Bitcoin Price Prediction April 2025

Bitcoin, the world’s first cryptocurrency, emerged in 2009 as a decentralized digital currency, operating independently of central banks and governments. Its initial years saw slow adoption and relatively low prices. However, Bitcoin has since experienced periods of explosive growth, punctuated by significant market corrections, establishing itself as a prominent asset class with a global market capitalization reaching trillions of dollars at its peak. Currently, Bitcoin’s market position remains volatile, influenced by a complex interplay of factors.

Bitcoin’s price volatility is a defining characteristic. Several factors contribute to these fluctuations. Regulatory changes worldwide significantly impact investor confidence and trading volume. For example, stricter regulations in one major market can trigger a sell-off, while positive regulatory developments in another can lead to price increases. Macroeconomic factors, such as inflation, interest rates, and global economic uncertainty, also play a crucial role. Periods of high inflation often drive investors towards Bitcoin as a hedge against inflation, leading to price appreciation. Conversely, rising interest rates can make other investment options more attractive, potentially causing Bitcoin’s price to decline. Finally, market sentiment and speculation are powerful drivers. News events, social media trends, and pronouncements from influential figures in the cryptocurrency space can create significant short-term price swings.

Factors Influencing Bitcoin’s Price Volatility

The inherent volatility of Bitcoin is a complex issue with several interacting components. Technological advancements within the Bitcoin network, such as upgrades to its underlying protocol, can impact its efficiency and scalability, influencing investor confidence. Adoption by major corporations and institutions also affects price; significant investments from large firms can signal increased legitimacy and drive demand, whereas negative news or actions by large players can trigger sharp price drops. For instance, the adoption of Bitcoin by Tesla initially boosted its price, while later divestment by the same company had a negative impact. The overall level of market liquidity also matters. Periods of low liquidity can exacerbate price swings, as even relatively small trades can cause significant price movements. Conversely, high liquidity tends to moderate price volatility.

Challenges and Opportunities Facing Bitcoin

Bitcoin faces several challenges in the coming years. Scalability remains a concern; the network’s capacity to process transactions is a limiting factor, and solutions like the Lightning Network are still under development and require widespread adoption to alleviate congestion and high transaction fees. Energy consumption associated with Bitcoin mining is another persistent criticism, raising environmental concerns and prompting regulatory scrutiny. Furthermore, the regulatory landscape is constantly evolving, with different jurisdictions taking varying approaches to the regulation of cryptocurrencies. This uncertainty can create instability in the market.

Despite these challenges, Bitcoin also presents significant opportunities. Growing adoption among individuals and institutions is a key driver of potential future growth. As more people and businesses accept Bitcoin as a form of payment or store of value, its price could increase. Technological advancements, such as improvements in scalability and privacy features, can further enhance its appeal and functionality. Furthermore, the increasing integration of Bitcoin into traditional financial systems could lead to greater mainstream acceptance and price stability. The development of decentralized finance (DeFi) applications built on top of Bitcoin’s blockchain technology also offers opportunities for growth and innovation within the broader cryptocurrency ecosystem.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of factors. While no one can definitively state the price, understanding these influential elements provides a framework for informed speculation. These factors range from regulatory landscapes and technological advancements to macroeconomic conditions and institutional adoption.

Regulatory Changes and Bitcoin’s Price, Bitcoin Prediction April 2025

Government regulations significantly impact cryptocurrency markets. Clearer, more consistent regulatory frameworks could boost investor confidence, potentially driving up Bitcoin’s price. Conversely, overly restrictive or conflicting regulations across jurisdictions could stifle growth and suppress price. For example, a unified global regulatory approach similar to that applied to traditional securities could lead to increased institutional investment and price appreciation. Conversely, a fragmented and inconsistent approach, characterized by bans or excessive restrictions in major economies, could severely limit Bitcoin’s market potential.

Technological Advancements and Bitcoin’s Future

Technological improvements within the Bitcoin ecosystem play a crucial role. Scalability solutions like the Lightning Network, aiming to enhance transaction speeds and reduce fees, could attract more users and increase demand. Conversely, significant security breaches or the emergence of superior blockchain technologies could negatively impact Bitcoin’s dominance and price. Imagine, for instance, a highly successful competitor emerging that offers significantly faster transaction times and lower fees; this could potentially divert investment and lead to a decline in Bitcoin’s price.

Macroeconomic Factors and Bitcoin’s Value

Macroeconomic factors, such as inflation and recession, influence Bitcoin’s value as a store of value and hedge against economic uncertainty. High inflation could drive investors towards Bitcoin as a potential inflation hedge, increasing demand. Conversely, a global recession could lead to risk-averse behavior, potentially causing investors to sell off Bitcoin alongside other assets. For example, the 2008 financial crisis saw a surge in interest in Bitcoin as people sought alternative assets. A similar economic downturn in 2025 could lead to a similar pattern.

Institutional Adoption and Bitcoin’s Price

Increased institutional adoption, such as further investment from large corporations and financial institutions, could significantly impact Bitcoin’s price. Larger investments bring greater liquidity and stability to the market, potentially driving up the price. However, a sudden mass exodus of institutional investors, perhaps due to negative regulatory changes or a market crash, could trigger a sharp price decline. The entry of firms like MicroStrategy and Tesla into the Bitcoin market exemplifies the positive influence of institutional adoption. A reversal of this trend could have a substantially negative effect.

Key Events Affecting Bitcoin’s Price in 2025

Several key events could significantly influence Bitcoin’s price in 2025. These could include major regulatory announcements from influential governments, significant technological breakthroughs or setbacks within the Bitcoin ecosystem, or unforeseen global economic shocks. A successful Bitcoin ETF approval in a major market like the United States, for example, could greatly increase demand and push the price upward. Conversely, a major cyberattack targeting a significant Bitcoin exchange could cause a substantial price drop.

Bullish Bitcoin Market Scenario in April 2025

In a bullish scenario, widespread institutional adoption, coupled with positive regulatory developments and advancements in scalability, could drive Bitcoin’s price to new highs. Global macroeconomic stability, alongside increased adoption by retail investors, could further fuel this upward trajectory. Imagine a scenario where several large financial institutions publicly announce substantial Bitcoin investments, alongside a successful ETF launch and positive regulatory news from key jurisdictions; this could create a positive feedback loop, resulting in a significant price increase.

Bearish Bitcoin Market Scenario in April 2025

A bearish scenario might involve negative regulatory actions from major governments, a significant technological flaw exposing Bitcoin to vulnerabilities, or a severe global economic downturn. This combination of factors could erode investor confidence, leading to a price decline. For example, a series of coordinated regulatory crackdowns coupled with a major security breach could lead to widespread selling and a significant drop in Bitcoin’s value. This scenario might be further exacerbated by a prolonged global recession, resulting in a bear market.

Potential Price Ranges for Bitcoin in April 2025

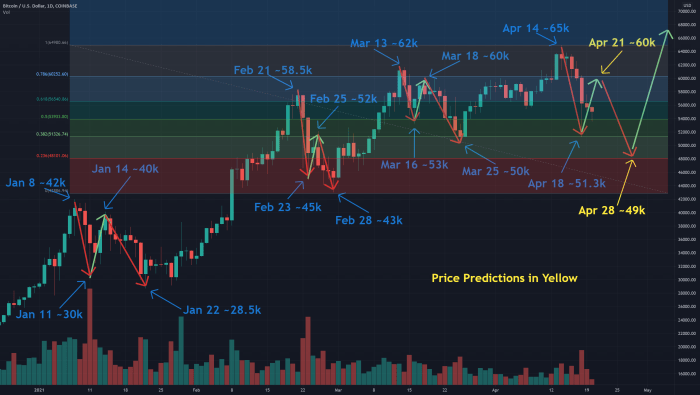

Predicting the price of Bitcoin is inherently speculative, as numerous factors influence its volatile nature. However, by analyzing various prediction models and their underlying assumptions, we can construct a range of potential price scenarios for April 2025. These scenarios, while not definitive, offer a framework for understanding the potential price movements based on different market conditions.

Bitcoin Price Prediction Models and Their Projected Ranges

The following table compares different models and their projected price ranges for Bitcoin in April 2025. It’s crucial to remember that these are just predictions, and the actual price could differ significantly. The methodologies behind these models vary widely, ranging from technical analysis of historical price data to fundamental analysis considering adoption rates and regulatory changes.

| Model Name | Predicted Price Range (USD) | Assumptions | Source |

|---|---|---|---|

| Stock-to-Flow Model (Adjusted) | $150,000 – $250,000 | Continued halving events, increasing institutional adoption, limited supply. This model is adjusted to account for previous inaccuracies and incorporates factors like market sentiment and regulatory uncertainty. | Various analysts building upon the original Stock-to-Flow model, incorporating refinements. |

| Technical Analysis Model (Average of Leading Indicators) | $75,000 – $125,000 | Based on moving averages, support and resistance levels, and other technical indicators. This model assumes a moderate level of volatility and continued institutional interest. | Aggregation of predictions from several reputable technical analysts. |

| Fundamental Analysis Model (Adoption Rate and Market Cap) | $50,000 – $100,000 | This model projects Bitcoin’s price based on projected market capitalization, considering factors like global adoption, competing cryptocurrencies, and economic growth. A slower adoption rate than optimistic models is assumed. | Research reports from financial institutions and cryptocurrency analysts. |

Methodology Behind Prediction Models

The Stock-to-Flow model, initially proposed by PlanB, uses the ratio of Bitcoin’s existing supply to its newly mined supply to predict its price. However, this model has shown limitations in accurately predicting price in the past. Adjustments to this model often incorporate additional factors such as macroeconomic conditions and regulatory changes to improve its accuracy. Technical analysis models utilize historical price charts and various indicators to identify potential price trends. These indicators include moving averages, relative strength index (RSI), and volume analysis. Fundamental analysis models, on the other hand, focus on evaluating the intrinsic value of Bitcoin based on factors such as its adoption rate, network effects, and overall market conditions. These models often involve projecting future market capitalization based on various assumptions about future adoption.

Categorization of Price Predictions by Scenario

The predictions above can be broadly categorized into optimistic, neutral, and pessimistic scenarios. The optimistic scenario ($150,000 – $250,000), as represented by the adjusted Stock-to-Flow model, assumes sustained high adoption rates, positive regulatory developments, and continued institutional investment. The neutral scenario ($75,000 – $125,000) reflects a more balanced view, considering both positive and negative factors. The pessimistic scenario ($50,000 – $100,000) anticipates slower adoption, increased regulatory scrutiny, or significant macroeconomic headwinds impacting the overall cryptocurrency market. It is important to note that these scenarios are not mutually exclusive, and the actual price could fall outside these ranges.

Technical Analysis of Bitcoin’s Price

Technical analysis uses historical price and volume data to predict future price movements. Unlike fundamental analysis, which focuses on macroeconomic factors, technical analysis relies solely on chart patterns and indicators to identify trends and potential turning points in Bitcoin’s price. While not foolproof, it provides a valuable perspective for traders and investors.

Moving Averages and RSI

Moving averages, such as the simple moving average (SMA) and exponential moving average (EMA), smooth out price fluctuations to identify trends. A common strategy involves comparing short-term and long-term moving averages: a bullish crossover occurs when a shorter-term MA crosses above a longer-term MA, suggesting an upward trend, while a bearish crossover signifies the opposite. The Relative Strength Index (RSI) is a momentum oscillator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 generally indicates an overbought market, suggesting a potential price correction, while an RSI below 30 suggests an oversold market, potentially signaling a price rebound. For example, in early 2021, a bullish crossover of the 50-day SMA above the 200-day SMA coincided with a period of significant price appreciation in Bitcoin, while later that year, a bearish crossover preceded a substantial price decline. Simultaneously observing the RSI can provide further context. If the RSI was above 70 during the bearish crossover, it could have strengthened the signal of an impending correction.

Chart Patterns

Chart patterns, recognizable formations on price charts, can offer insights into potential future price movements. Head and shoulders patterns, for instance, are often interpreted as bearish reversal signals, suggesting a price decline after a period of upward movement. Conversely, inverse head and shoulders patterns are typically viewed as bullish reversal signals. Triangles, which are characterized by converging trendlines, can indicate periods of consolidation before a breakout in either direction. The size and shape of these patterns can provide clues about the potential magnitude of the price movement. For example, a large head and shoulders pattern might suggest a more significant price decline than a smaller one. Accurate interpretation requires considering the overall market context and other technical indicators.

Comparison of Technical Analysis Methods

Different technical analysis methods have varying degrees of accuracy in predicting Bitcoin’s price. While moving averages provide a general sense of trend, they can lag behind significant price changes. RSI can provide early warnings of overbought or oversold conditions, but it’s not always accurate in predicting the timing or magnitude of price reversals. Chart patterns can offer insights into potential price movements, but their interpretation can be subjective and require significant experience. Combining multiple technical indicators and chart patterns can improve the accuracy of predictions, but no method guarantees perfect forecasting. The effectiveness of technical analysis also depends on the time frame considered; short-term predictions are generally more difficult than long-term predictions due to increased volatility. For example, relying solely on RSI might lead to missed opportunities if the market remains overbought or oversold for an extended period. A comprehensive approach integrating several methods offers a more robust analysis.

Fundamental Analysis of Bitcoin’s Price

Fundamental analysis of Bitcoin’s price focuses on the underlying factors driving its value, rather than solely relying on price charts. Unlike traditional assets, Bitcoin’s value proposition stems from its decentralized nature, scarcity, and growing adoption as a store of value and medium of exchange. Understanding these fundamental aspects is crucial for long-term price predictions.

Adoption Rate

The increasing adoption of Bitcoin by individuals, businesses, and institutions significantly influences its price. Widespread acceptance as a payment method, coupled with growing institutional investment, boosts demand and drives price appreciation. For example, the growing number of companies accepting Bitcoin as payment, such as MicroStrategy and Tesla’s previous investments, showcases the increasing institutional confidence in Bitcoin’s long-term viability, directly impacting its market valuation. Increased usage on payment platforms and Lightning Network transactions further contribute to this effect.

Network Effects

Bitcoin’s network effect is a powerful driver of its value. As more users join the network, the security and utility of the cryptocurrency increase, attracting even more users in a positive feedback loop. This increased network effect makes the Bitcoin network more resilient to attacks and increases its overall value proposition, thus influencing price positively. The larger the network, the more valuable the system becomes, mirroring the success of other network-based platforms like social media or e-commerce giants.

Mining Difficulty

The mining difficulty, adjusted periodically by the Bitcoin network, impacts the rate at which new Bitcoins are created. A higher difficulty means more computational power is required to mine a block, increasing the cost of mining and potentially impacting the supply of Bitcoin. This adjustment mechanism ensures the block creation time remains relatively constant, contributing to the network’s stability and predictable supply schedule. A high mining difficulty indicates a robust and secure network, which can positively influence investor confidence and consequently, price.

Bitcoin’s Supply and Demand Dynamics

Bitcoin’s fixed supply of 21 million coins is a crucial factor in its fundamental value. Unlike fiat currencies that can be inflated through printing, Bitcoin’s scarcity creates a deflationary pressure on its price. As demand increases, and the supply remains capped, the price is expected to rise. This scarcity is a core tenet of Bitcoin’s value proposition, differentiating it from traditional financial assets. Increased demand from institutional investors and retail traders, coupled with the finite supply, creates a strong bullish case for long-term price appreciation. Examples include the significant price surges witnessed during periods of increased market interest and adoption.

Impact of Bitcoin Halving Events

Bitcoin’s halving events, occurring approximately every four years, reduce the rate at which new Bitcoins are mined by half. This reduction in supply, while demand potentially remains consistent or increases, typically leads to upward price pressure. Historically, Bitcoin’s price has shown significant increases following previous halving events, although other factors also contribute to price movements. The halving events are predictable and programmed into Bitcoin’s code, making them a significant factor in long-term price predictions. The anticipation of reduced supply often leads to price increases even before the actual halving occurs. Analyzing past halving events provides valuable insights into potential price movements following the next halving.

Risks and Uncertainties Associated with Bitcoin Price Predictions: Bitcoin Prediction April 2025

Predicting the price of Bitcoin, especially over a long timeframe like April 2025, is inherently fraught with risk and uncertainty. Numerous factors, both internal to the cryptocurrency market and external to it, can significantly influence price movements, making accurate forecasting exceptionally challenging. While various analytical methods attempt to quantify these influences, inherent limitations exist, rendering any prediction inherently probabilistic rather than deterministic.

The inherent volatility of Bitcoin’s price is a major source of uncertainty. Unlike traditional assets, Bitcoin’s market capitalization is relatively small compared to global financial markets, making it susceptible to significant price swings based on relatively small trading volumes. This susceptibility is further amplified by the speculative nature of much of the Bitcoin market, leading to periods of intense buying frenzies and equally rapid sell-offs. These rapid changes can be triggered by various news events, regulatory announcements, technological developments, or even social media trends.

Limitations of Prediction Models

Various models, including technical analysis, fundamental analysis, and quantitative models, are employed to predict Bitcoin’s price. However, each has significant limitations. Technical analysis, relying on historical price and volume data, struggles to account for unforeseen events or shifts in market sentiment. Fundamental analysis, focusing on factors like adoption rates and technological advancements, often struggles to accurately quantify the impact of these factors on price. Quantitative models, while sophisticated, rely on assumptions about future market behavior that may not hold true. For example, a model predicting price based on historical volatility might fail to account for a major regulatory shift that drastically alters market dynamics. The 2021 bull run, followed by a significant correction, demonstrates the limitations of even the most sophisticated models. Many predictions at the height of the bull market significantly overestimated the long-term price trajectory.

Unpredictable Market Sentiment and its Impact

Market sentiment, encompassing the overall mood and expectations of investors, plays a crucial role in determining Bitcoin’s price. This sentiment is highly volatile and influenced by a complex interplay of factors, including news media coverage, social media trends, and overall economic conditions. A sudden surge of positive sentiment can drive prices significantly higher, while a shift towards negativity can trigger sharp declines. The influence of Elon Musk’s tweets on Bitcoin’s price in the past illustrates this unpredictable nature. His positive comments often led to immediate price increases, while negative statements triggered significant drops, demonstrating the power of influential figures in shaping market sentiment and its immediate impact on price. Predicting these shifts accurately is extremely difficult, if not impossible.

Regulatory Uncertainty and Geopolitical Risks

Government regulations and geopolitical events also contribute significantly to the uncertainty surrounding Bitcoin price predictions. Changes in regulatory frameworks, such as bans or restrictions on cryptocurrency trading or mining, can drastically impact price. Similarly, geopolitical instability or macroeconomic shocks can lead to significant market volatility, making accurate long-term predictions exceptionally challenging. The varying regulatory approaches adopted by different countries underscore the unpredictable nature of this factor. Some countries are actively embracing cryptocurrencies, while others are imposing strict regulations, creating a complex and constantly evolving landscape that impacts investor confidence and price.

Alternative Cryptocurrencies and Their Potential Impact

Predicting the cryptocurrency market in April 2025 requires considering not only Bitcoin’s trajectory but also the influence of alternative cryptocurrencies (altcoins) and the evolving technological landscape. The interplay between Bitcoin and altcoins, coupled with advancements in decentralized finance (DeFi) and non-fungible tokens (NFTs), will significantly shape the overall market dynamics.

Altcoins, encompassing a vast array of projects with varying functionalities and market capitalizations, possess the potential to both support and challenge Bitcoin’s dominance. Their performance relative to Bitcoin will depend on a multitude of factors including technological innovation, adoption rates, regulatory developments, and market sentiment. A strong performance by several leading altcoins could potentially draw investment away from Bitcoin, impacting its price. Conversely, a general downturn in the altcoin market could bolster Bitcoin’s position as a safe haven asset.

Ethereum’s Potential in Relation to Bitcoin

Ethereum, the second-largest cryptocurrency by market capitalization, is expected to continue its development and adoption in 2025. The successful implementation of Ethereum 2.0, with its transition to a proof-of-stake consensus mechanism, could significantly enhance its scalability and efficiency, potentially attracting more institutional investors. While a direct comparison of Bitcoin and Ethereum’s price in April 2025 is speculative, Ethereum’s growing utility in DeFi and NFT ecosystems suggests a potentially strong performance, potentially impacting Bitcoin’s market share. For example, the success of decentralized applications (dApps) built on Ethereum could lead to increased demand for ETH, potentially mirroring the growth seen in the DeFi boom of 2020-2021.

Impact of DeFi and NFTs on the Cryptocurrency Market

The decentralized finance (DeFi) and non-fungible token (NFT) sectors have demonstrated explosive growth, introducing innovative financial products and digital assets to the cryptocurrency landscape. DeFi protocols, offering decentralized lending, borrowing, and trading services, have attracted substantial investment and user engagement. Similarly, NFTs have gained widespread popularity, disrupting various industries, including art, gaming, and collectibles. In April 2025, the continued maturation and expansion of these sectors could lead to increased demand for cryptocurrencies beyond Bitcoin, potentially driving the prices of altcoins involved in these ecosystems. For instance, a surge in NFT trading volume might benefit cryptocurrencies specifically designed for NFT transactions or those hosting NFT marketplaces. The overall success of DeFi and NFTs would likely contribute to a more vibrant and diverse cryptocurrency market, even if it means a slight reduction in Bitcoin’s dominance.

Potential Disruption of Bitcoin’s Dominance

While Bitcoin’s first-mover advantage and brand recognition remain significant, several altcoins present a potential threat to its dominance. These threats stem from factors such as superior scalability, faster transaction speeds, lower transaction fees, and innovative functionalities not offered by Bitcoin. For example, a cryptocurrency with significantly improved scalability could attract users and developers frustrated by Bitcoin’s limitations. The extent of this disruption will depend on the rate of technological advancements, regulatory clarity, and the overall market sentiment towards altcoins. A scenario where several altcoins successfully address Bitcoin’s weaknesses could lead to a significant shift in market share, although Bitcoin’s established position as a store of value might still protect it from complete dethronement.

Bitcoin’s Role in the Global Financial System

Bitcoin’s potential integration into the global financial system is a complex issue, encompassing both its capacity to become a mainstream payment method and its disruptive potential towards established financial institutions. While its decentralized nature offers compelling advantages, significant hurdles remain before widespread adoption can be achieved.

Bitcoin’s ability to facilitate faster, cheaper, and more transparent cross-border transactions presents a compelling alternative to traditional banking systems. Its inherent resistance to censorship and control appeals to individuals and businesses seeking financial autonomy. However, the volatility of Bitcoin’s price and its relatively limited acceptance by merchants pose significant challenges to its widespread adoption as a daily payment method.

Bitcoin’s Potential as a Mainstream Payment Method

The potential for Bitcoin to become a mainstream payment method hinges on several factors. Increased merchant adoption is crucial, requiring user-friendly payment processing solutions and widespread education to alleviate concerns about price volatility and security. Furthermore, scalability improvements to the Bitcoin network are necessary to handle a larger volume of transactions without compromising speed or efficiency. The development of the Lightning Network, a layer-two scaling solution, represents a significant step in this direction, enabling faster and cheaper transactions. Successful integration with existing payment systems and the development of robust regulatory frameworks could further boost Bitcoin’s adoption as a mainstream payment method. Examples of companies already accepting Bitcoin include major retailers like MicroStrategy and Tesla, demonstrating a growing acceptance within the corporate sector. However, widespread consumer adoption remains a key challenge.

Challenges to Wider Bitcoin Acceptance

Several significant challenges hinder Bitcoin’s wider acceptance. The volatility of its price is a major deterrent for both merchants and consumers, creating uncertainty and risk. The complexity of using Bitcoin, including the need for digital wallets and understanding of cryptographic principles, also poses a barrier to entry for many potential users. Regulatory uncertainty in various jurisdictions adds another layer of complexity, impacting the legal and operational frameworks surrounding Bitcoin transactions. Security concerns, including the risk of theft from compromised wallets or exchanges, are also significant hurdles that need to be addressed through enhanced security measures and educational initiatives. The energy consumption associated with Bitcoin mining also raises environmental concerns, impacting its long-term sustainability and societal acceptance. Addressing these challenges is crucial for achieving broader acceptance.

Bitcoin’s Potential to Disrupt Traditional Financial Institutions

Bitcoin’s decentralized and transparent nature poses a significant challenge to the established financial system. Its potential to bypass intermediaries, such as banks and payment processors, could reduce transaction costs and increase efficiency. This disruptive potential could lead to increased competition and innovation within the financial sector, potentially driving down fees and improving services for consumers. However, the extent of this disruption depends on several factors, including regulatory responses and the ability of traditional institutions to adapt and integrate Bitcoin technologies into their operations. The rise of decentralized finance (DeFi) platforms, built upon blockchain technology, already demonstrates the potential for Bitcoin to disrupt traditional financial services. These platforms offer alternative lending, borrowing, and investment opportunities, operating outside the traditional banking system. While the long-term impact remains uncertain, the potential for significant disruption is undeniable.

Bitcoin Prediction April 2025 – Predicting Bitcoin’s price in April 2025 is challenging, influenced by numerous factors including market sentiment and technological advancements. A key event impacting such predictions is the Bitcoin halving, which significantly alters the rate of new Bitcoin creation. To understand its influence, it’s helpful to check when exactly the next halving occurred; you can find that information here: When Did Bitcoin Halving Happen 2025.

Therefore, understanding the timing of the halving is crucial for more accurate Bitcoin Prediction April 2025 estimations.

Predicting Bitcoin’s price in April 2025 is challenging, influenced by numerous factors including market sentiment and technological advancements. A key event impacting such predictions is the Bitcoin halving, which significantly alters the rate of new Bitcoin creation. To understand its influence, it’s helpful to check when exactly the next halving occurred; you can find that information here: When Did Bitcoin Halving Happen 2025.

Therefore, understanding the timing of the halving is crucial for more accurate Bitcoin Prediction April 2025 estimations.

Predicting Bitcoin’s price in April 2025 is challenging, influenced by numerous factors including market sentiment and technological advancements. A key event impacting such predictions is the Bitcoin halving, which significantly alters the rate of new Bitcoin creation. To understand its influence, it’s helpful to check when exactly the next halving occurred; you can find that information here: When Did Bitcoin Halving Happen 2025.

Therefore, understanding the timing of the halving is crucial for more accurate Bitcoin Prediction April 2025 estimations.

Predicting Bitcoin’s price in April 2025 is challenging, influenced by numerous factors including market sentiment and technological advancements. A key event impacting such predictions is the Bitcoin halving, which significantly alters the rate of new Bitcoin creation. To understand its influence, it’s helpful to check when exactly the next halving occurred; you can find that information here: When Did Bitcoin Halving Happen 2025.

Therefore, understanding the timing of the halving is crucial for more accurate Bitcoin Prediction April 2025 estimations.

Predicting Bitcoin’s price in April 2025 is challenging, influenced by numerous factors including market sentiment and technological advancements. A key event impacting such predictions is the Bitcoin halving, which significantly alters the rate of new Bitcoin creation. To understand its influence, it’s helpful to check when exactly the next halving occurred; you can find that information here: When Did Bitcoin Halving Happen 2025.

Therefore, understanding the timing of the halving is crucial for more accurate Bitcoin Prediction April 2025 estimations.

Predicting Bitcoin’s price in April 2025 is challenging, influenced by numerous factors including market sentiment and technological advancements. A key event impacting such predictions is the Bitcoin halving, which significantly alters the rate of new Bitcoin creation. To understand its influence, it’s helpful to check when exactly the next halving occurred; you can find that information here: When Did Bitcoin Halving Happen 2025.

Therefore, understanding the timing of the halving is crucial for more accurate Bitcoin Prediction April 2025 estimations.