Bitcoin Halving 2025

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined, and significantly impacts the circulating supply. Historically, halvings have been followed by periods of increased Bitcoin price, though the extent and duration vary. The upcoming 2025 halving is anticipated to generate considerable market interest and volatility.

Bitcoin Halving Mechanics and Historical Impact

The Bitcoin halving mechanism is integral to Bitcoin’s deflationary nature. It’s designed to control inflation by steadily decreasing the rate of new Bitcoin issuance. Currently, miners receive 6.25 BTC for each block they successfully mine and add to the blockchain. After the 2025 halving, this reward will be cut in half to 3.125 BTC. This reduction in supply, combined with continued (or increased) demand, is often cited as a catalyst for price appreciation. Analyzing previous halvings reveals a general upward trend in Bitcoin’s price following each event, although the time it takes for the price to react varies significantly. The impact is not solely attributable to the halving itself; other market factors, such as regulatory changes, technological advancements, and overall economic conditions, also play crucial roles.

Expected Supply Reduction and Market Dynamics in 2025

The 2025 halving will reduce the rate of Bitcoin issuance by 50%. This means approximately half as many new Bitcoins will enter circulation compared to the period before the halving. This reduction in supply is expected to exert upward pressure on price, particularly if demand remains strong or increases. However, predicting the precise impact is challenging. The market’s reaction will depend on various factors, including the overall macroeconomic climate, investor sentiment, and the adoption rate of Bitcoin by institutional and retail investors. Similar to previous halvings, a period of increased volatility is anticipated leading up to and following the event.

Anticipated Timeline and Market Speculation

The anticipation surrounding the 2025 halving is already building. Market participants are likely to engage in speculative trading, potentially driving price fluctuations in the months and years leading up to the event. Some investors might accumulate Bitcoin in anticipation of a post-halving price surge, while others might take profits before the halving, potentially creating downward pressure. The period leading up to the halving is expected to be characterized by heightened volatility and increased trading volume as market players position themselves for the anticipated event. This speculation could significantly influence the price before the actual halving takes place.

Previous Bitcoin Halvings: A Comparison

The following table summarizes the previous Bitcoin halvings, their dates, and the subsequent price movements. It’s important to note that these price changes are not solely attributable to the halving; numerous other market forces influence Bitcoin’s price.

| Date | Block Height (approx.) | Price Before Halving (USD) | Price After Halving (USD) |

|---|---|---|---|

| November 28, 2012 | 210,000 | ~$13 | ~$100+ (within ~1 year) |

| July 9, 2016 | 420,000 | ~$650 | ~$20,000+ (within ~3 years) |

| May 11, 2020 | 630,000 | ~$8,700 | ~$64,000+ (within ~1 year) |

Market Sentiment and Predictions

The 2025 Bitcoin halving, a significant event in the cryptocurrency’s lifecycle, has generated considerable speculation regarding its impact on price. Market sentiment is a complex mix of optimism and caution, influenced by various factors beyond the halving itself. Understanding these diverse perspectives is crucial for navigating the potential price volatility surrounding this event.

Market sentiment regarding the 2025 halving is largely bullish, with many analysts predicting a substantial price increase following the event. This optimism stems from the historical correlation between halvings and subsequent price rallies. However, this correlation isn’t absolute, and dissenting voices caution against overreliance on historical trends.

Expert Opinions on Price Impact

Various experts hold differing views on the magnitude of the price impact. Some analysts predict exponential growth, citing the reduced supply of newly mined Bitcoin as a primary driver. They often point to the previous halvings as evidence, noting significant price increases in the periods following those events. Others, however, are more conservative in their predictions, highlighting the influence of macroeconomic factors and regulatory uncertainty. These analysts argue that while the halving is a significant event, its impact is not isolated and is subject to broader market forces. For instance, some experts believe the price increase might be more gradual than previous cycles, or even muted if macroeconomic conditions remain unfavorable.

Factors Influencing Price Beyond the Halving

Several factors beyond the halving itself could significantly influence Bitcoin’s price. Regulatory clarity or uncertainty in major jurisdictions like the US will play a substantial role. Stringent regulations could dampen investor enthusiasm, while favorable regulations could attract institutional investment and boost prices. Macroeconomic conditions, such as inflation rates, interest rates, and overall economic growth, will also have a profound impact. A global recession, for instance, could lead to a flight to safety, potentially benefiting Bitcoin as a store of value, while robust economic growth might divert investment away from cryptocurrencies. Furthermore, technological advancements within the Bitcoin ecosystem, such as the Lightning Network’s adoption, could positively influence its usability and price. Conversely, significant security breaches or vulnerabilities within the Bitcoin network could severely damage investor confidence.

Potential Price Scenarios

The following Artikels potential price scenarios for Bitcoin following the 2025 halving, ranging from optimistic to pessimistic:

Bitcoin Halving Price 2025 – It’s important to note that these scenarios are speculative and based on various assumptions about market conditions and investor behavior. No prediction is guaranteed, and the actual price movement could deviate significantly from these estimates.

Predicting the Bitcoin Halving Price in 2025 is a complex undertaking, influenced by numerous market factors. A key event to consider is the Bitcoin April 2025 Halving, as detailed in this insightful article: Bitcoin April 2025 Halving. This halving, reducing the rate of new Bitcoin creation, will undoubtedly play a significant role in shaping the price trajectory of Bitcoin throughout the remainder of 2025 and beyond.

| Scenario | Price Prediction (USD) | Rationale |

|---|---|---|

| Optimistic | >$250,000 | Strong macroeconomic environment, favorable regulatory developments, continued institutional adoption, and significant retail investor interest combine to create a substantial price rally, exceeding previous halving cycles. This scenario echoes the post-2021 bull market, albeit potentially with greater institutional participation. |

| Neutral | $100,000 – $250,000 | Moderate macroeconomic conditions, some regulatory uncertainty, and continued, albeit slower, institutional adoption lead to a price increase, but less dramatic than the optimistic scenario. This outcome aligns with a more moderate market reaction, similar to the period following the 2016 halving. |

| Pessimistic | <$100,000 | Adverse macroeconomic conditions, negative regulatory developments, reduced investor confidence, and potential geopolitical instability could lead to a price decline or stagnation, even following the halving. This scenario mirrors the bear market conditions experienced in 2018 and 2022, where macroeconomic headwinds overshadowed the halving’s impact. |

Technical Analysis and Chart Patterns

Analyzing Bitcoin’s price action leading up to previous halvings reveals recurring patterns that may offer insights into potential price behavior in 2025. While past performance doesn’t guarantee future results, identifying these trends can inform trading strategies and risk management. Technical analysis, in conjunction with fundamental analysis, provides a more comprehensive view of the market.

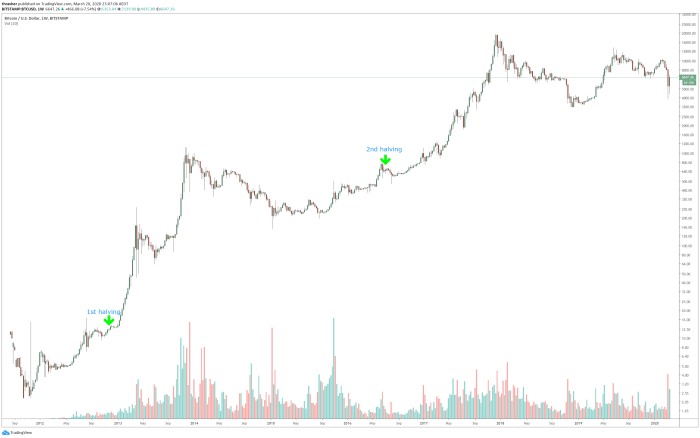

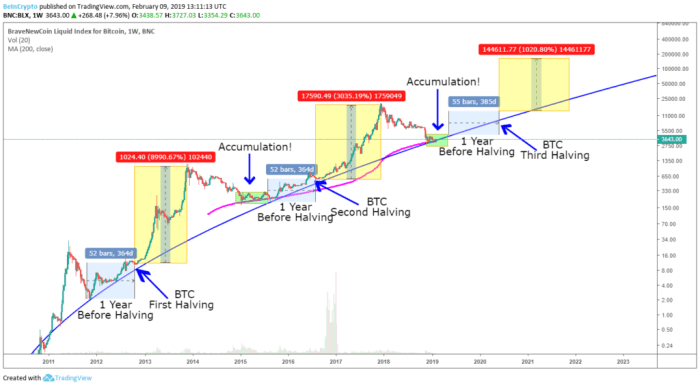

Price Action Before Previous Halvings

Examination of Bitcoin’s price charts before the 2012, 2016, and 2020 halvings reveals a common thread: a period of price accumulation followed by a significant price surge post-halving. The 2012 halving saw a gradual increase in price leading up to the event, followed by a substantial rally. Similarly, the 2016 halving exhibited a period of consolidation before a sharp price appreciation. The 2020 halving showed a similar pattern, albeit with more volatility. These observations suggest that the period leading up to a halving might be characterized by sideways trading or consolidation, setting the stage for a potential post-halving price surge. The length and intensity of these pre-halving phases varied, however, highlighting the unpredictable nature of the market.

Recurring Chart Patterns and Indicators

Several technical indicators and chart patterns have shown notable relevance in Bitcoin’s price movements around halvings. Head and shoulders patterns, double tops/bottoms, and triangle formations have appeared in the charts leading up to previous halvings. The Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands have also provided valuable insights into momentum and potential reversals. For instance, the RSI often reached oversold levels before significant price rallies, while the MACD provided signals of changing momentum. These indicators, used in conjunction with price action analysis, can help to identify potential buy and sell signals, but should not be solely relied upon.

Support and Resistance Levels

Support and resistance levels play a crucial role in shaping Bitcoin’s price movements. Historical price highs and lows act as significant resistance and support levels, respectively. The price often struggles to break through these levels, resulting in periods of consolidation or price reversals. Identifying these key levels before the 2025 halving will be critical in predicting potential price trajectories. For example, if the price approaches a strong historical resistance level before the halving, a pullback might be expected. Conversely, a successful break above a resistance level could signal a strong bullish trend. The strength of these support and resistance levels depends on the volume traded at those price points and the overall market sentiment.

Potential Price Trajectories

A visual representation could depict three potential price scenarios. Scenario one shows a gradual increase leading up to the halving, followed by a significant price surge exceeding previous all-time highs. This optimistic scenario assumes sustained positive market sentiment and increased institutional adoption. Scenario two illustrates a period of sideways consolidation before the halving, followed by a moderate price increase, possibly retracing to previous support levels before another rally. This scenario reflects a more cautious outlook, acknowledging potential market corrections. Scenario three presents a bearish outlook, depicting a significant price decline before the halving, followed by a slow recovery. This scenario considers potential negative macroeconomic factors or regulatory uncertainty impacting the market. Each scenario would be represented graphically by a line chart illustrating the price movement over time, highlighting key support and resistance levels.

On-Chain Metrics and Network Activity

Understanding Bitcoin’s on-chain metrics is crucial for predicting its price behavior, particularly around halving events. These metrics provide insights into network activity and miner behavior, offering valuable clues about potential price movements. Analyzing historical data from previous halvings allows us to identify patterns and anticipate potential scenarios for the 2025 halving.

Changes in key on-chain metrics can significantly influence Bitcoin’s price both before and after a halving. The reduced block reward after a halving directly impacts miner revenue, which can trigger adjustments in mining profitability and overall network activity. The anticipation of this event often leads to price fluctuations in the months preceding the halving.

Miner Revenue and Hash Rate

Miner revenue, directly tied to block rewards and transaction fees, is a primary indicator of Bitcoin’s health. A halving cuts the block reward in half, immediately impacting miner profitability. This can lead to a period of adjustment, with some less-efficient miners potentially exiting the network, causing a temporary decrease in the hash rate (the total computational power securing the network). Conversely, a sustained high price can offset the reduced block reward, maintaining or even increasing miner revenue and hash rate. For example, in the lead-up to the 2021 halving, the Bitcoin price rose significantly, mitigating the immediate impact of the reduced block reward on miner profitability. Following the 2016 halving, a similar pattern emerged, albeit with a more gradual price increase. Comparing the price action and hash rate changes across these events helps us to model potential outcomes for 2025.

Transaction Volume and Network Fees

Transaction volume, reflecting the number of transactions processed on the Bitcoin network, provides insight into user activity and demand. Higher transaction volume generally suggests increased network usage and potentially higher prices. Network fees, the costs associated with processing transactions, also play a role. High fees can indicate network congestion and potentially higher demand, contributing to price increases. Conversely, low transaction volume and fees might suggest decreased demand and could exert downward pressure on the price. Observing the correlation between transaction volume, network fees, and price movements in previous halving cycles allows us to develop more accurate predictions for 2025. The 2017 bull run, for instance, saw a significant increase in both transaction volume and fees, coinciding with a substantial price surge.

Active Addresses and Exchange Flows

The number of active addresses on the Bitcoin network indicates the level of user engagement. A rise in active addresses suggests increased adoption and potential price appreciation. Conversely, a decline could indicate waning interest. Analyzing the flow of Bitcoin between exchanges and wallets provides additional insight. A net outflow from exchanges often suggests accumulation by long-term holders, potentially indicating a bullish sentiment and future price appreciation. Conversely, a net inflow suggests selling pressure and could signal a bearish trend. For instance, the 2021 halving saw a notable increase in active addresses and net outflow from exchanges, which coincided with a subsequent price rally. Examining these patterns from previous halvings can help refine predictions for the 2025 event.

Impact on Bitcoin Mining and Miners: Bitcoin Halving Price 2025

The Bitcoin halving event, scheduled for 2025, significantly impacts Bitcoin miners’ profitability and the broader mining industry. This reduction in block rewards, the primary source of income for miners, necessitates adaptation and potentially reshapes the competitive landscape. The event’s consequences ripple through the entire ecosystem, influencing network security and technological innovation.

The halving directly cuts the Bitcoin reward miners receive for successfully adding a block to the blockchain in half. This immediately reduces their revenue stream. Miners operate on thin margins, and a sudden drop in income forces them to reassess their operational costs, including electricity consumption, hardware maintenance, and personnel expenses. Those unable to adapt to the lower profitability face potential losses and may be forced to shut down operations, leading to a consolidation of the mining industry. Conversely, more efficient and well-capitalized miners may gain a competitive advantage, expanding their market share.

Miner Profitability and Revenue After the Halving

The profitability of Bitcoin mining is a complex calculation, dependent on several factors including the Bitcoin price, mining difficulty, electricity costs, and the hash rate of the miner’s equipment. A halving directly impacts the revenue side of the equation, reducing the income generated per block mined. To maintain profitability, miners must either reduce their operating costs, increase their mining efficiency (through upgrades or more efficient operations), or rely on an increase in the Bitcoin price to compensate for the reduced block reward. For example, if the Bitcoin price remains stagnant or falls after the halving, many less efficient miners may become unprofitable and cease operations. Conversely, a significant price increase could offset the reduced reward and maintain profitability for even less efficient miners.

Consequences for the Mining Industry

The halving often leads to a period of consolidation within the Bitcoin mining industry. Less efficient and less capitalized mining operations may be forced to shut down due to decreased profitability. This leads to a concentration of mining power in the hands of larger, more efficient, and well-funded entities. This consolidation can have both positive and negative implications. Positively, it could lead to increased network security due to the concentration of hash power in the hands of fewer, more reliable operators. Negatively, it could lead to concerns about centralization and potential vulnerabilities if a small number of powerful mining entities control a significant portion of the network’s hash rate. Furthermore, the halving can spur technological advancements. Miners are incentivized to invest in more energy-efficient hardware and mining techniques to maintain profitability in the face of reduced rewards.

Mining Difficulty Adjustments and Network Security

Bitcoin’s mining difficulty automatically adjusts approximately every two weeks to maintain a consistent block generation time of around 10 minutes. This mechanism is crucial for the network’s security and stability. Following a halving, the reduced block reward doesn’t immediately impact the mining difficulty. However, if many miners become unprofitable and leave the network, the total hash rate decreases. This would lead to a longer block generation time. The difficulty adjustment mechanism then automatically reduces the mining difficulty, making it easier for the remaining miners to find blocks and maintain the target block generation time. This adjustment ensures the network continues to function securely, even with a reduced number of miners.

Miner Adaptation Strategies, Bitcoin Halving Price 2025

Miners will likely employ various strategies to adapt to the reduced block rewards. The success of these strategies will depend on several factors, including market conditions and the individual miner’s circumstances.

- Reduce Operating Costs: Negotiating lower electricity prices, optimizing energy consumption, and streamlining operational processes are crucial for maintaining profitability.

- Upgrade Mining Hardware: Investing in more energy-efficient and powerful ASICs (Application-Specific Integrated Circuits) can improve the hash rate and enhance profitability.

- Diversification of Revenue Streams: Exploring alternative revenue streams, such as offering mining-as-a-service or staking other cryptocurrencies, can provide additional income sources.

- Strategic Partnerships and Consolidation: Merging with or acquiring other mining operations can lead to economies of scale and improved efficiency.

- Focus on Energy Efficiency: Adopting sustainable energy sources and implementing energy-saving technologies can significantly reduce operating costs.

Potential Risks and Uncertainties

Predicting the price impact of the 2025 Bitcoin halving is inherently risky, fraught with uncertainties that stem from the volatile nature of the cryptocurrency market and the limitations of relying solely on historical data and technical analysis. While past halvings have shown a correlation with subsequent price increases, extrapolating this trend directly to 2025 overlooks crucial factors that could significantly alter the outcome.

The limitations of using historical data to predict future price movements are significant. Past performance is not necessarily indicative of future results, a maxim that holds particularly true in the highly speculative cryptocurrency market. The conditions surrounding each halving are unique, influenced by factors such as macroeconomic conditions, regulatory developments, technological advancements, and overall market sentiment. For example, the 2012 and 2016 halvings occurred in vastly different market contexts compared to the current environment, making direct comparisons challenging and potentially misleading.

Limitations of Historical Data in Price Prediction

Historical data analysis for Bitcoin halvings reveals a general upward trend following each event. However, this trend is not uniform. The time lag between the halving and the subsequent price surge varied considerably. Furthermore, external factors like the 2022 crypto winter, driven by macroeconomic instability and regulatory crackdowns, significantly impacted Bitcoin’s price, demonstrating the influence of forces beyond the halving itself. Relying solely on historical correlations without considering these contextual factors risks a significant miscalculation. A robust prediction model must account for the interplay of various economic and geopolitical events.

Influence of Unforeseen Events

Unforeseen events, often referred to as “black swan events,” can drastically alter the trajectory of Bitcoin’s price, regardless of the halving. These unpredictable occurrences, such as a major security breach affecting a significant exchange, a sudden shift in government regulation, or a global financial crisis, can trigger market panic and lead to sharp price drops. The 2020 COVID-19 pandemic, for example, initially caused a significant crash in the cryptocurrency market, highlighting the vulnerability of digital assets to unexpected global shocks.

Cascading Effects of Unforeseen Events

A flowchart illustrating the potential cascading effects of unforeseen events might begin with a trigger event (e.g., a major exchange hack). This could lead to a loss of investor confidence, resulting in a sell-off and decreased market liquidity. The reduced liquidity could then trigger further price drops, potentially causing margin calls for leveraged traders, exacerbating the sell-off. This downward spiral could negatively impact Bitcoin mining profitability, potentially leading to miners selling their holdings to cover costs, further depressing the price. Conversely, a positive black swan event, such as widespread institutional adoption, could trigger a massive buying spree, leading to a rapid price increase. The flowchart would visually represent this branching of potential outcomes, emphasizing the unpredictable nature of the market’s response to unforeseen circumstances.

Frequently Asked Questions

This section addresses some common queries regarding the Bitcoin halving event, specifically focusing on the anticipated 2025 halving. Understanding this event is crucial for navigating the potential market impacts.

Bitcoin Halving Mechanism and Implications

The Bitcoin halving is a programmed event built into the Bitcoin protocol. Approximately every four years, the reward given to Bitcoin miners for verifying transactions and adding new blocks to the blockchain is cut in half. This mechanism controls the rate at which new Bitcoins enter circulation, aiming to maintain a controlled inflation rate. The halving’s implication is a reduction in the supply of newly mined Bitcoin, potentially impacting its price due to basic supply and demand economics. Historically, halvings have been followed by periods of increased Bitcoin price appreciation, although this is not guaranteed.

Expected Date of the Next Bitcoin Halving

The next Bitcoin halving is expected around April 2025. The exact date depends on the block generation time, which can fluctuate slightly. However, based on historical data and current block times, April 2025 remains the most likely timeframe. This prediction is based on the consistent four-year cycle embedded within the Bitcoin protocol.

Bitcoin Halving’s Effect on Price

Historically, Bitcoin’s price has shown a tendency to increase following halving events. The 2012 and 2016 halvings were both followed by significant price rallies. However, it’s crucial to understand that correlation doesn’t equal causation. Other factors, such as market sentiment, regulatory changes, and overall economic conditions, significantly influence Bitcoin’s price. The price increase after a halving is often attributed to the reduced supply of new Bitcoins entering the market, increasing scarcity and potentially driving up demand. The 2020 halving, for example, saw a significant price increase in the following months, although other factors like institutional investment also played a role.

Potential Risks Associated with the 2025 Halving

While historical data suggests a positive correlation between halvings and price increases, the 2025 halving is not without potential risks. Market sentiment could be negative leading up to or following the event, potentially driving prices down. Unforeseen regulatory changes or macroeconomic events could also significantly impact Bitcoin’s price regardless of the halving. Furthermore, the increased price volatility often associated with halving events presents a significant risk for investors. The unpredictability of the market makes it crucial to approach any investment with caution and a thorough understanding of the risks involved. The 2020 halving, while ultimately resulting in a price increase, saw significant price fluctuations in the months leading up to and following the event, highlighting this volatility.

Predicting the Bitcoin Halving Price in 2025 is a complex endeavor, influenced by numerous market factors. A key element in this prediction is knowing the precise date of the halving, which you can find by checking the definitive resource on Halving Bitcoin Date 2025. Understanding this date allows for more accurate modeling of the potential price impact of the reduced Bitcoin supply after the halving event, helping to better assess the 2025 Bitcoin Halving Price.

Predicting the Bitcoin Halving price in 2025 is a complex endeavor, influenced by numerous market factors. Understanding the historical impact of halvings is crucial, and to plan for future investment, it’s helpful to know when the next halving will occur; you can find that information by checking out this resource: When Is The Next Bitcoin Halving After 2025.

Knowing the timing of future halvings allows for a more informed assessment of potential price movements around the 2025 halving event and beyond.

Predicting the Bitcoin Halving Price in 2025 is a complex endeavor, influenced by numerous market factors. Understanding the mechanics of the halving event itself is crucial; for detailed information on this pivotal event, refer to this comprehensive resource on the 2025 Bitcoin Halving. Ultimately, the price after the 2025 halving will depend on a combination of factors including adoption rates, regulatory changes, and overall market sentiment.

Predicting the Bitcoin Halving Price 2025 is a complex endeavor, influenced by numerous market factors. Understanding the precise timing of the event is crucial for accurate price predictions, and for that, you should check out the detailed analysis on Bitcoin Halving 2025 Time. Knowing the exact date helps refine models forecasting the subsequent price action following the halving, ultimately affecting our understanding of the Bitcoin Halving Price 2025.

Predicting the Bitcoin Halving Price 2025 is a complex endeavor, influenced by numerous market factors. Understanding the precise timing of the event is crucial for accurate price predictions, and for that, you should check out the detailed analysis on Bitcoin Halving 2025 Time. Knowing the exact date helps refine models forecasting the subsequent price action following the halving, ultimately affecting our understanding of the Bitcoin Halving Price 2025.