Bitcoin Halving 2025: Bitcoin Halving Price Chart 2025

The Bitcoin halving event, scheduled for approximately early 2025, is a significant occurrence in the cryptocurrency’s lifecycle. This event, where the reward for Bitcoin miners is cut in half, historically has preceded periods of substantial price volatility. Understanding the potential price movements surrounding this event requires examining past trends, various prediction models, and the interplay of influencing factors.

Bitcoin Halving 2025: Price Prediction Models

Several models attempt to predict Bitcoin’s price trajectory around the 2025 halving. These models often rely on historical data, analyzing the price movements following previous halvings and extrapolating those trends. One common approach involves observing the price action leading up to the halving, the immediate post-halving price reaction, and the subsequent price evolution over a 12-18 month period. A simplistic model might involve plotting a trendline based on past halving cycles, projecting a future price based on this trend. However, this approach ignores the influence of macroeconomic factors and market sentiment. More sophisticated models incorporate these variables, often using statistical techniques and incorporating indicators like on-chain metrics and trading volume. For instance, a model might integrate the Stock-to-Flow (S2F) model, which posits a relationship between Bitcoin’s scarcity and its price. Visualizing these different models side-by-side on a single chart would reveal the range of potential price outcomes, from conservative estimates to more bullish projections. A hypothetical chart might show a range of potential prices, from a conservative $100,000 to a more bullish prediction of $250,000 or even higher, depending on the model used and the assumptions made.

Historical Bitcoin Halving Price Movements

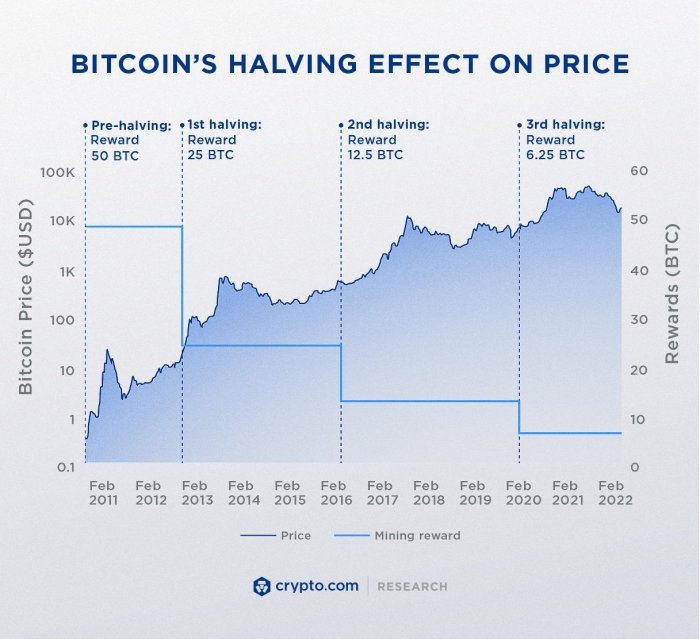

A visual comparison of Bitcoin’s price performance following previous halving events is crucial for context. Imagine a chart with three distinct lines, each representing the price action after the 2012, 2016, and 2020 halvings. The chart would clearly show the periods of significant price appreciation following each halving, though the timing and magnitude of these increases varied. The 2012 halving was followed by a relatively gradual price increase, while the 2016 halving saw a more dramatic surge. The 2020 halving exhibited a more complex pattern, with a period of consolidation followed by a substantial price rally. Highlighting the differences in the time it took for each price surge to materialize, as well as the peak prices achieved, would demonstrate the unpredictability of the market despite the consistent halving events. The chart should also illustrate the periods of volatility surrounding each halving, highlighting the risks associated with investing during these periods. For example, the chart might show a sharp price drop immediately after the halving in one instance, and a more gradual increase in another.

Factors Influencing Bitcoin’s Price Around the 2025 Halving

Numerous factors influence Bitcoin’s price, and their impact is amplified around a halving event. These factors can be broadly categorized into macroeconomic conditions, regulatory developments, technological advancements, and market sentiment. Macroeconomic factors, such as inflation rates, interest rates, and global economic growth, significantly impact Bitcoin’s price as investors seek alternative assets during periods of economic uncertainty. Regulatory clarity or uncertainty in different jurisdictions also plays a vital role, influencing institutional adoption and investor confidence. Technological advancements, such as the development of the Lightning Network or Taproot upgrades, can positively influence the Bitcoin ecosystem’s efficiency and adoption. Finally, market sentiment, driven by news cycles, social media trends, and overall investor psychology, can trigger significant price fluctuations. The interplay of these factors makes predicting the precise price trajectory challenging, emphasizing the need for a diversified approach to investment analysis and risk management. For example, a positive regulatory announcement could trigger a surge in price, while a major economic downturn might lead to a sell-off, regardless of the halving.

Historical Halving Impacts on Bitcoin Price

Bitcoin’s halving events, occurring approximately every four years, significantly reduce the rate at which new Bitcoins are created. This reduction in supply has historically been associated with notable price increases, though the extent and timing of these increases vary. Analyzing past halvings provides valuable insight into potential future price movements, although it’s crucial to remember that past performance is not indicative of future results. Several macroeconomic factors and evolving market sentiment also play crucial roles.

Price Movements Following Previous Halvings

The impact of Bitcoin halvings on price is a complex issue. While all three previous halvings have been followed by periods of substantial price appreciation, the timing and magnitude of these increases differed significantly. The first halving in November 2012 saw a relatively gradual price increase over the following year. The second halving in July 2016 was followed by a more pronounced and sustained price surge, culminating in the 2017 bull market. The third halving in May 2020 was followed by a period of consolidation before a significant price increase in late 2020 and early 2021. A simple comparison using hypothetical charts would show a gradual incline post-2012 halving, a steeper and more sustained rise after the 2016 halving, and a more volatile pattern with a delayed but significant surge after the 2020 halving. A table summarizing key price movements around each halving would further illustrate these differences, though creating such a table requires specific price data from reliable sources at the time of each halving. The table would include columns for the halving date, price before halving, price one year after halving, price three years after halving, and percentage change. These data points would demonstrate the variability of the price response.

Market Sentiment and Investor Behavior Around Halvings, Bitcoin Halving Price Chart 2025

Investor behavior and market sentiment surrounding halving events have evolved over time. Initially, awareness of the halving’s impact on scarcity was limited. However, with each subsequent halving, the event gained more prominence in the crypto community and mainstream media, leading to increased anticipation and speculation. The 2016 halving saw a growing number of investors recognizing the potential for price appreciation, contributing to the significant price surge. By 2020, the halving was widely anticipated as a major bullish catalyst, leading to increased buying pressure and a significant price rally. However, the market also experienced periods of correction and consolidation after each halving, highlighting the influence of other factors beyond the halving itself. This evolution of investor behavior is a crucial aspect to consider when assessing the potential impact of the 2024 halving.

Macroeconomic Factors Influencing Bitcoin Price

Macroeconomic factors have significantly influenced Bitcoin’s price trajectory following each halving. The 2017 bull market, following the 2016 halving, coincided with increased institutional interest and broader adoption of cryptocurrencies. Conversely, the 2020 halving occurred amidst a global pandemic and unprecedented economic uncertainty, resulting in a more complex and volatile price movement. Factors such as inflation, regulatory developments, and overall market sentiment all played a role in shaping Bitcoin’s price. For example, the increased inflation in 2021 could be considered as a contributing factor to the price increase, as investors sought alternative assets to hedge against inflation. Similarly, regulatory announcements or actions from governments around the world could have either positive or negative effects on investor confidence, leading to either price increase or decrease. The interplay of these macroeconomic factors with the supply-side impact of the halving creates a dynamic and unpredictable market environment.

Predicting the Bitcoin Halving Price Chart 2025 requires understanding the halving events’ impact. To accurately project future prices, we first need to know the precise timing of the next halving, which you can find by checking this resource: When Is The Next Bitcoin Halving 2025. Knowing this date allows for more accurate modeling of the Bitcoin Halving Price Chart 2025 and its potential effects on market trends.

Predicting the Bitcoin Halving Price Chart 2025 requires understanding the event’s timing. To accurately project price movements, knowing the precise date is crucial; you can find that information by checking What Day Is The Bitcoin Halving 2025. Once we have the exact date, we can better analyze historical data and incorporate it into more accurate models for the 2025 Bitcoin Halving Price Chart.

Predicting the Bitcoin Halving Price Chart 2025 requires understanding the event’s timing. To accurately project price movements, knowing the precise date is crucial; you can find that information by checking What Day Is The Bitcoin Halving 2025. Once we have the exact date, we can better analyze historical data and incorporate it into more accurate models for the 2025 Bitcoin Halving Price Chart.

Predicting the Bitcoin Halving Price Chart 2025 requires understanding the event’s timing. To accurately project price movements, knowing the precise date is crucial; you can find that information by checking What Day Is The Bitcoin Halving 2025. Once we have the exact date, we can better analyze historical data and incorporate it into more accurate models for the 2025 Bitcoin Halving Price Chart.

Predicting the Bitcoin Halving Price Chart 2025 requires understanding the event’s timing. To accurately project price movements, knowing the precise date is crucial; you can find that information by checking What Day Is The Bitcoin Halving 2025. Once we have the exact date, we can better analyze historical data and incorporate it into more accurate models for the 2025 Bitcoin Halving Price Chart.

Predicting the Bitcoin Halving Price Chart 2025 requires understanding the event’s timing. To accurately project price movements, knowing the precise date is crucial; you can find that information by checking What Day Is The Bitcoin Halving 2025. Once we have the exact date, we can better analyze historical data and incorporate it into more accurate models for the 2025 Bitcoin Halving Price Chart.