Investing in Bitcoin

Bitcoin, with its decentralized nature and potential for high returns, has captivated investors worldwide. However, its volatile nature and inherent risks demand a cautious approach. Understanding both the potential rewards and the significant downsides is crucial before considering any investment. This section explores the multifaceted nature of Bitcoin investment, emphasizing responsible decision-making.

Investing in Bitcoin presents a unique opportunity for substantial profit, driven by factors such as increasing adoption, limited supply, and technological advancements. However, this potential is inextricably linked to significant risks. The cryptocurrency market is known for its extreme volatility, with prices subject to rapid and unpredictable swings influenced by market sentiment, regulatory changes, and technological developments. These fluctuations can lead to substantial losses in a short period. Furthermore, the decentralized and unregulated nature of Bitcoin increases the risk of scams, hacks, and theft. The complexity of the technology also presents a barrier to entry for many potential investors, increasing the chance of making uninformed decisions.

Risk Management Strategies for Bitcoin Investment

Effective risk management is paramount when investing in Bitcoin. Diversification is a key strategy, spreading investments across various asset classes to mitigate losses should one investment underperform. This could involve allocating a small percentage of one’s overall portfolio to Bitcoin, rather than committing a significant portion. Dollar-cost averaging, a method of investing a fixed amount at regular intervals regardless of price fluctuations, helps to reduce the impact of volatility. This strategy mitigates the risk of investing a large sum at a market peak. Finally, securing Bitcoin holdings through the use of robust hardware wallets and employing strong security practices is essential to protect against theft and loss. Regularly reviewing and updating security measures is vital.

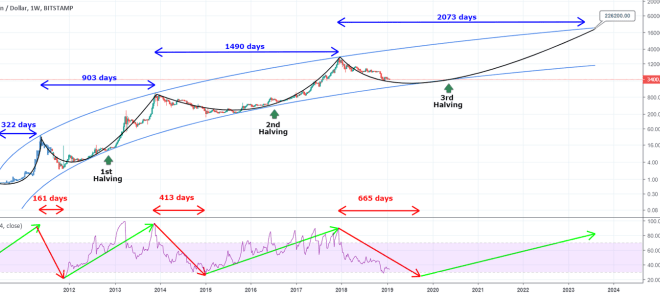

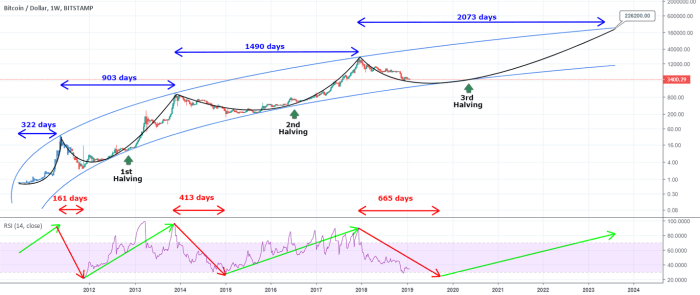

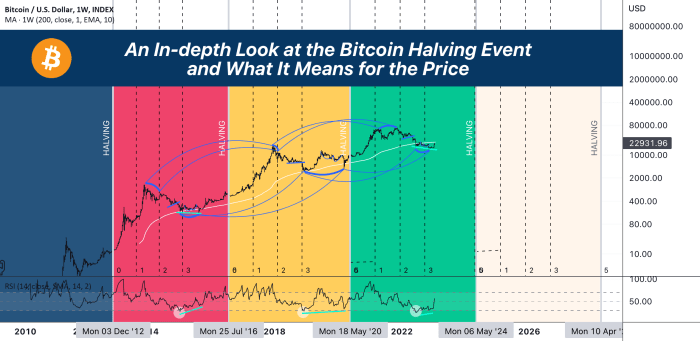

Importance of Thorough Research, Bitcoin Halving 2025 Price Prediction

Before investing in Bitcoin, comprehensive research is essential. Understanding the underlying technology, its potential applications, and the factors influencing its price is crucial. Analyzing market trends, reading reputable financial news sources, and staying informed about regulatory developments can help investors make more informed decisions. This research should include examining the history of Bitcoin’s price volatility and understanding the various factors that have driven its price movements in the past. For example, studying the impact of previous halving events on Bitcoin’s price can provide insights into potential future scenarios, although past performance is not necessarily indicative of future results.

Investing Only What You Can Afford to Lose

This fundamental principle of investing applies especially strongly to Bitcoin. Only invest capital that you can afford to lose entirely without impacting your financial stability or lifestyle. The high volatility of Bitcoin means that there is a real possibility of losing your entire investment. Therefore, it is crucial to avoid investing borrowed money or funds that are essential for meeting immediate financial obligations. A responsible investment strategy always prioritizes financial security and avoids excessive risk-taking. Consider Bitcoin as a speculative investment, acknowledging the potential for significant losses, rather than a guaranteed path to wealth.

Frequently Asked Questions (FAQs): Bitcoin Halving 2025 Price Prediction

This section addresses common questions regarding the Bitcoin halving and its potential impact on the price of Bitcoin in 2025. Understanding these key aspects is crucial for anyone considering investment in this volatile yet potentially rewarding cryptocurrency.

Bitcoin Halving Explained

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by half. This occurs approximately every four years, or every 210,000 blocks mined. Essentially, it’s a built-in deflationary mechanism designed to control the supply of Bitcoin. The halving reduces the reward miners receive for verifying transactions and adding new blocks to the blockchain.

The Halving’s Effect on Bitcoin’s Price

Historically, Bitcoin’s price has tended to increase following previous halving events. This is largely attributed to the reduced supply of new Bitcoins entering the market, potentially creating upward pressure on demand. The 2012 and 2016 halvings were followed by significant price increases, although the timing and magnitude of these increases varied. It’s important to note that correlation doesn’t equal causation; other market factors also significantly influence Bitcoin’s price.

Factors Influencing the 2025 Bitcoin Price

Several factors beyond the halving will likely influence Bitcoin’s price in 2025. These include macroeconomic conditions (e.g., inflation, interest rates), regulatory developments (e.g., government policies regarding cryptocurrencies), technological advancements (e.g., scalability solutions for Bitcoin), and overall market sentiment and adoption rates. Predicting the precise interplay of these factors is challenging, making accurate price forecasting inherently difficult. For example, the increased adoption of Bitcoin by institutional investors could drive demand, while a global economic downturn might reduce overall investment appetite, thus affecting the price.

Bitcoin Investment Risks and Rewards

Investing in Bitcoin carries significant risks. Its price is highly volatile, subject to dramatic swings in both directions. Regulatory uncertainty, security breaches, and technological disruptions are also potential risks. However, Bitcoin also offers the potential for high rewards. Its limited supply and growing adoption could lead to substantial price appreciation over the long term. As with any investment, careful consideration of your risk tolerance and financial goals is essential before investing in Bitcoin. Diversification of your investment portfolio is also a recommended strategy to mitigate risk.

Predicting the Bitcoin Halving 2025 price is a complex undertaking, influenced by numerous market factors. To effectively reach potential investors interested in this prediction, a robust marketing strategy is crucial, and setting up a Google Ads Account could significantly improve your campaign’s reach and visibility. This targeted advertising can help ensure your Bitcoin Halving 2025 price prediction reaches the right audience.