Bitcoin Prediction 2025 Reddit

Predicting the future price of Bitcoin is a notoriously difficult task, and Reddit, with its diverse and often speculative community, reflects this uncertainty. While offering a wide range of opinions, Reddit discussions regarding Bitcoin’s 2025 price generally showcase a blend of optimism, pessimism, and a healthy dose of meme-driven speculation. The overall sentiment is highly volatile, shifting rapidly based on market trends, technological developments, and regulatory news.

Reddit’s prediction landscape for Bitcoin in 2025 is diverse and heavily influenced by the platform’s decentralized nature. Users’ predictions are often based on varying degrees of technical analysis, fundamental analysis, and gut feeling. The lack of central moderation on most relevant subreddits leads to a wide spectrum of opinions, from extremely bullish to extremely bearish.

Subreddits Dedicated to Bitcoin and Their Prediction Styles

Several prominent subreddits are central to Bitcoin price prediction discussions. r/Bitcoin, the largest and most established Bitcoin subreddit, tends to attract a mix of long-term holders (“HODLers”), technical analysts, and those interested in the underlying technology. Predictions here often involve charting patterns, examining on-chain metrics, and considering macroeconomic factors. In contrast, subreddits like r/CryptoCurrency or r/BitcoinMarkets often feature more speculative and short-term oriented predictions, frequently influenced by current market sentiment and news cycles. The style of predictions on r/CCryptocurrency tends to be more volatile and reactive to immediate price swings, while r/Bitcoin’s discussions usually incorporate a longer-term perspective, though still susceptible to market fluctuations. Finally, more niche subreddits focused on specific aspects of Bitcoin, like mining or development, might offer predictions based on their particular area of expertise.

Range of Bitcoin Price Predictions for 2025 on Reddit

The range of Bitcoin price predictions on Reddit for 2025 is exceptionally wide, spanning from extremely low predictions (some suggesting prices below current levels due to various bearish scenarios like increased regulation or market crashes) to extremely high predictions (reaching into the hundreds of thousands of dollars per Bitcoin, fueled by bullish scenarios such as widespread institutional adoption or significant technological advancements). For example, some users might base a low prediction on the possibility of a prolonged bear market, citing historical precedents and concerns about macroeconomic instability. Conversely, a high prediction might be based on the expectation of increasing institutional investment and a growing demand for Bitcoin as a store of value, possibly pointing to past periods of rapid price appreciation as a justification. It’s crucial to remember that these predictions are speculative and lack any guarantee of accuracy. The actual price in 2025 will be determined by a multitude of interacting factors, making any single prediction highly uncertain.

Factors Influencing Reddit’s Bitcoin Predictions for 2025

Reddit’s Bitcoin price predictions for 2025 are a complex interplay of various factors, reflecting the diverse perspectives and information available to its vast user base. These predictions aren’t solely based on technical analysis; they’re heavily influenced by broader economic trends, technological developments, regulatory landscapes, and significant market events. Understanding these influences provides valuable insight into the formation and variability of these online forecasts.

Macroeconomic factors significantly shape the sentiment surrounding Bitcoin on Reddit. Periods of high inflation, for instance, often lead to increased interest in Bitcoin as a hedge against inflation, fueling bullish predictions. Conversely, rising interest rates, which increase the opportunity cost of holding non-yielding assets like Bitcoin, can dampen enthusiasm and lead to more bearish predictions. Recessions, characterized by economic uncertainty, can create a mixed bag of predictions, with some seeing Bitcoin as a safe haven and others fearing a further price decline alongside broader market crashes. For example, the 2022 bear market, coinciding with rising interest rates and high inflation, saw a significant shift in Reddit’s predictive sentiment towards lower Bitcoin prices.

Macroeconomic Influences on Bitcoin Price Predictions

The correlation between macroeconomic indicators and Bitcoin price is not always straightforward and often debated. While inflation might drive demand for Bitcoin as a store of value, the impact of interest rate hikes is more complex. Higher rates can reduce investment in riskier assets, potentially impacting Bitcoin’s price. The severity of a recession and its duration also play a significant role. A short, sharp recession might lead to temporary price drops, while a prolonged downturn could result in more sustained bearish sentiment on platforms like Reddit. The interplay of these factors creates a dynamic environment, resulting in fluctuating predictions. For example, some Reddit users might predict a surge in Bitcoin’s price during inflationary periods, while others might foresee a drop due to potential tightening of monetary policy.

Technological Advancements and Bitcoin Predictions

Technological advancements impacting Bitcoin’s scalability and usability directly influence Reddit’s predictive discussions. The adoption and effectiveness of scaling solutions, such as the Lightning Network, are frequently discussed. Wider adoption of the Lightning Network, which enables faster and cheaper transactions, could potentially lead to increased Bitcoin usage and, consequently, more optimistic price predictions. Conversely, significant technological hurdles or security concerns surrounding these solutions might dampen enthusiasm and lead to more cautious predictions. The ongoing development and implementation of layer-2 solutions are frequently analyzed and debated on Reddit, influencing the overall sentiment.

Regulatory Changes and Their Impact

Global Bitcoin regulations and taxation policies significantly impact the conversation surrounding Bitcoin’s future price on Reddit. Favorable regulatory frameworks, such as clear guidelines for Bitcoin taxation and acceptance of Bitcoin as a legitimate asset class, could attract institutional investment and boost the price. Conversely, stringent regulations, such as outright bans or excessively high taxes, could negatively impact price predictions. Discussions around regulatory clarity and uncertainty often dominate Reddit threads, shaping the sentiment towards future price movements. For example, news of a country adopting Bitcoin as legal tender could trigger a wave of bullish predictions, while news of a regulatory crackdown could cause the opposite effect.

Influence of Significant Market Events

Major market events, such as Bitcoin halvings and exchange hacks, profoundly impact Reddit’s predictive discussions. Bitcoin halvings, which reduce the rate of new Bitcoin creation, are often associated with long-term bullish price predictions due to the reduced supply. Conversely, major exchange hacks, which can lead to significant loss of funds and erode investor confidence, can trigger negative sentiment and more pessimistic predictions. The immediate impact of these events is often reflected in the short-term predictions on Reddit, with longer-term predictions often taking into account the historical impact of similar events. For instance, the Mt. Gox hack in 2014 had a significant negative impact on the market, influencing subsequent predictions for several years.

Analyzing Different Perspectives on Reddit

Reddit’s Bitcoin prediction threads for 2025 showcase a fascinating dichotomy of bullish and bearish sentiment, fueled by diverse analytical approaches and interpretations of market indicators. Understanding these differing viewpoints is crucial for navigating the complexities of Bitcoin price forecasting.

Bitcoin Prediction 2025 Reddit – The range of predictions on Reddit reflects the inherent volatility and uncertainty surrounding Bitcoin’s future. While some users confidently predict prices exceeding $100,000, others foresee a significant correction, potentially pushing the price far below current levels. These differing predictions stem not only from differing interpretations of the same data but also from the employment of various analytical methods.

Discussions on Bitcoin Prediction 2025 Reddit are often lively and varied, with predictions ranging wildly. Understanding these predictions requires looking at various factors, including current market trends and technological advancements. For a detailed perspective on potential price points, you might find this analysis helpful: Bitcoin Price In 2025 Year. Ultimately, though, Reddit discussions only offer a snapshot of collective opinion, not a definitive forecast for Bitcoin’s future.

Bullish and Bearish Predictions on Reddit

Bullish predictions often cite factors like increasing institutional adoption, growing global demand, and the limited supply of Bitcoin as drivers of price appreciation. For example, posts frequently highlight the potential for Bitcoin to become a significant store of value in a world grappling with inflation and economic uncertainty. These arguments are often supported by technical analysis, pointing to potential breakouts above key resistance levels. Conversely, bearish predictions emphasize potential regulatory hurdles, macroeconomic downturns, and the cyclical nature of cryptocurrency markets. Concerns about environmental impact and the potential for a “crypto winter” also contribute to bearish sentiment. One example would be Reddit threads highlighting historical price crashes and correlating them with broader economic trends. Bearish users might point to the possibility of a significant market correction as a necessary event to eliminate speculation and establish a more sustainable price range.

Prediction Methodologies Employed on Reddit

Reddit users employ a variety of methodologies to arrive at their Bitcoin price predictions for 2025. Technical analysis, focusing on chart patterns, indicators (like RSI and MACD), and historical price movements, is prevalent. Fundamental analysis, which considers factors like adoption rates, regulatory changes, and technological advancements, also plays a significant role. Some users combine these approaches, while others rely on more qualitative assessments, incorporating news events, social sentiment, and broader macroeconomic trends into their forecasts. A smaller subset of users might even utilize on-chain metrics, examining data like transaction volume, mining difficulty, and network activity to gauge market sentiment and predict future price movements.

Examples of Reddit Posts Illustrating Diverse Viewpoints

One example of a bullish post might show a technical chart highlighting a potential “golden cross,” suggesting a significant upward price movement. The user would likely support this with arguments about growing institutional investment and positive media coverage. In contrast, a bearish post might cite a historical analogy to previous Bitcoin bear markets, emphasizing the cyclical nature of the cryptocurrency and predicting a prolonged period of low prices. This user might support their argument by pointing to macroeconomic factors like rising interest rates or potential regulatory crackdowns. Another user might focus on on-chain data, highlighting a decrease in active addresses as a signal of weakening market sentiment.

Summary of Key Arguments for and Against Significant Price Movements in 2025

| Argument For Significant Price Increase | Supporting Evidence from Reddit | Argument For Significant Price Decrease | Supporting Evidence from Reddit |

|---|---|---|---|

| Increased Institutional Adoption | Posts highlighting investments by large corporations and financial institutions. | Regulatory Crackdowns | Discussions about potential government regulations impacting Bitcoin’s price. |

| Growing Global Demand | References to increasing Bitcoin usage in developing countries and emerging markets. | Macroeconomic Downturn | Analysis linking Bitcoin price to broader economic indicators and potential recessions. |

| Limited Supply of Bitcoin | Emphasis on Bitcoin’s scarcity and its potential as a deflationary asset. | Environmental Concerns | Posts discussing the energy consumption of Bitcoin mining and its impact on sustainability. |

| Technological Advancements | Discussions about scaling solutions and improvements to the Bitcoin network. | Increased Competition from Altcoins | Analysis comparing Bitcoin to other cryptocurrencies and highlighting potential market share losses. |

The Reliability and Accuracy of Reddit Predictions: Bitcoin Prediction 2025 Reddit

Predicting Bitcoin’s price is notoriously difficult, and Reddit, while a vibrant hub for cryptocurrency discussion, is no exception. The platform’s decentralized and anonymous nature, coupled with the inherent volatility of Bitcoin, makes assessing the reliability and accuracy of its price predictions a complex task. Many factors contribute to the often-widely varying and ultimately unreliable nature of these forecasts.

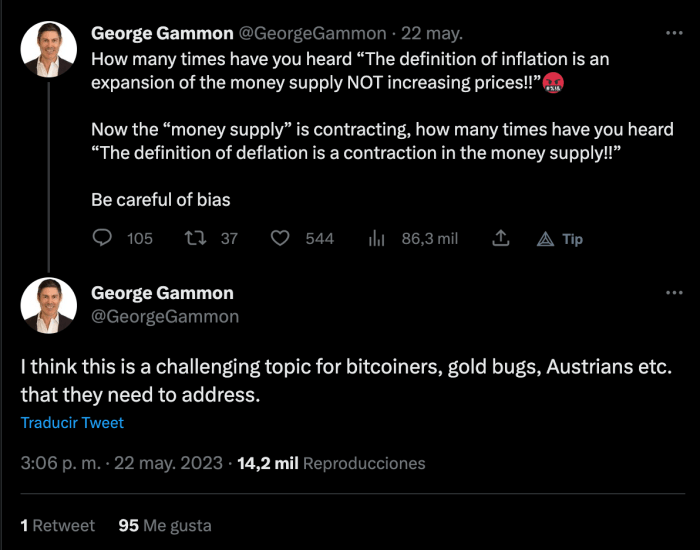

The limitations and potential biases inherent in Reddit’s Bitcoin price predictions stem from several sources. Firstly, the anonymity of many users prevents verification of their expertise or even their sincerity. Secondly, confirmation bias—the tendency to seek out and interpret information confirming pre-existing beliefs—is rampant. Users may selectively highlight positive news while ignoring contradictory data, leading to overly optimistic (or pessimistic) predictions. Finally, the inherent “wisdom of the crowds” effect, while sometimes accurate, is not guaranteed, especially in a highly speculative market like Bitcoin. The crowd’s collective intelligence can be easily skewed by misinformation, hype cycles, and the influence of prominent, potentially biased, community members.

Historical Accuracy of Reddit Bitcoin Predictions

Evaluating the historical accuracy of Reddit’s Bitcoin predictions requires careful consideration. While pinpointing specific predictions and their outcomes is challenging due to the sheer volume of posts and the lack of a centralized record-keeping system, anecdotal evidence suggests a mixed bag. Many predictions, especially those made during periods of significant market volatility, have been wildly inaccurate. For example, in late 2017, numerous Reddit posts predicted Bitcoin would reach $100,000 or more within a short timeframe. The actual price peaked around $20,000 before experiencing a significant correction. Conversely, some predictions during periods of relative market stability have proven surprisingly accurate, although often with a significant margin of error in timing. The lack of systematic data collection on Reddit predictions makes comprehensive analysis difficult, hindering the ability to definitively assess overall accuracy rates.

Examples of Accurate and Inaccurate Predictions

While precise data on Reddit’s predictive accuracy is unavailable, we can look at illustrative examples. One example of a relatively accurate prediction (though with timing inaccuracies) involved predictions made in early 2020, following the halving event. Many users correctly anticipated a subsequent price increase, though the magnitude and timing differed significantly from their predictions. On the other hand, numerous predictions made during the 2018 bear market drastically underestimated the depth and duration of the downturn. These examples highlight the unpredictable nature of Bitcoin and the limitations of crowd-sourced forecasting on platforms like Reddit. The accuracy of any prediction depends heavily on the underlying assumptions and the unpredictable influence of external factors.

Factors Contributing to Unreliable Crowd-Sourced Predictions

Several factors contribute to the unreliability of crowd-sourced predictions on platforms like Reddit. The lack of accountability and verification of users’ expertise is a major issue. Anyone can post a prediction, regardless of their knowledge or understanding of the market. The inherent volatility of Bitcoin, coupled with the influence of news cycles and social media hype, further complicates accurate forecasting. Furthermore, the presence of bots and coordinated campaigns designed to manipulate market sentiment can significantly skew crowd-sourced opinions, rendering them unreliable. Finally, the echo chamber effect within online communities can reinforce biases and prevent the consideration of alternative perspectives, leading to inaccurate and overly optimistic or pessimistic predictions.

Responsible Investing and Risk Assessment

Investing in Bitcoin, or any cryptocurrency, based on discussions found on online forums like Reddit requires a cautious and informed approach. While Reddit can offer a diverse range of opinions and perspectives, it’s crucial to understand that these opinions are not financial advice and should never be the sole basis for investment decisions. Relying solely on Reddit for investment strategies can lead to significant financial losses.

The inherent volatility of the cryptocurrency market amplifies the risks associated with using online forums as primary sources of information. Reddit discussions often reflect the prevailing sentiment of the moment, which can be highly susceptible to hype, fear, and misinformation. This can lead to impulsive decisions, buying high during periods of exuberance and selling low during market corrections, ultimately resulting in substantial losses.

The Importance of Independent Research

Before making any investment decision influenced by Reddit discussions, it is paramount to conduct thorough independent research. This involves critically evaluating the information presented on Reddit, cross-referencing it with data from reputable sources, and understanding the underlying technology and market dynamics of Bitcoin. For example, a positive Reddit thread about a specific Bitcoin development might not necessarily translate into a guaranteed price increase. Independent research into the actual impact of that development on Bitcoin’s adoption and functionality is essential before making an investment. Failing to conduct such research increases the likelihood of making uninformed decisions.

Risks Associated with Relying on Online Forums, Bitcoin Prediction 2025 Reddit

Relying solely on online forums like Reddit for financial advice presents several significant risks. These include exposure to misinformation, manipulation, and the lack of professional guidance. Unverified claims, biased opinions, and even deliberate misinformation campaigns can easily spread on online forums, leading investors astray. Furthermore, the absence of regulatory oversight and professional accountability on Reddit means there is no guarantee of the accuracy or integrity of the information shared. The absence of a structured approach to risk assessment inherent in professional financial advice is a key risk. For instance, an individual might be swayed by a Reddit post predicting a substantial price increase, neglecting to consider the potential for a sharp downturn and the resulting financial consequences.

Evaluating the Credibility of Reddit Sources

Evaluating the credibility of sources on Reddit requires a critical and discerning approach. Several factors should be considered: the poster’s history and reputation on the platform, the quality and sourcing of their information, and the presence of supporting evidence. Look for users with a history of providing accurate and well-researched information. Be wary of posts lacking verifiable sources or those that promote specific projects or investments aggressively. Consider whether the information presented aligns with information from other credible sources. For example, a user claiming Bitcoin will reach $100,000 by 2025 without providing any supporting analysis or referencing reputable market forecasts should be viewed with extreme skepticism.

Reputable Sources for Bitcoin Information

To obtain accurate and unbiased information on Bitcoin and the cryptocurrency market, it is vital to consult reputable sources. These include established financial news outlets like Bloomberg and Reuters, cryptocurrency data providers like CoinMarketCap and CoinGecko, and research firms specializing in blockchain technology and digital assets. Governmental regulatory bodies and academic research papers can also offer valuable insights. Always cross-reference information from multiple sources to gain a more comprehensive and balanced perspective. Relying solely on a single source, even a seemingly reputable one, can still expose you to biases and potential inaccuracies.

Illustrative Examples from Reddit

Reddit, with its diverse and often highly speculative community, offers a fascinating case study in Bitcoin price prediction. While individual posts shouldn’t be taken as financial advice, analyzing trends and reasoning within these discussions can reveal interesting insights into market sentiment and the factors driving predictions. The examples below illustrate the range of opinions and the often-unconventional methods used to justify them.

Many Reddit threads dedicated to Bitcoin predictions for 2025 rely on a mixture of technical analysis, fundamental analysis, and often, pure speculation. Some users base their forecasts on historical price movements, charting patterns, and comparing Bitcoin’s adoption rate to that of other technologies. Others focus on macroeconomic factors, such as inflation, regulatory changes, or the overall state of the global economy. Still others simply express gut feelings or base their predictions on their own understanding of the technology and its potential.

Reddit Thread Example: The “Halving Hype”

One popular thread on r/Bitcoin predicted a price surge to $250,000 by 2025, primarily based on the upcoming Bitcoin halving events. The argument centered around the idea that the reduced supply of newly mined Bitcoin, coupled with increasing demand, would inevitably drive the price higher. The thread included several charts illustrating the historical correlation between Bitcoin halvings and subsequent price increases. One hypothetical chart depicted a steadily rising price curve, with sharp upward spikes coinciding with each halving event. The data points on this imagined chart would show the price of Bitcoin at various points in time, leading up to and including the projected $250,000 mark in 2025. The trend line would be clearly upward, though with some fluctuations reflecting market volatility. Another chart visualized the diminishing supply of Bitcoin over time, illustrating the scarcity argument.

Reddit Post Example: The “Technological Adoption” Prediction

A single Reddit post on r/Cryptocurrency predicted a more conservative price of $100,000 by 2025. This prediction was primarily based on the projected growth in Bitcoin’s adoption as a payment method and store of value. The user argued that increased institutional investment, coupled with growing mainstream awareness and acceptance, would lead to a gradual but steady increase in demand, ultimately driving the price higher. The reasoning involved extrapolating current adoption trends and comparing them to historical adoption curves of other technologies. This user didn’t provide a chart, but the implied visualization would likely show a less dramatic, more gradual upward trend compared to the “Halving Hype” prediction, suggesting a more stable growth trajectory.

Hypothetical Scenario: Impact of a $500,000 Prediction

Imagine a prominent Reddit user posts a detailed analysis predicting a Bitcoin price of $500,000 by 2025, supported by complex charts and seemingly robust reasoning. This prediction, widely shared and discussed, could significantly influence investor sentiment. A surge of new investors, driven by FOMO (fear of missing out), might pour money into Bitcoin, temporarily driving the price upwards. However, if the prediction proves inaccurate, it could lead to a significant market correction as investors panic-sell, potentially causing substantial losses for those who invested based on this prediction. This highlights the inherent risks involved in relying on speculative predictions from online forums, even those seemingly well-reasoned.

Frequently Asked Questions (FAQs)

This section addresses common questions regarding Bitcoin price predictions found on Reddit, their reliability, influencing factors, and where to find more dependable investment information. Understanding these aspects is crucial for navigating the often-volatile world of cryptocurrency investment.

Common Bitcoin Price Predictions on Reddit for 2025

Reddit discussions on Bitcoin’s 2025 price range widely. While specific numbers vary greatly depending on the user and their rationale, a common theme emerges: significant price volatility and a broad spectrum of potential outcomes. Some predict relatively modest increases, perhaps in the $50,000 to $100,000 range, citing factors like regulatory uncertainty and macroeconomic conditions. Others hold significantly more bullish views, suggesting prices could reach $250,000 or even higher, basing their predictions on factors such as increased adoption, technological advancements, and a potential scarcity effect. It’s vital to remember that these are merely speculative opinions, not guaranteed outcomes.

Reliability of Bitcoin Predictions from Reddit

The reliability of Bitcoin predictions from Reddit is questionable. Reddit, while a valuable platform for information sharing, is not a financial forecasting institution. Predictions are often influenced by individual biases, speculative hype, and a lack of rigorous analysis. Many Reddit users may lack the necessary financial expertise to make accurate price projections. Furthermore, the platform’s anonymous nature makes it difficult to verify the credibility of sources and their predictive capabilities. The presence of “pump and dump” schemes and emotionally driven posts further contributes to unreliable and potentially misleading information. Therefore, it’s crucial to treat any Reddit prediction with a significant degree of skepticism.

Factors Influencing Bitcoin Price Predictions on Reddit

Several factors shape Bitcoin price predictions on Reddit. These include: prevailing market sentiment (bullish or bearish), recent news events (e.g., regulatory announcements, technological breakthroughs, or macroeconomic shifts), technical analysis interpretations (chart patterns, indicators), fundamental analysis (assessments of Bitcoin’s underlying value proposition), and community sentiment and speculation (driven by social media trends and discussions within online communities). The interplay of these factors creates a dynamic and often unpredictable environment for price forecasting. For example, positive news about Bitcoin adoption by a major corporation might lead to a surge in bullish predictions, while regulatory crackdowns could trigger a wave of pessimistic forecasts.

Sources for More Reliable Information on Bitcoin Investments

For reliable information on Bitcoin investments, consult reputable sources such as established financial news outlets (e.g., Bloomberg, Reuters, The Wall Street Journal), cryptocurrency research firms (e.g., CoinMetrics, Glassnode), and government regulatory bodies (e.g., the SEC in the US). Thoroughly research any investment before committing capital. Consider consulting with a qualified financial advisor who understands the risks associated with cryptocurrency investments. Always be wary of promises of guaranteed returns or overly optimistic predictions. Remember that past performance is not indicative of future results, and Bitcoin’s price is highly volatile.

Discussions on Bitcoin Prediction 2025 Reddit often involve wide-ranging speculation. Understanding the broader cryptocurrency market is key, and for that, a helpful resource is this prediction for Crypto Price In 2025. Considering this broader context significantly enhances the informed nature of Bitcoin Prediction 2025 Reddit conversations, adding depth to individual predictions.

Discussions regarding Bitcoin Prediction 2025 Reddit often involve a wide range of opinions, from wildly optimistic to cautiously pessimistic. For a more data-driven perspective on potential price movements, you might find the analysis at Bitcoin Price 2025 Prediction helpful. Ultimately, though, these predictions should be considered alongside the ongoing Reddit conversations to gain a more comprehensive understanding of the cryptocurrency’s future.

Discussions around Bitcoin Prediction 2025 Reddit often involve speculation on potential price surges. A key element in these predictions centers around the possibility of a significant Bitcoin Price 2025 Bull Run , which would drastically alter the landscape of cryptocurrency investment. Consequently, understanding the factors driving these bullish forecasts is crucial for navigating the conversations found on Reddit.

Discussions regarding Bitcoin Prediction 2025 are prevalent on Reddit, with users sharing various perspectives and analyses. Understanding the intricacies of Bitcoin’s potential future value often involves exploring related projects, such as gaining insight from a resource like the Bitcoin Minetrix Price Prediction 2025 which can offer a different lens on the cryptocurrency market. Ultimately, these diverse viewpoints contribute to a richer understanding of the Bitcoin Prediction 2025 Reddit conversation.