Bitcoin’s Price History and Predictions for 2025

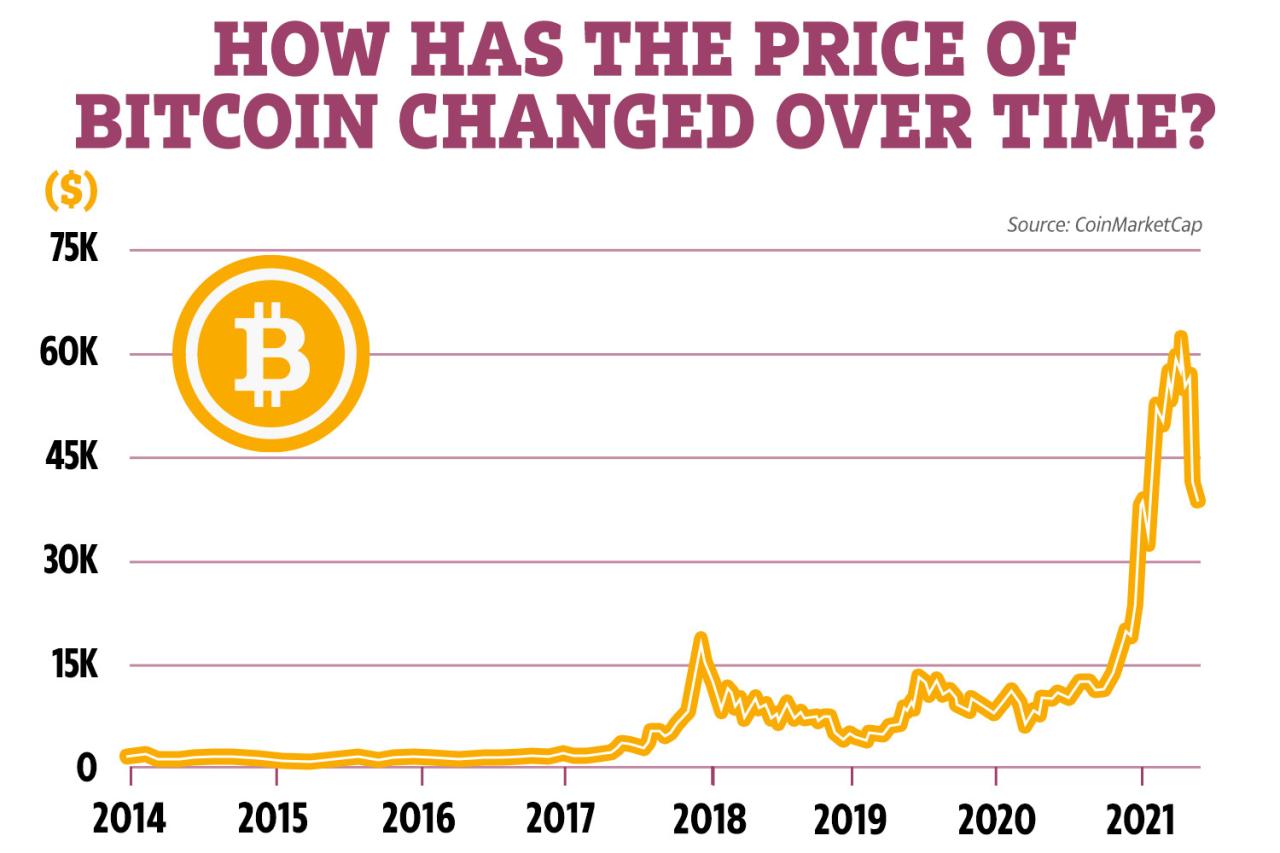

Bitcoin’s journey since its inception in 2009 has been nothing short of dramatic, marked by periods of explosive growth punctuated by significant corrections. Understanding this volatile history is crucial for attempting to predict its future price trajectory.

Bitcoin’s Price Fluctuations: A Historical Overview

From its initial negligible value, Bitcoin experienced its first significant price surge in 2011, reaching over $30. The subsequent years saw further growth, albeit with considerable volatility. Major milestones include the 2013 bull run that took Bitcoin to over $1,000, followed by a sharp correction. The 2017 bull market propelled Bitcoin to its all-time high (ATH) of nearly $20,000, only to be followed by a prolonged bear market. More recently, Bitcoin has experienced another significant bull run, reaching new highs, demonstrating its capacity for both substantial gains and considerable losses. These fluctuations reflect the interplay of various factors, including technological advancements, regulatory changes, and overall market sentiment.

Analysis of Historical Price Trends and Indicators

Analyzing Bitcoin’s price history reveals a cyclical pattern, characterized by periods of rapid growth followed by periods of consolidation or decline. These cycles appear to be influenced by factors like halving events (which reduce the rate of new Bitcoin creation), technological upgrades, and broader macroeconomic conditions. While no reliable formula exists to precisely predict future prices, identifying these patterns can offer insights into potential future price movements. For example, observing the time elapsed between bull and bear markets, and the magnitude of price changes during those periods, can inform more nuanced predictions. Analyzing on-chain metrics, such as transaction volume and network activity, can also provide additional indicators.

Potential Price Ranges for Bitcoin in 2025: Market Scenarios

Predicting Bitcoin’s price in 2025 involves considering various market scenarios. A bullish scenario, fueled by widespread adoption, positive regulatory developments, and continued technological innovation, could see Bitcoin reach prices significantly higher than its current ATH. Estimates in this scenario range from $100,000 to potentially even higher figures, depending on the speed and extent of adoption. Conversely, a bearish scenario, driven by factors like increased regulatory scrutiny, a major market crash, or a loss of investor confidence, could result in significantly lower prices. In this case, prices might remain stagnant or even fall below current levels. A sideways scenario, characterized by moderate price fluctuations within a defined range, is also possible, reflecting a period of consolidation before another significant price movement.

Factors Influencing Bitcoin’s Price

Several factors significantly influence Bitcoin’s price. Regulatory changes, particularly those concerning cryptocurrency trading and taxation, can have a profound impact. Positive regulatory frameworks can boost investor confidence and increase market participation, while restrictive measures can lead to price declines. Technological advancements, such as the development of the Lightning Network, improving scalability and transaction speeds, can positively influence price. Market sentiment, driven by news events, social media trends, and overall investor psychology, also plays a crucial role. Macroeconomic factors, including inflation and global economic uncertainty, can also influence investor appetite for Bitcoin as a potential hedge against inflation.

Visual Representation: Historical Price Movements and Projected Price Ranges for 2025

Imagine a line graph with the x-axis representing time (from 2009 to 2025) and the y-axis representing Bitcoin’s price in USD. The line would initially be very close to zero, then show a gradual increase with spikes and dips representing the various bull and bear markets described earlier. Key data points would include the 2011, 2013, 2017, and recent price peaks and troughs. For the 2025 projection, three separate lines could be overlaid on the historical data: one representing a bullish scenario (reaching, for example, $150,000), another a bearish scenario (remaining around current levels or slightly lower), and a third representing a sideways scenario (fluctuating within a range, say, between $30,000 and $60,000). The graph would clearly illustrate the historical volatility and the range of potential future outcomes, emphasizing the uncertainty inherent in price predictions. The different scenarios would be clearly labeled and differentiated by color coding. This visualization would provide a clear and concise overview of Bitcoin’s price history and potential future trajectories.

Factors Influencing Bitcoin’s Price in 2025: Bitcoin Highest Price 2025

Predicting Bitcoin’s price in 2025 is inherently complex, relying on the interplay of various macroeconomic, technological, regulatory, and sentiment-driven factors. These elements are interconnected and often influence each other, making any forecast inherently uncertain. However, by examining each factor individually, we can gain a clearer understanding of the potential price drivers.

Macroeconomic Factors, Bitcoin Highest Price 2025

Macroeconomic conditions significantly impact Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, rising interest rates can make holding Bitcoin less attractive compared to interest-bearing assets, potentially reducing demand. Strong global economic growth might lead to increased risk appetite, potentially benefiting Bitcoin as a higher-risk, higher-reward asset. Conversely, a global recession could cause investors to move towards safer assets, negatively impacting Bitcoin’s price. The strength of the US dollar also plays a role; a strong dollar tends to correlate with lower Bitcoin prices due to Bitcoin’s pricing in USD.

Technological Advancements

Technological developments within the Bitcoin ecosystem are crucial for its long-term viability and price. Layer-2 scaling solutions, such as the Lightning Network, aim to improve transaction speed and reduce fees, making Bitcoin more usable for everyday transactions. Widespread adoption of these solutions could increase demand and positively impact the price. Increased institutional adoption, through the use of Bitcoin as a reserve asset by corporations or investment firms, could also lead to significant price appreciation. Conversely, the failure of layer-2 solutions to gain traction or a lack of institutional adoption could hinder price growth. Furthermore, advancements in competing cryptocurrencies could divert investment away from Bitcoin.

Regulatory Developments

Regulatory clarity and acceptance are vital for Bitcoin’s mainstream adoption. The approval of a Bitcoin ETF (Exchange-Traded Fund) in major markets could significantly increase institutional investment and liquidity, leading to a price surge. Conversely, stricter regulations or outright bans in key jurisdictions could severely restrict Bitcoin’s accessibility and negatively impact its price. Regulatory uncertainty itself can create volatility and make price prediction challenging. Examples include differing regulatory stances between the US and China, which can create price swings as investors react to news and announcements.

Market Sentiment

Market sentiment, encompassing investor confidence, media narratives, and social media trends, exerts a powerful influence on Bitcoin’s price. Positive media coverage and widespread investor optimism can fuel price rallies, while negative news or social media-driven FUD (Fear, Uncertainty, and Doubt) can trigger sharp price drops. Significant events, such as major cryptocurrency exchange hacks or influential figures expressing strong opinions, can drastically alter market sentiment and consequently Bitcoin’s price. This is particularly relevant in the short term, as investor psychology often drives rapid and sometimes irrational price movements.

Factors Influencing Bitcoin’s Price in 2025: Summary Table

| Factor | Positive Impact | Negative Impact | Likelihood |

|---|---|---|---|

| Macroeconomic Factors (Inflation, Interest Rates, Global Growth) | High inflation drives demand as a hedge; Strong growth increases risk appetite. | Rising interest rates reduce attractiveness; Recession reduces risk appetite. | Medium to High |

| Technological Advancements (Layer-2, Institutional Adoption) | Improved scalability and usability increase demand; Institutional investment boosts liquidity. | Failure of Layer-2 solutions; Lack of institutional adoption. | Medium |

| Regulatory Developments (ETF Approvals, Stricter Regulations) | ETF approvals increase institutional investment; Regulatory clarity boosts confidence. | Stricter regulations or bans limit accessibility; Regulatory uncertainty creates volatility. | Medium to High |

| Market Sentiment (Investor Confidence, Media Coverage) | Positive news and investor optimism drive price rallies. | Negative news and FUD trigger price drops; Major events can cause volatility. | High |

Bitcoin Highest Price 2025 – Predicting the Bitcoin highest price in 2025 is challenging, dependent on numerous factors influencing market trends. Understanding the broader price fluctuations throughout the year is crucial; for a detailed analysis of potential price movements, check out this insightful resource on Bitcoin Price In 2025 Year. This comprehensive overview helps contextualize any predictions regarding the Bitcoin highest price in 2025, offering a more nuanced perspective.

Predicting the Bitcoin highest price in 2025 is challenging, given its volatile nature. Many analysts attempt to forecast this, often basing their predictions on various market factors. To gain further insight into potential price trajectories, you might find this resource helpful: What Price Will Bitcoin Reach In 2025. Ultimately, the Bitcoin highest price in 2025 will depend on a complex interplay of technological advancements, regulatory changes, and overall market sentiment.

Predicting the Bitcoin highest price in 2025 is challenging, dependent on various market factors and technological advancements. To understand potential price points, it’s helpful to consider broader questions of value, such as those explored in this insightful article: What Is Bitcoin Worth In 2025. Ultimately, the highest price will likely depend on the answers provided within that resource, as it directly influences estimations for the future of Bitcoin’s market cap and overall value.

Predicting the Bitcoin highest price in 2025 is challenging, with various factors influencing its trajectory. Understanding different prediction models is crucial, and one such model is explored in detail at Bitcoin Price 2025 Plan B , which offers insights into potential price movements. Ultimately, the Bitcoin highest price in 2025 remains speculative, depending on market forces and adoption rates.

Predicting the Bitcoin highest price in 2025 is challenging, involving numerous factors influencing its value. To gain some insight into potential year-end figures, reviewing forecasts is helpful; a detailed analysis is available at Btc Price Prediction December 2025. Understanding December’s predicted value significantly aids in estimating the overall highest price achieved throughout the entire year of 2025 for Bitcoin.