Long-Term Implications of the 2025 Halving

The 2025 Bitcoin halving, reducing the block reward for miners by half, is a significant event with potentially profound long-term consequences for Bitcoin’s value, adoption, and the broader cryptocurrency market. Understanding these implications requires considering the interplay of supply, demand, and market sentiment.

Bitcoin’s Scarcity and Value Proposition

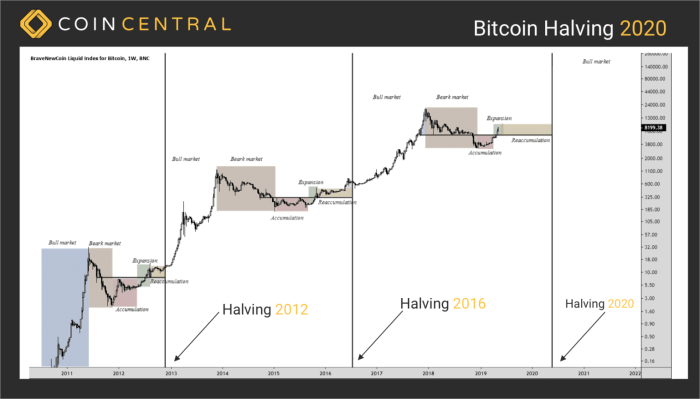

The halving directly impacts Bitcoin’s scarcity. By reducing the rate of new Bitcoin entering circulation, the halving reinforces Bitcoin’s deflationary nature. This inherent scarcity, coupled with increasing demand, is often cited as a key driver of Bitcoin’s price appreciation. Historically, halvings have preceded periods of significant price increases, although this is not guaranteed. The long-term effect hinges on whether demand continues to outpace the reduced supply, maintaining or increasing upward price pressure. Similar to precious metals like gold, where limited supply contributes to value, Bitcoin’s scarcity is a central pillar of its value proposition.

Impact on Bitcoin Adoption

The 2025 halving’s impact on Bitcoin’s adoption as a store of value and medium of exchange is complex. Increased price volatility following a halving could hinder adoption as a medium of exchange due to uncertainty. However, if the halving leads to a sustained price increase, it could strengthen Bitcoin’s position as a store of value, attracting institutional and individual investors seeking inflation hedges. The long-term adoption trajectory depends on factors beyond the halving itself, including regulatory clarity, technological advancements, and overall market confidence. Consider the example of gold, which has maintained its position as a store of value for centuries despite periods of price fluctuation. Bitcoin’s adoption path might mirror this, with its store-of-value function potentially dominating its use as a daily transactional currency.

Implications for the Broader Cryptocurrency Market

The 2025 Bitcoin halving will likely influence the broader cryptocurrency market. Bitcoin’s price movements often affect altcoins, creating a ripple effect across the entire ecosystem. A significant Bitcoin price surge could trigger a “bull run” for other cryptocurrencies, attracting new investment and boosting overall market capitalization. Conversely, a period of stagnation or decline in Bitcoin’s price post-halving could negatively impact the entire market. The interconnectedness of the crypto market means that Bitcoin’s dominance and performance play a significant role in shaping the fortunes of other cryptocurrencies.

Hypothetical Scenario: Long-Term Consequences

Let’s imagine a scenario where the 2025 halving leads to a sustained increase in Bitcoin’s price, reaching $150,000 within three years. This could trigger significant institutional investment, driving further price appreciation and cementing Bitcoin’s role as a prominent store of value. Increased demand could lead to network congestion, necessitating scalability solutions. The broader cryptocurrency market would likely experience a bull run, with many altcoins experiencing substantial price increases. However, this scenario also carries risks. Such a dramatic price surge could attract increased regulatory scrutiny and potential market manipulation, potentially leading to corrections. Conversely, a failure to meet anticipated price targets could lead to a prolonged bear market, impacting investor confidence and potentially delaying widespread adoption. This hypothetical scenario highlights the potential, yet uncertain, nature of the long-term consequences of the halving.

Frequently Asked Questions (FAQs): Bitcoin Halving In 2025

This section addresses common queries regarding the upcoming Bitcoin halving in 2025, providing clarity on its mechanics, potential impact, and associated risks and opportunities. Understanding these aspects is crucial for anyone interested in navigating the cryptocurrency market in the coming years.

Bitcoin Halving Explained

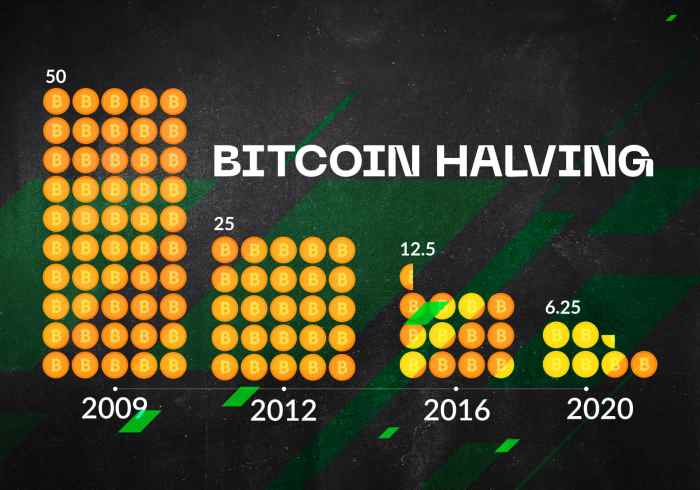

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by half. This occurs approximately every four years, or every 210,000 blocks mined. The halving mechanism is designed to control Bitcoin’s inflation and maintain its scarcity over time. Essentially, it slows down the influx of new Bitcoin into circulation.

Expected Date of the Next Bitcoin Halving

The next Bitcoin halving is expected to occur in the first half of 2025. The precise date will depend on the rate of block creation, which can fluctuate slightly. While pinpointing the exact day is impossible until it happens, analysts generally anticipate it to fall sometime between April and July 2025.

Impact of a Bitcoin Halving on Price

Historically, Bitcoin halvings have been followed by periods of significant price appreciation. The reduced supply of newly mined Bitcoin, coupled with continued (or increased) demand, often leads to upward pressure on the price. This pattern was observed after the 2012 and 2016 halvings. However, it’s crucial to remember that other factors also influence Bitcoin’s price, such as regulatory changes, macroeconomic conditions, and market sentiment. Therefore, while a price increase is a common historical trend, it is not guaranteed. For example, the 2020 halving was followed by a period of price appreciation, but this was also influenced by broader adoption and institutional investment.

Risks and Opportunities Associated with the 2025 Halving, Bitcoin Halving In 2025

The 2025 halving presents both risks and opportunities for investors. A potential opportunity lies in the possibility of significant price appreciation following the event, as seen in previous cycles. However, the cryptocurrency market is inherently volatile, and a price increase is not guaranteed. Risks include the possibility of a price correction after the initial post-halving rally, or a prolonged period of sideways price movement. Furthermore, the overall macroeconomic climate and regulatory landscape could significantly impact Bitcoin’s price regardless of the halving. Investors should carefully assess their risk tolerance and diversify their portfolios accordingly. Past performance is not indicative of future results.

Illustrative Table: Comparing Halving Events

Analyzing previous Bitcoin halving events provides valuable insights into potential market reactions and long-term trends. While past performance is not indicative of future results, examining these historical data points offers a framework for understanding the impact of halving on key metrics. The following table summarizes the significant changes observed around each halving. Note that precise figures vary slightly depending on the data source and the exact timing of measurement.

Bitcoin Halving Events Comparison

| Date | Block Reward (BTC) Before/After | Price (USD) Before/After (Approximate) | Market Cap (USD) Before/After (Approximate) |

|---|---|---|---|

| November 28, 2012 | 50 BTC / 25 BTC | $13.40 / ~$13.00 (within a year) | ~$1.5 Billion / ~$1.2 Billion (within a year) |

| July 9, 2016 | 25 BTC / 12.5 BTC | ~$650 / ~$750-800 (within a year) | ~$6.5 Billion / ~$7-8 Billion (within a year) |

| May 11, 2020 | 12.5 BTC / 6.25 BTC | ~$8,700 / ~$19,000+ (within a year) | ~$150 Billion / ~$350 Billion+ (within a year) |

Visual Representation

This section details the design of a chart visualizing Bitcoin’s diminishing supply over time, emphasizing the impact of each halving event. The chart will clearly illustrate the relationship between Bitcoin’s supply and the halving schedule, providing a visual representation of this key aspect of Bitcoin’s monetary policy. The design prioritizes clarity and ease of understanding, enabling viewers to quickly grasp the long-term implications of the halving events.

The chart will be a line graph, displaying the cumulative supply of Bitcoin on the vertical (Y) axis and time (in years) on the horizontal (X) axis. The Y-axis will range from zero to 21 million (the maximum number of Bitcoins), marked with increments of 1 million. The X-axis will cover a period from Bitcoin’s inception (2009) to at least 2140, encompassing several halving events. Each halving event will be clearly marked on the graph, potentially using a vertical dashed line to visually separate the periods before and after each event.

Bitcoin Supply Over Time Chart Details

The line graph will show a steadily increasing Bitcoin supply, with distinct changes in the slope of the line at each halving event. Before each halving, the rate of Bitcoin creation (block reward) will be depicted by a steeper slope, indicating faster supply growth. After each halving, the slope will become less steep, reflecting the reduced block reward and slower growth in Bitcoin’s circulating supply. Data points representing the total supply of Bitcoin at the end of each year will be plotted on the line. These data points will be clearly labeled with the corresponding year and the total Bitcoin supply at that point. The chart’s title will be “Bitcoin Supply Over Time (2009-2140),” and a legend will clearly indicate the halving events with their respective years. The colors used will be visually distinct and easy to interpret. For example, the line representing Bitcoin supply could be a bold blue, while the vertical dashed lines marking halving events could be a lighter gray. This color scheme will ensure optimal visual clarity and contrast. The font used throughout the chart will be clean, easily readable, and consistent with a professional style. Annotations could be added to highlight significant milestones, such as the estimated year when the majority of Bitcoins are mined.