Bitcoin Halving History

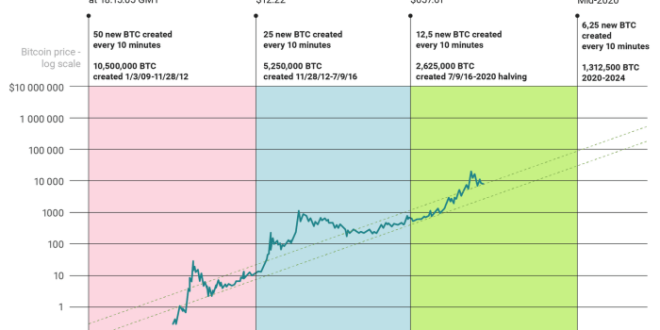

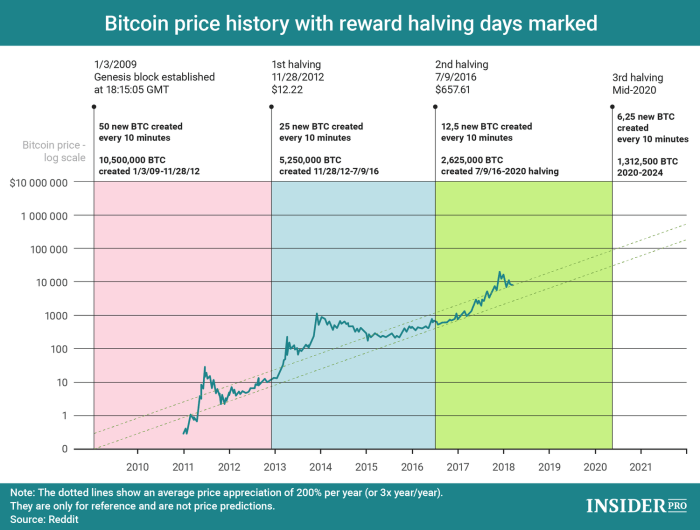

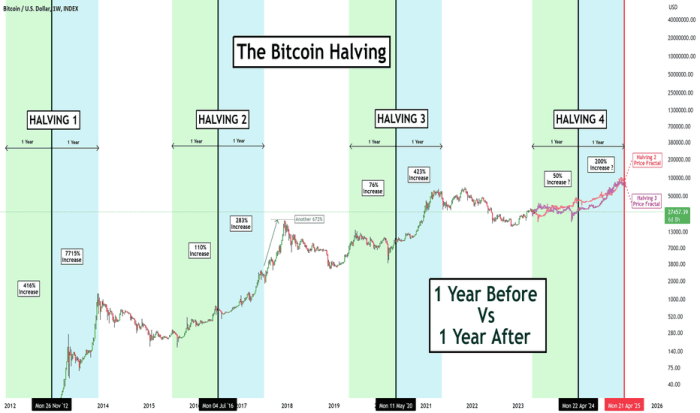

Bitcoin halvings are a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined, and is designed to control inflation and maintain the scarcity of Bitcoin. Understanding the historical impact of these halvings provides valuable insight into Bitcoin’s price behavior and market dynamics.

Bitcoin Halving Timeline and Price Impact

The following table details the three previous Bitcoin halvings, including the date, block height achieved at the halving, the average Bitcoin price in the six months preceding the event, and the average price in the six months following. Note that these prices are averages and actual price fluctuations during these periods were significantly more volatile. Furthermore, attributing price changes solely to the halving is an oversimplification, as numerous other economic and market factors play crucial roles.

| Date | Block Height | Pre-Halving Price (6-month avg. USD) | Post-Halving Price (6-month avg. USD) |

|---|---|---|---|

| November 28, 2012 | 210,000 | ~ $12 | ~ $120 |

| July 9, 2016 | 420,000 | ~ $650 | ~ $1,100 |

| May 11, 2020 | 630,000 | ~ $8,700 | ~ $29,000 |

Economic Factors Influencing Bitcoin Price Around Halvings

The price movements surrounding Bitcoin halvings are complex and influenced by a multitude of interconnected factors. Before a halving, anticipation often leads to price increases as investors speculate on future scarcity. After a halving, the reduced supply can theoretically support higher prices, though this effect is not immediate and is often influenced by broader market trends, regulatory changes, and adoption rates. For instance, the 2020 halving coincided with increased institutional investment and growing mainstream interest in Bitcoin, contributing significantly to the substantial price increase observed in the following months. Conversely, macroeconomic factors like inflation and overall market sentiment can significantly impact Bitcoin’s price, regardless of the halving.

Market Sentiment and Cryptocurrency Market Conditions

Market sentiment surrounding each halving has varied. The first halving in 2012 occurred during Bitcoin’s early days, with a relatively smaller market capitalization and limited institutional involvement. Subsequent halvings saw increasing levels of institutional investment and media attention, leading to greater market volatility and anticipation. The overall cryptocurrency market conditions also played a significant role. For example, the 2020 halving occurred during a period of relative stability in the broader cryptocurrency market, which contributed to the sustained price appreciation. However, the subsequent bull market was eventually followed by a significant correction, demonstrating that halvings alone do not guarantee sustained upward price trends. The interplay between the halving’s impact on supply and other market forces is crucial in shaping price dynamics.

Understanding the Bitcoin Halving Mechanism

The Bitcoin halving is a crucial programmed event within the Bitcoin protocol, designed to control the rate at which new Bitcoins enter circulation. This mechanism is integral to Bitcoin’s deflationary nature and its long-term economic model. It’s not a manual adjustment; rather, it’s an automatic process dictated by the underlying code.

The halving mechanism directly impacts Bitcoin’s supply by reducing the reward miners receive for successfully validating and adding new blocks to the blockchain. This reward, initially set at 50 BTC per block, is halved every 210,000 blocks, approximately every four years. This reduction in the block reward directly translates to a slower rate of Bitcoin creation. The halving event is not a change in the total number of Bitcoins that can ever exist (currently capped at 21 million), but rather a change in the *rate* at which those Bitcoins are released.

Bitcoin Halving Code Changes

Each halving event requires a minor update to the Bitcoin core software. These changes are primarily focused on modifying the block reward variable within the codebase. The code itself doesn’t undergo significant restructuring; instead, a single line or a small section of code related to the mining reward is altered to reflect the halved value. These updates are thoroughly vetted and tested within the Bitcoin community before being deployed across the network to ensure seamless operation and prevent any unintended consequences. The changes are relatively straightforward, primarily focusing on adjusting a single parameter within the consensus rules. The simplicity of the change underscores the elegance and robustness of the Bitcoin protocol’s design.

Impact on Bitcoin Creation Rate

The halving mechanism profoundly affects the rate at which new Bitcoins are added to the circulating supply. Before the first halving, the rate of Bitcoin creation was relatively high. Each block added approximately 50 BTC to the total supply. After the first halving, this rate dropped to 25 BTC per block. Subsequent halvings further reduced this rate to 12.5 BTC, 6.25 BTC, and so on. This decreasing rate ensures that Bitcoin’s scarcity increases over time.

To illustrate this, consider a simple visual representation: imagine a graph with time on the x-axis and the rate of Bitcoin creation on the y-axis. Before the first halving, the line would be relatively flat and high, representing a constant rate of 50 BTC per block. After each halving, the line would abruptly step down to a lower, but still relatively constant, rate. Each step down would represent a halving event, clearly showing the diminishing rate of Bitcoin creation. This stepwise decrease creates a visually striking representation of Bitcoin’s controlled inflation. The graph would show a clear pattern of decreasing supply growth, highlighting the effect of the halving on Bitcoin’s overall supply. This controlled reduction in supply is a key feature of Bitcoin’s design, intended to mimic the scarcity of precious metals and limit inflationary pressures.

Predicting the 2025 Bitcoin Halving Impact

Predicting the precise impact of the 2025 Bitcoin halving on its price is inherently challenging. While historical data suggests a correlation between halvings and subsequent price increases, numerous other factors influence Bitcoin’s market dynamics, making any prediction inherently speculative. This section explores potential price scenarios, analyzes historical trends, and identifies key influencing factors to provide a more nuanced understanding of the possibilities.

Potential Price Scenarios for the 2025 Bitcoin Halving

Several models attempt to forecast Bitcoin’s price trajectory around the halving. These models vary significantly in their methodologies and assumptions, leading to widely diverging predictions. The following table compares three distinct approaches: a conservative model, a moderate model, and a bullish model. It’s crucial to remember that these are merely illustrative examples and not financial advice.

| Model | Pre-Halving Price (2024 Q4) | Post-Halving Price (2026 Q4) | Rationale |

|---|---|---|---|

| Conservative | $30,000 – $40,000 | $40,000 – $60,000 | Assumes modest growth driven primarily by halving-induced scarcity, but tempered by macroeconomic uncertainty and potential regulatory headwinds. Similar to the price action following the 2016 halving. |

| Moderate | $40,000 – $60,000 | $80,000 – $120,000 | Projects a more substantial price increase, reflecting a combination of halving effects and increased institutional adoption. This aligns with the more significant price surge seen after the 2012 halving, though not necessarily at the same rate of increase. |

| Bullish | $60,000 – $80,000 | $150,000 – $250,000 or more | Anticipates a significant price rally fueled by widespread adoption, positive regulatory developments, and strong macroeconomic tailwinds. This scenario is less likely but not impossible, mirroring some aspects of the 2017 bull run, albeit within a different overall market context. |

Historical Analysis of Bitcoin Halving Impacts

Analyzing the previous Bitcoin halvings reveals a general trend of price appreciation following each event. However, the timing and magnitude of these price increases varied significantly. The 2012 halving was followed by a substantial price surge, while the 2016 halving led to a more gradual increase. The 2020 halving saw a significant price increase, but it was followed by a period of consolidation before the 2021 bull run. These variations highlight the influence of external factors beyond the halving itself. The delay between the halving and the price surge is also notable, suggesting that market sentiment and other economic events play a crucial role.

Key Factors Influencing Bitcoin’s Price Post-2025 Halving

Several factors beyond the halving mechanism itself will significantly influence Bitcoin’s price in the aftermath of the 2025 event. These include:

* Regulatory Changes: Government regulations worldwide can substantially impact Bitcoin’s price and adoption rate. Clearer regulatory frameworks could boost confidence and investment, while restrictive policies could dampen enthusiasm.

* Adoption Rates: Increased institutional and individual adoption will likely drive price appreciation. Widespread adoption by major financial institutions, alongside continued growth in retail investment, is a crucial driver of price increases.

* Macroeconomic Conditions: Global economic conditions, such as inflation, interest rates, and geopolitical events, can significantly influence Bitcoin’s price. Periods of economic uncertainty often lead investors to seek alternative assets like Bitcoin, while periods of economic stability may lead to decreased demand.

* Technological Developments: Advancements in Bitcoin’s underlying technology, such as the Lightning Network’s scalability improvements, can positively impact its adoption and, consequently, its price. Improvements in transaction speed and lower fees can make Bitcoin more attractive for everyday use.

* Competition from Alternative Cryptocurrencies: The emergence of new cryptocurrencies and blockchain technologies could divert investment away from Bitcoin, potentially impacting its price.

The Impact of Halving on Bitcoin Mining: Bitcoin Halving History 2025

The Bitcoin halving, a programmed event that reduces the reward for mining new blocks by half, significantly impacts the profitability and operational dynamics of the Bitcoin mining industry. This event, occurring approximately every four years, creates a period of adjustment and reshaping within the ecosystem. The reduced block reward necessitates miners to adapt their strategies to maintain profitability and contribute to the network’s security.

The halving directly affects miners’ profitability by reducing their revenue stream. Before the halving, miners receive a certain number of bitcoins for successfully adding a block to the blockchain. After the halving, this reward is cut in half. To maintain profitability, miners must either increase their efficiency (lowering operational costs) or experience a rise in Bitcoin’s price. If neither of these occurs, some miners may become unprofitable and choose to shut down their operations. This process can lead to a period of consolidation within the mining industry.

Miner Profitability and the 2025 Halving

The 2025 halving will undoubtedly present challenges to miners. The profitability of mining is directly tied to the price of Bitcoin, the cost of electricity, and the efficiency of mining hardware. If the Bitcoin price remains relatively stable or experiences only modest growth, less efficient miners – those with higher operating costs – will likely be forced to exit the market. This is because their revenue from mining will no longer cover their expenses. This dynamic is analogous to the 2020 halving, where many smaller miners were unable to compete and consolidated, leading to an increase in the dominance of larger mining pools. Conversely, a significant price surge following the halving could offset the reduced block reward, potentially making mining profitable even for less efficient operations.

Impact on Hashrate and Network Security

The halving’s effect on the hashrate – the total computational power dedicated to securing the Bitcoin network – is complex. While a reduction in the number of miners could initially lead to a decrease in the hashrate, this effect is often temporary. The increased profitability of more efficient miners can incentivize them to expand their operations, potentially offsetting the decline. Furthermore, advancements in mining hardware technology can also contribute to a continued increase in the hashrate, even after the halving. A decline in hashrate, however, poses a risk to the network’s security, making it potentially more vulnerable to attacks. The network’s resilience against 51% attacks relies heavily on a robust hashrate. Historically, the hashrate has shown remarkable resilience to halving events, generally recovering and even growing over time.

Predictions for the Future of Bitcoin Mining Post-2025 Halving

Predicting the future of Bitcoin mining is inherently challenging, involving numerous interdependent variables. Energy costs are a critical factor. Regions with cheaper electricity will naturally attract more mining operations, influencing the geographical distribution of mining activity. Technological advancements in mining hardware, such as the development of more energy-efficient ASICs (Application-Specific Integrated Circuits), will play a crucial role in shaping the industry’s landscape. Miners constantly seek to improve their efficiency to remain competitive. The success of these efforts, coupled with the price of Bitcoin, will determine the long-term viability and profitability of Bitcoin mining after the 2025 halving. We might see a further concentration of mining power in the hands of larger, more efficient operators, similar to past halving cycles. A sustained rise in the price of Bitcoin would alleviate many of these concerns, however, allowing smaller miners to remain competitive.

Bitcoin Halving and Market Psychology

The Bitcoin halving, a programmed reduction in the rate of new Bitcoin creation, significantly impacts investor and trader psychology, often leading to considerable market volatility. This impact stems from the interplay of anticipation, speculation, and the inherent scarcity of Bitcoin. The halving event is widely publicized, creating a self-fulfilling prophecy where expectations themselves influence the market.

The anticipation and speculation surrounding the halving often drive price volatility. Investors and traders tend to adjust their positions based on their predictions of post-halving price movements. This leads to periods of intense buying and selling activity, creating price swings that can be substantial. The belief that the reduced supply will lead to increased scarcity and thus higher prices fuels this speculative behavior. The closer the halving date approaches, the more pronounced this volatility tends to become.

Market Reactions to Previous Halvings

The 2012, 2016, and 2020 halvings offer valuable insights into market reactions. While each halving occurred within a different macroeconomic and market context, some common patterns emerge. All three halvings were preceded by periods of price increase, fueled by anticipation. However, the post-halving price movements varied significantly. Following the 2012 halving, Bitcoin’s price experienced a relatively modest increase. The 2016 halving was followed by a significant bull run, while the 2020 halving saw a more complex price trajectory, with a period of significant price appreciation followed by a correction.

These differences highlight the complex interplay between the halving’s impact on supply and other market forces, including regulatory changes, technological advancements, and overall investor sentiment. For example, the 2016 halving coincided with growing institutional interest in Bitcoin, contributing to the subsequent bull market. Conversely, the 2020 halving occurred during a period of heightened global uncertainty due to the COVID-19 pandemic, adding another layer of complexity to market dynamics. Analyzing these past events helps to understand the potential range of outcomes for the 2025 halving, although predicting the exact market response remains challenging.

Alternative Cryptocurrencies and the Halving Effect

While Bitcoin’s halving events have garnered significant attention, many other cryptocurrencies employ similar reward reduction mechanisms. Understanding how these events impact different projects provides valuable insights into the broader cryptocurrency ecosystem and the unique characteristics of each blockchain. This section explores the similarities and differences in halving events across various cryptocurrencies, focusing on the resulting market reactions.

The halving mechanism, while conceptually similar across different cryptocurrencies, often manifests with varying degrees of impact. This is largely due to differences in factors such as the total supply of coins, the size and engagement of the community, the underlying technology, and the overall market capitalization. Consequently, a direct comparison between Bitcoin’s halvings and those of other cryptocurrencies requires a nuanced approach, considering these contextual factors.

Comparison of Halving Events Across Cryptocurrencies

Several prominent cryptocurrencies, including Litecoin, Dogecoin, and DASH, have implemented halving mechanisms. Litecoin, often referred to as “Bitcoin’s little brother,” shares a similar proof-of-work consensus mechanism and has experienced halvings that, while not as impactful as Bitcoin’s, still demonstrated noticeable effects on its price and mining dynamics. Dogecoin’s halving, on the other hand, showed a less pronounced impact, possibly due to its meme-driven nature and less robust underlying technology compared to Bitcoin or Litecoin. DASH, with its focus on privacy and speed, experienced a halving event with a relatively muted market response, highlighting the diverse factors at play. These examples showcase the varying degrees of impact that halving events can have depending on the specific cryptocurrency and its broader context.

Market Reaction Differences Based on Cryptocurrency Attributes, Bitcoin Halving History 2025

The market response to halving events is significantly influenced by several factors inherent to each cryptocurrency. The size and activity of the community are crucial; a larger, more engaged community tends to exhibit stronger price reactions to major events like halvings. Market capitalization plays a significant role as well; smaller cryptocurrencies with lower market caps might experience more volatile price swings in response to a halving compared to established projects with larger market caps. The overall market sentiment and the broader macroeconomic conditions also influence the reaction. For example, a halving event during a period of general market downturn might produce a less pronounced effect than one occurring during a bull market. Finally, the technological characteristics of the cryptocurrency and its unique features (like privacy, scalability, or smart contract functionality) also impact the response. For instance, a cryptocurrency known for its innovative features might experience a more positive market reaction than one with less unique characteristics.

Bitcoin Halving History 2025 – Bitcoin’s halving history shows a consistent pattern of reduced block rewards, impacting supply and potentially influencing price. Understanding past halvings is key to anticipating future market behavior, and to explore potential outcomes, it’s helpful to consider what might happen after the next reduction. For insightful analysis on this, check out this article: What Will Happen After Bitcoin Halving In 2025.

Analyzing this data will allow for a better understanding of the Bitcoin Halving History 2025 and beyond.

Bitcoin’s halving history shows a consistent pattern of reduced block rewards, impacting supply and potentially influencing price. Understanding past halvings is key to anticipating future market behavior, and to explore potential outcomes, it’s helpful to consider what might happen after the next reduction. For insightful analysis on this, check out this article: What Will Happen After Bitcoin Halving In 2025.

Analyzing this data will allow for a better understanding of the Bitcoin Halving History 2025 and beyond.