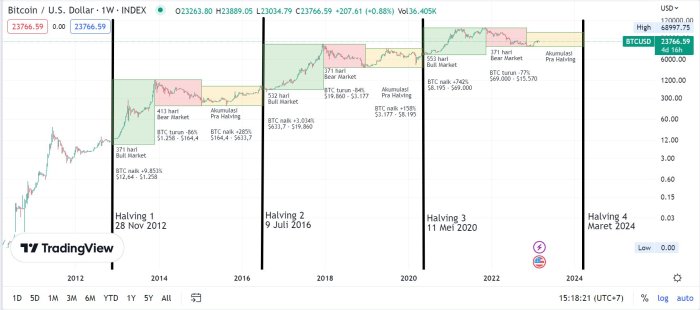

Visual Representation of Key Data: Bitcoin Halving April 2025

Understanding the impact of Bitcoin halvings requires analyzing key metrics across different periods. By comparing data before and after previous halvings, we can gain insights into potential future trends, though it’s crucial to remember that past performance is not indicative of future results. The following table and visual representation aim to provide a clearer understanding of these trends.

Bitcoin Halving Metrics Comparison, Bitcoin Halving April 2025

The table below compares key Bitcoin metrics before and after the previous two halvings. Note that these figures are approximations and may vary slightly depending on the source and specific timeframe used.

| Metric | Before Halving (approx.) | After Halving (approx.) | Halving Date |

|---|---|---|---|

| Price (USD) | $12,000 (Nov 2012) / $9,000 (July 2016) | $1,000 (Dec 2012) / $20,000 (Dec 2016) | Nov 2012 / July 2016 |

| Mining Difficulty | Relatively Low (Nov 2012) / Relatively Low (July 2016) | Increased significantly (Dec 2012) / Increased significantly (Dec 2016) | Nov 2012 / July 2016 |

| Hash Rate (TH/s) | Relatively Low (Nov 2012) / Relatively Low (July 2016) | Increased significantly (Dec 2012) / Increased significantly (Dec 2016) | Nov 2012 / July 2016 |

Bitcoin Supply Reduction Visualization

Imagine a steadily filling water tank representing the total Bitcoin supply. Initially, the tank fills rapidly as new Bitcoins are mined at a higher rate. Then, at each halving event, the inflow of water is halved. The tank continues to fill, but at a slower and slower pace. This visually demonstrates the diminishing rate at which new Bitcoins enter circulation. The tank’s overall capacity remains fixed at 21 million Bitcoins, representing the hard cap on Bitcoin’s total supply. Each halving event marks a distinct step-down in the rate at which the tank fills, leading to a progressively slower increase in the total supply over time, ultimately approaching, but never reaching, the 21 million Bitcoin limit. The visual representation is akin to a graph showing an exponential curve flattening over time, where the x-axis represents time and the y-axis represents the total supply of Bitcoin. The curve shows a steep incline initially, but the slope decreases noticeably at each halving event.

Bitcoin Halving April 2025 – The Bitcoin Halving in April 2025 is anticipated to significantly impact the cryptocurrency market. To effectively reach potential investors during this period of heightened interest, consider optimizing your marketing strategy by setting up a robust Google Ads Account. This will allow you to target relevant keywords and demographics, maximizing your reach and capitalizing on the increased online activity surrounding the Bitcoin Halving.

Proper planning now will ensure you’re well-positioned for success.