Investor Sentiment and Market Predictions

The Bitcoin halving in March 2025 is a significant event anticipated to impact investor sentiment and market prices. The reduced supply of newly mined Bitcoin, coupled with existing demand, is expected to create upward pressure on the price, although the extent of this impact remains a subject of debate and speculation among market analysts. The following sections explore various perspectives on investor response and potential price movements.

Anticipated Investor Response

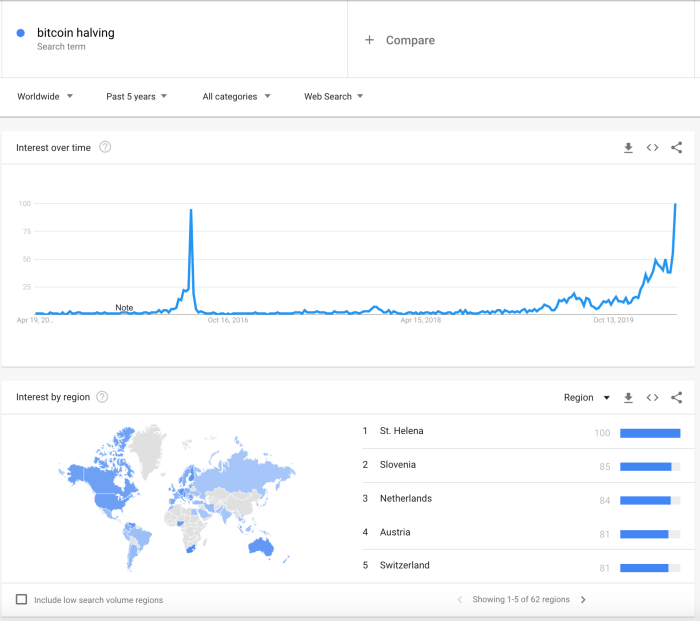

Investor sentiment leading up to the halving is likely to be a mix of optimism, caution, and speculation. Historically, the halving events have preceded periods of significant price appreciation, leading many investors to anticipate a similar outcome. However, macroeconomic factors, regulatory uncertainty, and overall market conditions will significantly influence investor behavior. Experienced investors may adopt a more cautious approach, while others may engage in speculative trading based on price predictions. The overall market sentiment will be influenced by a complex interplay of factors, including broader economic trends, technological advancements within the Bitcoin ecosystem, and news related to regulations.

Potential Price Fluctuations

Several scenarios are possible regarding price fluctuations. A conservative scenario might see a gradual price increase in the months leading up to the halving, followed by a moderate surge after the event, potentially consolidating around a new higher price range. A more bullish scenario could involve a significant price rally in anticipation of the halving, leading to a sharp increase immediately following the event, potentially followed by a period of correction. Conversely, a bearish scenario could see the price remain relatively stagnant or even decline due to macroeconomic headwinds or negative news events, despite the halving. The price trajectory will likely depend on the interplay of supply and demand, investor sentiment, and broader market conditions. For example, the 2020 halving saw a significant price increase in the months following the event, but this was also influenced by the broader adoption of Bitcoin as a store of value.

Comparison of Expert Predictions

Expert predictions vary significantly. Some analysts predict a substantial price surge, citing the historical correlation between halving events and price increases. They often point to the reduced supply as a primary driver of price appreciation. Others are more cautious, highlighting the influence of macroeconomic factors and the potential for regulatory uncertainty to dampen the positive impact of the halving. Some analysts use quantitative models based on historical data to predict future price movements, while others rely on qualitative analysis, considering factors like adoption rates and investor sentiment. The lack of consensus underscores the inherent uncertainty in predicting future price movements. For example, some analysts might forecast a price of $100,000 by the end of 2025, while others might predict a more modest increase to $50,000 or even a price decline.

Potential Price Trajectories

A visual representation of potential price trajectories after the halving could be described as follows:

Scenario 1 (Bullish): The price shows a steady climb in the months before the halving, accelerating sharply immediately after. A peak is reached several months later, followed by a period of consolidation around a significantly higher price level. The graph would show a steep upward curve after the halving, followed by a gentler slope as the price stabilizes.

Scenario 2 (Conservative): The price increases gradually in the lead-up to the halving, followed by a more moderate, but still noticeable, rise after the event. The graph would show a gentler, more linear upward trend, with less dramatic price swings.

Scenario 3 (Bearish): The price remains relatively flat or experiences a slight decline before and after the halving. The graph would show a relatively flat line, possibly with minor fluctuations, but no significant upward trend. This would be a relatively straight, flat line or a slightly downward sloping line.

Technical Analysis and On-Chain Metrics

The Bitcoin halving, a significant event reducing the rate of new Bitcoin creation, often influences market dynamics. Analyzing on-chain metrics alongside technical indicators provides a more comprehensive understanding of potential price movements and network health leading up to and following the 2025 halving. This approach combines quantitative data with price chart analysis to create a more robust predictive framework.

Understanding on-chain metrics is crucial for interpreting investor behavior and predicting market trends around the halving. These metrics provide a deeper insight into the underlying network activity, offering a perspective often missing from traditional price chart analysis alone. By examining these metrics, we can identify potential shifts in sentiment and anticipate potential price reactions.

Key On-Chain Metrics and Their Significance

Several key on-chain metrics can illuminate investor behavior and predict market trends. These metrics provide a more objective measure of market sentiment compared to purely speculative analyses. For example, the Miner’s Position Index (MPI) gauges the proportion of miners holding onto their Bitcoin rather than selling it. A high MPI might suggest strong conviction among miners, potentially indicating price support. Conversely, a low MPI could signal potential selling pressure. Another crucial metric is the Net Unrealized Profit/Loss (NUPL), which measures the difference between the current market price and the average acquisition cost of all Bitcoin. A high NUPL might suggest a market potentially overbought and prone to corrections. Finally, the exchange flow shows the net movement of Bitcoin to and from cryptocurrency exchanges. A significant outflow from exchanges often implies increased accumulation by long-term holders, suggesting bullish sentiment.

Interpreting On-Chain Data for Network Health, Bitcoin Halving March 2025

Analyzing on-chain data allows us to assess the overall health and stability of the Bitcoin network. For instance, consistent increases in the number of active addresses suggest growing adoption and network usage. Similarly, an increase in the transaction volume and the average transaction fee indicates higher network activity and potentially increased demand. Conversely, a sharp decline in these metrics could signal a decrease in network usage and potentially bearish sentiment. Examining the hash rate, which measures the computational power securing the network, provides insights into the network’s security. A consistently high hash rate suggests a robust and secure network. Analyzing these metrics together provides a holistic picture of the network’s health and stability.

Technical Indicators and Trading Opportunities

Technical indicators, when combined with on-chain data, can provide valuable insights into potential buying or selling opportunities around the halving. For example, the Relative Strength Index (RSI) can signal overbought or oversold conditions. A high RSI might suggest that the price is overbought and susceptible to a correction, while a low RSI might indicate that the price is oversold and a potential rebound could be imminent. Moving averages, such as the 200-day moving average, can help identify long-term trends. A price break above the 200-day moving average is often considered a bullish signal, while a break below it can be considered bearish. It’s crucial to remember that these indicators should be used in conjunction with on-chain metrics for a more comprehensive and accurate assessment. For instance, a bullish technical indicator combined with a high NUPL might suggest caution, indicating potential for a price correction despite the bullish technical signal.

Regulatory Landscape and its Influence

The regulatory landscape surrounding Bitcoin is a dynamic and complex one, significantly impacting its price and adoption, particularly in the lead-up to and aftermath of the 2025 halving. Varying approaches across jurisdictions create diverse investment climates, influencing both institutional and retail participation. Macroeconomic factors further complicate this picture, intertwining with regulatory decisions to shape Bitcoin’s trajectory.

Potential Regulatory Changes and Their Influence on Bitcoin

Regulatory changes, whether supportive or restrictive, can significantly influence Bitcoin’s price and adoption. Favorable regulations, such as clear guidelines for taxation and licensing, could boost institutional investment and mainstream adoption, potentially driving up prices. Conversely, stringent regulations, including outright bans or excessive restrictions, could stifle growth and lead to price volatility, potentially causing a downturn. The anticipation of upcoming regulations can also impact the market, with uncertainty often leading to price fluctuations before the actual implementation of any new laws. For example, the increased regulatory scrutiny of cryptocurrencies in certain jurisdictions in 2022 led to a period of market uncertainty and price corrections.

Regulatory Environments Across Countries and Their Impact

Bitcoin’s regulatory environment varies drastically across countries. Some countries, such as El Salvador, have embraced Bitcoin as legal tender, creating a favorable environment for its adoption and potentially stimulating price appreciation within their borders. Other countries, like China, have implemented outright bans, effectively eliminating domestic trading and impacting global price dynamics through reduced demand. The European Union is currently developing a comprehensive regulatory framework for cryptocurrencies, aiming to balance innovation with consumer protection. The outcome of this framework will significantly influence the EU’s Bitcoin market and potentially set a precedent for other regions. The United States, meanwhile, continues to grapple with a fragmented regulatory approach, with different agencies overseeing various aspects of the cryptocurrency market, leading to uncertainty and potentially hindering widespread institutional adoption.

Global Macroeconomic Factors and Bitcoin’s Price

Global macroeconomic factors, such as inflation, interest rates, and geopolitical instability, significantly impact Bitcoin’s price, especially in relation to the halving. Periods of high inflation, for instance, can increase demand for Bitcoin as a hedge against inflation, potentially driving its price upward. Conversely, rising interest rates can reduce investment in riskier assets like Bitcoin, potentially leading to price declines. Geopolitical events, such as wars or sanctions, can also create volatility in the market, impacting Bitcoin’s price irrespective of the halving. For example, the 2022 Russian invasion of Ukraine caused significant market volatility across various asset classes, including Bitcoin.

Summary of the Regulatory Landscape in Major Bitcoin Markets

| Country/Region | Regulatory Approach | Impact on Bitcoin Investment |

|————————–|—————————————————|—————————————————————|

| El Salvador | Bitcoin legal tender | High adoption, potentially positive price impact domestically |

| United States | Fragmented, evolving | Uncertainty, potentially hindering widespread institutional adoption |

| European Union | Developing comprehensive framework | Outcome will significantly influence the EU Bitcoin market |

| China | Outright ban | Significantly reduced domestic demand, global price impact |

| Singapore | Relatively progressive, focusing on licensing | Attracting institutional investors |

| Switzerland | Relatively friendly, fostering innovation | Favorable environment for crypto businesses |

Long-Term Implications for Bitcoin: Bitcoin Halving March 2025

The 2025 Bitcoin halving, reducing the block reward for miners by half, is a significant event with far-reaching consequences for Bitcoin’s long-term trajectory. Its impact extends beyond immediate price fluctuations, influencing Bitcoin’s role in the global financial landscape and its position within the broader cryptocurrency ecosystem. Understanding these implications is crucial for investors and those interested in the future of decentralized finance.

The halving’s primary impact stems from its effect on Bitcoin’s inflation rate. By reducing the rate at which new Bitcoins enter circulation, the halving creates a deflationary pressure, potentially increasing its scarcity and, consequently, its value. This is a key factor in Bitcoin’s appeal as a store of value, mirroring the behavior of precious metals like gold. However, the impact on Bitcoin’s usability as a medium of exchange is more nuanced.

Bitcoin as a Store of Value and Medium of Exchange

The halving’s effect on Bitcoin’s store-of-value proposition is largely positive. Reduced inflation makes Bitcoin a more attractive asset for long-term holders, potentially driving up its price as demand increases relative to supply. However, its role as a medium of exchange is more complex. While increased scarcity might enhance its perceived value, its volatility and transaction fees could hinder its widespread adoption for everyday transactions. The price volatility associated with Bitcoin, amplified by events like halvings, could discourage merchants from accepting it as payment due to the risk of fluctuating value. Conversely, a price increase driven by scarcity could make Bitcoin a more desirable asset for larger transactions, potentially increasing its utility in high-value transfers. The outcome depends on a balance between price stability and demand for its use in commerce.

Bitcoin Adoption Rate and Role in the Broader Financial System

The 2025 halving could influence Bitcoin’s adoption rate in several ways. A significant price increase following the halving might attract new investors and increase mainstream awareness, boosting adoption. Conversely, sustained volatility could deter some potential users. The halving’s impact on the broader financial system is also uncertain. Increased institutional adoption and regulatory clarity could lead to greater integration into existing financial frameworks. However, regulatory uncertainty and potential restrictions could limit its growth and influence. Examples of increased institutional adoption include companies like MicroStrategy and Tesla adding Bitcoin to their balance sheets, demonstrating a growing belief in its long-term potential. Conversely, regulatory crackdowns in certain jurisdictions could limit its expansion into those markets.

Comparison with Other Cryptocurrencies’ Inflation Control Strategies

Bitcoin’s halving mechanism is unique among cryptocurrencies. Many altcoins utilize different inflation control mechanisms, such as burning tokens or adjusting block rewards based on network activity. These alternatives offer varying degrees of control over inflation, each with its own set of advantages and disadvantages. For example, some cryptocurrencies employ a fixed supply, limiting the total number of coins that can ever be created. Others use dynamic inflation rates that adjust based on factors like network usage or market capitalization. These contrasting strategies highlight the diversity of approaches to managing inflation within the cryptocurrency landscape. A comparison of these mechanisms reveals that Bitcoin’s pre-programmed halving provides a predictable and transparent inflation schedule, offering a degree of certainty not found in many other projects.

Bitcoin’s Dominance in the Cryptocurrency Market

Maintaining its dominance after the halving will depend on several factors. These include Bitcoin’s continued technological advancements, its strong network effects, and its established brand recognition. However, competition from other cryptocurrencies with potentially superior scalability or functionality remains a significant challenge. The success of competing cryptocurrencies in addressing Bitcoin’s limitations, such as transaction speed and fees, could potentially erode Bitcoin’s market share. Maintaining dominance will require Bitcoin to adapt and innovate, potentially through layer-2 scaling solutions or technological upgrades to enhance its efficiency and usability. The degree to which Bitcoin successfully addresses these challenges will significantly impact its ability to retain its position as the leading cryptocurrency.

Frequently Asked Questions (FAQs)

This section addresses common queries surrounding the Bitcoin halving event, a significant occurrence in the Bitcoin network’s history. Understanding the halving mechanism, its historical impact, and potential future consequences is crucial for anyone interested in Bitcoin’s long-term trajectory.

Bitcoin Halving Explained

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined). Approximately every four years, the reward miners receive for successfully adding a block of transactions to the blockchain is cut in half. This mechanism is designed to control Bitcoin’s inflation rate and maintain its scarcity over time. The initial reward was 50 BTC per block; after the first halving, it became 25 BTC, then 12.5 BTC, and the next halving will reduce it to 6.25 BTC.

Timing of the Next Bitcoin Halving

The next Bitcoin halving is expected to occur around March 2025. The exact date will depend on the time it takes to mine blocks, which can fluctuate slightly. However, the general timeframe is well-established based on the Bitcoin protocol’s pre-programmed schedule.

Impact of the Halving on Bitcoin’s Price

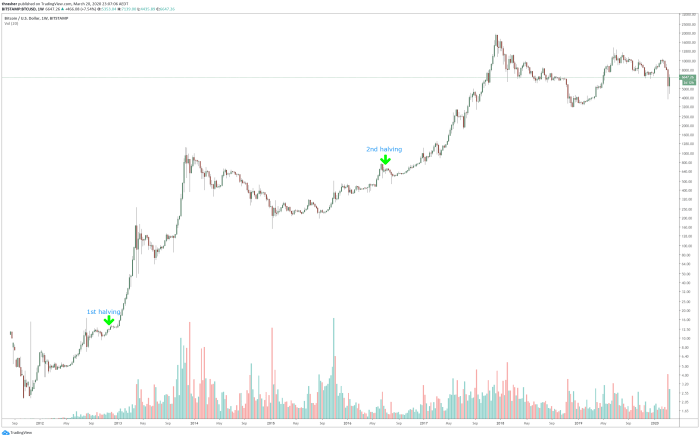

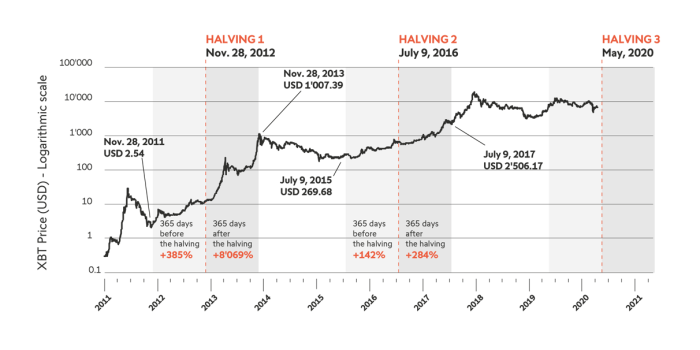

Historically, Bitcoin’s price has tended to increase in the period following a halving. This is largely attributed to the reduced supply of new Bitcoins entering the market, potentially creating upward pressure on demand. The 2012 and 2016 halvings were followed by significant price rallies, although other market factors also contributed to these price movements. Predicting the exact price impact of the 2025 halving is impossible, as various economic and geopolitical events could influence the market. However, the reduced supply is expected to be a significant factor. For example, the 2012 halving was followed by a price increase from around $10 to over $1,000 within a few years, and the 2016 halving was followed by a price increase from around $650 to over $20,000. It’s important to note these are past performances and not indicative of future results.

Investing in Bitcoin Before the Halving: Risks and Rewards

Investing in Bitcoin before a halving presents both significant risks and potential rewards. The potential reward lies in the possibility of capital appreciation as the price rises after the halving, as seen historically. However, the market is highly volatile, and the price could fall before or after the halving due to various factors unrelated to the halving itself. Furthermore, there’s no guarantee of price appreciation following a halving. Investors should carefully assess their risk tolerance and only invest what they can afford to lose. Past performance is not indicative of future results.

Potential Downsides of the Halving

While often viewed positively, the halving also presents potential downsides. The reduced miner rewards could lead to a decrease in mining profitability, potentially impacting the network’s security. Some miners might choose to shut down their operations, leading to a decline in the hashrate (computing power securing the network). This could make the network more vulnerable to attacks. Furthermore, the anticipation of the halving itself might lead to a price bubble that subsequently bursts, resulting in significant price corrections. This is a risk that investors need to consider.

Bitcoin Halving March 2025 – The Bitcoin Halving in March 2025 is a significant event for the cryptocurrency’s future, impacting its inflation rate and potentially its price. Pinpointing the exact date requires precise block counting, and to find out more about that, you can check this resource: What Date Is Bitcoin Halving 2025. Ultimately, the March 2025 Bitcoin Halving remains a key date to watch for within the cryptocurrency market.

The Bitcoin Halving in March 2025 is a significant event for the cryptocurrency, anticipated to impact its price and mining dynamics. To better understand the specific date and its potential implications, it’s helpful to consult resources dedicated to this event, such as the detailed analysis provided by Bitcoin Halving 2025 Daye. Returning to the March 2025 halving, analysts are already speculating on the potential market reactions surrounding this pivotal moment in Bitcoin’s history.

The Bitcoin Halving in March 2025 is a significant event for the cryptocurrency’s future, impacting its inflation rate and potentially its price. Precisely pinpointing the date requires careful consideration of block times, and for the most accurate information on this, you should consult a reliable source like this page detailing the Halving Bitcoin 2025 Date. Understanding this date is crucial for anyone interested in the long-term prospects of Bitcoin Halving March 2025 and its market implications.

The Bitcoin Halving in March 2025 is a significant event for the cryptocurrency, expected to impact its price and mining dynamics. Understanding this event requires examining the broader context of Bitcoin’s halving cycles, which you can explore further by visiting this resource on Halving 2025 Bitcoin. Returning to the March 2025 halving, its effects are likely to be felt throughout the year and beyond, shaping the future trajectory of Bitcoin’s value and adoption.

While many anticipate the Bitcoin Halving in March 2025, it’s worth noting that predictions vary. Some sources, like this article on Bitcoin Halving Is Expected To Occur In April 2025. , suggest a later date in April. Regardless of the exact month, the Bitcoin Halving in 2025 is a significant event for the cryptocurrency’s future.

The Bitcoin Halving in March 2025 is a significant event for the cryptocurrency’s future, impacting its inflation rate and potentially its price. To confirm the precise date and understand its implications, you might find this resource helpful: When Is The Bitcoin Halving 2025. Ultimately, the March 2025 Bitcoin Halving will be a key moment to watch for market shifts and long-term trends.