Bitcoin June 2025 Price Prediction: Bitcoin June 2025 Prediction

Bitcoin’s journey since its inception in 2009 has been nothing short of remarkable, marked by periods of explosive growth and dramatic crashes. From its humble beginnings worth mere cents, it has reached all-time highs exceeding $68,000, showcasing its immense potential while simultaneously highlighting its inherent volatility. Major market events, such as the 2017 bull run fueled by increasing institutional interest and the 2022 crypto winter triggered by macroeconomic factors and regulatory uncertainty, have significantly shaped its price trajectory. Understanding this history is crucial for any attempt at future price prediction.

Bitcoin’s price volatility stems from a complex interplay of factors. These include macroeconomic conditions (inflation rates, interest rate hikes, global economic recessions), regulatory changes (government policies concerning cryptocurrency adoption and taxation), technological advancements (scaling solutions, new applications), and market sentiment (investor confidence, media narratives, and social media influence). The decentralized nature of Bitcoin, while a core strength, also contributes to its price fluctuations as it lacks the regulatory oversight and stability mechanisms of traditional financial assets. Supply and demand dynamics, coupled with the relatively small market capitalization compared to established asset classes, further amplify these price swings.

Factors Influencing Bitcoin’s Price Volatility

The unpredictable nature of Bitcoin’s price is a defining characteristic. Several key factors contribute to this volatility. Firstly, macroeconomic trends significantly impact Bitcoin’s price. For instance, periods of high inflation often lead investors to seek alternative assets, including Bitcoin, potentially driving its price upwards. Conversely, rising interest rates can make holding Bitcoin less attractive compared to higher-yielding bonds, leading to price drops. Secondly, regulatory developments worldwide play a crucial role. Stringent regulations can dampen investor enthusiasm, while supportive policies can boost adoption and price. Thirdly, technological advancements, such as the implementation of layer-2 scaling solutions aimed at improving transaction speed and reducing fees, can positively impact Bitcoin’s utility and, consequently, its price. Finally, market sentiment, driven by news cycles, social media trends, and the overall confidence in the cryptocurrency market, can create significant short-term price fluctuations. The 2021 meme stock phenomenon, for example, shows how quickly sentiment can shift and influence asset prices, a trend observable in the cryptocurrency market as well.

Current Market Sentiment Regarding Bitcoin’s Future, Bitcoin June 2025 Prediction

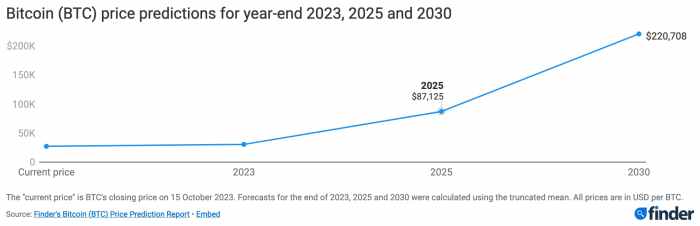

Currently, the market sentiment surrounding Bitcoin’s future is mixed. While some analysts remain bullish, predicting continued growth driven by increasing institutional adoption and the potential for Bitcoin to become a mainstream store of value, others express caution, citing ongoing regulatory uncertainty and the potential for further macroeconomic headwinds. The narrative is further complicated by the ongoing development of competing cryptocurrencies and blockchain technologies. Many believe that Bitcoin’s long-term value proposition remains strong, based on its scarcity and its position as the first and most established cryptocurrency. However, the path to achieving widespread adoption and achieving price stability remains uncertain, with short-term price movements likely to remain volatile. Historical precedent suggests that significant price increases are often followed by periods of consolidation or correction, making precise price predictions inherently challenging.

Bitcoin June 2025 Prediction – Predicting Bitcoin’s price in June 2025 is challenging, with various factors influencing its trajectory. A key event impacting these predictions is the Bitcoin Halving Day in 2025, a significant event that reduces the rate of new Bitcoin creation. For a deeper understanding of this halving event and its potential consequences, check out this resource on Bitcoin Halving Day 2025.

Ultimately, the halving’s impact on the June 2025 Bitcoin price remains a subject of ongoing debate and analysis among experts.

Predicting Bitcoin’s price in June 2025 is challenging, with various factors influencing its trajectory. A key event to consider when forecasting is the Bitcoin halving, which significantly impacts the supply of new Bitcoins. To understand the timing of this crucial event, refer to this helpful resource: Cuando Es El Halving De Bitcoin 2025. Knowing the halving date allows for a more informed prediction of Bitcoin’s price in June 2025, taking into account the anticipated changes in supply and potential market reactions.

Predicting Bitcoin’s price in June 2025 is challenging, given the inherent volatility of the cryptocurrency market. Understanding the impact of the halving event is crucial for any accurate forecast, and a detailed analysis can be found in this insightful resource: Bitcoin Price Prediction 2025 Halving Usd. Considering the halving’s effect on supply and potential market reactions, a more refined Bitcoin June 2025 prediction might then be possible.

Predicting Bitcoin’s price in June 2025 is inherently speculative, but a key factor influencing forecasts is the upcoming halving event. Understanding the historical impact of previous halvings is crucial; for detailed information on the timing and potential effects of the 2025 halving, check out this informative resource on the Halving Bitcoin 2025 Day. Ultimately, this event will likely play a significant role in shaping Bitcoin’s trajectory leading up to and beyond June 2025.

Predicting Bitcoin’s value in June 2025 is challenging, requiring careful consideration of various market factors. To gain a more comprehensive perspective, understanding potential price movements later in the year is crucial. For insights into the potential trajectory, you might find the analysis on Bitcoin Prediction December 2025 helpful in informing your June 2025 projections. Ultimately, Bitcoin’s June 2025 price will depend on the overall market trends established throughout the year.

Predicting Bitcoin’s price in June 2025 is challenging, with various factors influencing its trajectory. A key event to consider is the Bitcoin Halving, which significantly impacts the cryptocurrency’s supply and often precedes price changes. To understand the timing of this crucial event, check out this resource on the Bitcoin Halving Event Date 2025 , as its impact on the subsequent Bitcoin June 2025 Prediction is substantial and widely debated among analysts.