Bitcoin Halving 2025

The Bitcoin halving, a pre-programmed event occurring approximately every four years, is a significant occurrence in the cryptocurrency’s lifecycle. This event reduces the rate at which new Bitcoins are created, effectively decreasing the inflation rate of the network. Understanding the mechanics of this event and its historical impact is crucial for navigating the potential market fluctuations surrounding the 2025 halving.

Bitcoin Halving Mechanics and Historical Price Impact

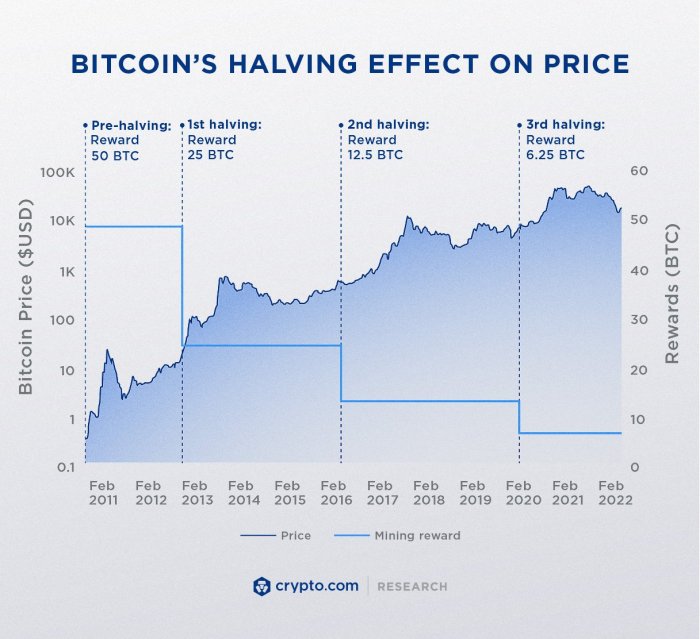

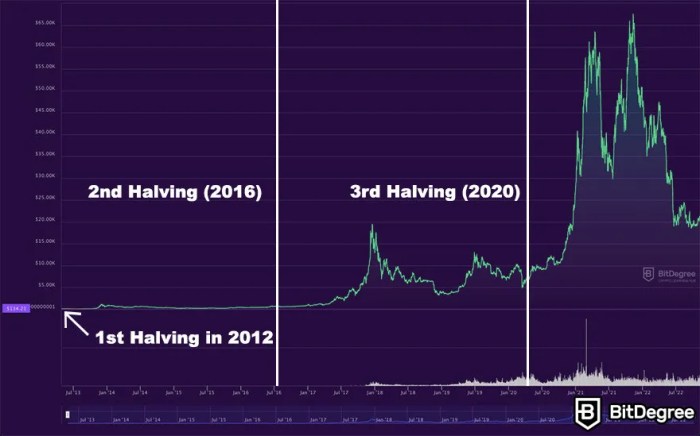

The Bitcoin halving mechanism is embedded within the Bitcoin protocol. Every 210,000 blocks mined, the reward given to miners for successfully adding a new block to the blockchain is halved. This started with a 50 BTC block reward, reduced to 25 BTC, then 12.5 BTC, and will be reduced to 6.25 BTC in 2025. Historically, halving events have been followed by periods of increased Bitcoin price, although the duration and magnitude of these price increases have varied. The scarcity introduced by the reduced supply is often cited as a primary driver for this price appreciation. However, it’s important to note that other market factors, such as overall economic conditions and regulatory changes, also significantly influence Bitcoin’s price.

Projected Bitcoin Supply After the 2025 Halving

After the 2025 halving, the rate of new Bitcoin entering circulation will decrease significantly. The total supply of Bitcoin is capped at 21 million coins. While the exact date of the final Bitcoin being mined is uncertain, it’s projected to occur sometime in the late 2140s. The reduced issuance post-2025 will further contribute to the scarcity of Bitcoin, potentially leading to increased demand and price appreciation, mirroring the impact observed in previous halvings. This limited supply is a fundamental element of Bitcoin’s deflationary nature, a key characteristic that differentiates it from inflationary fiat currencies.

Comparison of Market Conditions Leading Up to Previous Halvings

The market conditions leading up to each halving have been notably different. The 2012 halving occurred during Bitcoin’s early stages, with relatively low market capitalization and limited mainstream awareness. The 2016 halving saw increased institutional interest and growing adoption, while the 2020 halving took place amid a broader cryptocurrency boom. Currently, the market faces a complex landscape with macroeconomic uncertainties, regulatory scrutiny, and increased competition from alternative cryptocurrencies. Comparing these diverse contexts highlights the difficulty in predicting the precise impact of the 2025 halving. The unique characteristics of each preceding halving period emphasizes the importance of considering the current market climate alongside historical trends.

Potential Price Scenarios Following the 2025 Halving

Following the 2025 halving, several price scenarios are plausible. A bullish scenario suggests that the reduced supply, coupled with sustained or increased demand, could drive a significant price increase. This is supported by the historical price appreciation following previous halvings. Conversely, a bearish scenario might involve a prolonged period of price stagnation or even a decline, potentially driven by macroeconomic factors or negative regulatory developments. The actual outcome will likely depend on a complex interplay of factors, making definitive prediction challenging. It is crucial to remember that past performance is not indicative of future results and that market volatility is inherent to cryptocurrencies. Examples from the previous halving cycles demonstrate the wide range of potential outcomes. For instance, the 2012 halving was followed by a period of gradual price growth, whereas the 2020 halving led to a significant price surge.

Key Metrics Before and After Past Halvings

| Metric | Before 2012 Halving | After 2012 Halving | Before 2016 Halving | After 2016 Halving | Before 2020 Halving | After 2020 Halving |

|---|---|---|---|---|---|---|

| Bitcoin Price (USD) | ~ $5 | ~ $12 | ~ $650 | ~ $20,000 | ~ $9,000 | ~ $60,000 |

| Block Reward (BTC) | 50 | 25 | 25 | 12.5 | 12.5 | 6.25 |

| Mining Difficulty | (Data varies, needs specific source) | (Data varies, needs specific source) | (Data varies, needs specific source) | (Data varies, needs specific source) | (Data varies, needs specific source) | (Data varies, needs specific source) |

The Impact of the 2025 Halving on Miners

The Bitcoin halving event of 2025, scheduled to reduce the block reward from 6.25 BTC to 3.125 BTC, will significantly impact Bitcoin miners’ operations and the overall network. This reduction in reward directly affects miners’ profitability, forcing them to adapt their strategies to remain viable. The consequences extend beyond individual miners, influencing the network’s hashrate, security, and degree of decentralization.

Reduced Block Reward and Miner Profitability

The halving will immediately cut miners’ revenue in half, assuming all other factors remain constant. This means that the same mining operation will generate significantly less income. Profitability will depend heavily on the price of Bitcoin, the cost of electricity, and the efficiency of mining hardware. If the Bitcoin price doesn’t increase sufficiently to compensate for the reduced block reward, many miners, particularly those operating with less efficient equipment or higher electricity costs, may find themselves unprofitable. For example, a miner with high electricity costs and older ASICs might have been marginally profitable before the halving but become completely unprofitable afterward. This scenario highlights the critical importance of operational efficiency and the price of Bitcoin post-halving.

Miner Adaptation Strategies

Faced with reduced profitability, miners will likely employ several strategies to adapt. These include upgrading to more energy-efficient hardware (ASICs) to reduce operational costs, negotiating lower electricity prices with providers, diversifying revenue streams by exploring services like mining pools and node operation, and potentially relocating to regions with cheaper energy. Some miners might also choose to consolidate operations, merging smaller operations to achieve economies of scale. The most drastic measure would be to cease mining operations altogether if profitability becomes unsustainable.

Impact on Hashrate and Network Security

The halving’s effect on the hashrate – the total computational power securing the Bitcoin network – is complex and uncertain. A decline in profitability could lead some miners to shut down, resulting in a decrease in the hashrate. This could theoretically reduce the network’s security, making it more vulnerable to 51% attacks. However, the price of Bitcoin often increases following a halving, potentially offsetting the reduced block reward and attracting new miners, potentially increasing the hashrate. The net effect will depend on the interplay of these opposing forces. Historically, Bitcoin has demonstrated resilience, with the hashrate recovering after previous halvings.

Centralization vs. Decentralization of Mining

The halving could potentially exacerbate the centralization of Bitcoin mining. Larger, well-capitalized mining operations with access to cheap electricity and efficient hardware are better positioned to withstand the reduced profitability. This could lead to a consolidation of mining power in the hands of fewer entities, potentially raising concerns about the network’s decentralization. However, the entry of new, efficient miners and technological advancements could counteract this trend, maintaining a relatively decentralized network. The outcome depends on several factors, including technological innovation, regulatory environments, and the overall market conditions.

Decision-Making Flowchart for a Bitcoin Miner

A flowchart depicting a Bitcoin miner’s decision-making process after the halving might look like this:

[Start] –> [Is my operation profitable after the halving?] –> [Yes] –> [Maintain operations] –> [End] [No] –> [Can I reduce costs (e.g., cheaper electricity, more efficient hardware)?] –> [Yes] –> [Implement cost reduction strategies] –> [Is operation now profitable?] –> [Yes] –> [Maintain operations] –> [End] [No] –> [Can I diversify revenue streams (e.g., mining pool, node operation)?] –> [Yes] –> [Diversify] –> [Is operation now profitable?] –> [Yes] –> [Maintain operations] –> [End] [No] –> [Should I cease operations?] –> [Yes] –> [Cease operations] –> [End] [No] –> [Explore other options (e.g., relocation, consolidation)] –> [Find viable option?] –> [Yes] –> [Implement option] –> [Is operation now profitable?] –> [Yes] –> [Maintain operations] –> [End] [No] –> [Cease operations] –> [End]Investor Sentiment and Market Predictions

The Bitcoin halving in 2025 is a significant event anticipated to impact investor sentiment and market predictions regarding Bitcoin’s price. Understanding the diverse perspectives and potential catalysts is crucial for navigating the market leading up to and following this event. The historical context of previous halvings and various predictive models offer valuable insights into potential price movements.

Investor Perspectives on the 2025 Halving’s Price Influence

Different investor groups hold varying perspectives on the 2025 halving’s impact on Bitcoin’s price. Bullish investors believe the halving will significantly reduce the supply of new Bitcoins entering the market, leading to increased scarcity and, consequently, a price surge. This is based on the historical correlation between previous halvings and subsequent price increases. Conversely, some bearish investors argue that the market has already priced in the halving’s effect, or that other macroeconomic factors will outweigh its influence. A more neutral perspective suggests that the halving will be one factor among many influencing price, with its impact ultimately dependent on broader market conditions, regulatory developments, and technological advancements.

Potential Catalysts Influencing Bitcoin’s Price, Bitcoin Halving 2025 Time

Several factors could act as catalysts, driving Bitcoin’s price before and after the 2025 halving. Positive catalysts include increased institutional adoption, positive regulatory developments, the growth of the Bitcoin Lightning Network improving transaction speeds and scalability, and a general increase in investor confidence in cryptocurrencies. Conversely, negative catalysts could include heightened regulatory scrutiny, a major security breach affecting a major exchange, a significant macroeconomic downturn impacting investor risk appetite, or negative news impacting the overall cryptocurrency market. The interplay of these positive and negative catalysts will ultimately determine the price trajectory. For example, the 2017 bull run was partly fueled by increased institutional interest and mainstream media coverage, while the 2022 bear market was partly driven by macroeconomic factors and regulatory uncertainty.

Comparison of Current and Past Market Sentiments

The current market sentiment surrounding Bitcoin is significantly different from that observed before previous halvings. While there’s still considerable anticipation surrounding the 2025 halving, the market has matured considerably since 2012 and 2016. The increased institutional involvement, regulatory scrutiny, and the overall market sophistication have tempered some of the extreme bullishness observed in earlier cycles. The market is arguably more nuanced and less susceptible to wild speculation driven solely by the halving event. This increased maturity suggests a potentially more measured price response compared to previous halving cycles.

Bitcoin Price Prediction Models

Various models attempt to forecast Bitcoin’s future value. These include on-chain metrics such as the Stock-to-Flow (S2F) model, which correlates Bitcoin’s scarcity with its price. While S2F has shown some historical correlation, it’s not a perfect predictor and its accuracy has been debated. Other models incorporate technical analysis, focusing on chart patterns and trading volume to predict price movements. Furthermore, macroeconomic models attempt to integrate broader economic factors to project Bitcoin’s price. These models often provide a range of potential outcomes rather than a single point prediction, acknowledging the inherent uncertainty in the market. For instance, some models might predict a price range of $100,000-$200,000 based on certain assumptions about adoption rates and macroeconomic conditions.

Timeline of Key Events and Potential Market Impacts

A timeline highlighting key events leading up to and following the 2025 halving is crucial for understanding potential market impacts. The period leading up to the halving might witness increased volatility as investors position themselves. The halving itself is likely to be followed by a period of uncertainty, with the price potentially consolidating before any significant price movement. Subsequent events, such as further institutional adoption or regulatory changes, could then drive significant price changes. For example, a positive regulatory development after the halving could amplify the positive price impact. Conversely, a negative regulatory development could dampen the expected price increase or even lead to a price decline. This timeline should be viewed as a dynamic framework, subject to the influence of unforeseen events.

| Time Period | Event | Potential Market Impact |

|---|---|---|

| 2023-2024 | Increased Institutional Investment, Regulatory Developments | Potential price increase or consolidation depending on the nature of the news |

| Early 2025 | Approaching Halving Date | Increased volatility, anticipation building |

| Mid-2025 | Bitcoin Halving | Short-term uncertainty, potential price consolidation |

| Late 2025 – 2026 | Post-Halving Market Dynamics | Potential price increase or decrease depending on broader market conditions and adoption rates |

The Role of Regulation and Adoption: Bitcoin Halving 2025 Time

The 2025 Bitcoin halving will undoubtedly impact the cryptocurrency’s trajectory, but its success hinges significantly on the interplay between global regulation and increased adoption. Regulatory frameworks and the level of institutional and mainstream acceptance will shape Bitcoin’s price volatility and overall market position in the post-halving era. Understanding these dynamics is crucial for navigating the evolving landscape.

Global Regulatory Influences on Bitcoin’s Price and Adoption

The impact of global regulations on Bitcoin’s price and adoption after the halving is multifaceted. Stringent regulations in major economies could stifle innovation and investment, potentially suppressing price growth. Conversely, clear, consistent, and investor-friendly regulatory frameworks could foster trust and encourage broader participation, driving up demand and price. The differing approaches taken by various governments will create a complex and dynamic global regulatory environment for Bitcoin. For example, a nation with clear guidelines on Bitcoin taxation and security could attract significant investment, while another with a blanket ban could see capital flight. The overall global regulatory landscape will therefore play a crucial role in shaping the market after the halving.

Institutional Adoption’s Effect on Market Dynamics

Increased institutional adoption, such as the growing involvement of hedge funds, asset management firms, and corporations, significantly alters market dynamics. Large-scale investments inject liquidity, potentially stabilizing prices and reducing volatility. Institutional investors often bring sophisticated risk management strategies and a focus on long-term growth, which can counterbalance the speculative tendencies of retail investors. The entry of these large players often signals a shift towards greater market maturity and reduces the influence of short-term price fluctuations driven by individual traders. For example, the entry of MicroStrategy and Tesla into the Bitcoin market signaled a significant shift in investor sentiment and attracted further institutional investment.

Regulatory Landscapes in Major Economies

Regulatory landscapes vary considerably across major economies. The United States, for instance, has a fragmented regulatory approach with different agencies overseeing various aspects of cryptocurrencies. The European Union is developing a more unified framework, aiming for a harmonized approach across member states. Meanwhile, some countries have embraced a more progressive approach, establishing regulatory sandboxes to foster innovation while mitigating risks. China, on the other hand, has imposed a near-total ban on cryptocurrency transactions. These contrasting approaches create diverse investment environments, influencing capital flows and Bitcoin’s overall market performance. This divergence will likely continue to shape the global Bitcoin market after the halving.

Wider Mainstream Adoption and Price Volatility

Wider mainstream adoption, driven by factors such as increased user-friendliness, improved infrastructure, and enhanced regulatory clarity, can significantly impact Bitcoin’s price volatility. As the number of users increases, the market becomes more liquid and less susceptible to large price swings caused by individual trades or events. Greater liquidity and broader participation tend to dampen price volatility, leading to a more stable market. However, it’s important to note that significant price movements can still occur, particularly in response to major geopolitical events or regulatory changes. The adoption of Bitcoin as a payment method by large retailers could be a key factor in reducing volatility, as it would increase the demand for Bitcoin for everyday transactions.

Potential Regulatory Hurdles and Opportunities

The post-halving period presents both significant regulatory hurdles and exciting opportunities for Bitcoin.

Bitcoin Halving 2025 Time – The following points Artikel potential challenges and prospects:

- Increased Scrutiny: Regulatory bodies worldwide are likely to increase their scrutiny of Bitcoin and other cryptocurrencies, potentially leading to stricter regulations.

- Taxation Challenges: Determining the appropriate tax treatment of Bitcoin transactions remains a complex issue for many governments.

- Money Laundering Concerns: The potential use of Bitcoin for illicit activities continues to be a major concern for regulators.

- Consumer Protection: Ensuring adequate consumer protection in the cryptocurrency market is a critical challenge.

- Cross-Border Regulation: The global nature of Bitcoin necessitates international cooperation on regulatory frameworks.

- Innovation Opportunities: Clear and consistent regulations can foster innovation in the Bitcoin ecosystem, leading to the development of new applications and services.

- Investment Opportunities: A well-defined regulatory environment can attract significant institutional investment, boosting market liquidity and stability.

- Financial Inclusion: Bitcoin’s potential to provide financial services to underserved populations is a significant opportunity.

Long-Term Implications of the 2025 Halving

The 2025 Bitcoin halving, reducing the rate of newly minted Bitcoin by half, is a significant event with profound long-term implications for the cryptocurrency’s scarcity, value, and influence on the broader digital asset landscape. Understanding these implications requires examining its effect on Bitcoin’s fundamental value proposition and its ripple effects across the cryptocurrency market.

The halving directly impacts Bitcoin’s scarcity, a core tenet of its value proposition. By reducing the supply of new Bitcoin entering circulation, the halving increases the relative scarcity of existing Bitcoin. This increased scarcity, coupled with consistent demand, is predicted to drive upward pressure on price, a phenomenon observed in previous halving events. This effect is not simply based on speculation; it’s rooted in fundamental economic principles of supply and demand. As the supply decreases and demand remains relatively constant or increases, the price tends to rise to reflect the increased value of each individual Bitcoin.

Bitcoin’s Scarcity and Value

The inherent scarcity of Bitcoin, capped at 21 million coins, is a key differentiator from traditional fiat currencies. The halving mechanism reinforces this scarcity, making Bitcoin a deflationary asset in a world dominated by inflationary currencies. This deflationary characteristic is often cited as a reason for long-term investment in Bitcoin, as its value is expected to appreciate over time due to its limited supply. The 2025 halving will further solidify this deflationary pressure, potentially increasing its appeal to investors seeking a hedge against inflation. Historical data from previous halvings supports this prediction, showing a general upward trend in Bitcoin’s price following these events. For example, the price increase following the 2012 and 2016 halvings are often cited as evidence supporting this theory. However, it is important to note that other market factors can significantly influence the price.

Impact on the Broader Cryptocurrency Market

The 2025 halving’s influence extends beyond Bitcoin. The event is likely to attract renewed attention to the entire cryptocurrency market, potentially driving increased investment and interest in other digital assets. This effect could be amplified if Bitcoin’s price experiences a significant increase post-halving, potentially leading to a “halo effect” where investors see the success of Bitcoin as indicative of the potential of the broader crypto market. Conversely, a lackluster price performance could dampen enthusiasm for altcoins. The overall impact will depend on various factors, including the prevailing macroeconomic climate and regulatory developments.

Bitcoin’s Future as a Leading Cryptocurrency

The 2025 halving presents a significant test for Bitcoin’s position as the leading cryptocurrency. While its first-mover advantage and established network effect are substantial strengths, competition from other cryptocurrencies continues to intensify. The halving’s success in driving price appreciation and attracting new investment will be crucial in maintaining Bitcoin’s dominance. If the halving fails to deliver the expected price surge, it could embolden competitors and potentially shift market share. However, Bitcoin’s established brand recognition and network security are strong defenses against such challenges.

Long-Term Price Appreciation Through Scarcity

The concept of scarcity is central to Bitcoin’s long-term price appreciation. Imagine a limited-edition collectible item; its value increases as fewer units exist. Bitcoin operates similarly. The halving mechanism, by reducing the rate of new Bitcoin creation, directly increases its scarcity. This inherent scarcity, combined with increasing demand driven by factors such as adoption and institutional investment, creates a powerful upward pressure on its price. While market volatility and external factors will undoubtedly play a role, the halving acts as a predictable, built-in mechanism for increasing Bitcoin’s long-term value. This mechanism is fundamental to Bitcoin’s design and is a key factor in its appeal as a long-term investment. The predictable nature of the halving allows investors to anticipate and potentially capitalize on this long-term appreciation, making it a significant factor in the overall investment strategy for many.

Frequently Asked Questions (FAQs) about the Bitcoin Halving 2025

The Bitcoin halving is a significant event in the cryptocurrency world, occurring approximately every four years. Understanding its mechanics and potential impact is crucial for both investors and miners. This section addresses some common questions surrounding the 2025 halving.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the reward given to Bitcoin miners for successfully verifying and adding new blocks of transactions to the blockchain. This reward, initially set at 50 BTC per block, is halved with each halving. The halving mechanism is designed to control Bitcoin’s inflation rate, ensuring its long-term scarcity and potentially impacting its value.

Expected Timing of the 2025 Halving

The precise date of the 2025 Bitcoin halving is determined by the Bitcoin network’s block generation time, which is approximately 10 minutes. While not an exact science, based on historical data and current block times, the halving is expected to occur sometime in the Spring of 2025. Slight variations are possible due to fluctuations in block generation time.

The Halving’s Effect on Bitcoin Price

Historically, Bitcoin’s price has tended to increase in the periods following a halving event. This is largely attributed to the decreased supply of newly minted Bitcoin. However, it’s crucial to remember that numerous other factors influence Bitcoin’s price, including regulatory changes, market sentiment, and overall economic conditions. The 2012 and 2016 halvings were followed by significant price increases, but this doesn’t guarantee a similar outcome in 2025. For example, the price surged from around $12 to over $1,000 after the 2012 halving, and from around $650 to almost $20,000 after the 2016 halving. These past performances, however, are not indicative of future results.

Potential Risks Associated with the Halving

While often viewed positively, the halving also presents potential risks. A significant risk is the possibility of a price correction after any initial price surge. Increased selling pressure from miners seeking to offset reduced rewards could contribute to this. Furthermore, the halving’s impact is not solely determined by supply; demand-side factors, macroeconomic conditions, and regulatory actions play equally important roles. Unexpected negative events in the broader financial markets could also outweigh any positive effects from the halving.

Impact of the Halving on Bitcoin Miners

The halving directly impacts Bitcoin miners by reducing their revenue per block mined. This can lead to increased operational costs and decreased profitability, potentially forcing less efficient miners to shut down their operations. Miners might respond by increasing their hashing power to maintain profitability, leading to higher energy consumption and environmental concerns. This could also trigger a consolidation within the mining industry, with larger, more efficient mining operations gaining market share. Alternatively, some miners may choose to temporarily halt operations or explore alternative revenue streams.

The Bitcoin Halving 2025 Time is a significant event for cryptocurrency investors. Many are already strategizing their marketing plans around this, and effective advertising is key. To reach a wider audience, consider setting up a robust Google Ads Account to target those interested in Bitcoin and related investments. Properly leveraging this platform can significantly boost your reach in the lead-up to and following the Bitcoin Halving 2025 Time.