Forbes’ Perspective on the 2025 Halving

Forbes, a prominent business publication, has consistently covered Bitcoin and its halving events, offering a range of analyses and predictions. Their coverage reflects a complex and evolving understanding of Bitcoin’s market dynamics, acknowledging both the potential for significant price appreciation and the inherent volatility of the cryptocurrency market. While not always uniformly bullish, their articles generally reflect a serious engagement with the fundamental aspects of Bitcoin’s design and its potential long-term impact.

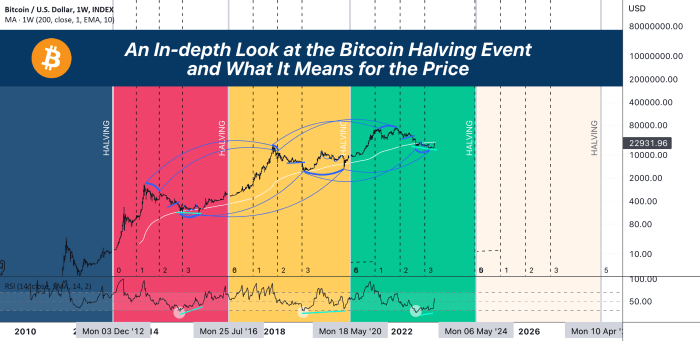

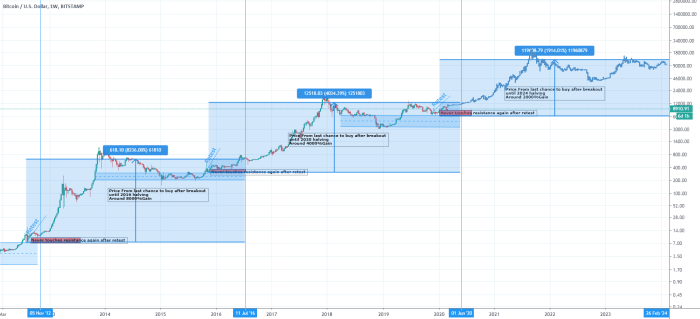

Forbes’ past articles on Bitcoin halvings have frequently highlighted the impact of reduced supply on price. The halving, which cuts the rate at which new Bitcoins are mined in half, is often presented as a key factor influencing scarcity and, consequently, potential price increases. Analysts have drawn parallels with previous halving events, pointing to historical price surges following these occurrences. However, they have also cautioned against simple extrapolations, acknowledging that other market forces, such as regulatory changes, macroeconomic conditions, and overall investor sentiment, play crucial roles.

Recurring Themes in Forbes’ Bitcoin Halving Analyses

Forbes’ analysts consistently emphasize the interplay between Bitcoin’s inherent scarcity and external market factors. While the halving is presented as a significant supply-side event that could potentially drive price appreciation, articles often caution against viewing it as a guaranteed catalyst for price increases. Several articles have stressed the importance of considering broader economic trends, technological developments within the cryptocurrency space, and regulatory landscapes in any price prediction. The narrative consistently acknowledges the unpredictable nature of cryptocurrency markets, emphasizing the need for caution and a balanced perspective. For instance, while some articles highlight the potential for substantial price increases post-halving, others emphasize the risk of price corrections or periods of consolidation.

Forbes’ Overall Stance on Bitcoin’s Long-Term Prospects

Forbes’ overall stance on Bitcoin’s long-term prospects, particularly in the context of the 2025 halving, appears cautiously optimistic. While acknowledging the inherent risks associated with investing in cryptocurrencies, many articles suggest that the 2025 halving could be a significant event with the potential to influence price. This optimism is often tempered with warnings about market volatility and the need for thorough due diligence before investing. The publication’s coverage frequently highlights the arguments for Bitcoin as a potential store of value and a hedge against inflation, while simultaneously acknowledging the counterarguments and potential risks. For example, several articles have explored the impact of potential regulatory changes on Bitcoin’s price, acknowledging the possibility of both positive and negative outcomes. The overall approach demonstrates a balanced perspective, acknowledging both the potential upside and downside risks associated with Bitcoin and the 2025 halving.

Market Predictions and Price Speculation

Predicting Bitcoin’s price, especially around a halving event, is notoriously difficult. Numerous factors influence its value, making any prediction inherently uncertain. However, analyzing the forecasts of various analysts and considering macroeconomic trends offers a glimpse into potential price scenarios for the 2025 Bitcoin halving.

The impact of the 2025 halving on Bitcoin’s price will depend on a complex interplay of factors, not solely the reduced supply. Macroeconomic conditions, regulatory changes, technological advancements, and overall market sentiment will all play significant roles. While the halving itself is a predictable event, its effect on price is anything but.

Price Predictions from Financial Analysts

Several analysts have offered price predictions for Bitcoin after the 2025 halving, ranging from conservative to extremely bullish. These predictions are often based on different models and assumptions, making direct comparisons challenging. For instance, some analysts use historical price action following previous halvings as a basis for their projections, while others incorporate more sophisticated quantitative models that consider various market indicators. It’s crucial to remember that these are just predictions, not guarantees. One analyst, for example, might project a price of $150,000 based on a model emphasizing the scarcity of Bitcoin after the halving, while another might offer a more conservative estimate of $75,000, citing potential macroeconomic headwinds. The range of predictions highlights the inherent uncertainty in forecasting Bitcoin’s price.

Impact of Macroeconomic Factors

Macroeconomic factors, such as inflation, interest rates, and global economic growth, significantly influence Bitcoin’s price. For instance, high inflation could drive investors towards Bitcoin as a hedge against inflation, potentially pushing its price upwards. Conversely, rising interest rates might make holding Bitcoin less attractive compared to other assets offering higher yields, potentially putting downward pressure on its price. A global recession could also lead to decreased investor appetite for riskier assets like Bitcoin, potentially causing a price decline. The interplay between these macroeconomic forces and the halving’s impact on Bitcoin’s supply is a key factor determining its future price. The 2022 bear market, for example, was partly driven by rising interest rates and a global economic slowdown, impacting Bitcoin’s price regardless of the upcoming halving.

Bullish and Bearish Scenarios

A bullish scenario for Bitcoin in 2025 might involve a continuation of institutional adoption, increased demand from emerging markets, and a positive macroeconomic environment. This combination could lead to a significant price surge following the halving, potentially exceeding even the most optimistic predictions. Conversely, a bearish scenario could involve increased regulatory scrutiny, a prolonged period of macroeconomic uncertainty, or a loss of investor confidence. This could result in a subdued price reaction to the halving, or even a further price decline. The actual outcome will likely fall somewhere between these extremes, depending on how these various factors evolve. For instance, a scenario where inflation remains high but economic growth slows could lead to a moderate price increase, while a scenario with low inflation and robust economic growth might result in a less dramatic price reaction.

Mining Difficulty and Hashrate Adjustments: Bitcoin Halving 2025 Prediction Forbes

The Bitcoin halving event, occurring approximately every four years, significantly impacts the network’s economics by reducing the block reward miners receive for validating transactions. This, in turn, triggers adjustments in mining difficulty and hashrate, influencing the overall health and security of the Bitcoin blockchain. Understanding these adjustments is crucial for predicting the network’s future behavior and its impact on various stakeholders.

The Bitcoin network automatically adjusts its mining difficulty every 2016 blocks (approximately two weeks) to maintain a consistent block generation time of around 10 minutes. After a halving, the block reward is cut in half, leading to reduced profitability for miners. This initially causes a decrease in the overall hashrate, as some miners may become unprofitable and shut down their operations. The difficulty adjustment mechanism then responds to this drop in hashrate by decreasing the mining difficulty, making it easier for the remaining miners to find and solve blocks. This ensures the network maintains its target block generation time. The inverse is also true: an increase in hashrate leads to a difficulty increase. This constant adjustment maintains the stability of the network.

Consequences of Hashrate Changes After the 2025 Halving

The 2025 halving will likely trigger a period of uncertainty regarding the hashrate. While the initial drop in hashrate is expected due to reduced profitability, the subsequent recovery depends on several factors, including the Bitcoin price, energy costs, and the adoption of more efficient mining hardware. A significant and sustained drop in hashrate could compromise the network’s security, making it more vulnerable to 51% attacks. Conversely, a rapid increase in hashrate could indicate strong miner confidence and continued network growth. The speed and extent of these changes will significantly influence the post-halving market dynamics. For example, the 2020 halving saw a temporary dip in hashrate followed by a substantial increase as miners upgraded their equipment and the Bitcoin price rose. This demonstrates the dynamic interplay between these factors.

Impact on Smaller Miners versus Larger Mining Operations

The impact of hashrate adjustments and the halving varies significantly depending on the scale of the mining operation. Larger mining operations, with access to cheaper energy, advanced hardware, and economies of scale, are better positioned to weather periods of low profitability. They can absorb the initial drop in profitability and may even increase their market share as smaller miners exit the market. Smaller miners, on the other hand, often operate on tighter margins and may find it difficult to remain profitable after a halving. They may be forced to shut down their operations, leading to a consolidation of the mining industry. This process of consolidation can be both beneficial and detrimental. While it can lead to a more efficient and resilient network, it also raises concerns about centralization and potential vulnerabilities. The 2012 and 2016 halvings both saw a significant decrease in the number of smaller miners. The extent to which this trend repeats in 2025 will significantly impact the network’s decentralization.

Impact on Bitcoin Supply and Demand

The 2025 Bitcoin halving, reducing the block reward for miners by half, will significantly impact the cryptocurrency’s supply and demand dynamics. This event, occurring roughly every four years, has historically been associated with periods of increased price volatility and altered market sentiment. Understanding the interplay between these factors is crucial for navigating the potential market shifts.

The halving directly impacts Bitcoin’s inflation rate. By reducing the rate at which new Bitcoins enter circulation, the halving creates a scenario of artificially constrained supply. This reduced supply, in a market with relatively consistent or even increasing demand, can theoretically exert upward pressure on the price. This effect is based on the fundamental economic principle of supply and demand; when supply decreases and demand remains constant or increases, prices generally rise. However, the actual impact is complex and depends on several other factors.

Investor Sentiment and Trading Volume

Investor sentiment surrounding Bitcoin is highly susceptible to external factors like macroeconomic conditions, regulatory changes, and technological advancements. The halving itself acts as a significant catalyst, often generating considerable media attention and speculation. This heightened interest can lead to increased trading volume as investors anticipate price movements. Historically, periods leading up to and following halvings have seen increased volatility, with prices sometimes experiencing sharp rises or falls depending on the prevailing market conditions and investor confidence. For example, the 2016 halving was followed by a significant price increase, while the 2020 halving’s impact was less pronounced due to the already existing upward trend. The 2025 halving’s effect will likely be influenced by the broader cryptocurrency market environment at that time.

Supply, Demand, and Price Volatility Interplay

The relationship between Bitcoin’s supply, demand, and price volatility is intricate. While a reduced supply theoretically pushes prices higher, this effect is not guaranteed. Demand plays a crucial role; if demand weakens or remains stagnant despite the reduced supply, the price increase may be muted or even absent. Furthermore, the halving’s impact on price is often not immediate but rather unfolds over time. Speculative trading, driven by anticipation of the halving’s effect, can lead to significant price swings both before and after the event. External factors like regulatory developments or broader economic trends can also influence the market’s response, potentially overriding the direct impact of the halving on supply. The price volatility is often amplified during periods of uncertainty surrounding the halving’s actual impact.

Long-Term Implications for Bitcoin’s Value

The 2025 Bitcoin halving, reducing the rate of new Bitcoin creation by half, is expected to have profound and long-lasting effects on Bitcoin’s value proposition, its adoption across various sectors, and its relationship with the broader financial landscape. While predicting the precise impact is inherently challenging, analyzing historical trends and current market dynamics allows for a reasoned assessment of potential long-term implications.

The decreased supply of newly minted Bitcoin, coupled with potentially sustained or increased demand, forms the core argument for a post-halving price increase. However, the actual outcome will depend on a complex interplay of factors including macroeconomic conditions, regulatory developments, and the overall evolution of the cryptocurrency market. The halving’s influence extends beyond simple price fluctuations; it significantly impacts Bitcoin’s long-term viability as a store of value, a medium of exchange, and a technological innovation.

Bitcoin Adoption and Use Cases

The 2025 halving could act as a catalyst for broader Bitcoin adoption. A potential price increase following the halving might attract new investors and businesses, leading to increased transaction volume and the development of new use cases. For instance, we might see greater integration of Bitcoin into existing financial systems, such as payment processors or institutional investment portfolios. The increased scarcity of Bitcoin, driven by the halving, could further solidify its position as a digital gold, attracting investors seeking a hedge against inflation or geopolitical instability. This increased adoption could lead to a more robust and resilient Bitcoin network, further enhancing its long-term value. Examples include the growing number of companies accepting Bitcoin as payment and the increasing institutional investment in Bitcoin-related products.

Impact on the Cryptocurrency Market and Traditional Finance

The 2025 halving’s impact will not be confined to Bitcoin alone. Its ripple effects are likely to be felt across the broader cryptocurrency market. A significant price increase in Bitcoin could trigger a positive sentiment, potentially leading to increased investment in other cryptocurrencies. However, it could also lead to increased regulatory scrutiny, impacting the entire sector. Furthermore, the halving could strengthen the relationship between the cryptocurrency market and traditional finance. As Bitcoin becomes more established and integrated into mainstream financial systems, the lines between traditional and decentralized finance might become increasingly blurred. The increasing acceptance of Bitcoin by institutional investors exemplifies this growing connection.

Potential Milestones and Developments Post-Halving

A timeline illustrating potential milestones and developments following the 2025 halving could include the following:

Bitcoin Halving 2025 Prediction Forbes – The immediate period following the halving (2025-2026) might see a period of market volatility, with price fluctuations influenced by market sentiment and macroeconomic factors. This will be a period of observation and analysis for investors and regulators alike. A potential scenario is a period of consolidation following an initial price surge, allowing for a more sustainable price discovery.

Forbes’ Bitcoin Halving 2025 predictions vary widely, with some analysts anticipating significant price increases. To accurately gauge the impact, pinpointing the exact date is crucial; determining precisely when this event occurs is key to understanding its market effects. For a definitive answer on the question, “What Day Is Bitcoin Halving 2025?”, check out this resource: What Day Is Bitcoin Halving 2025.

Knowing the date allows for a more informed assessment of Forbes’ predictions and their potential accuracy.

In the mid-term (2027-2028), increased adoption and institutional investment could lead to greater price stability and the development of new Bitcoin-based applications and services. The focus may shift towards practical applications of Bitcoin technology rather than speculative trading. We might see further integration into payment systems and supply chain management.

Forbes’ Bitcoin Halving 2025 predictions vary widely, with some analysts anticipating significant price increases. Pinpointing the exact moment is crucial for strategic investment, so knowing precisely when the halving occurs is key; to find out, check this resource: What Time Is The Bitcoin Halving 2025. Understanding this timing is essential for accurately interpreting Forbes’ predictions and their implications for the Bitcoin market in 2025 and beyond.

The long-term (2029 onwards) could see Bitcoin’s role evolve further, possibly becoming a significant component of global financial systems. Increased regulatory clarity and broader adoption could lead to a more mature and stable Bitcoin market. The long-term value of Bitcoin will depend on its ability to continue adapting and innovating to meet the changing needs of its users and the broader financial landscape.

Forbes’ Bitcoin Halving 2025 predictions vary widely, reflecting the inherent volatility of the cryptocurrency market. To accurately assess these predictions, understanding the precise timing of the halving is crucial. For a definitive answer to the question, “When is the 2025 Bitcoin Halving?”, consult this helpful resource: When Is The 2025 Bitcoin Halving. This knowledge then allows for a more informed interpretation of Forbes’ analyses regarding the potential impact of the 2025 Bitcoin Halving.

Risks and Uncertainties Surrounding the Prediction

Predicting Bitcoin’s price, especially around a halving event, is inherently fraught with uncertainty. While the halving itself is a predictable event (reducing the rate of new Bitcoin creation), its impact on price is far from guaranteed. Numerous factors beyond the halving’s direct influence can significantly alter any projected price trajectory. These factors introduce substantial risk for investors relying on these predictions.

Numerous factors beyond the halving’s direct influence can significantly alter any projected price trajectory. These factors introduce substantial risk for investors relying on these predictions. It’s crucial to understand that cryptocurrency markets are notoriously volatile, and even the most sophisticated models can be inaccurate.

Regulatory Changes and Government Actions

Government regulations play a significant role in the cryptocurrency market’s stability and growth. Changes in regulatory frameworks, whether in the United States, China, or the European Union, can dramatically impact Bitcoin’s price. A sudden crackdown on cryptocurrency exchanges or stricter KYC/AML (Know Your Customer/Anti-Money Laundering) regulations could lead to decreased trading volume and price volatility. Conversely, positive regulatory developments, such as the clear establishment of a regulatory framework, could lead to increased institutional investment and price appreciation. The example of China’s 2021 ban on cryptocurrency trading significantly impacted the price, illustrating the potent influence of government actions.

Macroeconomic Conditions and Global Events

Global economic events, such as recessions, inflation, and geopolitical instability, exert considerable influence on Bitcoin’s price. During periods of economic uncertainty, investors often flock to safe-haven assets like gold, potentially diverting funds away from riskier investments like Bitcoin. Conversely, periods of high inflation might drive investors towards Bitcoin as a hedge against inflation, potentially boosting its price. The 2008 financial crisis and the subsequent increase in Bitcoin adoption illustrate this correlation.

Technological Developments and Competition

Technological advancements within the cryptocurrency space, such as the emergence of new, competing cryptocurrencies or significant improvements to existing blockchain technologies, could impact Bitcoin’s dominance and, consequently, its price. The rise of Ethereum and other smart contract platforms has shown the potential for alternative cryptocurrencies to gain market share, potentially impacting Bitcoin’s value. Similarly, improvements in scalability and transaction speed of other cryptocurrencies could attract investors away from Bitcoin.

Market Sentiment and Speculation

Market sentiment, driven by news events, social media trends, and investor psychology, plays a crucial role in Bitcoin’s price volatility. Periods of intense fear or exuberance can lead to significant price swings, irrespective of the halving’s impact. For instance, Elon Musk’s tweets about Bitcoin have historically demonstrated the power of market sentiment to influence price. This underscores the importance of avoiding emotional decision-making when investing in Bitcoin.

Mitigating Investment Risks, Bitcoin Halving 2025 Prediction Forbes

Strategies to mitigate risks associated with Bitcoin investments include diversification, thorough due diligence, risk tolerance assessment, and a long-term investment horizon. Diversifying one’s portfolio across various asset classes, including traditional investments, reduces reliance on any single asset’s performance. Thorough research into Bitcoin’s underlying technology, market trends, and regulatory landscape helps in making informed investment decisions. Understanding one’s own risk tolerance is crucial to avoid impulsive decisions driven by market fluctuations. Finally, adopting a long-term investment perspective allows investors to weather short-term volatility and potentially benefit from the long-term growth potential of Bitcoin.

Alternative Perspectives and Counterarguments

While many anticipate a significant price surge following the 2025 Bitcoin halving, it’s crucial to acknowledge alternative viewpoints and potential counterarguments. The relationship between halving events and price movements isn’t necessarily linear or guaranteed, and other market forces significantly influence Bitcoin’s value.

The prevailing narrative focuses on the reduced supply of newly mined Bitcoin leading to increased scarcity and higher prices. However, this overlooks several key factors. For example, the halving’s impact is often intertwined with broader macroeconomic conditions, regulatory changes, and technological advancements within the cryptocurrency space. A bear market preceding the halving could significantly dampen the anticipated price increase, even with the reduced supply. Furthermore, the halving itself is a predictable event, meaning its impact might be partially priced in beforehand, reducing the magnitude of any subsequent price jump.

Macroeconomic Factors and Regulatory Uncertainty

The influence of macroeconomic conditions on Bitcoin’s price cannot be understated. For example, the 2022 bear market, driven partly by rising inflation and interest rate hikes, significantly impacted Bitcoin’s price regardless of the approaching halving. Similarly, regulatory uncertainty in various jurisdictions can create volatility and overshadow the effects of the halving. Stringent regulations could suppress demand, while a more favorable regulatory environment could potentially boost it, regardless of the halving’s impact on supply. Consider the contrasting regulatory landscapes in the US and El Salvador as examples of how government policies can significantly influence Bitcoin’s price trajectory.

Technological Advancements and Competition

Technological advancements in the cryptocurrency space also present counterarguments to the simplistic supply-and-demand narrative surrounding the halving. The emergence of competing cryptocurrencies with potentially superior features or scalability could divert investment away from Bitcoin, mitigating the halving’s price impact. Improvements in mining technology could also offset the reduced block rewards, potentially impacting the overall mining profitability and network security. For instance, the development of more energy-efficient mining hardware could lead to a sustained hashrate even with a reduced block reward.

The Role of Market Sentiment and Speculation

Market sentiment and speculation play a crucial role in Bitcoin’s price fluctuations, often overshadowing fundamental factors like the halving. Periods of intense fear, uncertainty, and doubt (FUD) can drive down the price, while periods of hype and exuberance can lead to significant price increases, irrespective of the halving’s impact on supply. The 2017 Bitcoin bubble, driven largely by speculation and hype, illustrates the power of market sentiment to outweigh fundamental factors in determining short-term price movements. Similarly, the 2021 bull run saw significant price appreciation despite the halving occurring earlier in the year.

Comparing Halving Effects with Other Factors

The long-term effects of the halving need to be considered in conjunction with other factors that influence Bitcoin’s price. Adoption rates, institutional investment, technological advancements, and regulatory developments all play a significant role. While the halving creates a predictable shift in the rate of new Bitcoin entering circulation, the overall market dynamics determine how this shift translates into price changes. A sustained increase in institutional adoption, for instance, could significantly outweigh the impact of a reduced supply, leading to price appreciation even in the absence of a halving-driven surge. Conversely, a lack of widespread adoption could dampen the halving’s positive effects.

Illustrative Examples

Predicting Bitcoin’s price after a halving is inherently speculative, but visualizing potential scenarios helps understand the range of possibilities. We can construct hypothetical price trajectories based on various assumptions about market sentiment, adoption rates, and macroeconomic factors. These examples are not financial advice, and actual price movements may differ significantly.

Several factors influence Bitcoin’s price following a halving, including supply-demand dynamics, regulatory changes, and overall market sentiment. To illustrate, we’ll present two contrasting scenarios: a bullish scenario reflecting high market confidence and a bearish scenario reflecting increased uncertainty. We will also present a more neutral scenario, representing a moderate market response. These scenarios utilize hypothetical data for illustrative purposes and should not be interpreted as definitive predictions.

Price Trajectory Scenarios

The following chart depicts three potential price trajectories for Bitcoin in the 24 months following the 2025 halving. The X-axis represents time in months, and the Y-axis represents Bitcoin’s price in USD.

Scenario 1: Bullish Market This scenario assumes sustained high demand, positive regulatory developments, and increasing institutional adoption. The price begins a gradual increase in the months leading up to the halving, then accelerates sharply after the halving due to the reduced supply. The curve would show a steep upward trend, potentially exceeding previous all-time highs within a year. Data sources for this scenario are extrapolated from historical Bitcoin price movements following previous halvings, adjusted for anticipated increased adoption and market maturity. It assumes a positive global macroeconomic environment.

Scenario 2: Bearish Market This scenario assumes a negative macroeconomic climate, increased regulatory scrutiny, and reduced investor confidence. The price may initially rise slightly after the halving due to the reduced supply, but this is quickly followed by a downturn as negative factors outweigh the impact of the halving. The curve would show a relatively flat trajectory, or even a decline, after an initial short-lived surge. Data for this scenario considers historical periods of market downturn and incorporates potential negative impacts of regulatory uncertainty and economic recession.

Scenario 3: Neutral Market This scenario assumes a moderate level of investor confidence and a relatively stable macroeconomic environment. The price increases gradually after the halving, reflecting the reduced supply, but the increase is less dramatic than in the bullish scenario. The curve would display a moderate upward trend, reflecting a balanced interplay of supply and demand factors. Data for this scenario incorporates historical data from previous halvings, factoring in a more balanced market response.

Potential Price Ranges and Probabilities

The following table summarizes the potential price ranges and their associated probabilities based on the three scenarios described above. These probabilities are subjective estimates based on analysis of historical data and current market conditions. They are not guaranteed outcomes.

| Scenario | Probability | Price Range (Low) (USD) | Price Range (High) (USD) | Underlying Assumptions |

|---|---|---|---|---|

| Bullish | 25% | 150,000 | 300,000 | High demand, positive regulation, strong institutional adoption, positive macroeconomic environment |

| Neutral | 50% | 75,000 | 150,000 | Moderate demand, stable regulation, moderate institutional adoption, stable macroeconomic environment |

| Bearish | 25% | 30,000 | 75,000 | Low demand, negative regulation, weak institutional adoption, negative macroeconomic environment |

Frequently Asked Questions

This section addresses common queries surrounding the 2025 Bitcoin halving, offering insights into its mechanics, historical impact, and potential future implications. Understanding these aspects is crucial for navigating the complexities of the cryptocurrency market.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created and added to the circulating supply. This occurs approximately every four years, or every 210,000 blocks mined. The halving cuts the block reward in half, meaning miners receive fewer Bitcoins for successfully verifying transactions and adding new blocks to the blockchain. The initial block reward was 50 BTC, and it has been halved three times already, currently standing at 6.25 BTC per block.

Bitcoin Halving’s Price Impact

Historically, Bitcoin halvings have been followed by periods of significant price appreciation. The 2012 and 2016 halvings were both followed by substantial bull runs, although the timing and magnitude of price increases varied. This is often attributed to the reduced supply of new Bitcoins entering the market, potentially increasing scarcity and driving up demand. However, it’s crucial to note that other factors, such as market sentiment, regulatory changes, and technological advancements, also significantly influence Bitcoin’s price. The 2020 halving, while initially showing positive momentum, was followed by a period of consolidation before the subsequent bull run. This highlights the complex interplay of factors beyond the halving itself.

Risks of Investing in Bitcoin Around a Halving

Investing in Bitcoin carries inherent risks, amplified around a halving event due to heightened volatility. The price could experience sharp fluctuations, both upwards and downwards, driven by speculation and market sentiment. The “buy the dip” strategy, popular around halvings, is not risk-free; investors could experience significant losses if the price continues to decline. Furthermore, the halving’s impact is not guaranteed, and other macroeconomic factors can override its influence. Risk mitigation strategies include diversification, only investing what you can afford to lose, and conducting thorough research before making investment decisions. Dollar-cost averaging, a strategy of investing fixed amounts at regular intervals, can also help mitigate risk by reducing the impact of price volatility.

Alternative Viewpoints on the 2025 Halving

Some analysts believe the halving’s impact on price is overstated, arguing that the market has already priced in the event. Others point to the potential for increased adoption and institutional investment to drive demand, regardless of the halving. There are also concerns about the potential for increased mining centralization and the environmental impact of Bitcoin mining, which could negatively affect the price. These differing perspectives highlight the uncertainty inherent in predicting Bitcoin’s future price. For example, some believe the halving’s impact will be muted due to the already significant adoption of Bitcoin compared to previous halvings.

Reliable Information Sources on the 2025 Halving

For reliable information on the 2025 Bitcoin halving, consult reputable sources such as CoinDesk, CoinGecko, and Messari. Academic research papers and publications from established financial institutions can also offer valuable insights. Always critically evaluate information from less established sources, considering the potential for bias or misinformation. Furthermore, examining historical data and analyzing market trends from credible sources provides a more informed perspective on potential future outcomes. Remember that relying on a single source is insufficient; cross-referencing information from multiple reputable sources is crucial for a comprehensive understanding.

Forbes’ Bitcoin Halving 2025 predictions vary widely, with some analysts anticipating significant price increases. To accurately gauge potential impacts, understanding the precise timing is crucial; for that, check out this helpful resource on When Halving Bitcoin 2025 which provides a detailed timeline. Ultimately, these predictions inform, but don’t definitively dictate, the future trajectory of Bitcoin’s price post-halving.

Forbes’ predictions regarding the Bitcoin Halving in 2025 often center on its potential impact on price volatility. To accurately assess these predictions, understanding the precise date of the halving is crucial. You can find the confirmed date by checking this resource: Bitcoin Halving 2025 Date. Knowing this date allows for a more informed interpretation of Forbes’ analysis and its implications for Bitcoin’s future.

Forbes’ Bitcoin Halving 2025 predictions vary widely, with analysts offering diverse perspectives on its potential impact. To accurately gauge these predictions, understanding the precise timing is crucial; for that, check out this resource on When Does Bitcoin Halving 2025 to better contextualize the various forecasts from Forbes and other sources regarding the 2025 Bitcoin halving’s effects.

Ultimately, these predictions hinge on the actual date of the event.