Predicting Bitcoin’s Price After the 2025 Halving

Predicting the price of Bitcoin after any halving event is inherently challenging due to the cryptocurrency’s volatility and the influence of numerous interconnected factors. While historical data suggests a correlation between halvings and subsequent price increases, extrapolating this trend directly into future price predictions is unreliable. Several models attempt to forecast Bitcoin’s price, each with its own strengths and weaknesses, assumptions, and limitations.

Stock-to-Flow Model and Its Limitations

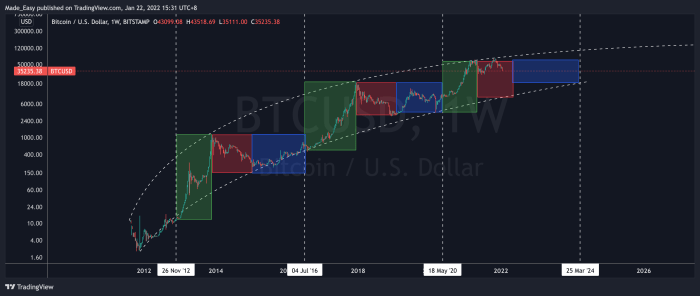

The Stock-to-Flow (S2F) model, popularized by PlanB, attempts to predict Bitcoin’s price based on its scarcity. It posits that as the rate of new Bitcoin creation decreases (due to halvings), its value should increase proportionally, mirroring the price behavior of scarce commodities like gold. The model calculates a ratio of the existing Bitcoin supply to the newly mined Bitcoin per year. A lower stock-to-flow ratio indicates greater scarcity, theoretically driving up the price.

However, the S2F model has significant limitations. It primarily focuses on supply-side dynamics, neglecting crucial demand-side factors such as regulatory changes, technological advancements, macroeconomic conditions, and market sentiment. The model’s past accuracy, while impressive in certain periods, doesn’t guarantee future performance. Furthermore, the model’s assumptions about a consistent relationship between scarcity and price might not hold true in a rapidly evolving market like cryptocurrency. The 2021 bull run partially validated the model’s predictions, but the subsequent price decline demonstrated its limitations in accurately predicting market corrections and long-term trends. For example, the model significantly overestimated Bitcoin’s price in late 2021 and throughout 2022.

Comparison of Price Prediction Models

Several other models exist, including those based on on-chain metrics (e.g., transaction volume, active addresses), technical analysis (e.g., chart patterns, moving averages), and macroeconomic indicators (e.g., inflation, interest rates). On-chain analysis provides insights into network activity and user behavior, offering a more nuanced view compared to purely price-based models. Technical analysis, while subjective, can identify potential support and resistance levels. Macroeconomic indicators can help assess the broader economic context impacting Bitcoin’s price. Each model possesses its own set of assumptions and limitations, and combining insights from multiple models can offer a more comprehensive perspective. No single model consistently outperforms others.

Scenario Analysis for Bitcoin’s Price in 2025 and Beyond

Considering various market conditions, we can construct a scenario analysis.

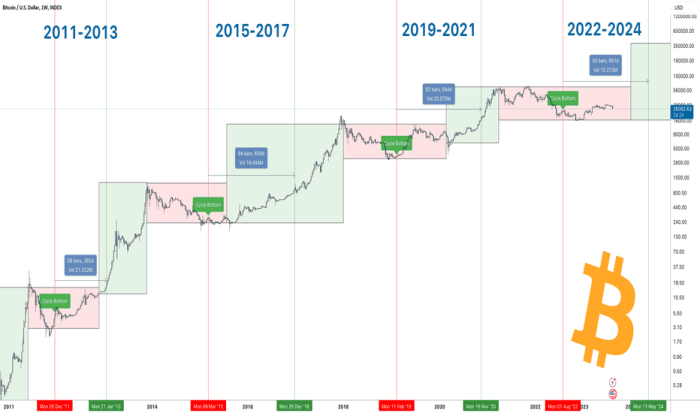

A bullish scenario assumes widespread institutional adoption, positive regulatory developments, and sustained macroeconomic uncertainty. In this case, Bitcoin’s price could potentially exceed $100,000 by the end of 2025, driven by strong demand and limited supply. This scenario is analogous to the 2017 bull run, albeit with a potentially higher ceiling due to increased institutional involvement.

A neutral scenario assumes a continuation of current market trends, with moderate adoption and relatively stable macroeconomic conditions. Under this scenario, Bitcoin’s price might range between $50,000 and $80,000 by the end of 2025. This scenario resembles the period following the 2013 halving, with gradual price appreciation interspersed with periods of consolidation.

A bearish scenario considers negative regulatory actions, a broader cryptocurrency market crash, or a significant improvement in global macroeconomic conditions reducing the appeal of Bitcoin as a safe-haven asset. In this case, Bitcoin’s price could potentially remain below $50,000 throughout 2025. This would be similar to the bear market following the 2011 halving.

Expert Opinions and Market Analyses

Various analysts and institutions offer diverse price predictions. Some predict prices exceeding $100,000, while others offer more conservative estimates. These predictions often rely on different models and assumptions, making direct comparison challenging. It is crucial to consider the source’s credibility, methodology, and potential biases when evaluating such forecasts. The overall consensus points to significant price volatility in the coming years, highlighting the uncertainty inherent in predicting Bitcoin’s future price.

Timeline of Key Events and Potential Price Inflection Points

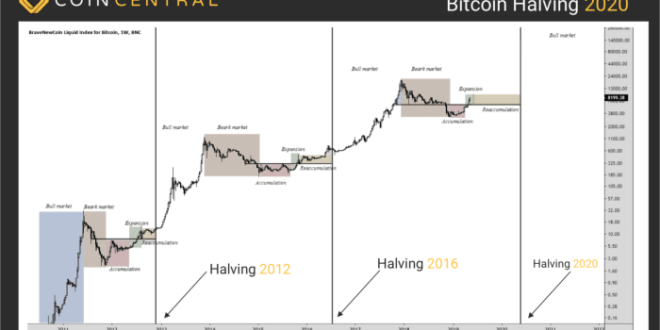

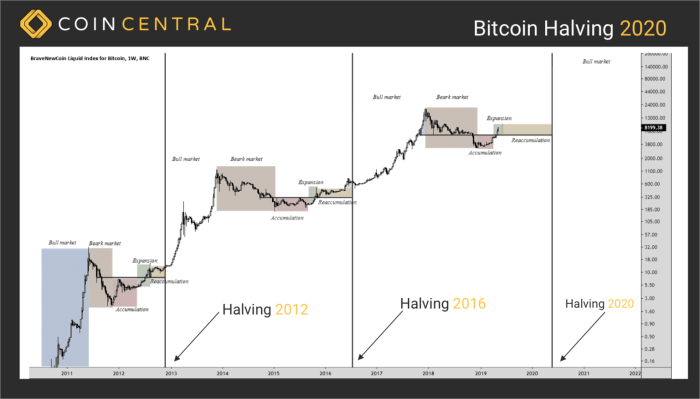

Bitcoin Halving Cycle Chart 2025 – A timeline highlighting key events and potential price inflection points leading up to and following the 2025 halving is crucial for understanding potential price movements. The period leading up to the halving is likely to see increased speculation and price volatility. The halving itself could serve as a catalyst for a price increase, but the magnitude and duration of this increase will depend on various factors. The months following the halving will be critical for observing whether the price increase is sustainable. Regulatory changes, major technological advancements, and macroeconomic shifts could all trigger significant price changes. A detailed timeline would require incorporating specific dates and events as they unfold, making precise predictions impossible at this stage. However, the framework of this timeline allows for a dynamic understanding of the factors influencing Bitcoin’s price.

Investing and Trading Strategies Around the 2025 Halving

The Bitcoin halving, a predictable event that reduces the rate of new Bitcoin creation, historically has preceded periods of significant price appreciation. However, the market’s reaction is complex and influenced by numerous factors beyond the halving itself. Therefore, a well-defined investment strategy incorporating risk management is crucial for navigating this potentially volatile period.

Investment Strategies for the 2025 Halving

Several strategies can be employed to approach the 2025 Bitcoin halving. These range from conservative long-term holding to more aggressive short-term trading, each with its own risk profile. The optimal strategy depends on individual risk tolerance, investment goals, and market outlook.

Risk Management Techniques, Bitcoin Halving Cycle Chart 2025

High volatility is a defining characteristic of the cryptocurrency market, especially around major events like the halving. Effective risk management is paramount to protect capital. Diversification across different asset classes (not just Bitcoin) is a fundamental principle. Setting stop-loss orders to automatically sell if the price drops below a predetermined level can limit potential losses. Furthermore, only investing what one can afford to lose is crucial. Dollar-cost averaging, where investments are spread out over time rather than a lump sum, can reduce the impact of market fluctuations.

Advantages and Disadvantages of Long-Term Holding versus Short-Term Trading

Long-term holding (HODLing) is a popular strategy, based on the belief that Bitcoin’s value will appreciate significantly over the long term. Advantages include avoiding the stress of frequent trading and potentially benefiting from substantial price gains. However, it requires patience and the ability to withstand periods of price stagnation or even decline. Conversely, short-term trading seeks to profit from short-term price movements. Advantages include the potential for quicker returns, but it requires significant market knowledge, technical analysis skills, and a higher risk tolerance. Disadvantages include higher transaction costs and the risk of significant losses from rapid price swings.

Comparison of Bitcoin Investment Vehicles

Spot purchases involve directly buying Bitcoin at the current market price. This is the simplest approach but exposes the investor to the full market risk. Futures contracts allow investors to speculate on future price movements without owning the underlying asset. They offer leverage, amplifying potential gains but also losses. Exchange-Traded Funds (ETFs) provide diversified exposure to Bitcoin through a regulated investment vehicle, typically offering lower fees and easier access than direct purchases. Each vehicle carries different levels of risk and regulatory oversight.

Interpreting On-Chain Metrics for Trading Decisions

On-chain metrics, data derived from the Bitcoin blockchain itself, can offer valuable insights into market sentiment and potential price movements. For example, an increase in the number of active addresses or a rise in the mining hash rate could suggest growing adoption and potentially higher prices. Conversely, a decline in transaction volume or an increase in the number of coins held on exchanges might indicate bearish sentiment. Analyzing these metrics in conjunction with other market indicators can help inform trading decisions around the halving cycle. However, it is crucial to remember that on-chain data is not a perfect predictor of future price movements, and its interpretation requires expertise and caution. For instance, the 2016 halving saw a significant price increase following the event, but the 2020 halving saw a more gradual price rise over a longer period. This highlights the complexity of the market and the importance of a holistic approach to analysis.

Frequently Asked Questions (FAQs): Bitcoin Halving Cycle Chart 2025

This section addresses common queries regarding the Bitcoin halving cycle, its impact on price, and investment strategies surrounding this significant event. Understanding the halving mechanism and its historical context is crucial for informed decision-making.

The Bitcoin Halving Cycle

The Bitcoin halving is a programmed event embedded in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by half. This occurs approximately every four years, or every 210,000 blocks mined. The halving mechanism is designed to control inflation and maintain Bitcoin’s scarcity. Before the first halving, miners received 50 BTC per block. After the first halving, this was reduced to 25 BTC, then 12.5 BTC, and currently stands at 6.25 BTC. The next halving will reduce this reward to 3.125 BTC. This controlled reduction in supply is a core element of Bitcoin’s deflationary monetary policy.

The Next Bitcoin Halving’s Expected Date

The next Bitcoin halving is expected to occur in early 2025. The precise date depends on the time it takes to mine the 210,000 blocks leading up to the event. While we can estimate based on current mining difficulty, the exact date remains uncertain until the block is mined. However, the community generally anticipates the halving to happen around April or May 2025.

The Halving’s Effect on Bitcoin’s Price

Historically, Bitcoin’s price has tended to increase in the period following a halving. This is largely attributed to the reduced supply of newly mined coins. The halving event doesn’t directly cause a price increase, but it creates a scenario of decreased inflation and increased scarcity, potentially driving demand and thus price. However, it’s crucial to remember that other market forces, such as regulatory changes, technological advancements, and overall economic conditions, significantly influence Bitcoin’s price. The 2012 and 2016 halvings were followed by significant price rallies, but the 2020 halving’s price impact was less immediate and dramatic, demonstrating the complexity of factors at play.

Investing in Bitcoin Before the 2025 Halving

Investing in Bitcoin before the 2025 halving presents both potential rewards and substantial risks. The historical correlation between halvings and subsequent price increases suggests a potential upside. However, this is not guaranteed. The cryptocurrency market is highly volatile, and factors beyond the halving can significantly impact the price. Investors should carefully consider their risk tolerance, diversify their portfolio, and only invest what they can afford to lose. A thorough understanding of Bitcoin’s underlying technology and market dynamics is essential before making any investment decisions. Past performance is not indicative of future results.

Potential Risks Associated with Investing in Bitcoin

Bitcoin’s price volatility is a major risk. The market has experienced dramatic price swings in the past, and significant losses are possible. Regulatory uncertainty is another considerable risk, as governments worldwide are still developing their approaches to regulating cryptocurrencies. Security risks, such as hacking and theft from exchanges or personal wallets, are also significant concerns. Investors should take steps to mitigate these risks by using secure wallets, diversifying their investments, and staying informed about regulatory developments. Furthermore, understanding the technological aspects of Bitcoin and the potential for technological disruption within the cryptocurrency space is vital.

Understanding the Bitcoin Halving Cycle Chart 2025 requires knowing the precise dates of past halvings. To accurately plot the future cycle, one needs to consult reliable sources detailing previous events; for instance, determining the exact date of the next halving is crucial. You can find information on this by checking out this resource: When Was Bitcoin Halving In 2025.

This data then allows for a more precise projection on the Bitcoin Halving Cycle Chart 2025.