Bitcoin Price Prediction for August 2025: Bitcoin Prediction For August 2025

Bitcoin, since its inception in 2009, has demonstrated remarkable growth alongside periods of extreme volatility. Its journey from a niche digital currency to a globally recognized asset class has been punctuated by dramatic price swings, making accurate prediction exceptionally challenging. Understanding the factors influencing Bitcoin’s price is crucial for any attempt at forecasting its future value.

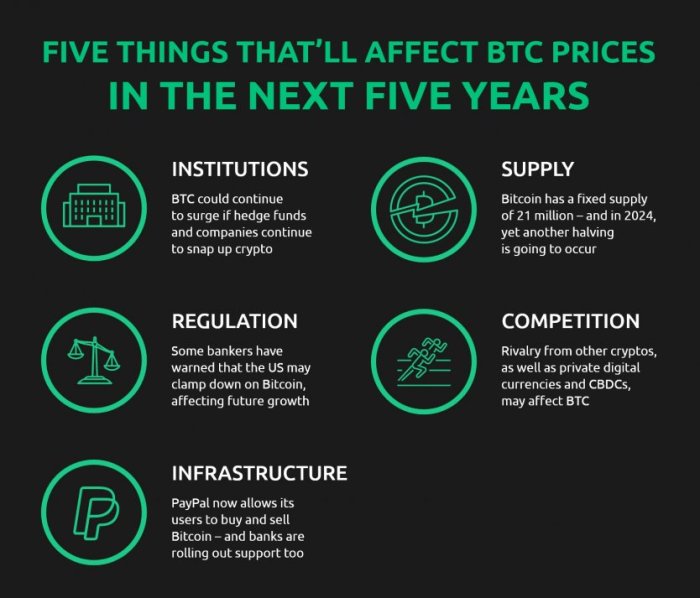

Bitcoin’s price is a complex interplay of several key factors. Regulatory landscapes across different countries significantly impact investor confidence and market liquidity. For example, a nation’s adoption of clear and favorable Bitcoin regulations can lead to increased investment and higher prices, while restrictive measures can trigger price drops. Technological advancements, such as improvements in scalability and transaction speed, can also influence price movements. Positive developments often lead to increased adoption and, consequently, higher demand. Conversely, major technological setbacks can erode investor trust and depress prices. Finally, market sentiment, driven by news, media coverage, and overall investor psychology, plays a crucial role. Periods of widespread optimism often lead to price rallies, while negative news or market uncertainty can trigger significant sell-offs.

Factors Influencing Bitcoin Price Prediction Accuracy

Predicting Bitcoin’s price with any degree of certainty is inherently difficult. The cryptocurrency market is relatively young and characterized by high volatility, making it susceptible to speculative bubbles and rapid price corrections. Unlike traditional assets with established valuation models, Bitcoin’s value is largely driven by market forces and sentiment, making it prone to unpredictable fluctuations. Furthermore, the decentralized nature of Bitcoin, while a key strength, makes it difficult to accurately model its price based on traditional economic principles. External events, such as geopolitical instability or macroeconomic shifts, can also significantly impact Bitcoin’s price, adding another layer of complexity to any prediction model. Past performance, therefore, is not necessarily indicative of future results. For instance, while Bitcoin experienced substantial growth in 2021, it also suffered a significant correction in 2022, highlighting the unpredictable nature of the market. Accurate prediction requires sophisticated models incorporating numerous variables, and even then, a significant margin of error is unavoidable.

Analyzing Historical Bitcoin Price Trends

Bitcoin’s price history is characterized by extreme volatility, punctuated by periods of dramatic growth and equally sharp corrections. Understanding these trends is crucial for any attempt to predict future price movements, although it’s important to remember that past performance is not necessarily indicative of future results. Analyzing these trends helps to identify potential patterns, although the cryptocurrency market is inherently unpredictable.

Bitcoin’s journey began with a price near zero in 2009. Early adoption saw slow growth, with the price remaining relatively low for several years. The first major price surge occurred in 2013, reaching over $1,000 before a significant correction. Subsequent years saw a roller coaster of price fluctuations, with notable highs in 2017 (reaching nearly $20,000) and 2021 (exceeding $60,000). Each peak was followed by a substantial drop, highlighting the inherent risk associated with Bitcoin investment.

Recurring Price Patterns and Cycles

While Bitcoin’s price movements are notoriously erratic, some analysts have attempted to identify recurring patterns. These often involve cycles of bull and bear markets, characterized by periods of rapid price appreciation followed by prolonged periods of decline. The length and intensity of these cycles have varied over time, making it difficult to pinpoint precise timing. Some believe these cycles are related to the halving events, where the rate of Bitcoin creation is cut in half, leading to decreased supply and potentially influencing price. However, other factors, such as regulatory changes, technological advancements, and macroeconomic conditions, also play significant roles.

Comparison of Past Predictions with Actual Outcomes

Numerous predictions regarding Bitcoin’s price have been made throughout its history, ranging from wildly optimistic to extremely pessimistic forecasts. Many of these predictions have proven inaccurate. For example, some early predictions significantly underestimated Bitcoin’s potential, while others dramatically overestimated its growth trajectory. The inherent unpredictability of the cryptocurrency market makes accurate long-term price forecasting extremely challenging. The impact of unexpected events, such as regulatory crackdowns or major technological breakthroughs, can significantly alter price trends, rendering even sophisticated models ineffective. Therefore, it’s crucial to approach all price predictions with a healthy dose of skepticism and recognize the significant limitations of extrapolating past performance into the future.

Influence of Macroeconomic Factors

Bitcoin’s price, despite its decentralized nature, is significantly influenced by broader macroeconomic trends. Understanding these influences is crucial for any attempt to predict its future value. Factors such as inflation, interest rates, and global economic stability all play a role in shaping investor sentiment and, consequently, Bitcoin’s market performance. Furthermore, the correlation between Bitcoin and traditional financial markets adds another layer of complexity to price forecasting.

The interplay between macroeconomic conditions and Bitcoin’s price is complex and not always straightforward. While Bitcoin is often touted as a hedge against inflation, its price can also be negatively affected by rising interest rates, which often lead investors to seek safer, higher-yielding assets. Global economic uncertainty can increase demand for Bitcoin as a safe haven asset, but conversely, a severe global recession could lead to a widespread sell-off across all asset classes, including Bitcoin.

Inflation’s Impact on Bitcoin

High inflation erodes the purchasing power of fiat currencies, potentially driving investors towards alternative assets like Bitcoin, seen by some as a store of value. However, the relationship isn’t always linear. Periods of high inflation can also lead to increased volatility in Bitcoin’s price, making it a riskier investment for some. For example, the surge in inflation during 2021-2022 coincided with periods of both significant Bitcoin price increases and decreases, reflecting the complex interplay between inflation and investor sentiment. The perceived “safe haven” aspect of Bitcoin may be more influential during periods of hyperinflation, as seen in some historical examples of countries experiencing extreme economic instability.

Interest Rates and Bitcoin

Rising interest rates generally decrease the attractiveness of Bitcoin, as investors might shift their capital towards higher-yielding, less volatile investments such as government bonds or high-yield savings accounts. Conversely, low interest rates can make Bitcoin more appealing as a potential store of value and a higher-return alternative. The Federal Reserve’s interest rate hikes in 2022, for instance, correlated with a downturn in Bitcoin’s price, reflecting a shift in investor preferences towards less risky assets. This dynamic highlights the sensitivity of Bitcoin to monetary policy decisions.

Bitcoin’s Correlation with the Stock Market

Bitcoin’s price often shows a degree of correlation with the performance of traditional stock markets, particularly during periods of significant market movements. This correlation is not always consistent, however, and its strength can vary considerably depending on several factors, including overall market sentiment, regulatory changes, and technological developments within the cryptocurrency space. During periods of market uncertainty, investors may simultaneously sell both stocks and Bitcoin, leading to a negative correlation. Conversely, during periods of overall market optimism, Bitcoin might experience price increases alongside stock markets. Analyzing this correlation requires a nuanced understanding of the interconnectedness of various financial markets.

Geopolitical Events and Bitcoin

Geopolitical instability and uncertainty can significantly influence Bitcoin’s price. Events such as wars, political upheavals, or sanctions can trigger a flight to safety, leading to increased demand for Bitcoin as a decentralized and less regulated asset. Conversely, positive geopolitical developments might lead to a decrease in demand as investors shift their focus to other assets perceived as less risky. The Russian invasion of Ukraine in 2022, for example, led to a period of increased volatility in Bitcoin’s price as investors sought safe havens amidst geopolitical uncertainty. The subsequent imposition of sanctions on Russia also highlighted the potential role of Bitcoin in circumventing traditional financial systems, influencing its price dynamics.

Technological Advancements and Bitcoin’s Future

Technological advancements are pivotal in shaping Bitcoin’s trajectory and its potential price in August 2025 and beyond. The interplay between scaling solutions, institutional investment, and network improvements like the Lightning Network will significantly influence Bitcoin’s usability, transaction efficiency, and overall market perception.

Layer-2 scaling solutions and institutional investment are key factors driving Bitcoin’s future growth and price. The Lightning Network, a second-layer payment protocol, addresses Bitcoin’s scalability challenges, impacting transaction speeds and costs. These combined forces could propel Bitcoin to new heights.

Layer-2 Scaling Solutions and Bitcoin Adoption

Layer-2 scaling solutions, such as the Lightning Network and the Liquid Network, aim to alleviate Bitcoin’s inherent scalability limitations. By processing transactions off-chain, these solutions drastically reduce congestion on the main blockchain, leading to faster transaction times and lower fees. Increased transaction speed and affordability make Bitcoin more attractive for everyday use, potentially boosting adoption and driving demand, thereby impacting its price. For example, if the Lightning Network achieves widespread adoption, allowing for near-instantaneous and low-cost microtransactions, it could facilitate a significant increase in Bitcoin’s use for everyday purchases, driving demand and potentially pushing the price upward.

Institutional Investment and Bitcoin’s Price

The involvement of institutional investors, including large corporations, hedge funds, and investment firms, significantly impacts Bitcoin’s price. Their substantial investments inject liquidity into the market, increasing stability and potentially driving price appreciation. For instance, MicroStrategy’s significant Bitcoin holdings have served as a strong signal of confidence in Bitcoin’s long-term value, potentially influencing other investors and contributing to price increases. This institutional participation adds a layer of legitimacy and credibility to Bitcoin, attracting further investment and potentially fueling price growth.

Bitcoin’s Lightning Network and Transaction Efficiency

The Lightning Network is a crucial layer-2 solution designed to enhance Bitcoin’s scalability and efficiency. By enabling off-chain transactions, it significantly reduces transaction fees and processing times. This improvement in usability makes Bitcoin more competitive with traditional payment systems and potentially increases its appeal to a wider range of users and businesses. Imagine a scenario where sending Bitcoin across borders becomes as cheap and fast as sending an email – the Lightning Network’s potential to achieve this could dramatically increase Bitcoin adoption and influence its price. The network’s ongoing development and increasing adoption are key factors to watch when considering Bitcoin’s future price.

Regulatory Landscape and its Impact

The regulatory landscape surrounding Bitcoin and other cryptocurrencies is constantly evolving and significantly impacts their price and adoption. Different countries’ approaches vary widely, from outright bans to comprehensive regulatory frameworks. This diverse regulatory environment creates uncertainty, influencing investor sentiment and, consequently, Bitcoin’s price volatility.

The impact of varying regulatory stances on Bitcoin’s price is complex and multifaceted. For instance, countries with clear and investor-friendly regulations often see increased Bitcoin trading volume and higher prices, reflecting greater investor confidence. Conversely, nations with restrictive or unclear regulations might experience lower trading activity and suppressed prices due to uncertainty and potential legal risks. The regulatory environment can also indirectly influence price through its effect on the availability of financial services related to Bitcoin, such as custodial services and exchange platforms.

Regulatory Approaches of Different Governments

Governments worldwide have adopted diverse approaches to regulating cryptocurrencies. Some, like El Salvador, have embraced Bitcoin as legal tender, potentially driving up demand and price within their borders. Others, such as China, have implemented outright bans, significantly impacting Bitcoin’s price through reduced trading activity and investor participation from that large market. Many countries are pursuing a more nuanced approach, aiming to regulate cryptocurrencies without stifling innovation. This often involves establishing licensing requirements for cryptocurrency exchanges, implementing anti-money laundering (AML) and know-your-customer (KYC) protocols, and clarifying the tax implications of Bitcoin transactions. The European Union’s Markets in Crypto-Assets (MiCA) regulation is a prime example of a comprehensive regulatory framework aimed at balancing innovation with consumer protection and financial stability. The United States, on the other hand, has a more fragmented regulatory landscape, with different agencies overseeing various aspects of the cryptocurrency market, leading to some uncertainty and regulatory arbitrage opportunities.

Potential Effects of Future Regulations on Bitcoin’s Adoption and Price

Future regulations will likely play a crucial role in shaping Bitcoin’s future adoption and price. Clear and consistent global regulatory frameworks could boost investor confidence, leading to increased institutional investment and potentially higher prices. Conversely, overly restrictive or inconsistent regulations could stifle innovation and limit adoption, potentially suppressing prices. The development of international regulatory cooperation and harmonization of standards would be particularly impactful, reducing regulatory arbitrage and creating a more stable and predictable environment for Bitcoin. However, the lack of such global coordination could lead to continued price volatility as different jurisdictions adopt conflicting approaches. For example, a scenario where major global economies adopt significantly different regulatory frameworks could create substantial price fluctuations as capital flows shift between jurisdictions with more or less favorable regulations. The potential for regulatory uncertainty to impact price is significant, as investors often react negatively to ambiguity and uncertainty in the regulatory environment.

Bitcoin Adoption and Market Sentiment

Bitcoin’s price is significantly influenced by its adoption rate and the overall market sentiment. These factors are intertwined, creating a complex dynamic where increased adoption often leads to positive sentiment, driving price increases, and vice-versa. Social media, news outlets, and macroeconomic conditions all play crucial roles in shaping this sentiment.

Social media platforms and news sources, both traditional and online, are powerful drivers of Bitcoin’s market sentiment. Positive news coverage, endorsements from influential figures, and growing user adoption often fuel bullish sentiment, leading to price increases. Conversely, negative news, regulatory uncertainty, or security breaches can trigger bearish sentiment and price drops. The speed and reach of information dissemination on these platforms amplify the impact of both positive and negative news, creating a highly volatile market.

Social Media and News Influence on Market Sentiment, Bitcoin Prediction For August 2025

Social media’s influence on Bitcoin’s price is undeniable. Platforms like Twitter and Telegram host active communities discussing Bitcoin, sharing price predictions, and reacting to news events in real-time. A surge in positive tweets or a trending hashtag can quickly translate into increased buying pressure, pushing the price upward. Conversely, negative sentiment expressed across multiple platforms can lead to sell-offs. The speed and reach of this information, often bypassing traditional media filters, contribute to the market’s volatility. For example, a single tweet from a prominent figure in the tech industry can significantly impact Bitcoin’s price within hours. Similarly, news reports about large-scale Bitcoin adoption by institutions or governments can trigger substantial price increases.

Mainstream Media Coverage and Bitcoin’s Price

Mainstream media coverage, while often slower to react than social media, carries significant weight in shaping public perception and influencing investor behavior. Positive articles in reputable financial publications can legitimize Bitcoin in the eyes of mainstream investors, attracting new capital and pushing prices higher. Conversely, negative or sensationalized coverage can create fear, uncertainty, and doubt (FUD), leading to sell-offs. The impact of mainstream media is often less immediate than that of social media, but its effect tends to be more sustained. For instance, a series of positive articles in the Wall Street Journal highlighting Bitcoin’s potential as a store of value could gradually increase institutional investment and boost the price over an extended period.

Bitcoin Adoption Rate and Price Relationship

The relationship between Bitcoin’s adoption rate and its price is largely positive and self-reinforcing. As more individuals and institutions adopt Bitcoin, the demand increases, leading to price appreciation. This increased price, in turn, attracts further adoption, creating a positive feedback loop. Increased adoption can manifest in various ways, including rising transaction volumes, growing numbers of Bitcoin ATMs, and increased merchant acceptance. For example, the increasing adoption of Bitcoin by businesses as a payment method demonstrates growing confidence in the cryptocurrency and is usually followed by a rise in its price. Conversely, a significant decrease in adoption can lead to a decline in demand and subsequently, a drop in price. This demonstrates a clear correlation between the rate of adoption and the overall value of Bitcoin.

Potential Scenarios for Bitcoin’s Price in August 2025

Predicting Bitcoin’s price with certainty is impossible, but by considering historical trends, macroeconomic factors, technological advancements, regulatory changes, and market sentiment, we can Artikel plausible price scenarios for August 2025. These scenarios represent a range of possibilities, not definitive predictions.

Scenario Analysis: Bullish, Bearish, and Neutral

The following table details three potential price scenarios for Bitcoin in August 2025, each justified by the previously discussed factors. A bullish scenario reflects a highly positive outlook, a bearish scenario a pessimistic one, and a neutral scenario a relatively stable market. It’s crucial to remember that these are just potential outcomes, and the actual price could fall outside these ranges.

| Scenario | Description | Price Range (USD) | Justification |

|---|---|---|---|

| Bullish | Widespread adoption, positive regulatory developments, and sustained technological innovation drive significant price appreciation. Increased institutional investment and a strong macroeconomic environment contribute to this upward trend. | $150,000 – $250,000 | This scenario assumes a continuation of the current trend of increasing institutional adoption, coupled with positive regulatory developments in key markets. Technological advancements, such as the Lightning Network’s widespread adoption, could also contribute to increased transaction speed and lower fees, boosting demand. A strong global economy would further support this bullish outlook, as investors might seek refuge in Bitcoin as a hedge against inflation. Similar to the 2021 bull run, but potentially with more sustained growth due to greater institutional involvement. |

| Bearish | Negative regulatory actions, a global economic downturn, or a major security breach impacting Bitcoin’s network could trigger a significant price decline. Decreased investor confidence and a lack of further technological breakthroughs would exacerbate the downturn. | $20,000 – $40,000 | This scenario reflects a pessimistic outlook, potentially driven by a major global economic crisis impacting investor confidence across all asset classes. Stringent regulatory crackdowns in major markets could also severely restrict Bitcoin’s growth. A significant security flaw or hacking event could also erode trust in the network, leading to a sharp price correction. This scenario is reminiscent of the 2018 bear market, though the extent of the decline could be influenced by factors such as the level of institutional investment and the resilience of the overall cryptocurrency market. |

| Neutral | A period of consolidation and sideways trading, characterized by moderate price fluctuations. Regulatory uncertainty and macroeconomic instability offset positive developments such as technological advancements and increased adoption. | $50,000 – $80,000 | This scenario represents a more balanced outlook. While positive factors like technological improvements and gradual adoption continue, they are counterbalanced by uncertainty regarding regulatory frameworks and macroeconomic conditions. This could result in a period of relatively stable prices with moderate fluctuations, similar to the market consolidation periods observed in Bitcoin’s history. This range represents a relatively flat trajectory, neither a significant bull run nor a drastic bear market. |

Risks and Uncertainties

Investing in Bitcoin, like any other asset class, carries inherent risks and uncertainties. While the potential for high returns is alluring, a thorough understanding of these risks is crucial for making informed investment decisions. The volatile nature of the cryptocurrency market, coupled with its relatively young age, means that significant price fluctuations are commonplace and difficult to predict with certainty.

Bitcoin’s price is susceptible to a wide range of factors, making accurate future price predictions challenging. These factors range from macroeconomic events like global economic downturns or changes in monetary policy to technological advancements within the cryptocurrency space itself, and shifts in regulatory landscapes. The lack of intrinsic value, unlike traditional assets like gold or real estate, also contributes to its volatility and uncertainty.

Key Risks Associated with Bitcoin Investment

The inherent volatility of Bitcoin is a primary concern for investors. Sharp price swings, both upward and downward, can occur rapidly and unexpectedly, leading to significant gains or losses in a short period. For example, the price of Bitcoin has experienced multiple instances of substantial increases followed by equally dramatic corrections throughout its history. This volatility makes it unsuitable for risk-averse investors with a low tolerance for loss. Furthermore, the decentralized nature of Bitcoin, while a strength for many, also means that there is no central authority to protect investors from fraud or loss due to technical issues. Security breaches, hacks of exchanges, and the loss of private keys can result in the permanent loss of funds. Regulatory uncertainty adds another layer of risk. Governments worldwide are still grappling with how to regulate cryptocurrencies, and changes in regulatory frameworks could significantly impact Bitcoin’s price and accessibility.

Uncertainties Surrounding Bitcoin’s Future Price

Predicting Bitcoin’s future price with accuracy is virtually impossible. Numerous factors influence its price, many of which are unpredictable. These include macroeconomic conditions (inflation, interest rates, economic growth), technological developments (scaling solutions, new cryptocurrencies), regulatory changes (government bans, taxation policies), and market sentiment (media coverage, investor confidence). While historical price trends can provide some insights, they are not necessarily indicative of future performance. For instance, past bull markets don’t guarantee future bull markets, and past price corrections don’t dictate the magnitude or timing of future corrections. The interplay of these various factors creates a highly complex and unpredictable environment for price forecasting. Many predictions rely on assumptions that may or may not hold true in the future.

Importance of Diversification in a Cryptocurrency Portfolio

Diversification is a crucial risk management strategy for any investment portfolio, and this is especially true for cryptocurrency investments. Concentrating solely on Bitcoin exposes investors to significant risk should the price decline substantially. A diversified portfolio, including investments in other cryptocurrencies with different underlying technologies, market capitalizations, and use cases, can help mitigate this risk. By spreading investments across various assets, investors can reduce their overall portfolio volatility and potentially enhance returns. For example, an investor might allocate a portion of their portfolio to Ethereum, which has a different focus than Bitcoin, or to other promising projects with strong fundamentals. This approach reduces the impact of any single asset’s price fluctuation on the overall portfolio performance. Diversification, however, does not eliminate risk entirely but rather aims to reduce it.

Illustrative Examples

To further clarify the potential price fluctuations of Bitcoin in August 2025, let’s examine two hypothetical scenarios illustrating the impact of significant global events and widespread adoption. These scenarios are not predictions but rather illustrative examples to highlight potential price drivers.

Significant Global Event Impacting Bitcoin’s Price

Imagine a major geopolitical crisis erupts in August 2025, specifically a prolonged conflict involving two major global powers. This conflict disrupts global supply chains, leading to significant inflation and uncertainty in traditional financial markets. Investors, seeking a safe haven asset and a hedge against inflation, flock to Bitcoin. Demand surges dramatically, pushing the price above $200,000. This scenario assumes a relatively low level of regulatory intervention, allowing the market to react freely to the increased demand. The increased volatility associated with the crisis would, however, lead to significant price swings throughout the month, with potential drops and rebounds depending on the evolving geopolitical situation. The initial surge could be followed by a period of consolidation as investors assess the long-term implications of the crisis, before another potential surge if the crisis continues. This scenario demonstrates how unforeseen global events can significantly impact Bitcoin’s price, even in the absence of fundamental changes within the Bitcoin ecosystem itself.

Impact of Widespread Bitcoin Adoption on Price

In a contrasting scenario, let’s consider a situation where Bitcoin adoption accelerates significantly by August 2025. Imagine that several large corporations, including major payment processors and e-commerce platforms, fully integrate Bitcoin into their systems. Simultaneously, several countries, particularly those with unstable fiat currencies, begin to explore the use of Bitcoin as a form of legal tender or a supplementary currency. This widespread adoption leads to a dramatic increase in transaction volume and network usage. Assuming a steady increase in adoption throughout the year leading to this point, we could see an adoption rate exceeding 5% of the global population actively using Bitcoin by August 2025. This increased usage, coupled with a growing institutional acceptance, drives the price beyond $150,000. This scenario highlights the potential for positive price action fueled by organic growth and increased utility, even in the absence of external shocks. The increased demand from both individual users and institutions would contribute to a steady price increase, potentially experiencing some minor corrections due to market fluctuations, but ultimately trending upwards. This exemplifies how increased utility and adoption can significantly influence Bitcoin’s price.

Frequently Asked Questions (FAQ)

This section addresses common questions regarding Bitcoin’s price prediction for August 2025 and investing in Bitcoin. Understanding these points is crucial for informed decision-making in the volatile cryptocurrency market.

Bitcoin’s Most Likely Price in August 2025

Predicting a precise Bitcoin price for August 2025 is inherently difficult due to the cryptocurrency’s volatile nature and the influence of numerous unpredictable factors. While various models and analysts offer projections, ranging from significantly lower to substantially higher than current prices, it’s more accurate to discuss potential price ranges based on different scenarios. For example, a conservative estimate might consider factors like sustained economic uncertainty and regulatory hurdles, resulting in a price range significantly lower than current levels. Conversely, a more optimistic outlook might incorporate factors such as widespread adoption, technological advancements, and positive regulatory developments, leading to significantly higher price projections. Ultimately, the actual price will depend on the interplay of these and other unforeseen events. A range, rather than a single figure, provides a more realistic representation of the possibilities.

Safety of Investing in Bitcoin

Investing in Bitcoin carries significant risk, primarily due to its high price volatility. The price can fluctuate dramatically in short periods, leading to substantial gains or losses. Furthermore, the cryptocurrency market is relatively new and unregulated in many jurisdictions, making it susceptible to scams, hacks, and market manipulation. However, Bitcoin also offers the potential for substantial rewards. Its decentralized nature and limited supply are seen as attractive features by many investors, potentially leading to long-term price appreciation. Therefore, a decision to invest in Bitcoin should be made only after careful consideration of both the potential rewards and the considerable risks involved, aligning with one’s personal risk tolerance and financial goals.

Protecting Against Bitcoin Price Volatility

Mitigating risk associated with Bitcoin’s price volatility involves several strategies. Diversification is key; spreading investments across different asset classes (stocks, bonds, real estate) reduces the overall impact of Bitcoin’s price fluctuations on a portfolio. Dollar-cost averaging, a strategy of investing a fixed amount of money at regular intervals, regardless of price, helps to reduce the impact of buying high and selling low. Furthermore, only investing what one can afford to lose is crucial. Avoid using borrowed money or funds essential for other needs. Staying informed about market trends and news affecting Bitcoin’s price can also aid in making informed decisions. Finally, understanding the technology behind Bitcoin and the factors influencing its price can help in developing a more robust investment strategy.

Bitcoin’s Potential Long-Term Prospects

Bitcoin’s long-term prospects are a subject of ongoing debate. Its potential for widespread adoption as a store of value, a medium of exchange, or a unit of account remains uncertain. Technological advancements, such as the Lightning Network, aim to improve Bitcoin’s scalability and transaction speed, potentially boosting its adoption. However, challenges remain, including regulatory uncertainty, environmental concerns related to its energy consumption, and the emergence of competing cryptocurrencies. Despite these challenges, Bitcoin’s decentralized nature, limited supply, and growing acceptance by some institutional investors suggest it could maintain its position as a significant digital asset in the long term. The long-term outcome, however, depends on various complex and interconnected factors, making definitive predictions extremely challenging.

Disclaimer

This Bitcoin price prediction for August 2025 is for informational purposes only and should not be considered as financial advice. The cryptocurrency market is highly volatile and unpredictable, and past performance is not indicative of future results. Any investment decisions you make based on this information are solely your responsibility.

The information presented here is based on analysis of historical data, current market trends, and expert opinions, but it does not guarantee future outcomes. Significant unforeseen events, regulatory changes, or technological disruptions could significantly impact Bitcoin’s price. Therefore, it is crucial to conduct your own thorough research and seek advice from qualified financial professionals before making any investment decisions related to Bitcoin or any other cryptocurrency.

Investment Risks

Investing in cryptocurrencies, including Bitcoin, carries substantial risk. Price fluctuations can be extreme, leading to significant gains or losses in a short period. The market is susceptible to manipulation, security breaches, and regulatory uncertainty. There’s also a risk of losing your entire investment. For example, the sharp decline in Bitcoin’s price in 2022 serves as a stark reminder of the inherent volatility of the cryptocurrency market. Investors should be prepared for potential losses and only invest what they can afford to lose. Diversification of investments is also highly recommended to mitigate risk.

Predicting Bitcoin’s price in August 2025 is challenging, but a key factor to consider is the impact of the upcoming halving. Understanding the precise timing is crucial, which is why checking the confirmed Bitcoin Halving Date 2025 is essential for any serious forecast. This event significantly influences Bitcoin’s supply dynamics and often precedes periods of price volatility, thus impacting the Bitcoin Prediction for August 2025 considerably.

Predicting Bitcoin’s price in August 2025 is challenging, but a key factor to consider is the Bitcoin halving event. Understanding the timing is crucial for any accurate forecast, and you can find details on the projected date by checking this resource on the Fecha Halving Bitcoin 2025. This event significantly impacts Bitcoin’s supply and, consequently, its potential price trajectory in August 2025.

Accurately predicting Bitcoin’s price for August 2025 is challenging, requiring analysis of various market factors. To gain a broader perspective, understanding potential price movements in subsequent months is crucial. For instance, consider checking out this insightful analysis on the Bitcoin Prediction October 2025 to better contextualize the August forecast. Ultimately, both predictions hinge on broader economic trends and regulatory developments impacting the cryptocurrency market.

Accurately predicting Bitcoin’s price for August 2025 is challenging, given the cryptocurrency’s volatility. Understanding the potential trajectory requires considering various factors, and a key aspect of that is examining the predicted trends for the following month. To gain further insight, it’s helpful to review the projected trends outlined in the Bitcoin Prediction September 2025 report, which can inform expectations for August’s closing price.

Ultimately, both August and September’s predictions contribute to a broader understanding of Bitcoin’s potential performance in the latter half of 2025.

Predicting Bitcoin’s price for August 2025 involves considering various factors, including regulatory changes and overall market sentiment. To gain a more comprehensive perspective, it’s helpful to examine projections extending beyond August. For instance, understanding the potential trajectory in October provides valuable context; you can find insights on this by checking out the Bitcoin Price Prediction October 2025 analysis.

Ultimately, both the August and October predictions contribute to a broader understanding of Bitcoin’s potential price movement throughout 2025.

Accurately predicting Bitcoin’s price in August 2025 is challenging, given the inherent volatility of the cryptocurrency market. However, a key factor to consider is the impact of the next Bitcoin halving, as detailed in this insightful analysis: Bitcoin Halving Price Prediction 2025. Understanding the potential effects of reduced Bitcoin supply on price is crucial for formulating a comprehensive Bitcoin Prediction For August 2025.