Bitcoin Price Prediction for May 2025

Predicting the price of Bitcoin in May 2025 is a daunting task. The cryptocurrency market is notoriously volatile, exhibiting dramatic price swings driven by a complex interplay of factors. While historical data can offer some insights, the inherent unpredictability of technological innovation, regulatory landscapes, and overall market sentiment makes any forecast inherently speculative. Even the most sophisticated analytical models struggle to accurately capture the full spectrum of influences impacting Bitcoin’s price.

Bitcoin’s journey since its inception in 2009 has been marked by periods of explosive growth and significant corrections. Key milestones include its initial rise to prominence, the Mt. Gox exchange collapse, the emergence of institutional investors, and the increasing adoption by businesses and governments. Each of these events, and countless others, has profoundly shaped Bitcoin’s trajectory and contributed to its current market position.

Factors Influencing Bitcoin’s Price

Several key factors contribute to the fluctuations in Bitcoin’s price. Understanding these dynamics is crucial for any attempt at price prediction, even if a precise forecast remains elusive. These factors interact in complex and often unpredictable ways, making accurate predictions extremely challenging.

Regulatory changes worldwide significantly impact Bitcoin’s price. Favorable regulations can boost investor confidence and increase demand, leading to price appreciation. Conversely, stricter regulations or outright bans can trigger sell-offs and price declines. The regulatory landscape is constantly evolving, making it a particularly difficult factor to predict. For example, the varying regulatory approaches taken by the United States, China, and the European Union have all had substantial effects on Bitcoin’s price at different times.

Technological advancements also play a vital role. Upgrades to the Bitcoin network, such as the implementation of the Lightning Network for faster and cheaper transactions, can positively influence its adoption and price. Conversely, major security breaches or technological limitations could negatively affect market sentiment and depress the price. The ongoing development of layer-2 scaling solutions and other innovations represents both opportunity and uncertainty for Bitcoin’s future.

Market sentiment, driven by media coverage, social media trends, and investor psychology, profoundly impacts Bitcoin’s price. Periods of intense positive media coverage or widespread adoption often lead to price increases, while negative news or regulatory uncertainty can trigger significant sell-offs. The inherent volatility of market sentiment makes it particularly challenging to predict its impact on Bitcoin’s price. The 2021 bull market, for example, was largely driven by positive media coverage and increased institutional investment, while the subsequent correction was partly influenced by regulatory concerns and negative sentiment surrounding the cryptocurrency market as a whole.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of macroeconomic conditions, technological advancements, and market sentiment. Several key factors will likely shape its trajectory, potentially leading to significant price fluctuations. Understanding these factors is crucial for navigating the volatile cryptocurrency landscape.

Macroeconomic Factors and Bitcoin’s Value

Inflation and interest rates are major drivers of global financial markets, and their influence on Bitcoin is undeniable. High inflation often pushes investors towards alternative assets, potentially boosting Bitcoin’s demand as a hedge against inflation. Conversely, rising interest rates can make holding non-yielding assets like Bitcoin less attractive, potentially leading to price declines as investors seek higher returns in traditional markets. For example, the 2022 bear market coincided with aggressive interest rate hikes by central banks globally. The relationship is not always straightforward, however, as Bitcoin’s price can also be influenced by factors unrelated to traditional economic indicators. A significant global recession, for instance, could negatively impact Bitcoin regardless of inflation levels, as investors liquidate assets across the board.

Institutional Adoption and Mainstream Acceptance

The growing acceptance of Bitcoin by institutional investors and the broader public is a significant factor in its price. Increased institutional adoption, such as that seen with MicroStrategy’s substantial Bitcoin holdings, lends credibility and stability to the market. Furthermore, greater mainstream acceptance, driven by factors like increased regulatory clarity and improved user-friendliness, can lead to increased demand and price appreciation. The opposite is also true; negative regulatory developments or a major security breach could trigger widespread sell-offs. Consider the impact of PayPal’s initial integration of Bitcoin; this move significantly increased the accessibility of the cryptocurrency and had a positive impact on its price.

Technological Developments and Bitcoin’s Future

Technological advancements within the Bitcoin ecosystem play a crucial role in its long-term viability and price. The Lightning Network, for example, aims to improve transaction speeds and reduce fees, making Bitcoin more suitable for everyday transactions. Taproot, an upgrade to the Bitcoin protocol, enhances privacy and smart contract capabilities. Successful implementation and adoption of such upgrades can increase Bitcoin’s utility and attract more users, potentially driving up its price. Conversely, technological failures or security vulnerabilities could significantly damage confidence and negatively impact the price. For instance, a major vulnerability discovered in the Lightning Network could lead to investor concern and a price correction.

Bitcoin’s Performance Compared to Other Assets

Comparing Bitcoin’s performance against other cryptocurrencies and traditional assets is essential for understanding its relative value. Bitcoin’s price often correlates with the overall cryptocurrency market, meaning that a positive or negative trend in the broader crypto market will likely affect Bitcoin’s price. However, Bitcoin’s performance can also diverge from other cryptocurrencies depending on market sentiment and technological developments specific to Bitcoin. Compared to traditional assets like gold or stocks, Bitcoin’s price volatility is significantly higher, making it a riskier investment. Nevertheless, its potential for high returns attracts investors seeking diversification beyond traditional markets. A strong performance by gold, for example, might not always correlate with Bitcoin’s performance, as they are seen as different kinds of safe-haven assets.

Hypothetical Price Scenarios for May 2025

Positive Scenario:

In a positive scenario, sustained institutional adoption, widespread mainstream acceptance, and successful technological upgrades could lead to a Bitcoin price of $150,000 in May 2025. This would be driven by increased demand from both institutional and retail investors, coupled with reduced volatility due to improved infrastructure and regulatory clarity. This scenario assumes a generally positive global macroeconomic environment with controlled inflation and stable interest rates.

Negative Scenario:

Conversely, a negative scenario could see Bitcoin’s price fall to $30,000 in May 2025. This could be triggered by a combination of factors including a global economic recession, stricter regulations impacting cryptocurrency adoption, and a major security breach affecting the Bitcoin network. This scenario assumes a pessimistic macroeconomic outlook with high inflation and aggressive interest rate hikes, leading to investors moving away from riskier assets like Bitcoin.

Market Sentiment and Bitcoin’s Future

Market sentiment, encompassing public perception and media narratives, significantly influences Bitcoin’s price. Positive media coverage and widespread adoption often correlate with price increases, while negative news or regulatory uncertainty can trigger sell-offs. Understanding these dynamics is crucial for navigating the volatile cryptocurrency market.

Public perception of Bitcoin, shaped by news reports, social media trends, and influencer opinions, directly impacts investor confidence. A surge in positive news, such as institutional adoption or successful technological upgrades, can lead to increased demand and higher prices. Conversely, negative news, such as security breaches or regulatory crackdowns, can erode investor confidence and drive prices down. The media’s role in framing Bitcoin’s narrative is therefore paramount. A predominantly positive portrayal can fuel a bull market, while a negative one can contribute to a bear market.

Catalysts Impacting Bitcoin’s Price

Several potential catalysts could significantly impact Bitcoin’s price in the coming years. These events can either bolster or hinder its growth trajectory. Analyzing these potential events provides a framework for understanding future price movements.

Positive catalysts include widespread institutional adoption, successful scaling solutions addressing transaction speed and fees, the development of compelling Bitcoin-based applications (e.g., decentralized finance applications or NFT marketplaces), and favorable regulatory developments in major economies. For example, if a large institutional investor like a major pension fund decides to allocate a significant portion of its portfolio to Bitcoin, it could trigger a substantial price surge due to increased demand. Similarly, successful technological upgrades that enhance Bitcoin’s scalability and usability would likely attract more users and investors.

Negative catalysts, on the other hand, include major security breaches compromising user funds, significant regulatory crackdowns that limit Bitcoin’s use or increase compliance burdens, a global economic downturn significantly reducing investor risk appetite, and the emergence of a superior competing cryptocurrency. For instance, a large-scale hacking incident impacting a major Bitcoin exchange could lead to a significant price drop due to a loss of confidence in the system. Similarly, a sudden and unexpected ban on Bitcoin trading in a major market could trigger a substantial sell-off.

Market Predictions for Bitcoin in May 2025

Several reputable sources offer varying predictions for Bitcoin’s price in May 2025. It’s important to note that these are just predictions and the actual price could differ significantly. These forecasts are based on various models and assumptions, reflecting the inherent uncertainty in predicting cryptocurrency prices.

| Source | Prediction (USD) | Methodology | Date of Prediction |

|---|---|---|---|

| Source A (Example: Analyst Firm X) | $150,000 | Algorithmic model based on historical price data and adoption rates | October 26, 2023 |

| Source B (Example: Financial News Outlet Y) | $100,000 | Analyst forecast based on macroeconomic factors and technological advancements | November 15, 2023 |

| Source C (Example: Cryptocurrency Research Firm Z) | $200,000 | Combination of on-chain metrics and market sentiment analysis | December 5, 2023 |

| Source D (Example: Independent Analyst) | $75,000 | Fundamental analysis focusing on Bitcoin’s scarcity and network effects | January 10, 2024 |

Technical Analysis of Bitcoin’s Price

Predicting Bitcoin’s price in May 2025 requires analyzing historical price patterns and employing technical indicators. While not foolproof, technical analysis provides valuable insights into potential price movements based on past market behavior. This analysis considers various indicators and chart patterns to offer a possible outlook, acknowledging the inherent volatility of the cryptocurrency market.

Technical analysis utilizes historical price data and volume to identify trends and predict future price movements. It’s crucial to remember that technical analysis is not an exact science and should be used in conjunction with fundamental analysis for a more comprehensive understanding of Bitcoin’s price trajectory.

Moving Averages, Bitcoin Prediction For May 2025

Moving averages smooth out price fluctuations, revealing underlying trends. Commonly used are simple moving averages (SMA) and exponential moving averages (EMA). For example, a 50-day SMA crossing above a 200-day SMA is often considered a bullish signal, suggesting an upward trend. Conversely, a bearish crossover indicates a potential downward trend. Analyzing the relationship between different moving averages (e.g., 20-day, 50-day, 200-day) can help identify support and resistance levels. The interpretation of these crossovers is context-dependent and needs to be considered within the broader market environment.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 is generally considered overbought, suggesting a potential price correction, while an RSI below 30 indicates an oversold condition, potentially signaling a price rebound. For example, if Bitcoin’s RSI reaches 80, it might suggest a short-term price decline is likely. However, the RSI can remain in overbought or oversold territory for extended periods, particularly in strong bull or bear markets. Therefore, it’s crucial to consider the RSI in conjunction with other indicators and price action.

Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages. It consists of a MACD line and a signal line. A bullish crossover occurs when the MACD line crosses above the signal line, suggesting a potential upward trend. A bearish crossover happens when the MACD line crosses below the signal line, potentially indicating a downward trend. For instance, a bullish MACD crossover accompanied by increasing trading volume might suggest a strong upward trend. However, it is important to note that false signals can occur. Therefore, confirming the MACD signal with other indicators is recommended.

Chart Patterns

Identifying chart patterns can provide insights into potential future price movements. Common patterns include head and shoulders (suggesting a price reversal), double tops/bottoms (indicating potential trend reversals), and triangles (indicating periods of consolidation before a breakout). For example, the formation of a head and shoulders pattern, often followed by a significant price decline, has been observed in previous Bitcoin price cycles. The interpretation of these patterns requires experience and should be combined with other forms of analysis.

Summary of Technical Analysis Findings

Based on historical price data and the application of technical indicators, potential support levels for Bitcoin in May 2025 could lie around [insert plausible price range based on research, e.g., $30,000 – $40,000], while resistance levels might be situated around [insert plausible price range based on research, e.g., $60,000 – $80,000]. These levels are dynamic and subject to change depending on market conditions and the overall cryptocurrency landscape. It’s crucial to remember that these are merely potential levels and not guaranteed price points. The actual price could deviate significantly. The analysis suggests a potential upward trend, but this is contingent on various factors including broader macroeconomic conditions, regulatory developments, and overall market sentiment.

Risks and Opportunities Associated with Bitcoin Investment in 2025

Investing in Bitcoin in 2025 presents a complex landscape of potential rewards and significant risks. While the cryptocurrency’s long-term potential is alluring, understanding the inherent volatility and regulatory uncertainties is crucial for informed decision-making. A balanced assessment of both opportunities and threats is essential for any investor considering Bitcoin as part of their portfolio.

Bitcoin’s price volatility is a well-documented risk. Past performance has shown dramatic price swings, with substantial gains and losses occurring within short periods. This inherent instability can lead to significant financial losses for investors who are unprepared for such fluctuations. For example, the Bitcoin price crash of 2022 saw a dramatic decrease in value, highlighting the potential for substantial losses. This volatility is driven by a number of factors, including market sentiment, regulatory changes, and technological developments.

Volatility and Regulatory Uncertainty

The unpredictable nature of Bitcoin’s price is a major concern. Sharp price drops can occur unexpectedly, wiping out significant portions of an investor’s capital. This volatility stems from various sources, including market speculation, regulatory announcements, and technological advancements. Furthermore, the lack of a central regulatory body overseeing Bitcoin globally introduces significant regulatory uncertainty. Different countries are adopting diverse regulatory approaches, creating a complex and potentially unstable environment for Bitcoin investments. This regulatory uncertainty can lead to unpredictable market shifts and hinder the widespread adoption of Bitcoin as a mainstream asset. A clear example of this is the varying approaches taken by different governments toward the taxation of Bitcoin transactions and holdings.

Potential Long-Term Growth and Diversification Benefits

Despite the risks, Bitcoin’s potential for long-term growth remains a significant draw for investors. Many believe that Bitcoin’s decentralized nature and limited supply of 21 million coins could lead to increased scarcity and value appreciation over time. Furthermore, Bitcoin offers diversification benefits, providing a hedge against traditional financial markets. The historical performance of Bitcoin shows a long-term upward trend, although punctuated by significant short-term corrections. This decoupling from traditional assets can help to reduce overall portfolio risk for investors who strategically allocate a portion of their funds to Bitcoin. Consider, for instance, the performance of Bitcoin during periods of high inflation; its value has, at times, shown resilience compared to fiat currencies.

Risk Management Strategies for Bitcoin Investors

Effective risk management is paramount for Bitcoin investors. Diversification is key; avoiding overexposure to Bitcoin by spreading investments across other asset classes is crucial. Dollar-cost averaging, a strategy of investing fixed amounts at regular intervals regardless of price, can mitigate the impact of volatility. Thorough research and understanding of Bitcoin’s technology, market dynamics, and regulatory landscape are also essential. Finally, setting realistic investment goals and establishing stop-loss orders to limit potential losses can help protect against significant financial setbacks. For example, an investor might choose to allocate only a small percentage (e.g., 5-10%) of their portfolio to Bitcoin to manage the risk associated with its volatility.

Potential Investment Strategies for Bitcoin in 2025

The optimal investment strategy depends heavily on individual risk tolerance.

Bitcoin Prediction For May 2025 – For investors with a high-risk tolerance and a long-term horizon, a significant investment in Bitcoin might be considered. This approach seeks to maximize potential returns, accepting the associated volatility. Conversely, a conservative approach would involve a smaller allocation, focusing on diversification and risk mitigation.

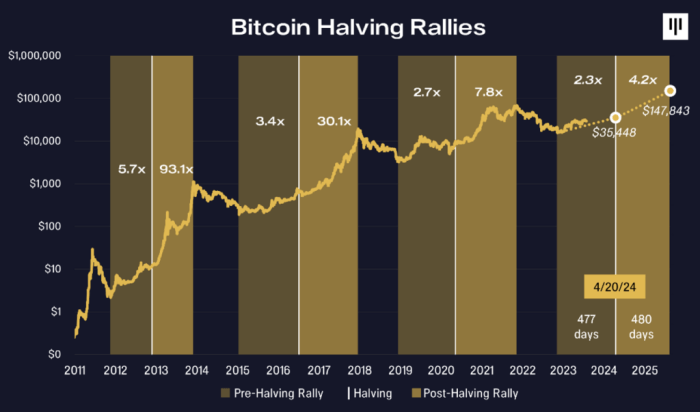

Predicting Bitcoin’s price for May 2025 is challenging, but understanding the market’s dynamics is key. A significant factor influencing any prediction is the upcoming Bitcoin halving, and its potential market impact is thoroughly explored in this insightful article: Bitcoin Halving:Impact On The Market 2025 Ocean News. Considering the halving’s effects on supply and demand is crucial for formulating a reasonable Bitcoin Prediction For May 2025.

- High-Risk Tolerance: Investing a substantial portion of one’s portfolio in Bitcoin, potentially leveraging through margin trading (with awareness of the heightened risk). This strategy is only suitable for investors comfortable with potentially significant losses.

- Moderate Risk Tolerance: Implementing a dollar-cost averaging strategy over an extended period, investing a moderate portion of one’s portfolio in Bitcoin alongside other asset classes. This approach seeks to balance potential returns with risk mitigation.

- Low-Risk Tolerance: Investing a small percentage of one’s portfolio in Bitcoin, primarily as a diversification tool, and prioritizing preservation of capital. This approach focuses on minimizing risk, accepting lower potential returns.

Bitcoin’s Role in the Global Financial System

Bitcoin’s decentralized nature and cryptographic security present a significant challenge to traditional financial systems, potentially disrupting established norms and power structures. Its inherent transparency, coupled with its ability to operate outside the control of central banks and governments, offers both opportunities and risks for the global financial landscape.

Bitcoin’s potential to revolutionize the global financial system stems from its unique characteristics. It offers a faster, cheaper, and more transparent alternative to traditional cross-border payment systems, which are often slow, expensive, and opaque. Furthermore, its potential as a store of value and hedge against inflation is attracting increasing attention from investors and businesses alike.

Cross-Border Payments and Remittances

Bitcoin’s decentralized nature facilitates faster and cheaper cross-border payments compared to traditional methods like SWIFT. Transactions are processed directly between parties, bypassing intermediaries and reducing fees. This is particularly beneficial for remittances, where billions of dollars are sent annually by migrant workers to their home countries. The current system often involves high fees and lengthy processing times, while Bitcoin offers a potential solution to these problems. For example, sending money from the US to a developing country using Bitcoin can often be significantly faster and cheaper than using traditional bank transfers. The speed and reduced costs can improve the lives of millions who rely on remittances.

Bitcoin as a Store of Value and Hedge Against Inflation

Many view Bitcoin as a potential store of value, similar to gold. Its limited supply of 21 million coins creates scarcity, potentially driving up its price over time. Furthermore, some investors see Bitcoin as a hedge against inflation, believing its value will increase during periods of economic uncertainty or high inflation. This belief stems from the idea that Bitcoin’s supply is fixed, unlike fiat currencies that can be inflated by central banks. For instance, during periods of high inflation in countries like Venezuela, Bitcoin has seen increased adoption as individuals seek to preserve their purchasing power.

Bitcoin vs. Gold as a Store of Value

Both Bitcoin and gold are often considered stores of value, but they possess distinct characteristics. Gold has a long history as a store of value, backed by centuries of tradition and tangible physical presence. Bitcoin, on the other hand, is a digital asset, its value derived from its scarcity and technological innovation. While gold’s value can be affected by supply and demand factors, its physical nature provides a degree of inherent security. Bitcoin’s value is entirely determined by market forces and is susceptible to volatility. However, Bitcoin offers advantages in terms of divisibility, transferability, and security compared to gold, making it a compelling alternative for certain investors. The choice between Bitcoin and gold as a store of value depends on individual risk tolerance and investment goals.

Frequently Asked Questions (FAQ) about Bitcoin Prediction for May 2025

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is a complex undertaking. Numerous interconnected factors influence its value, making precise predictions incredibly challenging, if not impossible. The following sections address common questions surrounding Bitcoin price prediction for May 2025.

Bitcoin Price Prediction Accuracy

Accurately predicting Bitcoin’s price is inherently difficult due to the cryptocurrency’s volatile nature and susceptibility to a wide range of influences. These include regulatory changes, market sentiment shifts, technological advancements, macroeconomic conditions, and even major news events unrelated to the cryptocurrency market itself. The decentralized and speculative nature of Bitcoin amplifies price fluctuations, making any prediction prone to significant error. Past performance is not necessarily indicative of future results, a crucial point often overlooked in price forecasting. For example, while Bitcoin experienced substantial growth in 2021, it subsequently underwent a considerable correction. This highlights the unpredictable nature of the market.

Key Factors Influencing Bitcoin Price Predictions

Several crucial factors must be considered when attempting to predict Bitcoin’s price. These include: the overall state of the global economy (recessions, inflation, interest rate changes); regulatory developments impacting cryptocurrency adoption and trading; technological advancements within the Bitcoin network itself (such as scaling solutions); the level of institutional and retail investor interest; and prevailing market sentiment (fear, uncertainty, and doubt or FUD versus excitement and optimism). The interplay of these elements significantly impacts Bitcoin’s price. For instance, increased regulatory clarity might attract institutional investors, potentially driving price upwards, while negative news or a global economic downturn could lead to a price drop.

Risks and Rewards of Bitcoin Investment in 2025

Investing in Bitcoin in 2025, or any time, presents both significant risks and potential rewards. On the reward side, the potential for substantial returns is a primary draw. Bitcoin’s history shows periods of remarkable price appreciation. However, the inherent volatility of the market means significant losses are equally possible. Risks include price fluctuations, regulatory uncertainty, security breaches affecting exchanges or wallets, and the possibility of technological obsolescence. Effective risk management is crucial; this includes diversifying investments, only investing what one can afford to lose, and thoroughly researching before committing funds. Never invest based solely on hype or speculation.

Reliable Sources for Bitcoin Price Prediction Information

Finding reliable information about Bitcoin price predictions requires a critical approach. Avoid sources offering guaranteed returns or overly optimistic predictions. Instead, focus on reputable financial news outlets, established cryptocurrency analysis firms, and independent researchers who provide data-driven insights and acknowledge the inherent uncertainties involved in price forecasting. Always cross-reference information from multiple sources to gain a more comprehensive perspective. Be wary of social media hype and unverified claims; remember that much of the information online is speculative and lacks verifiable evidence.

Disclaimer: Bitcoin Prediction For May 2025

The information provided in this document regarding Bitcoin’s potential price in May 2025 is purely speculative and should not be considered financial advice. Cryptocurrency markets are inherently volatile and unpredictable, influenced by a multitude of factors that can shift rapidly and unexpectedly. Past performance is not indicative of future results. Any projections presented here are based on current market trends and analysis, but these trends can change dramatically. Therefore, these predictions carry a significant degree of uncertainty.

Predicting the price of Bitcoin, or any cryptocurrency, with certainty is impossible. Numerous unforeseen events, from regulatory changes to technological advancements and shifts in global economic conditions, can drastically impact Bitcoin’s value. The information presented here is for educational and informational purposes only, and should not be interpreted as a recommendation to buy, sell, or hold Bitcoin or any other cryptocurrency.

Risks of Cryptocurrency Investment

Investing in cryptocurrencies like Bitcoin involves substantial risk. Price fluctuations can be extreme, leading to significant losses in a short period. The cryptocurrency market is relatively new and lacks the established regulatory frameworks and investor protections found in traditional financial markets. This lack of regulation increases the potential for fraud, scams, and security breaches. Furthermore, the technical complexity of cryptocurrencies can present challenges for investors unfamiliar with blockchain technology and digital wallets. Consider, for example, the significant price drops Bitcoin experienced in 2018 and 2022, highlighting the inherent volatility of the market. These events underscore the importance of thorough research and risk assessment before investing.

Importance of Independent Research and Professional Advice

Before making any investment decisions related to Bitcoin or any other cryptocurrency, it is crucial to conduct thorough independent research and seek advice from qualified financial professionals. This includes understanding the underlying technology, market trends, regulatory landscape, and your own risk tolerance. A financial advisor can help you assess your investment goals, risk profile, and determine if cryptocurrency investments align with your overall financial strategy. Relying solely on predictions or analyses found online, without conducting your own due diligence, is highly discouraged. The potential for financial loss is substantial, and informed decision-making is paramount.

Predicting Bitcoin’s price in May 2025 is challenging, but a key factor to consider is the upcoming halving event. Understanding the precise timing of this halving is crucial for accurate forecasting, and you can find the projected dates by checking this resource on Bitcoin Halving 2025 Dates. The halving’s impact on Bitcoin’s scarcity and potential price appreciation in May 2025 remains a subject of ongoing discussion and analysis within the cryptocurrency community.

Predicting Bitcoin’s price in May 2025 is challenging, with various factors influencing its trajectory. A key event to consider is the Bitcoin Halving, scheduled for sometime in 2024, which will significantly impact future supply. For detailed information on the precise date of this halving, check out this resource on the Bitcoin Halving 2025 Datum ; understanding this date is crucial for refining any Bitcoin price prediction for May 2025.

Therefore, accurate predictions necessitate careful consideration of the halving’s impact on market dynamics.

Predicting Bitcoin’s price in May 2025 is challenging, but a significant factor to consider is the upcoming halving. The reduced Bitcoin supply following the halving, as detailed in this article Bitcoin Halving Is Expected To Occur In April 2025. , is generally expected to exert upward pressure on the price. Therefore, any Bitcoin prediction for May 2025 must account for this anticipated post-halving market impact.

Predicting Bitcoin’s price in May 2025 is challenging, influenced by numerous factors. A key event impacting these predictions is the upcoming Bitcoin Halving, significantly affecting the supply of new Bitcoins. To understand the timing of this crucial event, check out the details on the Bitcoin Halving Date 2025. This halving will undoubtedly play a major role in shaping Bitcoin’s trajectory and therefore, our predictions for May 2025.

Predicting Bitcoin’s price in May 2025 is challenging, influenced by various factors including its halving cycle. To understand the potential impact on Bitcoin’s price in 2025, it’s crucial to know the timing of previous halvings; you can find out when the last Bitcoin halving before 2025 occurred by checking this helpful resource: When Was The Last Bitcoin Halving Before 2025.

This information provides valuable context for formulating more accurate Bitcoin predictions for May 2025.