Alternative Investment Strategies: Bitcoin Halving Chart 2025 Prediction

Given Bitcoin’s inherent volatility, diversifying investments is crucial for mitigating risk and achieving long-term financial goals. A balanced portfolio reduces reliance on any single asset’s performance, especially one as prone to price swings as Bitcoin. This section explores alternative strategies and the importance of responsible investment practices.

Diversification Strategies for Cryptocurrency Portfolios

Diversification within a cryptocurrency portfolio involves spreading investments across different cryptocurrencies, each with varying market capitalizations, functionalities, and risk profiles. For example, an investor might allocate a portion of their portfolio to established cryptocurrencies like Ethereum or stablecoins like USDC, alongside Bitcoin. This reduces the impact of a potential Bitcoin downturn. Another approach involves diversifying into different sectors within the crypto ecosystem, such as DeFi (Decentralized Finance) tokens or NFTs (Non-Fungible Tokens). This diversification helps to balance exposure to different market segments and reduce overall portfolio risk. The benefits include reduced volatility and potential for higher overall returns, although it also increases the complexity of portfolio management. Drawbacks can include increased research time required to understand each asset and potential for increased transaction fees.

Risk Management in Bitcoin Investments

Effective risk management is paramount when investing in Bitcoin. This involves understanding the inherent volatility of the market and establishing clear risk tolerance levels. Investors should only invest what they can afford to lose, avoiding the use of borrowed funds or leverage. Setting stop-loss orders can help limit potential losses if the price falls unexpectedly. Regularly reviewing and adjusting the portfolio based on market conditions and personal financial goals is also essential. For instance, a risk-averse investor might choose to allocate a smaller percentage of their overall portfolio to Bitcoin, while a more risk-tolerant investor might allocate a larger percentage. Failure to manage risk appropriately can lead to significant financial losses.

Responsible Investment Practices in the Cryptocurrency Market

Responsible investment in the cryptocurrency market involves conducting thorough due diligence before investing in any cryptocurrency. This includes researching the project’s whitepaper, understanding its underlying technology, and evaluating the team behind it. Staying informed about market trends and regulatory developments is crucial. Avoiding impulsive decisions driven by hype or fear is also essential. Examples of responsible practices include using secure wallets, diversifying investments, and avoiding scams or pump-and-dump schemes. Additionally, investors should be aware of the tax implications of cryptocurrency transactions and ensure compliance with relevant regulations. Failure to follow responsible practices can lead to significant financial losses or legal repercussions.

FAQs about the Bitcoin Halving and 2025 Predictions

The Bitcoin halving is a significant event in the cryptocurrency’s lifecycle, impacting its supply and potentially its price. Understanding this event and the associated predictions for 2025 requires careful consideration of historical trends and inherent market uncertainties. This section addresses frequently asked questions surrounding the Bitcoin halving and its projected impact.

The Bitcoin Halving Explained

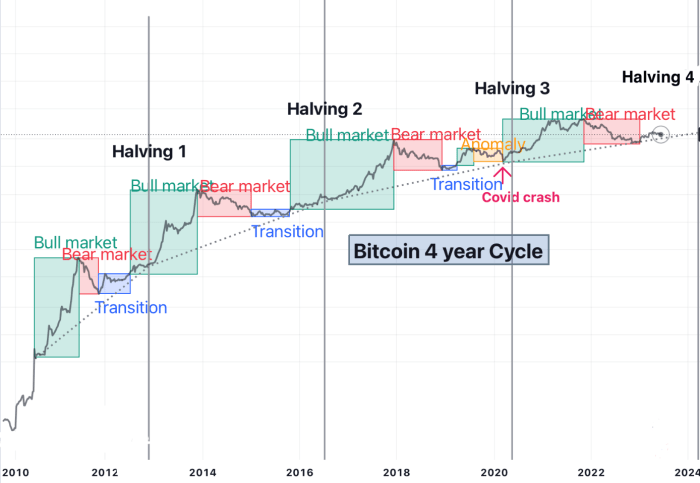

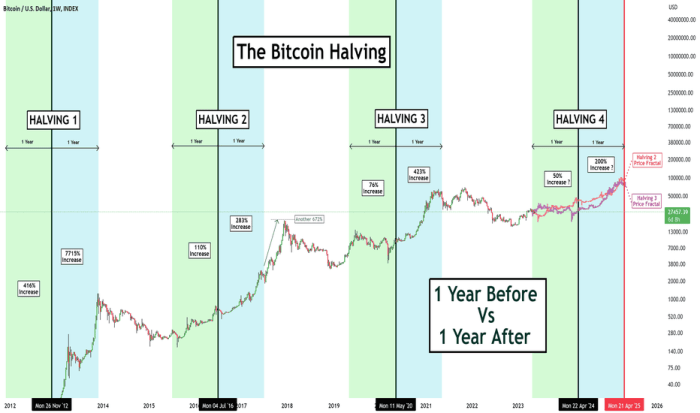

The Bitcoin halving is a programmed event that reduces the rate at which new Bitcoins are created and added to the circulating supply. This occurs approximately every four years, or every 210,000 blocks mined. The halving cuts the block reward, the amount of Bitcoin miners receive for verifying transactions and adding new blocks to the blockchain, in half. For example, the initial block reward was 50 BTC; after the first halving, it became 25 BTC, then 12.5 BTC, and so on. This controlled inflation mechanism is a core feature of Bitcoin’s design, intended to maintain scarcity and potentially increase its value over time.

The Halving’s Impact on Bitcoin’s Price

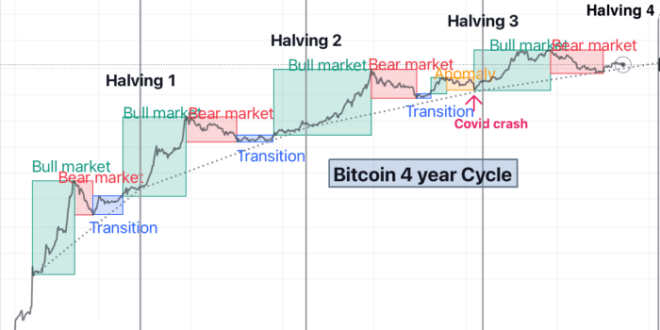

Historically, Bitcoin’s price has tended to increase in the period following a halving event. This is often attributed to the reduced supply of new Bitcoins entering the market, potentially increasing demand and driving up the price. The 2012 and 2016 halvings were followed by significant price increases, although the timing and magnitude of these increases varied. However, it’s crucial to note that other factors, such as market sentiment, regulatory changes, and technological advancements, also significantly influence Bitcoin’s price. The 2020 halving, for example, was followed by a period of price appreciation but also experienced significant volatility. Therefore, while a correlation exists, it’s not a guaranteed causal relationship.

Reliability of 2025 Halving Predictions

Predicting the precise impact of the 2025 halving on Bitcoin’s price is highly speculative. Numerous factors beyond the halving itself can affect the market. These include macroeconomic conditions (e.g., inflation, recession), regulatory developments (e.g., government bans or approvals), technological innovations (e.g., competing cryptocurrencies, improvements in blockchain technology), and overall investor sentiment. Past performance is not indicative of future results, and relying solely on historical trends to predict the 2025 halving’s effect would be overly simplistic and potentially misleading. Any prediction should be viewed with a high degree of caution.

Risks Involved in Bitcoin Investment

Investing in Bitcoin carries significant risks. The cryptocurrency market is notoriously volatile, experiencing substantial price swings in short periods. This volatility can lead to substantial losses for investors. Furthermore, regulatory uncertainty poses a risk. Governments worldwide are still developing their regulatory frameworks for cryptocurrencies, and changes in regulations could negatively impact Bitcoin’s price and accessibility. Security risks, such as hacking and theft from exchanges or personal wallets, are also a concern. Finally, the long-term viability of Bitcoin itself remains a subject of debate among experts.

Alternative Investment Options

Investors seeking diversification and potentially lower risk might consider alternative investments. These could include traditional asset classes like stocks, bonds, and real estate, which offer varying levels of risk and return. Other options include precious metals (gold, silver), which often serve as a hedge against inflation, and diversified investment funds (mutual funds, ETFs) that spread risk across a portfolio of assets. The choice of alternative investment depends on individual risk tolerance, investment goals, and time horizon. It is advisable to consult with a qualified financial advisor before making any investment decisions.

Illustrative Chart: Bitcoin Price Prediction (2025)

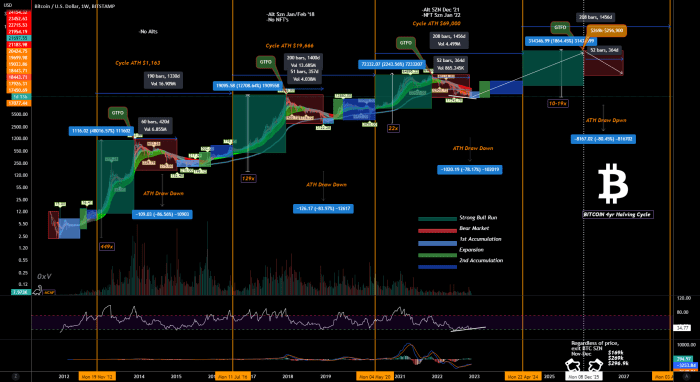

This chart visually represents three potential price scenarios for Bitcoin following the 2025 halving. These scenarios – bullish, neutral, and bearish – are based on varying assumptions regarding market adoption, regulatory landscape, and macroeconomic conditions. The chart aims to provide a range of possible outcomes, not a definitive prediction.

The chart uses a line graph format. The x-axis represents time, spanning from the date of the 2025 halving to the end of 2025. The y-axis represents the price of Bitcoin in US dollars, ranging from a conservative low to a potentially very high price, encompassing the potential price fluctuations across the three scenarios. Each scenario is represented by a distinct colored line.

Bitcoin Price Trajectories: Bullish, Neutral, and Bearish Scenarios, Bitcoin Halving Chart 2025 Prediction

The bullish scenario line shows a sharp upward trajectory after the halving, reflecting significant investor optimism and increased demand. This line incorporates a relatively high price increase, potentially exceeding previous post-halving price increases, driven by factors such as widespread institutional adoption, positive regulatory developments, and continued technological advancements. For example, this line might show a price increase from $50,000 at the halving to $150,000 by the end of 2025. This scenario assumes a positive macroeconomic climate and a lack of significant negative events impacting the cryptocurrency market.

The neutral scenario line exhibits a more moderate upward trend. This line reflects a more cautious outlook, incorporating a less aggressive price increase compared to the bullish scenario. The price increase is driven by the typical effects of the halving, such as reduced supply, but tempered by factors such as ongoing macroeconomic uncertainty or less enthusiastic investor sentiment. For instance, this line might show a price increase from $50,000 to $80,000 by the end of 2025. This scenario assumes a relatively stable macroeconomic environment with neither particularly positive nor negative developments significantly impacting Bitcoin’s price.

The bearish scenario line displays a relatively flat or slightly downward trajectory. This line represents a pessimistic outlook, incorporating factors such as increased regulatory scrutiny, macroeconomic downturns, or a loss of investor confidence. This scenario reflects a potential price decrease or stagnant growth following the halving, possibly due to factors such as a global recession impacting investor risk appetite. For example, this line might show a price decrease from $50,000 to $40,000 or a stagnation around the $50,000 mark by the end of 2025. This scenario assumes a negative macroeconomic climate and potentially negative regulatory changes affecting the cryptocurrency market.