Mining and its Implications Post-Halving

The 2025 Bitcoin halving, reducing the block reward by half, will significantly impact the Bitcoin mining landscape. This event creates both substantial challenges and exciting opportunities for miners, reshaping the industry’s dynamics and potentially leading to significant consolidation and technological advancements.

Challenges Faced by Bitcoin Miners Post-Halving

The immediate challenge following a halving is the reduced profitability of mining. With fewer newly minted Bitcoins awarded per block, miners must rely more heavily on transaction fees to cover operational costs. This necessitates a higher Bitcoin price or significantly reduced operational expenses to maintain profitability. Miners facing high energy costs or less efficient hardware will be particularly vulnerable, potentially leading to some miners ceasing operations altogether. This could manifest in a decline in the overall hash rate, at least temporarily, until the market adjusts. The 2012 and 2016 halvings provided precedents for this, although the market conditions and technological landscape have evolved significantly since then. For example, the increasing adoption of sustainable energy sources by some mining operations might mitigate the impact of rising energy costs.

Opportunities for Bitcoin Miners Post-Halving

Despite the challenges, the halving also presents opportunities. Miners who can maintain operations efficiently, through cost optimization or access to cheaper energy, will benefit from a potentially higher Bitcoin price and increased market share. Those who invest in more efficient mining hardware or develop innovative mining strategies will also be better positioned for success. This competitive pressure could spur innovation and the adoption of more sustainable and efficient mining practices. The increased scarcity of newly mined Bitcoin might also lead to increased investor demand, pushing the price higher and offsetting the reduced block reward.

Consolidation within the Bitcoin Mining Industry

The post-halving period often witnesses consolidation within the mining industry. Less efficient or less well-capitalized miners may be forced to sell their equipment or merge with larger operations to survive. This leads to a more concentrated industry with fewer, but larger, mining entities dominating the hash rate. This trend has been observed after previous halvings, with larger mining pools emerging as market leaders. This consolidation could potentially lead to increased centralization concerns, although the decentralized nature of Bitcoin’s network remains relatively resilient even with a concentrated mining landscape.

Impact of the Halving on Energy Consumption of Bitcoin Mining

The halving’s impact on energy consumption is complex. While reduced profitability might lead some miners to shut down, thereby reducing overall energy consumption, the increased competition could incentivize the adoption of more energy-efficient technologies. This could potentially offset the initial decrease in energy use, or even lead to a net increase in the long term, as more efficient miners expand their operations. The overall effect will depend on the interplay between these competing forces and the evolution of mining technology. The long-term trend, however, is expected to be towards greater energy efficiency in Bitcoin mining.

Development of More Energy-Efficient Mining Technologies, Bitcoin Halving Day 2025

The pursuit of profitability post-halving will drive innovation in mining technology. The development and adoption of more energy-efficient ASICs (Application-Specific Integrated Circuits), improved cooling systems, and the integration of renewable energy sources will become crucial for miners’ survival. This will not only reduce operational costs but also address environmental concerns associated with Bitcoin mining. Companies are already investing heavily in research and development to improve the energy efficiency of mining hardware and operations. This ongoing technological advancement is likely to continue to be a key factor in shaping the future of Bitcoin mining.

Impact on Bitcoin Adoption and Usage

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, has historically coincided with periods of increased price volatility and, consequently, heightened public interest and adoption. While correlation doesn’t equal causation, analyzing past halvings offers valuable insights into potential future trends. Understanding these trends is crucial for predicting the impact of the 2025 halving on Bitcoin’s overall adoption and usage across various demographics.

Previous halvings have demonstrably influenced Bitcoin’s adoption rates. The 2012 halving, for example, preceded a significant price surge, drawing in new investors and increasing media coverage, thus boosting adoption. Similarly, the 2016 halving, although less dramatic in its immediate price impact, contributed to a broader awareness of Bitcoin and its underlying technology, paving the way for increased usage in the following years. These periods saw increased participation from both retail investors and businesses exploring Bitcoin’s potential as a payment method or store of value.

Increased Bitcoin Adoption Among Various Demographics Post-Halving

The 2025 halving could potentially accelerate Bitcoin adoption among several key demographics. Younger generations, already familiar with digital currencies and decentralized technologies, may be particularly drawn to Bitcoin’s scarcity and potential as a hedge against inflation. Moreover, increased media attention surrounding the halving could educate a broader audience, including older demographics traditionally less involved in cryptocurrency, about Bitcoin’s value proposition. Businesses, especially those operating internationally and seeking to reduce transaction fees, might also increase their use of Bitcoin as a means of payment. However, the extent of this adoption will depend on various factors, including regulatory clarity, economic conditions, and the overall stability of the cryptocurrency market.

Factors Accelerating or Hindering Bitcoin Adoption After 2025

Several factors could significantly influence Bitcoin adoption post-2025. Regulatory clarity and supportive government policies in major economies could significantly boost institutional investment and mainstream adoption. Conversely, restrictive regulations or negative media narratives could hinder progress. Technological advancements, such as the development of more user-friendly wallets and improved scalability solutions, would likely accelerate adoption. Conversely, persistent scalability issues or security breaches could erode confidence and slow down growth. Finally, macroeconomic conditions, including inflation rates and global economic stability, will significantly impact Bitcoin’s attractiveness as a store of value and a potential investment asset. A period of high inflation, for example, could drive increased demand for Bitcoin as a hedge against currency devaluation.

Potential Real-World Applications of Bitcoin in 2025

By 2025, Bitcoin’s real-world applications could extend beyond its current uses. Imagine a scenario where international remittances are significantly facilitated by Bitcoin’s low transaction fees and speed, particularly benefiting migrant workers sending money back to their home countries. Businesses, especially e-commerce platforms, could increasingly integrate Bitcoin as a payment option, offering customers a faster and potentially cheaper alternative to traditional payment processors. Furthermore, supply chain management could benefit from Bitcoin’s transparency and immutability, allowing for greater traceability of goods and reduced instances of fraud. Finally, the development of decentralized finance (DeFi) applications built on Bitcoin’s blockchain could unlock further innovative applications, potentially disrupting traditional financial services. The realization of these scenarios depends, however, on technological advancements, regulatory frameworks, and the overall acceptance of Bitcoin within the broader financial ecosystem.

Risks and Uncertainties Associated with the Halving: Bitcoin Halving Day 2025

The Bitcoin halving, while generally anticipated as a bullish event, presents a complex interplay of factors that introduce significant risks and uncertainties. The reduced block reward doesn’t guarantee price appreciation; instead, it alters the market dynamics, creating potential vulnerabilities alongside opportunities. Understanding these risks is crucial for informed investment decisions.

The 2025 halving, like previous ones, could trigger unpredictable market reactions. While historically, halvings have preceded periods of price increase, this correlation doesn’t imply causation. External factors, such as macroeconomic conditions, regulatory changes, and technological advancements, can significantly influence Bitcoin’s price trajectory, irrespective of the halving.

Potential Price Volatility After the Halving

The immediate aftermath of a halving often witnesses heightened price volatility. The reduced supply of newly minted Bitcoin can create upward pressure, attracting buyers anticipating future price appreciation. However, this can also lead to intense price swings, potentially resulting in sharp corrections. For example, the 2016 halving was followed by a period of consolidation before a significant price surge, while the 2020 halving saw a more immediate, albeit volatile, price increase. The outcome for 2025 remains uncertain, influenced by various interacting market forces.

Unforeseen Events and Their Impact

Unforeseen events, ranging from geopolitical instability to major technological disruptions, pose significant risks to Bitcoin’s price and adoption. A global economic downturn, for instance, could negatively impact investor sentiment, leading to a sell-off regardless of the halving. Similarly, a major security breach or a significant regulatory crackdown could severely undermine confidence in Bitcoin. The 2022 crypto winter, driven by macroeconomic factors and regulatory uncertainty, illustrates the potential for external events to override the anticipated effects of a halving.

Risk Comparison: Pre- and Post-Halving Investment

Investing in Bitcoin before the halving involves the risk of a price correction before the anticipated bullish run. Investors might face losses if the price fails to react positively to the halving or if negative external factors dominate. Investing after the halving carries the risk of buying at a higher price point, potentially missing the initial price surge. The optimal entry point remains a matter of speculation, dependent on individual risk tolerance and market predictions. Historical data offers some guidance but doesn’t guarantee future performance.

Risk Mitigation Strategies for Bitcoin Investments

Mitigating risks associated with Bitcoin investments involves a diversified approach. Dollar-cost averaging, for example, involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This strategy reduces the impact of buying high or selling low. Furthermore, diversification across different asset classes, including traditional investments, can help balance overall portfolio risk. Finally, thorough research and understanding of Bitcoin’s inherent volatility are paramount before making any investment decision. A conservative approach, coupled with a long-term perspective, can help manage the inherent uncertainties associated with Bitcoin investments.

Frequently Asked Questions (FAQs)

The Bitcoin halving in 2025 is a significant event that will impact the cryptocurrency market. This section addresses common questions surrounding the halving, covering price predictions, mining implications, and the overall market effect. We’ll then delve into more technical aspects of the halving mechanism itself.

General FAQs about the 2025 Bitcoin Halving

| Question | Answer |

|---|---|

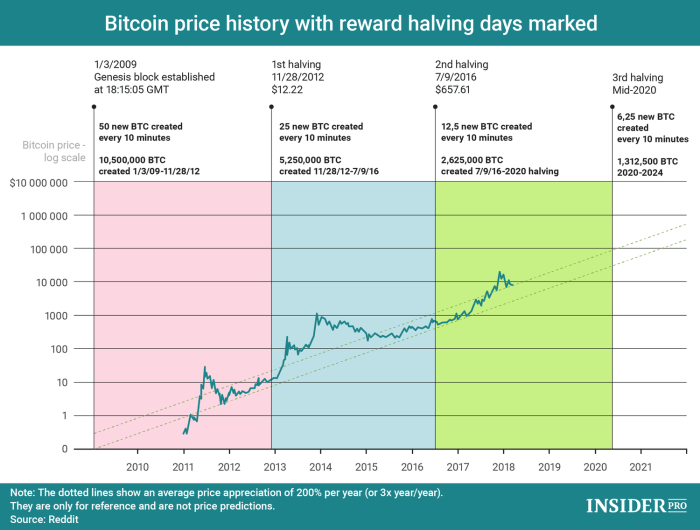

| What is the Bitcoin halving? | The Bitcoin halving is a programmed event in the Bitcoin protocol where the reward given to Bitcoin miners for successfully adding new blocks to the blockchain is reduced by half. This occurs approximately every four years. |

| When is the next Bitcoin halving expected? | The next halving is anticipated to occur sometime in the spring or summer of 2025, depending on the block creation time. |

| How will the halving affect the Bitcoin price? | Historically, Bitcoin’s price has tended to increase following a halving event. This is primarily attributed to the reduced supply of newly minted Bitcoin, potentially increasing its scarcity and driving up demand. However, it’s crucial to remember that price is influenced by many factors beyond the halving, including market sentiment, regulatory changes, and overall economic conditions. Past performance is not indicative of future results. For example, the halving in 2012 saw a subsequent price increase, but the increase wasn’t immediate and the market experienced fluctuations. Similarly, the 2016 halving was followed by a period of price growth, though again not immediately and with considerable volatility. |

| How will the halving impact Bitcoin miners? | The halving will reduce the revenue generated by Bitcoin miners. To remain profitable, miners will need to increase efficiency, potentially through upgrading their hardware or finding cheaper sources of energy. Some less efficient miners may be forced to shut down, leading to a consolidation of the mining industry. |

| What is the overall market impact expected from the 2025 halving? | The halving’s market impact is difficult to predict with certainty. While it might lead to increased price volatility in the short term, the long-term effect depends on several intertwined factors, including macroeconomic conditions, regulatory frameworks, and overall market sentiment. Past halvings have shown varied impacts, highlighting the complexity of predicting the outcome. |

Technical FAQs about the Bitcoin Halving Mechanism

Bitcoin Halving Day 2025 – The following points detail the technical aspects of the Bitcoin halving and its effect on the blockchain.

- The halving is hardcoded into the Bitcoin protocol, meaning it’s an intrinsic part of the system and cannot be altered without a significant protocol upgrade (which is highly improbable given the decentralized nature of Bitcoin).

- The block reward reduction is precisely 50%. This means that after the halving, miners will receive half the Bitcoin they previously earned for successfully mining a block.

- The halving doesn’t directly affect the transaction fees paid by users; however, indirectly, a decrease in mining profitability could potentially lead to higher transaction fees if miners adjust their fees to compensate for the reduced block reward.

- The halving affects the rate at which new Bitcoins are introduced into circulation, slowing down the inflation rate of the Bitcoin supply. This is a core feature designed to maintain Bitcoin’s scarcity over time.

- The halving mechanism is not a singular event; it is a recurring event built into the Bitcoin code to occur approximately every 210,000 blocks, which translates to roughly four years.

Visual Representation of Data

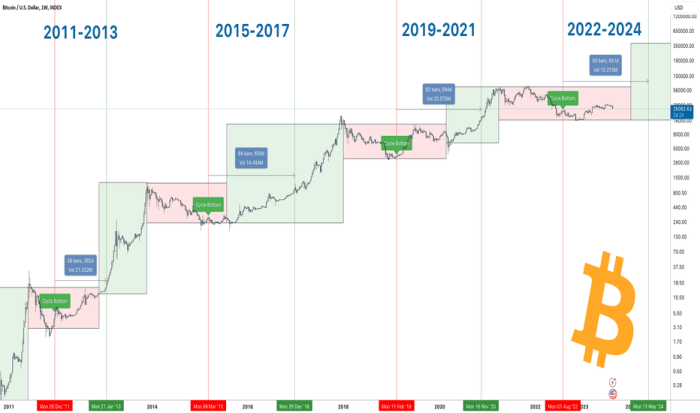

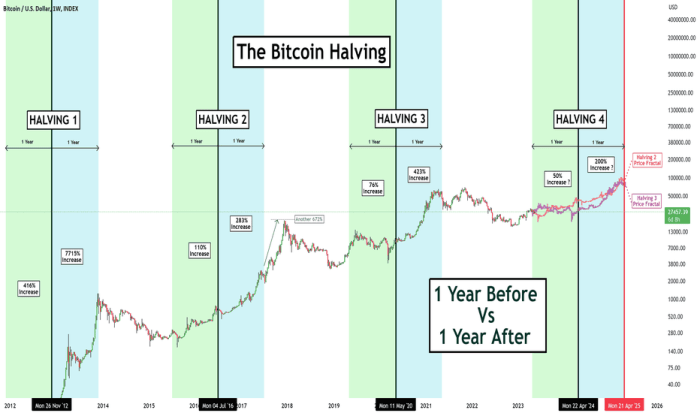

Understanding Bitcoin’s price behavior around halving events requires a visual approach to grasp the complex interplay of market forces. Analyzing historical data provides valuable insights into potential future trends, although it’s crucial to remember that past performance is not indicative of future results. The following chart illustrates Bitcoin’s price performance in the periods surrounding previous halvings.

The chart below depicts Bitcoin’s price action for approximately two years before and after each halving event. The data used comprises the daily closing price of Bitcoin from reputable cryptocurrency exchanges, sourced from CoinMarketCap and CoinGecko, for the periods encompassing the 2012, 2016, and 2020 halvings. The methodology involves plotting the price data on a line graph, with the halving date clearly marked. The y-axis represents the Bitcoin price in USD, and the x-axis represents the time elapsed (in months) relative to the halving date. Each halving event is represented by a separate line on the graph, allowing for visual comparison of price movements across different cycles. Note that this representation simplifies the complex market dynamics and does not incorporate other factors that may influence Bitcoin’s price.

Bitcoin Price Performance Around Halving Events

Imagine a line graph with three distinct lines, each representing a Bitcoin halving event. The x-axis spans approximately four years, centered on each halving date (marked with a vertical dashed line). The y-axis displays the Bitcoin price in US dollars, using a logarithmic scale to better visualize the significant price fluctuations. The first line, representing the 2012 halving, shows a gradual price increase in the months leading up to the event, followed by a more pronounced surge afterward. The 2016 halving shows a similar pattern, but with a longer period of relatively flat price action before the eventual surge. Finally, the 2020 halving line demonstrates a sharp price increase leading up to the event, followed by a substantial peak, and then a significant correction. The visual clearly demonstrates that while a price increase often follows a halving event, the timing and magnitude of this increase are variable and influenced by various market factors. The graph allows for a clear comparison of the price action around each halving event, highlighting both similarities and differences in the market’s response. The use of a logarithmic scale is crucial for accurately representing the wide range of price movements over these periods.

Bitcoin Halving Day 2025

The Bitcoin halving event of 2025, anticipated to occur in April, marks a significant milestone in the cryptocurrency’s history. This event, where the reward for Bitcoin miners is cut in half, has historically been followed by periods of price volatility and shifts in the network’s dynamics. This section summarizes key takeaways and explores the long-term implications of this upcoming halving.

Key Takeaways and Insights from the 2025 Halving Analysis

The analysis of the upcoming halving reveals several key insights. Understanding these points is crucial for navigating the potential market shifts and long-term implications for Bitcoin’s future.

- Reduced Block Reward: The most immediate impact is the halving of the block reward paid to miners, decreasing the rate of new Bitcoin entering circulation. This is expected to reduce inflation significantly. Historically, halvings have been followed by periods of increased price appreciation, though this is not guaranteed.

- Miner Revenue Adjustments: Miners will need to adapt to the reduced block reward. This might involve increasing mining efficiency, consolidating operations, or raising transaction fees. The ability of miners to adjust to this change will influence network security and stability.

- Increased Scarcity: The reduced supply of newly minted Bitcoin increases its scarcity. This fundamental aspect of Bitcoin’s design is a key driver of its value proposition for many investors. The decreased supply combined with potential increased demand could lead to price appreciation.

- Network Security Implications: The halving’s impact on miner profitability could potentially affect the network’s security. If the profitability falls below a certain threshold, it might lead to a decrease in the hash rate (the computational power securing the network). However, past halvings have shown the network’s resilience and ability to adapt.

Long-Term Implications of the 2025 Halving

The long-term consequences of the 2025 halving are complex and depend on several interconnected factors, including broader macroeconomic conditions, regulatory developments, and technological advancements within the cryptocurrency space. However, several key long-term implications can be anticipated.

The reduced inflation rate, resulting from the halving, could contribute to Bitcoin’s position as a store of value. This is analogous to how gold’s scarcity contributes to its perceived value. If Bitcoin continues to gain adoption as a store of value, the halving could act as a catalyst for further price appreciation over the long term. However, it’s crucial to remember that external factors, such as global economic uncertainty, could significantly influence Bitcoin’s price irrespective of the halving. For example, the 2022 bear market, which coincided with increased macroeconomic uncertainty, saw a significant price drop despite the halving having occurred in 2020.

Furthermore, the halving could stimulate innovation within the Bitcoin ecosystem. The reduced miner profitability might drive the development of more efficient mining hardware and strategies, potentially leading to a more sustainable and environmentally friendly Bitcoin mining industry. This could also lead to a greater focus on Layer-2 scaling solutions, enabling faster and cheaper transactions, which are crucial for widespread adoption.