Bitcoin Plan B

Bitcoin Plan B, a popular yet controversial theory, attempts to predict the future price of Bitcoin based on its stock-to-flow (S2F) model. This model posits a correlation between Bitcoin’s scarcity (represented by its stock-to-flow ratio) and its price. It gained significant traction in the cryptocurrency community, particularly during Bitcoin’s 2020-2021 bull run, but its accuracy has been debated extensively since.

Core Tenets of Bitcoin Plan B

Plan B’s core tenet rests on the assertion that Bitcoin’s price is primarily driven by its scarcity, analogous to precious metals like gold. The stock-to-flow ratio, calculated by dividing the existing supply of Bitcoin by the newly mined Bitcoin in a given year, is used as the primary indicator. A lower stock-to-flow ratio signifies greater abundance and potentially lower price, while a higher ratio suggests scarcity and potentially higher price. The theory suggests a strong positive correlation between the S2F ratio and Bitcoin’s price. Plan B’s models further incorporated modifications and adjustments to the basic S2F model, incorporating factors like halving events.

Historical Context of Plan B’s Emergence

Plan B, the pseudonym of the theory’s creator, began publicly presenting the S2F model for Bitcoin in late 2019. The theory gained considerable attention as Bitcoin’s price began its substantial rally in 2020. The timing coincided with the halving event, a pre-programmed reduction in Bitcoin’s block reward, which further contributed to the narrative of increasing scarcity and potential price appreciation. The predictions made by Plan B, particularly the projected price targets for 2021, garnered significant media attention and influenced many investors’ decisions.

Comparison with Other Bitcoin Price Prediction Models

Numerous models attempt to predict Bitcoin’s price, employing various methodologies. Some utilize technical analysis, focusing on chart patterns and trading volume. Others incorporate on-chain metrics, examining factors like transaction fees and network activity. Plan B’s S2F model stands apart by emphasizing the fundamental scarcity of Bitcoin as the primary driver of its price, unlike models that heavily rely on short-term market sentiment or technical indicators. While other models may incorporate scarcity as one factor, Plan B gives it primary weight.

Key Assumptions Underlying Plan B’s Projections

The accuracy of Plan B’s projections hinges on several key assumptions. Firstly, it assumes a direct and strong correlation between Bitcoin’s stock-to-flow ratio and its price. Secondly, it assumes that the market will consistently value Bitcoin based on its scarcity, similar to how precious metals are valued. Thirdly, it assumes that external factors, such as regulatory changes or macroeconomic events, will not significantly impact Bitcoin’s price relative to its S2F value. These assumptions have been challenged, as market behavior can be unpredictable and influenced by numerous factors beyond just scarcity.

Methodology for Generating Plan B’s Predictions

Plan B’s methodology involves calculating Bitcoin’s stock-to-flow ratio at various points in time and extrapolating potential price movements based on historical correlations. The initial S2F model was subsequently refined with modifications, including the introduction of S2FX, which incorporated additional factors to account for potential market dynamics. The model relies heavily on regression analysis to establish the relationship between the S2F ratio and Bitcoin’s price, creating predictive models based on historical data and extrapolated trends. For example, Plan B’s predictions for 2021 were based on the observed correlation between past S2F ratios and price, projecting a continued rise based on the anticipated increase in scarcity due to the halving. However, these predictions ultimately did not fully materialize.

Plan B’s Stock-to-Flow Model

Plan B’s stock-to-flow (S2F) model attempts to predict Bitcoin’s price based on its scarcity, measured by the ratio of its existing supply (stock) to its newly mined supply (flow). The model posits a correlation between this ratio and Bitcoin’s price, suggesting that as Bitcoin becomes scarcer, its price will increase.

Stock-to-Flow Model Explanation

The S2F model operates on a relatively simple principle. First, the total supply of Bitcoin is determined. This is the “stock.” Next, the newly mined Bitcoin in a given period (typically a year) is calculated. This is the “flow.” The S2F ratio is then calculated by dividing the stock by the flow. A higher S2F ratio indicates greater scarcity, and the model suggests this correlates with a higher price. The model further incorporates halving events, where the rate of new Bitcoin creation is halved, significantly impacting the flow and thus the S2F ratio. These halvings are treated as key inflection points for price increases.

Limitations and Potential Biases of the Stock-to-Flow Model

The S2F model, while intuitively appealing, suffers from several limitations. It’s a purely quantitative model, neglecting crucial qualitative factors influencing Bitcoin’s price, such as regulatory changes, market sentiment, technological advancements, and macroeconomic conditions. The model assumes a direct and constant relationship between scarcity and price, which may not always hold true. External shocks and market manipulation can significantly impact price regardless of the S2F ratio. Furthermore, the model’s historical accuracy relies on backtesting, which can be susceptible to biases and selective data choices. Finally, the model’s predictive power diminishes as it moves further into the future, due to the increasing uncertainty of future adoption rates and market dynamics.

Examples of Accurate Price Predictions

While not perfectly accurate, the S2F model has shown some correlation with Bitcoin’s price movements in the past. For instance, the model accurately predicted, to a certain degree, the price surge following the 2020 halving. However, it’s crucial to note that many other factors contributed to this price increase, and attributing it solely to the S2F model would be an oversimplification. The model’s predictions have become less precise in recent years, highlighting the limitations of relying solely on a scarcity-based metric.

Comparison with Other Forecasting Techniques

The S2F model’s accuracy compares favorably to some simpler technical analysis methods, but it falls short when compared to more sophisticated econometric models that incorporate a wider range of variables. Traditional fundamental analysis, which considers factors like adoption rate, transaction volume, and developer activity, often provides a more comprehensive, albeit less precise, prediction. Machine learning models, trained on extensive historical data, have also shown potential in forecasting Bitcoin’s price, although their accuracy is also subject to limitations.

Visual Representation of the Stock-to-Flow Model

Imagine a graph with two lines. The first line represents the total supply of Bitcoin (stock) – starting low and gradually increasing at a decreasing rate due to halvings. The second line represents the newly mined Bitcoin per year (flow) – initially high, then decreasing stepwise at each halving. The S2F ratio, plotted as a third line, is derived by dividing the stock line by the flow line. This ratio shows an upward trend, punctuated by sharp increases after each halving. The price of Bitcoin, plotted on a separate axis, is shown to generally follow the trend of the S2F ratio, albeit with significant deviations reflecting market volatility. The graph illustrates the core concept: increasing scarcity (higher S2F) tends to correlate with higher prices, but the relationship is not perfectly linear.

Criticisms and Challenges to Plan B: Bitcoin Plan B

Plan B’s stock-to-flow (S2F) model, while influential in the Bitcoin community, has faced significant criticism and challenges. These criticisms stem from both methodological concerns and the inherent unpredictability of market forces and external events. Understanding these counterarguments is crucial for a balanced perspective on Bitcoin’s price prediction models.

Major Criticisms of the Stock-to-Flow Model

The S2F model’s simplicity is both its strength and weakness. Critics argue that it oversimplifies a complex market by focusing solely on the scarcity of Bitcoin, neglecting other crucial factors influencing price. These factors include regulatory changes, technological advancements, macroeconomic conditions, and market sentiment. The model’s reliance on historical data, while seemingly robust, may not accurately predict future behavior, especially given the unprecedented nature of Bitcoin’s market evolution. Furthermore, the model’s historical fit is sometimes questioned, with some arguing that the correlation observed is coincidental rather than causal. The lack of incorporation of network effects and adoption rates is another significant criticism, as these factors are inherently intertwined with Bitcoin’s value proposition.

Impact of Unforeseen Events on Plan B’s Predictions

Unforeseen events can significantly impact Bitcoin’s price, potentially invalidating Plan B’s predictions. For instance, a major regulatory crackdown on cryptocurrency exchanges could dramatically reduce trading volume and suppress price. Similarly, the emergence of a superior cryptocurrency or a technological breakthrough rendering Bitcoin obsolete could negatively affect its value. Conversely, a global financial crisis leading to a flight to safety could significantly boost Bitcoin’s price, exceeding Plan B’s projections. The 2022 “crypto winter,” for example, demonstrated the impact of macroeconomic factors and market sentiment on Bitcoin’s price, deviating from the S2F model’s predictions.

Comparison of Arguments for and Against Plan B’s Validity

Arguments in favor of Plan B’s validity often highlight the model’s simplicity and its apparent historical accuracy in predicting Bitcoin’s price movements, at least in certain periods. Proponents emphasize the scarcity of Bitcoin as a fundamental driver of its value, arguing that this scarcity is inherently linked to price appreciation. Conversely, counterarguments focus on the model’s limitations, its failure to account for various market dynamics, and the potential for unforeseen events to significantly alter Bitcoin’s price trajectory. The lack of a robust theoretical foundation beyond the simple S2F ratio is a key point of contention. Essentially, the debate revolves around the relative importance of scarcity versus other factors influencing Bitcoin’s price.

Impact of Bitcoin Adoption on Plan B’s Projections

Increased Bitcoin adoption can both support and challenge Plan B’s projections. Widespread adoption would increase demand, potentially driving the price higher than the model predicts. However, mass adoption could also lead to increased regulatory scrutiny and potential market manipulation, potentially negating the positive price impact. The rate of adoption, therefore, is a critical variable that the S2F model doesn’t directly address, creating uncertainty in its predictive power. For example, while increased institutional adoption initially boosted Bitcoin’s price, subsequent regulatory uncertainty caused price volatility, highlighting the complex interplay between adoption and external factors.

Key Counterarguments to Plan B

| Counterargument | Elaboration | Example | Impact on S2F Model |

|---|---|---|---|

| Oversimplification of Market Factors | The model ignores crucial factors like regulation, technology, and market sentiment. | 2022 bear market, driven by macroeconomic conditions and regulatory uncertainty. | Underestimates price volatility and potential for downward corrections. |

| Limited Predictive Power | Historical correlation doesn’t guarantee future performance. | The model’s accuracy has diminished in recent years. | Predictions become increasingly unreliable over time. |

| Unforeseen Events | Black swan events (e.g., major regulatory changes) can drastically alter Bitcoin’s price. | A significant regulatory crackdown could severely depress the price. | The model fails to account for these unpredictable events. |

| Ignoring Network Effects | The model doesn’t account for the impact of network growth and user adoption on price. | Increased adoption could lead to higher prices than predicted. | Potential for underestimation or overestimation of price, depending on adoption rate. |

Plan B’s Impact on the Bitcoin Market

Plan B’s Stock-to-Flow (S2F) model, while controversial, has undeniably had a significant impact on the Bitcoin market. His predictions, widely disseminated through social media, have influenced investor psychology, price volatility, and overall market sentiment, shaping how various market participants perceive and interact with Bitcoin. This analysis examines the multifaceted influence of Plan B’s work on the cryptocurrency’s trajectory.

Plan B’s Psychological Effect on Bitcoin Investors

Plan B’s bold predictions, particularly his price targets based on the S2F model, have created a powerful psychological effect on Bitcoin investors. Many have viewed his forecasts as self-fulfilling prophecies, leading to increased buying pressure during periods when the price appeared to align with his predictions. Conversely, periods where the price deviated significantly from his model triggered fear and uncertainty, sometimes leading to sell-offs. This demonstrates the potent influence of a single, highly publicized model on the collective investor mindset. The model provided a concrete, albeit debatable, framework for price expectations, thus influencing investment strategies and risk tolerance levels.

Influence of Plan B on Bitcoin’s Price Volatility

While correlation doesn’t equal causation, Plan B’s predictions have coincided with periods of both significant price increases and substantial volatility in the Bitcoin market. For instance, the anticipation surrounding his projected price targets often fueled speculative trading, leading to dramatic price swings. Conversely, when the price failed to meet his predicted levels, it resulted in sharp corrections. This highlights the inherent risk associated with basing investment decisions solely on a single model, especially one as complex and debated as the S2F model. The amplified volatility, whether directly caused by Plan B’s influence or merely coincidental, underscores the importance of diversification and risk management in Bitcoin investing.

Examples of Plan B’s Predictions Affecting Market Sentiment

Several instances illustrate the impact of Plan B’s predictions on market sentiment. His prediction of Bitcoin reaching a price of $100,000 by the end of 2021 generated significant hype and attracted new investors. Conversely, when the price failed to reach this target, it led to a period of uncertainty and a subsequent price correction. This demonstrates how his predictions, regardless of their accuracy, shaped the narrative and expectations surrounding Bitcoin’s price. The expectation of a certain price target, even if based on a controversial model, has the power to significantly influence investor behavior and market sentiment.

Role of Social Media in Spreading Plan B’s Ideas

Social media platforms, particularly Twitter, played a crucial role in amplifying Plan B’s influence. His concise and visually appealing charts and graphs, coupled with his frequent engagement with followers, fostered a large and engaged online community. This online community actively discussed and debated his predictions, further spreading his ideas and impacting market sentiment. The ease of dissemination through social media allowed his model to reach a broad audience of both seasoned investors and newcomers, effectively shaping the broader public perception of Bitcoin’s price potential.

Interpretation and Utilization of Plan B’s Predictions by Market Participants

Different market participants interpreted and utilized Plan B’s predictions in diverse ways. Some investors treated his model as a primary investment guide, basing their trading strategies heavily on his projected price targets. Others used his work as a supplementary tool, incorporating it alongside other market indicators and fundamental analysis. Still others remained skeptical, viewing the S2F model as an oversimplification of a complex market. This demonstrates the varied interpretations and applications of Plan B’s model, highlighting the subjective nature of interpreting and applying market predictions. The diversity in responses demonstrates the model’s lack of universally accepted validation and its influence on the range of investment strategies.

Bitcoin Plan B and Future Predictions

Plan B’s stock-to-flow (S2F) model, while controversial, has significantly influenced Bitcoin price predictions and the broader market sentiment. His predictions, while not always perfectly accurate, have generated considerable discussion and debate within the cryptocurrency community. This section delves into Plan B’s recent predictions, their potential implications, and a comparison with other prominent analysts’ forecasts.

Plan B’s Recent Predictions and Their Implications

Plan B’s most recent predictions, while not explicitly stated as specific price targets in recent times, generally center around the long-term upward trajectory of Bitcoin’s price based on the S2F model’s underlying principles. The core idea remains that Bitcoin’s scarcity, driven by its fixed supply, will inevitably drive price appreciation over time. The implications for long-term holders are significant, suggesting potential substantial returns if Plan B’s assumptions hold true. However, it’s crucial to remember that the S2F model is a simplification of complex market dynamics and doesn’t account for external factors like regulatory changes, technological advancements, or macroeconomic events. A continued upward trend, as suggested by the model, would significantly benefit those who have held Bitcoin for an extended period, potentially yielding massive profits. Conversely, a failure of the prediction could result in significant losses for those heavily invested based on this model.

Hypothetical Scenario: Failure of Plan B’s Predictions

Imagine a scenario where macroeconomic factors, such as a prolonged global recession or stricter cryptocurrency regulations, significantly dampen Bitcoin’s price growth. This scenario could lead to a prolonged period of stagnation or even a substantial price decline, contradicting Plan B’s predictions. The impact on long-term holders would be severe, potentially eroding their investments and challenging the credibility of the S2F model. Such a scenario might also trigger a broader reassessment of the Bitcoin market’s fundamental value proposition and its long-term growth potential. This would likely lead to a significant shift in market sentiment and investor confidence. For example, if Bitcoin fails to reach even a fraction of the price predicted by Plan B’s model within a reasonable timeframe, it could trigger a mass sell-off and potentially a bear market.

Comparison with Other Prominent Bitcoin Analysts

Several other prominent Bitcoin analysts offer differing predictions. Some share a bullish outlook, albeit with varying price targets and timelines, often citing factors beyond the S2F model, such as increasing adoption, institutional investment, and the potential for Bitcoin to act as a hedge against inflation. Others hold more cautious perspectives, emphasizing the inherent volatility of the cryptocurrency market and the potential risks associated with its speculative nature. For instance, some analysts might focus on network adoption metrics or on-chain data to inform their predictions, offering a more nuanced perspective than solely relying on the S2F model. The divergence in predictions highlights the complexity of forecasting Bitcoin’s future price, underscoring the need for diversified investment strategies and a thorough understanding of the risks involved.

Potential Future Scenarios Based on Plan B’s Model, Bitcoin Plan B

The following scenarios represent potential outcomes based on Plan B’s S2F model, acknowledging the inherent uncertainties and limitations of any predictive model:

- Scenario 1: Continued Upward Trajectory: Bitcoin’s price continues to rise, broadly aligning with Plan B’s predictions, driven by increasing scarcity and growing institutional adoption. This scenario would be characterized by sustained periods of price appreciation, punctuated by periods of correction.

- Scenario 2: Stagnation and Consolidation: Bitcoin’s price experiences a period of prolonged stagnation or consolidation, failing to meet Plan B’s projected price targets. This scenario might be attributed to macroeconomic factors, regulatory uncertainty, or a general loss of investor confidence.

- Scenario 3: Significant Price Decline: A significant and prolonged price decline occurs, substantially contradicting Plan B’s predictions. This scenario could be triggered by a major market crash, a significant regulatory crackdown, or a technological disruption within the cryptocurrency space.

Frequently Asked Questions about Bitcoin Plan B

This section addresses common queries surrounding Bitcoin Plan B, a model developed by analyst PlanB to predict Bitcoin’s price based on its stock-to-flow ratio. Understanding this model requires clarifying its mechanics, limitations, and historical performance.

Bitcoin Plan B Definition

Bitcoin Plan B refers to a price prediction model created by an anonymous analyst known as PlanB. This model utilizes the stock-to-flow (S2F) ratio of Bitcoin to forecast its future price. The S2F ratio compares the existing supply of Bitcoin to the newly mined Bitcoin each year. A lower S2F ratio generally indicates higher supply and potentially lower value, while a higher S2F ratio suggests scarcity and potentially higher value.

Stock-to-Flow Model Explanation

The Stock-to-Flow model posits that the scarcity of an asset directly influences its price. For Bitcoin, the stock represents the total number of Bitcoins in circulation, while the flow represents the newly mined Bitcoins added to the supply annually. The S2F ratio is calculated by dividing the stock by the flow. PlanB’s model suggests a strong correlation between Bitcoin’s historical S2F ratio and its price, implying that as Bitcoin becomes scarcer (lower flow), its price tends to increase. The model extrapolates this historical relationship to predict future price movements. For example, a higher S2F ratio, as seen in precious metals like gold, historically correlates with higher prices due to limited supply.

Limitations of Plan B’s Predictions

Plan B’s model, while insightful, has limitations. Firstly, it’s a purely statistical model based on historical correlations, not a fundamental valuation. It doesn’t account for unforeseen events such as regulatory changes, market sentiment shifts, or technological disruptions that could significantly impact Bitcoin’s price. Secondly, the model’s accuracy relies heavily on the continued adherence to Bitcoin’s pre-programmed halving schedule, which reduces the rate of new Bitcoin creation. Any deviation from this schedule could invalidate the model’s predictions. Finally, extrapolating past trends into the future inherently carries uncertainty; what worked historically might not continue to hold true.

Historical Accuracy of Plan B’s Predictions

PlanB’s predictions have shown mixed results. While some of his earlier predictions aligned with Bitcoin’s price movements, others have missed the mark considerably. The model’s accuracy has been debated extensively within the cryptocurrency community. Some periods saw surprisingly accurate price predictions, while others demonstrated significant deviations. This inconsistency highlights the inherent limitations of relying solely on a statistical model to forecast the complex and volatile cryptocurrency market.

Future of Bitcoin According to Plan B

PlanB’s model suggests a long-term bullish outlook for Bitcoin’s price. Based on the decreasing flow of newly mined Bitcoin and the increasing S2F ratio, the model projects substantial price appreciation over time. However, it’s crucial to remember that these are predictions based on a specific model with inherent limitations and not guaranteed outcomes. The actual future price of Bitcoin will depend on a multitude of factors beyond the scope of the S2F model. The model serves as one perspective among many, not a definitive forecast.

Bitcoin Plan B, a popular model for predicting Bitcoin’s price, relies on on-chain metrics to forecast future values. Understanding the accuracy of these predictions often involves examining historical data, and a great resource for this is the analysis available at Plan B Bitcoin Price. This analysis helps assess the model’s effectiveness and provides context for interpreting Bitcoin Plan B’s projections.

Bitcoin Plan B, a popular theory regarding Bitcoin’s future price, often sparks lively debate. Understanding its core tenets requires examining various market factors and, crucially, analyzing predictions like those found in the detailed Bitcoin Price Prediction Plan B analysis. Ultimately, Bitcoin Plan B’s success hinges on the accuracy of these projections and the broader adoption of Bitcoin itself.

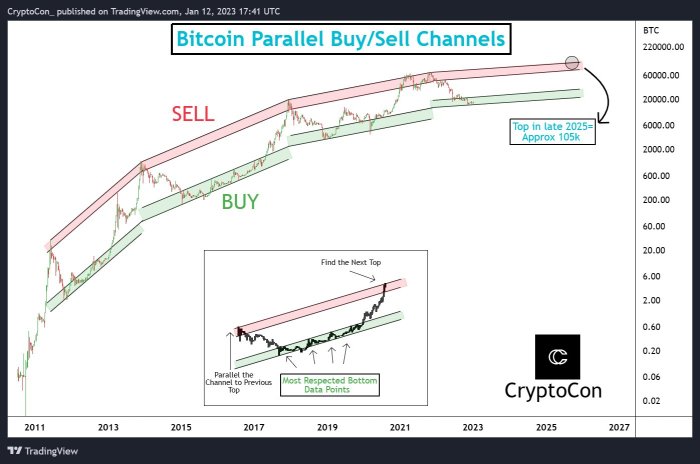

Bitcoin Plan B, a model predicting Bitcoin’s future price, relies on various factors influencing market behavior. Understanding potential price peaks is crucial, and a helpful resource for exploring this is the analysis provided at Bitcoin Price Top 2025. This external perspective complements Plan B’s methodology, offering a broader understanding of the variables at play in forecasting Bitcoin’s long-term trajectory.

Ultimately, both approaches contribute to a more comprehensive assessment of Bitcoin’s potential.

Bitcoin Plan B’s predictions have sparked considerable debate within the crypto community. Understanding the potential for a significant price increase is crucial to evaluating its accuracy, and a helpful resource for this is the analysis found on Bitcoin Price Rise Potential 2025. Ultimately, the success or failure of Plan B hinges on various market factors and whether these projections accurately reflect future market behavior.

Bitcoin Plan B, the pseudonymous analyst, is known for his bold predictions about Bitcoin’s price. To understand his perspective, it’s crucial to examine his past forecasts, readily available through resources like this detailed analysis of his predictions: Bitcoin Plan B Prediction. While not always perfectly accurate, Plan B’s work offers valuable insight into potential Bitcoin price trajectories, continuing the discussion surrounding this influential figure in the cryptocurrency space.