Bitcoin Halving 2025: Bitcoin Halving 2025 Price

The Bitcoin halving, a pre-programmed event occurring approximately every four years, is a significant moment in the cryptocurrency’s lifecycle. This event directly impacts the rate at which new Bitcoins are created, influencing the overall supply and potentially impacting its market price. Understanding the mechanics and historical context of these halvings is crucial for comprehending their potential influence on Bitcoin’s future.

Bitcoin Halving Mechanics and Historical Price Impact

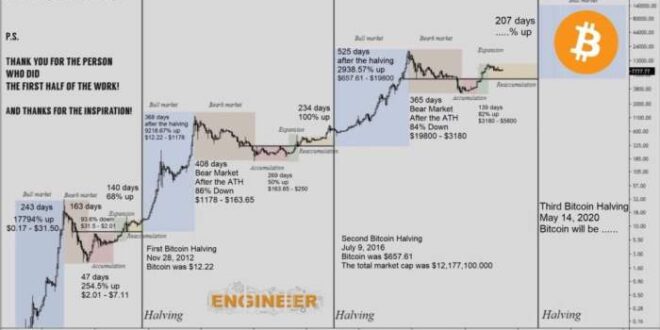

The Bitcoin halving reduces the reward paid to Bitcoin miners for successfully validating transactions and adding new blocks to the blockchain. This reward, initially set at 50 BTC per block, is halved every 210,000 blocks mined. Historically, halvings have been followed by periods of increased Bitcoin price, although the timing and magnitude of these price increases have varied. The 2012 halving saw a gradual price increase over the following year, while the 2016 halving was followed by a more dramatic price surge in 2017. The 2020 halving also led to a significant price increase, although the market dynamics were influenced by other factors as well. The correlation isn’t perfectly predictable, however, as other market forces play a significant role.

Expected Reward Reduction in 2025

In the 2025 halving, the block reward will be reduced from 6.25 BTC to 3.125 BTC per block. This represents a 50% decrease in the newly minted Bitcoin entering circulation with each block mined. This reduction in supply is a key factor often cited as a potential catalyst for price appreciation.

Bitcoin Scarcity and Price Relationship, Bitcoin Halving 2025 Price

Bitcoin’s design incorporates a hard cap of 21 million coins. The halving mechanism contributes to the scarcity of Bitcoin, as the rate of new coin creation steadily decreases over time. Economic theory suggests that, all else being equal, a decrease in supply with consistent or increasing demand can lead to an increase in price. This fundamental principle of supply and demand is often applied to Bitcoin’s price prediction following halving events.

Comparison of the 2025 Halving to Previous Events

While the mechanics of each halving remain consistent – a 50% reduction in block reward – the macroeconomic environment and market sentiment surrounding each event differ significantly. The 2012 halving occurred during Bitcoin’s early stages, with relatively low market capitalization and limited adoption. The 2016 and 2020 halvings took place in more mature markets with increased institutional interest and global awareness. The 2025 halving will likely occur within a context shaped by ongoing regulatory developments, broader cryptocurrency market trends, and potentially evolving global economic conditions. Therefore, direct comparisons with past events should be approached cautiously, as they cannot perfectly predict the future price movement. While past halvings have generally been followed by price increases, other factors are at play and no guarantee of similar outcomes exists.