Bitcoin Halving 2025: Bitcoin Halving 2025 Prediction

The Bitcoin halving, a programmed event reducing the rate of newly mined Bitcoin by half, is anticipated in 2025. This event has historically had a significant impact on Bitcoin’s price and market sentiment, making its prediction a crucial aspect of Bitcoin market analysis. Understanding the historical trends and considering potential influencing factors will allow for a more informed perspective on the 2025 halving’s effects.

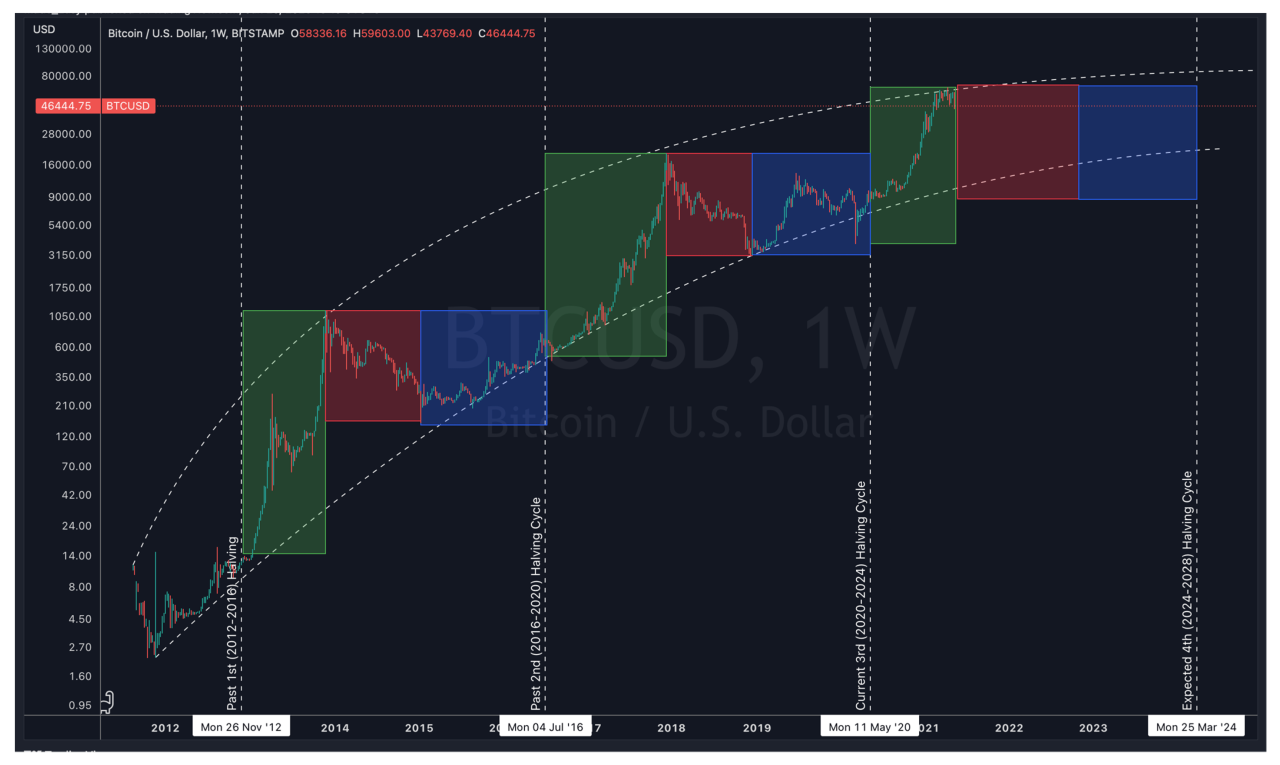

Historical Impact of Previous Halvings

Previous Bitcoin halvings have generally been followed by periods of increased price appreciation, although the timing and magnitude of these price increases have varied. The first halving in 2012 saw a gradual price increase over the following year. The second halving in 2016 was followed by a more substantial price surge in 2017, culminating in a record high. The third halving in 2020 also led to a significant price rally in 2021. These historical patterns suggest a potential positive correlation between halvings and price appreciation, although it’s crucial to remember that other factors significantly influence Bitcoin’s price. The impact isn’t immediate; rather, it unfolds over time, influenced by market dynamics.

Factors Influencing the 2025 Halving

Several factors could influence the impact of the 2025 halving. Macroeconomic conditions, such as inflation rates and global economic growth, will likely play a crucial role. Regulatory changes in major jurisdictions could also significantly affect Bitcoin’s price and adoption rate. The level of institutional investment and the overall sentiment within the cryptocurrency market will also be key determinants. For example, a period of global economic uncertainty might dampen the positive price impact of the halving, whereas strong institutional adoption could amplify it.

Comparison with Previous Halvings

While past halvings offer valuable insights, it’s important to acknowledge that the cryptocurrency market has matured considerably since 2012. The increased institutional involvement, greater regulatory scrutiny, and broader market awareness all differentiate the 2025 halving from its predecessors. The sheer scale of the Bitcoin market is also dramatically larger now, meaning price movements could be less volatile percentage-wise, yet potentially larger in absolute terms. Therefore, directly extrapolating the past performance to predict the future is not advisable.

Short-Term and Long-Term Price Implications

In the short term, the 2025 halving could lead to increased price volatility as investors speculate on the future price trajectory. A price increase is generally expected, but the magnitude is highly uncertain and dependent on the aforementioned factors. In the long term, the halving’s impact is anticipated to be more significant, as the reduced supply of newly mined Bitcoin could contribute to a gradual increase in its scarcity and, consequently, its value. This long-term effect is often cited as a fundamental driver of Bitcoin’s price appreciation.

Potential Price Trajectory Scenarios, Bitcoin Halving 2025 Prediction

Illustrative Chart 1: This chart would depict three possible price scenarios post-halving: a bullish scenario showing a steep price increase, a neutral scenario showing moderate growth, and a bearish scenario showing a price decline or stagnation. The X-axis would represent time (months post-halving), and the Y-axis would represent Bitcoin’s price in USD. Data points would represent hypothetical price levels at different time intervals. The trends would illustrate the varying degrees of price appreciation or depreciation under different market conditions.

Illustrative Chart 2: This chart would illustrate the relationship between Bitcoin’s halving events and subsequent price movements. It would show a timeline of past halvings, marking the date of each event and plotting Bitcoin’s price in the periods before and after. The data points would represent Bitcoin’s price at specific intervals, and trend lines would visually represent the price changes following each halving. This chart would visually demonstrate the historical correlation (or lack thereof) between halvings and price movements.

Predicting the Bitcoin Halving 2025 impact is a complex task, requiring careful analysis of various market factors. To effectively reach potential investors interested in this event, a robust online marketing strategy is crucial; consider optimizing your campaign using a well-managed Google Ads Account to target the right audience. This will help you capitalize on the increased interest surrounding the Bitcoin Halving 2025 Prediction and maximize your reach.