Predicting the 2025 Bitcoin Halving

Predicting the price of Bitcoin, especially around a halving event, is notoriously difficult. While the halving itself is a predictable event (reducing the rate of new Bitcoin creation), its impact on price is heavily influenced by a complex interplay of factors, making accurate forecasting challenging. This section will explore the difficulties involved in predicting the 2025 halving date’s impact and discuss various approaches to forecasting.

Factors Influencing Bitcoin Price Volatility and Their Impact on Predictions

Numerous factors contribute to Bitcoin’s volatility, significantly impacting any price prediction. These include macroeconomic conditions (e.g., inflation, interest rates, recessionary fears), regulatory changes (e.g., government bans or favorable legislation), technological advancements (e.g., scaling solutions, new cryptocurrencies), market sentiment (e.g., news cycles, social media trends), and significant events (e.g., hacks, bankruptcies, geopolitical instability). For instance, the 2022 crypto winter, triggered by a combination of macroeconomic factors and the collapse of TerraUSD, dramatically impacted Bitcoin’s price, highlighting the difficulty in accounting for unforeseen events in predictive models. These unpredictable shocks can invalidate even the most sophisticated forecasting techniques.

Limitations of Using Historical Data to Forecast Future Price Movements

Relying solely on historical data to predict future Bitcoin price movements is inherently flawed. The cryptocurrency market is relatively young and highly volatile, exhibiting characteristics different from traditional asset classes. Past price trends, while informative, don’t necessarily guarantee future performance. The market’s rapid evolution, coupled with the influence of new technologies and regulatory landscapes, renders simple extrapolations of historical patterns unreliable. For example, the price surge after the 2016 halving cannot be directly extrapolated to predict the 2020 or 2025 halving’s impact, given the vastly different market conditions and levels of institutional adoption.

Different Forecasting Models and Their Applicability

Several forecasting models attempt to predict Bitcoin’s price, each with its strengths and limitations. Technical analysis utilizes price charts and technical indicators (e.g., moving averages, relative strength index) to identify trends and potential turning points. However, its effectiveness is debatable, as it often relies on subjective interpretation and can generate conflicting signals. Fundamental analysis assesses the underlying value of Bitcoin based on factors like adoption rate, network security, and technological advancements. While offering a more robust framework, it struggles to quantify the impact of intangible factors like market sentiment and regulatory uncertainty. Quantitative models, such as time series analysis, can incorporate multiple variables to generate forecasts, but their accuracy heavily depends on the quality and completeness of the input data and the model’s assumptions. Ultimately, no single model guarantees accurate predictions.

Hypothetical Scenario: Geopolitical Events and the 2025 Halving

Consider a hypothetical scenario where a major geopolitical event, such as a significant international conflict or a global financial crisis, occurs in the lead-up to the 2025 Bitcoin halving. Such an event could trigger a “flight to safety,” potentially driving investors towards Bitcoin as a hedge against instability. This could lead to a significant increase in demand and price appreciation, even exceeding the price increases observed in previous halving cycles. Conversely, if the event leads to widespread risk aversion and a general sell-off in all asset classes, Bitcoin’s price could decline regardless of the halving. The impact would depend on the severity and nature of the event, as well as the overall market sentiment. The 2020 halving, occurring amidst the COVID-19 pandemic, saw a mixed reaction, highlighting the complex interplay between macroeconomic factors and Bitcoin’s price.

Market Sentiment and Price Speculation

The Bitcoin halving, a significant event in the cryptocurrency’s lifecycle, invariably triggers intense speculation about its future price. Current market sentiment, influenced by a complex interplay of factors, plays a crucial role in shaping price movements leading up to and following the 2025 halving. Understanding this sentiment, particularly the actions of institutional and retail investors, is key to predicting potential price ranges.

Market sentiment surrounding Bitcoin is currently a mixture of optimism and apprehension. The macroeconomic environment, including inflation rates and regulatory uncertainty, significantly influences investor confidence. Positive news regarding Bitcoin adoption by institutions or favorable regulatory developments tend to bolster bullish sentiment, while negative news or increased regulatory scrutiny can fuel bearish sentiment. This fluctuating sentiment creates volatility, making price prediction challenging but also presenting potential opportunities for savvy investors.

Institutional and Retail Investor Influence, Bitcoin Halving 2025 Prediction Date

Institutional investors, such as large hedge funds and corporations, exert considerable influence on Bitcoin’s price due to their substantial capital. Their entry into the market often signals confidence and can drive prices upward. Conversely, their withdrawals can trigger sell-offs. Retail traders, on the other hand, often react more emotionally to market fluctuations, contributing to price volatility. Their collective buying and selling decisions can amplify price swings, particularly in the period leading up to the halving. The interplay between these two investor groups is a critical determinant of Bitcoin’s price trajectory. For example, in previous halving cycles, the influx of institutional capital following periods of retail investor enthusiasm has helped sustain upward price trends.

Potential Price Ranges

Predicting Bitcoin’s price is inherently speculative, but considering various market scenarios can help establish potential price ranges. A bullish scenario, characterized by sustained institutional investment, widespread adoption, and positive regulatory developments, could see Bitcoin’s price significantly exceed its previous all-time high. A more conservative, neutral scenario might predict a moderate price increase, influenced by the halving’s reduced supply but tempered by macroeconomic headwinds. A bearish scenario, however, might see limited price appreciation or even a decline, driven by factors like increased regulatory pressure, a broader crypto market downturn, or a lack of significant institutional interest. These scenarios underscore the inherent uncertainty associated with price forecasting.

Bullish and Bearish Price Predictions Post-Halving

The following table compares potential bullish and bearish predictions for Bitcoin’s price following the 2025 halving. These are illustrative examples and should not be considered financial advice. Actual price movements will depend on numerous unpredictable factors.

| Scenario | Price Range (USD) | Underlying Factors | Example/Real-life Case |

|---|---|---|---|

| Bullish | $150,000 – $250,000+ | High institutional adoption, positive regulatory landscape, strong macroeconomic conditions. | Similar to the price surge following the 2016 and 2020 halvings, but potentially amplified by increased institutional participation. |

| Neutral | $75,000 – $125,000 | Moderate institutional interest, mixed regulatory environment, stable macroeconomic conditions. | A scenario reflecting a more gradual price increase, similar to the period between the 2012 and 2016 halvings. |

| Bearish | $30,000 – $60,000 | Limited institutional adoption, negative regulatory developments, unfavorable macroeconomic conditions. | A scenario potentially reflecting a period of market consolidation or even a price correction, similar to the period following the 2012 halving. |

Risks and Uncertainties Associated with Predictions: Bitcoin Halving 2025 Prediction Date

Predicting Bitcoin’s price after a halving, while a tempting endeavor, is fraught with inherent risks and uncertainties. The cryptocurrency market is notoriously volatile, influenced by a complex interplay of factors that are often unpredictable. Any forecast must acknowledge these limitations and account for the potential for significant deviations from expected outcomes. This section will explore the key risks and uncertainties involved, emphasizing the importance of prudent risk management.

Predicting Bitcoin’s price trajectory following the 2025 halving is challenging due to the numerous unpredictable variables at play. Market sentiment, regulatory changes, technological advancements, and macroeconomic factors can all significantly impact Bitcoin’s price, making accurate predictions extremely difficult. Furthermore, the historical correlation between halving events and price increases is not guaranteed to repeat in the future. Past performance is not indicative of future results, and relying solely on historical trends can be misleading.

Unforeseen Events and Market Disruptions

Unforeseen events, often termed “black swan” events, can drastically alter market expectations and severely impact Bitcoin’s price. These events are characterized by their rarity, high impact, and often unpredictable nature. A sudden, significant regulatory crackdown in a major market, for instance, could trigger a sharp price decline. Similarly, a major security breach affecting a prominent cryptocurrency exchange or a significant geopolitical event could dramatically influence investor sentiment and market volatility. The inherent unpredictability of such events necessitates a cautious approach to price forecasting.

The Importance of Diversification and Risk Management

Given the inherent risks involved in Bitcoin price predictions, it’s crucial to adopt a diversified investment strategy and implement effective risk management techniques. Diversification involves spreading investments across various asset classes, reducing the overall portfolio’s exposure to any single asset’s volatility. This could involve investing in other cryptocurrencies, traditional assets like stocks and bonds, or alternative investments. Risk management involves setting clear investment goals, defining acceptable levels of risk, and employing strategies to mitigate potential losses. This could include setting stop-loss orders to limit potential losses or using hedging strategies to protect against price declines.

Potential “Black Swan” Events

Several potential “black swan” events could significantly impact Bitcoin’s price. These include:

- A major regulatory crackdown on cryptocurrency trading in a significant market, leading to reduced liquidity and decreased investor confidence.

- A successful and widely adopted alternative cryptocurrency emerging, challenging Bitcoin’s dominance.

- A large-scale security breach compromising a major cryptocurrency exchange, eroding trust in the system.

- A significant global economic recession or financial crisis, leading to a flight to safety and a decline in risk assets, including Bitcoin.

- A major technological flaw or vulnerability discovered in the Bitcoin network, potentially leading to a security breach or network disruption.

It is vital to understand that this list is not exhaustive, and other unforeseen events could equally impact the market. The unpredictability of such events highlights the need for careful consideration and a robust risk management strategy when investing in Bitcoin.

Frequently Asked Questions (FAQ)

This section addresses common questions surrounding the upcoming Bitcoin halving in 2025, offering clarity on its mechanics, projected impact, and associated risks. Understanding these aspects is crucial for anyone interested in navigating the cryptocurrency market during this significant event.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, halving the reward given to Bitcoin miners for successfully adding new blocks to the blockchain. The halving mechanism is designed to control Bitcoin’s inflation rate, making it a deflationary asset in the long run.

Projected Date of the 2025 Bitcoin Halving

The 2025 Bitcoin halving is projected to occur around April 2025. This projection is based on the consistent block time of approximately 10 minutes. By tracking the number of blocks mined and extrapolating based on the known block reward reduction schedule, we can estimate the date with a reasonable degree of accuracy. However, minor variations are possible due to fluctuations in mining difficulty.

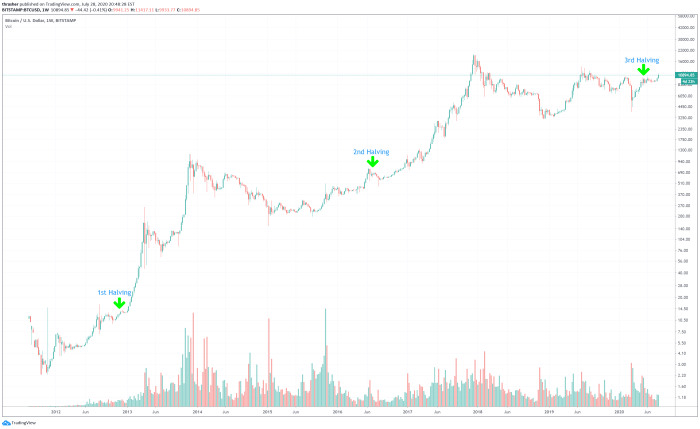

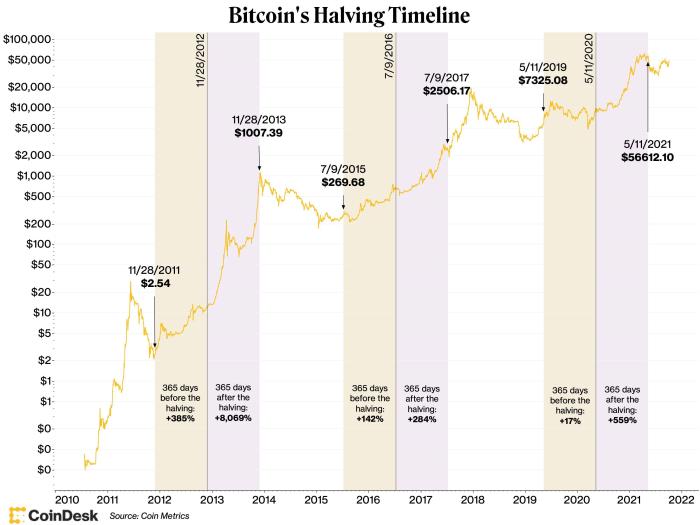

Impact of a Bitcoin Halving on Bitcoin’s Price

Historically, Bitcoin halvings have been followed by periods of significant price appreciation. The 2012 and 2016 halvings, for example, were both followed by substantial bull runs. This is often attributed to the reduced supply of new Bitcoins entering the market, potentially increasing scarcity and driving up demand. However, it’s crucial to remember that correlation doesn’t equal causation; other market factors also influence Bitcoin’s price. The impact of the 2025 halving remains uncertain, and the price may not necessarily follow the same pattern as previous halvings.

Reliability of Bitcoin Halving Predictions

Predicting the precise impact of a Bitcoin halving on its price is unreliable. While historical data suggests a positive correlation, numerous other factors influence Bitcoin’s price, including regulatory changes, macroeconomic conditions, technological advancements, and overall market sentiment. Predictions should be viewed with caution, and relying solely on halving predictions for investment decisions is risky. For example, the 2020 halving was followed by a significant price increase, but the subsequent market downturn demonstrates the limitations of solely basing investment decisions on halving predictions.

Risks Associated with Investing in Bitcoin Around the Halving

Investing in Bitcoin around a halving carries significant risks. The price volatility of Bitcoin is inherently high, and the anticipation surrounding the halving can lead to speculative bubbles and subsequent price crashes. Other risks include regulatory uncertainty, security breaches, and the potential for market manipulation. Investors should diversify their portfolios, conduct thorough due diligence, and only invest amounts they can afford to lose. Employing risk management strategies, such as dollar-cost averaging and setting stop-loss orders, can help mitigate some of these risks.

Illustrative Scenarios

Predicting the precise impact of the 2025 Bitcoin halving is inherently challenging, given the volatile nature of the cryptocurrency market. However, exploring potential outcomes through illustrative scenarios can provide a valuable framework for understanding the range of possibilities. These scenarios are not exhaustive, but they highlight key market dynamics and investor behaviors that could influence Bitcoin’s price.

Bitcoin Price Increase After Halving

In this scenario, the halving triggers a significant price increase due to a confluence of factors. Reduced supply coupled with sustained or increased demand leads to a price surge. Investors, anticipating scarcity and potential future price appreciation, actively accumulate Bitcoin, driving up demand further. Positive media coverage and increased institutional investment amplify the upward momentum. This scenario mirrors the price increases observed after previous halvings, although the magnitude of the increase may vary. For example, following the 2016 halving, Bitcoin’s price experienced a substantial rally. This upward trend could be fueled by a renewed belief in Bitcoin’s long-term value proposition as a store of value and a hedge against inflation, potentially attracting new investors and pushing the price significantly higher.

Bitcoin Price Stability After Halving

This scenario depicts a situation where the halving’s impact on price is muted. Increased demand resulting from the reduced supply is balanced by various countervailing forces. These forces could include macroeconomic headwinds, regulatory uncertainty, or a general lack of enthusiasm from new investors. The price might fluctuate within a relatively narrow range, with periods of modest gains offset by periods of slight corrections. Investor behavior in this scenario is characterized by caution and a wait-and-see approach. Many investors might hold onto their existing Bitcoin, but large-scale buying might be absent, preventing a significant price surge. This outcome would reflect a market that is less sensitive to the halving event than in previous cycles, possibly due to increased market maturity or the influence of other economic factors.

Bitcoin Price Decrease After Halving

This scenario explores a less optimistic outcome. Despite the reduced supply, a number of factors could lead to a price decline after the halving. These include a broader cryptocurrency market downturn, negative regulatory developments, or a loss of investor confidence. Existing Bitcoin holders might be forced to sell due to financial pressures, increasing supply and putting downward pressure on the price. Negative news and speculation could further exacerbate the decline, creating a self-fulfilling prophecy. Investor behavior would be characterized by fear and uncertainty, with many looking to sell their holdings to minimize potential losses. This scenario, while less likely, highlights the risks inherent in cryptocurrency investments and the unpredictable nature of the market. It’s important to remember that even events like halvings, which historically have correlated with price increases, do not guarantee future price movements.

Visual Representation of Scenarios

Scenario 1 (Price Increase): A sharply rising line graph, showing a significant upward trend after the halving date. The line’s slope is steep, indicating rapid price appreciation. The graph could be annotated with labels like “Increased Demand,” “Institutional Investment,” and “Scarcity.”

Scenario 2 (Price Stability): A relatively flat line graph after the halving date, with minor fluctuations around a central value. The graph could be annotated with labels such as “Balanced Supply and Demand,” “Market Caution,” and “Macroeconomic Factors.”

Scenario 3 (Price Decrease): A steeply falling line graph after the halving date, indicating a significant price decline. The graph could be annotated with labels such as “Negative News,” “Regulatory Uncertainty,” and “Forced Selling.”

Predicting the exact Bitcoin Halving 2025 date is challenging, given the complexities of the Bitcoin network. However, analysts often refer to resources like Halving 2025 Bitcoin for insights into the upcoming event. Understanding this event is crucial for forecasting potential price movements and market trends surrounding the Bitcoin Halving 2025 Prediction Date.

Predicting the Bitcoin Halving 2025 date involves complex calculations based on block generation times. While various predictions exist, pinpointing the exact moment remains challenging. For precise details on the anticipated date and time, you can consult this comprehensive resource: Bitcoin Halving 2025 Date And Time. Understanding this precise date is crucial for accurately forecasting potential market impacts following the Bitcoin Halving 2025 Prediction Date.

Predicting the exact Bitcoin Halving 2025 date remains a complex task, relying on estimations of block times. However, many anticipate the event to occur in April, as detailed in this insightful analysis of the Bitcoin April 2025 Halving. Therefore, while the precise day remains uncertain, April 2025 is currently the leading contender for the Bitcoin Halving 2025 Prediction Date.

Predicting the Bitcoin Halving 2025 date requires understanding the underlying mechanism of block reward reductions. To determine the precise timing, we need to consider the average block time and the current block height; a helpful resource for this is When Is Bitcoin Halving In 2025 , which provides updated calculations. Ultimately, these calculations inform any Bitcoin Halving 2025 Prediction Date.

Predicting the Bitcoin Halving 2025 date involves analyzing the blockchain’s block generation times, which can fluctuate. To get a precise understanding of the potential timing, it’s helpful to consult resources that track this data, such as this site detailing the Bitcoin Halving Date 2025 Time. Ultimately, while pinpointing the exact date remains challenging, understanding the factors affecting the halving allows for more accurate predictions.

Predicting the exact Bitcoin Halving 2025 date requires careful analysis of the blockchain’s block generation times. This event, significantly impacting Bitcoin’s inflation rate, is a key factor in price speculation. For a detailed understanding of the mechanics and potential implications, you should refer to this comprehensive resource on the 2025 Bitcoin Halving. Ultimately, pinpointing the precise date for the 2025 Bitcoin Halving remains a subject of ongoing discussion and prediction amongst experts.