Risks and Opportunities Associated with Bitcoin Investment

Investing in Bitcoin, like any other asset class, presents a unique blend of risks and opportunities. Understanding both sides of this equation is crucial for making informed investment decisions. While the potential for high returns is alluring, the inherent volatility and regulatory uncertainty demand careful consideration. This section will delve into the key risks and opportunities, offering insights into mitigating potential downsides.

Bitcoin Volatility

Bitcoin’s price is notoriously volatile. Significant price swings, both upward and downward, are common. For example, in 2021, Bitcoin experienced a dramatic surge, reaching near $65,000, only to subsequently undergo a significant correction. This volatility stems from various factors, including market sentiment, regulatory announcements, and technological developments. Such fluctuations can lead to substantial losses for investors if not properly managed. Investors should be prepared for periods of significant price drops and have a robust risk management strategy in place. This might include diversification across different asset classes and a clear understanding of their own risk tolerance.

Regulatory Uncertainty, Bitcoin Prediction February 2025

The regulatory landscape surrounding Bitcoin remains uncertain globally. Different jurisdictions have adopted varying approaches, ranging from outright bans to more permissive regulatory frameworks. This uncertainty can impact Bitcoin’s price and liquidity. Changes in regulations can create significant market volatility, impacting investor confidence and potentially leading to price fluctuations. For example, a sudden crackdown on cryptocurrency exchanges in a major market could negatively impact Bitcoin’s price. Staying informed about regulatory developments is crucial for navigating this uncertainty.

Security Risks

Bitcoin, being a decentralized digital currency, is susceptible to various security risks. These include hacking of exchanges, theft of private keys, and scams. Investors need to be aware of these risks and take appropriate measures to protect their investments. This involves using secure wallets, practicing good cybersecurity hygiene, and only using reputable exchanges. Losses due to security breaches can be substantial and irreversible.

Opportunities for Diversification

Bitcoin offers a potential opportunity for portfolio diversification. Its low correlation with traditional asset classes like stocks and bonds can help reduce overall portfolio risk. Adding Bitcoin to a diversified portfolio can potentially improve risk-adjusted returns. For example, during periods of market downturn, Bitcoin’s price might not necessarily move in the same direction as traditional assets, potentially offering some protection against overall portfolio losses.

Potential for High Returns

Historically, Bitcoin has demonstrated the potential for significant returns. While past performance is not indicative of future results, the potential for substantial appreciation remains a key driver for investment. The scarcity of Bitcoin, with a fixed supply of 21 million coins, is often cited as a factor contributing to its potential long-term value appreciation. However, it’s crucial to remember that this potential comes with considerable risk.

Mitigating Risks

Mitigating the risks associated with Bitcoin investment requires a multi-faceted approach. This includes thorough research and due diligence before investing, diversifying across different asset classes, employing a robust risk management strategy, and using secure storage methods for Bitcoin holdings. It is also crucial to only invest an amount that one can afford to lose and to avoid making emotional investment decisions based on market hype. Staying informed about market trends and regulatory developments is also essential.

Expert Opinions and Market Sentiment: Bitcoin Prediction February 2025

Predicting Bitcoin’s price is inherently speculative, yet analyzing expert opinions and prevailing market sentiment offers valuable insight into potential price trajectories. While no one can definitively state Bitcoin’s price in February 2025, examining diverse perspectives reveals a range of possibilities, influenced by factors like technological advancements, regulatory changes, and macroeconomic conditions.

Experts’ predictions for Bitcoin’s price in February 2025 vary significantly. This divergence reflects the inherent uncertainty in the cryptocurrency market and the differing methodologies employed by analysts. Some analysts base their predictions on technical indicators, such as chart patterns and trading volume, while others incorporate fundamental factors, including adoption rates, network security, and regulatory developments.

Leading Analyst Predictions

A spectrum of predictions exists among prominent cryptocurrency analysts. For example, some bullish analysts, citing increasing institutional adoption and the scarcity of Bitcoin, predict prices well above $100,000. These analysts often point to the limited supply of Bitcoin (21 million coins) as a primary driver of future price appreciation, arguing that increasing demand will outpace supply, leading to significant price increases. Conversely, some bearish analysts express concerns about regulatory uncertainty and potential macroeconomic downturns, predicting prices significantly lower than current levels. These analysts often highlight the volatility of the cryptocurrency market and the potential for large-scale sell-offs. A middle ground exists, with some analysts projecting moderate growth, perhaps in the $50,000 – $80,000 range, based on a more conservative assessment of adoption and market conditions. It’s crucial to remember that these are just predictions, and the actual price could differ significantly. For instance, PlanB’s stock-to-flow model, a popular but controversial method, has historically yielded inaccurate predictions.

Market Sentiment Analysis

Market sentiment, gauged through social media sentiment analysis, news coverage, and investor surveys, reveals a mixed picture. Bullish sentiment is often fueled by news of institutional investments, positive regulatory developments in certain jurisdictions, and technological advancements within the Bitcoin ecosystem. Conversely, bearish sentiment can arise from regulatory crackdowns, market crashes in other asset classes, or negative news related to cryptocurrency scams or security breaches. The overall sentiment tends to fluctuate dramatically, reflecting the volatile nature of the Bitcoin market. For example, periods of intense regulatory scrutiny often lead to a dip in bullish sentiment, while positive news about Bitcoin adoption by major corporations can quickly shift sentiment toward optimism.

Comparison of Perspectives and Consensus

While there is no broad consensus on Bitcoin’s precise price in February 2025, a common thread runs through many analyses: the inherent uncertainty and volatility of the cryptocurrency market. The significant disagreement among analysts highlights the complexity of predicting Bitcoin’s price, influenced by a multitude of interconnected factors. The lack of a unified prediction emphasizes the need for investors to conduct their own thorough research and assess their own risk tolerance before investing in Bitcoin. A key difference lies in the weight given to technical analysis versus fundamental analysis, with some experts placing more emphasis on chart patterns while others focus on long-term adoption and network effects.

Disclaimer and Conclusion (Note: Conclusion excluded)

This analysis regarding potential Bitcoin price movements in February 2025 is purely speculative and should not be interpreted as financial advice. The cryptocurrency market is inherently volatile and unpredictable, subject to numerous factors beyond the scope of any single prediction. Past performance is not indicative of future results. Any investment decision related to Bitcoin or other cryptocurrencies carries significant risk, including the potential for total loss of invested capital.

The information presented here is for educational purposes only and should not be considered a recommendation to buy, sell, or hold any cryptocurrency. Readers are strongly urged to conduct their own thorough research and seek advice from qualified financial professionals before making any investment decisions. We assume no responsibility for any losses incurred as a result of relying on the information contained within this analysis. Remember that investing in cryptocurrencies is inherently risky, and you should only invest what you can afford to lose.

Risk Factors in Bitcoin Investment

Investing in Bitcoin involves a multitude of risks. Price volatility is a primary concern, with Bitcoin’s value fluctuating dramatically in short periods. Regulatory uncertainty poses another challenge, as governmental policies concerning cryptocurrencies are constantly evolving and can significantly impact their value. Technological risks, such as security breaches or network vulnerabilities, also exist. Furthermore, the lack of inherent value and reliance on market sentiment make Bitcoin a highly speculative asset. Consider the example of the 2018 Bitcoin bear market, where the price plummeted from nearly $20,000 to under $4,000 in a matter of months, illustrating the significant potential for losses. This volatility underscores the need for caution and careful risk management.

Disclaimer Regarding Predictions

It is crucial to understand that any prediction, including those regarding Bitcoin’s price in February 2025, is inherently uncertain. Numerous unforeseen events, such as global economic shifts, technological advancements, or regulatory changes, could drastically alter the market landscape. While historical data and current trends can inform analysis, they cannot definitively predict future outcomes. This analysis attempts to provide a possible scenario based on available information, but it does not guarantee accuracy or success. Remember that even expert opinions can be wrong, and relying solely on predictions can lead to significant financial losses. Always approach cryptocurrency investment with a healthy dose of skepticism and a comprehensive understanding of the inherent risks.

Frequently Asked Questions (FAQ)

This section addresses common questions regarding Bitcoin’s potential price in February 2025 and related investment considerations. Understanding the inherent volatility and unpredictability of the cryptocurrency market is crucial before making any investment decisions. Remember, past performance is not indicative of future results.

Bitcoin’s Most Likely Price in February 2025

Predicting Bitcoin’s price with certainty is impossible. Numerous factors, including regulatory changes, technological advancements, and overall market sentiment, significantly influence its value. While some analysts offer price targets, these are educated guesses, not guarantees. For example, a prediction of $100,000 might be based on the assumption of widespread institutional adoption and continued technological development, but unforeseen events could easily push the price higher or lower. It’s more prudent to consider a range of possibilities rather than a single point prediction. A realistic approach involves considering various scenarios and their associated probabilities.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable. Predictive models often rely on historical data and current trends, but the cryptocurrency market is notoriously volatile and susceptible to unexpected events. News cycles, regulatory actions, and even social media trends can dramatically impact Bitcoin’s price in short periods. Therefore, any prediction should be viewed with considerable skepticism. Over-reliance on predictions can lead to poor investment decisions. Consider diverse viewpoints and always factor in a significant margin of error.

Factors Influencing Significant Price Changes

Several factors can cause substantial price increases or decreases in Bitcoin. Positive factors include increased institutional adoption, positive regulatory developments (like clear, supportive guidelines), advancements in Bitcoin’s underlying technology (like the Lightning Network improving scalability), and growing mainstream acceptance. Conversely, negative factors include negative regulatory crackdowns (like outright bans or stringent regulations), significant security breaches impacting user confidence, macroeconomic events (like global recessions), and large-scale sell-offs by major holders. The interplay of these factors creates a complex and unpredictable market dynamic.

Investment Timing in 2024

Whether 2024 is a “good” time to invest in Bitcoin depends entirely on individual risk tolerance and investment goals. Bitcoin’s price can fluctuate wildly, leading to significant gains or losses. Before investing, it’s crucial to conduct thorough research, understand the risks involved, and only invest what you can afford to lose. Consider diversifying your portfolio to mitigate risk and consult with a qualified financial advisor before making any investment decisions. The potential for high rewards comes with equally high risks.

Long-Term Prospects for Bitcoin

Bitcoin’s long-term prospects are a subject of ongoing debate. Some believe it has the potential to become a dominant global store of value, while others are more skeptical. Its decentralized nature and limited supply are key arguments in its favor. However, challenges remain, including scalability issues, regulatory uncertainty, and the emergence of competing cryptocurrencies. The long-term success of Bitcoin depends on its ability to overcome these challenges and continue to attract users and institutional adoption. The future is uncertain, but Bitcoin’s unique characteristics provide a compelling case for its continued relevance.

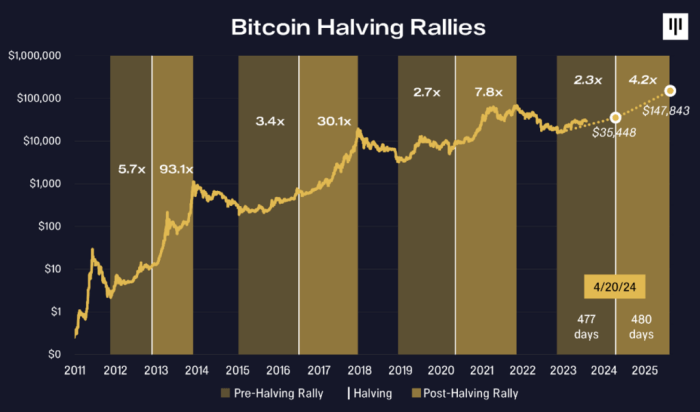

Bitcoin Prediction February 2025 – Predicting Bitcoin’s price in February 2025 is challenging, but understanding historical trends is crucial. A key factor to consider is the upcoming Bitcoin halving, significantly impacting supply and potentially influencing price. To visualize the potential effects of this halving event, check out this helpful chart: Bitcoin Halving 2025 Chart. Ultimately, using this resource alongside other market analyses will aid in forming a more informed prediction for Bitcoin’s value in February 2025.

Predicting Bitcoin’s price in February 2025 is challenging, influenced by numerous factors. A key event impacting these predictions is the Bitcoin Price Halving in 2024, which typically leads to increased scarcity and often precedes price increases. For a deeper dive into this significant event, check out this informative resource on the Bitcoin Price Halving 2025. Understanding the halving’s potential impact is crucial for any serious Bitcoin price prediction for February 2025.

Predicting Bitcoin’s price in February 2025 is challenging, relying heavily on various factors. A key element influencing these predictions is the Bitcoin halving, which significantly impacts the rate of new Bitcoin entering circulation. To understand its influence, it’s crucial to know exactly when this event occurred; you can find this information by checking out this resource: When Was The 2025 Bitcoin Halving.

Understanding the halving’s timing is therefore vital for more accurate Bitcoin Prediction February 2025 forecasts.

Predicting Bitcoin’s price in February 2025 is challenging, relying heavily on various factors. A key element influencing these predictions is the Bitcoin halving, which significantly impacts the rate of new Bitcoin entering circulation. To understand its influence, it’s crucial to know exactly when this event occurred; you can find this information by checking out this resource: When Was The 2025 Bitcoin Halving.

Understanding the halving’s timing is therefore vital for more accurate Bitcoin Prediction February 2025 forecasts.

Predicting Bitcoin’s price in February 2025 is challenging, relying heavily on various factors. A key element influencing these predictions is the Bitcoin halving, which significantly impacts the rate of new Bitcoin entering circulation. To understand its influence, it’s crucial to know exactly when this event occurred; you can find this information by checking out this resource: When Was The 2025 Bitcoin Halving.

Understanding the halving’s timing is therefore vital for more accurate Bitcoin Prediction February 2025 forecasts.

Predicting Bitcoin’s price in February 2025 is challenging, given its volatile nature. A significant factor influencing this prediction is the upcoming Bitcoin halving, which will reduce the rate of new Bitcoin creation. To understand its potential impact, it’s crucial to consider the implications of this event; for more information, check out this resource on What Is Bitcoin Halving 2025 Prediction.

Ultimately, the halving’s effect on Bitcoin’s price in February 2025 remains a subject of ongoing debate and analysis.

Predicting Bitcoin’s price in February 2025 is inherently speculative, relying on various factors like regulatory changes and market sentiment. However, effective advertising can significantly impact any cryptocurrency venture’s success; consider setting up a robust Google Ads Account to reach potential investors interested in Bitcoin predictions and related financial products. Ultimately, a well-executed marketing strategy can influence the perception and adoption of Bitcoin, potentially affecting its value by February 2025.