Bitcoin Adoption and Technological Advancements

Bitcoin’s journey from a niche technology to a globally recognized asset has been remarkable. Understanding its current adoption rates and the ongoing technological advancements is crucial for predicting its future trajectory. This section explores the current state of Bitcoin adoption, highlighting key regions and demographics, and delves into the technological innovations shaping its future.

Bitcoin adoption is not uniform across the globe. While its popularity is undeniable, penetration varies significantly based on factors such as regulatory environments, economic conditions, and technological literacy.

Global Bitcoin Adoption Rates and Demographics

Several factors influence Bitcoin adoption. Developed nations with robust financial infrastructure and high internet penetration generally exhibit higher adoption rates, although this is not universally true. Regions with unstable currencies or limited access to traditional banking services often see increased interest in Bitcoin as an alternative financial tool. Younger demographics, particularly millennials and Gen Z, tend to show greater familiarity and adoption compared to older generations. However, the increasing interest from institutional investors is also a significant factor driving wider adoption. Data from various cryptocurrency research firms shows a general upward trend in global Bitcoin adoption, although precise figures are difficult to definitively state due to the decentralized and anonymous nature of some transactions. However, anecdotal evidence, news reports, and surveys point to increasing use and acceptance.

Technological Advancements in the Bitcoin Ecosystem

The Lightning Network is a prime example of a second-layer scaling solution designed to improve Bitcoin’s transaction speed and reduce fees. It operates as a network built on top of the Bitcoin blockchain, allowing for faster and cheaper transactions off-chain. This essentially means transactions are processed outside the main Bitcoin blockchain, only recording the final settlement on the main chain. This significantly reduces congestion and lowers fees associated with on-chain transactions. Other second-layer scaling solutions are also under development, each aiming to address different aspects of Bitcoin’s scalability.

Impact of Second-Layer Scaling Solutions

Second-layer scaling solutions like the Lightning Network have the potential to dramatically increase Bitcoin’s transaction throughput. Currently, Bitcoin’s transaction speed is relatively slow compared to some other cryptocurrencies. However, the implementation of successful second-layer solutions could bring significant improvements, making Bitcoin more suitable for everyday transactions, rather than primarily a store of value. The reduction in transaction fees would also make it more accessible to a wider range of users. The success of these solutions depends on factors such as user adoption, network stability, and the ongoing development and improvement of the underlying technology.

Scalability Comparison with Other Cryptocurrencies, Bitcoin Prediction In 2025

Bitcoin’s scalability has been a subject of ongoing discussion. Compared to cryptocurrencies designed specifically for high transaction speeds, such as Solana or Cardano, Bitcoin’s native transaction speed is slower. However, the argument is often made that Bitcoin prioritizes security and decentralization over sheer speed. The implementation of second-layer solutions aims to bridge this gap, allowing Bitcoin to achieve both high security and improved scalability without compromising its core principles. The long-term scalability of Bitcoin will likely depend on the continued success of second-layer solutions and further technological innovations.

Timeline of Significant Technological Milestones

A timeline showcasing significant technological milestones in Bitcoin’s history would include:

- 2009: Bitcoin’s genesis block is mined, marking the birth of the Bitcoin network.

- 2010: The first real-world Bitcoin transaction occurs.

- 2012: The first Bitcoin exchange is launched.

- 2015: The Lightning Network is first proposed.

- 2017: Bitcoin experiences a significant price surge, bringing it into the mainstream consciousness.

- 2021: El Salvador adopts Bitcoin as legal tender, a landmark event in global Bitcoin adoption.

This timeline highlights key moments, but many other significant developments have contributed to Bitcoin’s evolution. Ongoing research and development continue to push the boundaries of Bitcoin’s capabilities.

Bitcoin’s Role in the Global Financial System: Bitcoin Prediction In 2025

Bitcoin’s emergence presents a significant challenge and potential disruption to the established global financial system. Its decentralized nature and unique characteristics offer both opportunities and risks, reshaping how we think about money, transactions, and financial control. This section will explore Bitcoin’s potential impact, examining its role as a store of value and medium of exchange, while also considering the inherent risks involved.

Bitcoin’s potential to disrupt traditional financial systems stems from its inherent decentralization. Unlike centralized systems controlled by banks and governments, Bitcoin operates on a peer-to-peer network, removing intermediaries and potentially reducing transaction costs and processing times. This decentralized architecture offers the potential for greater financial inclusion, particularly in regions with limited access to traditional banking services. The transparent nature of the blockchain also enhances accountability and reduces the risk of fraud.

Bitcoin as a Store of Value and Medium of Exchange

Bitcoin’s utility as a store of value is a subject of ongoing debate. Its limited supply of 21 million coins creates scarcity, a key factor influencing its price. However, its volatility presents a significant challenge to its adoption as a stable store of value, unlike traditional currencies or precious metals. As a medium of exchange, Bitcoin faces hurdles in widespread adoption due to its price fluctuations and the relatively slow transaction speeds compared to traditional payment systems. Despite these limitations, the increasing number of merchants accepting Bitcoin suggests a growing acceptance as a form of payment. Examples include companies like Overstock and Microsoft, which have accepted Bitcoin payments in the past, though this acceptance has varied over time depending on market conditions.

Decentralization vs. Centralization

Bitcoin’s decentralized nature contrasts sharply with the centralized nature of traditional financial institutions. Centralized systems, such as banks, are susceptible to single points of failure, regulatory capture, and censorship. Bitcoin’s distributed ledger technology (DLT) mitigates these risks by distributing control across a vast network of nodes. This resilience to censorship and single points of failure is a key advantage, although it also presents challenges in terms of regulation and oversight. The absence of a central authority, however, makes it difficult to resolve disputes or recover lost funds. This contrasts with traditional systems where regulatory bodies and consumer protection laws offer some level of recourse.

Risks Associated with Bitcoin’s Use in the Global Financial System

Several risks are associated with Bitcoin’s integration into the global financial system. Volatility remains a major concern, with Bitcoin’s price subject to significant fluctuations, impacting its reliability as a medium of exchange or store of value. Regulatory uncertainty further complicates its adoption, with varying regulatory frameworks across different jurisdictions. Security risks, such as hacking and theft, also pose a significant challenge. The anonymity afforded by Bitcoin can also facilitate illicit activities, such as money laundering and financing terrorism, although efforts are underway to enhance traceability and transparency. Finally, the energy consumption associated with Bitcoin mining remains a significant environmental concern.

Advantages and Disadvantages of Bitcoin as a Financial Instrument

| Advantage | Disadvantage |

|---|---|

| Decentralized and censorship-resistant | High volatility and price fluctuations |

| Transparent and auditable transactions | Regulatory uncertainty and potential for misuse |

| Lower transaction fees (potentially) | Security risks and potential for loss of funds |

| Increased financial inclusion | High energy consumption associated with mining |

| Faster cross-border transactions | Complexity for users and limited understanding |

Expert Opinions and Predictions

Predicting Bitcoin’s price is inherently speculative, given its volatile nature and dependence on numerous interconnected factors. However, analyzing expert opinions offers valuable insights into potential price trajectories, allowing for a more informed understanding of the range of possible outcomes in 2025. These predictions vary widely, reflecting the diverse methodologies and underlying assumptions employed by different analysts.

Diverse Expert Perspectives on Bitcoin’s Future Price

Prominent economists and cryptocurrency analysts hold significantly diverging views on Bitcoin’s future price. Some, like Tim Draper, a well-known venture capitalist, have historically expressed extremely bullish sentiments, predicting prices far exceeding $250,000 per Bitcoin in the coming years. Conversely, other analysts, often citing macroeconomic factors and regulatory uncertainty, maintain more conservative or even bearish stances, forecasting significantly lower price targets. These differences highlight the complexity of accurately forecasting Bitcoin’s price, emphasizing the crucial role of individual analytical frameworks and assumptions. For instance, some analysts heavily weigh adoption rates and network effects, while others prioritize macroeconomic indicators like inflation and interest rates.

Summary of Bitcoin Price Predictions for 2025

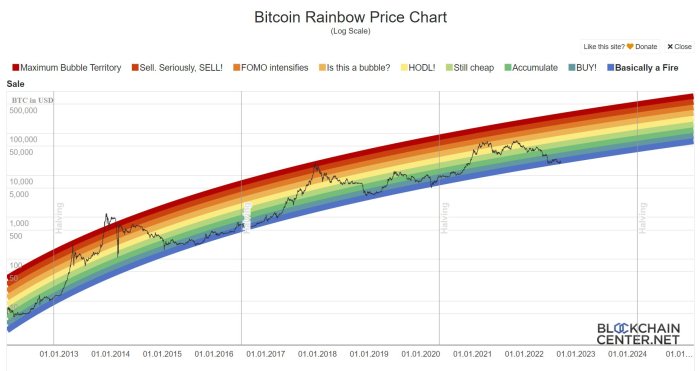

A range of price predictions for Bitcoin in 2025 exists, with significant variation depending on the source and methodology. Some analysts predict prices exceeding $100,000, citing continued institutional adoption and technological advancements. Others suggest a more moderate increase, potentially reaching $50,000 to $75,000, based on a more cautious outlook regarding market sentiment and regulatory developments. Conversely, bearish predictions exist, with some analysts suggesting prices could remain relatively stagnant or even decline, potentially falling below current levels depending on macroeconomic conditions. It’s crucial to remember that these are merely predictions, and the actual price could deviate significantly from these estimates. For example, a report from Finder.com, based on a panel of experts, averaged a prediction of approximately $67,000 for 2025, highlighting the wide spectrum of potential outcomes.

Visualization of Different Price Prediction Models

A graph visualizing these predictions would show several lines representing different price models. The x-axis would represent time (leading up to 2025), and the y-axis would represent the Bitcoin price. One line might represent a highly bullish prediction, showing exponential growth, while another might depict a more moderate, linear increase. A third line could illustrate a bearish scenario, potentially showing a price decline or stagnation. The visual representation would clearly highlight the range of uncertainty inherent in Bitcoin price prediction. The graph would not show a single, definitive prediction, but rather a spectrum of possibilities, each linked to a specific analyst’s methodology and assumptions.

Methodologies Used in Forming Bitcoin Price Predictions

Analysts employ various methodologies to form their predictions. Some utilize technical analysis, studying historical price charts and patterns to identify trends and predict future movements. Others employ fundamental analysis, examining factors such as Bitcoin’s adoption rate, market capitalization, and macroeconomic conditions. Quantitative models, incorporating various statistical and econometric techniques, are also frequently used. The choice of methodology significantly impacts the resulting prediction. For instance, a technical analyst might focus on support and resistance levels, while a fundamental analyst might consider factors like regulatory changes and technological developments. The reliability of each prediction depends heavily on the validity and robustness of the underlying methodology and the accuracy of the input data.

Risks and Uncertainties Associated with Bitcoin

Investing in Bitcoin, like any other asset class, carries inherent risks. Understanding these risks is crucial for making informed investment decisions and managing potential losses. While the potential for high returns is a significant draw, the volatility and security concerns associated with Bitcoin cannot be ignored. This section will Artikel the key risks and explore potential mitigation strategies.

Price Volatility

Bitcoin’s price is notoriously volatile, experiencing dramatic swings in value over short periods. This volatility stems from several factors, including regulatory uncertainty, market sentiment, and technological developments. For example, the price of Bitcoin can fluctuate by hundreds of dollars in a single day, leading to significant gains or substantial losses for investors. This high volatility makes Bitcoin a risky investment, particularly for those with a low risk tolerance or short-term investment horizons. Historical price data clearly demonstrates this volatility, with periods of rapid growth followed by equally sharp declines. Consider the price drop in 2018, where the price fell from nearly $20,000 to under $4,000 in a matter of months, wiping out a significant portion of investor wealth.

Security Risks

Bitcoin’s decentralized nature, while a strength in terms of censorship resistance, also presents security challenges. The risk of hacking and theft is a significant concern for Bitcoin holders. Exchanges, where Bitcoin is often stored, have been targeted by hackers in the past, resulting in substantial losses for users. Furthermore, individuals holding Bitcoin in their own wallets are vulnerable to theft if their private keys are compromised. Losing access to private keys effectively means losing access to the Bitcoin held in that wallet, with little to no recourse for recovery. Robust security measures, such as using reputable exchanges and employing strong password management practices, are essential to mitigate these risks.

Regulatory Uncertainty

The regulatory landscape surrounding Bitcoin is constantly evolving and varies significantly across different jurisdictions. Governments worldwide are still grappling with how to regulate cryptocurrencies, leading to uncertainty about the future legal status of Bitcoin. Changes in regulations can have a significant impact on Bitcoin’s price and accessibility, potentially leading to sudden market shifts. For example, a sudden ban on Bitcoin trading in a major market could cause a sharp price decline. Staying informed about regulatory developments and understanding the legal framework in your region is crucial for navigating this uncertainty.

Comparison with Other Investment Options

Compared to traditional investment options like stocks and bonds, Bitcoin presents a higher risk-reward profile. While stocks and bonds offer relatively lower volatility and some degree of regulatory protection, Bitcoin’s volatility and lack of inherent value make it a significantly riskier investment. Diversification is crucial; relying solely on Bitcoin for investment exposes an investor to significant potential losses. A balanced portfolio that includes a mix of asset classes can help mitigate the risks associated with Bitcoin investment.

Potential Risks and Mitigation Strategies

The following table summarizes some key risks and suggests potential mitigation strategies:

| Risk | Mitigation Strategy |

|---|---|

| Price Volatility | Dollar-cost averaging, diversification, long-term investment horizon |

| Security Risks (Hacking, Theft) | Use reputable exchanges, secure hardware wallets, strong password management, two-factor authentication |

| Regulatory Uncertainty | Stay informed about regulatory developments, diversify geographically |

| Market Manipulation | Avoid impulsive trading decisions, conduct thorough research |

| Technological Risks | Stay informed about technological advancements and potential vulnerabilities |

Frequently Asked Questions (FAQs)

This section addresses common questions regarding Bitcoin’s potential price and risks in 2025, comparing it to other assets, and highlighting key technological advancements that could influence its future. Understanding these factors is crucial for informed investment decisions.

Bitcoin’s Potential Price in 2025

Predicting Bitcoin’s price is inherently speculative, influenced by numerous interconnected factors. Several scenarios are possible. A conservative estimate, considering potential regulatory hurdles and market volatility, might place the price range between $50,000 and $100,000. A more bullish scenario, factoring in widespread adoption and technological advancements, could see Bitcoin reach prices exceeding $200,000. However, a bearish scenario, involving significant regulatory crackdown or a major market downturn, could see the price fall below $20,000. These are just possibilities, and the actual price will depend on a complex interplay of market forces. For example, the 2017 bull run saw Bitcoin reach nearly $20,000, while the subsequent bear market saw it fall significantly.

Likelihood of Reaching Specific Price Targets

The probability of Bitcoin reaching a specific price target in 2025 is difficult to quantify precisely. While historical data and technical analysis can offer insights, unforeseen events can significantly alter the trajectory. For instance, widespread institutional adoption could drive prices higher than current models predict, whereas a global economic crisis could cause a sharp decline. Therefore, assigning specific probabilities is unreliable; instead, focusing on the range of possibilities Artikeld above provides a more realistic assessment. Think of it like weather forecasting; we can predict the likelihood of rain, but not with absolute certainty.

Risks Associated with Investing in Bitcoin in 2025

Investing in Bitcoin carries inherent risks. Volatility remains a primary concern; price swings can be dramatic, leading to substantial gains or losses. Regulatory uncertainty poses another significant risk, with governments worldwide still grappling with how to regulate cryptocurrencies. Security breaches, both at the individual and exchange level, represent another area of concern. Finally, the relatively nascent nature of the Bitcoin market makes it susceptible to manipulation and speculative bubbles. Mitigation strategies include diversification of investments, secure storage practices, and staying informed about regulatory developments.

Bitcoin Compared to Other Investment Assets

Compared to traditional assets like stocks and bonds, Bitcoin offers higher potential returns but also significantly greater risk. Stocks and bonds typically exhibit lower volatility, though their returns are generally less dramatic. Gold, often viewed as a safe haven asset, also shows lower volatility than Bitcoin but offers potentially lower returns. The risk-return profile of Bitcoin is distinct, requiring investors to have a high risk tolerance and a long-term perspective. Diversifying across asset classes, including Bitcoin, allows investors to potentially balance risk and return based on their individual risk profiles.

Impact of Technological Developments on Bitcoin’s Price

Technological advancements can significantly impact Bitcoin’s price. Improvements in scalability, such as the Lightning Network, could increase transaction speed and reduce fees, potentially boosting adoption. The development of more energy-efficient mining techniques could also have a positive impact. Conversely, the emergence of competing cryptocurrencies with superior technology could negatively affect Bitcoin’s dominance. For example, the development of faster and more efficient blockchains could attract investors away from Bitcoin, influencing its price. Therefore, keeping abreast of technological developments within the cryptocurrency space is vital for assessing future price movements.

Bitcoin Prediction In 2025 – Predicting Bitcoin’s value in 2025 is challenging, with various factors influencing its trajectory. For a detailed analysis of potential price movements and market trends, you might find the insights at Prediction For Bitcoin 2025 helpful. Ultimately, Bitcoin’s future price in 2025 remains speculative, depending on technological advancements, regulatory changes, and overall market sentiment.

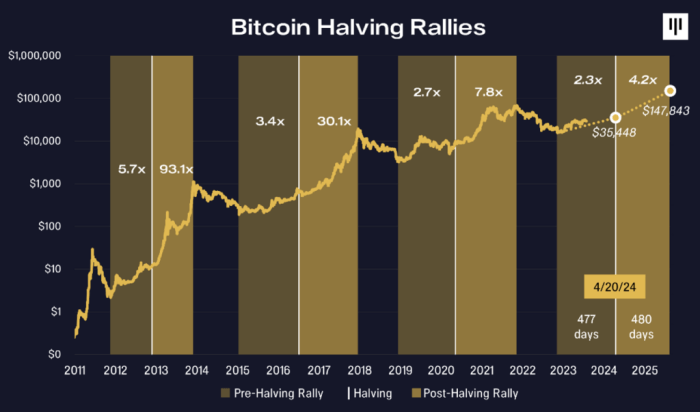

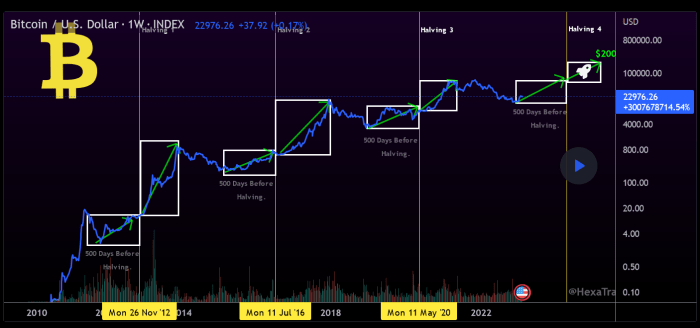

Predicting Bitcoin’s price in 2025 is challenging, influenced by numerous factors including technological advancements and regulatory changes. A key event impacting these predictions is the Bitcoin halving, which significantly alters the rate of new Bitcoin creation. To understand the timing of this crucial event and its potential effects, check out this resource on When Is The Bitcoin Halving In 2025.

Ultimately, the halving’s impact on Bitcoin’s price in 2025 remains a subject of ongoing debate and analysis.

Predicting Bitcoin’s price in 2025 is a complex undertaking, influenced by numerous factors. A key element to consider is the impact of the upcoming halving event, which will significantly reduce the rate of new Bitcoin creation. For detailed analysis on this crucial event, check out this insightful resource on Bitcoin Halving 2025 Predictions. Understanding the potential consequences of the halving is vital for any comprehensive Bitcoin prediction in 2025, helping to form a more accurate forecast.

Predicting Bitcoin’s price in 2025 is a complex undertaking, influenced by numerous factors. A key element to consider is the impact of the upcoming halving event, which will significantly reduce the rate of new Bitcoin creation. For detailed analysis on this crucial event, check out this insightful resource on Bitcoin Halving 2025 Predictions. Understanding the potential consequences of the halving is vital for any comprehensive Bitcoin prediction in 2025, helping to form a more accurate forecast.

Predicting Bitcoin’s price in 2025 is a complex undertaking, influenced by numerous factors. A key element to consider is the impact of the upcoming halving event, which will significantly reduce the rate of new Bitcoin creation. For detailed analysis on this crucial event, check out this insightful resource on Bitcoin Halving 2025 Predictions. Understanding the potential consequences of the halving is vital for any comprehensive Bitcoin prediction in 2025, helping to form a more accurate forecast.

Predicting Bitcoin’s price in 2025 is a complex undertaking, influenced by numerous factors. A key element to consider is the impact of the upcoming halving event, which will significantly reduce the rate of new Bitcoin creation. For detailed analysis on this crucial event, check out this insightful resource on Bitcoin Halving 2025 Predictions. Understanding the potential consequences of the halving is vital for any comprehensive Bitcoin prediction in 2025, helping to form a more accurate forecast.