Bitcoin Halving 2025: Bitcoin Halving Graph 2025

The Bitcoin halving, a pre-programmed event in the Bitcoin protocol, is anticipated to occur in 2025. This event significantly impacts the cryptocurrency’s inflation rate and is often followed by periods of price volatility. Understanding the mechanics of this event and its historical impact is crucial for assessing its potential influence on Bitcoin’s future price.

Bitcoin Halving Mechanics and Historical Impact, Bitcoin Halving Graph 2025

The Bitcoin halving reduces the reward given to Bitcoin miners for successfully verifying and adding new blocks to the blockchain. This reward, initially 50 BTC per block, is halved approximately every four years. Historically, the halving events of 2012, 2016, and 2020 have been followed by significant price increases, although the timing and magnitude of these increases have varied. The reduced supply of newly minted Bitcoin, coupled with persistent demand, is often cited as the primary driver behind these price surges. However, it’s crucial to remember that other macroeconomic factors and market sentiment also play a significant role.

Expected Consequences of the 2025 Halving on Supply and Demand

The 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC. This will decrease the rate at which new Bitcoins enter circulation, further tightening the supply. Assuming consistent or increasing demand, this reduction in supply is expected to exert upward pressure on the price. The magnitude of this price increase, however, remains uncertain and depends on various market dynamics. Past halvings provide a historical context, but they do not guarantee a similar outcome in 2025. For example, the 2020 halving was followed by a significant price rally, but the subsequent market correction demonstrates the complexity of price prediction.

Factors Influencing Bitcoin’s Price After the 2025 Halving

Several factors could influence Bitcoin’s price after the 2025 halving. Bullish scenarios include continued institutional adoption, increasing global macroeconomic uncertainty driving investors towards Bitcoin as a safe haven asset, and technological advancements improving Bitcoin’s scalability and usability. Bearish scenarios include increased regulatory scrutiny, a major security breach impacting trust in the network, or a significant macroeconomic downturn leading to widespread risk aversion. The interplay of these and other factors will ultimately determine the post-halving price trajectory. For instance, the 2012 halving coincided with increased media attention and early adoption, contributing to subsequent price growth. Conversely, the 2016 halving occurred during a period of relative market quiet, with price appreciation following more gradually.

Timeline of Key Events Surrounding the 2025 Bitcoin Halving

The lead-up to and aftermath of the 2025 halving will likely involve a series of interconnected events. In the months preceding the halving, we can anticipate increased speculation and volatility in the market as investors position themselves for the anticipated event. The halving itself will be a significant marker. The months and years following the halving will see the impact of the reduced supply play out, alongside the influence of various macroeconomic and market-specific factors. Predicting the exact timing and nature of these events is impossible, but analyzing historical trends and current market conditions can provide a framework for understanding potential outcomes. For example, the period leading up to the 2020 halving saw a gradual price increase, followed by a sharp rise post-halving, illustrating the potential for both anticipation and reaction effects.

Analyzing Historical Halving Cycles

Bitcoin’s halving events, occurring approximately every four years, have significantly impacted its price and network dynamics. Analyzing past halvings provides valuable insights into potential future trends, although it’s crucial to remember that past performance is not indicative of future results and many other factors influence Bitcoin’s price. Understanding these historical patterns, however, allows for a more informed perspective on the upcoming 2025 halving.

Bitcoin Halving Graph 2025 – Comparing the price movements after each halving reveals both similarities and differences. While a price surge has generally followed each halving, the magnitude and duration of these increases have varied considerably. Several factors, including broader macroeconomic conditions, regulatory changes, and overall market sentiment, play a crucial role in shaping the post-halving price trajectory. Furthermore, the market conditions leading up to each halving have also differed significantly, influencing the subsequent price action.

Miner Behavior and Network Security Post-Halving

The halving directly impacts Bitcoin miners by reducing their block rewards. This reduction necessitates an adjustment in mining profitability. Historically, miners have responded in various ways. Some miners may choose to exit the market due to reduced profitability, while others may consolidate their operations or increase their hashrate to maintain their market share. This dynamic influences the overall network security. A reduction in the number of miners could, in theory, lead to a temporary vulnerability, although the Bitcoin network’s inherent security mechanisms often mitigate this risk. However, the impact on network security is complex and dependent on several factors, including the overall hashrate and the distribution of mining power. The post-halving period often sees a period of consolidation within the mining industry, with larger, more efficient operations gaining a competitive advantage.

Comparison of Key Metrics Across Halving Cycles

The following table compares key metrics across previous Bitcoin halving cycles. It’s important to note that the price before and after the halving is a snapshot in time and can fluctuate significantly during the period surrounding the event. Market capitalization is calculated based on the prevailing Bitcoin price at the time.

| Date of Halving | Block Reward (BTC) | Price Before Halving (USD) | Price After Halving (USD) | Market Cap Before Halving (USD) | Market Cap After Halving (USD) |

|---|---|---|---|---|---|

| November 28, 2012 | 50 | 13.45 | 70.00 | 1.5 Billion | 8 Billion (approximate) |

| July 9, 2016 | 25 | 650 | 2,000 | 11 Billion | 32 Billion (approximate) |

| May 11, 2020 | 12.5 | 8,700 | 19,000 | 160 Billion | 350 Billion (approximate) |

Predicting the 2025 Halving Impact

The Bitcoin halving event of 2025, scheduled for sometime in April, presents a significant opportunity to analyze its potential impact on Bitcoin’s price and overall market trajectory. Predicting the precise effects is inherently challenging, given the complex interplay of macroeconomic conditions, regulatory landscapes, and investor sentiment. However, by examining key influencing factors, we can develop a more informed perspective on potential price movements.

Macroeconomic Factors and Bitcoin’s Price in 2025

Global macroeconomic conditions will undoubtedly play a crucial role in shaping Bitcoin’s price performance following the 2025 halving. Factors such as inflation rates, interest rate policies implemented by central banks (like the Federal Reserve), and overall economic growth will significantly influence investor appetite for risk assets, including Bitcoin. For instance, a period of high inflation and rising interest rates could potentially drive investors towards safer, more traditional assets, potentially reducing demand for Bitcoin in the short term. Conversely, a period of economic uncertainty or deflationary pressures could increase the appeal of Bitcoin as a hedge against inflation, boosting its price. The interplay of these forces is complex and difficult to predict with certainty, but understanding their potential impact is crucial for assessing the 2025 halving’s effects.

Regulatory Changes and Bitcoin’s Trajectory

Regulatory developments across the globe will have a substantial impact on Bitcoin’s price and adoption. Increased regulatory clarity and favorable legislation in major jurisdictions could lead to increased institutional investment and mainstream adoption, potentially driving price appreciation. Conversely, stricter regulations, particularly those aimed at limiting or restricting Bitcoin’s use, could negatively impact its price and overall market growth. The evolving regulatory landscape in the United States, for example, with ongoing discussions about stablecoins and potential Bitcoin ETFs, will be a key factor influencing Bitcoin’s future. Different countries’ approaches to cryptocurrency regulation, ranging from outright bans to permissive frameworks, will also create varied market dynamics.

Institutional Investment and Bitcoin’s Price

Institutional investment is increasingly viewed as a key driver of Bitcoin’s price. The entry of large financial institutions, such as investment firms and hedge funds, into the Bitcoin market can lead to significant price increases due to their substantial buying power. However, the level of institutional participation is also subject to macroeconomic conditions and regulatory uncertainty. For example, the significant increase in Bitcoin’s price in 2020 and 2021 can partially be attributed to growing institutional interest. Conversely, periods of economic uncertainty or negative regulatory developments might cause institutional investors to reduce their Bitcoin holdings, potentially putting downward pressure on its price. The level of institutional confidence and their investment strategies will be critical factors in determining Bitcoin’s price after the 2025 halving.

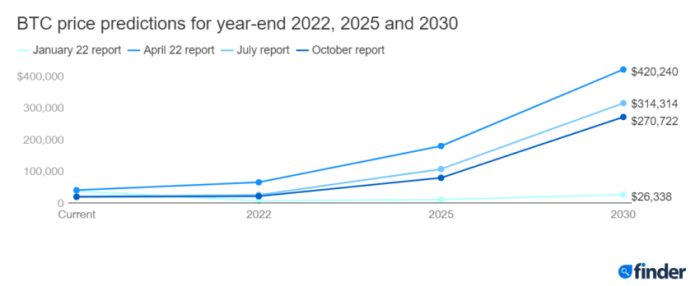

Comparative Analysis of Bitcoin Price Prediction Models

Numerous price prediction models exist, ranging from technical analysis based on historical price charts and trading volume to more complex quantitative models incorporating macroeconomic and fundamental factors. These models often produce widely varying predictions, reflecting the inherent uncertainty associated with forecasting asset prices. For example, some models might extrapolate historical price trends, predicting a significant price surge after the halving based on past cycles. Others might incorporate factors such as network growth, transaction fees, and macroeconomic indicators to arrive at more nuanced predictions. It’s crucial to approach these models with caution, acknowledging their limitations and inherent uncertainties. A thorough review of multiple models, considering their underlying assumptions and methodologies, offers a more comprehensive view, albeit still far from a definitive forecast. No single model provides a perfectly accurate prediction, highlighting the complexity and unpredictability of the cryptocurrency market.

Bitcoin Halving and Market Sentiment

The impact of Bitcoin halvings on market sentiment has evolved significantly over the years. Initially, the halvings were relatively less anticipated events, with their effect on price less pronounced. However, as Bitcoin’s adoption grew, so did the awareness and anticipation surrounding these events, leading to increasingly pronounced market reactions. This evolution is tied to the increasing sophistication of the market and the growing influence of social media and mainstream news coverage.

The relationship between Bitcoin halvings and market sentiment is complex, involving a dynamic interplay of investor psychology, media narratives, and fundamental factors. Understanding this interplay is crucial for navigating the often volatile market conditions surrounding these events.

Evolution of Market Sentiment Surrounding Bitcoin Halvings

Early halvings saw more subdued market reactions, largely due to the smaller size of the Bitcoin market and less widespread understanding of the halving’s implications. As Bitcoin’s popularity grew, so did the anticipation of each halving. The 2012 halving, for instance, was less impactful than the 2016 or 2020 halvings, which saw significant price increases in the months following the event. This demonstrates a clear correlation between increasing market awareness and the magnitude of the market response to a halving. The growing influence of social media and crypto-focused news outlets amplified the anticipation and speculation, creating a self-reinforcing cycle.

Investor Psychology and the Influence of FOMO

Investor psychology plays a significant role in shaping price fluctuations around Bitcoin halvings. The anticipation of reduced supply often leads to increased buying pressure, driving up the price. This is exacerbated by FOMO (fear of missing out), as investors fear being left behind if the price continues to rise. Conversely, periods of uncertainty or negative news can lead to sell-offs, even in the face of a halving’s fundamentally bullish implications. For example, macroeconomic events or regulatory uncertainty can overshadow the positive narrative surrounding a halving. The 2020 halving occurred during a period of global uncertainty due to the COVID-19 pandemic, yet still saw significant price increases later that year, although the initial reaction was somewhat muted. This shows that while FOMO is a significant factor, broader economic conditions can significantly impact the market’s response.

The Role of Social Media and News Coverage

Social media platforms and mainstream news outlets significantly influence public perception of Bitcoin halvings. Positive news coverage and enthusiastic social media discussions can create a positive feedback loop, driving up demand and prices. Conversely, negative or skeptical reporting can dampen enthusiasm and lead to price corrections. The narrative surrounding each halving is carefully constructed and disseminated through various channels, impacting investor sentiment. The proliferation of crypto influencers and their often-amplified opinions further contributes to the volatility and emotional swings observed in the market around these events. A prime example of this influence is the significant increase in social media chatter surrounding the 2020 halving, contributing to a substantial price rally in the months that followed.

Hypothetical Scenario: Market Confidence and Post-Halving Price

Let’s consider two hypothetical scenarios illustrating the impact of different market confidence levels on post-halving price:

Scenario 1: High Market Confidence. Strong macroeconomic conditions, positive regulatory developments, and widespread adoption of Bitcoin lead to extremely high confidence. The halving acts as a catalyst, triggering a significant price surge, potentially exceeding previous halving cycles’ performance. This scenario is characterized by sustained buying pressure and a generally positive narrative surrounding Bitcoin’s future. A price increase exceeding 100% within a year post-halving is plausible in this scenario.

Scenario 2: Low Market Confidence. Negative macroeconomic conditions, regulatory uncertainty, and negative media coverage create a climate of low confidence. The halving’s impact is muted, and the price may experience a short-term bump followed by a period of stagnation or even decline. This scenario reflects a pessimistic outlook on Bitcoin’s future, leading to reduced buying pressure and increased selling. A modest price increase or even a price decline in the year following the halving is possible.

The 2025 Halving Graph

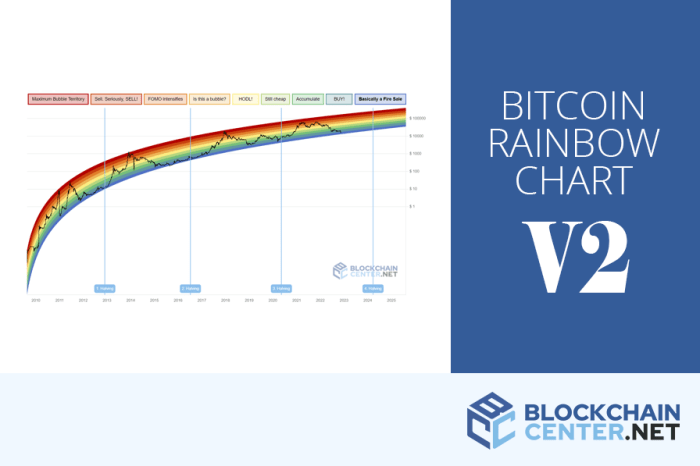

A visual representation of projected Bitcoin price movements surrounding the 2025 halving is crucial for understanding potential market dynamics. While predicting the future price of Bitcoin is inherently uncertain, analyzing historical trends and incorporating relevant economic factors allows for the creation of a plausible projection. This graph, however, should be viewed as a potential scenario rather than a definitive prediction.

The following sections detail the methodology behind creating a projected Bitcoin price graph for the 2025 halving, explore alternative visualizations, and demonstrate how to interpret the key insights.

Graph Projection Methodology

The projected Bitcoin price graph uses a combination of historical data analysis and forecasting techniques. Specifically, we examine the price action leading up to and following the previous halving events (2012, 2016, and 2020). This involves identifying patterns such as the pre-halving accumulation phase, the post-halving price surge (often followed by a correction), and the overall long-term price trend. We then apply statistical methods, such as moving averages and regression analysis, to establish a baseline projection. However, it’s crucial to note that this methodology relies on the assumption that historical patterns will, to some degree, repeat themselves. This assumption, however, is a simplification and does not account for unforeseen market events, technological advancements, or regulatory changes that could significantly impact Bitcoin’s price. Furthermore, the model’s accuracy is limited by the inherent volatility of the cryptocurrency market. The projection does not consider external factors like macroeconomic conditions, geopolitical events, or changes in investor sentiment, which are known to significantly influence Bitcoin’s price. The resulting graph, therefore, should be interpreted as a possible scenario, not a guaranteed outcome. A realistic graph might show a gradual price increase in the months leading up to the halving, followed by a more significant surge afterward, eventually tapering off and potentially experiencing corrections along the way. This would resemble the general patterns observed in previous halving cycles, albeit with a different scale and trajectory.

Alternative Graph Designs

Beyond the price projection, alternative graphs can provide valuable insights into the 2025 halving’s impact.

One such graph could illustrate mining profitability, plotting the Bitcoin price against the mining cost per coin. This would highlight the potential for miners to remain profitable despite the reduced block reward. A decrease in mining profitability could indicate a potential for miners to sell their holdings, creating downward pressure on the price. Conversely, sustained profitability could signal continued network security and growth.

Another useful graph would visualize the Bitcoin network hash rate. This metric reflects the computational power securing the network. A sustained or increased hash rate after the halving would indicate a healthy and resilient network, suggesting strong confidence among miners. A significant drop, however, could signal potential vulnerabilities. The graph could show the hash rate trend over time, highlighting periods of growth and decline relative to halving events.

Interpreting Key Insights

The primary insight derived from the projected price graph is the potential for a price increase following the 2025 halving. However, the magnitude and duration of this increase are highly uncertain. The alternative graphs—mining profitability and hash rate—provide crucial context. For example, if the mining profitability graph shows declining profitability despite a rising Bitcoin price, it could suggest that the price increase is unsustainable in the long term. Similarly, a declining hash rate could indicate a potential weakness in the network security, regardless of price movements. Investors should interpret the graph not as a trading signal but as a tool for risk assessment. It’s crucial to consider the limitations of the projection and incorporate other relevant factors into their investment decisions. Historical examples, like the 2020 halving, which saw a significant price increase following the event, can provide some reference points, but it is essential to remember that each halving occurs under unique macroeconomic and market conditions.

Frequently Asked Questions (FAQs)

This section addresses common queries regarding Bitcoin halvings, focusing on their mechanics, impact, and associated risks. Understanding these aspects is crucial for anyone considering investing in Bitcoin, particularly around the halving events.

Bitcoin Halving Definition

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by half. This occurs approximately every four years, reducing the inflation rate of the Bitcoin supply. The halving is designed to maintain scarcity and control the long-term supply of Bitcoin.

Next Bitcoin Halving Date

The next Bitcoin halving is expected around April 2025. This date is estimated based on the average block generation time of approximately 10 minutes. The halving occurs after approximately every 210,000 blocks are mined. While the exact date can vary slightly due to fluctuations in block times, the projected timeframe remains consistent with the Bitcoin protocol’s design.

Bitcoin Halving Price Impact

Historically, Bitcoin halvings have been followed by periods of significant price appreciation. This is often attributed to the interplay of supply and demand. Reduced supply of newly mined Bitcoin, coupled with sustained or increased demand, can create upward pressure on the price. However, it’s crucial to note that other market factors also influence price movements. For example, the 2012 and 2016 halvings were followed by substantial price increases, although the timing and magnitude varied.

Price Increase Guarantees After a Halving

There are no guarantees of price increases after a Bitcoin halving. While historical data suggests a positive correlation, numerous other factors influence Bitcoin’s price, including macroeconomic conditions, regulatory changes, technological developments, and overall market sentiment. It’s essential to remember that past performance is not indicative of future results. The 2012 halving saw a gradual price increase, while the 2016 halving saw a more dramatic, but delayed, surge. These variations highlight the complexity of predicting price movements.

Risks Associated with Investing Around a Halving

Investing in Bitcoin around a halving carries inherent risks. The price volatility of Bitcoin is well-known, and this volatility can be amplified during periods of anticipation and the aftermath of a halving. Market manipulation, unexpected regulatory actions, or negative news events could negatively impact the price, regardless of the halving. Furthermore, the “buy the dip” mentality prevalent around halvings can lead to overvaluation and subsequent corrections. Investors should carefully consider their risk tolerance and diversify their portfolios.