Bitcoin’s Price History and Market Trends: Bitcoin Lowest Price Prediction 2025

Bitcoin’s journey since its inception in 2009 has been nothing short of dramatic, marked by periods of explosive growth punctuated by significant corrections. Understanding this volatile history is crucial for any attempt to predict future price movements. This analysis will explore the key factors driving Bitcoin’s price fluctuations and contextualize its performance against other assets.

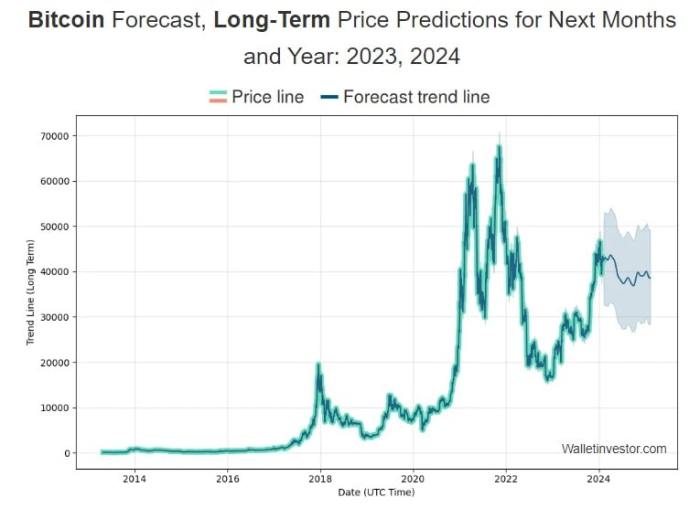

Bitcoin’s price initially remained relatively low for several years, trading at fractions of a dollar. However, it experienced its first major surge in 2013, reaching over $1,000 for the first time, fueled by increasing media attention and early adoption by investors. This was followed by a period of consolidation and then a meteoric rise in 2017, culminating in a peak of nearly $20,000. The subsequent “crypto winter” saw a dramatic price drop, with Bitcoin falling to around $3,000 in 2018. A significant recovery began in 2019, leading to another bull run in 2020-2021, pushing Bitcoin’s price above $60,000. Since then, the price has experienced significant volatility, fluctuating considerably within a wide range.

Factors Influencing Bitcoin’s Price

Several interconnected factors contribute to Bitcoin’s price volatility. Regulatory changes, both positive and negative, significantly impact investor sentiment and market liquidity. For instance, positive regulatory developments in certain jurisdictions can lead to increased institutional investment and price appreciation, while conversely, stricter regulations can trigger sell-offs. Technological advancements, such as the development of the Lightning Network, which aims to improve transaction speeds and reduce fees, can also influence price, often positively impacting investor confidence. Market sentiment, driven by media coverage, social media trends, and overall economic conditions, plays a dominant role. Fear, uncertainty, and doubt (FUD) can lead to sharp price declines, while periods of optimism and excitement can fuel significant price rallies. Finally, macroeconomic factors, such as inflation, interest rates, and global economic uncertainty, significantly influence investor risk appetite and consequently, Bitcoin’s price.

Bitcoin’s Price Performance Compared to Other Assets

Comparing Bitcoin’s performance to other assets reveals its unique characteristics. While traditional assets like gold and stocks often exhibit more moderate price swings, Bitcoin’s volatility is significantly higher. However, Bitcoin has also demonstrated periods of outperformance compared to these traditional assets, especially during times of macroeconomic uncertainty or inflationary pressures. Comparing Bitcoin’s performance to other cryptocurrencies shows a similar pattern of volatility, although Bitcoin’s market capitalization generally makes it less susceptible to extreme price swings than smaller altcoins. Some altcoins have exhibited far greater price volatility than Bitcoin, with some experiencing exponential growth followed by drastic collapses.

Visual Representation of Bitcoin’s Price History

Imagine a graph with the horizontal axis representing time (from 2009 to the present) and the vertical axis representing Bitcoin’s price in US dollars. The line representing Bitcoin’s price would start near zero in 2009, showing gradual growth in its early years. Then, it would sharply ascend in 2013, followed by a period of fluctuating growth. A dramatic spike would be visible in late 2017, reaching a peak near $20,000, followed by a steep decline into 2018. The line would then show a gradual recovery and another significant upward trend in 2020-2021, reaching its all-time high above $60,000. Finally, the line would show considerable fluctuation since then, indicating significant price volatility within a broad range. The overall shape would illustrate the cyclical nature of Bitcoin’s price movements, with periods of significant growth and subsequent corrections.

Factors Influencing Bitcoin’s Future Price

Predicting Bitcoin’s price in 2025 is inherently complex, depending on a confluence of macroeconomic conditions, technological advancements, regulatory landscapes, and unforeseen events. While no one can definitively state the price, understanding the key factors influencing its trajectory is crucial for informed speculation.

Macroeconomic Factors and Bitcoin’s Price

Inflation and interest rates significantly impact Bitcoin’s price. High inflation often drives investors towards alternative assets like Bitcoin, perceived as a hedge against inflation. Conversely, rising interest rates can make holding Bitcoin less attractive, as investors might shift to higher-yielding bonds or other fixed-income instruments. For example, the 2022 Bitcoin price downturn correlated with aggressive interest rate hikes by central banks globally. A scenario of persistent high inflation coupled with relatively low interest rates in 2025 could potentially support Bitcoin’s price, while the opposite could dampen it.

Technological Advancements and Bitcoin’s Value

Technological advancements are pivotal in shaping Bitcoin’s future. Scaling solutions like the Lightning Network aim to improve transaction speed and reduce fees, making Bitcoin more practical for everyday use. The development and adoption of new applications built on Bitcoin, such as decentralized finance (DeFi) protocols or non-fungible token (NFT) marketplaces, could increase demand and drive up the price. Conversely, a failure to address scalability issues or security vulnerabilities could negatively impact its value. Consider the impact of the successful implementation of Taproot, a significant upgrade enhancing Bitcoin’s scalability and privacy, as a positive example.

Regulatory Developments and Bitcoin’s Price Trajectory

Regulatory clarity and acceptance are essential for Bitcoin’s mainstream adoption. Favorable regulations, such as clear guidelines on taxation and anti-money laundering (AML) compliance, could attract institutional investors and boost the price. Conversely, stringent regulations or outright bans in major economies could severely depress the price. The contrasting regulatory approaches of El Salvador (adoption) and China (ban) illustrate the significant impact of government policies on Bitcoin’s price.

Potential Catalysts for Price Fluctuations

Several events could act as catalysts for Bitcoin’s price. Positive catalysts include widespread institutional adoption, integration into mainstream financial systems, successful development of Layer-2 scaling solutions, and positive regulatory developments. Negative catalysts could include major security breaches, significant regulatory crackdowns, macroeconomic instability leading to a flight to safety away from risk assets, or the emergence of a superior competing cryptocurrency. The 2021 bull run, partly fueled by Tesla’s Bitcoin investment, serves as a prime example of a positive catalyst.

Summary of Factors Influencing Bitcoin’s Price, Bitcoin Lowest Price Prediction 2025

| Positive Factors | Negative Factors | Positive Factors | Negative Factors |

|---|---|---|---|

| High Inflation | High Interest Rates | Successful Scaling Solutions | Security Breaches |

| Favorable Regulations | Stringent Regulations/Bans | Widespread Institutional Adoption | Macroeconomic Instability |

| Increased Use Cases (DeFi, NFTs) | Emergence of Superior Competitors | Positive Media Coverage | Negative Media Coverage/Public Perception |

Expert Predictions and Market Sentiment

Predicting Bitcoin’s price is notoriously difficult, yet numerous analysts and institutions attempt to forecast its future value. These predictions often vary widely, influenced by differing methodologies, market interpretations, and underlying assumptions about technological adoption, regulatory changes, and macroeconomic factors. Understanding the range of these predictions and the prevailing market sentiment is crucial for navigating the volatility inherent in the cryptocurrency market.

Bitcoin Lowest Price Prediction 2025 – A multitude of factors contribute to the diverse range of Bitcoin price predictions for 2025. These factors include the anticipated impact of the Bitcoin halving event, the overall health of the global economy, and the evolving regulatory landscape surrounding cryptocurrencies. Furthermore, the inherent speculative nature of Bitcoin’s market adds another layer of complexity to accurate forecasting.

Bitcoin Price Predictions for 2025

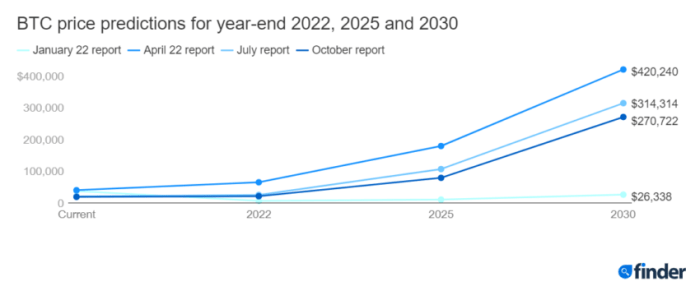

Several prominent analysts and financial institutions have offered their price predictions for Bitcoin in 2025. While specific numbers vary considerably, a common thread is the expectation of continued price fluctuation, with potential for significant gains or losses depending on the interplay of various market forces. It’s important to remember these are predictions, not guarantees, and should be treated as such.

For instance, some analysts, basing their projections on adoption rates and technological advancements, predict a price well above $100,000 by 2025. Others, focusing on potential regulatory hurdles or macroeconomic downturns, offer significantly more conservative estimates, potentially in the range of $30,000 to $50,000. Still others remain cautiously optimistic, anticipating a steady, yet less dramatic, increase in price.

Comparison of Viewpoints on Bitcoin’s Price Range in 2025

The divergence in price predictions reflects differing perspectives on the future of Bitcoin. Some analysts believe Bitcoin will continue its upward trajectory, driven by increasing institutional adoption, growing demand from retail investors, and its perceived role as a hedge against inflation. Conversely, other analysts are more cautious, citing concerns about regulatory uncertainty, the potential for market manipulation, and the possibility of competing cryptocurrencies gaining market share.

The following table summarizes some hypothetical examples of contrasting viewpoints, highlighting the range of possibilities:

| Analyst/Institution | Price Prediction (USD) | Rationale |

|---|---|---|

| Analyst A (Bullish) | $150,000 | High adoption rates, institutional investment, limited supply |

| Analyst B (Bearish) | $25,000 | Regulatory crackdown, macroeconomic downturn, increased competition |

| Institution C (Neutral) | $50,000 – $75,000 | Balanced view considering both positive and negative factors |

Current Market Sentiment and its Influence on Future Price Movements

Current market sentiment plays a significant role in shaping Bitcoin’s price. Periods of strong positive sentiment, often fueled by news of increased institutional adoption or technological breakthroughs, tend to drive prices higher. Conversely, periods of negative sentiment, perhaps triggered by regulatory uncertainty or a broader market downturn, can lead to price declines. Analyzing social media trends, news coverage, and investor sentiment indices can provide valuable insights into the prevailing market mood.

Impact of Significant Events on Bitcoin’s Price

Significant events, such as the Bitcoin halving, can have a substantial impact on its price. The halving, which reduces the rate at which new Bitcoins are created, is often viewed as a deflationary event that can increase scarcity and potentially drive up the price. Historically, Bitcoin’s price has often seen an increase following a halving event, although the timing and magnitude of this effect can vary.

For example, the 2016 halving was followed by a significant price increase, while the 2020 halving saw a more gradual price appreciation. The upcoming halving in 2024 is anticipated to influence price in 2025, though the extent remains speculative.

Contrasting Perspectives on Bitcoin’s Future

The diverse opinions regarding Bitcoin’s future highlight the inherent uncertainty surrounding its price trajectory. These contrasting perspectives stem from different interpretations of market data, technological advancements, and regulatory developments.

- Bullish View: Bitcoin will become a mainstream asset, achieving widespread adoption and significantly increasing in value due to its scarcity and potential as a store of value.

- Bearish View: Bitcoin will face increased regulatory scrutiny and competition from alternative cryptocurrencies, leading to a decline in price and market dominance.

- Neutral View: Bitcoin will experience periods of both growth and decline, with its long-term price trajectory dependent on a variety of factors, including macroeconomic conditions and technological innovations.

Bitcoin Adoption and Network Growth

The price of Bitcoin is intrinsically linked to its adoption and the growth of its underlying network. Increased adoption leads to higher demand, pushing the price upward, while network growth signifies the expanding utility and resilience of the Bitcoin ecosystem. Understanding this relationship is crucial for predicting Bitcoin’s future price trajectory.

Bitcoin’s adoption rate and network growth are positively correlated. As more individuals and institutions utilize Bitcoin for transactions, payments, or as a store of value, the network’s activity increases, reflected in metrics such as transaction volume and hash rate. Conversely, a decline in adoption often coincides with a decrease in network activity and a potential price dip. However, it’s important to note that correlation doesn’t equal causation; other factors also significantly influence Bitcoin’s price.

Bitcoin Network Growth Metrics and Price Correlation

Several key metrics illustrate Bitcoin’s network growth. The transaction volume indicates the number of transactions processed on the Bitcoin network over a given period. A higher transaction volume generally suggests increased usage and adoption. The hash rate, representing the computational power securing the Bitcoin network, is another crucial indicator. A higher hash rate signifies a more robust and secure network, which can positively impact investor confidence and price. While these metrics don’t perfectly predict price movements, historical data shows a general tendency for price increases to accompany periods of high transaction volume and hash rate. For example, the significant price surge in 2020-2021 coincided with a substantial increase in both transaction volume and hash rate. Conversely, periods of lower network activity have often been associated with price corrections.

Institutional Investment and Mainstream Adoption

The entry of institutional investors, such as large corporations and hedge funds, into the Bitcoin market has a considerable impact on price. These investors often bring substantial capital, driving up demand and potentially causing price appreciation. Similarly, mainstream adoption, where Bitcoin becomes widely accepted as a payment method by businesses and individuals, can significantly boost its price. Increased regulatory clarity and the development of user-friendly Bitcoin applications can facilitate mainstream adoption. For example, the growing acceptance of Bitcoin by payment processors and e-commerce platforms contributes to its broader adoption and price appreciation.

Key Regions and Demographics Driving Bitcoin Adoption

Geographic location and demographic characteristics play a role in Bitcoin adoption. Regions with higher levels of financial instability or limited access to traditional financial services often see greater adoption of Bitcoin as an alternative. Similarly, younger demographics, generally more tech-savvy and open to new technologies, tend to show higher rates of Bitcoin adoption. For instance, El Salvador’s adoption of Bitcoin as legal tender dramatically increased Bitcoin’s usage within the country and impacted its price, albeit indirectly. Meanwhile, strong adoption in regions like North America and Western Europe also significantly contributes to global Bitcoin demand and price.

Bitcoin Network Metrics Over Time

| Year | Transaction Volume (average daily) | Hash Rate (average TH/s) | Price (USD) – Year End |

|---|---|---|---|

| 2017 | ~250,000 | ~10,000 | $14,000 |

| 2019 | ~300,000 | ~60,000 | $7,200 |

| 2021 | ~400,000 | ~150,000 | $47,000 |

| 2023 | ~500,000 | ~250,000 | $30,000 (estimated) |

Predicting the lowest Bitcoin price in 2025 is challenging, given the cryptocurrency’s volatile nature. However, understanding related altcoin predictions can offer some context. For instance, checking out community sentiment on Bitcoin Cash’s potential, as reflected in discussions like those found on Bitcoin Cash Price Prediction 2025 Reddit , might indirectly shed light on broader market trends affecting Bitcoin’s floor price.

Ultimately, though, Bitcoin’s lowest price in 2025 will depend on numerous interacting factors.

Predicting the lowest Bitcoin price in 2025 is challenging, depending heavily on various market factors. To gain a broader perspective on potential price movements, it’s helpful to consider wider market predictions; for a comprehensive overview, check out this resource on Bitcoin 2025 Predictions. Understanding these broader predictions can help contextualize any estimates for the lowest potential price point for Bitcoin in 2025, allowing for a more informed assessment.

Predicting the lowest Bitcoin price in 2025 is challenging, with various factors influencing its volatility. To understand potential price floors, it’s helpful to consider broader market predictions; for a comprehensive overview, check out this insightful analysis on What Will Bitcoin Price Be In 2025. Ultimately, the lowest price will depend on numerous economic and technological developments affecting Bitcoin’s adoption and market sentiment.

Predicting the lowest Bitcoin price in 2025 is challenging, given the cryptocurrency’s volatility. However, understanding potential price movements earlier in the year can offer some insight. To get a sense of the market’s trajectory, checking out the projected price for January 2025 is useful, as seen in this analysis: Bitcoin Price By January 2025. This data point can help inform estimations for the overall lowest price throughout the rest of 2025.

Predicting the lowest Bitcoin price in 2025 is challenging, influenced by numerous factors including global economic conditions and regulatory changes. Understanding the potential performance of related cryptocurrencies, such as gaining insight into the projected value with a resource like this article on the Bitcoin Cash Price 2025 , can offer a broader perspective. Ultimately, Bitcoin’s lowest price in 2025 will depend on the interplay of these various market forces.