Understanding the Impact of the Halving

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, is a significant occurrence in the cryptocurrency’s lifecycle. Its impact, however, is complex and subject to various interpretations, influenced by both internal and external factors. Understanding these potential effects is crucial for navigating the market’s likely response.

Short-Term and Long-Term Price Implications

The halving’s immediate effect on price is often speculative. Historically, we’ve seen periods of increased price volatility leading up to and following a halving. The reduced supply of newly mined Bitcoin can create upward pressure on price, particularly if demand remains strong or increases. However, short-term price movements are susceptible to market sentiment and broader economic conditions. In the long term, the halving’s impact on scarcity could lead to sustained price appreciation, assuming continued adoption and network utility. The extent of this appreciation, however, is heavily debated, with predictions varying wildly.

Macroeconomic Factors and Bitcoin’s Price

The Bitcoin price is not immune to macroeconomic influences. Factors such as inflation rates, interest rate hikes, and global economic uncertainty significantly impact investor behavior and risk appetite. Following a halving, these macroeconomic factors can either amplify or dampen the halving’s price effect. For example, a period of high inflation might drive investors towards Bitcoin as a hedge against inflation, thus boosting its price. Conversely, a global recession could lead to risk-aversion, potentially suppressing Bitcoin’s price regardless of the halving.

Impact on Bitcoin Mining Profitability and Network Security

The halving directly affects Bitcoin mining profitability. The reduced block reward means miners earn less for each block they mine. This can lead to less profitable mining operations ceasing operations, potentially reducing the network’s hashrate (computing power). However, a decrease in miners could also lead to increased efficiency and consolidation within the mining industry. Despite the potential for short-term challenges, the halving ultimately strengthens the network’s security by making it more difficult for malicious actors to conduct 51% attacks. The difficulty adjustment mechanism ensures the network maintains a consistent block time, mitigating the immediate impact on security.

Perspectives on Halving’s Effect on Adoption and Market Sentiment

Opinions diverge regarding the halving’s impact on Bitcoin adoption and market sentiment. Some believe the halving will boost investor confidence and attract new entrants to the market, leading to increased adoption. Others are more cautious, suggesting that the halving’s price effect might be less pronounced than previously observed, or even overshadowed by macroeconomic headwinds. Market sentiment, often driven by media coverage and social media trends, plays a crucial role in determining the overall impact of the halving. Positive sentiment can amplify price increases, while negative sentiment can lead to sell-offs, irrespective of the halving’s fundamental impact.

Expert Predictions on Bitcoin’s Price After the 2025 Halving

Predicting future prices is inherently speculative. However, analyzing expert opinions can provide insights into potential price ranges. It’s crucial to remember that these are merely predictions, and the actual price may differ significantly.

| Expert | Predicted Price (USD) | Prediction Date | Basis for Prediction |

|---|---|---|---|

| Analyst A | $150,000 | October 2023 | Based on historical halving cycles and increasing institutional adoption |

| Analyst B | $100,000 – $120,000 | November 2023 | Considers macroeconomic factors and potential regulatory changes |

| Analyst C | $75,000 | December 2023 | Focuses on mining profitability and network hashrate |

| Analyst D | $200,000+ | January 2024 | Emphasizes Bitcoin’s scarcity and potential as a store of value |

The Halving’s Effect on Bitcoin Mining: Bitcoin Halving 2025 Time Clock

The Bitcoin halving, a pre-programmed event reducing the block reward miners receive by half, significantly impacts the economics of Bitcoin mining. This event, occurring approximately every four years, creates a ripple effect throughout the ecosystem, influencing miner profitability, network security, and energy consumption. Understanding these impacts is crucial for anyone involved in or observing the Bitcoin network.

Bitcoin Halving 2025 Time Clock – The halving directly affects miners’ revenue by decreasing the amount of newly minted Bitcoin they receive for successfully validating transactions and adding blocks to the blockchain. Before the halving, miners earn a certain number of Bitcoin per block; after the halving, this reward is cut in half. This immediately reduces their income stream, forcing them to adapt or potentially exit the market. The impact is felt most acutely by miners operating with high operational costs and low mining efficiency.

Monitoring the Bitcoin Halving 2025 Time Clock is crucial for investors. Precise prediction of the halving’s impact remains challenging, but understanding the timing is key. For detailed analysis on this, check out the comprehensive prediction resource at When Is Bitcoin Halving 2025 Prediction to inform your strategies. Ultimately, the Bitcoin Halving 2025 Time Clock will significantly influence market trends in the coming years.

Mining Difficulty Adjustment

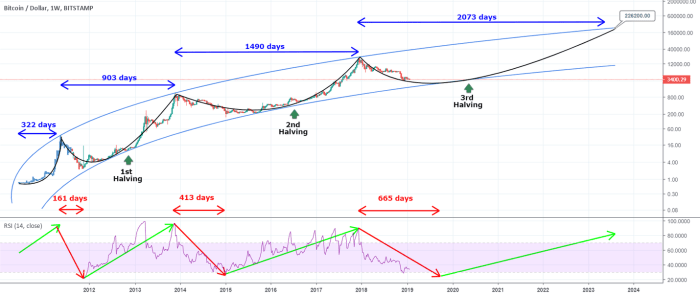

The Bitcoin network automatically adjusts its mining difficulty every 2016 blocks (approximately two weeks) to maintain a consistent block generation time of around 10 minutes. Following a halving, the initial effect is a decrease in miner revenue. However, this reduction in reward doesn’t immediately translate into a proportional decrease in mining difficulty. The difficulty adjustment mechanism aims to balance the network’s hashrate (the total computational power dedicated to mining) with the reduced block reward. While initially the difficulty might remain relatively stable, a significant drop in the total hashrate following the halving could lead to a subsequent decrease in difficulty, making mining marginally more profitable for the remaining miners. Conversely, if miners continue to invest in new equipment and the overall hashrate remains high, the difficulty could stay high or even increase. The 2016 halving saw a period of relative stability in difficulty followed by an increase, while the 2020 halving led to a more gradual adjustment.

Impact on Energy Consumption

The halving’s effect on energy consumption is complex and not directly proportional to the reduction in block reward. While a decrease in miner revenue could theoretically lead some less efficient miners to shut down, reducing overall energy consumption, this effect is often countered by several factors. Firstly, miners might continue operations even with reduced profitability, hoping for a price increase in Bitcoin. Secondly, the more efficient and large-scale mining operations might consolidate their market share, potentially offsetting any reduction in energy use. Finally, the ongoing technological advancements in mining hardware often lead to greater energy efficiency, which can either mitigate or exacerbate the overall energy impact. For example, the adoption of more efficient ASICs (Application-Specific Integrated Circuits) could lead to a decrease in energy consumption per Bitcoin mined, despite a higher overall hashrate.

Comparison of Mining Landscapes Across Halvings

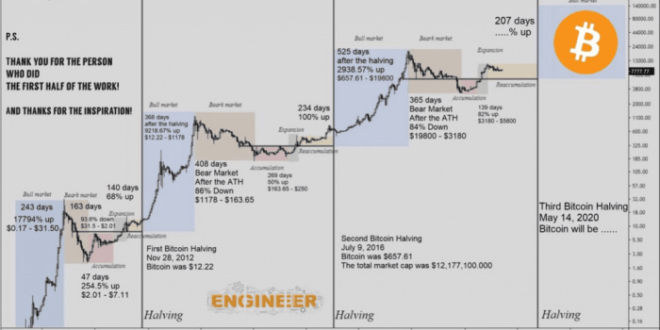

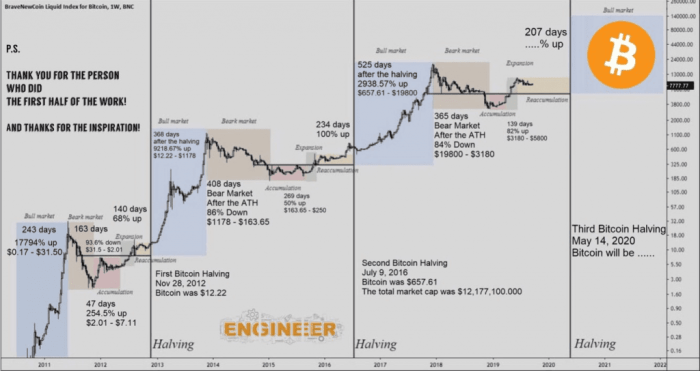

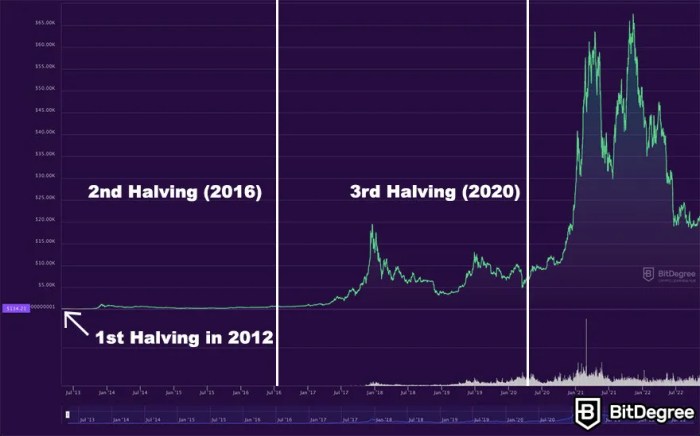

Analyzing previous halvings reveals contrasting patterns. The 2012 halving saw a significant price increase following the event, partially offsetting the reduced block reward. The 2016 halving also resulted in a price increase, but the market reaction was more gradual. The 2020 halving, however, was followed by a period of relative price stability before a substantial price surge later in the year. The mining landscape before each halving was characterized by varying levels of technological maturity, regulatory environments, and overall market sentiment. The post-halving periods saw adjustments in mining profitability, leading to consolidation in the industry and shifts in the geographical distribution of mining activity.

Miner Adaptation Strategies

Miners need to employ various strategies to navigate the post-halving environment. These strategies often involve a combination of operational efficiency improvements and risk mitigation techniques.

A list of potential strategies includes:

- Improving operational efficiency: This includes upgrading to more energy-efficient mining hardware, optimizing cooling systems, and negotiating better electricity rates.

- Diversification of revenue streams: Miners can explore alternative revenue streams such as offering hosting services, participating in staking, or engaging in other blockchain-related activities.

- Strategic partnerships and mergers: Collaborating with other miners or merging operations can help reduce costs and increase bargaining power.

- Hedging against price volatility: Employing financial instruments like futures contracts or options can help mitigate the risk of Bitcoin price fluctuations.

- Focusing on sustainable energy sources: Utilizing renewable energy sources can reduce operational costs and improve the environmental profile of mining operations.

Investor Sentiment and Market Speculation

Investor sentiment surrounding Bitcoin halvings significantly influences its price, often creating a period of heightened volatility. Market speculation plays a crucial role in amplifying these price movements, both before and after the event. Understanding this interplay is vital for navigating the risks and opportunities presented by investing in Bitcoin around a halving.

Investor Sentiment’s Influence on Bitcoin Price

The anticipation surrounding a Bitcoin halving, which reduces the rate of new Bitcoin creation, often generates considerable excitement and bullish sentiment among investors. This positive outlook leads to increased demand, pushing the price upward. Conversely, negative sentiment, perhaps driven by broader market downturns or regulatory uncertainty, can dampen this effect, resulting in less pronounced price increases or even price declines. The strength of this influence is often amplified by media coverage and social media discussions, creating a self-reinforcing feedback loop. For example, the halving in 2020 saw a period of price increase leading up to the event, driven by anticipation, followed by a period of consolidation and then further growth. However, external factors like the overall macroeconomic environment can still significantly impact the price regardless of halving expectations.

Market Speculation and Price Volatility

Market speculation significantly contributes to the volatility observed around Bitcoin halvings. Traders often engage in leveraged trading, amplifying both gains and losses. This speculative activity can lead to sharp price swings, especially in the period leading up to the halving, as traders position themselves for anticipated price movements. The uncertainty surrounding the actual impact of the halving further fuels speculation. Some investors believe the reduced supply will inevitably lead to higher prices, while others are more cautious, considering potential macroeconomic factors or regulatory changes. This divergence in opinion creates a volatile trading environment. The 2016 halving, for instance, saw a period of relatively subdued price action immediately following the event, before experiencing a significant price surge later.

Risks and Opportunities of Investing Around the Halving

Investing in Bitcoin around a halving presents both significant risks and opportunities. The potential for substantial price appreciation is a major draw, but the heightened volatility increases the risk of significant losses. Market manipulation and unexpected regulatory actions are additional risks to consider. Opportunities exist for those who can accurately predict market sentiment and the subsequent price movements. Sophisticated trading strategies, incorporating technical and fundamental analysis, can help mitigate some of the risks and capitalize on the opportunities. However, it’s crucial to remember that no investment strategy guarantees profits.

Investment Strategies Considering the Halving

Several investment strategies can be employed to navigate the halving event. A conservative approach might involve accumulating Bitcoin gradually in the months leading up to the halving, reducing exposure to potential price drops. A more aggressive strategy could involve leveraging trading, aiming to profit from short-term price fluctuations. Dollar-cost averaging (DCA) remains a popular strategy, mitigating the risk of investing a lump sum at a market peak. Diversification across different asset classes is also crucial to reduce overall portfolio risk. The optimal strategy depends on individual risk tolerance and investment goals.

Analyzing Historical Price Data to Predict Post-Halving Movements

Analyzing historical price data from previous halvings can provide valuable insights, but it’s crucial to understand that past performance is not indicative of future results. Analyzing factors like the overall market sentiment before and after each halving, the macroeconomic climate, and the adoption rate of Bitcoin can offer clues about potential price movements. Technical analysis, such as studying chart patterns and identifying support and resistance levels, can also be used to form predictions. However, it is vital to consider the limitations of such analysis and the inherent uncertainty associated with predicting future price movements. Comparing the price action around the 2012, 2016, and 2020 halvings can reveal trends and patterns, but external factors should always be taken into account. For example, the 2020 halving coincided with a period of global uncertainty due to the pandemic, influencing the price movements beyond the direct impact of the halving itself.

Beyond the Price

The Bitcoin halving, occurring approximately every four years, is more than just a price catalyst; it’s a fundamental event shaping Bitcoin’s long-term trajectory. Understanding its implications beyond short-term market fluctuations is crucial to grasping Bitcoin’s potential as a decentralized digital currency and a store of value.

The halving significantly impacts Bitcoin’s value proposition by directly influencing its scarcity. This reduction in the rate of new Bitcoin creation mimics the scarcity of precious metals like gold, a key factor in their historical value. This inherent scarcity, combined with increasing demand, is predicted to drive long-term price appreciation, though the extent of this appreciation is always subject to market forces.

Bitcoin’s Decentralized Narrative, Bitcoin Halving 2025 Time Clock

The halving reinforces Bitcoin’s core narrative as a decentralized, censorship-resistant digital currency. The predictable, algorithmic nature of the halving demonstrates a system operating autonomously, free from manipulation by central authorities or individuals. This programmed scarcity contrasts sharply with fiat currencies, whose supply can be inflated by central banks, potentially eroding their purchasing power. The consistent adherence to the halving schedule strengthens confidence in Bitcoin’s integrity and its ability to function as a sound monetary system.

Bitcoin’s Scarcity and Store of Value Potential

The halving mechanism directly contributes to Bitcoin’s scarcity. The fixed supply of 21 million Bitcoin, coupled with the halving’s progressively slower rate of new coin creation, creates a deflationary pressure. This is analogous to how limited supply drives up the value of rare collectibles or precious metals. As demand for Bitcoin increases, and the supply growth slows, the price is expected to rise. This inherent scarcity strengthens Bitcoin’s potential as a long-term store of value, acting as a hedge against inflation and economic uncertainty. Historically, assets with limited supply have often outperformed inflationary assets over the long term.

Comparison with Other Cryptocurrencies

While other cryptocurrencies may employ similar mechanisms to control their supply, Bitcoin’s halving is unique in its predictability and long-standing track record. Some cryptocurrencies have dynamic supply adjustments, which can be influenced by market conditions or governance decisions. Others might have a fixed supply but lack the established history and widespread adoption of Bitcoin. The Bitcoin halving, therefore, stands out as a predictable and consistently executed mechanism that contributes significantly to its market position and overall value proposition.

Long-Term Supply Effects Visualization

Imagine a graph charting Bitcoin’s total supply over time. The y-axis represents the total number of Bitcoins, and the x-axis represents time in years. The line starts relatively steep, representing the rapid increase in Bitcoin supply in the early years. As halvings occur (marked by distinct points on the x-axis), the slope of the line gradually flattens. The line asymptotically approaches the 21 million Bitcoin limit, visually demonstrating the decreasing rate of new Bitcoin entering circulation and the eventual stabilization of the total supply. This visualization highlights the long-term scarcity effect of the halving mechanism.

Frequently Asked Questions (FAQ)

This section addresses common queries regarding the Bitcoin halving, providing clarity on its mechanics, impact, and implications for investors. Understanding these aspects is crucial for navigating the cryptocurrency market effectively.

Bitcoin Halving Explained

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by half. This occurs approximately every four years, or every 210,000 blocks mined. It’s a key component of Bitcoin’s deflationary design, intended to control inflation and maintain scarcity. Essentially, miners receive half the Bitcoin reward for successfully adding a block to the blockchain after a halving.

Timing of the Next Bitcoin Halving

The next Bitcoin halving is projected to occur in the spring of 2025. The exact date depends on the rate of block creation, which can fluctuate slightly. However, estimations are based on the consistent average block time of around 10 minutes. By tracking the number of blocks mined and extrapolating based on the historical average, developers can provide a reasonably accurate prediction.

The Halving’s Effect on Bitcoin’s Price

Historically, Bitcoin’s price has tended to increase in the period following a halving. This is largely attributed to the reduced supply of newly mined Bitcoin, potentially increasing demand. The 2012 and 2016 halvings were followed by significant price rallies, though it’s important to note that other factors also influence the price, and past performance is not indicative of future results. The price increase isn’t guaranteed, and other market forces could easily overshadow the halving’s effect. For example, macroeconomic conditions, regulatory changes, and overall investor sentiment can all impact Bitcoin’s price.

Risks and Rewards of Investing Before a Halving

Investing in Bitcoin before a halving carries both significant risks and potential rewards. The potential reward is the possibility of profiting from a price increase following the halving. However, the risk lies in the inherent volatility of the cryptocurrency market. The price could decline before or after the halving, leading to potential losses. Furthermore, the timing of the market is notoriously difficult to predict accurately. Investing only what you can afford to lose is paramount. Consider your risk tolerance and diversify your portfolio accordingly. Successful investors often adopt a long-term perspective, mitigating the impact of short-term price fluctuations.

Long-Term Implications of the Halving

The long-term implications of the Bitcoin halving extend beyond price fluctuations. The reduced supply of new Bitcoin reinforces its scarcity, potentially increasing its value as a store of value over time. This could contribute to increased adoption and strengthen Bitcoin’s position as a digital gold. However, competing cryptocurrencies and technological advancements could influence Bitcoin’s long-term dominance. The halving is just one factor among many that will shape Bitcoin’s future. Ultimately, its success depends on various elements, including network security, scalability, and wider societal acceptance.

Monitoring the Bitcoin Halving 2025 Time Clock is crucial for understanding the upcoming event’s impact. To gain a deeper understanding of the anticipated changes, it’s beneficial to consult detailed information, such as that provided by Halving Bitcoin 2025 Data. This data allows for a more informed perspective on the Bitcoin Halving 2025 Time Clock and its potential consequences.

Many are keenly watching the Bitcoin Halving 2025 Time Clock, anticipating the significant impact on Bitcoin’s supply. A key question surrounding this event is, naturally, “When Is The Next Bitcoin Halving 2025?” You can find a precise countdown and analysis by visiting this helpful resource: When Is The Next Bitcoin Halving 2025. Understanding this date is crucial for anyone tracking the Bitcoin Halving 2025 Time Clock and its potential market effects.

Monitoring the Bitcoin Halving 2025 Time Clock is crucial for investors. Understanding the precise date is equally important, and for that, you can check the detailed information provided on this helpful resource: Halving Bitcoin 2025 Fecha. Returning to the clock itself, its countdown provides a tangible representation of the approaching halving event and its potential market impact.

Monitoring the Bitcoin Halving 2025 Time Clock is crucial for investors. Understanding the implications requires a visual representation of the halving events, which is readily available via a comprehensive chart; you can find a detailed breakdown of this at Bitcoin Halving Chart 2025. Returning to the time clock, precise predictions remain challenging, but this chart offers valuable context for informed speculation.

Many are keenly watching the Bitcoin Halving 2025 Time Clock, eager to see the impact of this significant event. Precisely determining the halving date requires careful calculation, and a useful resource for this is the website detailing When Halving Bitcoin 2025 , which provides up-to-date information. Using this data, we can then refine our predictions for the Bitcoin Halving 2025 Time Clock and its potential consequences.