Bitcoin Halving 2025: Bitcoin Halving 2025 When

The Bitcoin halving, a programmed event occurring approximately every four years, is a significant occurrence in the cryptocurrency’s lifecycle. This event reduces the rate at which new Bitcoins are created, effectively decreasing the supply entering the market. Historically, halvings have been followed by periods of significant price appreciation, although this is not guaranteed and other factors play a crucial role. The 2025 halving, expected around April, presents another opportunity to observe this phenomenon’s impact.

Bitcoin Halving Mechanics and Historical Price Impact

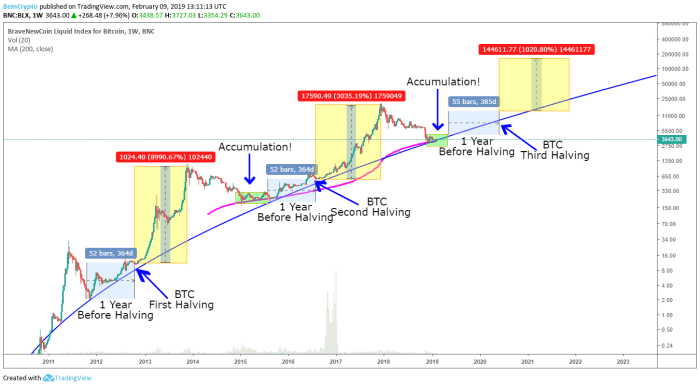

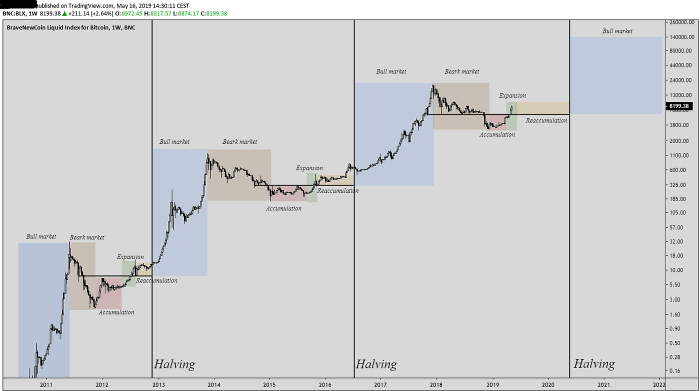

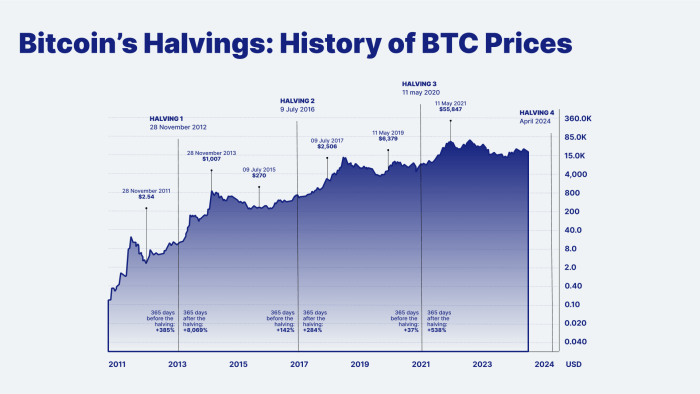

The Bitcoin halving mechanism is encoded in the Bitcoin protocol. Every 210,000 blocks mined, the reward given to miners for verifying transactions is cut in half. This started with a reward of 50 BTC per block, and has since been halved three times, currently standing at 6.25 BTC. The 2025 halving will reduce this to 3.125 BTC. Historically, the previous halvings in 2012, 2016, and 2020 were followed by substantial price increases, although the timing and magnitude varied considerably. The price surge isn’t solely attributable to the halving, but it’s widely considered a significant contributing factor, primarily due to the decreased supply coupled with persistent demand.

Potential Market Reactions Surrounding the 2025 Halving

Leading up to the 2025 halving, we can anticipate increased speculation and volatility in the Bitcoin market. Investors may begin accumulating Bitcoin in anticipation of a post-halving price increase, potentially driving the price up before the event. Following the halving, the market reaction could be similarly volatile, with potential for both significant price appreciation and a period of consolidation or even a temporary price dip, depending on broader macroeconomic conditions and overall market sentiment. The 2020 halving, for example, saw a period of price consolidation before a substantial price surge in late 2020 and early 2021.

Comparison of the 2025 Halving to Previous Events

While the halving mechanism remains consistent, the surrounding market conditions differ significantly between halving cycles. The 2012 halving occurred during Bitcoin’s early days, with a much smaller market capitalization and fewer participants. The 2016 and 2020 halvings took place in a progressively more mature and regulated market. The 2025 halving will likely occur within a context shaped by increasing institutional adoption, regulatory scrutiny, and potentially different macroeconomic circumstances than previous halvings. This makes direct comparison challenging, as the interplay of these factors will significantly influence the market’s response.

Influence of Macroeconomic Factors on Bitcoin’s Price

Macroeconomic factors, such as inflation, interest rates, and global economic uncertainty, significantly influence Bitcoin’s price, independent of the halving. For instance, periods of high inflation can drive investors towards alternative assets like Bitcoin, potentially boosting its price. Conversely, rising interest rates can make holding Bitcoin less attractive compared to higher-yielding investments. The overall global economic climate will likely play a more significant role in shaping Bitcoin’s price trajectory post-halving than in previous cycles due to the increased institutional involvement and integration into traditional financial markets.

Timeline of Key Events Surrounding the 2025 Bitcoin Halving

A precise timeline is difficult to predict, but we can anticipate certain key events. The halving itself is projected to occur around April 2025, based on the block generation rate. Leading up to this, we can expect increased media coverage, heightened investor interest, and potentially significant price fluctuations. The months following the halving will be crucial in observing the market’s reaction, with the potential for both short-term volatility and long-term price trends to emerge. Predicting specific price movements remains speculative, but historical trends and macroeconomic conditions will be important indicators.

Predicting Bitcoin’s Price After the 2025 Halving

The Bitcoin halving, a programmed event that reduces the rate of new Bitcoin creation, is widely anticipated to impact the cryptocurrency’s price. While predicting the future price of any asset is inherently speculative, analyzing historical data, market trends, and potential influencing factors can help construct plausible scenarios for Bitcoin’s price trajectory post-2025 halving. This analysis will explore several potential price scenarios, considering various market conditions and influential factors.

Price Prediction Scenarios Based on Market Conditions

Several scenarios can be envisioned depending on the overall market sentiment and macroeconomic conditions. A bullish scenario assumes sustained institutional adoption, positive regulatory developments, and continued technological advancements. Conversely, a bearish scenario might involve increased regulatory scrutiny, economic downturns, or a loss of investor confidence. A neutral scenario would see a moderate price increase, reflecting a balance of positive and negative influences. For example, a bullish scenario might project a price increase to $100,000 or more within a year of the halving, while a bearish scenario could see a price stagnation or even a decline. A neutral scenario might suggest a price range of $50,000-$75,000. These projections are highly speculative and depend on a multitude of factors.

Impact of Regulatory Changes on Bitcoin’s Price

Regulatory clarity and acceptance are crucial for Bitcoin’s price stability and growth. Favorable regulatory frameworks, such as clear guidelines on taxation and licensing, could attract more institutional investors and boost price. Conversely, stricter regulations, including outright bans or excessively burdensome compliance requirements, could negatively impact the price. The regulatory landscape varies significantly across jurisdictions, adding another layer of complexity to price prediction. For instance, if major economies like the US and China adopt clear, pro-Bitcoin regulations, we could expect a significant positive price impact. Conversely, a global crackdown on cryptocurrency could lead to a significant price drop.

Role of Adoption Rates and Technological Advancements, Bitcoin Halving 2025 When

Increased adoption by both individuals and institutions is a key driver of Bitcoin’s price. Wider acceptance as a payment method, coupled with increased use in decentralized finance (DeFi) applications, could significantly boost demand and price. Technological advancements, such as the development of the Lightning Network for faster and cheaper transactions, also contribute positively. Increased adoption, for example, could be measured by the number of active wallets and transaction volume. Technological improvements could be assessed by metrics such as transaction speed and network capacity. A significant increase in either could contribute to a price surge.

Comparison of Price Prediction Models

Various models exist for predicting cryptocurrency prices, including technical analysis (using charts and indicators), fundamental analysis (assessing intrinsic value), and quantitative models (employing statistical methods). Technical analysis, for example, might focus on identifying support and resistance levels, while fundamental analysis might consider factors like the halving event and network hash rate. Quantitative models might use machine learning to identify patterns and make predictions. Each model has its limitations, and relying on a single model is risky. A comprehensive approach combining different models and perspectives is generally more effective.

Visual Representation of Potential Price Trajectories

A chart depicting potential price trajectories could show three lines representing the bullish, bearish, and neutral scenarios Artikeld earlier. The X-axis would represent time (in months or years after the halving), and the Y-axis would represent Bitcoin’s price in USD. The bullish line would show a steep upward trend, the bearish line a relatively flat or downward trend, and the neutral line a moderate upward trend. The chart would visually illustrate the range of possible outcomes, highlighting the uncertainty inherent in price prediction. The chart would not be included here, but its description provides a clear mental image of the data visualization. The visualization would also include shaded areas representing uncertainty around each trajectory, acknowledging the inherent volatility of the cryptocurrency market.

The Impact of the Halving on Bitcoin Mining

The Bitcoin halving, a programmed event that reduces the block reward paid to miners by half, significantly impacts the economics and operational strategies of the Bitcoin mining industry. Understanding these impacts is crucial for predicting the network’s future health and security. The 2025 halving, in particular, will be a significant test of the network’s resilience and adaptability.

Miner Profitability and Operational Strategies

The halving directly reduces miners’ revenue. Before the halving, miners receive a certain number of Bitcoins for each block they successfully mine. After the halving, this reward is cut in half. To maintain profitability, miners must adapt. This often involves increasing efficiency through upgrades to their hardware, negotiating lower electricity costs, or consolidating operations to achieve economies of scale. Miners with high operating costs or inefficient equipment may be forced to shut down, leading to a shakeout in the industry. This can be seen as a natural market correction, weeding out less competitive miners. For example, the 2020 halving saw a significant increase in the hash rate despite the reduced block reward, indicating that more efficient miners were able to compensate for the lower payout.

Mining Centralization and Decentralization

The halving’s impact on mining centralization is complex and debated. Some argue that it will lead to increased centralization, as only the largest and most efficient mining operations, often those with access to cheap energy and advanced technology, can remain profitable. This could potentially concentrate mining power in fewer hands, raising concerns about network security and censorship resistance. Conversely, others argue that the halving could incentivize innovation and the adoption of more energy-efficient technologies, leading to a more decentralized network with a wider distribution of mining power. The outcome will depend on factors such as the pace of technological advancement and the availability of cheap energy sources. The 2016 halving, for instance, did not lead to a significant increase in centralization, demonstrating the resilience of the network.

Energy Consumption of the Bitcoin Network

The halving’s effect on Bitcoin’s energy consumption is not straightforward. While the reduced block reward incentivizes miners to improve efficiency, the overall energy consumption of the network depends on several factors, including the hash rate (a measure of the network’s computational power), the efficiency of mining hardware, and the price of Bitcoin. If the hash rate remains stable or increases after the halving (as it has historically), the energy consumption may not decrease significantly. However, advancements in mining hardware and increased efficiency could potentially offset the effect of a stable or increased hash rate, leading to a lower overall energy footprint.

Technological Advancements in Bitcoin Mining

The halving acts as a catalyst for innovation in Bitcoin mining. Miners are constantly seeking ways to improve their efficiency and reduce their operating costs. This leads to the development and adoption of more powerful and energy-efficient ASICs (Application-Specific Integrated Circuits), improved cooling systems, and more sophisticated mining farm management techniques. The development of new ASIC chips with improved hash rates and power efficiency is a continuous process. For example, the transition from older generation ASICs to newer ones with significantly improved performance has been a recurring theme in the Bitcoin mining industry. Furthermore, research into alternative mining methods, such as immersion cooling, aims to reduce energy consumption.

Comparative Analysis of Mining Hardware

Post-halving, the competitiveness of different mining hardware will be significantly impacted. Older, less efficient ASICs will become less profitable, potentially rendering them obsolete. Miners will increasingly favor newer generation ASICs with higher hash rates and lower power consumption per unit of hash rate. A comparative analysis would involve comparing metrics such as hash rate (measured in TH/s or PH/s), power consumption (measured in Watts), and the resulting profitability (calculated considering the block reward, electricity costs, and hardware costs). This analysis would show a clear preference for newer, more efficient models, demonstrating the constant arms race for technological superiority in the Bitcoin mining industry. For instance, comparing the Antminer S19 XP with an older model like the Antminer S9 would highlight the significant improvements in efficiency achieved over time.

Bitcoin Halving 2025: Bitcoin Halving 2025 When

The Bitcoin halving event of 2025 is generating considerable buzz within the cryptocurrency investment community. While past halvings have been followed by periods of price appreciation, the extent of this effect in 2025 remains uncertain, influenced by a multitude of macroeconomic and market-specific factors. Understanding prevailing investor sentiment and employing suitable investment strategies are crucial for navigating this potentially volatile period.

Investor Sentiment Surrounding the 2025 Halving

Investor sentiment regarding the 2025 halving is a complex mix of optimism and caution. Many believe the reduced supply of newly mined Bitcoin, a core element of the halving mechanism, will create upward pressure on price, mirroring past trends. This expectation is driving some investors to accumulate Bitcoin in anticipation of future price increases. However, a significant portion of investors remain skeptical, citing factors such as ongoing regulatory uncertainty, macroeconomic headwinds, and the potential for market manipulation. The overall sentiment is arguably less uniformly bullish than in previous halving cycles, reflecting a more mature and sophisticated cryptocurrency market. The general uncertainty is fueling a cautious approach among many investors.

Investment Strategies for Navigating the Halving Period

Several investment strategies can be employed to navigate the period surrounding the 2025 halving. These strategies range from long-term HODLing (holding onto Bitcoin) to more active trading approaches. Long-term investors often view the halving as a buying opportunity, aiming to accumulate Bitcoin at potentially lower prices before the anticipated price surge. Short-term investors, on the other hand, may employ more tactical strategies, such as leveraging derivatives or engaging in short-term price speculation. Dollar-cost averaging (DCA), a strategy involving regular purchases of Bitcoin regardless of price fluctuations, is another popular approach, mitigating the risk of timing the market perfectly.

Potential Risks and Opportunities for Investors

The period surrounding the halving presents both significant opportunities and considerable risks. A major opportunity lies in the potential for substantial price appreciation following the halving, offering significant returns for long-term holders. However, risks include the possibility of price stagnation or even a decline, particularly if broader market conditions are unfavorable. Regulatory uncertainty also poses a significant risk, as government actions could negatively impact Bitcoin’s price. Furthermore, the halving itself doesn’t guarantee price increases; it’s merely one factor among many influencing the market. The timing of the price increase, if any, is also uncertain, making it challenging for short-term investors.

Implications of the Halving for Long-Term and Short-Term Investors

The 2025 halving holds different implications for long-term and short-term investors. For long-term investors, the halving is often seen as a positive catalyst for long-term growth, reinforcing their belief in Bitcoin’s value proposition as a scarce asset. They are less concerned with short-term price fluctuations and are more likely to focus on accumulating Bitcoin over time. Short-term investors, however, are more susceptible to market volatility and may need to employ more sophisticated trading strategies to manage risk and potentially profit from short-term price movements. Their investment decisions are heavily influenced by short-term market trends and price predictions.

Assessing Risk Tolerance for Different Investment Strategies

Assessing risk tolerance is crucial before implementing any investment strategy. Long-term HODLing, for example, is generally considered a lower-risk strategy compared to short-term trading, which involves significantly higher volatility and potential for losses. Investors with a higher risk tolerance might consider leveraged trading or options strategies, while those with lower risk tolerance might prefer DCA or simply holding Bitcoin. A crucial element is understanding one’s personal financial situation and comfort level with potential losses. Consider the impact of a significant price drop on your overall financial well-being before making any investment decisions. For example, an investor with a large portfolio might tolerate a higher risk than someone investing a smaller portion of their savings.

Frequently Asked Questions about the Bitcoin Halving 2025

The Bitcoin halving is a significant event in the cryptocurrency world, occurring approximately every four years. It significantly impacts the rate at which new Bitcoins are created, influencing supply and potentially affecting its price. This section addresses common questions surrounding the 2025 halving.

Bitcoin Halving Explained

The Bitcoin halving is a programmed reduction in the reward given to Bitcoin miners for successfully verifying and adding new blocks of transactions to the blockchain. Initially, miners received 50 BTC per block. Every 210,000 blocks mined (approximately every four years), this reward is cut in half. This process continues until all 21 million Bitcoins are mined, at which point the miner reward will cease. The halving mechanism is a core part of Bitcoin’s deflationary design, controlling the supply of new Bitcoins entering circulation.

Bitcoin Halving Date in 2025

While the exact date is difficult to predict with absolute certainty due to variations in block mining times, the Bitcoin halving in 2025 is estimated to occur around April 2025. The precise date depends on the average time it takes miners to solve the complex cryptographic puzzles required to add new blocks to the blockchain. This time can fluctuate slightly depending on the overall network hash rate (computing power). Previous halvings have shown minor deviations from the predicted date.

The Halving’s Effect on Bitcoin Price

Historically, Bitcoin’s price has shown an upward trend following previous halvings. This is largely attributed to the reduced supply of new Bitcoins entering the market, potentially increasing scarcity and driving demand. The 2012 and 2016 halvings were followed by significant price increases, although other market factors also played a role. However, it’s crucial to remember that past performance is not indicative of future results. The 2025 halving’s impact on price will depend on various factors including overall market sentiment, regulatory developments, and macroeconomic conditions. For example, the 2020 halving saw a price increase, but it was followed by a significant correction before a later surge.

Buying Bitcoin Before the Halving: Pros and Cons

Buying Bitcoin before a halving presents both opportunities and risks. A potential benefit is the possibility of capital appreciation if the historical trend of price increases after halvings continues. However, investing before the halving also exposes investors to significant market volatility. The price could drop significantly before the halving event, leading to losses. Therefore, a thorough risk assessment and understanding of your own investment tolerance are paramount. It’s crucial to remember that Bitcoin is a highly volatile asset, and no one can guarantee price movements.

Risks Associated with Investing Around the Halving

Investing in Bitcoin, especially around the halving, carries substantial risks. Market volatility is a primary concern; price fluctuations can be dramatic, leading to significant gains or losses in short periods. Regulatory uncertainty, security breaches, and macroeconomic factors can all impact Bitcoin’s price. Furthermore, the halving itself doesn’t guarantee a price increase; it’s merely one factor among many influencing the market. The potential for scams and fraudulent activities is also heightened during periods of high market interest. Investors should only invest what they can afford to lose and thoroughly research the risks before making any investment decisions.

Beyond the Price

While the price fluctuations of Bitcoin following a halving are often the primary focus, the 2025 halving will have far-reaching consequences beyond simple market value changes. Its impact will resonate across Bitcoin’s functionality, adoption, and the broader cryptocurrency landscape. Understanding these broader implications is crucial for a comprehensive perspective.

Bitcoin’s Role as a Store of Value and Medium of Exchange

The halving reduces the rate of new Bitcoin creation, potentially increasing its scarcity. This could strengthen its appeal as a store of value, mirroring precious metals like gold. However, its usability as a medium of exchange remains dependent on transaction fees and network scalability solutions. Increased scarcity might encourage higher transaction fees, potentially hindering its widespread adoption for everyday purchases. The success of layer-two scaling solutions will be pivotal in determining whether Bitcoin can effectively balance its role as a store of value with its function as a transactional currency. A successful implementation of the Lightning Network, for instance, could significantly improve its transactional efficiency.

Institutional and Governmental Adoption

The 2025 halving could influence institutional and governmental adoption of Bitcoin in several ways. A perceived increase in Bitcoin’s value due to scarcity might encourage larger institutions to allocate a portion of their assets to Bitcoin, viewing it as a hedge against inflation or a diversifying investment. However, governmental regulations and acceptance remain critical hurdles. Governments might respond to increased Bitcoin adoption by implementing clearer regulatory frameworks, potentially boosting or hindering its legitimacy and use depending on the nature of the regulations. The example of El Salvador’s adoption, while controversial, illustrates the potential for, and challenges of, national-level Bitcoin integration.

Development of Bitcoin-Related Technologies and Applications

The halving’s impact on the profitability of Bitcoin mining could incentivize innovation in mining technology and efficiency. Miners might explore more sustainable and cost-effective mining solutions, such as renewable energy sources and improved hardware. Furthermore, the halving could spur development in related technologies like the Lightning Network, Taproot upgrades, and other initiatives aimed at improving Bitcoin’s scalability and usability. Increased investment in these areas could lead to a more robust and user-friendly Bitcoin ecosystem.

Impact on the Overall Cryptocurrency Market Landscape

The 2025 halving is unlikely to be isolated to Bitcoin’s price; its effects will ripple through the broader cryptocurrency market. A significant price increase in Bitcoin might lead to increased interest in the entire cryptocurrency space, attracting new investors and driving up the value of altcoins. Conversely, a lackluster response could dampen overall market sentiment. The correlation between Bitcoin’s price and the performance of other cryptocurrencies is well-established, suggesting a strong interdependence. Past halvings have demonstrated this interconnectedness, with periods of increased market activity following the event.

Short-Term and Long-Term Effects of the Halving

| Effect | Short-Term (1-2 years) | Long-Term (3-5 years) | Example/Real-life Case |

|---|---|---|---|

| Bitcoin Price | Potential increase due to reduced supply, but volatility remains | Price influenced by broader adoption, regulation, and technological advancements | Previous halvings showed initial price increases followed by periods of fluctuation. |

| Mining Profitability | Initially decreased due to reduced block rewards, leading to potential consolidation | Potential increase if demand outpaces supply, or through technological efficiency gains | Less efficient miners might exit the market after the halving. |

| Adoption | Limited impact initially, largely dependent on existing adoption trends | Increased adoption potentially driven by price appreciation and improved infrastructure | The growth of Lightning Network usage could drive increased adoption. |

| Market Sentiment | Positive sentiment potentially fueled by price increase, but subject to market volatility | Long-term sentiment influenced by regulatory clarity and overall market health | Positive media coverage following a price increase could improve sentiment. |