Bitcoin Halving 2025

The Bitcoin halving, a programmed event occurring approximately every four years, significantly reduces the rate at which new Bitcoins are created. This event has historically had a profound impact on the cryptocurrency’s price and overall market sentiment. Understanding the historical trends and potential economic factors influencing the 2025 halving is crucial for navigating the anticipated market volatility.

Historical Impact of Previous Halvings

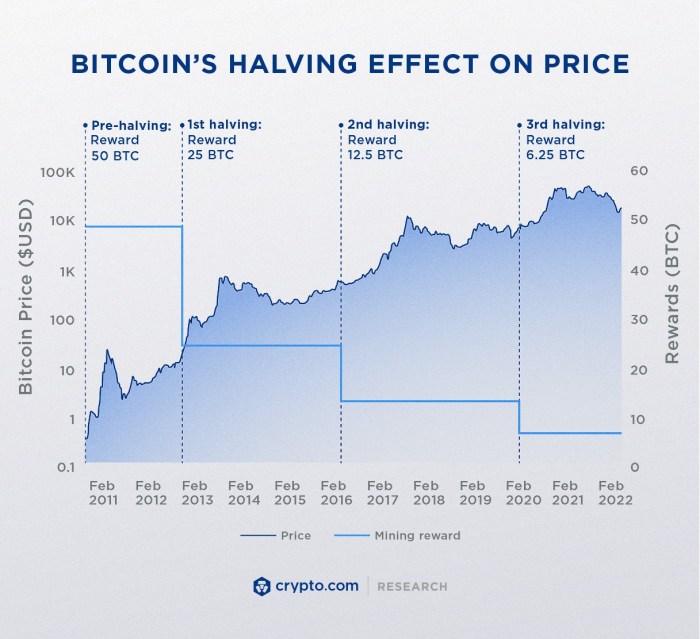

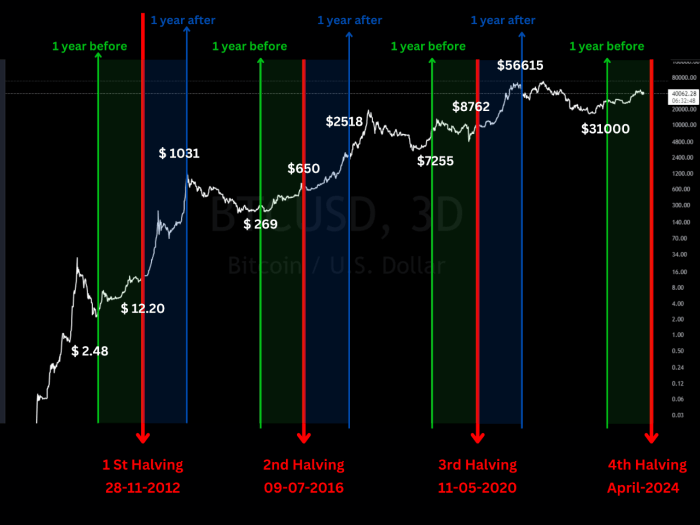

Previous Bitcoin halvings have demonstrated a correlation between the reduced block reward and subsequent price increases. The 2012 halving saw a gradual price rise leading up to and following the event. Similarly, the 2016 halving was followed by a significant bull market, culminating in the 2017 price peak. The 2020 halving, while initially showing less immediate impact, eventually contributed to the 2021 bull run. However, it’s crucial to remember correlation does not equal causation; other market factors significantly influence Bitcoin’s price.

Economic Factors Influencing the 2025 Halving

Several economic factors could significantly influence the 2025 halving’s impact. Macroeconomic conditions, such as inflation rates, interest rates, and overall global economic stability, will play a vital role. Regulatory developments surrounding cryptocurrencies in major jurisdictions will also be influential. Furthermore, the adoption rate of Bitcoin as a store of value, a medium of exchange, and a unit of account will significantly affect its price trajectory. Finally, the level of institutional and retail investor interest in Bitcoin leading up to and following the halving will be a key driver.

Comparison of Market Conditions Leading Up to Previous Halvings

Comparing the market conditions leading up to the 2025 halving with previous events reveals both similarities and differences. Similar to previous cycles, we see growing anticipation and speculation surrounding the halving. However, unlike previous halvings, the cryptocurrency market is significantly more mature and regulated, with increased institutional involvement. The overall market capitalization of cryptocurrencies is also considerably larger than in previous cycles, indicating a more complex and potentially less predictable market environment.

Expected Reduction in Bitcoin’s Block Reward and Implications for Miners

The 2025 halving will reduce Bitcoin’s block reward by half, from 6.25 BTC to 3.125 BTC. This reduction in miner revenue will directly impact profitability, potentially leading to increased mining difficulty and a consolidation of the mining industry. Miners with higher operating costs might be forced to shut down or adapt, potentially leading to a more centralized mining landscape. This could have both positive and negative implications for the network’s security and decentralization.

Potential Price Scenarios Following the 2025 Halving

Predicting Bitcoin’s price is inherently speculative, but we can illustrate potential scenarios based on historical data and current market conditions.

| Scenario | Description | Visual Representation (Description) |

|---|---|---|

| Bullish | Strong upward price movement driven by increased demand and scarcity following the halving. This scenario assumes positive macroeconomic conditions, continued institutional adoption, and a lack of major regulatory setbacks. The price could potentially surpass previous all-time highs. | A steeply rising line graph showing a significant price increase following the halving date, potentially exceeding previous peaks. The line shows consistent upward momentum. |

| Bearish | Limited or negative price movement, potentially due to macroeconomic headwinds, regulatory uncertainty, or a lack of sustained investor interest. This scenario anticipates a continuation of the bear market or a prolonged period of sideways price action. | A relatively flat or slightly declining line graph showing little to no price increase following the halving. The line shows minimal upward or significant downward momentum. |

| Neutral | A moderate price increase, potentially driven by the halving but tempered by other market forces. This scenario suggests a balanced outcome, with the halving’s impact being offset by other economic and market factors. The price might see a gradual increase but remain within a certain range. | A gradually rising line graph showing a moderate price increase following the halving. The line shows consistent but less steep upward momentum compared to the bullish scenario. |

Predicting the Bitcoin Halving Date

Bitcoin’s halving, a programmed reduction in the rate of new Bitcoin creation, is a significant event influencing its price and network dynamics. Predicting the precise date of future halvings is, surprisingly, relatively straightforward due to the inherent predictability of the underlying mechanism.

The Bitcoin Halving Mechanism and Mathematical Predictability

The Bitcoin halving occurs approximately every four years. This isn’t arbitrary; it’s built into the Bitcoin protocol. Every 210,000 blocks mined, the reward for miners creating a new block is halved. Since the average block creation time is roughly 10 minutes, we can estimate the time between halvings. However, this is an approximation. The actual block time fluctuates due to network conditions and mining difficulty adjustments. The difficulty adjustment mechanism aims to keep the block creation rate around 10 minutes, but variations do occur. This makes precise prediction challenging, despite the fundamentally predictable nature of the halving schedule. The formula to calculate the approximate block height of a halving is: Block Height = (Halving Number - 1) * 210,000. This formula only gives an approximation as the block time is not perfectly constant.

Factors Potentially Causing Deviation from the Predicted Halving Date

While the halving is mathematically predictable in principle, several factors can influence the actual date. Significant changes in the Bitcoin network’s hash rate (the total computational power securing the network) can affect block creation times. A sudden increase in hash rate would lead to blocks being mined faster than the average, potentially bringing the halving forward slightly. Conversely, a significant drop in hash rate could delay it. Furthermore, unforeseen events, like major protocol upgrades or unexpected network congestion, could also cause minor deviations. These deviations, however, are generally minor compared to the overall four-year cycle.

Comparison of Halving Date Prediction Models

Several models exist to predict the Bitcoin halving date, each with varying degrees of precision. Simpler models primarily rely on the average block time and the formula mentioned above. More sophisticated models incorporate historical block time data and statistical analysis to account for variations. Some models even incorporate factors like hash rate fluctuations into their predictions. The accuracy of these predictions depends on the model’s complexity and the quality of the input data. More complex models tend to be more accurate, but even these models provide estimates rather than definitive dates. A crucial limitation across all models is the inherent unpredictability of the future network conditions.

Timeline of Key Events Leading to the 2025 Halving

The lead-up to the 2025 halving involves several key events and milestones that can influence the overall market sentiment and potentially affect the halving date indirectly. For example, significant regulatory changes or major technological advancements could impact the hash rate and, consequently, the block creation time. A timeline might include:

- 2023-2024: Continued development of layer-2 scaling solutions and institutional adoption.

- Mid-2024: Increased market speculation and anticipation of the halving event.

- Late 2024: Potential price volatility as the halving date approaches.

- Early 2025: The halving event itself, potentially followed by further price fluctuations.

These events influence the overall market sentiment and could indirectly impact the block creation time and the precise date of the halving, although this influence is likely to be minimal.

Comparison of Predicted Halving Dates from Different Sources

The following table compares predicted halving dates from various sources, highlighting discrepancies and potential causes:

| Source | Predicted Date | Methodology | Confidence Level |

|---|---|---|---|

| Source A (e.g., a blockchain explorer) | March 2025 | Average block time calculation | High (given historical data) |

| Source B (e.g., a cryptocurrency analytics firm) | April 2025 | Statistical model incorporating hash rate variations | Medium (due to inherent uncertainties) |

| Source C (e.g., a news outlet) | March/April 2025 | Based on Source A and B data | Low (due to reliance on other sources) |

| Source D (e.g., an individual prediction) | May 2025 | Unclear methodology | Very Low (due to lack of transparency) |

Note: The dates and sources are illustrative examples. Actual predictions will vary based on the data used and the methodology applied. Discrepancies arise from differences in data sources, methodologies, and assumptions about future network conditions.

The Impact of the 2025 Halving on Bitcoin’s Price

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, is anticipated to significantly impact the cryptocurrency’s price in 2025. Understanding this impact requires examining the interplay between Bitcoin’s inherent scarcity and its perceived value in the market. The halving’s effect is not guaranteed, however, and depends on various market factors.

Bitcoin Scarcity and Perceived Value

Bitcoin’s value proposition is fundamentally rooted in its scarcity. With a fixed maximum supply of 21 million coins, the halving reinforces this scarcity by reducing the rate of new Bitcoin entering circulation. This reduction in supply, all else being equal, should theoretically increase its value due to basic economic principles of supply and demand. The perceived value, however, is also influenced by investor sentiment, regulatory changes, and technological advancements, making the prediction of price movements complex. For example, the increasing adoption of Bitcoin by institutional investors has already influenced its price, independently of halving events.

Reduced Supply’s Effect on Demand and Price

The 2025 halving will reduce the rate at which new Bitcoins are mined by approximately 50%. This decrease in supply is expected to create upward pressure on the price, assuming demand remains relatively stable or increases. If demand increases proportionally or surpasses the reduction in supply, the price could experience a substantial rise. Conversely, if demand weakens or remains stagnant, the price impact might be less pronounced or even negative. Historical data from previous halvings shows a general upward trend in price following the event, but the magnitude and duration of the increase have varied considerably.

Comparison to Past Halving Cycles

The Bitcoin halvings of 2012 and 2016 were followed by significant price increases, albeit with differing timelines. The 2012 halving saw a gradual price appreciation over several months, while the 2016 halving led to a more pronounced and rapid price surge. However, external factors beyond the halving itself, such as market sentiment, regulatory changes, and macroeconomic conditions, played a crucial role in shaping the price movements during these periods. The 2020 halving, while not resulting in an immediate price surge, eventually contributed to a significant price increase later that year and into 2021. Therefore, while past halvings offer valuable insights, they don’t guarantee a specific price trajectory for the 2025 event.

Potential Catalysts Amplifying or Diminishing the Halving’s Impact

Several factors could either amplify or mitigate the price impact of the 2025 halving. Positive catalysts include increased institutional adoption, positive regulatory developments, and advancements in Bitcoin’s underlying technology. Conversely, negative catalysts could include heightened regulatory scrutiny, macroeconomic instability, or the emergence of competing cryptocurrencies with superior features or adoption rates. The overall impact will depend on the net effect of these competing forces. For instance, a global economic recession could dampen investor enthusiasm, reducing the price impact despite the halving.

Arguments For and Against a Significant Price Increase

The arguments for a significant price increase after the 2025 halving primarily center on the reduced supply of Bitcoin and the increased scarcity. The argument suggests that increased scarcity will drive demand and, consequently, price appreciation. Conversely, arguments against a significant price increase highlight the influence of external factors like macroeconomic conditions and regulatory uncertainties. These factors could overshadow the impact of the halving, leading to a less pronounced price movement or even a price decline. The overall outcome depends on the balance between these competing forces.

Beyond the Price

The Bitcoin halving, while often discussed in terms of its price impact, has far-reaching consequences extending beyond simple market fluctuations. Understanding these broader implications is crucial for a comprehensive assessment of the event’s significance. The reduction in new Bitcoin supply significantly affects various aspects of the cryptocurrency ecosystem, influencing mining operations, the broader crypto market, and even regulatory approaches.

Mining Profitability and Hash Rate

The halving directly impacts Bitcoin miners’ profitability. With fewer newly minted Bitcoin awarded for each block mined, the revenue generated per block is halved. This reduction necessitates miners to either increase their efficiency (through more powerful hardware or more efficient energy consumption) or face reduced profitability, potentially leading to some miners exiting the network. This could, in turn, temporarily decrease the overall network hash rate—the computational power securing the blockchain—though historically, the price increase following a halving often compensates for the reduced block reward. For example, the 2020 halving saw a period of decreased hash rate initially, followed by a significant increase as the price rose, attracting more miners. The long-term effect on hash rate depends on the interplay between the reduced block reward and the price appreciation.

Impact on the Overall Cryptocurrency Market, Bitcoin Halving Date 2025 Prediction

The Bitcoin halving doesn’t exist in isolation; it influences the broader cryptocurrency market. Anticipation of the halving often leads to increased buying pressure on Bitcoin, potentially driving up its price. This can have a ripple effect, positively impacting the prices of altcoins (alternative cryptocurrencies) as investors seek exposure to the broader crypto market. However, a sharp decline in Bitcoin’s price after the halving (although historically unlikely) could trigger a sell-off across the entire market. The correlation between Bitcoin’s price and altcoin prices is significant, making the halving a key event for the entire crypto space.

Implications for Bitcoin Adoption and Global Finance

The halving can indirectly influence Bitcoin adoption. A price increase following the halving, coupled with increased media attention, could attract new investors and users. This heightened interest might boost the number of merchants accepting Bitcoin as payment and the integration of Bitcoin into financial services. Increased adoption could further solidify Bitcoin’s position as a store of value and potentially a medium of exchange, albeit gradually and dependent on various factors beyond the halving itself. The long-term goal of Bitcoin’s creators is to establish it as a decentralized alternative to traditional financial systems. The halving, while not directly driving adoption, can be a catalyst for increased awareness and potentially broader acceptance.

Regulatory Scrutiny and Government Policies

The halving’s impact on Bitcoin’s price and market capitalization can influence government policies and regulatory scrutiny. A significant price surge might attract more attention from regulators, leading to increased efforts to monitor and potentially regulate Bitcoin and the broader cryptocurrency market. Conversely, a period of price stagnation or decline might temporarily lessen regulatory pressure. The response from governments will likely vary depending on their existing regulatory frameworks and their overall stance on cryptocurrencies. The 2025 halving could, therefore, influence the regulatory landscape in various jurisdictions, impacting the ease with which Bitcoin can be used and traded.

Potential Long-Term Consequences

The 2025 halving’s long-term effects on the cryptocurrency ecosystem are multifaceted and difficult to predict with certainty. However, several potential consequences are worth considering:

- Increased Bitcoin scarcity and potential for higher long-term price appreciation.

- Shift in mining landscape, with smaller, less efficient miners potentially exiting the market.

- Enhanced network security due to a more concentrated and efficient mining pool.

- Increased institutional adoption of Bitcoin as a store of value.

- Evolution of regulatory frameworks concerning cryptocurrencies globally.

- Greater integration of Bitcoin into the traditional financial system, albeit possibly at a slower pace than some anticipate.

Frequently Asked Questions about the Bitcoin Halving in 2025: Bitcoin Halving Date 2025 Prediction

The Bitcoin halving, a significant event in the cryptocurrency’s lifecycle, is anticipated in 2025. However, several aspects surrounding this event remain subject to speculation and require clarification. This section addresses common queries regarding the 2025 halving, providing insights into its potential impacts and associated uncertainties.

Bitcoin Halving’s Exact Date in 2025

Pinpointing the precise date of the 2025 Bitcoin halving is challenging. The halving occurs approximately every four years, when the reward for Bitcoin miners processing transactions is cut in half. This is determined by the blockchain’s block generation time, which is targeted at roughly ten minutes. However, this target isn’t always perfectly met; the actual time can fluctuate due to variations in network hashrate and mining difficulty adjustments. Therefore, the halving date is usually predicted within a range of a few days, rather than a single, definitive date. This range accounts for the inherent variability in block generation times. For example, predictions might place the halving sometime between mid-March and early April 2025, illustrating the inherent uncertainty.

The 2025 Halving’s Effect on Bitcoin’s Price

The impact of the 2025 halving on Bitcoin’s price is a subject of ongoing debate. Historically, halvings have been followed by periods of price appreciation, primarily due to the reduced supply of newly mined Bitcoin. This reduced supply, coupled with consistent or increased demand, can theoretically push prices upward. However, it’s crucial to remember that numerous other factors influence Bitcoin’s price, including macroeconomic conditions, regulatory changes, market sentiment, and technological developments. Bearish scenarios could involve a continuation of a bear market or a lack of significant buying pressure despite the reduced supply. The 2012 and 2016 halvings saw subsequent price increases, but these were not immediate and were influenced by broader market dynamics. Therefore, predicting a specific price movement is unreliable.

Risks of Investing in Bitcoin Before the 2025 Halving

Investing in Bitcoin before the 2025 halving, or at any time, carries inherent risks. Bitcoin’s price is famously volatile, experiencing significant price swings in short periods. Market corrections, sudden drops in value, and overall market uncertainty are all possibilities. Furthermore, the cryptocurrency market is relatively young and largely unregulated in many jurisdictions, leading to additional risks like scams, security breaches, and potential regulatory crackdowns. Investors should thoroughly understand these risks and only invest what they can afford to lose. The speculative nature of the market should always be considered.

The Halving’s Impact on Bitcoin Miners

The halving significantly impacts Bitcoin miners’ profitability. As the block reward is halved, miners’ revenue per block decreases. This reduction can force less efficient miners out of the market, leading to a consolidation of the mining industry. More efficient, larger-scale operations with lower operating costs will be more likely to survive. This consolidation could lead to increased centralization of the Bitcoin network, a concern for some proponents of decentralized systems. Miners may need to adjust their operations, potentially increasing fees or seeking alternative revenue streams to maintain profitability.

Broader Implications for the Cryptocurrency Market

The 2025 Bitcoin halving will likely have ripple effects across the entire cryptocurrency market. Bitcoin’s price movements often influence the performance of other cryptocurrencies. A significant price increase in Bitcoin could lead to a broader market rally, while a decline could trigger a sell-off across various crypto assets. Furthermore, the halving could spur renewed interest in Bitcoin and the broader crypto space, attracting new investors and driving innovation. Conversely, a lack of significant price movement post-halving could lead to decreased investor enthusiasm. The interconnectedness of the crypto market means that the halving’s impact extends far beyond Bitcoin itself.