Bitcoin Halving 2025

The Bitcoin halving, a pre-programmed event in the Bitcoin protocol, is anticipated to occur in 2025. This event, which roughly happens every four years, reduces the rate at which new Bitcoins are created and added to the circulating supply. This has historically had a significant impact on Bitcoin’s price, often leading to periods of price appreciation. Understanding the mechanics of this event and its historical context is crucial for forming informed expectations about its potential effects in 2025.

Bitcoin Halving Mechanics and Historical Impact

The Bitcoin halving mechanism is designed to control inflation. Every 210,000 blocks mined, the reward given to miners for verifying transactions is cut in half. This halving reduces the rate of new Bitcoin entering circulation, making the cryptocurrency inherently deflationary over the long term. Historically, each halving has been followed by a period of significant price increase, although the timing and magnitude of these increases have varied. This price appreciation is often attributed to a combination of factors, including decreased supply, increased demand, and anticipation of future price increases. However, it’s important to remember that correlation does not equal causation, and other market factors significantly influence Bitcoin’s price.

Projected Bitcoin Supply After the 2025 Halving

Following the 2025 halving, the block reward will decrease from 6.25 BTC to 3.125 BTC per block. The total supply of Bitcoin is capped at 21 million coins. While the exact date of the halving is subject to minor variations depending on the mining rate, the reduction in block reward will definitively lead to a slower rate of new Bitcoin entering circulation. This reduced supply, combined with persistent demand, is a key factor often cited as a potential catalyst for price appreciation.

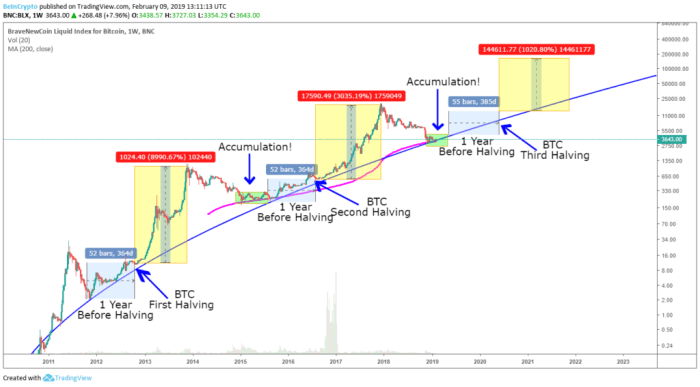

Comparison of Market Conditions Leading Up to Previous Halvings

The market conditions leading up to each Bitcoin halving have been significantly different. The first halving in 2012 occurred during Bitcoin’s early stages, with a relatively small market capitalization and limited awareness. The 2016 halving took place in a more mature market, with increased institutional interest and a larger user base. The 2020 halving happened amidst a period of growing institutional adoption and increasing mainstream awareness. In 2025, the market is expected to be even more mature, with potentially increased regulatory scrutiny and a broader range of participants. Comparing these vastly different market contexts highlights the difficulty in predicting the precise impact of the 2025 halving.

Potential Price Scenarios Following the 2025 Halving

Predicting Bitcoin’s price after the 2025 halving is inherently speculative. A bullish scenario could see a significant price increase driven by reduced supply, continued institutional adoption, and positive regulatory developments. Conversely, a bearish scenario might involve a price decline due to factors such as macroeconomic uncertainty, regulatory crackdowns, or a general market downturn. The actual outcome will likely depend on a complex interplay of factors, including broader macroeconomic trends, regulatory developments, and the overall sentiment within the cryptocurrency market.

Bitcoin Price Action After Previous Halvings

The table below summarizes Bitcoin’s price action following the previous halvings. Note that these are simplified representations and don’t fully capture the complex price movements in the periods following each event.

| Halving Date | Price Before (USD) | Price After (USD) – Peak | Percentage Change |

|---|---|---|---|

| November 2012 | ~13 USD | ~1147 USD (Dec 2013) | ~8782% |

| July 2016 | ~650 USD | ~20000 USD (Dec 2017) | ~2077% |

| May 2020 | ~8700 USD | ~68789 USD (Nov 2021) | ~692% |

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently challenging, given the cryptocurrency’s volatility and susceptibility to a wide array of influences. However, by analyzing key macroeconomic, regulatory, technological, and security factors, we can gain a clearer understanding of the potential forces shaping its value. This analysis focuses on the interplay of these factors and their likely impact on Bitcoin’s price trajectory leading up to and beyond the 2025 halving event.

Macroeconomic Factors

Macroeconomic conditions significantly influence Bitcoin’s price. Periods of high inflation often drive investors towards alternative assets like Bitcoin, perceived as a hedge against inflation. Conversely, rising interest rates can decrease Bitcoin’s attractiveness as investors seek higher returns from traditional assets. Recessionary fears can also impact Bitcoin’s price, leading to either a flight to safety (driving up its value) or a sell-off as investors liquidate assets to cover losses in other markets. For example, the 2022 bear market was partially driven by rising interest rates and fears of a global recession. The strength of the US dollar, a global reserve currency, also plays a significant role, as a stronger dollar often correlates with a weaker Bitcoin price.

Regulatory Developments

Global and regional regulatory frameworks significantly impact Bitcoin adoption and price. Favorable regulations, such as clear guidelines for Bitcoin exchanges and institutional investors, can boost investor confidence and increase demand. Conversely, restrictive regulations or outright bans can severely limit Bitcoin’s growth and negatively affect its price. The varying regulatory approaches across different jurisdictions, such as El Salvador’s adoption of Bitcoin as legal tender versus China’s ban, highlight the significant impact of regulatory landscapes on Bitcoin’s price. Increased regulatory clarity globally could lead to a surge in institutional investment and, consequently, price appreciation.

Technological Advancements

Technological advancements within the Bitcoin ecosystem are crucial in determining its long-term value. Layer-2 scaling solutions, like the Lightning Network, aim to improve transaction speed and reduce fees, making Bitcoin more practical for everyday use. Increased institutional adoption, driven by improved custody solutions and regulatory clarity, could lead to higher demand and price appreciation. For instance, the growing number of publicly traded companies holding Bitcoin on their balance sheets signals increasing institutional confidence. These technological and adoption improvements could significantly impact the price, driving wider adoption and increasing its overall utility.

Bitcoin’s Network Security and Hashrate

Bitcoin’s network security, measured by its hashrate (the computational power securing the network), is paramount to its long-term value. A high hashrate signifies a more secure and resilient network, deterring attacks and increasing investor confidence. A significant drop in hashrate could signal vulnerabilities and negatively impact the price. Conversely, a sustained increase in hashrate demonstrates network strength and can contribute to price stability and growth. The network’s robustness is a fundamental factor underpinning Bitcoin’s value proposition as a decentralized, secure digital asset.

Potential Black Swan Events

Unforeseen events, or “black swans,” can significantly disrupt Bitcoin’s price. These could include major security breaches compromising the Bitcoin network, unforeseen regulatory crackdowns leading to widespread adoption restrictions, a significant technological flaw discovered in the Bitcoin protocol, or a major geopolitical event causing widespread market instability. The 2020 COVID-19 pandemic, while not directly targeting Bitcoin, illustrates how unforeseen global events can significantly impact cryptocurrency markets, creating both volatility and opportunities. The potential for such unforeseen events underscores the inherent risk associated with Bitcoin investment.

Bitcoin Adoption and Market Sentiment in 2025

Predicting the future of Bitcoin adoption and market sentiment is inherently challenging, given the volatile nature of cryptocurrency markets and the constantly evolving regulatory landscape. However, by analyzing current trends and extrapolating based on historical data, we can formulate plausible scenarios for Bitcoin’s trajectory by 2025. This analysis will focus on institutional investment, Bitcoin’s utility as both a store of value and medium of exchange, and the overall shift in public perception.

Projected Growth of Bitcoin Adoption Among Institutional Investors, Bitcoin Prediction 2025 Halving

Institutional investors, including hedge funds, asset management firms, and corporations, are increasingly incorporating Bitcoin into their portfolios. The 2021 bull run saw significant institutional inflows, driven by a desire for diversification and exposure to a potentially high-growth asset. By 2025, this trend is expected to continue, albeit potentially at a slower pace than the initial surge. Factors such as regulatory clarity, the development of robust custodial solutions, and the maturation of Bitcoin’s underlying technology will all influence the rate of institutional adoption. We might see a scenario where large financial institutions, initially hesitant, begin to allocate a larger percentage of their assets to Bitcoin, mirroring the gradual integration of other alternative assets into mainstream portfolios. For example, BlackRock’s recent filing for a spot Bitcoin ETF signals a potential shift in the landscape. This suggests a future where institutional adoption surpasses current levels significantly, potentially reaching a point where Bitcoin holdings represent a notable fraction of overall institutional investment portfolios.

Increased Bitcoin Usage as a Store of Value and a Medium of Exchange

Bitcoin’s potential as a store of value is increasingly recognized, driven by its scarcity and decentralized nature. However, its adoption as a medium of exchange remains relatively limited. While the transaction fees and volatility remain obstacles, the development of the Lightning Network and other second-layer solutions aims to address these challenges. By 2025, we might see a notable increase in Bitcoin’s use for cross-border payments, particularly in regions with unstable fiat currencies or underdeveloped financial systems. The growth of Bitcoin ATMs and merchant acceptance, albeit slowly, could contribute to increased adoption as a medium of exchange, though its widespread use as everyday currency in developed economies might remain limited. El Salvador’s adoption of Bitcoin as legal tender, despite its challenges, serves as a real-world example, albeit a controversial one, of the potential for wider adoption as a medium of exchange, especially in nations seeking financial innovation and independence.

Evolution of Public Sentiment Towards Bitcoin by 2025

Public sentiment towards Bitcoin has fluctuated significantly since its inception. Periods of high price volatility have often been accompanied by increased skepticism and negative media coverage, while price rallies tend to generate greater interest and positive sentiment. By 2025, a more nuanced and informed public perception is likely to emerge. While volatility will likely persist, a larger segment of the population might understand Bitcoin’s underlying technology and its potential implications. Increased media literacy and education efforts could contribute to a more balanced and less emotionally driven understanding of Bitcoin’s role in the financial ecosystem. This doesn’t necessarily imply universal acceptance, but rather a shift from outright dismissal to a more considered and measured assessment.

Comparison of Current and Projected Bitcoin Adoption Rates

Currently, Bitcoin adoption is concentrated among tech-savvy individuals, early adopters, and a growing number of institutional investors. However, widespread mainstream adoption remains limited. By 2025, a significant expansion of adoption across various demographics is anticipated. While precise figures are impossible to predict, we can expect a noticeable increase in the number of Bitcoin users and holders, particularly among younger generations who are more comfortable with digital assets. The gap between early adopters and the general public will likely narrow, although mass adoption might still be several years away.

Projected Bitcoin Adoption Rates Across Different Demographics

The following text-based representation illustrates projected adoption rates (hypothetical percentages) across different age groups in 2025. These are illustrative and should not be interpreted as precise predictions.

| Age Group | Projected Adoption Rate (%) |

|—————–|—————————|

| 18-35 | 25 |

| 36-55 | 15 |

| 56+ | 5 |

This table suggests a higher adoption rate among younger generations, reflecting their greater familiarity with technology and digital currencies. It also illustrates the potential for future growth, as the older demographics show lower adoption rates but potentially demonstrate a growing interest in the future. This projection reflects a general trend observed across emerging technologies, where younger generations often adopt new innovations more readily.

Risks and Challenges Facing Bitcoin in 2025

Bitcoin’s continued growth isn’t without its hurdles. By 2025, several significant risks and challenges could impact its trajectory, ranging from technical vulnerabilities to regulatory uncertainty and environmental concerns. Understanding these potential obstacles is crucial for assessing Bitcoin’s long-term prospects.

Security Risks and Vulnerabilities

While Bitcoin’s underlying blockchain technology is robust, various security risks persist. These include the ongoing threat of sophisticated hacking attempts targeting exchanges and individual wallets, the potential for 51% attacks on smaller, less-secure altcoins which could indirectly affect Bitcoin’s reputation, and the persistent risk of vulnerabilities in software wallets or exchanges being exploited. Furthermore, the increasing sophistication of phishing scams and social engineering attacks poses a constant threat to users’ funds. For example, the 2022 collapse of the FTX exchange highlighted the vulnerabilities inherent in centralized custody solutions and the potential for significant financial losses due to security breaches. Robust security practices, including the use of hardware wallets and multi-signature transactions, remain crucial to mitigate these risks.

Challenges Posed by Energy Consumption

Bitcoin mining’s energy intensity remains a significant concern. The environmental impact of the vast amounts of electricity required for mining continues to draw criticism and regulatory scrutiny. While the transition to more sustainable energy sources for mining is underway, the scale of Bitcoin’s energy consumption presents a substantial challenge to its long-term viability, particularly in regions with limited renewable energy infrastructure. For instance, the carbon footprint of Bitcoin mining in countries heavily reliant on fossil fuels could become a major obstacle to wider adoption, leading to potential regulatory restrictions. This necessitates a continuous focus on improving mining efficiency and exploring more environmentally friendly solutions.

Regulatory Crackdowns on Bitcoin and Cryptocurrencies

The regulatory landscape surrounding Bitcoin and cryptocurrencies remains highly fragmented and uncertain. Governments worldwide are grappling with how to regulate this nascent asset class, leading to the potential for differing and sometimes conflicting regulations across jurisdictions. Increased regulatory scrutiny, including stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, could hinder Bitcoin’s accessibility and potentially stifle its growth. Examples include China’s ban on cryptocurrency trading and the ongoing debate in the United States regarding cryptocurrency regulation, illustrating the potential for significant disruptions to the market. Navigating this complex and evolving regulatory environment will be a key challenge for Bitcoin in 2025.

Risks Associated with Market Manipulation and Price Volatility

Bitcoin’s price is notoriously volatile, subject to significant swings driven by various factors, including market sentiment, regulatory announcements, and macroeconomic events. This volatility creates opportunities for market manipulation, particularly by large players with significant holdings. The potential for “whale” manipulation, where large investors influence the price through coordinated buying or selling, remains a considerable risk. For example, the significant price drops experienced in previous years highlight the vulnerability of the market to large-scale sell-offs. Strengthening market transparency and improving regulatory oversight are crucial to mitigating the risks associated with price manipulation and volatility.

Potential Threats to Bitcoin’s Long-Term Viability

The following table categorizes potential threats to Bitcoin’s long-term viability based on their severity and likelihood.

| Threat | Severity | Likelihood |

|---|---|---|

| Widespread regulatory crackdowns leading to significant limitations on use | High | Medium |

| A major security breach compromising a significant portion of Bitcoin’s network | High | Low |

| Failure to adopt more sustainable mining practices, leading to increased environmental pressure | Medium | High |

| Emergence of a superior competing cryptocurrency | Medium | Medium |

| Persistent market manipulation and price volatility undermining investor confidence | Medium | High |

Alternative Predictions and Expert Opinions: Bitcoin Prediction 2025 Halving

Predicting Bitcoin’s price is notoriously difficult, with experts offering a wide range of forecasts for 2025. These predictions stem from varying methodologies, underlying assumptions about market adoption, and interpretations of macroeconomic factors. Understanding the diversity of these viewpoints is crucial for a comprehensive perspective on potential future scenarios.

Comparison of Bitcoin Price Predictions

Several prominent analysts and firms have published Bitcoin price predictions for 2025. These predictions often differ significantly, reflecting the inherent uncertainty in the cryptocurrency market. For instance, some analysts, basing their predictions on adoption rates and network effects, forecast prices exceeding $100,000, while others, focusing on potential regulatory hurdles and macroeconomic instability, predict considerably lower figures, even below $50,000. The range highlights the wide spectrum of possibilities and the limitations of any single predictive model. These differences underscore the importance of considering multiple perspectives before forming an opinion.

Methodologies Used in Price Predictions

Different experts employ diverse methodologies to arrive at their price predictions. Some utilize sophisticated econometric models incorporating historical price data, transaction volume, and market capitalization. Others focus on fundamental analysis, considering factors such as the supply and demand dynamics of Bitcoin, its potential as a store of value, and its adoption by institutional investors. Still others rely on technical analysis, interpreting chart patterns and indicators to predict future price movements. The choice of methodology significantly influences the resulting prediction, leading to discrepancies in the outcomes.

Impact of Differing Assumptions on Price Predictions

The assumptions made about future market conditions are a major driver of differing price predictions. For example, predictions assuming widespread institutional adoption and a stable macroeconomic environment tend to be significantly higher than those assuming limited adoption and significant regulatory uncertainty or a global economic downturn. The anticipation of a positive regulatory environment versus a negative one, for instance, can significantly alter the projected price. Similarly, differing assumptions about the rate of technological innovation in the crypto space can also lead to divergent outcomes.

Summary of Prominent Research Reports

While specific reports are constantly evolving, many research firms regularly publish analyses of Bitcoin’s potential. These reports often include scenarios outlining various price trajectories depending on different assumptions. For instance, a hypothetical report from “Crypto Research Group” might present a “bullish” scenario predicting a price of $150,000 based on high adoption and institutional investment, and a “bearish” scenario predicting a price of $30,000 based on regulatory crackdowns and decreased investor interest. The inclusion of such varied scenarios within a single report highlights the uncertainties involved.

“Bitcoin’s price in 2025 will ultimately depend on the interplay of technological advancements, regulatory clarity, and broader macroeconomic trends. While the halving event will undoubtedly play a role, it’s only one piece of a much larger and complex puzzle. We anticipate a range of outcomes, but a price between $60,000 and $90,000 seems most probable given current trends.” – Dr. Anya Sharma, Fictional Chief Economist, Global Crypto Insights.

Frequently Asked Questions (FAQs)

This section addresses common questions regarding the Bitcoin halving, its impact on price, influencing factors, investment risks, and reliable information sources. Understanding these aspects is crucial for navigating the complexities of the Bitcoin market.

Bitcoin Halving Explained

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by half. This occurs approximately every four years, or every 210,000 blocks mined. The halving mechanism is designed to control Bitcoin’s inflation rate and maintain its scarcity over time. For example, the initial block reward was 50 BTC, reduced to 25 BTC after the first halving, then 12.5 BTC after the second, and currently stands at 6.25 BTC. The next halving, in 2025, will reduce this reward to 3.125 BTC.

The Halving’s Effect on Bitcoin’s Price

Historically, Bitcoin’s price has often seen an upward trend following a halving event. This is primarily attributed to the decreased supply of newly mined Bitcoin, potentially increasing its scarcity and driving demand. However, it’s important to note that other factors also influence the price, and a price increase isn’t guaranteed. The 2012 and 2016 halvings were followed by significant price rallies, but various market conditions also played a role. Predicting the exact impact of the 2025 halving is challenging due to the complexity of the cryptocurrency market.

Major Factors Influencing Bitcoin’s Price in 2025

Several interconnected factors will likely influence Bitcoin’s price in 2025. These include macroeconomic conditions (like inflation and interest rates), technological advancements (such as layer-2 scaling solutions), regulatory developments (government policies on cryptocurrencies), and overall market sentiment (investor confidence and adoption rates). For instance, a global economic downturn could negatively impact Bitcoin’s price, while widespread institutional adoption could drive prices higher. Technological innovations that enhance Bitcoin’s efficiency and usability could also boost its appeal.

Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries inherent risks. Its price is highly volatile, subject to significant fluctuations in short periods. Regulatory uncertainty in various jurisdictions poses another risk, as governments could implement policies that negatively affect Bitcoin’s value or accessibility. Security risks, such as exchange hacks or loss of private keys, are also significant concerns. Furthermore, the decentralized nature of Bitcoin means there is no central authority to protect investors from losses. Finally, Bitcoin’s price is susceptible to market manipulation and speculative bubbles.

Reliable Information Sources for Bitcoin Predictions

Reliable information about Bitcoin predictions should be sought from reputable sources. These include established financial news outlets with dedicated cryptocurrency coverage, peer-reviewed academic research on blockchain technology and cryptocurrencies, and reports from well-regarded market analysis firms specializing in digital assets. It is crucial to be discerning and critical of information found online, particularly on social media, as much of it may be biased, inaccurate, or misleading. Always cross-reference information from multiple credible sources before making any investment decisions.

Predicting Bitcoin’s price in 2025 after the halving is a complex endeavor, influenced by numerous factors. Understanding the historical impact of previous halvings is crucial, and a valuable resource for this analysis is available at Bitcoin Halving 2025 Preis , which provides insights into potential price movements. Ultimately, Bitcoin Prediction 2025 Halving remains speculative, yet informed analysis like this can help refine our estimations.

Predicting Bitcoin’s price after the 2025 halving is a complex undertaking, influenced by numerous factors beyond the reduced supply. Understanding the mechanics of this event is crucial for any prediction, and a great resource for this is the detailed analysis found on this website: 2025. Bitcoin. Halving..

Ultimately, Bitcoin’s future price in 2025 will depend on a confluence of market sentiment, regulatory developments, and technological advancements, making any prediction inherently uncertain.

Predicting Bitcoin’s price after the 2025 halving is a complex undertaking, with various factors influencing the outcome. To understand the potential impact, staying updated on relevant news is crucial. For comprehensive coverage, check out the latest developments at Bitcoin Halving 2025 News to better inform your Bitcoin Prediction 2025 Halving analysis. Ultimately, the halving’s effect remains a subject of ongoing discussion and speculation within the crypto community.

Predicting Bitcoin’s price after the 2025 halving is a complex endeavor, with many analysts offering diverse forecasts. To stay informed on the event itself, you can follow real-time updates at Bitcoin Halving 2025 Live. Understanding the halving’s impact is crucial for accurate Bitcoin Prediction 2025 Halving analysis, influencing future price trajectories.