Bitcoin Prediction December 2025

Bitcoin, the world’s first decentralized cryptocurrency, has captivated investors and technologists alike with its volatile nature and transformative potential. Its meteoric rise and subsequent dramatic dips have created a landscape of both immense opportunity and significant risk. Predicting its price in December 2025, therefore, is a complex undertaking requiring careful consideration of numerous factors. While no prediction is foolproof, informed speculation based on historical trends, technological advancements, and macroeconomic conditions can offer a more nuanced perspective.

Bitcoin’s journey since its inception in 2009 has been nothing short of extraordinary. From a niche digital asset to a globally recognized store of value and medium of exchange, it has profoundly impacted the financial world, challenging traditional banking systems and inspiring the creation of countless alternative cryptocurrencies. This rapid evolution, however, also highlights the inherent volatility and uncertainty associated with its future price trajectory. Predicting Bitcoin’s price accurately is hampered by the inherent unpredictability of market sentiment, regulatory changes, technological disruptions, and the overall global economic climate. Numerous factors, often intertwined and difficult to quantify, can dramatically influence its value.

Challenges in Predicting Bitcoin’s Future Price

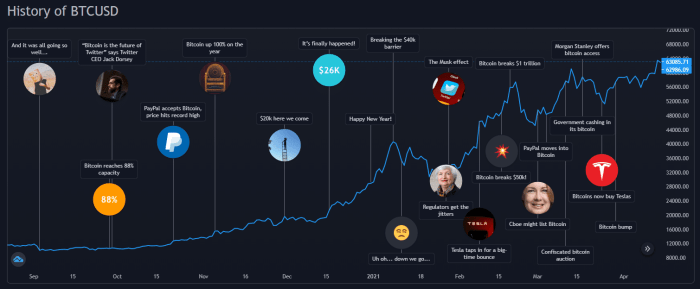

Accurately forecasting Bitcoin’s price in December 2025 presents a formidable challenge. The cryptocurrency market is notoriously volatile, subject to significant price swings driven by a complex interplay of factors. These include, but are not limited to, speculative trading, regulatory announcements, technological developments (such as scaling solutions or the emergence of competing cryptocurrencies), macroeconomic conditions (like inflation rates and interest rate policies), and even social media sentiment. For example, Elon Musk’s tweets have historically been shown to significantly impact Bitcoin’s price, highlighting the influence of unpredictable external events. Furthermore, the relatively young age of Bitcoin and the lack of a long historical dataset make it difficult to apply traditional financial modeling techniques with complete confidence. The absence of a central authority controlling Bitcoin also contributes to its unpredictability, making it vulnerable to both rapid appreciation and equally swift depreciation. Attempts at prediction must therefore account for this inherent uncertainty and consider a wide range of potential scenarios.

Factors Influencing Bitcoin’s Price in 2025: Bitcoin Prediction December 2025

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of macroeconomic conditions, technological advancements, regulatory landscapes, and market sentiment. While precise prediction is impossible, analyzing these factors offers valuable insights into potential price movements.

Macroeconomic Factors

Global economic conditions significantly influence Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, rising interest rates can make alternative investments more attractive, potentially diverting capital away from Bitcoin and depressing its price. Strong global economic growth might lead to increased risk appetite, benefiting Bitcoin’s price, while a recession could trigger risk aversion, causing a price decline. The interplay between these factors is complex and not always predictable. For example, the 2022 inflationary environment saw Bitcoin’s price decline alongside other risk assets, highlighting the influence of broader economic trends.

Technological Advancements

Technological developments within the cryptocurrency space will play a crucial role. Layer-2 scaling solutions, such as the Lightning Network, aim to improve Bitcoin’s transaction speed and reduce fees. Widespread adoption of these solutions could enhance Bitcoin’s usability and potentially boost its price. The emergence of new cryptocurrencies with innovative features could also impact Bitcoin’s dominance and price, either through competition or by inspiring technological improvements within the Bitcoin ecosystem itself. For instance, the rise of Ethereum and its smart contract capabilities initially presented a challenge to Bitcoin’s dominance, but ultimately spurred innovation within the Bitcoin community to address scalability and functionality concerns.

Regulatory Changes

Government regulations and legal frameworks profoundly affect Bitcoin’s market. Clear and favorable regulatory environments can encourage institutional investment and broader adoption, potentially driving up the price. Conversely, restrictive regulations or outright bans can significantly limit Bitcoin’s accessibility and negatively impact its value. The regulatory landscape varies widely across countries, and the evolution of these policies will be a key factor in Bitcoin’s future price. For example, El Salvador’s adoption of Bitcoin as legal tender created a unique market dynamic, though its long-term impact is still unfolding.

Institutional Adoption

Increased investment from large corporations and financial institutions is a significant driver of Bitcoin’s price. As more institutional players enter the market, their buying pressure can push prices higher. This also adds legitimacy and stability to the Bitcoin market, attracting further investment. Examples include MicroStrategy’s substantial Bitcoin holdings and Tesla’s past involvement, which significantly impacted Bitcoin’s price at the time of their announcements. However, institutional divestment can have the opposite effect, potentially leading to price corrections.

Market Sentiment and Speculation

News events, social media trends, and overall market sentiment heavily influence Bitcoin’s price. Positive news, such as major institutional adoption or technological breakthroughs, can trigger price rallies fueled by speculation. Conversely, negative news, such as regulatory crackdowns or security breaches, can lead to significant price drops. The volatile nature of Bitcoin is partly due to its susceptibility to market sentiment and speculative trading. The meme-driven rallies and subsequent crashes associated with Dogecoin and other memecoins illustrate the significant influence of social media trends and speculation.

| Factor | Potential Positive Influence | Potential Negative Influence | Example |

|---|---|---|---|

| Macroeconomic Factors | High inflation driving demand as a hedge; strong economic growth increasing risk appetite | Rising interest rates diverting capital; economic recession triggering risk aversion | 2022 inflation and interest rate hikes negatively impacting Bitcoin price. |

| Technological Advancements | Improved scalability (Layer-2 solutions) enhancing usability; innovation leading to increased adoption | Competition from new cryptocurrencies; technological limitations hindering adoption | Lightning Network improving Bitcoin transaction speeds. |

| Regulatory Changes | Clear and favorable regulations attracting institutional investment | Restrictive regulations or bans limiting accessibility | El Salvador’s adoption of Bitcoin as legal tender. |

| Institutional Adoption | Increased buying pressure from large corporations and financial institutions | Institutional divestment leading to price corrections | MicroStrategy’s significant Bitcoin holdings. |

| Market Sentiment & Speculation | Positive news and social media trends driving price rallies | Negative news and FUD leading to price drops | Dogecoin’s price volatility driven by social media trends. |

Potential Price Scenarios for Bitcoin in December 2025

Predicting the price of Bitcoin is inherently speculative, but by analyzing historical trends, technological advancements, and macroeconomic factors, we can construct plausible scenarios for its value in December 2025. These scenarios represent a range of possibilities, from highly optimistic to pessimistic, and a more neutral middle ground. Remember, these are educated guesses, not financial advice.

Bullish Scenario: Bitcoin Surges to New Heights, Bitcoin Prediction December 2025

This scenario envisions a significantly bullish market for Bitcoin by December 2025. Several factors contribute to this optimistic outlook. Widespread institutional adoption, coupled with increasing regulatory clarity in key markets, could drive substantial investment. Furthermore, continued technological advancements, such as the scaling solutions improving transaction speeds and reducing fees, would enhance Bitcoin’s usability and attractiveness. Growing global adoption, particularly in emerging economies, would further fuel demand. This scenario assumes a generally positive macroeconomic environment, with relatively low inflation and stable global financial markets.

In this bullish scenario, we project a Bitcoin price of $250,000 by December 2025. This target is based on the potential for increased scarcity due to halving events, continued institutional investment, and growing mainstream adoption. Imagine a world where Bitcoin is accepted as a mainstream store of value and a medium of exchange, similar to gold’s historical role. The narrative would involve a steady climb throughout the years leading up to 2025, punctuated by periods of consolidation and occasional corrections, but ultimately driven upwards by strong fundamental demand. This positive momentum would likely attract a wider range of investors, pushing the price to unprecedented levels.

Bearish Scenario: Bitcoin Faces Headwinds and Consolidation

Conversely, a bearish scenario sees Bitcoin facing significant headwinds in the coming years. Increased regulatory scrutiny, particularly in the face of increased scrutiny of cryptocurrencies and their use in illicit activities, could dampen investor enthusiasm. A global economic downturn or a major geopolitical event could also negatively impact the cryptocurrency market, leading to significant price declines. Furthermore, the emergence of competing cryptocurrencies with superior technology or features could erode Bitcoin’s dominance.

Under this pessimistic outlook, we predict a Bitcoin price of $30,000 by December 2025. This significantly lower price reflects a prolonged period of market uncertainty and lackluster investor confidence. The narrative here involves a series of setbacks and challenges, including regulatory hurdles, economic instability, and intense competition from other cryptocurrencies. This scenario paints a picture of a market struggling to regain its footing, with Bitcoin experiencing prolonged periods of sideways trading and occasional sharp drops. This would likely lead to a much lower price than its current value, as many investors might exit the market or hold off on investments due to risk aversion. The price would be influenced by fear, uncertainty, and doubt, significantly impacting the overall value.

Neutral Scenario: Bitcoin Consolidates and Finds Stability

This scenario represents a more moderate outlook, where Bitcoin experiences neither a dramatic surge nor a significant crash. It envisions a period of consolidation, with the price fluctuating within a defined range. This would be driven by a balance of positive and negative factors. While some institutional adoption and technological advancements continue, regulatory uncertainty and macroeconomic headwinds would partially offset these gains. The overall market sentiment would be relatively neutral, neither overly bullish nor excessively bearish.

In this neutral scenario, we anticipate a Bitcoin price of $75,000 by December 2025. This price target reflects a balance between potential growth and potential risks. The narrative here involves a gradual, steady increase in price, punctuated by periods of consolidation and minor corrections. The market would likely remain volatile, but the overall trend would be one of gradual appreciation. This would be driven by factors such as ongoing adoption by businesses and individuals, while regulatory uncertainty and the potential for negative macroeconomic events would act as a brake on significant price increases. It’s a scenario of cautious optimism, reflecting a mature market finding its equilibrium.

Risks and Opportunities Associated with Bitcoin Investment

Investing in Bitcoin, like any other asset class, presents a unique blend of potential rewards and inherent risks. Understanding both sides of this equation is crucial for making informed investment decisions. The cryptocurrency market’s volatility and the relative infancy of the technology contribute significantly to the uncertainty involved. However, the potential for substantial returns and the possibility of portfolio diversification also make Bitcoin an attractive proposition for some investors.

Potential Risks of Bitcoin Investment

The risks associated with Bitcoin investment are multifaceted and can be significant. Careful consideration of these factors is paramount before committing capital. Ignoring these risks could lead to substantial financial losses.

- Volatility: Bitcoin’s price is notoriously volatile, experiencing dramatic swings in value over short periods. For example, in 2021, Bitcoin’s price reached an all-time high, only to subsequently undergo a significant correction. This volatility makes it challenging to predict short-term price movements and increases the risk of substantial losses for investors who are not prepared for such fluctuations.

- Security Breaches: Bitcoin exchanges and individual wallets are potential targets for hackers. The loss of private keys, which are essential for accessing Bitcoin holdings, can result in the irreversible loss of funds. High-profile exchange hacks have demonstrated the vulnerability of digital assets to cyberattacks.

- Regulatory Uncertainty: The regulatory landscape surrounding Bitcoin and cryptocurrencies is constantly evolving and varies significantly across jurisdictions. Changes in regulations can impact the price of Bitcoin and the ease with which it can be traded or used. This uncertainty creates an additional layer of risk for investors.

- Market Manipulation: The relatively smaller size of the Bitcoin market compared to traditional financial markets makes it potentially more susceptible to manipulation by large investors or coordinated groups. This can lead to artificial price swings that negatively impact individual investors.

Potential Opportunities of Bitcoin Investment

Despite the inherent risks, Bitcoin investment also offers several compelling opportunities for those willing to accept the associated uncertainties. These opportunities can be substantial, particularly for long-term investors.

- Long-Term Growth Potential: Many analysts believe that Bitcoin has the potential for long-term growth, driven by factors such as increasing adoption, limited supply, and its role as a potential store of value. While past performance is not indicative of future results, the historical growth of Bitcoin has been significant for early investors.

- Diversification Benefits: Bitcoin’s low correlation with traditional asset classes like stocks and bonds can offer diversification benefits to a portfolio. Adding Bitcoin to a diversified portfolio may reduce overall portfolio risk, though this is not guaranteed.

- Technological Innovation: The underlying technology behind Bitcoin, blockchain, has the potential to revolutionize various industries beyond finance. Investing in Bitcoin can be viewed as a way to indirectly participate in this technological revolution.

- Hedge Against Inflation: Some investors see Bitcoin as a potential hedge against inflation, given its limited supply and its potential to maintain value even during periods of economic uncertainty. However, this is still a debated topic and not a guaranteed outcome.

Risk and Opportunity Comparison

The risks and opportunities associated with Bitcoin investment are inherently intertwined. The high volatility that presents a significant risk also creates the potential for substantial gains. Regulatory uncertainty, while a risk, could also lead to positive developments that increase Bitcoin’s legitimacy and adoption. Ultimately, the decision of whether to invest in Bitcoin involves a careful assessment of one’s risk tolerance and investment goals, weighing the potential rewards against the potential downsides. A balanced approach is essential.

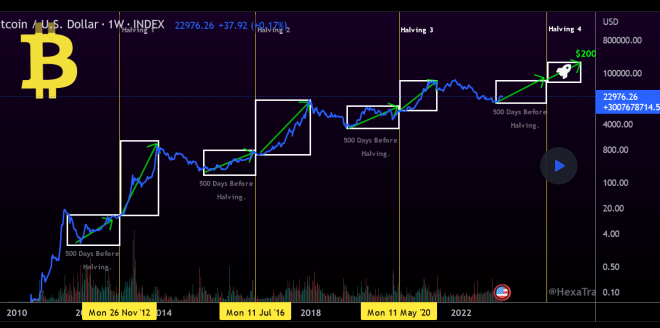

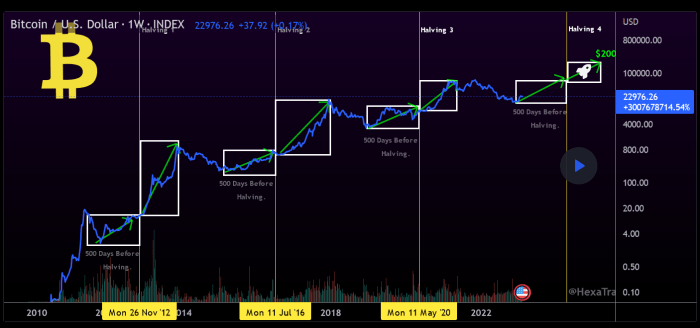

Bitcoin Prediction December 2025 – Predicting Bitcoin’s price in December 2025 is challenging, with various factors influencing its trajectory. A key event to consider when formulating any prediction is the Bitcoin halving, which significantly impacts the cryptocurrency’s supply. To understand its potential effect, it’s helpful to learn more about the mechanics of this event by reading this informative article: Que Es El Halving De Bitcoin 2025.

Ultimately, understanding the halving’s impact is crucial for any serious Bitcoin price prediction for December 2025.

Predicting Bitcoin’s price in December 2025 is challenging, influenced by numerous factors. A key event impacting this prediction is the 2025 Bitcoin halving, significantly altering the rate of new Bitcoin creation; you can find detailed analysis on this at 2025 Bitcoin Halving Prediction. Understanding the halving’s potential effects is crucial for any reasonable Bitcoin Prediction December 2025 forecast.

Predicting Bitcoin’s price in December 2025 is challenging, influenced by numerous factors. A key event impacting this prediction is the 2025 Bitcoin halving, significantly altering the rate of new Bitcoin creation; you can find detailed analysis on this at 2025 Bitcoin Halving Prediction. Understanding the halving’s potential effects is crucial for any reasonable Bitcoin Prediction December 2025 forecast.

Predicting Bitcoin’s price in December 2025 is challenging, influenced by numerous factors. A key event impacting this prediction is the 2025 Bitcoin halving, significantly altering the rate of new Bitcoin creation; you can find detailed analysis on this at 2025 Bitcoin Halving Prediction. Understanding the halving’s potential effects is crucial for any reasonable Bitcoin Prediction December 2025 forecast.

Predicting Bitcoin’s price in December 2025 is challenging, influenced by numerous factors. A key event impacting this prediction is the 2025 Bitcoin halving, significantly altering the rate of new Bitcoin creation; you can find detailed analysis on this at 2025 Bitcoin Halving Prediction. Understanding the halving’s potential effects is crucial for any reasonable Bitcoin Prediction December 2025 forecast.

Predicting Bitcoin’s price in December 2025 is challenging, influenced by numerous factors. A key event impacting this prediction is the 2025 Bitcoin halving, significantly altering the rate of new Bitcoin creation; you can find detailed analysis on this at 2025 Bitcoin Halving Prediction. Understanding the halving’s potential effects is crucial for any reasonable Bitcoin Prediction December 2025 forecast.