Bitcoin Prediction For 2025

Bitcoin, the world’s first cryptocurrency, has captivated investors and technologists alike with its volatile nature and immense potential. Since its inception, Bitcoin’s price has experienced dramatic swings, from near-worthlessness to record highs, punctuated by periods of explosive growth and sharp corrections. Understanding these fluctuations is crucial to predicting its future trajectory. This analysis will delve into the factors that could shape Bitcoin’s price by 2025, offering a reasoned perspective on its potential value.

Bitcoin’s journey has been marked by significant milestones. Its initial years saw slow adoption and relatively low prices. The 2017 bull run propelled Bitcoin to unprecedented heights, exceeding $19,000, only to be followed by a significant market correction. Subsequent years witnessed periods of both growth and consolidation, influenced by regulatory changes, technological advancements, and macroeconomic factors. These events, coupled with increasing institutional interest and wider adoption, have established Bitcoin as a significant asset class, though its price remains highly susceptible to market sentiment.

Factors Influencing Bitcoin’s Price in 2025

Several interconnected factors will likely influence Bitcoin’s price by 2025. These include the continued adoption by institutional investors, the expansion of the Bitcoin ecosystem through decentralized finance (DeFi) and non-fungible tokens (NFTs), regulatory developments globally, and macroeconomic conditions such as inflation and interest rates. The interplay of these factors will determine the overall market sentiment and consequently, Bitcoin’s value. For example, widespread institutional adoption, coupled with positive regulatory frameworks, could drive substantial price increases, mirroring the effect seen in the 2017 bull run, albeit potentially on a larger scale given the increased maturity of the market. Conversely, unfavorable regulatory changes or a global economic downturn could trigger significant price corrections.

Institutional Adoption and Market Maturity

The increasing involvement of institutional investors, such as hedge funds and corporations, significantly impacts Bitcoin’s price stability and potential for growth. Their entry signals a shift from a largely speculative market to one with more established investment strategies. This increased institutional participation contributes to price stability by reducing volatility caused by individual retail traders. Furthermore, institutional investment often involves larger sums of capital, potentially driving significant price appreciation if the trend continues. The example of MicroStrategy, a publicly traded business intelligence company that has accumulated a significant Bitcoin holding, demonstrates the potential impact of large-scale institutional investment.

Technological Advancements and Ecosystem Growth

The Bitcoin ecosystem is constantly evolving. The development of the Lightning Network, a layer-2 scaling solution, aims to improve transaction speed and reduce fees, making Bitcoin more suitable for everyday transactions. Furthermore, the growth of DeFi and NFTs built on Bitcoin’s blockchain expands its utility beyond a simple store of value. These technological advancements could drive increased adoption and, consequently, higher demand and price. The success of other cryptocurrencies leveraging similar technologies could also indirectly influence Bitcoin’s price, showcasing the potential of blockchain technology as a whole.

Regulatory Landscape and Global Macroeconomic Conditions

Regulatory clarity and stability are crucial for Bitcoin’s long-term growth. Favorable regulatory frameworks, particularly in major economies, could attract more institutional investment and mainstream adoption. Conversely, restrictive regulations could hinder growth and suppress price. Additionally, macroeconomic factors such as inflation and interest rates play a significant role. High inflation might drive investors towards Bitcoin as a hedge against inflation, increasing demand. Conversely, rising interest rates could divert investment away from riskier assets like Bitcoin, potentially leading to price declines. The interplay between these regulatory and macroeconomic factors will be a key determinant of Bitcoin’s price trajectory in 2025.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of macroeconomic factors, regulatory landscapes, technological advancements, institutional involvement, and public sentiment. These elements are interconnected and their combined influence will ultimately determine Bitcoin’s trajectory.

Macroeconomic Factors and Bitcoin’s Price

Global economic conditions, inflation rates, and interest rate policies significantly impact Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against inflation, increasing demand and potentially pushing prices upward. Conversely, rising interest rates might divert investment away from riskier assets like Bitcoin into more stable, interest-bearing instruments, leading to price decreases. Recessions or periods of significant global economic uncertainty could also trigger a flight to safety, impacting Bitcoin’s price depending on its perceived risk profile at that time. The correlation between Bitcoin’s price and the performance of traditional markets, such as the S&P 500, is often observed, indicating a degree of interconnectedness. For example, during periods of market downturn, Bitcoin has historically experienced price volatility, often mirroring the negative sentiment in traditional markets.

Regulatory Developments and Government Policies

Government regulations and policies worldwide play a crucial role in shaping Bitcoin’s future. Clear and consistent regulatory frameworks could foster greater institutional adoption and investor confidence, potentially driving up the price. Conversely, overly restrictive or unclear regulations could stifle growth and lead to price declines. Different jurisdictions are adopting varying approaches, from outright bans to permissive regulatory sandboxes. The ongoing debate surrounding Bitcoin’s classification as a security or a commodity further exemplifies the uncertainty and its potential impact on price. The implementation of a robust regulatory framework, such as that seen in some parts of Europe, could encourage institutional investment, stabilizing the market and driving price appreciation. Conversely, a sudden and drastic regulatory crackdown, such as the Chinese ban in 2021, could lead to a significant and rapid price drop.

Technological Advancements and Bitcoin Adoption

Technological advancements in the Bitcoin ecosystem are vital for its long-term growth and price stability. Layer-2 scaling solutions, like the Lightning Network, aim to improve transaction speed and reduce fees, making Bitcoin more user-friendly and accessible. Improvements in mining efficiency, through advancements in hardware and software, can also impact the overall cost of mining and potentially influence the network’s security and stability. The development and adoption of these technologies can positively impact Bitcoin’s price by increasing its usability and reducing barriers to entry for everyday users and businesses. For example, the increased adoption of the Lightning Network could lead to a surge in Bitcoin transactions, potentially boosting its price.

Institutional Adoption and Market Stability

Increased investment from corporations and financial institutions significantly impacts Bitcoin’s market capitalization and price stability. As institutional investors allocate larger portions of their portfolios to Bitcoin, it can lead to increased liquidity and reduced price volatility. Grayscale Bitcoin Trust, for instance, is a notable example of institutional investment in Bitcoin. The growing acceptance of Bitcoin as a legitimate asset class by major financial players can lend credibility and stability to the market, potentially reducing the impact of short-term price fluctuations.

Public Sentiment, Media Coverage, and Social Media Trends

Public sentiment, media coverage, and social media trends heavily influence Bitcoin’s price volatility. Positive media coverage and widespread adoption by celebrities or influencers can drive up demand and prices. Conversely, negative news or regulatory uncertainty can trigger sell-offs and price drops. The highly publicized Elon Musk tweets regarding Bitcoin are a prime example of the influence of social media on Bitcoin’s price. These events highlight the significant role of public perception and information dissemination in shaping Bitcoin’s price trajectory.

Potential Black Swan Events

Unforeseen events with significant market impact, often referred to as “black swan” events, could significantly influence Bitcoin’s price in 2025. These could include major security breaches, unexpected regulatory changes, or a significant technological disruption within the cryptocurrency space. A large-scale cyberattack compromising a major Bitcoin exchange, for example, could severely damage investor confidence and trigger a substantial price drop. The emergence of a highly competitive, technologically superior alternative cryptocurrency could also pose a significant threat to Bitcoin’s dominance. While predicting these events is impossible, acknowledging their potential impact is crucial for understanding the inherent risks associated with Bitcoin investment.

Potential Price Scenarios for Bitcoin in 2025

Predicting the price of Bitcoin is inherently speculative, influenced by a complex interplay of technological advancements, regulatory changes, market sentiment, and macroeconomic factors. While no one can definitively state Bitcoin’s price in 2025, exploring plausible scenarios based on current trends and potential future events offers valuable insight. The following Artikels three distinct scenarios: bullish, bearish, and neutral, each with its own set of underlying assumptions and potential risks.

Bitcoin Price Scenarios in 2025

The following table summarizes three potential price scenarios for Bitcoin by 2025. Each scenario is based on a different set of assumptions regarding the factors influencing Bitcoin’s price. It’s crucial to remember that these are just possibilities, and the actual price could fall outside these ranges.

| Scenario | Price Prediction (USD) | Supporting Factors | Potential Risks |

|---|---|---|---|

| Bullish | $150,000 – $200,000 | Widespread institutional adoption; increased regulatory clarity leading to greater investor confidence; continued technological advancements improving scalability and transaction speeds; growing demand from emerging markets; a significant macroeconomic event driving investors towards Bitcoin as a safe haven asset (similar to the 2020-2021 bull run, albeit potentially on a larger scale). Successful implementation of the Lightning Network could significantly enhance Bitcoin’s usability and transaction volume. | Regulatory crackdowns in major jurisdictions; a significant security breach undermining trust; a major technological flaw discovered; a global economic crisis impacting risk appetite; market manipulation leading to sharp price corrections; the emergence of a superior cryptocurrency. The historical precedent of Bitcoin’s price cycles showing significant corrections after bull runs needs to be considered. |

| Bearish | $20,000 – $30,000 | Increased regulatory scrutiny leading to stricter rules and limitations on Bitcoin trading and usage; a prolonged period of macroeconomic instability and uncertainty; a major security flaw or exploit impacting the Bitcoin network; a significant technological advancement in competing cryptocurrencies leading to market share erosion; negative press and public perception fueled by scams or environmental concerns; a lack of significant institutional adoption. A global recession could significantly reduce investment in risk assets like Bitcoin. | The scenario underestimates the resilience of Bitcoin’s network and the potential for technological improvements; a significant positive event could trigger a rapid price increase; underestimation of the growing demand for Bitcoin in emerging markets. The history of Bitcoin demonstrates a capacity for surprising resilience and unexpected growth spurts. |

| Neutral | $50,000 – $75,000 | A period of consolidation and sideways trading; moderate institutional adoption; continued technological development without major breakthroughs; a relatively stable macroeconomic environment; gradual increase in Bitcoin’s use case as a store of value and a medium of exchange; balanced regulatory landscape with neither significant restrictions nor widespread adoption. This scenario assumes a continuation of current trends without any major disruptions or breakthroughs. | Unexpected regulatory changes; unforeseen technological disruptions; significant macroeconomic shocks; the emergence of a compelling alternative cryptocurrency; shifts in market sentiment based on unpredictable events. The neutrality of this scenario inherently assumes a relatively stable environment, which may not be realistic given the volatility of the cryptocurrency market. |

Bitcoin’s Role in the Future Financial Landscape (2025)

By 2025, Bitcoin’s position within the global financial system is projected to be significantly more established than it is today, though its ultimate role remains a subject of ongoing debate. Its potential impact spans several key areas, including its use as a store of value, a medium of exchange, and an investment asset, all while influencing traditional finance and the broader cryptocurrency ecosystem.

Bitcoin’s potential influence on the future financial landscape in 2025 is multifaceted. Its decentralized nature and limited supply present a compelling case against traditional fiat currencies vulnerable to inflation and government control. Conversely, its volatility and regulatory uncertainty pose significant challenges to widespread adoption as a primary medium of exchange. The evolution of Bitcoin’s role will depend on technological advancements, regulatory frameworks, and overall market sentiment.

Bitcoin as a Store of Value

Bitcoin’s scarcity, capped at 21 million coins, positions it as a potential hedge against inflation. Historically, during periods of economic uncertainty, Bitcoin’s price has often increased, suggesting investor confidence in its ability to retain value. However, its price volatility remains a significant drawback compared to more stable assets like gold. For example, the price swings experienced in 2021 and 2022 highlight this inherent risk. In 2025, Bitcoin’s status as a store of value will likely depend on its ability to demonstrate consistent price stability, or at least predictable patterns, alongside continued macroeconomic instability in traditional markets.

Bitcoin as a Medium of Exchange

While Bitcoin’s adoption as a medium of exchange is growing, widespread acceptance remains limited in 2024. Transaction fees can be high, and processing times can be slower than traditional payment systems. Furthermore, the volatility of Bitcoin’s price makes it a risky choice for everyday transactions. However, advancements in the Lightning Network and other second-layer solutions aim to address scalability and transaction speed issues. If these improvements are successful, Bitcoin’s role as a medium of exchange could increase substantially by 2025, especially in regions with unstable fiat currencies or limited access to traditional banking services. The potential for merchant adoption in certain niche markets (e.g., international remittances) is also significant.

Bitcoin as an Investment Asset

Bitcoin has established itself as a significant asset class within the investment world. Its limited supply and potential for appreciation attract investors seeking diversification and exposure to emerging technologies. However, its price volatility and regulatory uncertainty present significant risks. By 2025, institutional investment in Bitcoin is expected to continue growing, alongside the development of more sophisticated investment products such as Bitcoin ETFs. This institutional interest could help stabilize Bitcoin’s price and increase its overall acceptance as a legitimate investment asset. However, it’s crucial to remember that past performance does not guarantee future results, and the investment landscape is constantly evolving. For example, the integration of Bitcoin into traditional investment portfolios, while growing, still faces hurdles.

Bitcoin’s Impact on Traditional Finance

The growing adoption of Bitcoin challenges the established order of traditional finance. Its decentralized nature disrupts the centralized control of banks and governments over monetary policy and transactions. The increasing use of Bitcoin as an alternative asset could lead to reduced demand for traditional financial instruments, potentially impacting investment strategies and banking practices. In 2025, banks and financial institutions are likely to continue exploring ways to integrate Bitcoin and other cryptocurrencies into their offerings, either through direct investment or the provision of related services. This could include the development of new financial products and services designed to cater to the growing demand for digital assets.

Bitcoin’s Impact on Other Cryptocurrencies and the Blockchain Ecosystem

Bitcoin’s success and market dominance have a significant impact on the broader cryptocurrency and blockchain ecosystem. Its technological advancements and network effects influence the development and adoption of other cryptocurrencies and blockchain-based applications. In 2025, the relationship between Bitcoin and altcoins will likely remain complex, with altcoins continuing to offer specialized functionalities and potentially competing with Bitcoin in specific niches. However, Bitcoin’s established position and network effect will likely continue to give it a significant advantage. The overall growth of the blockchain ecosystem is likely to be intertwined with Bitcoin’s success, creating a positive feedback loop.

Risks and Challenges Facing Bitcoin in 2025: Bitcoin Prediction For 2025

Predicting the future of Bitcoin is inherently complex, involving numerous interconnected factors. While the potential for growth remains significant, several risks and challenges could significantly impact Bitcoin’s trajectory in 2025. Understanding these potential obstacles is crucial for any investor or stakeholder involved in the cryptocurrency ecosystem.

Scalability Issues

Bitcoin’s current transaction processing speed is limited, leading to higher fees and slower confirmation times during periods of high network activity. This scalability problem could hinder Bitcoin’s ability to become a widely used payment system for everyday transactions. For example, during periods of intense trading activity, transaction fees have spiked dramatically, making small transactions impractical. Addressing this limitation through technological advancements like the Lightning Network is ongoing, but its widespread adoption remains a key challenge. Increased transaction volume coupled with slow processing could lead to user frustration and potentially drive users towards alternative cryptocurrencies with faster transaction speeds.

Security Vulnerabilities

Despite its decentralized nature, Bitcoin is not immune to security risks. Exchanges and individual wallets remain vulnerable to hacking and theft. The high value of Bitcoin makes it an attractive target for cybercriminals. Furthermore, vulnerabilities in the Bitcoin protocol itself, though rare, could have catastrophic consequences. The Mt. Gox exchange hack, which resulted in the loss of millions of dollars worth of Bitcoin, serves as a stark reminder of the potential for large-scale security breaches. Robust security measures, including multi-factor authentication and cold storage, are essential for mitigating these risks, but complete elimination of risk is impossible.

Regulatory Uncertainty

The regulatory landscape for Bitcoin is constantly evolving and differs significantly across jurisdictions. Governments worldwide are grappling with how to regulate cryptocurrencies, leading to uncertainty for investors and businesses. Unclear or overly restrictive regulations could stifle innovation and adoption. For instance, some countries have outright banned Bitcoin, while others have implemented strict Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, increasing compliance costs and potentially hindering growth. The lack of a globally unified regulatory framework poses a significant challenge to Bitcoin’s long-term stability and growth.

Market Manipulation and Sell-offs

Bitcoin’s relatively small market capitalization compared to traditional assets makes it susceptible to market manipulation. Large holders, or “whales,” can significantly influence the price through coordinated buying or selling activities. Sudden large-scale sell-offs can trigger sharp price drops, potentially causing significant losses for investors. The 2018 Bitcoin bear market, which saw a drastic price decline, serves as an example of the impact of such events. Increased market transparency and stronger regulatory oversight are necessary to mitigate the risk of manipulation and minimize the impact of sell-offs.

Environmental Impact of Bitcoin Mining, Bitcoin Prediction For 2025

Bitcoin mining consumes significant amounts of energy, raising concerns about its environmental impact. The energy consumption is primarily due to the computationally intensive process of validating transactions and adding new blocks to the blockchain. This energy consumption translates into a substantial carbon footprint, particularly if mining operations rely heavily on fossil fuels. Efforts to transition to more sustainable energy sources for mining, such as renewable energy, are underway, but the overall environmental impact remains a significant challenge and a topic of ongoing debate. Solutions include utilizing renewable energy sources for mining operations and improving the efficiency of mining hardware.

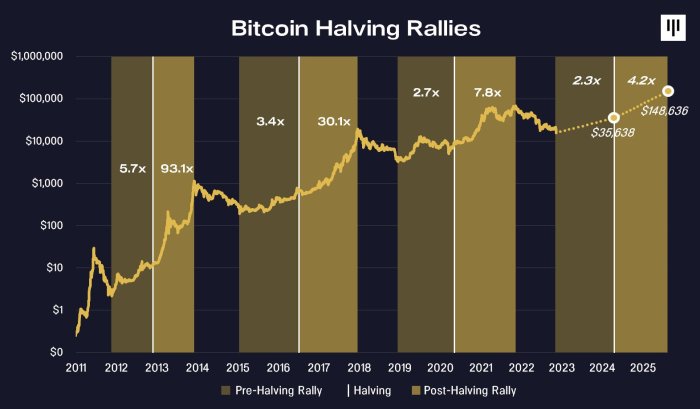

Bitcoin Prediction For 2025 – Predicting Bitcoin’s price in 2025 is challenging, involving numerous factors like adoption rates and regulatory changes. A key event influencing these predictions is the 2025 Bitcoin halving, significantly impacting the supply dynamics. To understand the potential price implications of this halving, check out this insightful analysis on the 2025 Bitcoin Halving Price , which offers valuable context for broader Bitcoin price predictions for 2025.

Ultimately, the interplay of various market forces will determine the final price.

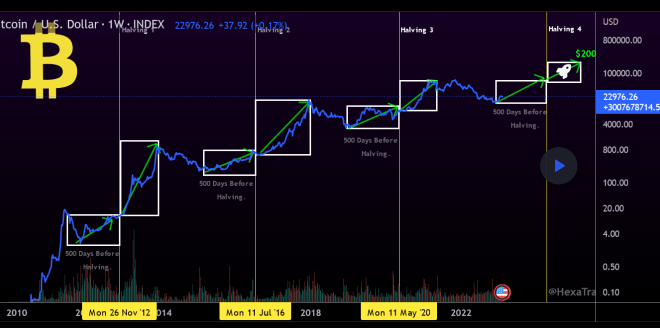

Predicting Bitcoin’s price in 2025 is challenging, with various factors influencing its trajectory. A key element to consider is the impact of the 2024 halving, which will reduce the rate of new Bitcoin creation. To understand the potential consequences, it’s crucial to examine the historical effects of previous halvings and explore potential future scenarios; for detailed analysis, check out this insightful article on Bitcoin After Halving 2025.

Ultimately, this analysis will help refine our Bitcoin Prediction For 2025.

Predicting Bitcoin’s price in 2025 is a complex undertaking, influenced by numerous factors. A key element to consider is the upcoming halving event, and for insightful analysis on its potential impact, check out this Forbes article on Bitcoin Halving 2025 Prediction Forbes. Understanding the halving’s effects is crucial for forming a comprehensive Bitcoin prediction for 2025, as it significantly impacts the supply dynamics of the cryptocurrency.

Predicting Bitcoin’s price in 2025 is challenging, with various factors influencing its trajectory. A key element to consider is the impact of the next Bitcoin halving, as explored in this insightful analysis: Bitcoin Price Next Halving 2025. Understanding the historical correlation between halving events and subsequent price movements is crucial for formulating a comprehensive Bitcoin Prediction For 2025.

Predicting Bitcoin’s price in 2025 is challenging, but understanding historical trends is key. A crucial factor to consider is the impact of the Bitcoin halving, and to visualize this, you should check out this resource: Bitcoin Halving Chart 2025 Price. Analyzing this chart can offer valuable insights into potential price fluctuations and help refine Bitcoin Prediction For 2025.

Predicting Bitcoin’s price in 2025 is challenging, but understanding historical trends is key. A crucial factor to consider is the impact of the Bitcoin halving, and to visualize this, you should check out this resource: Bitcoin Halving Chart 2025 Price. Analyzing this chart can offer valuable insights into potential price fluctuations and help refine Bitcoin Prediction For 2025.