Bitcoin Halving 2025

The Bitcoin halving, a significant event in the cryptocurrency’s lifecycle, is scheduled for 2025. This event, programmed into Bitcoin’s code, will reduce the rate at which new Bitcoins are created, impacting the overall supply and potentially influencing its market price. Understanding the historical context and the mechanics of this halving is crucial for navigating the potential market shifts.

Bitcoin Halving: A Core Mechanism

The Bitcoin halving is a pre-programmed reduction in the block reward that miners receive for verifying and adding new transactions to the blockchain. This reward, initially set at 50 BTC per block, is halved approximately every four years. The 2025 halving will mark the fourth such event in Bitcoin’s history, reducing the block reward from the current 6.25 BTC to 3.125 BTC. This reduction in newly minted Bitcoin directly affects the inflation rate of the cryptocurrency.

Historical Impact of Bitcoin Halvings

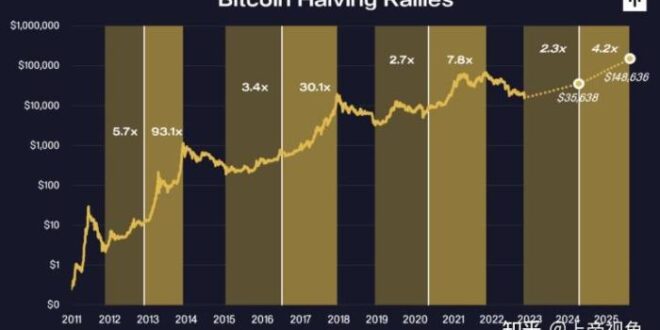

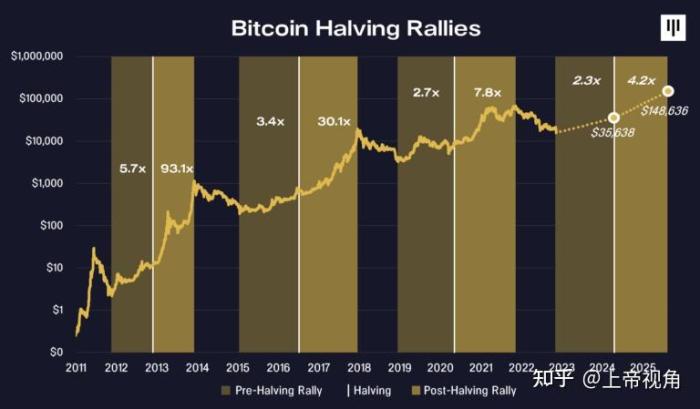

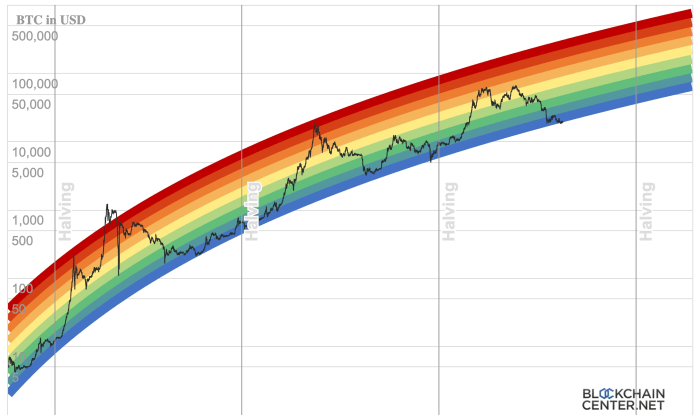

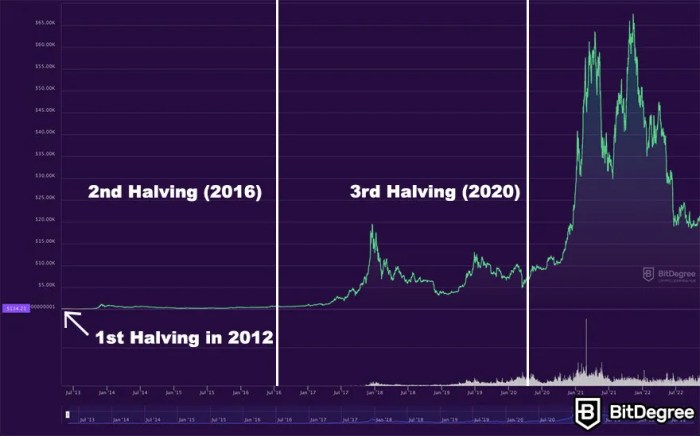

Previous halving events have demonstrated a notable correlation with subsequent price increases, although the exact causal relationship is complex and debated. The first halving in 2012 saw a relatively modest price increase. However, the subsequent halvings in 2016 and 2020 were followed by significant price rallies, albeit with periods of volatility and corrections. For example, following the 2020 halving, Bitcoin’s price experienced a substantial surge, reaching an all-time high later that year before undergoing a significant correction. This demonstrates that while a price increase often follows, it’s not guaranteed, and other market factors significantly influence the price. Attributing price movements solely to halving events is an oversimplification.

Expected Reduction in Block Reward

The 2025 halving will definitively reduce the block reward from 6.25 BTC to 3.125 BTC. This represents a 50% decrease in the rate at which new Bitcoins enter circulation. This reduction in supply, coupled with potentially sustained or increased demand, is a primary factor anticipated to contribute to price appreciation. However, macroeconomic conditions, regulatory changes, and overall market sentiment will all play a significant role in shaping the actual price movement. The historical data shows a correlation, not a certainty, between halving events and price increases. Predicting the exact price impact remains challenging and speculative.

Factors Influencing Bitcoin’s Price After the 2025 Halving: Bitcoin Prediction After Halving 2025

The 2025 Bitcoin halving, reducing the rate of new Bitcoin creation, is a significant event anticipated to impact its price. However, the actual price movement will be a complex interplay of various factors, not solely determined by the halving itself. Understanding these contributing elements is crucial for informed speculation about Bitcoin’s future value.

Supply and Demand Dynamics

The halving directly impacts Bitcoin’s supply. By reducing the rate of new Bitcoin entering circulation, the halving creates a scenario of decreased supply. Assuming demand remains relatively constant or increases, this reduced supply can theoretically drive up the price due to basic economic principles of scarcity. However, this is not guaranteed. The actual effect depends heavily on the prevailing market demand at the time. A surge in demand post-halving could lead to significant price appreciation, while a decline or stagnation in demand could mitigate the halving’s impact or even lead to price drops despite the reduced supply. The interplay between supply and demand is, therefore, paramount in determining the price trajectory. For example, the 2012 and 2016 halvings saw subsequent price increases, but the timing and magnitude of these increases varied significantly, highlighting the influence of other market factors.

Macroeconomic Influences

Global macroeconomic conditions significantly influence Bitcoin’s price. Factors like inflation rates, interest rate hikes by central banks, and overall economic growth or recession can heavily impact investor sentiment towards risk assets, including Bitcoin. High inflation might push investors towards Bitcoin as a hedge against inflation, increasing demand. Conversely, rising interest rates could make holding Bitcoin less attractive compared to higher-yielding bonds, potentially leading to price decreases. The state of the global economy, therefore, acts as a powerful external force shaping Bitcoin’s price irrespective of the halving. The 2022 bear market, for instance, was largely attributed to rising interest rates and a general economic downturn.

Regulatory Impact

Regulatory changes at national and international levels can profoundly affect Bitcoin’s price. Favorable regulations, such as clear legal frameworks for cryptocurrency trading and investment, could boost investor confidence and increase demand. Conversely, stringent regulations or outright bans can severely limit accessibility and trading volume, potentially suppressing the price. The regulatory landscape varies considerably across jurisdictions. A nation’s stance on cryptocurrencies, whether supportive, neutral, or restrictive, directly impacts its adoption rate and consequently, its influence on the global Bitcoin price. For instance, increased regulatory clarity in a major market like the United States could significantly boost Bitcoin’s price.

Technological Advancements

Technological advancements within the Bitcoin ecosystem can also impact its price. Improvements in scalability, transaction speed, and energy efficiency could attract more users and institutions, potentially increasing demand. Conversely, significant technological setbacks, such as major security breaches or unforeseen vulnerabilities, could erode investor confidence and lead to price declines. The development and adoption of the Lightning Network, for example, is a positive technological advancement that aims to improve Bitcoin’s scalability and transaction speed, potentially contributing positively to its price in the long term.

Increased Institutional Adoption Scenario

Imagine a scenario where major institutional investors, such as pension funds and sovereign wealth funds, significantly increase their Bitcoin holdings in the period following the 2025 halving. This influx of capital, driven by factors like diversification strategies and inflation hedging, could create substantial upward pressure on the price. Let’s hypothesize that $1 trillion in new institutional investment flows into Bitcoin within a year post-halving. Given the relatively limited supply of Bitcoin, this massive injection of capital could potentially lead to a significant price surge, possibly exceeding previous all-time highs, as the demand dramatically outpaces the limited supply created by the halving. This is a simplified scenario, but it illustrates the potential for institutional adoption to act as a powerful catalyst for price increases.

Predictive Models and Their Limitations

Predicting Bitcoin’s price after the 2025 halving, or at any time, is a notoriously difficult task. Numerous models exist, each with its own strengths and weaknesses, and none offer guaranteed accuracy. The inherent volatility of the cryptocurrency market, coupled with the influence of external factors, makes precise forecasting extremely challenging. Understanding the limitations of these models is crucial for informed decision-making.

Predicting Bitcoin’s price involves various methodologies, primarily technical analysis and fundamental analysis. Technical analysis focuses on historical price and volume data to identify patterns and trends, aiming to predict future price movements. This approach uses tools like moving averages, relative strength index (RSI), and chart patterns. Fundamental analysis, on the other hand, considers factors influencing Bitcoin’s underlying value, such as adoption rate, network security, regulatory developments, and macroeconomic conditions. Both approaches have limitations and are often used in conjunction.

Technical Analysis Methods and Limitations

Technical analysis relies heavily on identifying past patterns, assuming they will repeat in the future. However, the cryptocurrency market is known for its unpredictable nature, often defying historical trends. Over-reliance on technical indicators can lead to inaccurate predictions, particularly during periods of high volatility or significant market shifts. For example, a “head and shoulders” pattern, often interpreted as a bearish reversal, might fail to materialize, leading to substantial losses for traders who solely rely on this technical indicator. Furthermore, the effectiveness of technical indicators can vary across different timeframes, requiring careful consideration and interpretation.

Fundamental Analysis Methods and Limitations

Fundamental analysis attempts to assess Bitcoin’s intrinsic value based on factors such as its scarcity (limited supply of 21 million coins), growing adoption by institutions and individuals, and the security of its blockchain network. However, predicting the future adoption rate or the impact of regulatory changes remains highly speculative. Macroeconomic events, like global inflation or recessionary periods, also significantly impact Bitcoin’s price, making it difficult to isolate the impact of purely fundamental factors. For instance, while increased institutional adoption might suggest a bullish outlook, unexpected regulatory crackdowns could negate this positive influence, leading to a significant price drop.

Examples of Past Price Predictions and Their Accuracy

Many analysts have made Bitcoin price predictions in the past, with varying degrees of success. For instance, some predicted Bitcoin would reach $100,000 by the end of 2021, a prediction that did not materialize. Others have used the Stock-to-Flow model, which correlates Bitcoin’s price with its scarcity, generating predictions that have sometimes been accurate in the short term but ultimately failed to capture the market’s volatility in the long term. The inherent difficulty in predicting the confluence of factors influencing Bitcoin’s price highlights the limitations of these predictions.

Comparative Analysis of Predictive Models

Several models attempt to predict Bitcoin’s price, each with its own strengths and weaknesses. A comparison is shown below. It’s crucial to remember that these are just examples and that no model guarantees accurate predictions.

| Model | Strengths | Weaknesses | Predicted Price Range (Post-2025 Halving) |

|---|---|---|---|

| Stock-to-Flow (S2F) | Simple, based on fundamental scarcity | Oversimplified, ignores market sentiment and external factors | Highly variable, with past predictions ranging from $100,000 to over $1 million |

| On-Chain Metrics (e.g., MVRV Z-Score) | Provides insights into market sentiment and potential price movements | Can be complex to interpret, requires advanced understanding | Wide range, often correlated with other models but not providing specific numerical predictions |

| Technical Analysis (various indicators) | Identifies potential support and resistance levels, trends | Highly subjective, prone to false signals, relies on past patterns | Highly variable depending on the specific indicators used; difficult to establish a common range |

Potential Price Scenarios After the 2025 Halving

Predicting Bitcoin’s price after the 2025 halving is inherently speculative, but analyzing various scenarios based on historical trends and market factors provides valuable insights. The following Artikels three potential price paths – bullish, bearish, and neutral – each with its supporting factors and visual representation.

Bullish Price Scenario

A bullish scenario envisions a significant price surge following the 2025 halving, potentially exceeding previous all-time highs. This surge would be driven by a confluence of factors. Increased scarcity due to the reduced Bitcoin supply, coupled with sustained institutional and retail investor demand, could propel prices upward. Furthermore, successful scaling solutions and growing adoption of Bitcoin as a store of value and a payment method would contribute to this positive momentum. We might see a scenario similar to the post-2021 halving rally, but potentially more pronounced given increased global macroeconomic uncertainty pushing investors towards alternative assets. The graph depicting this scenario would show a steep upward trajectory beginning around the halving date, accelerating in the months following, and potentially leveling off after reaching a significantly higher price point. The visual representation would showcase an exponential curve, gradually steepening post-halving.

Bearish Price Scenario

Conversely, a bearish scenario anticipates a relatively subdued or even declining price following the 2025 halving. Several factors could contribute to this outcome. A prolonged period of macroeconomic instability, regulatory uncertainty, or a significant crypto market correction could negatively impact Bitcoin’s price. Increased competition from alternative cryptocurrencies or technological advancements rendering Bitcoin less relevant could also dampen its price appreciation. Moreover, a lack of widespread institutional adoption or a decrease in retail investor interest could lead to a bearish trend. The visual representation of this scenario would depict a relatively flat or slightly downward-sloping line after the halving, possibly with minor upward corrections, but ultimately failing to reach previous highs within a reasonable timeframe. It would contrast sharply with the exponential growth illustrated in the bullish scenario. This would resemble the price action following the 2016 halving, which saw a period of consolidation before the subsequent bull run.

Neutral Price Scenario

A neutral scenario suggests a more moderate price movement post-halving, characterized by periods of both upward and downward trends. This scenario acknowledges the inherent volatility of the cryptocurrency market and the complex interplay of factors influencing Bitcoin’s price. It anticipates a price range within a certain boundary, potentially fluctuating around the pre-halving price level or experiencing moderate growth. This scenario would involve a more balanced outlook, incorporating elements of both bullish and bearish predictions. The visual representation would display a price line oscillating within a defined channel, showing periods of growth and decline, without a clear dominant trend either upward or downward. This would resemble a sideways trend, with the price consolidating within a specific range for an extended period. The probability of various price points within this range could be assigned based on historical data and expert opinions, illustrating the uncertainty inherent in this scenario.

Investing in Bitcoin After the 2025 Halving

Investing in Bitcoin after the 2025 halving presents a complex scenario, balancing potential significant rewards with inherent risks. The reduced supply of newly minted Bitcoin, a key factor influencing price, will interact with broader market forces and investor sentiment to determine the actual outcome. Understanding these dynamics is crucial for making informed investment decisions.

Key Risks Associated with Bitcoin Investment

Bitcoin’s price volatility is well-documented. Sharp price swings, both upward and downward, are common, and the market can be influenced by a wide range of factors, including regulatory changes, technological developments, and macroeconomic conditions. Investing after a halving doesn’t eliminate this inherent volatility; in fact, the anticipation leading up to and following the halving can exacerbate it. Furthermore, the decentralized nature of Bitcoin, while a strength, also means there’s less regulatory oversight and protection compared to traditional investments. Security risks, such as exchange hacks or loss of private keys, remain a constant concern, potentially leading to significant financial losses. Finally, the long-term viability of Bitcoin itself remains a subject of debate among experts, and unforeseen technological disruptions could negatively impact its value. For example, the emergence of a superior cryptocurrency or a significant shift in public perception could significantly depress Bitcoin’s price.

Potential Rewards and Opportunities

Despite the risks, the potential rewards of investing in Bitcoin are substantial. Historically, Bitcoin’s price has demonstrated a tendency to appreciate significantly following halving events. This is largely attributed to the decreased supply of new coins entering the market, creating potential scarcity and driving up demand. Successful long-term investment in Bitcoin has yielded extraordinary returns for early adopters. Beyond price appreciation, Bitcoin offers diversification benefits, providing an alternative asset class outside of traditional markets. Its decentralized nature protects it from potential government control or manipulation, offering a degree of independence not found in many other investment vehicles. Moreover, the growing adoption of Bitcoin as a payment method and store of value expands its utility and potential for future growth. The success of companies like MicroStrategy, which have adopted Bitcoin as part of their treasury strategy, provides a real-world example of the potential benefits of long-term Bitcoin investment.

Strategies for Mitigating Risks, Bitcoin Prediction After Halving 2025

Effective risk mitigation involves a multi-pronged approach. Diversification is paramount; avoid investing your entire portfolio in Bitcoin. Dollar-cost averaging (DCA), a strategy involving regular, consistent purchases of Bitcoin regardless of price fluctuations, helps reduce the impact of volatility. Thorough research and due diligence are essential before investing. Understand the technology, the market dynamics, and the risks involved. Secure storage of Bitcoin is crucial; use reputable hardware wallets or robust security measures for your exchange accounts. Only invest what you can afford to lose. This is not just a financial recommendation; it’s a critical aspect of managing the emotional and psychological pressures that accompany volatile investments. Finally, consider seeking advice from a qualified financial advisor before making significant investments in Bitcoin.

Comparing Investment Approaches

Long-term holding (HODLing) is a popular strategy that aims to capitalize on Bitcoin’s potential long-term appreciation. This approach requires patience and a tolerance for volatility, but it can potentially yield significant returns over time. In contrast, short-term trading involves frequent buying and selling of Bitcoin to profit from short-term price movements. This strategy requires a higher level of market knowledge, technical analysis skills, and a greater risk tolerance. The success of short-term trading depends heavily on market timing and predicting short-term price fluctuations, which is inherently difficult and risky. Each approach carries its own set of risks and rewards, and the optimal strategy depends on individual risk tolerance, financial goals, and market expertise. Consider the potential rewards and the associated risks carefully before deciding on a particular approach.

The Long-Term Outlook for Bitcoin

Bitcoin’s long-term prospects are a subject of intense debate, with opinions ranging from complete dismissal to predictions of widespread adoption. Its future hinges on a complex interplay of technological advancements, regulatory developments, and evolving market sentiment. Understanding these factors is crucial for assessing its potential as a store of value and a medium of exchange in the decades to come.

Bitcoin’s potential as a store of value rests on its inherent scarcity – a fixed supply of 21 million coins. This contrasts sharply with fiat currencies, which are susceptible to inflation through government printing. Its decentralized nature, resistant to censorship and manipulation by central authorities, further enhances its appeal as a hedge against economic instability. However, its volatility remains a significant barrier to widespread adoption as a store of value, requiring substantial risk tolerance from investors. The historical performance of Bitcoin, marked by significant price swings, underscores this inherent volatility. For example, the price of Bitcoin has seen dramatic increases and decreases, sometimes within short timeframes, showcasing its inherent risk.

Bitcoin as a Store of Value

The limited supply and decentralized nature of Bitcoin are key arguments for its potential as a long-term store of value. Historically, precious metals like gold have served this role, maintaining their value over extended periods due to scarcity and inherent properties. Bitcoin proponents argue it shares similar characteristics, albeit with the added advantage of digital accessibility and global transferability. However, Bitcoin’s volatility and susceptibility to market manipulation represent significant challenges to its acceptance as a reliable store of value comparable to gold. Its price is heavily influenced by speculative trading and news cycles, factors that don’t significantly affect the price of gold.

Bitcoin as a Medium of Exchange

While Bitcoin’s adoption as a medium of exchange is still limited, its potential in this area is growing. The speed and low cost of international transactions are attractive features for businesses and individuals operating across borders. However, scalability issues, transaction fees, and the volatility of Bitcoin’s price pose significant hurdles. The relatively slow transaction speeds compared to traditional payment systems also limit its widespread use for everyday purchases. For example, while some businesses accept Bitcoin, its use for everyday transactions like groceries or utilities is still rare compared to established payment methods like credit cards or mobile payment systems.

Factors Influencing Bitcoin’s Long-Term Success or Failure

Several factors could significantly impact Bitcoin’s long-term trajectory. Technological advancements, such as the development of the Lightning Network, aim to address scalability issues and reduce transaction fees. Regulatory clarity and acceptance by governments are crucial for mainstream adoption. Furthermore, the emergence of competing cryptocurrencies and the development of alternative technologies could challenge Bitcoin’s dominance. Conversely, factors such as increased regulatory uncertainty, major security breaches, or the widespread adoption of alternative cryptocurrencies could hinder its long-term success. The level of public trust and acceptance will be critical to its overall trajectory.

Bitcoin’s Role in the Evolving Global Financial Landscape

Bitcoin’s potential impact on the global financial landscape is far-reaching. It challenges traditional financial institutions by offering a decentralized and transparent alternative. Its potential to facilitate cross-border payments and reduce reliance on intermediaries could reshape international finance. However, its integration into existing financial systems requires careful consideration of regulatory frameworks and risk management strategies. The future role of Bitcoin will likely depend on its ability to adapt to evolving regulatory environments and integrate effectively into existing financial infrastructure.

Comparison with Other Prominent Cryptocurrencies

Bitcoin’s dominance in the cryptocurrency market is undeniable, but its long-term position is not guaranteed. Other cryptocurrencies, such as Ethereum, offer different functionalities and potential use cases. Ethereum’s smart contract capabilities, for example, have led to the development of decentralized applications (dApps) and decentralized finance (DeFi) platforms. The success of alternative cryptocurrencies with improved scalability, transaction speeds, or unique functionalities could potentially erode Bitcoin’s market share. The competitive landscape within the cryptocurrency market will be a major factor in shaping Bitcoin’s future.

Frequently Asked Questions (FAQ)

This section addresses common queries regarding the Bitcoin halving event of 2025 and its potential impact on Bitcoin’s price and the cryptocurrency market as a whole. Understanding these factors is crucial for informed decision-making regarding any investment strategy involving Bitcoin.

The Bitcoin Halving and its Price Impact

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, and it cuts the block reward in half. For example, the block reward was 50 BTC in the first halving, then 25 BTC, then 12.5 BTC, and the next halving in 2025 will reduce it to 6.25 BTC. This reduction in the supply of newly minted Bitcoin is often associated with an increase in price due to the basic principles of supply and demand. A decreased supply, coupled with sustained or increased demand, typically leads to price appreciation. However, it’s important to remember that other market factors significantly influence the price, and the halving’s impact is not guaranteed. The 2012 and 2016 halvings were followed by significant price increases, but other market forces were also at play.

The Next Bitcoin Halving’s Expected Date

The next Bitcoin halving is expected to occur in early April 2025. The precise date depends on the block time, which fluctuates slightly. However, based on the current block generation rate, April 2025 is a highly probable timeframe. It’s important to monitor the Bitcoin blockchain for the exact block height and confirmation of the halving event.

Potential Risks of Investing in Bitcoin After the 2025 Halving

Investing in Bitcoin, even after a halving, carries inherent risks. Market volatility is a significant concern; Bitcoin’s price can fluctuate dramatically in short periods. Regulatory uncertainty poses another risk, as governments worldwide are still developing their approaches to regulating cryptocurrencies. Technological risks, such as security breaches or protocol vulnerabilities, also exist. Furthermore, the narrative surrounding Bitcoin can shift rapidly, influencing investor sentiment and price movements. Finally, the possibility of a “halving-less” price increase, where the price rises significantly *before* the halving event, cannot be ruled out.

Potential Benefits of Investing in Bitcoin After the 2025 Halving

Despite the risks, investing in Bitcoin after the 2025 halving could offer several potential benefits. Historically, halvings have been associated with long-term price appreciation. The reduced supply of new Bitcoin could lead to scarcity and increased value over time. Bitcoin’s decentralized nature and its position as a store of value are also attractive to many investors. Furthermore, the growing adoption of Bitcoin by institutions and mainstream businesses could boost its price and overall market capitalization. Finally, the potential for significant long-term gains, similar to what was observed after previous halvings, is a significant incentive for many investors.

Bitcoin Halving Compared to Other Cryptocurrency Market Events

The Bitcoin halving is unique among cryptocurrency events due to its programmed nature and its direct impact on Bitcoin’s supply. Unlike other market events driven by news, regulations, or technological advancements, the halving is a predictable, recurring event built into the Bitcoin protocol. While other cryptocurrencies might experience similar supply adjustments, none have the same level of market dominance and established history as Bitcoin. Other significant market events include regulatory changes, major technological upgrades, and influential endorsements or criticisms from key figures in the finance and technology industries. These events, however, are unpredictable and often lead to higher volatility than the relatively predictable halving event.