Investor Sentiment and Market Predictions: Bitcoin Halving Dates 2025

Investor sentiment surrounding Bitcoin in the lead-up to the 2025 halving is a complex interplay of factors, including past halving cycles, macroeconomic conditions, and regulatory developments. Understanding this sentiment is crucial for gauging potential price movements and market volatility. While predicting the future is inherently uncertain, analyzing various market predictions can provide valuable insights into potential scenarios.

Investor Sentiment Leading Up to the 2025 Halving

The general sentiment among Bitcoin investors is typically one of cautious optimism. Past halvings have historically been followed by periods of significant price appreciation, leading many to anticipate a similar pattern in 2025. However, this optimism is tempered by concerns about macroeconomic uncertainty, potential regulatory crackdowns in various jurisdictions, and the overall volatility inherent in the cryptocurrency market. Some investors are accumulating Bitcoin in anticipation of the halving, while others are adopting a more wait-and-see approach, preferring to observe market developments before making significant investments. The strength of the US dollar and potential interest rate hikes also influence investor sentiment, creating a complex and dynamic picture.

Market Predictions for Bitcoin’s Price After the 2025 Halving

Market predictions for Bitcoin’s price post-halving vary significantly, reflecting the diverse perspectives and underlying assumptions of analysts and investors. These predictions can be broadly categorized into bullish, neutral, and bearish scenarios.

Categorization of Market Predictions Based on Underlying Assumptions

Bullish predictions typically assume a continuation of Bitcoin’s adoption as a store of value and a hedge against inflation, coupled with the scarcity created by the halving. These predictions often project substantial price increases, sometimes exceeding previous halving cycles. Neutral predictions acknowledge the impact of the halving but also consider factors such as regulatory uncertainty and macroeconomic conditions that could mitigate price increases. Bearish predictions, on the other hand, emphasize potential negative factors such as regulatory crackdowns, macroeconomic downturns, or a lack of further adoption, potentially leading to price stagnation or even decline.

Summary of Key Market Predictions

| Source | Prediction | Rationale | Category |

|---|---|---|---|

| Analyst A (Example) | $150,000 by end of 2025 | Based on historical halving cycles and increasing institutional adoption. | Bullish |

| Research Firm B (Example) | $75,000 – $100,000 by end of 2025 | Considers both the halving effect and potential macroeconomic headwinds. | Neutral |

| Analyst C (Example) | $50,000 by end of 2025 | Highlights regulatory risks and potential market saturation. | Bearish |

| Trading Platform D (Example) | $100,000 – $200,000 by mid-2026 | Emphasizes the long-term scarcity of Bitcoin and increasing demand. | Bullish |

Long-Term Implications of the 2025 Halving

The 2025 Bitcoin halving, reducing the block reward for miners by half, is a significant event with potentially profound long-term implications for Bitcoin’s value, adoption, and the broader cryptocurrency landscape. Understanding these potential effects requires considering Bitcoin’s inherent scarcity and the historical impact of previous halvings.

Bitcoin’s Scarcity and Value Proposition, Bitcoin Halving Dates 2025

The halving mechanism is central to Bitcoin’s deflationary nature. By reducing the rate of new Bitcoin creation, each coin becomes relatively more scarce over time. This increased scarcity, coupled with growing demand, is a key driver of Bitcoin’s value proposition. Historically, halvings have preceded periods of significant price appreciation, although the timing and magnitude of price movements are influenced by numerous other market factors. The 2025 halving is expected to further solidify Bitcoin’s position as a store of value, potentially attracting investors seeking inflation hedges and long-term growth opportunities. This increased scarcity could lead to higher prices, assuming demand remains strong or increases.

Potential Price Scenarios and Adoption Post-Halving

Several scenarios are possible following the 2025 halving. A bullish scenario might see a gradual price increase leading up to the halving, followed by a substantial surge afterward, mirroring the patterns observed after previous halvings. This would likely be fueled by increased institutional and retail investor interest, alongside a growing acceptance of Bitcoin as a legitimate asset class. Conversely, a more conservative scenario might see a less dramatic price increase, potentially hampered by macroeconomic factors or regulatory uncertainty. A bearish scenario, though less likely given historical trends, could involve a period of price stagnation or even a temporary decline before the halving’s effects fully materialize. Adoption, however, is expected to continue its upward trajectory regardless of short-term price fluctuations, driven by increasing technological integration and broader societal acceptance. For example, the growing use of Bitcoin as a payment method in El Salvador could be a precursor to wider adoption globally.

Impact on the Broader Cryptocurrency Market

The 2025 Bitcoin halving is unlikely to be isolated in its impact. The event will likely influence the entire cryptocurrency market. Altcoins, often correlated with Bitcoin’s price movements, may experience significant price volatility in response to the halving’s effects. A strong bullish run in Bitcoin could trigger a “bull market” for other cryptocurrencies, while a less pronounced reaction from Bitcoin might lead to a more subdued response from the broader market. Moreover, the increased focus on Bitcoin’s scarcity might indirectly boost the value of other scarce cryptocurrencies or those with unique value propositions.

Illustrative Charts and Graphs

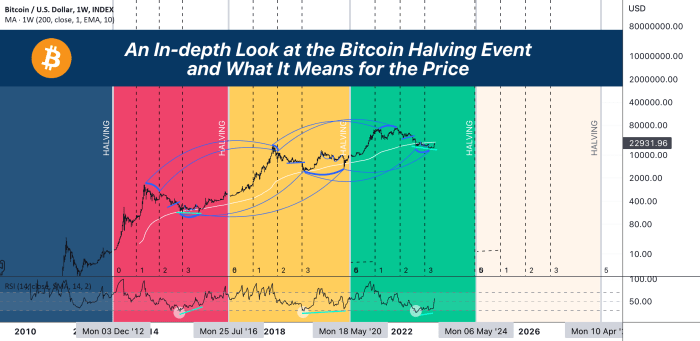

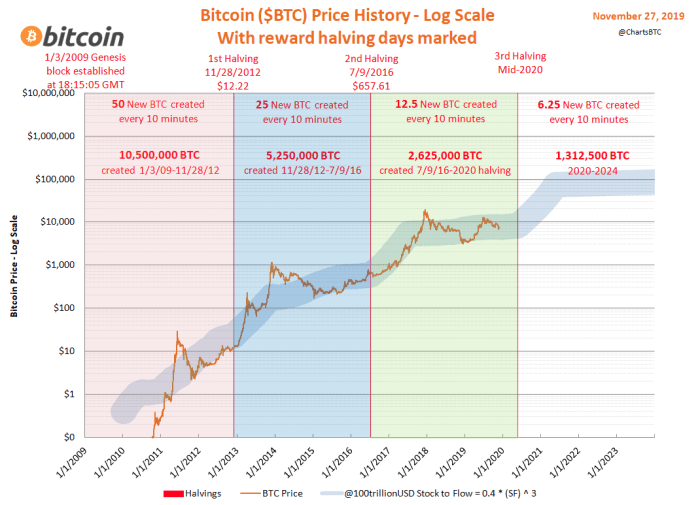

To illustrate potential scenarios, we can imagine several charts. One chart could depict Bitcoin’s price history, highlighting the periods preceding and following the previous halvings. This would show a clear upward trend in price after each halving, although the rate of increase varied. The chart’s X-axis would represent time (in years), and the Y-axis would represent Bitcoin’s price (in USD). A second chart could compare the Bitcoin price to the supply of Bitcoin over time, demonstrating the relationship between scarcity and price. This chart would have the same X and Y axes as the first chart, with a separate line representing the total supply of Bitcoin. A third chart could project various price scenarios post-2025 halving, based on different assumptions about market demand and macroeconomic conditions. This chart could show three lines: one for a bullish scenario (rapid price increase), one for a neutral scenario (gradual price increase), and one for a bearish scenario (stagnation or slight decrease). These charts would visually represent the complex interplay of factors influencing Bitcoin’s price and the potential long-term implications of the 2025 halving.

Frequently Asked Questions about the 2025 Bitcoin Halving

The Bitcoin halving is a significant event in the cryptocurrency’s lifecycle, impacting its supply and potentially its price. Understanding this event is crucial for anyone invested in or interested in Bitcoin. This section addresses common questions surrounding the 2025 halving.

Bitcoin Halving Explained

The Bitcoin halving is a programmed event that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, halving the block reward miners receive for verifying transactions and adding new blocks to the blockchain. This built-in mechanism controls Bitcoin’s inflation, aiming to maintain scarcity and long-term value. Before the first halving, miners received 50 BTC per block. After the first, it dropped to 25 BTC, then to 12.5 BTC, and the next halving will reduce it to 6.25 BTC.

Expected Date of the Next Bitcoin Halving

While the exact date depends on the Bitcoin network’s block time, the next halving is expected to occur around April 2025. The specific date will vary slightly depending on the mining hashrate and the time it takes to mine blocks. It’s important to note that these are estimates based on the current block time and are subject to minor changes. Past halvings have been reasonably predictable in their timing.

The Halving’s Impact on Bitcoin’s Price

Historically, Bitcoin’s price has shown an upward trend following previous halvings. This is largely attributed to the reduced supply of new Bitcoins entering the market. The decreased supply, coupled with sustained or increased demand, can lead to price appreciation. However, it’s crucial to remember that this is not a guaranteed outcome. Other market factors, such as regulatory changes, overall economic conditions, and investor sentiment, significantly influence Bitcoin’s price. For example, the 2012 halving preceded a period of significant price growth, and the 2016 halving was followed by a substantial price increase in 2017. The 2020 halving saw a price surge later in 2021. However, these historical trends don’t guarantee similar outcomes in the future.

Risks and Opportunities Associated with the Halving

The Bitcoin halving presents both risks and opportunities. A potential opportunity is the possibility of price appreciation due to decreased supply. However, a risk is that the anticipated price increase may not materialize, leading to disappointment and potential price corrections. Furthermore, the halving itself doesn’t guarantee a price surge; other market forces can easily outweigh its effects. For example, a significant negative event in the broader financial markets could negatively impact Bitcoin’s price regardless of the halving. Conversely, positive developments in the cryptocurrency space or increased institutional adoption could amplify the positive effects of the halving. Therefore, investors should approach the halving with a balanced perspective, considering both potential upsides and downsides.

Alternative Perspectives on the 2025 Halving

The Bitcoin halving, a predictable event reducing the rate of new Bitcoin creation, elicits diverse reactions across the cryptocurrency ecosystem. Understanding these varied perspectives is crucial for navigating the potential market shifts and technological implications of the 2025 event. The impact is not uniform; different stakeholders experience the halving in vastly different ways.

Miner Perspectives on the 2025 Halving

Miners, the backbone of Bitcoin’s security, face a direct impact from the halving. Reduced block rewards mean less income per block mined. This pressure often leads to increased operational costs and a potential consolidation within the mining industry, with smaller, less efficient miners forced to shut down or merge with larger operations. Some might adapt by increasing hash rate efficiency or diversifying revenue streams, perhaps through ancillary services like Bitcoin node operation or custodial services. The profitability of mining becomes heavily dependent on the Bitcoin price; a significant price increase following the halving could offset the reduced block reward, while a stagnant or declining price could lead to widespread difficulties. The 2012 and 2016 halvings offer historical precedent; both saw initial price dips followed by substantial price increases, though the timeline varied.

Investor Perspectives on the 2025 Halving

Investors generally view the halving as a bullish event, anticipating a price increase due to the decreased supply of newly mined Bitcoin. This expectation is based on the historical precedent of previous halvings. However, investor sentiment is not monolithic. Some investors are cautious, acknowledging that the market’s reaction isn’t guaranteed, and other factors like macroeconomic conditions and regulatory changes can significantly influence the price. Furthermore, the increased difficulty of mining after a halving can lead to a temporary price dip as miners adjust to the lower profitability. Sophisticated investors may use the period leading up to the halving to adjust their portfolios, potentially accumulating Bitcoin at lower prices or hedging against potential volatility.

Developer Perspectives on the 2025 Halving

Developers, focusing on the underlying technology and scalability of Bitcoin, may view the halving with less direct concern than miners or investors. While they might observe the economic effects, their primary focus remains on enhancing the network’s functionality, security, and adoption. The halving doesn’t directly impact the core development process; however, the subsequent economic shifts could influence funding for development projects, potentially leading to increased reliance on community contributions or alternative funding mechanisms. The long-term implications of the halving for Bitcoin’s adoption and its position within the broader financial landscape are areas of continued interest for developers. They may focus on initiatives that improve the efficiency and user experience of the Bitcoin network, regardless of the halving’s direct impact.

Comparison of Perspectives

The following table summarizes the differing perspectives on the 2025 Bitcoin halving:

| Stakeholder Group | Expected Impact | Potential Response |

|---|---|---|

| Miners | Reduced block rewards, increased operational pressure | Consolidation, increased efficiency, diversification of revenue streams |

| Investors | Anticipated price increase (bullish sentiment), but also potential short-term price dips | Portfolio adjustments, hedging against volatility |

| Developers | Indirect economic impact on funding and adoption | Focus on network improvements and scalability |