Bitcoin Halving 2025: Bitcoin Halving When 2025

The Bitcoin halving, a programmed event occurring approximately every four years, is a significant event in the cryptocurrency’s lifecycle. It reduces the rate at which new Bitcoins are created, impacting the inflation rate and potentially influencing its price. The 2025 halving, expected around April, is generating considerable anticipation within the crypto community, prompting speculation about its market effects.

Bitcoin Halving Mechanics and Historical Impact

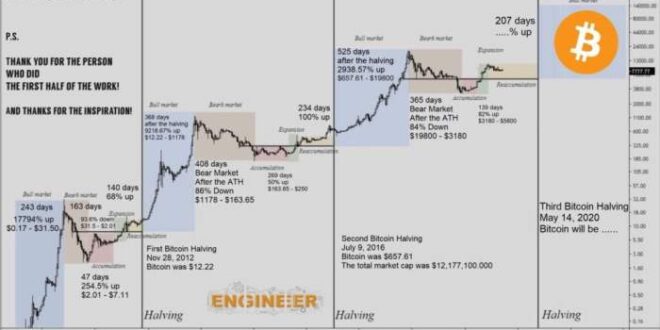

The Bitcoin halving mechanism is hardcoded into the Bitcoin protocol. It cuts the block reward, the amount of Bitcoin miners receive for verifying transactions and adding them to the blockchain, in half. Historically, halvings have been followed by periods of increased Bitcoin price, although the timing and magnitude of these price increases have varied. The 2012 halving was followed by a gradual price increase, while the 2016 halving preceded a substantial bull run. The 2020 halving also saw a significant price surge, though it was followed by a period of consolidation and subsequent price correction. The correlation isn’t absolute, as other market forces influence price movements.

Projected Bitcoin Supply Post-2025 Halving, Bitcoin Halving When 2025

After the 2025 halving, the block reward will be reduced to 3.125 BTC per block. This reduction in the rate of new Bitcoin creation will contribute to a slower increase in the circulating supply. While the exact total supply will depend on the mining rate, the overall trend will be a decreased inflation rate for Bitcoin. The total supply will continue to approach its hard cap of 21 million Bitcoins, making each Bitcoin increasingly scarce.

Potential Price Scenarios Following the 2025 Halving

Predicting Bitcoin’s price after any event is inherently speculative. A bullish scenario anticipates increased scarcity driving up demand and leading to a significant price appreciation, potentially mirroring the price action seen after previous halvings. Conversely, a bearish scenario suggests that macroeconomic factors, regulatory uncertainty, or a general market downturn could offset the positive impact of the halving, leading to price stagnation or even a decline. The actual outcome will likely depend on a complex interplay of these factors. For example, a repeat of the 2020 halving’s initial price surge, followed by a period of consolidation and correction, is a plausible scenario.

Comparison with Previous Halving Events

While each halving event shares the core mechanism of reducing the block reward, there are significant differences. The market conditions surrounding each halving are unique, influenced by factors such as regulatory landscape, adoption rates, and overall economic climate. The 2012 halving occurred during Bitcoin’s early stages with far lower adoption. The 2016 and 2020 halvings took place in a more mature market with greater institutional and public awareness. The 2025 halving will likely occur in a context shaped by the ongoing evolution of the cryptocurrency market and the broader macroeconomic environment.

Impact of Macroeconomic Factors

Macroeconomic factors play a crucial role in Bitcoin’s price. For example, consider a hypothetical scenario where a global recession occurs around the 2025 halving. Investors might flee riskier assets, including Bitcoin, leading to a price decline despite the reduced supply. Conversely, if global inflation remains high and traditional assets underperform, Bitcoin might be seen as a hedge against inflation, potentially driving up its price even in a recessionary environment. The interaction between the halving’s impact on supply and the prevailing macroeconomic conditions will be key to determining the post-halving price trajectory.

Bitcoin Halving When 2025 – The Bitcoin Halving in 2025 is anticipated to significantly impact the cryptocurrency market. Many investors are already strategizing their approaches, and effective advertising will be crucial. To reach a wider audience and capitalize on this event, consider setting up a robust marketing campaign using a well-optimized Google Ads Account. This will allow you to target potential investors interested in the Bitcoin Halving and its implications.

Proper planning now can yield significant returns during this period of market volatility.