the cryptocurrency world, occurring approximately every four years. This event reduces the rate at which new Bitcoins are created, impacting various aspects of the Bitcoin ecosystem. Understanding the halving’s mechanics and potential consequences is crucial for anyone involved in the Bitcoin market.

Bitcoin Halving Explained

A Bitcoin halving is a programmed reduction in the reward given to Bitcoin miners for successfully adding new blocks of transactions to the blockchain. This reward, initially 50 BTC per block, is halved every 210,000 blocks mined, approximately every four years. The halving mechanism is a core component of Bitcoin’s design, intended to control inflation and maintain scarcity.

Bitcoin Halving Date in 2025

While the exact date is dependent on the block mining rate, the Bitcoin halving in 2025 is anticipated to occur sometime in the spring, likely between April and May. The precise date will be determined as the 210,000th block approaches its completion. Mining difficulty adjustments will affect the exact timing, making precise prediction challenging.

The Halving’s Effect on Bitcoin’s Price

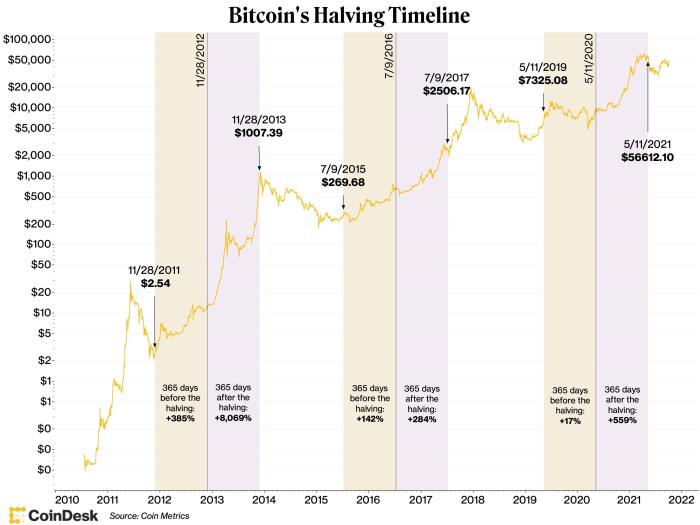

Historically, Bitcoin halvings have been followed by periods of significant price appreciation. The reduced supply of newly minted Bitcoins, combined with sustained or increased demand, can create upward price pressure. The 2012 and 2016 halvings both preceded substantial price increases, although other market factors also played a role. However, it’s important to note that past performance is not indicative of future results. The price impact of a halving is complex and depends on numerous interacting factors, including macroeconomic conditions, regulatory changes, and overall market sentiment.

Risks Associated with Investing Around the Halving, Bitcoin Halving 2025 Live

Investing in Bitcoin around a halving involves significant risks. The price increase following a halving is not guaranteed, and market volatility can be exceptionally high during this period. Speculative bubbles can form, leading to dramatic price swings and potential losses for investors. Furthermore, external factors such as regulatory changes or macroeconomic events can significantly influence Bitcoin’s price, irrespective of the halving. Investors should exercise caution and understand the inherent volatility of the cryptocurrency market.

The Halving’s Impact on Bitcoin Miners

The halving directly impacts Bitcoin miners’ profitability. With a reduced block reward, miners’ revenue per block decreases. This can lead to several consequences, including increased operational costs and reduced profitability for less efficient miners. Some miners may be forced to shut down operations or upgrade their equipment to maintain profitability, while others may adjust their strategies, potentially leading to a consolidation within the mining industry. The overall impact on the mining landscape will depend on factors such as the Bitcoin price and the cost of electricity.

Visual Representation of Halving Data (Table)

Understanding the impact of Bitcoin halvings requires analyzing historical data. The following table presents a clear visualization of key metrics surrounding past halving events, providing context for potential future scenarios. While predicting future Bitcoin prices is inherently speculative, examining past trends can offer valuable insights.

Historical Bitcoin Halving Data

This table displays the date of each halving, the block reward before and after the event, and the approximate Bitcoin price around the halving date. Note that the price is an approximation, taken from various market sources near the halving date and may vary slightly depending on the source.

| Halving Date | Block Reward Before (BTC) | Block Reward After (BTC) | Approximate Bitcoin Price (USD) at Halving |

|---|---|---|---|

| November 28, 2012 | 50 | 25 | $13.40 |

| July 9, 2016 | 25 | 12.5 | $650 |

| May 11, 2020 | 12.5 | 6.25 | $8700 |

Illustrating Bitcoin Halving Impact (Image Description): Bitcoin Halving 2025 Live

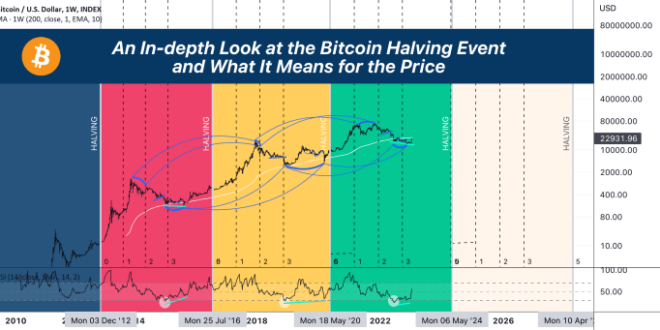

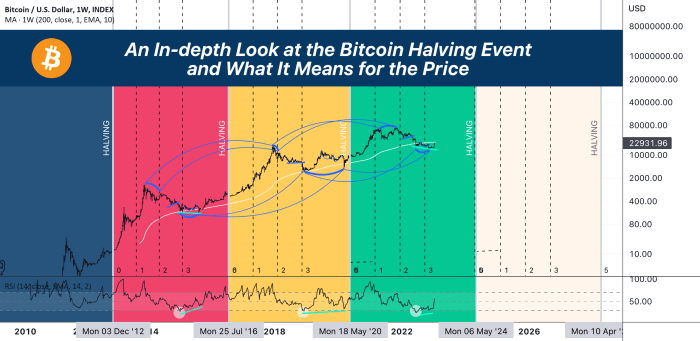

The image depicts the historical price of Bitcoin plotted against a timeline, clearly marking the dates of each Bitcoin halving event. The graph visually demonstrates the correlation, or lack thereof, between these halving events and subsequent price movements. The overall trend of Bitcoin’s price is also shown, providing context for the halving’s impact.

The x-axis of the graph represents time, spanning from Bitcoin’s inception to the present day. Each halving event is clearly marked with a vertical line, labeled with the corresponding year. The y-axis represents the price of Bitcoin, likely displayed in US dollars, using a logarithmic scale to better visualize the significant price fluctuations. The price data is represented by a line graph, showing the continuous price evolution over time.

Price Fluctuations Post-Halving

The image showcases the price behavior of Bitcoin in the periods following each halving. Ideally, it would highlight the initial price reaction immediately after a halving, showing whether the price increased, decreased, or remained relatively stable. The graph would then illustrate the price trend over the subsequent months and years, revealing the long-term impact of the halving on the price. Areas of significant price volatility are clearly visible, allowing for comparison across different halving cycles. The image might also include shaded areas to represent periods of bullish or bearish market sentiment.

Comparison of Halving Cycles

The visual representation allows for a direct comparison between the different halving cycles. By observing the price trajectories following each halving, the image facilitates the identification of similarities and differences in the market’s response. This comparison can reveal patterns or trends in the post-halving price behavior, helping to understand the impact of each halving event on the overall market dynamics. For instance, it may show whether the time it takes for the price to react to a halving has changed over time, or if the magnitude of price changes has been consistent.

Supply and Demand Dynamics

The image could subtly incorporate visual cues related to Bitcoin’s supply and demand dynamics. For example, the decreasing rate of Bitcoin issuance after each halving might be represented graphically, perhaps with a secondary line or shaded region, illustrating the reduction in new Bitcoin entering circulation. This would help to visually contextualize the impact of the halving on the scarcity of Bitcoin, a key factor influencing its price. This could also be accompanied by a visual representation of trading volume to show how the halving has affected trading activity.

Following the Bitcoin Halving 2025 Live event will be crucial for understanding the market’s reaction. A key date to keep in mind within this context is the anticipated Bitcoin Halving in April 2025, as detailed on this informative page: Bitcoin Halving April 2025. Understanding the specifics of this event will help predict the long-term effects observable during the Bitcoin Halving 2025 Live observation period.

The Bitcoin Halving 2025 Live event is anticipated with much excitement within the crypto community. Keeping track of the approaching halving is crucial for informed decision-making, and a useful resource for this is the Halving Bitcoin 2025 Countdown website. This countdown provides a clear visual representation of the time remaining until this significant event in the Bitcoin lifecycle, helping to prepare for the potential market shifts associated with Bitcoin Halving 2025 Live.

The Bitcoin Halving 2025 Live event is generating considerable excitement, with many speculating on the potential price impact. Understanding the likely price fluctuations is key, and for detailed analysis on this, you can check out this insightful resource on Halving Bitcoin 2025 Precio. Ultimately, the Bitcoin Halving 2025 Live event’s success will hinge on various factors, including the predicted price movements discussed in the linked article.

Following the Bitcoin Halving 2025 Live event will be crucial for understanding the market’s reaction. To gain a deeper understanding of the mechanics behind this significant event, it’s recommended to review resources such as this comprehensive guide on Halving 2025 Bitcoin , which provides detailed analysis. This will help you better interpret the data and trends observed during the Bitcoin Halving 2025 Live stream and subsequent market activity.

The Bitcoin Halving 2025 Live event is generating considerable excitement within the crypto community. Many are already speculating about the long-term effects of this significant reduction in Bitcoin’s block reward. Naturally, the question arises: what’s next? To find out when the next halving will occur, check out this informative resource: When Is The Next Bitcoin Halving After 2025.

Understanding this future event helps to better contextualize the implications of the upcoming Bitcoin Halving 2025 Live.

Following the Bitcoin Halving 2025 Live event will be crucial for understanding the market’s reaction. To accurately predict the event’s timing, however, it’s essential to consult reliable resources that address the question of Bitcoin Halving 2025 When. Understanding the precise date will allow for better preparation and analysis of the Bitcoin Halving 2025 Live impact.