Bitcoin Price Prediction

Predicting the price of Bitcoin in April 2025 is inherently speculative, given the cryptocurrency’s volatile nature and susceptibility to various unpredictable factors. However, by analyzing historical data, current market trends, and potential future influences, we can develop plausible price scenarios. This analysis will employ a combination of forecasting methodologies, acknowledging their limitations and strengths.

Bitcoin Price Prediction Model: April 2025

This model considers Bitcoin’s historical price movements, adoption rate, regulatory changes, macroeconomic conditions, and technological advancements. We will explore three scenarios: bullish, bearish, and neutral. The model utilizes a combination of technical analysis (identifying trends and patterns in price charts) and fundamental analysis (evaluating underlying factors influencing Bitcoin’s value). For example, past halving events have historically preceded significant price increases, a factor incorporated into the bullish scenario. Conversely, a major regulatory crackdown or a significant global economic downturn could trigger a bearish scenario. The neutral scenario assumes a continuation of current market conditions, with moderate growth and volatility.

Forecasting Methodologies: Strengths and Weaknesses

Several forecasting methodologies can be applied to Bitcoin price prediction. These include time series analysis (e.g., ARIMA models), machine learning algorithms (e.g., neural networks), and econometric models that incorporate macroeconomic variables. Time series analysis is useful for identifying trends and seasonality but may struggle to account for unforeseen events. Machine learning models can capture complex relationships but require large datasets and are susceptible to overfitting. Econometric models allow for the inclusion of economic factors but require strong assumptions about the relationships between variables. For example, a simple linear regression model might be used to correlate Bitcoin’s price with the adoption rate or the overall market capitalization of cryptocurrencies. However, this approach is limited as it assumes a linear relationship, which might not always hold true.

Visual Representation of Price Ranges

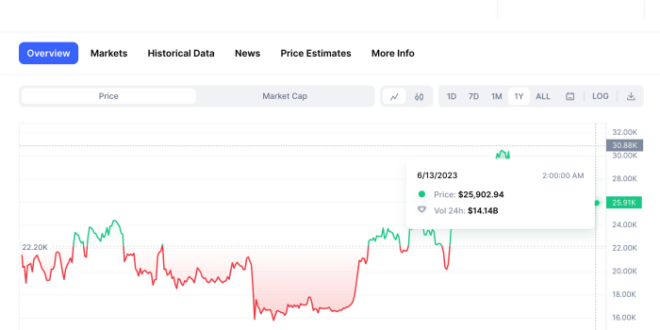

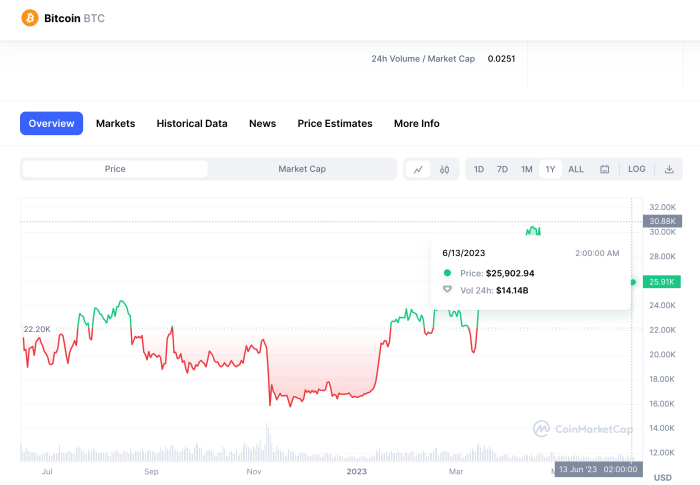

[Imagine a chart with a horizontal axis representing time (April 2025) and a vertical axis representing Bitcoin price in USD. Three lines represent the different scenarios: a bullish scenario showing a high price range (e.g., $150,000 – $200,000), a bearish scenario showing a low price range (e.g., $30,000 – $50,000), and a neutral scenario showing a mid-range price (e.g., $75,000 – $100,000). The chart uses historical Bitcoin price data from reputable sources like CoinMarketCap and TradingView, combined with estimations based on the aforementioned forecasting methodologies and expert opinions. The shaded area between the lines represents the uncertainty and potential price fluctuations within each scenario.]Key Assumptions and Limitations

| Assumption | Limitation |

|---|---|

| Continued adoption of Bitcoin as a store of value and medium of exchange. | Unpredictable regulatory changes could significantly impact adoption. |

| No major unforeseen technological disruptions or security breaches affecting Bitcoin. | The possibility of unforeseen events remains inherent in the cryptocurrency market. |

| Stable macroeconomic conditions globally. | Global economic downturns or unexpected geopolitical events could negatively impact Bitcoin’s price. |

| No significant changes in the Bitcoin mining landscape. | Changes in mining difficulty or energy costs could influence Bitcoin’s price. |

Factors Influencing Bitcoin’s Price in 2025: Bitcoin Prediction In April 2025

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of macroeconomic factors, regulatory landscapes, technological advancements, and adoption rates. While precise forecasting is impossible, analyzing these key influences offers valuable insights into potential price trajectories.

Macroeconomic Factors and Bitcoin’s Price

Global economic conditions, inflation rates, and interest rate policies will significantly shape Bitcoin’s price in 2025. High inflation, for example, could drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, aggressively rising interest rates might divert investment capital away from riskier assets like Bitcoin towards higher-yielding bonds, potentially suppressing its price. A global recession could also negatively impact Bitcoin’s price, as investors may liquidate assets to cover losses in other markets. The strength of the US dollar, a common benchmark for many assets, will also play a crucial role; a strong dollar might put downward pressure on Bitcoin’s price denominated in USD. For instance, the 2022 bear market saw a correlation between rising interest rates and a strengthening dollar, leading to a significant decline in Bitcoin’s value.

Regulatory Changes and Government Policies

Government regulations and policies will be a major determinant of Bitcoin’s price. Favorable regulations, such as clear guidelines for cryptocurrency exchanges and tax treatment, could boost institutional investment and mainstream adoption, driving price appreciation. Conversely, overly restrictive regulations or outright bans could severely limit Bitcoin’s growth and depress its price. The varying approaches of different governments globally will create a complex and dynamic regulatory environment, making price prediction even more challenging. Consider the contrasting approaches of El Salvador, which adopted Bitcoin as legal tender, and China, which banned cryptocurrency trading – these divergent policies highlight the significant impact of government actions.

Technological Advancements and Bitcoin’s Market Dominance

Technological advancements in the cryptocurrency space will impact Bitcoin’s market dominance and price. The development and adoption of layer-2 scaling solutions, such as the Lightning Network, could significantly improve Bitcoin’s transaction speed and reduce fees, making it more attractive for everyday use. However, the emergence of new cryptocurrencies with superior technology or features could challenge Bitcoin’s dominance, potentially diverting investment and reducing its market share. The success of competing cryptocurrencies offering faster transactions, lower fees, or enhanced smart contract capabilities could erode Bitcoin’s value. For example, the rise of Ethereum and its DeFi ecosystem demonstrates how technological innovation can reshape the cryptocurrency landscape.

Institutional and Mainstream Adoption

The extent of Bitcoin adoption by institutions and mainstream users will be a key driver of its price. Increased institutional investment, particularly from large corporations and hedge funds, could significantly boost demand and push the price higher. This is because institutional investors typically bring substantial capital and a longer-term investment horizon. Mainstream adoption, driven by factors like user-friendly interfaces and increased payment acceptance, would also contribute to price appreciation. The growing acceptance of Bitcoin by payment processors and the expansion of Bitcoin ATMs are examples of this increasing adoption. A significant influx of institutional capital, as seen with MicroStrategy’s substantial Bitcoin holdings, could create significant upward pressure on price.

Bitcoin’s Technological Developments and Their Impact

Bitcoin’s technological trajectory will significantly influence its price and adoption in 2025. Several factors, including the upcoming halving event and potential technological upgrades, will play crucial roles in shaping its future. Understanding these developments is key to forming a comprehensive price prediction.

Bitcoin Halving and its Price Impact

The Bitcoin halving event, scheduled to occur around April 2024, will reduce the rate at which new Bitcoins are created by approximately 50%. This reduction in supply, coupled with relatively consistent demand, is historically associated with an increase in Bitcoin’s price. The 2012 and 2016 halvings were followed by significant price rallies, although the timing and magnitude of these increases varied. Predicting the exact price impact of the 2024 halving is challenging, as market sentiment and macroeconomic conditions also play significant roles. However, based on historical precedent, a price increase following the 2024 halving is a reasonable expectation, potentially contributing to a higher price in April 2025. The extent of this increase will depend on several factors, including overall market demand and adoption rates. For instance, if institutional adoption accelerates, the impact could be more pronounced.

Potential Technological Developments in Bitcoin

Several technological developments could influence Bitcoin’s price and adoption by 2025. These include improvements to transaction speed and scalability, enhanced privacy features, and the development of layer-2 solutions. Increased transaction throughput, achieved through layer-2 scaling solutions like the Lightning Network, could make Bitcoin more suitable for everyday transactions, potentially driving up demand. Simultaneously, improvements in privacy features could attract a wider range of users concerned about transaction transparency. The success of these technological upgrades will depend on their adoption rate within the Bitcoin ecosystem and the overall market demand for such improvements.

Comparison of Proposed Bitcoin Upgrades

Several proposed Bitcoin upgrades aim to improve various aspects of the network. These improvements, however, often involve trade-offs. For example, increasing block size to enhance transaction speed could lead to increased energy consumption and centralization concerns. Conversely, focusing on layer-2 solutions might improve scalability without significantly altering the core protocol, but it might also increase complexity for users. A balance needs to be struck between improving the network’s functionality and maintaining its decentralized nature. The specific choice of upgrade paths will significantly influence Bitcoin’s future development and adoption. A focus on security and decentralization, for example, may attract users concerned about censorship-resistance, potentially driving the price upward.

Potential Market Capitalization Scenarios

| Technological Advancement Scenario | Market Capitalization (USD) – April 2025 (Estimate) | Rationale |

|---|---|---|

| Minimal Technological Advancement | $2 Trillion | Based on sustained demand and the impact of the 2024 halving, but without significant technological improvements driving widespread adoption. |

| Moderate Technological Advancement (e.g., widespread Lightning Network adoption) | $5 Trillion | Increased transaction speed and scalability leading to greater adoption and a higher market capitalization. |

| Significant Technological Advancement (e.g., substantial improvements in privacy and scalability) | $10 Trillion+ | Widespread adoption driven by significant improvements to the user experience, making Bitcoin more accessible and appealing to a broader audience. This scenario assumes significant macroeconomic factors are favorable. |

Risks and Opportunities in Bitcoin Investment (April 2025)

Investing in Bitcoin in April 2025 presents a complex landscape of potential rewards and significant risks. While Bitcoin’s long-term prospects remain a subject of debate, understanding the inherent volatility and evolving regulatory environment is crucial for informed decision-making. This section will analyze the key risks and opportunities, providing a framework for potential investment strategies.

Key Risks Associated with Bitcoin Investment

Bitcoin’s price is notoriously volatile, experiencing sharp swings in value within short periods. This volatility stems from various factors, including market sentiment, regulatory changes, and technological developments. In April 2025, unexpected news events or shifts in investor confidence could trigger significant price drops, potentially leading to substantial losses for investors. Regulatory uncertainty remains a persistent concern. Governments worldwide are still grappling with how to effectively regulate cryptocurrencies, and changes in regulatory frameworks could significantly impact Bitcoin’s value and trading accessibility. Furthermore, the decentralized nature of Bitcoin, while a strength in some respects, also makes it vulnerable to security threats such as hacking and scams. Sophisticated attacks targeting exchanges or individual wallets could result in the loss of funds. Finally, the lack of intrinsic value and its dependence on market speculation make Bitcoin inherently risky compared to traditional assets. For example, the 2022 crypto winter saw Bitcoin’s price plummet by over 60%, demonstrating the potential for dramatic losses.

Risk Mitigation Strategies

Effective risk management is crucial for Bitcoin investment. Diversification is a cornerstone of any robust investment strategy. Allocating only a small percentage of your overall portfolio to Bitcoin can limit potential losses during market downturns. Dollar-cost averaging, a strategy involving regular investments regardless of price fluctuations, helps mitigate the risk of investing a large sum at a market peak. Similarly, setting stop-loss orders can automatically sell your Bitcoin if the price falls below a predetermined threshold, limiting potential losses. Thorough due diligence is essential before investing in any Bitcoin-related product or service. Researching exchanges and wallets thoroughly to ensure their security and reputation can help avoid scams and hacks. Staying informed about regulatory developments and market trends is vital. Following reputable financial news sources and participating in informed discussions can help investors make more informed decisions.

Potential Opportunities in Bitcoin Investment

Despite the risks, Bitcoin presents several compelling opportunities in April 2025. Its potential for long-term growth remains a significant draw for investors. Many believe Bitcoin’s scarcity and growing adoption as a store of value and a medium of exchange could drive its price significantly higher over the long term. For example, some analysts predict a price exceeding $100,000 in the coming years, though such predictions are highly speculative. Bitcoin also offers diversification benefits for investors. Its low correlation with traditional asset classes like stocks and bonds can help reduce overall portfolio risk. The increasing integration of Bitcoin into the mainstream financial system could further enhance its appeal and potential for growth. The growing adoption of Bitcoin by institutional investors, such as large corporations and hedge funds, signals a growing acceptance of Bitcoin as a legitimate asset class.

Risks and Rewards Summary

| Risk Factor | Potential Impact | Mitigation Strategy |

|---|---|---|

| Volatility | Significant price swings leading to potential losses | Diversification, dollar-cost averaging, stop-loss orders |

| Regulatory Uncertainty | Changes in regulations impacting trading and value | Stay informed about regulatory developments |

| Security Threats | Hacking, scams, and loss of funds | Thorough due diligence, secure storage |

| Lack of Intrinsic Value | Dependence on market speculation | Diversification, long-term investment horizon |

| Reward Factor | Potential Impact | Mitigation Strategy |

| Long-Term Growth Potential | Significant price appreciation over time | Long-term investment horizon |

| Diversification Benefits | Reduced overall portfolio risk | Diversified portfolio allocation |

| Increased Adoption | Growing acceptance and integration into mainstream finance | Monitor market trends and adoption rates |

Bitcoin’s Role in the Global Financial System (2025)

By April 2025, Bitcoin’s position within the global financial system is projected to be significantly more integrated than it is today, although its precise role remains a subject of ongoing debate and speculation. Its decentralized nature and inherent resistance to censorship present both opportunities and challenges for its widespread adoption as a core component of global finance. The extent of its influence will depend on several factors, including regulatory developments, technological advancements, and overall market sentiment.

Bitcoin’s potential contribution to the global financial system rests on its three core functions: store of value, medium of exchange, and unit of account. Each of these functions presents both advantages and limitations when compared to traditional assets.

Bitcoin as a Store of Value

Bitcoin’s scarcity, limited supply of 21 million coins, and its decentralized nature position it as a potential store of value, similar to gold. Unlike gold, however, Bitcoin’s value is entirely determined by market forces, making it more volatile. While gold has a long history as a safe haven asset, Bitcoin’s track record is relatively short. Nevertheless, its growing adoption by institutional investors suggests a growing perception of it as a hedge against inflation and other macroeconomic uncertainties. The increasing acceptance of Bitcoin by institutional investors, such as MicroStrategy and Tesla, who have made significant investments in Bitcoin, supports this assessment. The comparison to gold highlights a key difference: gold has tangible value, while Bitcoin’s value is entirely digital and depends on widespread belief in its utility.

Bitcoin as a Medium of Exchange

Bitcoin’s use as a medium of exchange is still limited compared to fiat currencies. Transaction speeds and fees can be problematic, particularly during periods of high network congestion. However, the development of the Lightning Network and other second-layer scaling solutions aims to address these limitations. The increasing number of merchants accepting Bitcoin as payment, albeit still a small percentage globally, signifies a gradual shift towards its wider adoption in commerce. Examples include online retailers and some brick-and-mortar businesses, particularly those catering to a tech-savvy clientele. However, widespread adoption as a medium of exchange will require overcoming challenges related to volatility and regulatory uncertainty.

Bitcoin as a Unit of Account

Bitcoin’s potential as a unit of account is arguably the least developed of its three core functions. Its volatility makes it unsuitable for widespread use in pricing goods and services. While some businesses might price goods in Bitcoin, the fluctuation in its value necessitates constant conversion to fiat currencies for practical purposes. The lack of stable price makes it an impractical unit of account for most transactions. For Bitcoin to function effectively as a unit of account, its price stability needs to improve dramatically, which is unlikely in the short term.

Bitcoin’s Impact on the Traditional Financial System

The growing adoption of Bitcoin has the potential to disrupt the traditional financial system. Its decentralized nature challenges the centralized control exerted by governments and financial institutions. The potential for increased financial inclusion, particularly in underserved regions, is a significant positive aspect. However, the lack of regulation and the potential for illicit activities are significant concerns. The traditional financial system may need to adapt and integrate Bitcoin, or risk losing relevance in a world increasingly embracing decentralized technologies. The integration might lead to innovations in payment systems, cross-border transactions, and other financial services.

Potential Integration of Bitcoin with Traditional Financial Systems by April 2025

| Area of Integration | Potential Scenario by April 2025 | Example/Real-life Case |

|---|---|---|

| Custodial Services | Increased institutional adoption of Bitcoin custody solutions provided by traditional financial institutions. | Major banks offering Bitcoin custody services to high-net-worth individuals and institutional investors. |

| Payment Processing | Wider acceptance of Bitcoin payments by online and some brick-and-mortar businesses, facilitated by payment gateways. | Integration of Bitcoin payment options on major e-commerce platforms. |

| Investment Products | Growth in Bitcoin-related investment products, including ETFs and other investment vehicles offered by traditional financial institutions. | Launch of Bitcoin ETFs on major stock exchanges. |

| Regulatory Framework | Increased clarity on Bitcoin regulation in key jurisdictions, leading to greater institutional participation. | Establishment of clear regulatory guidelines for Bitcoin exchanges and custodians in the EU or US. |

Frequently Asked Questions (FAQ)

This section addresses common queries regarding Bitcoin’s potential price in April 2025, associated risks and benefits of investment, and its comparison with other investment vehicles. Understanding these aspects is crucial for making informed investment decisions.

Bitcoin’s Most Likely Price in April 2025

Predicting the precise price of Bitcoin is inherently challenging due to its volatile nature and susceptibility to various market forces. However, considering historical trends, technological advancements, and macroeconomic factors, a reasonable price range for April 2025 could be between $100,000 and $250,000. The lower end of this range assumes a period of consolidation and slower adoption, while the higher end reflects a scenario of continued mainstream acceptance and technological breakthroughs. Several factors influence this prediction, including the increasing adoption of Bitcoin by institutional investors, regulatory clarity in key markets, and the ongoing development of the Lightning Network, which aims to improve Bitcoin’s scalability and transaction speed. Conversely, factors like increased regulatory scrutiny, significant security breaches, or a broader cryptocurrency market downturn could push the price lower. It’s important to remember that this is merely a potential range, and the actual price could deviate significantly. For example, the price surge experienced in late 2020 and early 2021 showcases the extreme volatility inherent in Bitcoin’s market.

Biggest Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries substantial risks. Volatility is a primary concern; Bitcoin’s price has historically experienced dramatic swings, leading to significant gains and losses in short periods. Regulatory uncertainty is another major risk; governments worldwide are still developing frameworks for regulating cryptocurrencies, and changes in regulations could significantly impact Bitcoin’s value. Security breaches, targeting exchanges or individual wallets, represent a substantial threat to investors’ funds. Furthermore, the relatively young age of Bitcoin and the cryptocurrency market overall introduces inherent risks associated with an immature and evolving technology. Finally, the lack of intrinsic value, unlike traditional assets, makes Bitcoin’s value entirely dependent on market sentiment and speculation. Consider the Mt. Gox hack in 2014, which resulted in the loss of a significant amount of Bitcoin, as a stark reminder of these security risks.

Potential Benefits of Investing in Bitcoin

Despite the risks, Bitcoin offers potential long-term growth opportunities. Its decentralized nature and limited supply (21 million coins) are often cited as factors that could drive its price upwards over time. For investors seeking diversification, Bitcoin offers exposure to an asset class uncorrelated with traditional markets, potentially reducing overall portfolio risk. Additionally, some view Bitcoin as a hedge against inflation, as its fixed supply could protect its value during periods of economic instability and currency devaluation. The potential for substantial returns, as witnessed in past bull markets, is another significant draw for investors. The adoption of Bitcoin by large corporations like MicroStrategy, which has accumulated significant holdings, signals a growing belief in its long-term potential.

Bitcoin’s Comparison to Other Investment Options, Bitcoin Prediction In April 2025

Compared to traditional assets like gold, Bitcoin offers potentially higher returns but with significantly higher volatility. Gold is often seen as a safe haven asset, holding its value relatively well during economic downturns, while Bitcoin’s price can fluctuate wildly. Compared to stocks, Bitcoin’s performance is less correlated with traditional equity markets, offering diversification benefits but also higher risk. Unlike stocks, which represent ownership in a company with underlying assets and earnings, Bitcoin’s value is derived solely from market demand and speculation. The lack of dividends or interest payments further distinguishes Bitcoin from traditional investments. The comparison to government bonds highlights the stark contrast in risk profiles: government bonds are typically considered low-risk, low-return investments, while Bitcoin carries high risk with the potential for high returns.