Bitcoin Halving: Bitcoin Halving Is Expected To Occur In April 2025.

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, and it’s a significant event for the cryptocurrency’s long-term price trajectory and overall network dynamics. The upcoming halving, expected in April 2025, is generating considerable anticipation within the crypto community.

Bitcoin Halving Mechanism and Historical Impact

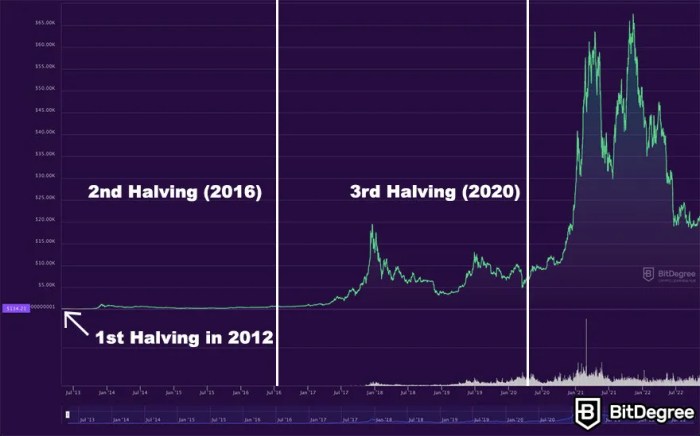

The Bitcoin halving mechanism is embedded within the Bitcoin code. It dictates that the reward miners receive for validating transactions and adding new blocks to the blockchain is cut in half at regular intervals. This reduction in the rate of new Bitcoin creation is designed to control inflation and maintain the scarcity of the cryptocurrency. Historically, previous halvings have been followed by periods of significant price appreciation, although the timing and magnitude of these price increases have varied. The 2012 halving was followed by a gradual price increase, while the 2016 halving preceded a substantial bull market. The 2020 halving also led to a significant price surge, although it was followed by a period of correction before a subsequent price increase. These historical trends suggest a potential link between halving events and price appreciation, although it’s crucial to remember that many other factors influence Bitcoin’s price.

Expected Supply Reduction in April 2025 and Potential Consequences

The April 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC. This represents a 50% decrease in the rate of new Bitcoin creation. This reduced supply, coupled with potentially sustained or increased demand, could lead to upward pressure on the price. However, predicting the exact impact is challenging, as various macroeconomic factors and market sentiment also play crucial roles. The consequences could range from a relatively modest price increase to a significant bull market, similar to those observed after previous halvings. The level of anticipation and the resulting speculative trading activity in the lead-up to the event will also influence the post-halving price movements.

Comparison with Previous Halvings

While all halvings share the common feature of reducing the block reward by half, there are notable differences between them. The market conditions surrounding each halving have varied significantly. For example, the 2012 halving occurred during the early stages of Bitcoin’s development, with a much smaller market capitalization and lower overall adoption compared to subsequent halvings. The 2016 and 2020 halvings occurred in a more mature market with increased institutional interest and global awareness of Bitcoin. The upcoming 2025 halving will likely occur in a market shaped by factors such as regulatory uncertainty, macroeconomic conditions, and the broader crypto market landscape, all of which can influence the price response.

Hypothetical Market Reaction Scenario

Let’s consider a hypothetical scenario: Suppose that leading up to the April 2025 halving, there is a period of relatively stable price action, followed by a surge in buying pressure as the halving approaches. This could be driven by anticipation of reduced supply and increased scarcity. Immediately following the halving, the price could experience a sharp increase, possibly fueled by further buying pressure from investors who anticipate future price appreciation. However, this could be followed by a period of consolidation or even a minor correction as some investors take profits. Over the longer term, if adoption continues to grow and macroeconomic conditions remain favorable, the price could continue to rise, potentially leading to a significant bull market similar to those observed after previous halvings, though this is not guaranteed. This scenario, while hypothetical, illustrates the potential for both short-term volatility and long-term price appreciation following the halving. However, other scenarios are equally plausible, highlighting the inherent uncertainty in predicting the precise market response.

Predicting Bitcoin’s Price After the 2025 Halving

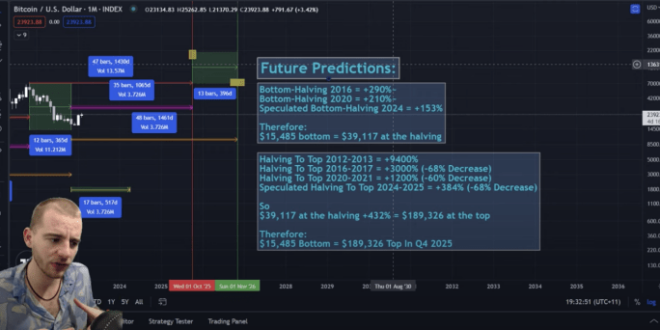

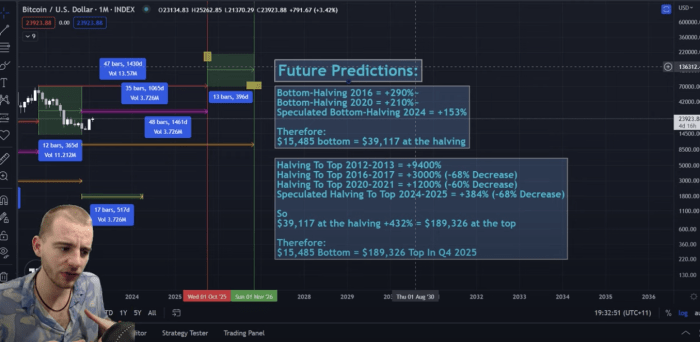

Predicting the price of Bitcoin after any event, let alone the highly anticipated 2025 halving, is inherently speculative. Numerous factors beyond the halving itself will significantly influence the cryptocurrency’s price trajectory. However, by examining historical trends, applying various analytical models, and considering external influences, we can explore a range of plausible price scenarios.

Price Prediction Models and Analyses

Several models attempt to forecast Bitcoin’s price post-halving. Stock-to-flow (S2F) models, popularized by PlanB, historically correlated Bitcoin’s price with its scarcity, suggesting a strong upward trend after halvings. However, the accuracy of this model has been debated, particularly after Bitcoin’s price deviated from its S2F predictions in the past. Other models incorporate on-chain metrics, such as transaction volume and network activity, to predict future price movements. These models often yield diverse results, highlighting the complexity of accurately forecasting Bitcoin’s price. For example, some analysts, using a combination of on-chain data and macroeconomic indicators, predict a price range of $150,000 to $250,000 by the end of 2025, while others remain more conservative, suggesting a range between $100,000 and $180,000. These predictions should be treated with caution, as they are based on assumptions that may or may not hold true.

Arguments for Bullish Price Movements

The halving event itself is a significant bullish catalyst. By reducing the rate of new Bitcoin creation, the halving inherently decreases the supply, potentially increasing scarcity and driving up demand, especially if adoption continues to grow. Historically, Bitcoin’s price has shown a positive correlation with the halving events, although the timing and magnitude of price increases have varied. Furthermore, increasing institutional adoption and the ongoing development of Bitcoin’s underlying technology could contribute to a sustained bullish trend. A positive regulatory environment in major markets could also significantly boost investor confidence and drive price appreciation.

Arguments for Bearish Price Movements

Conversely, several factors could lead to bearish price movements. A global economic downturn or a major regulatory crackdown on cryptocurrencies could negatively impact investor sentiment and trigger a sell-off. Increased competition from alternative cryptocurrencies or technological advancements that render Bitcoin less efficient could also dampen its price. Moreover, the historical correlation between halvings and price increases isn’t guaranteed to repeat; the market’s reaction to future halvings could be different from past responses. The current macroeconomic climate, characterized by high inflation and rising interest rates, might also exert downward pressure on Bitcoin’s price, irrespective of the halving.

Factors Beyond the Halving Influencing Bitcoin’s Price

The price of Bitcoin is not solely determined by the halving. Numerous other factors play a crucial role.

| Factor | Positive Impact | Negative Impact |

|---|---|---|

| Regulatory Changes | Favorable regulations in major jurisdictions could increase institutional investment and mainstream adoption, boosting price. | Stringent regulations or outright bans could significantly reduce demand and depress price. |

| Adoption Rates | Wider adoption by businesses, institutions, and individuals increases demand, driving up price. | Slow adoption or decreased interest could lead to price stagnation or decline. |

| Technological Advancements | Improvements in scalability, security, and transaction speed enhance Bitcoin’s utility and attract more users, potentially increasing price. | The emergence of superior competing technologies could diminish Bitcoin’s dominance and lower its price. |

| Macroeconomic Conditions | A stable or growing global economy often correlates with increased risk appetite, potentially benefiting Bitcoin’s price. | Economic downturns, inflation, and rising interest rates can lead to investors seeking safer assets, potentially causing a price drop. |

The Impact of the Halving on Bitcoin Mining

The Bitcoin halving, a programmed event that reduces the block reward paid to miners, significantly impacts the profitability and dynamics of the Bitcoin mining industry. This reduction, occurring approximately every four years, forces miners to adapt their operations to remain profitable in a landscape of shrinking rewards. The 2025 halving will be no different, presenting both challenges and opportunities for those involved in securing the Bitcoin network.

The halving directly affects miners’ profitability by reducing their income stream. Before the halving, miners receive a certain number of Bitcoins for successfully validating transactions and adding them to the blockchain. After the halving, this reward is cut in half. This immediately reduces the revenue generated per block mined, impacting the overall profitability of mining operations. The magnitude of this impact varies depending on factors like the price of Bitcoin, electricity costs, and the efficiency of mining hardware.

Miner Adjustments to Reduced Rewards

Miners will need to implement several strategies to offset the decreased profitability resulting from the halving. One crucial adjustment involves optimizing energy consumption. This might involve upgrading to more energy-efficient mining hardware, implementing better cooling systems, or relocating operations to regions with cheaper electricity. Furthermore, miners may need to improve their mining efficiency by investing in more powerful and technologically advanced ASICs (Application-Specific Integrated Circuits), which are specialized hardware designed for Bitcoin mining. Some might even consolidate operations, merging smaller mining pools to achieve economies of scale and reduce overhead costs.

Changes in Mining Landscape

The halving often leads to a reshuffling of the mining landscape. Less efficient and less profitable mining operations may be forced to shut down, leading to a consolidation of the industry. This could result in a smaller number of larger mining pools dominating the network’s hash rate. Conversely, the halving can also create opportunities for more efficient and technologically advanced miners to expand their market share. For example, miners who have invested in cutting-edge hardware and have access to cheap electricity may find themselves in a more advantageous position than others. The pre-halving landscape might see a multitude of smaller, less efficient miners competing for block rewards. Post-halving, this could shift towards fewer, larger, and more efficient operations, potentially leading to greater centralization, though the decentralized nature of Bitcoin remains a mitigating factor.

Visual Representation of Mining Profitability and Hash Rate Changes, Bitcoin Halving Is Expected To Occur In April 2025.

Imagine a graph with time on the x-axis and profitability (in USD per terahash per second) on the y-axis. Before the halving, the line representing profitability would be relatively high. At the moment of the halving, there would be a sharp drop in the line, reflecting the immediate reduction in block rewards. Over time, the line might gradually increase again, as miners adapt and the price of Bitcoin potentially rises. A separate graph, with the same x-axis but with hash rate (in TH/s) on the y-axis, would initially show a possible slight dip reflecting the exit of less efficient miners. However, assuming Bitcoin’s price remains stable or increases, the hash rate would likely recover and potentially increase over time as miners upgrade their equipment and new miners enter the market, driven by the potential for future price appreciation. The recovery rate would depend on various factors, including the price of Bitcoin, the cost of electricity, and the development of new, more efficient mining hardware.

Bitcoin Halving and Investor Sentiment

The anticipation of a Bitcoin halving significantly impacts investor behavior and market volatility. The halving, which reduces the rate of new Bitcoin creation, is often viewed as a deflationary event, potentially influencing supply and demand dynamics and consequently, price. This anticipation creates a period of heightened market activity, characterized by both bullish and bearish sentiment depending on individual investor perspectives and market conditions.

Investor behavior leading up to and following a halving is multifaceted. Many investors adopt a “buy the dip” strategy, anticipating price appreciation after the halving. Others employ a more cautious approach, waiting to see the immediate market reaction before making significant investments. Some might even choose to sell before the halving to lock in profits, while others might hedge their positions using derivatives or other risk management tools.

Investor Strategies Surrounding Bitcoin Halvings

The strategies employed by investors vary widely depending on their risk tolerance, investment horizon, and market outlook. Some investors, believing in Bitcoin’s long-term value proposition, will continue to accumulate Bitcoin regardless of short-term price fluctuations. This “HODL” (Hold On for Dear Life) strategy is a common approach among long-term Bitcoin believers. Conversely, short-term traders may focus on exploiting price volatility around the halving event, attempting to profit from both price increases and decreases through active trading. Others might diversify their portfolios to reduce risk, allocating capital to assets considered less correlated to Bitcoin’s price movements. Sophisticated investors may employ more complex strategies involving options trading or arbitrage opportunities arising from the price discrepancies across different exchanges.

Comparison of Sentiment Across Halvings

The sentiment surrounding each Bitcoin halving has varied, influenced by broader macroeconomic factors and the state of the cryptocurrency market at the time. The first halving in 2012 occurred during Bitcoin’s early stages, with relatively low market capitalization and limited mainstream awareness. The subsequent halvings in 2016 and 2020 saw significantly increased participation from institutional investors and a greater understanding of Bitcoin’s role in the financial landscape. The 2020 halving, for instance, coincided with a period of increased global uncertainty due to the COVID-19 pandemic, potentially influencing investor sentiment and market dynamics. While past halvings have generally been followed by periods of price appreciation, the extent and duration of these price increases have varied significantly. Therefore, extrapolating past performance to predict future outcomes is not guaranteed to be accurate.

Investor Sentiment and Price Movements: Historical Examples

Investor sentiment plays a crucial role in shaping Bitcoin’s price movements. For instance, the period leading up to the 2020 halving saw a gradual increase in Bitcoin’s price, fueled by growing anticipation and positive sentiment. Following the halving, the price experienced a significant surge, although this was also influenced by other factors such as increased institutional adoption and macroeconomic conditions. Conversely, the period following the 2016 halving saw a more gradual price increase, suggesting that the impact of the halving is not always immediate or uniform. The 2012 halving, occurring in a less mature market, saw less pronounced immediate price changes, but contributed to the overall upward trend of Bitcoin’s price in the years that followed. These examples highlight the complex interplay between the halving event, investor sentiment, and broader market forces in determining Bitcoin’s price.

Long-Term Implications of the 2025 Bitcoin Halving

The 2025 Bitcoin halving, reducing the rate of new Bitcoin creation by half, is a significant event with potentially profound long-term consequences for Bitcoin’s role in the global financial landscape and the broader cryptocurrency ecosystem. Understanding these implications requires considering its effects on Bitcoin’s scarcity, market dynamics, and overall adoption.

The halving’s primary long-term effect will stem from its impact on Bitcoin’s scarcity. By reducing the supply of newly mined Bitcoin, the halving is expected to increase its relative scarcity over time, potentially driving up its price, assuming demand remains consistent or increases. This increased scarcity could solidify Bitcoin’s position as a store of value, akin to gold, attracting investors seeking inflation hedges and alternative assets. However, the actual impact will depend on various factors, including macroeconomic conditions, regulatory changes, and the overall sentiment within the cryptocurrency market.

Bitcoin’s Position in the Cryptocurrency Market

The 2025 halving could significantly reshape Bitcoin’s dominance within the cryptocurrency market. Historically, halvings have been followed by periods of increased price volatility and subsequent price appreciation. This could further cement Bitcoin’s position as the leading cryptocurrency, attracting more investment and driving further adoption. Conversely, a prolonged bear market following the halving, or a surge in the popularity of alternative cryptocurrencies, could potentially diminish Bitcoin’s market share. The outcome will largely depend on how the market reacts to the reduced supply and the overall trajectory of the global economy. For example, if the halving coincides with a period of global economic uncertainty, Bitcoin’s safe-haven properties might be emphasized, leading to increased demand.

Impact on the Broader Cryptocurrency Market

The Bitcoin halving’s impact extends beyond Bitcoin itself. The event often triggers a ripple effect across the broader cryptocurrency market. Increased investor interest in Bitcoin might lead to a spillover effect, increasing investment in other cryptocurrencies. This could lead to a general market rally, boosting the value of altcoins. However, it’s equally possible that increased Bitcoin dominance could draw investment away from altcoins, potentially causing their prices to stagnate or even decline. The historical precedent shows a mixed bag, with some halvings resulting in altcoin rallies and others seeing altcoins underperform relative to Bitcoin.

Bitcoin Adoption as a Store of Value and Medium of Exchange

The halving’s long-term impact on Bitcoin’s adoption as a store of value and medium of exchange is complex. Increased scarcity, driven by the halving, could bolster its appeal as a store of value, particularly for long-term investors seeking inflation protection. However, its widespread adoption as a medium of exchange hinges on factors beyond the halving, including regulatory clarity, improved transaction speeds, and reduced fees. Increased adoption as a medium of exchange is more likely to occur gradually, with wider merchant acceptance and technological advancements playing crucial roles. For example, the integration of the Lightning Network could significantly improve transaction speeds and reduce fees, potentially boosting Bitcoin’s usability as a daily payment method.

Potential Long-Term Scenarios

The long-term effects of the 2025 halving are uncertain, but several potential scenarios are plausible:

- Increased Bitcoin Adoption and Price Appreciation: The halving leads to increased scarcity, driving up demand and price, solidifying Bitcoin’s position as a dominant store of value and leading to wider adoption as a medium of exchange. This scenario is supported by historical precedent, with past halvings often preceding periods of significant price growth.

- Increased Volatility Followed by Stabilization: The halving initially causes increased price volatility, but the market eventually stabilizes, with Bitcoin finding a new equilibrium at a higher price point. This reflects the inherent uncertainty associated with any significant market event, but suggests a potential for long-term growth.

- Limited Impact on Price and Adoption: Macroeconomic factors or other market forces overshadow the halving’s impact, resulting in only modest price changes and limited increases in adoption. This scenario highlights the influence of external factors on Bitcoin’s price and adoption.

- Significant Market Correction: Despite the halving, the market experiences a significant correction, driven by factors such as regulatory uncertainty or a broader economic downturn. This scenario underscores the risks associated with investing in cryptocurrencies, highlighting the importance of diversification and risk management.

Frequently Asked Questions about the Bitcoin Halving in 2025

The Bitcoin halving is a significant event in the cryptocurrency world, impacting mining profitability, network security, and potentially, the price of Bitcoin. Understanding this event is crucial for anyone involved in or interested in the cryptocurrency market. This section addresses some common questions surrounding the 2025 halving.

Bitcoin Halving Explained

The Bitcoin halving is a programmed event built into the Bitcoin protocol. Approximately every four years, the reward given to Bitcoin miners for verifying transactions and adding new blocks to the blockchain is cut in half. This reduction in the rate of new Bitcoin entering circulation is designed to control inflation and maintain the scarcity of Bitcoin over time. For example, the initial block reward was 50 BTC; after the first halving, it became 25 BTC, then 12.5 BTC, and the next halving in 2025 will reduce it to 6.25 BTC.

Expected Date of the Next Bitcoin Halving

The next Bitcoin halving is expected to occur in April 2025. The exact date depends on the time it takes to mine the blocks, which can fluctuate slightly. However, the approximate four-year cycle is consistently maintained due to the programmed halving mechanism. This predictability allows investors and miners to prepare for the event.

Bitcoin Halving’s Effect on Price

Historically, Bitcoin’s price has tended to increase in the period leading up to and following a halving event. This correlation is attributed to the reduced supply of new Bitcoin entering the market, potentially increasing its scarcity and value. However, it’s crucial to note that other market factors, such as overall economic conditions and regulatory changes, also significantly influence Bitcoin’s price. The 2012 and 2016 halvings were followed by substantial price increases, although the timing and magnitude of these price movements varied. Predicting the precise impact of the 2025 halving on price remains speculative.

Risks and Opportunities Associated with the Halving

The Bitcoin halving presents both risks and opportunities. A potential upside is the increased scarcity of Bitcoin, which could lead to higher prices. However, the halving could also trigger increased volatility in the market, potentially leading to price corrections or crashes. For miners, the reduced block reward creates a risk of decreased profitability unless the price of Bitcoin rises sufficiently to compensate. On the other hand, miners who can operate efficiently and maintain low costs may gain a competitive advantage. Investors should carefully assess their risk tolerance and diversify their portfolios accordingly. Past performance is not indicative of future results, and the 2025 halving’s impact could differ significantly from previous events.