Bitcoin Halving History: Bitcoin Halving History Chart 2025

Bitcoin halvings are a programmed, integral part of Bitcoin’s design, significantly impacting its inflation rate and overall scarcity. This process, occurring approximately every four years, reduces the block reward miners receive for verifying transactions and adding new blocks to the blockchain. Understanding the history of these halvings provides valuable insight into Bitcoin’s evolution and its future trajectory.

Bitcoin Halving History: A Timeline

The Bitcoin halving mechanism is defined within the Bitcoin protocol itself. It dictates that the reward paid to miners for successfully adding a block of transactions to the blockchain is halved at regular intervals. This interval is determined by the number of blocks mined, approximately every 210,000 blocks. This translates to roughly a four-year period, although slight variations can occur due to fluctuations in the time it takes to mine a block.

| Year | Approximate Block Height | Reward Change (BTC) | Significant Market Events |

|---|---|---|---|

| 2012 | 210,000 | 50 BTC to 25 BTC | Bitcoin price remained relatively low, consolidating around $10-$13. The halving itself had a relatively muted market impact at the time. |

| 2016 | 420,000 | 25 BTC to 12.5 BTC | Following the halving, Bitcoin’s price experienced a significant surge, rising from around $650 to over $20,000 in late 2017. This period was marked by intense speculation and increased mainstream media attention. |

| 2020 | 630,000 | 12.5 BTC to 6.25 BTC | The price of Bitcoin saw a gradual increase in the months following the halving, eventually reaching an all-time high in late 2021. The COVID-19 pandemic and increased institutional investment also influenced market dynamics. |

The Halving Mechanism and Bitcoin’s Scarcity, Bitcoin Halving History Chart 2025

The halving mechanism is governed by a simple, yet powerful, mathematical formula embedded in the Bitcoin code. The reward is halved every 210,000 blocks. This predictable reduction in new Bitcoin entering circulation is a core element of Bitcoin’s deflationary nature and contributes to its perceived scarcity.

The halving formula ensures a predictable reduction in Bitcoin’s inflation rate over time. The total supply of Bitcoin is capped at 21 million coins.

This fixed supply, coupled with the halving events, creates a scenario where the demand for Bitcoin may outpace the supply, potentially driving up its price. The long-term implications are significant, suggesting that Bitcoin’s scarcity will increase over time, potentially making it a more valuable asset in the future. Historical data suggests a correlation between halving events and subsequent price increases, although this is not a guaranteed outcome and various market forces influence the price.

Price Action Before and After Halvings

Bitcoin’s halving events, occurring approximately every four years, significantly reduce the rate at which new Bitcoin are mined. This reduction in supply has historically been associated with notable price movements, although the precise nature and timing of these movements are complex and not perfectly predictable. Analyzing past halvings provides valuable insights into potential price action surrounding future events, though it’s crucial to remember that past performance is not indicative of future results.

The periods leading up to and following previous halvings exhibit distinct price patterns. In the lead-up, anticipation of the reduced supply often fuels bullish sentiment, resulting in price increases. However, the magnitude and duration of these increases vary considerably. Following the halving, price movements are equally diverse, sometimes experiencing further growth, consolidation, or even temporary declines before resuming an upward trend. Several factors beyond the halving itself, including macroeconomic conditions, regulatory changes, and market sentiment, significantly influence Bitcoin’s price.

Price Action Around Each Halving

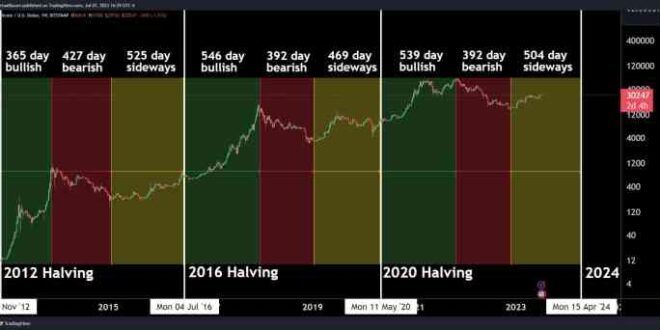

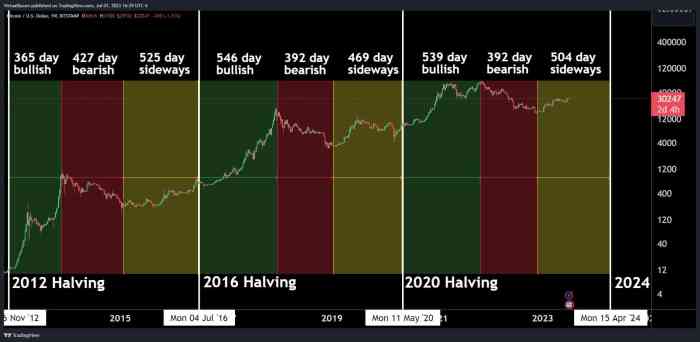

A chart visualizing the price action around each Bitcoin halving would show three distinct phases: pre-halving, during-halving, and post-halving. The pre-halving phase typically exhibits a gradual or sometimes sharp increase in price as anticipation builds. The halving event itself is usually marked by a period of relatively low volatility, although the price may move slightly up or down depending on the overall market sentiment. The post-halving phase is characterized by higher volatility, with prices potentially experiencing significant gains or corrections before eventually settling into a new trend. For example, the halving in 2012 saw a relatively modest price increase leading up to the event, followed by a period of significant growth over the subsequent year. The 2016 halving saw a more dramatic price increase in the lead-up, followed by a period of consolidation before the price eventually surged. The 2020 halving showed a similar pattern, with a significant price increase leading up to the event, followed by a period of both significant growth and substantial corrections before establishing a higher price floor. Such a chart would need to clearly illustrate these different phases and the varying degrees of volatility experienced in each. A visual representation would ideally include clearly labeled axes (date and price), distinct markers for each halving event, and potentially shaded regions to highlight periods of increased or decreased volatility. The captions would provide specific price ranges and percentage changes for each phase, allowing for a direct comparison across different halving events. This visual analysis would aid in understanding the diverse nature of price reactions and highlight the inherent unpredictability of market behavior.

Analyzing a Bitcoin Halving History Chart 2025 provides valuable insights into potential future price movements. Understanding past halving events is crucial for informed predictions, and to help with this, you can refer to a detailed analysis of the expected price impact at Halving Bitcoin 2025 Precio. Ultimately, this resource contributes to a more comprehensive understanding when interpreting the Bitcoin Halving History Chart 2025.

Understanding the Bitcoin Halving History Chart 2025 requires knowing the precise timing of each halving event. To accurately predict the 2025 halving and its impact, you’ll want to consult resources detailing the historical data, such as determining when exactly the next halving will occur. For a definitive answer on this crucial date, check out this resource: When Bitcoin Halving 2025.

This information is key to interpreting the Bitcoin Halving History Chart 2025 and making informed predictions.

Understanding the Bitcoin Halving History Chart 2025 requires knowing the precise timing of each halving event. To accurately predict the 2025 halving and its impact, you’ll want to consult resources detailing the historical data, such as determining when exactly the next halving will occur. For a definitive answer on this crucial date, check out this resource: When Bitcoin Halving 2025.

This information is key to interpreting the Bitcoin Halving History Chart 2025 and making informed predictions.

Understanding the Bitcoin Halving History Chart 2025 requires knowing the precise timing of each halving event. To accurately predict the 2025 halving and its impact, you’ll want to consult resources detailing the historical data, such as determining when exactly the next halving will occur. For a definitive answer on this crucial date, check out this resource: When Bitcoin Halving 2025.

This information is key to interpreting the Bitcoin Halving History Chart 2025 and making informed predictions.

Understanding the Bitcoin Halving History Chart 2025 requires knowing the precise timing of each halving event. To accurately predict the 2025 halving and its impact, you’ll want to consult resources detailing the historical data, such as determining when exactly the next halving will occur. For a definitive answer on this crucial date, check out this resource: When Bitcoin Halving 2025.

This information is key to interpreting the Bitcoin Halving History Chart 2025 and making informed predictions.

Understanding the Bitcoin Halving History Chart 2025 requires knowing the precise timing of each halving event. To accurately predict the 2025 halving and its impact, you’ll want to consult resources detailing the historical data, such as determining when exactly the next halving will occur. For a definitive answer on this crucial date, check out this resource: When Bitcoin Halving 2025.

This information is key to interpreting the Bitcoin Halving History Chart 2025 and making informed predictions.