Bitcoin’s Long-Term Outlook: Bitcoin Prediction End Of 2025

Bitcoin’s long-term potential is a subject of considerable debate, influenced by a complex interplay of technological advancements, regulatory landscapes, and evolving societal attitudes towards digital currencies. While predicting the future with certainty is impossible, analyzing historical trends and current developments allows us to construct plausible scenarios for Bitcoin’s trajectory over the next decade.

Bitcoin’s potential for growth hinges on several key factors. Increased adoption as a mainstream payment method, driven by improvements in transaction speed and cost, is crucial. Furthermore, the evolution of Bitcoin’s underlying technology, including the development of the Lightning Network for faster and cheaper transactions, and the ongoing exploration of layer-2 scaling solutions, will significantly impact its capacity to handle a larger user base. The regulatory environment, varying significantly across jurisdictions, also plays a pivotal role in determining Bitcoin’s accessibility and adoption rate. Finally, broader societal acceptance of cryptocurrencies and a growing understanding of decentralized finance (DeFi) are essential for widespread integration.

Bitcoin as a Mainstream Payment Method, Bitcoin Prediction End Of 2025

The potential for Bitcoin to become a widely accepted payment method depends on overcoming several challenges. Current transaction speeds and fees can be prohibitive for everyday use, but ongoing technological improvements, such as the Lightning Network, aim to address this. Moreover, widespread merchant adoption is crucial, requiring robust and user-friendly payment processing solutions. The volatility of Bitcoin’s price also poses a significant hurdle for both consumers and businesses, although this volatility may diminish over time as the market matures. The success of Bitcoin as a payment method will largely depend on its ability to provide a reliable, efficient, and secure alternative to traditional payment systems. Successful examples of Bitcoin adoption in specific sectors, like remittances in certain developing countries, suggest a path towards wider acceptance, although challenges remain.

Technological Evolution and Adaptability

Bitcoin’s underlying technology is constantly evolving. The development of the Lightning Network is a prime example of efforts to enhance scalability and transaction speed. Further advancements in layer-2 scaling solutions, such as sidechains and state channels, promise to improve transaction throughput and reduce fees. Research into improving privacy features, such as improved coin mixing protocols, is also ongoing. The ability of Bitcoin’s community to adapt to technological advancements and address emerging challenges will be key to its long-term viability and competitiveness. This ongoing development is crucial to ensuring Bitcoin remains relevant and adaptable to the changing technological landscape.

Potential Market Capitalization and Adoption Scenarios

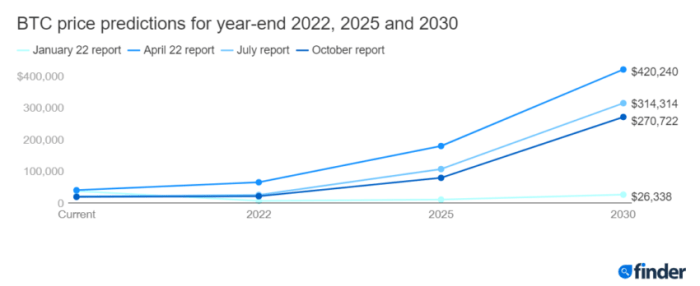

Predicting Bitcoin’s future market capitalization and adoption rates requires considering several variables. A conservative scenario might see Bitcoin maintain its position as a leading cryptocurrency, but with limited mainstream adoption, resulting in a relatively modest increase in market capitalization over the next decade. A more optimistic scenario envisions widespread adoption as a store of value and a payment method, leading to a significantly higher market capitalization, potentially surpassing that of gold or other established asset classes. However, this would require overcoming the challenges discussed previously, including regulatory hurdles and technological limitations. A pessimistic scenario involves increased regulatory scrutiny or technological disruption, leading to decreased adoption and a lower market capitalization. The actual outcome will likely fall somewhere between these extremes, depending on the interplay of various factors. For example, a scenario similar to the early growth of the internet could see Bitcoin’s market cap increase exponentially, while a scenario more like the adoption of early mobile phones could see slower but still significant growth.

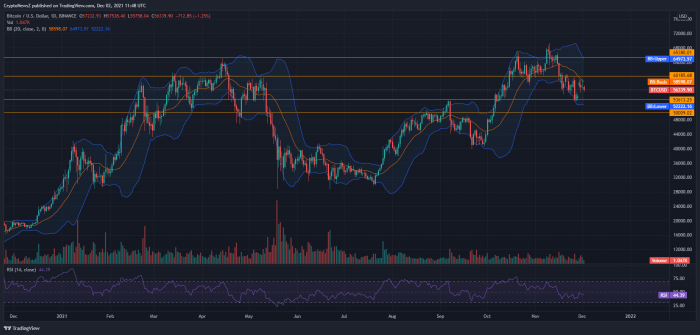

Visual Representation of Bitcoin’s Future Trajectory

Imagine a graph with time (in years) on the horizontal axis and Bitcoin’s price (in USD) and adoption rate (percentage of global population) on the vertical axis. The adoption rate curve would likely show a gradual increase, possibly accelerating in later years if the challenges to wider adoption are overcome. The price curve would likely exhibit volatility in the short term, but could trend upwards in the long term, following the adoption rate curve, albeit with periods of correction. However, the exact shape of both curves would be highly dependent on various factors, making a precise prediction impossible. The graph would show a positive correlation between adoption and price, but with the price exhibiting greater volatility. Periods of high adoption growth might be followed by periods of price consolidation or even temporary decline, reflecting the inherent volatility of the cryptocurrency market.

Frequently Asked Questions (FAQ)

This section addresses common queries regarding Bitcoin’s future price, investment risks, mining processes, and alternative cryptocurrencies. Understanding these aspects is crucial for making informed decisions in the volatile cryptocurrency market.

Bitcoin’s Price at the End of 2025

Predicting Bitcoin’s price with certainty is impossible. Numerous analysts offer varying forecasts, ranging from extremely bullish projections exceeding $100,000 to more conservative estimates in the $50,000-$70,000 range. These predictions depend on several factors, including widespread adoption, regulatory changes, technological advancements, and macroeconomic conditions. For example, a global recession could negatively impact Bitcoin’s price, while increased institutional investment could drive it higher. Ultimately, the actual price will likely fall somewhere within a wide range, and significant volatility is expected.

Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries substantial risks. Its price is notoriously volatile, experiencing sharp fluctuations in short periods. Regulatory uncertainty poses another significant threat, as governments worldwide grapple with how to regulate cryptocurrencies. Changes in regulations could impact Bitcoin’s price and accessibility. Security risks are also a concern, with the possibility of hacking, theft, and scams. Investors should be prepared for potential losses and carefully consider their risk tolerance before investing.

Bitcoin Mining and Environmental Impacts

Bitcoin mining involves using powerful computers to solve complex mathematical problems, validating transactions and adding them to the blockchain. This process consumes significant energy, primarily electricity, raising environmental concerns. The energy consumption varies depending on the mining hardware used and the source of electricity. Some mining operations utilize renewable energy sources, mitigating their environmental impact. However, the overall energy consumption of Bitcoin mining remains a subject of ongoing debate and efforts towards more sustainable mining practices are underway.

Bitcoin as an Investment

Whether Bitcoin is a “good” investment depends entirely on individual circumstances and risk tolerance. It’s a highly speculative asset with the potential for substantial returns but also significant losses. Investors with a high-risk tolerance and a long-term investment horizon might consider Bitcoin as part of a diversified portfolio. However, those with lower risk tolerance or shorter-term investment goals should exercise extreme caution or avoid Bitcoin altogether. It’s crucial to thoroughly research and understand the risks involved before investing any money.

Alternative Cryptocurrencies

Besides Bitcoin, numerous alternative cryptocurrencies (altcoins) exist, each with unique features and purposes. Ethereum, for instance, is a platform for decentralized applications (dApps) and smart contracts, offering functionalities beyond Bitcoin’s primary role as a digital currency. Solana and Cardano are other notable examples, focusing on scalability and smart contract capabilities. These altcoins often differ from Bitcoin in their technology, consensus mechanisms, and intended use cases. Investing in altcoins carries even greater risk than investing in Bitcoin due to their often smaller market capitalization and higher volatility.

Bitcoin Prediction End Of 2025 – Predicting Bitcoin’s price at the end of 2025 is challenging, influenced by numerous factors. A key event impacting these predictions is the Bitcoin Halving, significantly altering the rate of new Bitcoin entering circulation. For detailed analysis on the projected date of this halving, check out this resource: Bitcoin Halving Date 2025 Prediction. Understanding the halving’s timing is crucial for refining any Bitcoin price forecast for late 2025.

Predicting Bitcoin’s value at the end of 2025 is challenging, with various factors influencing its price. A key event impacting these predictions is the Bitcoin Halving, significantly affecting the rate of new Bitcoin entering circulation. To understand the precise timing of this event, check out the detailed analysis on the Bitcoin Halving 2025 Date And Time which is crucial for formulating accurate long-term Bitcoin price forecasts.

Ultimately, the halving’s impact on scarcity and investor sentiment will heavily influence the Bitcoin Prediction End Of 2025.

Predicting Bitcoin’s value at the end of 2025 is challenging, influenced by numerous factors. A key event impacting these predictions is the Bitcoin halving, significantly altering the rate of new Bitcoin creation. To understand the precise timing of this event, you might find this resource helpful: Bitcoin Halving 2025 Ngày Nào. Therefore, considering the halving’s date is crucial for any accurate Bitcoin prediction for the end of 2025.

Predicting Bitcoin’s price at the end of 2025 is challenging, with various factors influencing its trajectory. A key event to consider when forming such a prediction is the Date Of Bitcoin Halving In 2025 , as this halving significantly impacts the rate of new Bitcoin entering circulation. This event’s influence on supply and, consequently, potential price movements, is a crucial component of any comprehensive Bitcoin end-of-2025 forecast.

Predicting Bitcoin’s price at the end of 2025 is challenging, with various factors influencing its trajectory. A key event to consider is the Bitcoin halving in 2024, which will significantly reduce the rate of new Bitcoin creation. To understand the potential impact of this event on the price, it’s helpful to learn more about what the halving entails; you can find a detailed explanation here: What Does Halving Bitcoin 2025 Mean.

Understanding this halving is crucial for forming any informed prediction regarding Bitcoin’s value by the end of 2025.

Predicting Bitcoin’s price at the end of 2025 is challenging, with various factors influencing its trajectory. A key element to consider is the impact of the 2025 halving event, which will significantly reduce the rate of new Bitcoin creation. To gain insight into potential price movements around this event, check out this analysis on the Bitcoin Price At Halving 2025.

Understanding the halving’s likely effect is crucial for formulating any comprehensive Bitcoin prediction for late 2025.